Organic Soybean Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434228 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Organic Soybean Market Size

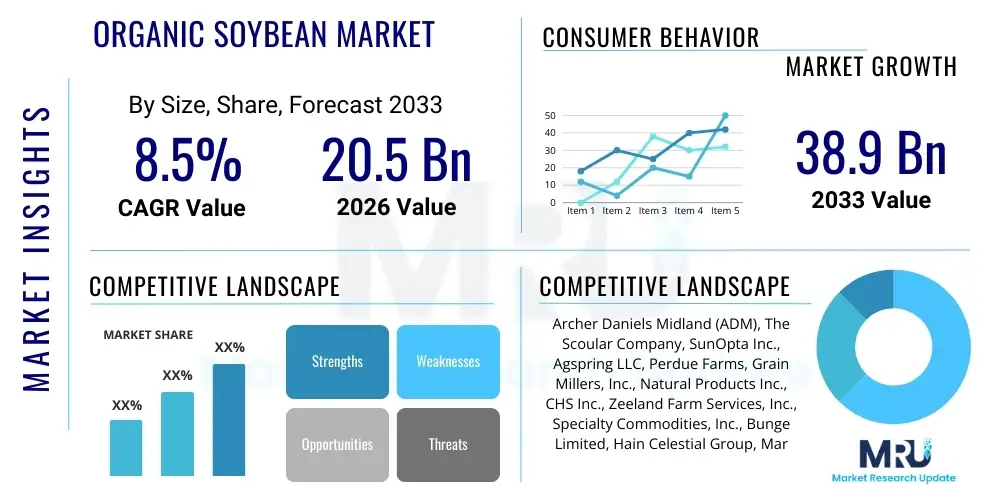

The Organic Soybean Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 20.5 Billion in 2026 and is projected to reach USD 38.9 Billion by the end of the forecast period in 2033. This consistent and robust growth trajectory is primarily fueled by escalating global consumer demand for certified organic food products, stringent regulatory frameworks supporting non-GMO crops, and the expanding utilization of organic soybeans in the rapidly growing plant-based protein sector. The increased adoption of sustainable agricultural practices across major cultivating regions further solidifies this market expansion.

Organic Soybean Market introduction

The Organic Soybean Market encompasses the trade, processing, and consumption of soybeans cultivated without the use of synthetic pesticides, chemical fertilizers, or genetically modified organisms (GMOs), adhering strictly to certified organic standards enforced by governmental or independent certification bodies. Organic soybeans serve as a foundational commodity, integral to both the human food chain and specialized animal feed sectors, distinguishing themselves through enhanced traceability and perceived health benefits. The cultivation process typically involves advanced rotation techniques, natural pest control, and sustainable soil management, ensuring a lower environmental footprint compared to conventional counterparts. Global demand dynamics are intricately linked to rising affluence and heightened awareness concerning food provenance and safety.

Major applications of organic soybeans span across various industries, notably in the production of organic soy milk, tofu, tempeh, natto, and diverse textured vegetable proteins (TVP) designed for meat analogues. Furthermore, organic soybean meal is a critical component in the organic livestock and poultry feed industry, where regulations prohibit the use of conventionally grown, potentially GMO feedstuffs. The inherent versatility and high nutritional density of the soybean—rich in protein, fiber, and essential micronutrients—make it an irreplaceable raw material in the burgeoning health and wellness market, especially within vegetarian and vegan diets. The supply chain demands rigorous oversight and separation protocols to maintain certification integrity from farm to consumer.

The market benefits significantly from several intrinsic and extrinsic factors. Intrinsically, organic soybeans are valued for their non-GMO status, aligning with consumer avoidance of genetic modification. Extrinsically, the market is driven by supportive government policies promoting organic agriculture, including subsidies and research grants, alongside compelling consumer preferences toward environmentally friendly and healthier food options. Driving factors also include technological advancements in organic cultivation methods that enhance yield and resilience against pests and diseases, thereby helping to mitigate the inherent challenges associated with organic farming, such as higher operational costs and labor intensity. The commitment to sustainability serves as a powerful market accelerator.

Organic Soybean Market Executive Summary

The Organic Soybean Market exhibits strong expansion potential, primarily driven by shifting demographics, favorable regulatory landscapes in developed economies, and a pervasive trend toward sustainable dietary choices. Business trends indicate a focus on vertical integration among key market players, aiming to secure reliable, certified supply chains and ensure quality control throughout the processing stages. There is also a notable increase in strategic partnerships between organic farmers' cooperatives and major food and beverage corporations seeking stable raw material sources for their organic product lines. Furthermore, innovation is concentrated on developing specialized organic soybean varieties tailored for specific end-use applications, such as high-protein varieties for meat substitute manufacturing, ensuring optimized performance and nutritional profiles.

Regionally, North America and Europe remain the dominant consumption centers, characterized by high disposable incomes and well-established organic certification infrastructures. North America, particularly the United States, drives demand through its mature organic retail sector and proactive consumer base prioritizing clean labels. Europe is distinguished by its rigorous organic standards and high demand for certified organic feed, creating a perpetual supply deficit that necessitates significant imports. Asia Pacific (APAC), led by China and India, is emerging as a critical growth engine. While APAC countries are major global producers, domestic consumption is accelerating due to rapid urbanization, increasing middle-class populations, and governmental support for domestic organic production and consumption policies, signaling future market equilibrium shifts.

Segment trends underscore the prominence of the food application segment, specifically the dairy and meat alternatives sub-segments, which are experiencing exponential growth due to the plant-based revolution. Within the distribution channel, e-commerce platforms and specialized organic retailers are gaining momentum, offering consumers convenient access to certified products and detailed traceability information. In terms of product type, organic non-GMO soybeans, processed into meal and oil, represent the largest volume segment, though the whole bean segment for direct culinary applications is showing accelerated growth. Market participants are heavily investing in ensuring the non-contamination and purity of organic soy seeds and processed derivatives to maintain the premium market positioning, which is critical for sustaining the high price point associated with organic certification.

AI Impact Analysis on Organic Soybean Market

User queries regarding AI's impact on the Organic Soybean Market predominantly revolve around optimizing sustainable farming practices, enhancing supply chain transparency, and ensuring strict organic integrity. Key themes consistently emerging include the utilization of AI for precision organic agriculture, specifically questions about using machine learning to predict pest outbreaks without synthetic interventions, optimizing complex crop rotation schedules, and calculating optimal natural nutrient application rates. Users are also concerned with how AI-driven blockchain solutions can certify the non-GMO status and organic origin of soybeans throughout the global distribution network, thereby mitigating fraud and boosting consumer trust. Expectations focus on AI reducing the high input costs typically associated with organic farming and improving yield predictability, which historically has been a major constraint for organic cultivators, ultimately making organic soybeans more competitive against conventional alternatives.

AI’s role is rapidly evolving from simple data management to complex predictive analytics within the organic agriculture sphere. By analyzing vast datasets related to soil microbiome health, microclimate variations, and historic yield performance, AI algorithms can provide highly localized, actionable insights to organic farmers. This capability allows for proactive resource management, such as precision irrigation based on real-time transpiration rates or targeted biological pest control application only where necessary, significantly conserving water and natural inputs. This paradigm shift toward data-driven organic farming is crucial for scaling production sustainably and efficiently, addressing the challenge of meeting surging global demand while adhering to stringent organic mandates.

Furthermore, the integration of AI within the organic soybean processing and certification ecosystem promises unprecedented levels of supply chain fidelity. Computer vision systems equipped with machine learning are being deployed at processing plants to automatically detect contaminants, non-organic material, or potential cross-contamination with GMO traces, ensuring purity standards are consistently met. This automated quality assurance minimizes reliance on manual checks, speeding up throughput and reducing human error. The combined effect of AI in field management, quality control, and transparent tracking via blockchain facilitates trust building across the value chain, crucial for maintaining the premium pricing structure of certified organic commodities and protecting the brand reputation of organic producers.

- AI-Driven Precision Organic Farming: Optimization of irrigation, natural fertilizer application, and crop rotation schedules using predictive modeling.

- Pest and Disease Prediction: Use of machine learning algorithms analyzing environmental sensors and aerial imagery to anticipate pest outbreaks, enabling timely deployment of organic control measures.

- Enhanced Traceability via Blockchain Integration: AI systems validating and logging organic certification data onto distributed ledger technologies, ensuring immutable proof of origin and non-GMO status.

- Automated Quality Control: Deployment of computer vision and machine learning for rapid, non-destructive testing of soybean batches to detect impurities and assess quality parameters during processing.

- Yield Optimization Modeling: Utilizing complex historical and environmental data to forecast optimal planting and harvesting times, reducing risks associated with weather variability in organic farming.

- Supply Chain Efficiency: AI algorithms streamlining logistics and inventory management for sensitive organic materials, minimizing spoilage and reducing transportation costs.

DRO & Impact Forces Of Organic Soybean Market

The Organic Soybean Market is propelled by powerful drivers centered on consumer health trends and environmental stewardship, while simultaneously facing significant operational and cost-related restraints. The primary driver is the widespread consumer demand for non-GMO, chemical-free food products, particularly in developed markets where health consciousness and awareness of conventional farming side effects are high. This demand is intrinsically linked to governmental support, including favorable policies and financial incentives for transitioning to organic cultivation, which serve as foundational pillars for market expansion. Opportunities largely reside in leveraging advanced agricultural technology for yield improvement and expanding into emerging markets where the organic penetration rate is currently low but rapidly accelerating, particularly for plant-based feed substitutes.

Restraints impose tangible limitations on market growth, most notably the higher production cost associated with organic farming practices, including increased labor requirements, greater reliance on manual weed control, and the typically lower yields compared to conventionally farmed soybeans. This results in premium pricing, which can restrict mass market penetration in price-sensitive economies. Furthermore, the rigorous and lengthy certification process, coupled with the constant threat of cross-contamination from adjacent conventional fields, creates ongoing operational complexity and supply chain vulnerability. Climate variability and extreme weather events pose a disproportionate risk to organic crops, which lack the resilience provided by synthetic chemical buffers, leading to unpredictable supply fluctuations.

The impact forces within this market are substantial, dictating investment strategies and supply chain architecture. The strong force of consumer preference (a social driver) compels manufacturers to prioritize certified organic inputs, effectively translating consumer ethics into commercial mandates. Regulatory environments (a political and economic driver) exert significant influence, as strict organic standards necessitate complex traceability systems, impacting the cost of compliance. The continuous innovation in plant-based food technology (a technological opportunity) creates persistent, escalating demand for high-quality organic soy protein isolates and concentrates. Addressing these forces requires sophisticated risk management strategies focusing on securing reliable organic land and investing in technology that enhances operational resilience and supply chain transparency.

Segmentation Analysis

The Organic Soybean Market is extensively segmented based on Type, Application, and Distribution Channel, reflecting the diverse end-use requirements and consumer purchasing behaviors across the global supply chain. Analyzing these segments provides critical insights into market dynamics, enabling stakeholders to pinpoint high-growth areas and tailor product offerings effectively. The Type segmentation primarily differentiates between organic soybean derivatives such as meal, oil, and whole beans, each catering to distinct industrial demands. Organic soybean meal dominates the volume market due to its indispensable role in the organic animal feed industry, while organic soybean oil is valued for its clean label status in cooking and food processing. The meticulous separation and certification standards applied across all processing stages ensure the integrity of these segments.

Application segmentation reveals the market's primary end-users, broadly divided into Food, Feed, and Industrial applications. The Food segment, encompassing direct human consumption products like soy milk, tofu, and meat alternatives, currently drives the highest value growth due to premium pricing and heightened plant-based dietary trends. The Feed segment remains the largest by volume, mandated by the growth of organic livestock farming globally, which requires certified organic feed ingredients. Industrial applications, although smaller, include the use of organic soy derivatives in biodegradable plastics and specialized lubricants, reflecting the market's expanding reach into sustainable industrial inputs. The robust growth in the food segment is prompting processors to invest heavily in refining technologies to produce high-purity organic isolates and concentrates.

The Distribution Channel segmentation analyzes how organic soybeans and their products reach the end consumer, spanning from direct farmer-to-processor sales to specialized retail networks. This segment is characterized by the need for verifiable documentation and cold chain management for certain processed goods. Traditional distribution methods, including wholesalers and food service providers, remain essential, but modern retail channels—specifically supermarkets, hypermarkets, and the rapidly growing e-commerce platforms—are capturing increasing market share. E-commerce platforms benefit from their ability to provide consumers with detailed information on organic certification, traceability, and farm origin, which is a key differentiator for organic consumers, further supporting the premium price point and enhancing consumer trust in the authenticity of the product.

- By Type:

- Organic Soybean Meal

- Organic Soybean Oil

- Organic Whole Beans

- By Application:

- Food Consumption (Tofu, Soy Milk, Tempeh, Meat Alternatives, Sauces)

- Feed Consumption (Poultry, Swine, Cattle Feed)

- Industrial Uses (Biofuel, Lubricants, Cosmetics)

- By Distribution Channel:

- Direct Sales (Business-to-Business)

- Retail (Supermarkets, Hypermarkets, Specialty Stores)

- E-commerce and Online Retail

Value Chain Analysis For Organic Soybean Market

The Organic Soybean Market value chain is inherently complex due to the stringent requirements for certification and segregation at every stage, demanding enhanced transparency compared to conventional agricultural supply chains. The upstream segment involves seed production and organic farming operations. Upstream analysis focuses on securing certified organic, non-GMO seeds, which is a critical and often challenging bottleneck given the risk of contamination. Organic farmers, the core producers, must adhere to strict rotational and input management practices. Their operational costs are high, and ensuring adequate yield requires specialized knowledge and technology. Farmer cooperatives play a vital role in aggregating produce, guaranteeing certified organic status, and negotiating favorable prices with processors, thereby maximizing farmer profitability and securing consistent supply volumes.

The midstream processing phase includes oil crushing, meal extraction, and further processing into food-grade derivatives like soy protein isolates and concentrates. This stage is crucial for maintaining the organic integrity of the product; processors must implement strict segregation protocols and frequently audit their facilities to prevent co-mingling with conventional or GMO soybeans. Distribution channels, forming the crucial link between processors and end-users, involve both direct and indirect routes. Direct sales are common between large processing facilities and major food manufacturers (B2B), particularly those producing private label organic products. These direct channels allow for customized logistics and supply agreements, ensuring just-in-time delivery of specialized organic ingredients.

Indirect distribution encompasses wholesalers, distributors, and finally, retail outlets, including specialized organic food stores and mainstream supermarkets, which cater directly to the consumer market. Retail channels necessitate robust marketing strategies that highlight the certified organic status and health benefits of the products. Certification bodies and auditing services (e.g., USDA Organic, EU Organic) are interwoven throughout the entire chain, acting as a crucial enabling service that verifies compliance at every step—from the farm’s soil practices to the final packaged product on the shelf. The high value placed on traceability means that logistics providers increasingly need specialized systems capable of documenting and tracking the origin and movement of organic commodities, often utilizing digital ledger technology to ensure immutable records.

Organic Soybean Market Potential Customers

The potential customer base for the Organic Soybean Market is highly diversified, encompassing industrial processors, major food and beverage manufacturers, and specialized feed producers, all unified by their requirement for certified, non-GMO organic ingredients. Primary industrial end-users include producers of plant-based dairy alternatives (such as soy milk and organic soy yogurt), who rely on high-quality organic soy protein to formulate their core products. Similarly, manufacturers specializing in meat analogues (e.g., organic soy burgers, sausages, and ground meat substitutes) represent a rapidly expanding customer segment, driven by global shifts toward flexitarian and vegan diets and their need for pure, high-protein organic input materials.

Another significant customer category is the organic livestock and aquaculture feed industry. Regulatory standards in organic farming strictly mandate the use of certified organic feed for livestock and poultry raised under organic conditions. Consequently, commercial feed mills that service organic farms are major bulk purchasers of organic soybean meal. This segment is characterized by large volume procurement and sensitivity to protein content and sourcing transparency. Furthermore, specialty food manufacturers focusing on fermented products like organic tofu, tempeh, and natto—staples in Asian and health-conscious diets—constitute a foundational and steady customer segment, demanding premium quality, whole organic soybeans.

Finally, the retail and food service sectors function as indirect but crucial potential customers. These buyers, including large supermarket chains, health food stores, and organic restaurants, directly purchase and distribute both raw organic soybeans and value-added organic soy products to the end consumer. Their purchasing decisions are heavily influenced by consumer demand trends, shelf life requirements, and the integrity of the product's organic certification. The rapid expansion of direct-to-consumer organic meal kits and specialized health supplement manufacturers also positions them as emerging, high-value purchasers requiring reliable, traceable organic soy ingredients for their proprietary formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 38.9 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archer Daniels Midland (ADM), The Scoular Company, SunOpta Inc., Agspring LLC, Perdue Farms, Grain Millers, Inc., Natural Products Inc., CHS Inc., Zeeland Farm Services, Inc., Specialty Commodities, Inc., Bunge Limited, Hain Celestial Group, Maro Organics, Stonebridge Ltd., Clarkson Grain Company, Inc., World Food Processing, LLC, Northern Grain and Feed, Louis Dreyfus Company B.V., Midwest Organic Farmers Cooperative, Beidahuang Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Soybean Market Key Technology Landscape

The technology landscape in the Organic Soybean Market is defined by innovations aimed at mitigating the operational difficulties of organic farming while strictly maintaining non-GMO and chemical-free standards. A key area of focus is non-GMO breeding and seed selection technology. Unlike conventional breeding that might employ genetic modification, organic seed technology focuses on classical breeding techniques to select robust, naturally resistant soybean varieties optimized for specific organic environments. Research is heavily invested in improving the inherent resistance of organic seeds to common pests and diseases, thereby reducing yield volatility, which is a significant challenge when synthetic pesticides are prohibited. These technologies ensure genetic purity and high quality, crucial for maintaining premium market pricing and meeting end-user specifications for protein and oil content.

Precision Organic Agriculture represents the next major technological leap. Since organic farming is input-intensive and relies heavily on natural processes, leveraging data and automation is paramount for efficiency. Technologies such as high-resolution satellite imagery, drone-based spectral analysis, and advanced sensor networks are used to monitor soil health, weed density, and plant nutrient uptake in real-time. This data is fed into predictive analytics models (often AI-driven) to precisely guide organic interventions, such as the localized application of organic manure or the mechanical removal of weeds, optimizing resource use and enhancing overall farm productivity without violating organic certifications. Mechanized weeding solutions, including autonomous field robots utilizing computer vision, are becoming critical tools to substitute for manual labor, a major cost component in organic cultivation.

Furthermore, technology focused on supply chain integrity is fundamental to the organic market. Traceability systems, particularly those incorporating blockchain technology, are becoming standard for organic soybeans. These systems create an immutable, transparent ledger recording every movement of the commodity, starting from the certified farm field, through the non-GMO testing facility, the processing plant, and finally to the retail shelf. This level of digital certification combats fraud, ensures consumer confidence in the "organic" label, and facilitates rapid recall management if required. Specialized drying and storage technologies are also employed post-harvest to prevent spoilage and contamination, ensuring the commodity maintains its high quality and premium status throughout the extensive global distribution network.

Regional Highlights

- North America: This region is a major consumer and increasingly, a producer of organic soybeans, driven by highly health-conscious consumers and robust demand for plant-based foods. The United States and Canada feature stringent organic labeling regulations and a mature retail infrastructure that strongly supports organic product sales. High per capita spending on specialty foods, coupled with governmental programs encouraging farmers to transition to organic certification, solidifies North America's position as a high-value market. Demand is particularly strong for high-protein organic soy ingredients used in the booming meat and dairy alternative sectors, often requiring significant imports to meet domestic processing capacity.

- Europe: Europe represents a significant import market for organic soybeans, largely due to its high domestic demand for certified organic animal feed, particularly in countries like Germany, France, and the Netherlands. European Union organic standards are among the strictest globally, dictating a necessity for non-GMO and residue-free sourcing, leading to chronic supply deficits. Regulatory frameworks, such as the EU Farm to Fork Strategy, are actively promoting organic land conversion, but current production lags behind consumption, ensuring the region remains a lucrative destination for global organic soybean exports, focusing heavily on traceable and sustainable sourcing practices.

- Asia Pacific (APAC): APAC is strategically important, serving both as a major global production hub (especially China and India) and a rapidly expanding consumption market. The growth is fueled by rising disposable incomes, urbanization, and increasing health awareness among the middle class, particularly in countries like Japan and South Korea, which have long traditions of soy-based diets. While significant volumes of organic soybeans are used in traditional foods (tofu, soy sauce), the adoption of Western-style organic packaged foods and organic feed is accelerating, positioning APAC for substantial future market growth, driven both by internal demand and export capabilities.

- Latin America: Countries like Brazil and Argentina are pivotal players due to their vast agricultural land and established conventional soybean industry infrastructure. Although the organic segment is smaller than conventional production, there is a growing governmental and agricultural push towards developing certified organic soybean cultivation for export, particularly capitalizing on the unmet demand in Europe and North America. Challenges remain regarding certification costs and maintaining non-GMO purity in regions dominated by conventional, often GMO, soybean production, yet the potential for scalable organic output is immense.

- Middle East and Africa (MEA): The MEA region is characterized by nascent but growing demand for organic products, largely concentrated in the urban centers of the UAE, Saudi Arabia, and South Africa. Market growth is dependent on imported supply chains. Demand is primarily driven by expatriate populations and high-income domestic consumers seeking premium, certified international products. The establishment of localized organic processing and packaging facilities is gradually improving the market penetration, though logistical complexities and high reliance on imports remain core limitations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Soybean Market.- Archer Daniels Midland (ADM)

- The Scoular Company

- SunOpta Inc.

- Agspring LLC

- Perdue Farms

- Grain Millers, Inc.

- Natural Products Inc.

- CHS Inc.

- Zeeland Farm Services, Inc.

- Specialty Commodities, Inc.

- Bunge Limited

- Hain Celestial Group

- Maro Organics

- Stonebridge Ltd.

- Clarkson Grain Company, Inc.

- World Food Processing, LLC

- Northern Grain and Feed

- Louis Dreyfus Company B.V.

- Midwest Organic Farmers Cooperative

- Beidahuang Group

Frequently Asked Questions

Analyze common user questions about the Organic Soybean market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the global Organic Soybean Market?

The market growth is fundamentally driven by surging consumer demand for non-GMO and pesticide-free food products, increased adoption of plant-based diets, and supportive governmental regulations that incentivize certified organic farming practices globally. The necessity for organic feed in the expanding organic livestock sector also provides substantial impetus.

How does the cost structure of organic soybeans compare to conventional soybeans?

Organic soybeans typically command a significant price premium over conventional soybeans due to higher operational expenditures. These increased costs stem from lower overall yields, greater labor intensity required for natural weed and pest control, and the extensive financial and time investment necessary for rigorous organic certification and supply chain segregation protocols.

Which application segment accounts for the highest value share in the Organic Soybean Market?

The Food Consumption application segment currently accounts for the highest value share, driven primarily by the high market price of finished goods such as organic tofu, soy milk, and meat alternatives. While the Feed segment consumes the largest volume, the premium nature and rapid growth of plant-based human food products generate superior revenue for the market.

What role does technology play in ensuring the integrity and traceability of organic soybeans?

Technology is crucial for maintaining organic integrity. Blockchain technology provides immutable, transparent records for tracking soybeans from seed to shelf, verifying non-GMO and organic status. Furthermore, AI-driven precision agriculture techniques optimize organic farming inputs and yield prediction, enhancing efficiency and minimizing the risk of contamination.

Which region is the largest importer of organic soybeans and why?

Europe is the largest net importer of organic soybeans globally. This high import reliance is attributed to the region’s high, mandatory demand for certified organic feed required by its large organic livestock sector, combined with insufficient domestic production capacity to meet the strict European Union organic standards for purity and volume.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager