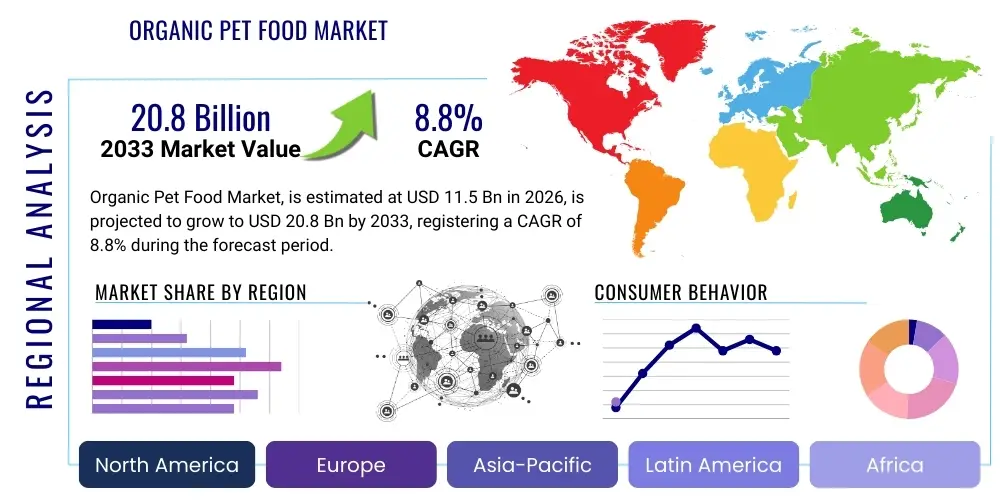

Organic Pet Food Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436252 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Organic Pet Food Market Size

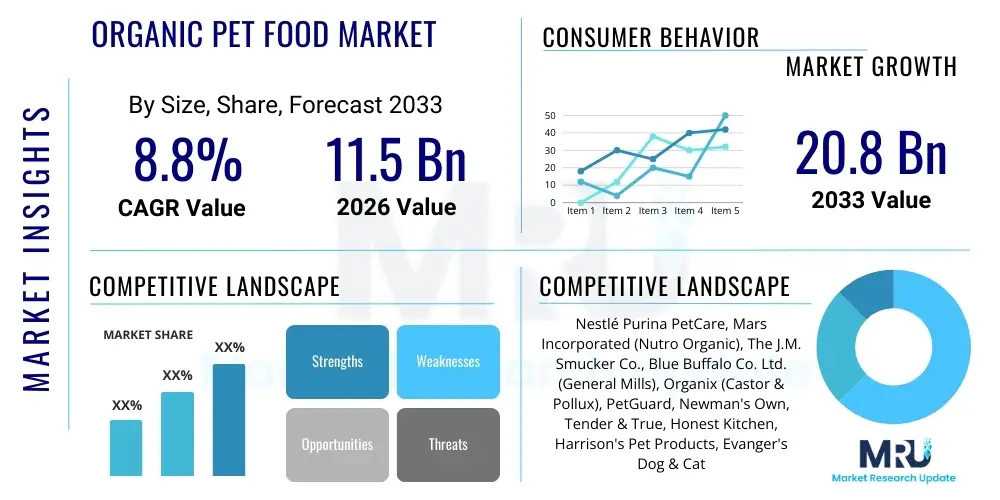

The Organic Pet Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 20.8 Billion by the end of the forecast period in 2033.

Organic Pet Food Market introduction

The Organic Pet Food Market encompasses commercially prepared sustenance for companion animals that adheres strictly to certified organic standards, meaning ingredients are produced without synthetic pesticides, fertilizers, antibiotics, growth hormones, or genetically modified organisms (GMOs). This segment has experienced robust expansion driven primarily by the "humanization" of pets, wherein owners increasingly scrutinize ingredient labels and demand high-quality, traceable, and natural food options mirroring their own dietary preferences. Organic pet food products often span dry kibble, wet food, treats, and raw or frozen formulations, catering to diverse dietary needs across different animal species, particularly dogs and cats.

Major applications of organic pet food extend beyond simple maintenance nutrition, increasingly focusing on addressing specific pet health issues such as allergies, sensitivities, and chronic conditions where clean, unadulterated ingredients are crucial for management and prevention. The product description emphasizes high protein content sourced from organic meats (e.g., chicken, beef, turkey), supplemented by organic grains, vegetables, and fruits, ensuring a holistic, balanced nutritional profile compliant with regulatory bodies like the USDA Organic standard or the EU equivalent. The verifiable sourcing and processing transparency offered by organic certification provide a competitive edge in a market saturated with conventional and "natural" claims.

Key benefits of transitioning to organic pet food include improved digestive health, reduced exposure to artificial additives and toxins, better coat condition, and enhanced overall vitality. Driving factors fueling this market growth include rising disposable incomes in developed economies, increasing awareness among millennials and Gen Z pet owners regarding sustainable and ethical consumption, and mounting scientific evidence highlighting the detrimental effects of conventional feed ingredients. Furthermore, the strong influence of veterinarian recommendations and specialized pet retail channels significantly contributes to consumer adoption rates.

Organic Pet Food Market Executive Summary

The Organic Pet Food Market is characterized by significant business trends focusing on vertical integration and innovation in raw material sourcing to mitigate supply chain volatility associated with certified organic ingredients. Leading manufacturers are investing heavily in advanced traceability systems and specialized formulation software to ensure stringent adherence to purity standards and regulatory compliance across diverse geographical jurisdictions. The business landscape is highly competitive, marked by frequent mergers, acquisitions, and strategic partnerships, particularly between established conventional pet food conglomerates and smaller, agile organic specialists seeking to scale production and expand distribution reach. Premiumization remains a central theme, as consumers are willing to pay a substantial premium for certified organic assurance, driving higher revenue per unit sold compared to mass-market alternatives.

Regionally, North America, particularly the United States, commands the largest market share, characterized by high pet ownership rates and a well-established culture of spending on premium pet wellness products. Europe follows closely, driven by stringent regulatory frameworks supporting organic certification and strong consumer emphasis on animal welfare and environmental sustainability, particularly in countries like Germany and the UK. The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid urbanization, increasing Western influence on pet ownership practices, and growing middle-class populations in China and India exhibiting greater purchasing power for specialized pet nutrition. Regional manufacturers are adapting product formulations to cater to local pet breeds and specific climate-related health needs.

Segment trends indicate that the Dry Organic Pet Food category continues to dominate sales due to its convenience, longer shelf life, and cost-effectiveness relative to wet or raw formats. However, the Frozen and Raw Organic Pet Food segment is witnessing the most explosive growth, driven by perceived superior nutritional value and minimal processing, appealing strongly to affluent consumers. By animal type, dog food remains the largest segment, yet organic cat food is showing accelerated penetration as feline owners adopt similar wellness and premium diet philosophies. The distribution channel evolution highlights a strong shift towards e-commerce platforms and specialized pet stores, offering greater product variety, detailed ingredient information, and direct-to-consumer relationships, bypassing traditional grocery channels.

AI Impact Analysis on Organic Pet Food Market

User queries regarding AI's influence in the Organic Pet Food Market frequently revolve around optimizing the complex organic supply chain, enhancing precision nutrition formulation, and improving quality assurance protocols. Users are keen to understand how AI can solve the inherent challenges of sourcing organic materials, which often suffer from greater price volatility and limited availability compared to conventional ingredients. Specifically, common concerns center on leveraging AI for predictive analytics to forecast demand fluctuations for highly specialized organic proteins and vegetables, thereby minimizing waste and optimizing inventory management in certified cold-chain logistics. There is also significant interest in AI-driven tools that can analyze vast amounts of genomic and metabolomic data related to pets, allowing for the creation of truly customized, hyper-personalized organic diet plans tailored to individual animal health metrics.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize the organic pet food formulation process. By analyzing real-time data from ingredient suppliers—including soil health data, harvest yields, and certification compliance records—AI systems can select the most nutrient-dense and compliant organic raw materials instantaneously. This capability drastically reduces the time and labor involved in manual quality checks and ensures that every batch meets the highest organic purity standards, a critical factor for maintaining consumer trust and regulatory compliance in this sensitive market niche. Furthermore, AI contributes significantly to brand authenticity by providing verifiable digital footprints for every ingredient.

Beyond formulation, AI tools are transforming consumer engagement and retail strategy. ML models are deployed to analyze purchasing patterns, subscription behavior, and feedback on specialized organic diets, allowing brands to rapidly iterate on product offerings and marketing messages. For instance, AI-powered chatbots and virtual nutritionists can guide potential customers through the complexities of organic certification and help them choose the appropriate organic product type (e.g., grain-free vs. limited ingredient) for their pet’s specific condition, thereby increasing conversion rates and enhancing the overall customer experience in the competitive e-commerce landscape.

- AI-driven supply chain transparency and optimization for volatile organic ingredient sourcing.

- Machine Learning algorithms for hyper-personalized, precision organic nutritional formulation based on pet biometric data.

- Predictive analytics to forecast demand for specialized organic proteins and minimize inventory spoilage.

- Automated quality assurance (QA) utilizing computer vision to detect contaminants or deviations in organic raw materials during processing.

- Enhanced consumer engagement through AI-powered personalized diet recommendation systems and subscription management tools.

DRO & Impact Forces Of Organic Pet Food Market

The Organic Pet Food Market is driven predominantly by the increasing trend of pet humanization, where owners treat pets as family members and are willing to expend significant resources on their health and longevity, prioritizing high-quality, certified organic inputs. Supporting this momentum is a growing body of scientific literature and robust consumer awareness regarding the potential health risks associated with synthetic additives, preservatives, and GMOs found in conventional pet feed, spurring demand for clean-label alternatives. Opportunities are significant in developing specialized therapeutic organic diets catering to common ailments like diabetes, kidney failure, or severe food sensitivities, niches where current offerings are limited, yet demand is high. Furthermore, global expansion, particularly into rapidly growing Asian markets with nascent organic product uptake, presents scalable revenue streams.

However, the market faces considerable restraints, primarily stemming from the substantially higher cost of certified organic raw materials compared to conventional feedstuffs, which translates directly into premium pricing inaccessible to price-sensitive consumer segments. Supply chain limitations pose a continuous challenge, as the infrastructure for large-scale, consistent sourcing, processing, and distribution of certified organic ingredients (especially proteins) is less developed and more prone to external factors like climate change and regulatory scrutiny. The complexity of obtaining and maintaining organic certifications across multiple international regulatory frameworks adds significant operational overhead and acts as a barrier to entry for smaller manufacturers.

The collective impact forces reveal that strong regulatory support for organic standards and high consumer willingness-to-pay are powerful accelerating factors, while cost sensitivity and supply chain fragility exert constant downward pressure. The competitive dynamics necessitate continuous innovation in sustainable and locally sourced organic ingredients to differentiate products and stabilize input costs. Ultimately, the market trajectory will be defined by the successful integration of technology (such as blockchain for traceability) to overcome supply constraints and the ability of brands to effectively communicate the verifiable health benefits of organic products to a skeptical yet highly engaged consumer base, ensuring premium pricing is justified by tangible value.

Segmentation Analysis

The Organic Pet Food Market is comprehensively segmented based on product type, source, animal type, and distribution channel, reflecting the complex and specialized nature of consumer demand within this niche. Product segmentation separates the market into Dry Pet Food, Wet Pet Food, Snacks/Treats, and Raw/Frozen formulations, each addressing different consumption habits and convenience levels, with Dry food historically dominating sales volume but Raw/Frozen exhibiting superior value growth. Source segmentation distinguishes between organic animal sources (meat, poultry, fish) and organic plant sources (grains, vegetables, fruits), which is crucial as consumers increasingly scrutinize the ethics and quality of the primary protein input.

Segmentation by animal type focuses predominantly on dogs and cats, as these two companion animals represent the vast majority of premium pet expenditure globally, although specialized organic feed for smaller animals (e.g., rabbits, hamsters) is emerging. The differentiation in nutritional requirements between canines (often omnivorous) and felines (obligate carnivores) necessitates distinct, highly specific organic formulations. Distribution channel segmentation is critical for market access, dividing sales between specialized pet stores (both physical and online), veterinary clinics, mass merchandisers, and direct-to-consumer (DTC) e-commerce platforms, with the latter experiencing the most rapid structural shift due to convenience and direct communication capabilities.

Understanding these segments allows market participants to tailor their offerings, marketing strategies, and distribution networks effectively. For instance, brands focusing on Raw/Frozen organic products often utilize specialized pet stores and DTC channels that can handle cold-chain logistics, targeting high-income, urban demographics. Conversely, dry organic kibble manufacturers leverage mass retail and large e-commerce platforms for wider reach. The ongoing trend towards personalized nutrition is further driving sub-segmentation based on life stage (puppy/kitten, adult, senior) and specific health requirements (weight management, joint health), all within the stringent confines of organic certification standards.

- By Product Type:

- Dry Pet Food

- Wet Pet Food

- Snacks/Treats

- Raw/Frozen Pet Food

- By Source:

- Organic Animal Source (Meat, Poultry, Fish)

- Organic Plant Source (Grains, Vegetables, Fruits)

- By Animal Type:

- Dogs

- Cats

- Others (Small mammals, Birds)

- By Distribution Channel:

- Specialized Pet Food Stores

- Veterinary Clinics

- Mass Merchandisers

- E-commerce/Online Retail

Value Chain Analysis For Organic Pet Food Market

The value chain for Organic Pet Food begins with the upstream segment, which is highly sensitive and dictates much of the final product cost and market availability. This stage involves the sourcing of certified organic raw materials, including organic farming and ranching operations responsible for organic meats, grains, and vegetables. Compliance with rigorous organic certification bodies (such as USDA or EU regulations) adds significant complexity and cost here, requiring specialized audits and dedicated logistics to prevent cross-contamination with non-organic inputs. Key activities include securing long-term contracts with certified organic suppliers and ensuring robust infrastructure for organic feed handling, processing, and initial preservation before transportation to manufacturing facilities.

The midstream phase involves manufacturing and processing. Direct activities include formulation development, utilizing specialized extrusion, cooking, or freezing techniques appropriate for maintaining the nutritional integrity of organic components. Manufacturers must invest in dedicated processing lines to maintain the organic status of the product, avoiding commingling with conventional ingredients, a critical regulatory requirement. Indirect activities include quality control testing—which is particularly intensive in the organic sector to verify the absence of pesticides, antibiotics, and GMOs—and packaging, which increasingly utilizes sustainable and biodegradable organic-certified materials to align with consumer ethics.

The downstream analysis focuses on distribution and retail. Distribution channels are broadly categorized into direct and indirect methods. Direct distribution involves sales through brand-owned websites and subscription services, offering greater control over customer data and margin realization, often utilized by high-end or niche organic brands. Indirect distribution leverages specialized pet store chains, large e-commerce marketplaces (e.g., Amazon, Chewy), and veterinary clinics. Specialized pet stores are essential as they provide expert advice and cater to the premium segment, while e-commerce channels facilitate broad geographical reach and support the logistical demands of heavy, perishable organic food products, including cold-chain management for raw or frozen formulations.

Organic Pet Food Market Potential Customers

The primary end-users and buyers of organic pet food are educated, affluent pet owners who prioritize the long-term health and wellness of their companion animals, often viewing their pets as integral family members (the 'pet humanization' trend). These customers are typically concentrated in urban and suburban areas of developed economies, falling predominantly within the millennial and Gen X demographics who demonstrate higher environmental and ethical consciousness. Key psychological drivers for this segment include a distrust of industrial farming practices, a strong preference for transparency and clean labels, and a willingness to absorb the substantial price premium associated with certified organic goods.

A significant subset of potential customers includes owners of pets with diagnosed allergies, digestive sensitivities, or chronic illnesses. For these buyers, organic food is not merely a preference but a perceived necessity, viewing the absence of common allergens, synthetics, and unknown chemicals as vital for managing their pet's condition effectively. These customers are heavily influenced by veterinarian recommendations, online health forums, and peer reviews, demonstrating intense brand loyalty once a product proves efficacious for their specific animal's needs. The decision-making process for this group is highly rational and research-driven, focusing on specific organic ingredient purity and nutritional composition over marketing aesthetics.

Furthermore, the market targets early adopters and sustainability-focused consumers who align their purchasing decisions with environmental impact. These buyers often seek brands that demonstrate holistic sustainability, extending beyond ingredient certification to include ethical sourcing, humane animal treatment, and eco-friendly packaging solutions. Marketing efforts toward these potential customers must therefore emphasize verifiable certifications, transparent supply chain narratives (e.g., farm-to-bowl), and documented environmental stewardship programs, satisfying both the wellness and ethical demands of the modern, discerning organic pet food consumer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 20.8 Billion |

| Growth Rate | 8.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé Purina PetCare, Mars Incorporated (Nutro Organic), The J.M. Smucker Co., Blue Buffalo Co. Ltd. (General Mills), Organix (Castor & Pollux), PetGuard, Newman's Own, Tender & True, Honest Kitchen, Harrison's Pet Products, Evanger's Dog & Cat Food, Primal Pet Foods, Darwin's Natural Pet Products, Carna4, Natural Balance, Biologically Appropriate Raw Food (BARF), Benevo, Yarrah Organic Petfood, Halo Pets, V-Dog. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Pet Food Market Key Technology Landscape

The technological landscape in the organic pet food sector is primarily focused on enhancing supply chain integrity, optimizing nutritional precision, and ensuring absolute adherence to purity standards without relying on synthetic processing aids. A cornerstone technology is the implementation of advanced traceability systems, frequently utilizing blockchain technology. Blockchain provides an immutable, transparent record of an ingredient's journey from the certified organic farm to the finished package. This technology is crucial for the organic market because it allows manufacturers to instantly verify the source and handling conditions of every input, providing consumers with the highly demanded level of sourcing transparency and guaranteeing that the product remains isolated from non-organic contaminants throughout the production cycle.

In the manufacturing domain, the focus is on minimal processing techniques that preserve the inherent nutrient content of organic ingredients. Technologies such as high-pressure processing (HPP) are becoming standard, particularly for raw or fresh organic pet food segments, offering a non-thermal pasteurization method that effectively eliminates pathogens while retaining the raw composition and nutritional value sought by organic consumers. Furthermore, sophisticated formulation software is employed, leveraging nutritional databases certified for organic compliance. These tools ensure that the limited palette of permissible organic ingredients is optimally balanced to meet AAFCO (Association of American Feed Control Officials) or FEDIAF (European Pet Food Industry Federation) standards, a complex task given the restrictions on conventional supplements and additives.

Finally, packaging technology plays a pivotal role in maintaining the integrity and shelf life of organic products, especially those formulated without conventional preservatives. Modified Atmosphere Packaging (MAP) and advanced vacuum sealing techniques are essential for preventing oxidation and microbial growth, thereby extending the natural shelf stability of organic wet and dry food. Alongside preservation, there is a substantial technological drive towards sustainable and bio-based packaging solutions derived from organic or recycled sources, aligning the product's ethical sourcing with its environmental footprint, thereby maximizing appeal to the core sustainable consumer demographic.

Regional Highlights

North America maintains its leadership in the Organic Pet Food Market, largely driven by the high per capita pet expenditure, a strong culture of preventative pet health, and the widespread adoption of premium and specialized diets. The U.S. market is characterized by a mature regulatory environment (USDA Organic standard) and powerful distribution networks, including massive specialized online retailers. Consumer awareness regarding the correlation between diet and pet longevity is exceptionally high, fostering continuous demand for organic, limited-ingredient, and therapeutic formulations. Canada also contributes significantly, mirroring U.S. trends but often showing a slightly higher propensity for locally sourced and environmentally responsible brands.

Europe represents the second-largest market, distinguished by strict regional standards regarding organic certification and animal welfare (such as the EU Organic logo), which lend credibility and trust to local producers. Countries like Germany, the UK, and France show high consumption rates, fueled by a general societal trend towards clean eating and ethical sourcing, extending directly to pet nutrition. The European market exhibits a stronger inclination towards raw and fresh organic diets compared to North America, supported by robust regulatory frameworks governing the production and handling of these perishable products. The emphasis here is not just on organic purity but also on the sustainability of the ingredients and the ethical rearing of the organic livestock used for protein sources.

The Asia Pacific (APAC) region is projected as the highest-growth market, undergoing a rapid transformation driven by Westernization of pet ownership and expanding disposable incomes, particularly in urban centers of China, Japan, and South Korea. While the overall volume of organic pet food consumption is currently lower than in the West, the adoption rate is accelerating, often skipping conventional market phases and moving directly to premium, specialized products. Market entry in APAC often requires significant adaptation, including navigating diverse local regulatory requirements and educating nascent consumer bases about the benefits and assurance provided by organic certification, presenting both logistical challenges and immense scale opportunities for global organic brands.

- North America (U.S., Canada): Market leader, high consumer awareness, robust e-commerce channels, and mature regulatory framework favoring premium organic diets.

- Europe (Germany, UK, France): Strong growth driven by strict EU organic standards, high ethical consumer demand, and preference for sustainable sourcing and raw/fresh formulations.

- Asia Pacific (China, Japan, South Korea): Fastest growing region, fueled by rising disposable income, rapid urbanization, and increasing acceptance of specialized, high-quality Western pet nutrition trends.

- Latin America (Brazil, Mexico): Emerging market characterized by increasing pet humanization but challenged by price sensitivity and less developed cold-chain infrastructure for raw organic products.

- Middle East & Africa (MEA): Nascent organic segment, primarily focused on luxury imports catering to expatriate and high-net-worth local populations in key urban hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Pet Food Market.- Nestlé Purina PetCare (Purina Beyond Organic)

- Mars Incorporated (Nutro Organic/Greenies)

- The J.M. Smucker Co. (Natural Balance)

- General Mills (Blue Buffalo Co. Ltd.)

- Organix (Castor & Pollux)

- PetGuard

- Newman's Own

- Tender & True

- The Honest Kitchen

- Harrison's Pet Products

- Evanger's Dog & Cat Food

- Primal Pet Foods

- Darwin's Natural Pet Products

- Carna4

- Halo Pets

- Yarrah Organic Petfood

- Party Animal Pet Food

- Biologically Appropriate Raw Food (BARF)

- Benevo

- V-Dog

Frequently Asked Questions

Analyze common user questions about the Organic Pet Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Organic Pet Food Market?

The Organic Pet Food Market is projected to grow at a robust CAGR of 8.8% between 2026 and 2033, driven by increasing consumer awareness and the ongoing trend of pet humanization globally, which necessitates high-quality, specialized nutrition.

What distinguishes certified organic pet food from natural or conventional products?

Certified organic pet food guarantees that ingredients are produced without synthetic pesticides, fertilizers, antibiotics, growth hormones, or GMOs, adhering to strict third-party standards (e.g., USDA Organic). Natural pet food, conversely, lacks this comprehensive regulatory purity assurance.

Which geographical region dominates the sales volume of organic pet food?

North America, specifically the United States, holds the largest market share due to high consumer willingness to pay for premium pet health products, well-established distribution infrastructure, and a mature consumer base prioritizing clean-label diets for their pets.

How does the high cost of organic ingredients affect market accessibility?

The significantly higher cost of certified organic raw materials is a primary restraint, resulting in premium pricing that limits accessibility primarily to affluent households. This cost necessitates continuous innovation in sourcing and supply chain efficiency to broaden market reach.

What major technological advancement is critical for maintaining supply chain transparency in the organic pet food sector?

Blockchain technology is critical for supply chain integrity, offering immutable, verifiable tracking of organic ingredients from farm to package. This ensures strict purity compliance and meets consumer demand for transparent sourcing narratives regarding certified products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager