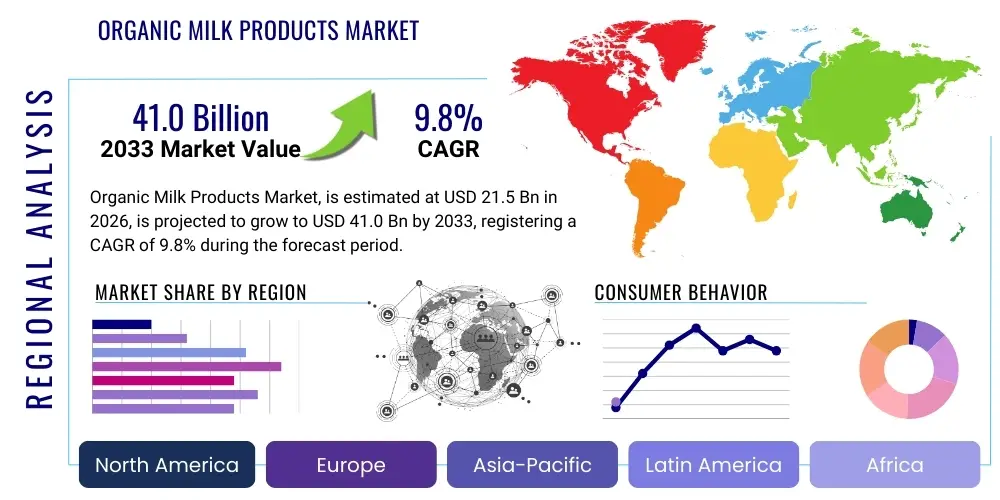

Organic Milk Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438913 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Organic Milk Products Market Size

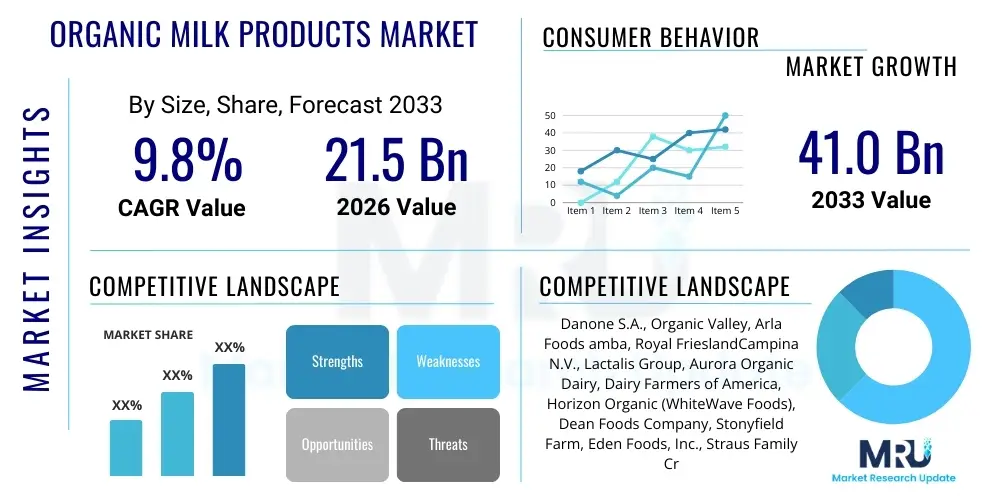

The Organic Milk Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 21.5 billion in 2026 and is projected to reach USD 41.0 billion by the end of the forecast period in 2033.

Organic Milk Products Market introduction

The Organic Milk Products Market encompasses dairy items derived from livestock raised according to strict organic farming standards, primarily focusing on extensive pasture grazing, avoiding synthetic pesticides, antibiotics, growth hormones, and genetically modified organisms (GMOs). This extensive category includes organic fluid milk (whole, skim, flavored), processed products like cheese, yogurt, butter, and specialized derivatives such as organic infant formula and ice cream, catering to a consumer base increasingly prioritizing health, environmental sustainability, and ethical animal welfare practices. The intrinsic value proposition of organic dairy centers on perceived purity and often documented superior nutritional profiles, which may include higher concentrations of beneficial fatty acids like conjugated linoleic acid (CLA) and Omega-3s, enhancing the product's appeal among wellness-focused demographics globally. The underlying demand surge is intrinsically linked to rising disposable incomes in developed and rapidly developing economies, coupled with sophisticated consumer education campaigns highlighting the potential negative impacts of conventional farming chemicals and promoting ecological responsibility.

Product descriptions within the market are highly diversified to capture a broad spectrum of consumer needs, ranging from standard pasteurized organic milk to specialty, minimally processed options such as grass-fed organic milk, A2 organic milk, and fortified organic beverages targeting specific nutritional gaps. Major applications span direct consumption as a beverage, extensive incorporation into home cooking, use as a foundational ingredient in baked goods, and significant penetration into the burgeoning food service industry, particularly in health-focused cafés, bakeries, and restaurants emphasizing clean labels and robust sustainable sourcing policies. The core benefits driving widespread adoption include a verified reduction in consumer exposure to chemical residues, mandated improvements in animal living conditions ensuring high welfare standards, and farming practices that actively promote soil health, biodiversity, and reduced carbon footprint, aligning perfectly with broader global movements toward ecological conservation.

Key driving factors accelerating global market expansion involve the establishment of increasingly stringent government regulations supporting organic certification, leading to higher product integrity and consumer trust. Simultaneously, robust advancements in the organic supply chain, encompassing improved logistics, cold chain management, and blockchain-enabled traceability, ensure product authenticity from farm to shelf. Substantial strategic investment by major multinational dairy conglomerates into dedicated organic production lines and acquisition of smaller organic producers are stabilizing the market and increasing distribution reach. Furthermore, the general increase in health consciousness and preventative wellness habits catalyzed by recent global health events has solidified organic milk products as an essential staple in health-focused households. Sustained, targeted marketing efforts that effectively communicate both the ecological and verified nutritional advantages of organic consumption are crucial in converting mainstream consumers, justifying the premium pricing, and maintaining market momentum across highly competitive global retail landscapes.

Organic Milk Products Market Executive Summary

The Organic Milk Products Market is experiencing dynamic growth, characterized by strong consumer preference shifts towards clean-label and sustainably produced foods. Business trends indicate significant capacity expansion among leading organic dairy producers, driven by strategic acquisitions and substantial capital investment in processing technology to improve efficiency and shelf life. The market structure is moderately fragmented, featuring large international players alongside numerous regional, cooperative-based organic farms focusing on local sourcing and direct-to-consumer models, which cater to niche demand for hyper-local products. A critical emerging business trend is the incorporation of advanced supply chain technologies, such as IoT and distributed ledger technology, to ensure complete traceability, combat fraud, and substantiate premium claims, thereby reinforcing brand integrity and consumer confidence in the organic certification process. This focus on transparency is paramount for maintaining the perceived value and market share of organic products in competitive retail environments globally.

Regionally, North America and Europe currently dominate the market share, benefiting from long-established organic farming infrastructure, supportive government policies, and high consumer awareness coupled with strong purchasing power capable of sustaining premium pricing. However, the Asia Pacific region is forecast to exhibit the fastest Compound Annual Growth Rate (CAGR) due to rapid urbanization, increasing Western dietary influence, and a burgeoning middle class in countries like China and India rapidly adopting premium food categories. Regulatory harmonization across economic blocs is streamlining trade, yet localized organic standards still pose integration challenges, leading key market players to tailor their production and certification strategies to specific regional requirements. Investment in cold chain infrastructure in emerging markets is crucial to unlock the full potential of these regions, ensuring product quality and safety across extended distribution networks.

Segment trends reveal that the fluid organic milk segment remains the dominant category by revenue, driven by its routine household consumption. Nonetheless, the organic processed products segment, particularly organic yogurt and specialty cheese, is projected to witness accelerated growth, fueled by innovation in flavor profiles, functional ingredients (probiotics), and convenient packaging formats catering to on-the-go consumption habits. The rising demand for organic infant formula highlights a critical, highly sensitive growth niche, reflecting parental willingness to invest significantly in perceived superior nutrition for their children. Furthermore, segmentation by distribution channel shows e-commerce and specialized organic retail stores are gaining market share, providing consumers with greater choice and accessibility compared to traditional hypermarkets, although mass grocery retail remains the primary channel for volume sales globally.

AI Impact Analysis on Organic Milk Products Market

User questions related to AI's impact frequently center on how technology can enhance traceability, optimize complex organic supply chains, predict demand fluctuations for high-value perishable goods, and improve sustainability auditing processes. Consumers and industry stakeholders are highly interested in AI-driven tools that can guarantee the authenticity of organic certifications, minimizing the risk of fraud, and ensuring that premium price points are justified by verifiable production methods. Key themes emerging from these queries include the potential for AI to optimize resource allocation on organic farms, such as precision feeding and pasture management, and the use of machine learning algorithms for rapid quality control and pathogen detection, ultimately reducing waste and improving overall product safety and shelf stability across the entire organic dairy chain. The expectation is that AI will primarily serve as a trust-enforcement and efficiency-enhancement mechanism within the inherently high-cost organic production model.

- AI enhances supply chain visibility and traceability using machine learning to analyze and verify farm-to-shelf organic certifications.

- Predictive analytics optimizes inventory management and reduces spoilage risk associated with short shelf-life organic fluid milk.

- Precision agriculture techniques utilizing AI improve resource efficiency, such as optimizing organic feed regimens and managing pasture health.

- Automated quality control systems employing computer vision detect contaminants or deviations in organic dairy products during processing.

- AI-powered demand forecasting accurately predicts consumer spikes for seasonal organic products, improving production planning and reducing stockouts.

- Generative AI tools assist in developing highly targeted marketing content focused on the nutritional and ethical benefits of organic milk.

- Robotics and automation, guided by AI, reduce labor costs in complex organic milking and processing environments while maintaining compliance.

- Machine learning models aid in genomic analysis of organic livestock, optimizing breeding for higher yield and disease resistance under organic constraints.

DRO & Impact Forces Of Organic Milk Products Market

The Organic Milk Products Market is primarily driven by escalating consumer health consciousness, particularly regarding the avoidance of synthetic hormones (rBST) and residual antibiotics often utilized in conventional dairy production. This health-centric approach is powerfully bolstered by robust media coverage and consumer education focusing on clean eating and preventative wellness, positioning organic dairy as a safer, more natural, and nutritionally denser alternative for regular household consumption. Concurrently, the significant growth in disposable income across key global economic regions, particularly in affluent pockets of North America, Western Europe, and emerging Asian economies, enables a widening consumer base to comfortably absorb the premium pricing associated with certified organic goods. Strong governmental and non-governmental organization support through subsidies, favorable tax incentives, and stringent, globally recognized labeling standards further incentivizes farmers to undertake the expensive and lengthy transition to organic certification, thereby ensuring a continually expanding and reliable supply chain necessary for sustained market growth. Furthermore, the verifiable environmental benefits derived from mandated organic farming practices, such as improved soil carbon sequestration, reduced water contamination, and demonstrable increases in regional biodiversity, resonate strongly with ethically motivated consumers, fundamentally transforming purchasing decisions into acts of ethical and environmental stewardship.

However, the market faces significant constraining factors, most notably the inherently high production costs associated with rigorous organic farming methods. Compliance with strict organic standards—including requirements for minimum extensive pasture grazing, costly non-GMO organic feed, and limitations on stocking density—inevitably results in significantly lower yields per animal and necessitates substantial upfront capital investment for farm conversion and certification. This structural increase in operational expenditure translates directly into a substantial premium at the retail level compared to conventional milk, a price disparity that acts as a significant barrier to entry for lower and middle-income demographics globally, severely limiting the market's overall potential penetration rate. Furthermore, maintaining the absolute integrity of the highly regulated organic supply chain presents continuous logistical and certification auditing challenges; instances of documented fraud or accidental mislabeling, though statistically infrequent, possess the potential to severely erode foundational consumer trust, which is the cornerstone justifying the organic premium and sustained market demand.

Significant opportunities for strategic market expansion exist in the rapidly developing economies of Asia Pacific and Latin America, where swift urbanization, increasing Western influence, and a rapidly expanding middle class are escalating the demand for premium, high-quality, sustainably sourced, and perceived safer food items. The development and targeted marketing of specialized organic dairy derivatives, such as high-grade organic whey protein targeting the athletic and wellness segment, premium organic lactose-free options, and enhanced organic infant formulas addressing critical demographic needs, offer substantial high-margin growth avenues. The increased adoption of advanced technology for supply chain transparency, specifically leveraging blockchain technology and advanced IoT sensors for verifiable data logging, presents a potent opportunity to effectively alleviate residual consumer skepticism regarding product authenticity, thereby reinforcing brand loyalty and justifying sustained price premiums. Moreover, strategic, large-scale partnerships between dominant global retailers and fragmented small-to-medium-sized organic farms can effectively stabilize supply, optimize distribution logistics, and ultimately make certified organic products more geographically accessible and competitively priced within the premium segment, ensuring robust long-term growth and mitigating localized supply volatility inherent in niche agricultural markets.

Segmentation Analysis

The Organic Milk Products Market is comprehensively segmented based on product type, packaging format, distribution channel, and application, reflecting the diverse consumption habits and purchasing preferences globally. This granular segmentation allows market participants to tailor their offerings, marketing strategies, and distribution networks to effectively capture various high-value consumer niches, moving beyond traditional fluid milk sales into higher-margin processed derivatives. Understanding these segments is critical for manufacturers aiming to optimize their product portfolio, particularly focusing on innovation in products such as organic yogurt and specialty cheese, which show significantly higher growth potential than mature fluid milk segments. Geographical analysis complements segmentation by identifying regions with untapped demand and specific regulatory nuances, driving regionalized production and sourcing strategies to meet localized consumer expectations regarding organic standards and freshness.

- By Product Type:

- Organic Fluid Milk (Whole Milk, Skimmed Milk, Reduced Fat Milk, Flavored Milk)

- Organic Processed Products (Yogurt, Cheese, Butter, Ice Cream, Desserts)

- Organic Dairy Ingredients (Organic Milk Powder, Organic Whey Protein)

- By Packaging Type:

- Cartons

- Bottles (Glass, Plastic)

- Pouches

- Cans

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores (Organic Retail Outlets)

- Online Retail and E-commerce

- By Application:

- Direct Consumption

- Food Service Industry

- Infant Nutrition

- Confectionery and Bakery

Value Chain Analysis For Organic Milk Products Market

The value chain for organic milk products begins with upstream activities heavily focused on certified organic feed production and ethical animal husbandry practices, which fundamentally dictate the final product’s quality and cost structure. Upstream involves rigorous oversight of organic fodder sourcing (must be non-GMO and free from prohibited substances), maintenance of large pasture areas for grazing, and veterinary care strictly adhering to organic guidelines, which prohibits routine use of antibiotics. The initial collection and transportation phase requires dedicated infrastructure to prevent cross-contamination with conventional milk, often necessitating specialized tanker fleets and segregated storage facilities. The integrity of the organic certification body throughout this phase is paramount, as it validates the premium status of the raw material and ensures compliance with often complex multi-national organic standards.

The midstream processing phase involves the conversion of raw organic milk into various end products like fluid milk, yogurt, cheese, and butter. This stage requires significant investment in advanced processing technologies such as ultra-high-temperature (UHT) processing and high-pressure processing (HPP) to enhance shelf life while minimizing nutritional degradation, all within facilities that often must be certified organic themselves to prevent contamination. Packaging—which includes sustainable and recyclable materials like Tetra Pak cartons and glass bottles—is a crucial step, emphasizing the environmental alignment of the brand. Efficiency in processing, specifically minimizing waste and maximizing yields from expensive organic raw materials, is a key determinant of overall profitability and competitive pricing in the retail market.

Downstream activities center on distribution channels, which are diverse, encompassing direct distribution to specialty organic retailers and large-scale indirect distribution through national and international supermarket chains, hypermarkets, and increasingly, specialized e-commerce platforms. Direct channels allow for higher margin capture and better brand storytelling, while indirect channels provide the necessary volume reach. Effective cold chain logistics are non-negotiable across both channels to preserve the freshness and safety of perishable organic products. The end-user purchase decision is heavily influenced by retail placement, clear organic labeling, and promotional activities, positioning the product based on ethical sourcing and health benefits, often commanding a premium price point compared to conventional alternatives.

Organic Milk Products Market Potential Customers

The primary customer base for Organic Milk Products is the health-conscious consumer segment, typically comprised of high-income households in developed economies that prioritize wellness, clean eating, and ingredient transparency. These buyers are generally highly educated regarding nutritional benefits and potential environmental impacts of conventional farming and are willing to pay a significant premium for products certified free from hormones, antibiotics, and synthetic pesticides. This core demographic includes parents purchasing organic infant formula and fluid milk, viewing it as a superior nutritional foundation for their children, and older adults focused on preventative health measures and managing specific dietary sensitivities.

Secondary customer groups include environmentally and ethically driven millennials and Gen Z consumers who use their purchasing power to support sustainable and animal-welfare-friendly agricultural practices. This group frequently purchases organic yogurt, processed snacks, and plant-based organic dairy alternatives, driven by a commitment to reducing their ecological footprint. Furthermore, the burgeoning food service industry, including high-end restaurants and health food chains, represents a crucial business-to-business (B2B) customer segment, utilizing organic milk products to meet the increasing clean-label demands of their patrons and differentiate their offerings in a competitive culinary market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 21.5 Billion |

| Market Forecast in 2033 | USD 41.0 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danone S.A., Organic Valley, Arla Foods amba, Royal FrieslandCampina N.V., Lactalis Group, Aurora Organic Dairy, Dairy Farmers of America, Horizon Organic (WhiteWave Foods), Dean Foods Company, Stonyfield Farm, Eden Foods, Inc., Straus Family Creamery, EkoNiva Group, California Farms, Good Health Dairy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Milk Products Market Key Technology Landscape

The technology landscape for the Organic Milk Products market is increasingly sophisticated, focusing heavily on guaranteeing product authenticity, enhancing processing efficiency, and extending the shelf life of highly perishable organic goods without compromising their nutritional integrity. Advanced pasteurization techniques, such as microfiltration and ultra-pasteurization (UP), are widely adopted to achieve longer shelf stability while avoiding excessive heat treatment, a critical consumer expectation in the organic segment. Furthermore, aseptic processing and packaging technologies are essential for organic milk powder and UHT products, enabling extended distribution networks, particularly vital for exporting organic goods to emerging markets with less developed cold chain infrastructure. Investment in high-precision sensory analysis and laboratory testing equipment is also paramount for validating the absence of contaminants and ensuring compliance with stringent organic residue limits.

Digital technologies play a transformative role in supply chain management, addressing the perennial consumer concern about organic traceability and fraud. The implementation of blockchain technology is gaining traction, providing an immutable, decentralized ledger to record every step of the organic milk journey—from cow’s feed consumption data and pasture time to processing batch records and retail timestamps. This digital transparency is critical for justifying the premium price point and building unbreakable consumer trust. Coupled with blockchain, IoT sensors placed on farms and in distribution vehicles monitor crucial environmental parameters like temperature and humidity in real-time, ensuring optimal handling and preventing temperature excursions that could compromise the organic product quality during transport across vast distances.

On the farming front, sustainable technology is driving efficiencies aligned with organic principles. Specialized feed formulation software utilizes machine learning to create optimized organic diets that maximize cow health and yield within regulatory constraints, minimizing the reliance on external supplements. Robotic milking systems are increasingly employed, allowing cows to be milked on demand while providing continuous data on individual animal health and productivity, enabling proactive management without the use of non-compliant veterinary interventions. Furthermore, advanced water treatment and waste management technologies are crucial for organic farms to meet high environmental standards, transforming manure into valuable organic fertilizer and ensuring responsible water usage, reinforcing the holistic sustainability ethos inherent to the organic milk products value proposition.

Regional Highlights

- North America (United States, Canada, Mexico): Dominates the global market share, driven by high consumer awareness, substantial disposable income, and a strong presence of established organic food retailers. The U.S. acts as the largest consumer base, with state-level policies supporting organic dairy cooperatives and farming innovation. Demand is robust across all segments, particularly for organic fluid milk and yogurt, with significant consumer readiness to pay premium prices for perceived health benefits.

- Europe (Germany, France, UK, Italy, Spain): Represents a mature and highly regulated organic market, characterized by strict EU organic standards (EC 834/2007) and strong government subsidies promoting transition to organic agriculture. Western European nations, especially Germany and France, exhibit high per capita consumption of organic dairy, with a rising focus on grass-fed and regional organic certifications, reflecting deep-rooted ethical and environmental purchasing values among the populace.

- Asia Pacific (China, India, Japan, South Korea): Poised for the fastest growth (highest CAGR) during the forecast period. This rapid expansion is fueled by accelerating urbanization, rising affluence leading to a shift toward premium, imported food items, and increasing concerns over food safety standards in domestic conventional production. China and India are emerging as critical demand centers, particularly for high-quality organic infant formula and milk powder, driving significant investment in localized organic supply chains and foreign imports.

- Latin America (Brazil, Argentina): Exhibits growing potential, primarily led by Brazil and Argentina, which possess substantial agricultural resources conducive to organic dairy farming. Market growth is constrained slightly by economic volatility and lower average consumer purchasing power, but demand is steadily increasing among affluent urban populations seeking healthier, locally sourced organic cheese and fluid milk products.

- Middle East and Africa (MEA): A nascent market segment focusing primarily on imported organic milk products to satisfy the demand from the expatriate community and high-net-worth local consumers in Gulf Cooperation Council (GCC) states. Challenges include climatic limitations for extensive organic grazing and underdeveloped cold chain logistics, making UHT organic milk and milk powder key import categories in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Milk Products Market.- Danone S.A.

- Organic Valley (CROPP Cooperative)

- Arla Foods amba

- Royal FrieslandCampina N.V.

- Lactalis Group

- Aurora Organic Dairy

- Dairy Farmers of America (DFA)

- Horizon Organic (WhiteWave Foods)

- Stonyfield Farm (Lactalis)

- Dean Foods Company (through subsidiaries)

- Straus Family Creamery

- Muller Group

- TINE SA

- EkoNiva Group

- California Farms

- Good Health Dairy

- Shamrock Foods Company

- Nestlé S.A. (via organic branded products)

- The a2 Milk Company (organic segment)

- Yeo Valley Organic

Frequently Asked Questions

Analyze common user questions about the Organic Milk Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the premium price of organic milk products?

The premium price is primarily driven by the significantly higher cost of production, which includes mandatory use of expensive certified organic, non-GMO feed, extensive pasture grazing requirements, lower stocking densities, and the substantial costs associated with continuous certification and rigorous supply chain compliance audits.

How does the organic milk market utilize technology to ensure product authenticity?

Technology ensures authenticity through the deployment of advanced traceability systems, most notably blockchain technology, which provides an immutable, decentralized record of the product’s journey from the certified organic farm to the consumer, verifying compliance at every critical touchpoint.

Which product segment is expected to show the highest growth rate in the organic milk market?

The organic processed products segment, particularly organic yogurt (due to functional health benefits like probiotics) and organic dairy ingredients (like whey protein), is projected to exhibit a faster Compound Annual Growth Rate compared to the more mature organic fluid milk segment.

What are the main environmental benefits associated with organic dairy farming?

Key environmental benefits include enhanced soil health and fertility through rotational grazing and natural fertilizers, reduction of water contamination by eliminating synthetic pesticides and chemical fertilizers, and promotion of regional biodiversity due to diversified farming practices.

Which geographical region is forecast to be the fastest-growing market for organic milk products?

The Asia Pacific (APAC) region is projected to be the fastest-growing market, driven by rapid increases in disposable incomes, accelerating urbanization, growing adoption of Western dietary habits, and heightened consumer concerns regarding general food safety and quality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager