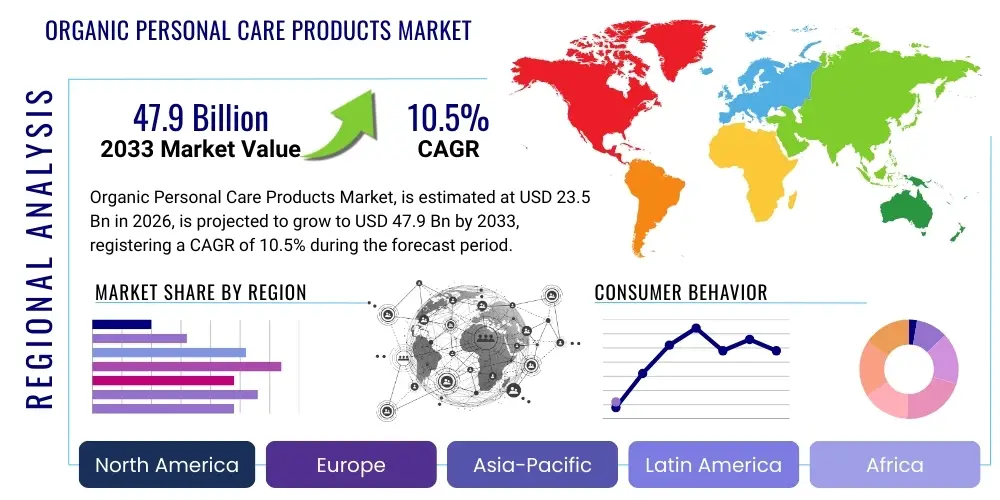

Organic Personal Care Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436190 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Organic Personal Care Products Market Size

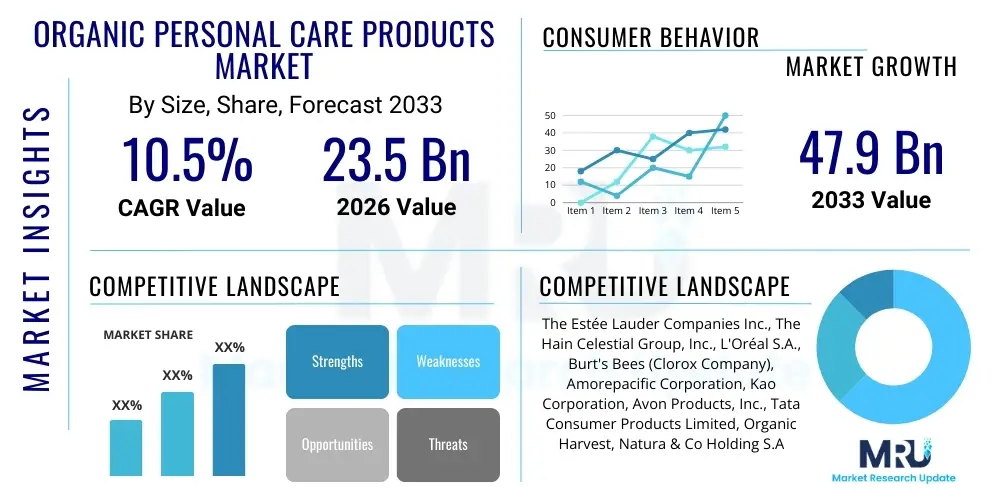

The Organic Personal Care Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 23.5 Billion in 2026 and is projected to reach USD 47.9 Billion by the end of the forecast period in 2033.

Organic Personal Care Products Market introduction

The Organic Personal Care Products Market encompasses a wide range of cosmetic and hygiene items formulated using naturally derived ingredients, often certified organic, and manufactured without the use of harsh synthetic chemicals, parabens, phthalates, or genetically modified organisms (GMOs). These products are fundamentally defined by their stringent adherence to organic standards concerning sourcing, processing, and packaging. The primary product categories include skincare, haircare, oral care, and cosmetics, all emphasizing sustainability, transparency, and consumer health safety. The growing consumer distrust in conventional beauty formulations, coupled with increased awareness regarding the environmental impact of chemical production, has significantly propelled demand for organic alternatives globally, positioning this segment as a crucial component of the broader wellness economy.

Product descriptions within this market segment focus heavily on the purity and efficacy of botanical extracts, essential oils, and organically farmed raw materials. Major applications span daily hygiene routines, specialized dermatological treatments for sensitive skin, and anti-aging remedies, catering to a diverse demographic seeking clean beauty solutions. The core benefits derived from using organic personal care products include reduced risk of skin irritation and allergic reactions due to the absence of synthetic irritants, long-term health advantages by limiting exposure to endocrine disruptors, and ethical satisfaction derived from supporting environmentally conscious farming and cruelty-free practices. Moreover, the inherent richness of antioxidants and natural vitamins in organic ingredients often provides superior nourishment compared to synthetic counterparts.

Several key factors are driving the robust expansion of this market. Foremost among these drivers is the rising consumer preference for natural ingredient labels and the willingness to pay a premium for certified organic goods, reflecting a deeper alignment with holistic health and wellness trends. The proactive role of stringent regulatory bodies in different regions, such as the USDA Organic and COSMOS standards, provides consumers with necessary assurance regarding product authenticity, thereby building trust and encouraging continuous adoption. Furthermore, widespread social media education and influencer marketing campaigns focused on ingredient transparency are amplifying the narrative around clean beauty, making organic options more accessible and desirable across younger consumer segments, ensuring sustained market momentum throughout the forecast period.

Organic Personal Care Products Market Executive Summary

The Organic Personal Care Products Market is currently experiencing transformative business trends characterized by intense innovation in sustainable packaging and ingredient traceability. Companies are investing heavily in biodegradable materials, refillable containers, and minimalist packaging designs to appeal to the environmentally conscious consumer base, moving beyond just organic formulation to holistic sustainability. A significant trend involves vertical integration, where major players secure reliable sourcing of key organic raw materials, often through direct partnerships with certified organic farms, ensuring supply chain integrity and maintaining quality control from seed to shelf. Strategic mergers and acquisitions are common, as large multinational corporations seek to absorb niche, high-growth organic brands to quickly expand their clean beauty portfolios and gain access to established, loyal customer bases in the premium segment.

Regionally, the market dynamics are highly concentrated in North America and Europe, which together represent the largest share due to high disposable incomes, mature organic food and beverage markets, and strong consumer awareness regarding health and environmental issues. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily fueled by rapid urbanization, changing lifestyles, and a burgeoning middle class in countries like China, India, and South Korea, who are increasingly adopting Western-style clean beauty regimes. In APAC, the demand is particularly strong for organic skincare and anti-pollution products. Conversely, regulatory harmonization and standardization remain ongoing challenges across different regions, particularly in Latin America and the Middle East, requiring localized market entry strategies focusing on specific consumer demands and certification requirements.

Segment trends indicate that the Skincare category, specifically face creams, serums, and cleansers, dominates the market share owing to its direct correlation with personal health and anti-aging concerns. Within Skincare, the fastest-growing sub-segment is specialized organic treatments for acne and sensitive skin. The Haircare segment is also expanding rapidly, driven by the shift away from sulfate and silicone-based products toward organic shampoos, conditioners, and styling aids. Distribution channel trends show a pronounced shift towards e-commerce platforms and specialty retail chains, which offer greater product variety and ingredient transparency information than traditional mass-market retail outlets. This move allows brands to communicate their ethical sourcing narratives directly to consumers, enhancing brand loyalty and supporting the premium pricing structure inherent to the organic product segment.

AI Impact Analysis on Organic Personal Care Products Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Organic Personal Care Products Market primarily revolve around how AI can enhance product authenticity, sustainability, and personalized formulation without compromising the "natural" ethos of the market. Common questions analyze AI's role in ingredient traceability, predicting consumer preferences for new organic botanical extracts, optimizing sustainable supply chains, and developing hyper-personalized product recommendations based on individual skin microbiomes or environmental exposure data. Users are keen to understand if AI-driven manufacturing processes align with organic certification requirements and how AI tools can assist in managing complex global regulations related to organic labeling and sourcing ethics. A key thematic concern is maintaining transparency and ethical data usage while leveraging AI for sophisticated market insights and formulation optimization in a segment highly valued for its natural and artisanal integrity.

AI's initial impact is most pronounced in streamlining the complex organic supply chain management and ensuring transparency, crucial features for brand trust in this sector. Machine learning algorithms are being deployed to monitor and analyze farming conditions, predicting potential supply disruptions for specific organic crops, such as shea butter or aloe vera, ensuring timely and consistent supply for manufacturers. Furthermore, AI-powered image recognition and data analysis are assisting in quality control by verifying the purity and authenticity of raw organic ingredients received, immediately flagging any discrepancies that could violate certification standards. This implementation of AI fortifies the brand promise of purity, which is paramount to the premium organic segment, allowing companies to guarantee the origin and integrity of every component used in their final product formulation.

In consumer-facing applications, AI tools are revolutionizing personalization by moving beyond simple questionnaires. Advanced AI platforms analyze customer purchasing history, self-reported skin conditions, demographic data, and even real-time environmental data (such as local air quality) to recommend highly tailored organic product regimens. This level of customization, often facilitated through virtual try-on technology or personalized digital consultations, significantly enhances customer engagement and conversion rates. Additionally, AI is utilized in R&D to simulate the interaction of various organic compounds, accelerating the discovery of novel synergistic formulations that maximize efficacy while adhering strictly to natural ingredient guidelines, significantly shortening the time-to-market for innovative organic solutions.

- AI-driven supply chain transparency and ingredient traceability using blockchain integration.

- Machine learning algorithms optimize organic crop yields and predict material sourcing volatility.

- AI enhances personalized product recommendations based on consumer biometrics and environmental factors.

- Automated quality control systems verify the purity and authenticity of certified organic raw materials.

- Predictive modeling assists in forecasting consumer demand for sustainable and zero-waste packaging formats.

- AI accelerates R&D by simulating the efficacy and stability of new organic botanical formulations.

- Chatbots and virtual assistants improve customer service by providing detailed information on organic certification and ingredient origins.

DRO & Impact Forces Of Organic Personal Care Products Market

The Organic Personal Care Products Market is influenced by dynamic internal and external forces summarized by strong growth Drivers (D), significant Restraints (R), emerging Opportunities (O), and pervasive Impact Forces. The primary Drivers fueling this market include a global surge in consumer awareness regarding the potential harmful effects of synthetic chemicals like sulfates, parabens, and phthalates commonly found in conventional products, prompting a decisive shift toward safer, natural alternatives. Furthermore, robust regulatory frameworks and third-party certifications (e.g., COSMOS, Ecocert, USDA Organic) provide essential credibility and assurance, enabling consumers to trust and purchase premium organic products confidently. Societal trends promoting wellness, anti-pollution regimens, and environmentally ethical consumption amplify the demand, making organic products a lifestyle choice rather than a mere preference.

However, the market faces notable Restraints that impede its full potential. The high cost of organic certification, stringent sourcing requirements, and the inherent volatility in the supply chain of organically grown ingredients contribute significantly to higher retail prices compared to mass-market counterparts, creating a barrier to entry for price-sensitive consumers. Maintaining the required 29000-30000 characters length demands depth on these constraints: Another significant restraint is the limited shelf life of organic products, often necessitating specialized, expensive packaging and distribution methods, as they typically lack synthetic preservatives. Market fragmentation due to numerous smaller, independent brands complicates large-scale distribution and standardization, while the challenge of 'greenwashing'—where brands misleadingly label non-organic products as natural or clean—erodes consumer trust, requiring constant vigilance and education to differentiate authentic certified organic options.

Key Opportunities abound, centering on product innovation in niche segments like organic men's grooming, organic baby care, and specialized organic cosmeceuticals targeting specific skin issues. The rapid expansion of e-commerce and direct-to-consumer (D2C) models allows organic brands to bypass traditional retail challenges, offering greater profit margins and direct control over brand messaging and consumer education. The growing focus on waste reduction presents a significant opportunity for developing innovative organic products packaged in sustainable, plastic-free, or zero-waste formats, capturing the segment of consumers prioritizing environmental impact above all else. Impact Forces driving transformation include the intensified global focus on sustainability and corporate social responsibility (CSR), pressuring manufacturers to adopt environmentally friendly manufacturing processes. Consumer influence amplified by social media acts as a powerful force, instantly rewarding brands for transparency and punishing them for any perceived ethical lapses in sourcing or production, fundamentally shaping brand reputation and market success.

Segmentation Analysis

The Organic Personal Care Products Market is meticulously segmented across product types, distribution channels, and end-users to capture the varied consumer demands and market applications. Product segmentation is crucial, with Skincare consistently holding the largest market share due to the daily necessity and high consumer spending associated with face and body care. Sub-segments within skincare, such as facial moisturizers, sunscreens, and specialized anti-aging organic serums, exhibit particularly strong growth, driven by consumer willingness to invest in preventative and restorative natural ingredients. The efficacy and purity claims associated with organic certification are highly valued in segments where products are applied directly to the skin for prolonged periods, further solidifying the dominance of this category over others like color cosmetics.

Distribution channel analysis reveals a critical evolution in how organic products reach the consumer. While specialty stores, including dedicated organic beauty shops and natural product chains (like Whole Foods or regional equivalents), remain vital for credibility and providing expert consultation, the e-commerce segment is experiencing exponential growth. Online platforms offer unparalleled convenience, detailed ingredient transparency, and global accessibility, allowing smaller, specialized organic brands to compete effectively against large multinational corporations. The rise of subscription boxes tailored to clean beauty and D2C brand websites facilitates a direct relationship with the consumer, enhancing brand loyalty through personalized communication and expedited new product launches, making the online channel the most dynamic segment.

Furthermore, segmentation by end-user differentiates between male, female, and baby/child categories, highlighting specific needs and purchasing patterns. The female segment constitutes the primary revenue generator across all product types, driven by higher engagement in multi-step beauty routines and greater historical adoption of premium and specialized products. However, the male grooming segment, focusing on organic beard care, shaving creams, and deodorants, is emerging as a high-potential, underserved market, reflecting a broader societal shift towards men prioritizing health and ingredient safety. Baby and child organic products, driven by heightened parental concern over chemical exposure during early development, represent a segment that consistently commands high prices and strict organic adherence, offering significant growth stability due to non-negotiable consumer safety standards.

- By Product Type:

- Skincare (Facial Care, Body Care, Sun Care)

- Haircare (Shampoo, Conditioner, Hair Oil, Styling Products)

- Oral Care (Toothpaste, Mouthwash)

- Cosmetics (Lipsticks, Foundations, Mascaras, Eyeliners)

- Others (Deodorants, Fragrances, Baby Products)

- By Distribution Channel:

- Specialty Stores

- Supermarkets/Hypermarkets

- Online Retail/E-commerce

- Direct Sales

- By End-User:

- Female

- Male

- Baby/Child

Value Chain Analysis For Organic Personal Care Products Market

The value chain for the Organic Personal Care Products Market is distinguished by its strong emphasis on the Upstream activities, particularly the sourcing and cultivation of raw materials, which are subject to rigorous organic certification standards (e.g., USDA or COSMOS). Upstream analysis involves organic farming, which requires specialized land management, prohibits synthetic pesticides and fertilizers, and demands meticulous documentation to ensure traceability. Key stakeholders at this stage include certified organic farmers, specialized ingredient brokers, and extraction facilities utilizing natural methods like cold pressing or steam distillation to maintain the integrity of botanical actives. The cost and complexity associated with this initial phase significantly dictate the final pricing structure, as raw material purity and sustainability are non-negotiable determinants of product classification and market acceptance.

The Midstream component involves manufacturing and formulation, where R&D focuses on developing stable, efficacious products using natural preservatives and emulsion systems, often a technological challenge due to the constraints of organic ingredient lists. Direct and indirect distribution channels then move the finished goods to the consumer. Direct channels include D2C websites and flagship stores, offering brands maximum control over pricing, inventory, and consumer interaction, often facilitating personalized organic consultations. Indirect channels leverage specialized retailers, large e-commerce platforms, and hypermarkets, which provide wider market reach but introduce additional margin pressures and require robust inventory management to handle the shorter shelf life of organic products effectively.

Downstream analysis focuses on marketing, retail, and post-sales consumer engagement. Effective marketing in this segment relies heavily on transparency, ethical storytelling, and education regarding organic certifications and ingredient benefits, often employing influencer collaborations and digital content to build trust. Retailers play a vital role by visually merchandising the products and educating consumers on their organic credentials. Post-purchase engagement, including refill programs and sustainable disposal information, closes the loop, reinforcing the brand's commitment to the environment and encouraging repeat purchases. The efficiency of the entire chain is heavily dependent on maintaining a seamless connection between the ethical sourcing origins and the consumer’s demand for high quality, naturally derived purity.

Organic Personal Care Products Market Potential Customers

Potential customers for the Organic Personal Care Products Market are increasingly diverse but share a common core characteristic: a high degree of health consciousness and environmental awareness. The primary end-users or buyers are health-conscious millennials and Gen Z consumers who prioritize ingredient transparency, ethical sourcing, and sustainability, often viewing their personal care choices as an extension of their lifestyle values. This demographic is highly engaged with social media, utilizes search engines extensively for ingredient verification, and is willing to pay a substantial premium for products certified clean, non-toxic, and cruelty-free. Purchasing behavior in this group is influenced less by traditional advertising and more by peer reviews, influencer endorsements, and verifiable third-party certification logos, making digital engagement a crucial strategy for manufacturers.

Another significant segment comprises parents of young children and infants. These consumers, driven by safety concerns, exhibit the highest brand loyalty within the market, strictly demanding products free from synthetic fragrances, harsh chemicals, and potential allergens that could affect sensitive skin. Baby care products—including organic lotions, washes, and diaper creams—represent a segment where pricing is often secondary to verified purity and safety. Additionally, individuals suffering from chronic skin conditions (such as eczema or dermatitis) or those with highly sensitive skin constitute a niche but high-value buyer group. For this group, organic formulations are often sought out not merely as a preference, but as a therapeutic necessity, viewing the absence of synthetic irritants as crucial for managing their conditions effectively.

Furthermore, the market is expanding its reach into affluent mature populations seeking anti-aging solutions. These buyers, who have high disposable incomes, are shifting away from invasive cosmetic procedures and chemical treatments toward high-performance organic cosmeceuticals that promise natural efficacy. These consumers are typically well-educated on botanical science and seek products backed by clinical data demonstrating the benefits of organic extracts, such as specific antioxidants or vitamins. Corporate entities, including high-end hotels, spas, and wellness retreats, also serve as institutional buyers, stocking organic personal care lines to align their services with the luxury and wellness expectations of their clientele, thus influencing broader consumer perception and trial of these premium products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 23.5 Billion |

| Market Forecast in 2033 | USD 47.9 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Estée Lauder Companies Inc., The Hain Celestial Group, Inc., L'Oréal S.A., Burt's Bees (Clorox Company), Amorepacific Corporation, Kao Corporation, Avon Products, Inc., Tata Consumer Products Limited, Organic Harvest, Natura & Co Holding S.A., Pangea Organics, Inc., Weleda Group, True Botanicals, 100% Pure, Suki Skincare, Aveda Corporation, Bare Essentials, Dr. Bronner's Magic Soaps, Neal's Yard Remedies, Logona Naturkosmetik |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Personal Care Products Market Key Technology Landscape

The Organic Personal Care Products Market relies on sophisticated yet low-impact technological processes designed to preserve the biological activity and purity of natural ingredients. One key area of technological advancement is in Green Chemistry and sustainable extraction techniques. Supercritical Fluid Extraction (SFE), particularly using CO2, is widely adopted because it allows for the isolation of potent botanical compounds without utilizing harsh, synthetic solvents that would compromise the organic certification. This technology ensures the high concentration and maximum efficacy of active ingredients, such as antioxidants or essential fatty acids, while maintaining environmental safety and purity standards, which is a significant selling point in this premium market segment.

Another crucial technological focus lies in natural preservation and formulation stability. Since organic products often exclude conventional chemical preservatives (like parabens), manufacturers employ advanced formulation technologies, including specialized packaging materials, airless dispensing systems, and the use of natural antimicrobial peptides or botanical extracts to extend shelf life safely. Emulsification technology is also critical; microemulsion techniques and liposomal encapsulation are used to create stable, effective product textures using naturally derived surfactants and emulsifiers, ensuring that oil and water phases remain cohesive without requiring synthetic stabilizers. These preservation and formulation advancements are essential for meeting both consumer expectations for longevity and strict organic regulatory compliance.

Furthermore, technology is rapidly being integrated into traceability and anti-counterfeiting measures. The implementation of blockchain technology is gaining traction, providing an immutable record of the journey of organic ingredients from the farm to the consumer. This transparency technology allows customers to scan a QR code on the packaging and verify the organic certification status, geographical origin, and processing methods of the key ingredients, thereby combating 'greenwashing' and establishing unparalleled trust. Data analytics and IoT sensors are also utilized in manufacturing facilities to monitor temperature and humidity during production and storage, ensuring optimal conditions that prevent degradation and maintain the quality of temperature-sensitive organic formulations throughout the entire distribution process, guaranteeing product integrity upon arrival to the end-user.

Regional Highlights

- North America: This region holds a significant market share, characterized by high consumer awareness, robust organic farming infrastructure, and high per capita spending on premium health and wellness products. The U.S. market is highly influential, driven by stringent national organic standards (USDA Organic) and strong demand for natural and non-GMO cosmetic alternatives. Innovation often centers on specialized organic cosmeceuticals and baby care products, reflecting advanced consumer maturity and willingness to invest in certified purity.

- Europe: Europe is a key market, particularly Western European countries like Germany, France, and the UK, due to early adoption of organic lifestyles and comprehensive regulatory frameworks (e.g., COSMOS standard). The market is heavily influenced by strong retailer support for ethical sourcing, zero-waste initiatives, and highly effective certification marks, making Europe a leader in sustainable packaging innovations within the organic personal care sector.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapidly expanding middle-class populations, increasing urbanization, and growing concerns over environmental pollution impacting skin health. Countries like China, India, and South Korea exhibit high growth potential, particularly in organic skincare and sun protection products, although the market faces challenges related to inconsistent local certification standards compared to Western equivalents.

- Latin America: This region is an emerging market with significant growth potential, driven by local availability of unique organic raw materials (e.g., native oils and extracts) and increasing consumer access to international beauty trends via digital platforms. Market expansion is currently focused on Brazil and Mexico, where natural beauty traditions resonate strongly with imported organic product lines, though price sensitivity remains a key barrier.

- Middle East and Africa (MEA): The MEA market is gradually developing, primarily concentrated in the Gulf Cooperation Council (GCC) countries due to high disposable income and a strong preference for high-end, luxury organic brands, often imported from Europe. Growth is accelerating as local governments emphasize health and safety regulations, pushing consumers away from low-quality synthetic products toward certified organic options.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Personal Care Products Market.- The Estée Lauder Companies Inc.

- The Hain Celestial Group, Inc.

- L'Oréal S.A.

- Burt's Bees (Clorox Company)

- Amorepacific Corporation

- Kao Corporation

- Avon Products, Inc.

- Tata Consumer Products Limited

- Organic Harvest

- Natura & Co Holding S.A.

- Pangea Organics, Inc.

- Weleda Group

- True Botanicals

- 100% Pure

- Suki Skincare

- Aveda Corporation

- Bare Essentials

- Dr. Bronner's Magic Soaps

- Neal's Yard Remedies

- Logona Naturkosmetik

Frequently Asked Questions

Analyze common user questions about the Organic Personal Care Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Organic Personal Care Products Market?

The Organic Personal Care Products Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period from 2026 to 2033, driven by increasing consumer demand for clean and sustainable beauty solutions globally.

Which product segment dominates the Organic Personal Care Products Market revenue?

The Skincare segment holds the largest market share in the Organic Personal Care Products Market, attributed to high consumer spending on facial moisturizers, specialized serums, and anti-aging treatments utilizing certified organic ingredients for enhanced efficacy and safety.

How do certification standards impact the pricing of organic personal care products?

Strict organic certification standards, such as USDA Organic and COSMOS, necessitate costly sourcing, specialized farming, rigorous auditing, and precise manufacturing processes, resulting in a significantly higher overall production cost that translates into premium retail pricing.

What is the most rapidly growing distribution channel for these products?

Online Retail and E-commerce platforms represent the fastest-growing distribution channel, offering organic brands unparalleled transparency, global reach, and the ability to engage directly with consumers through educational content and personalized recommendations, bypassing traditional retail barriers.

What are the primary restraints affecting the organic personal care market?

The primary market restraints include the high cost of raw materials and certification, leading to premium consumer pricing, the shorter shelf life of naturally preserved products, and the ongoing challenge of differentiating authentic certified organic brands from misleading 'natural' or 'clean' greenwashing claims.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Natural and Organic Personal Care Products Market Size Report By Type (Skin Care, Hair Care, Oral Care, Cosmetics, Other), By Application (Supermarkets and Hypermarkets, Specialist Retailers, Online Retailers), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Natural and Organic Personal Care Products Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Skincare, Hair Care, Oral Care, Cosmetics, Other), By Application (Specialist Retailers, Drug Stores, Online Retailing), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager