Organic Soymeal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433637 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Organic Soymeal Market Size

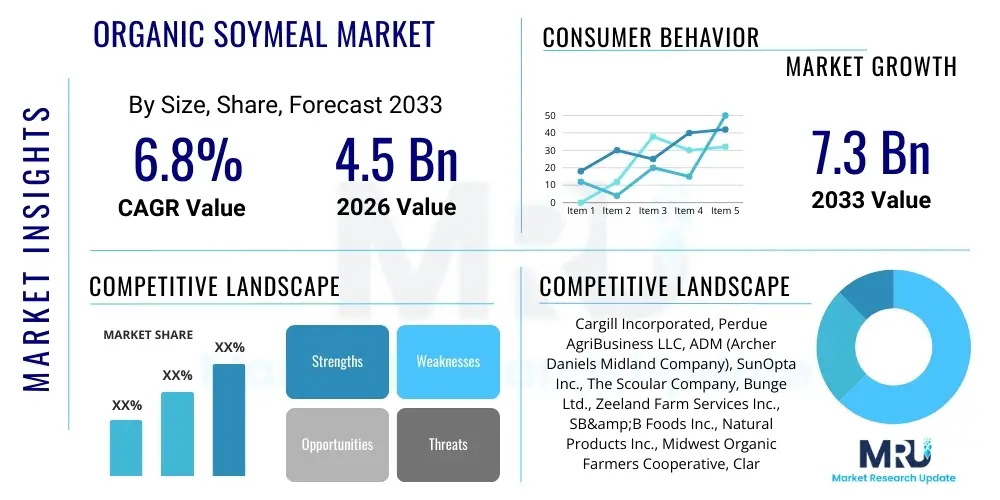

The Organic Soymeal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.3 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global emphasis on sustainable agriculture and the corresponding surge in consumer demand for certified organic meat, dairy, and poultry products. The market expansion is closely tied to the regulatory frameworks in developed economies that mandate or incentivize organic farming practices, ensuring a steady demand for high-quality, organic protein sources like soymeal in animal feed formulations.

Organic Soymeal Market introduction

Organic soymeal is a crucial protein-rich ingredient derived from soybeans grown without the use of synthetic pesticides, chemical fertilizers, or genetically modified organisms (GMOs), adhering strictly to certified organic farming standards. It serves primarily as a foundational protein source in feed for organic livestock, including poultry, swine, cattle, and aquaculture. The production process involves cleaning, dehulling, and crushing organic soybeans, typically using mechanical extraction methods (expeller pressing) to avoid chemical solvents like hexane, which aligns with organic processing requirements. Major applications span across the entire organic animal agriculture sector, providing essential amino acids necessary for optimal animal health and growth performance in certified organic production systems.

The primary benefits of utilizing organic soymeal include enhanced traceability, ensuring non-GMO status, and supporting sustainable, environmentally sound agricultural practices, which appeals to eco-conscious consumers and regulatory bodies. Moreover, it contributes to the premium positioning of end products (organic meat and milk) in highly profitable consumer segments. Key driving factors propelling the market include the rapid expansion of organic livestock populations globally, stringent organic certification requirements necessitating pure feed inputs, and robust growth in the overall organic food and beverage industry, particularly in North America and Europe, where demand for organic protein is consistently high.

Organic Soymeal Market Executive Summary

The Organic Soymeal Market exhibits robust growth driven by escalating global preferences for organic food, translating into increased demand for organic animal feed ingredients. Current business trends indicate a critical focus on securing certified organic raw material supply chains, leading to increased vertical integration among major feed manufacturers and soybean processors aiming to mitigate price volatility and supply risks associated with specialized organic inputs. Segment trends highlight that the poultry segment remains the dominant application area due to the efficiency and high protein requirement of organic poultry farming, while the dairy and aquaculture sectors are demonstrating high potential for future growth. Regional trends confirm that North America and Europe are the largest consumer markets, characterized by established organic infrastructure and high per capita spending on organic products, whereas the Asia Pacific region is rapidly emerging as a critical production and consumption hub, fueled by government initiatives promoting organic agriculture and rising middle-class disposable income.

AI Impact Analysis on Organic Soymeal Market

Analysis of common user questions reveals significant interest concerning how artificial intelligence (AI) and machine learning (ML) technologies might influence the highly regulated and complex supply chain of organic soymeal. Users frequently inquire about AI's potential to enhance traceability from farm to feed mill, optimize resource use in organic soybean farming (e.g., precision weeding and soil health monitoring), and predict market price fluctuations, which are notoriously severe in the organic commodity sector. Key user concerns revolve around the ethical deployment of AI in small-scale organic farming environments and the need for standardized data infrastructure across diverse certification bodies. Expectations center on AI providing predictive analytics for inventory management, ensuring compliance with strict organic standards, and identifying potential fraud or contamination risks within the global supply chain, thereby enhancing consumer trust and operational efficiency.

AI's primary impact is anticipated in optimizing the complex logistics inherent in organic supply chains, where maintaining separation from conventional products is critical. Through advanced sensor data analysis and satellite imagery, AI algorithms can predict yield quality and estimate the availability of certified organic soybeans, allowing crushers and feed manufacturers to plan procurement more effectively. Furthermore, AI-driven solutions are expected to significantly reduce production risks associated with organic farming, such as pest outbreaks or nutrient deficiencies, by offering highly localized and predictive insights, ultimately lowering the premium price volatility of organic soymeal and promoting wider adoption among feed producers.

- AI enhances farm-level precision in organic soybean cultivation, optimizing natural resource use and reducing reliance on manual labor for tasks like organic weed control through robotics.

- Machine learning models improve supply chain transparency and traceability by tracking certified organic status across multiple logistical steps, ensuring regulatory compliance.

- AI-powered predictive analytics offer more accurate forecasting of organic commodity prices, aiding risk management for buyers and sellers in a high-volatility market.

- Utilization of computer vision and AI in feed milling quality control rapidly verifies the purity and composition of organic soymeal, minimizing contamination risks.

- Generative AI tools assist in optimizing feed formulation, ensuring that the necessary nutritional balance is maintained using organic ingredients while minimizing waste.

DRO & Impact Forces Of Organic Soymeal Market

The dynamics of the Organic Soymeal Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping the strategic direction of the industry and exerting significant Impact Forces on market participants. The primary market Driver is the unrelenting growth of the global organic food sector, directly boosting the requirement for certified organic feed proteins, amplified by increasing consumer awareness regarding animal welfare and sustainable sourcing. Conversely, major Restraints include the high cost premium associated with organic certification and production, coupled with the inherent vulnerability of the organic soybean supply chain to weather extremes and limited global certified acreage, contributing to volatile pricing and supply shortages.

Significant Opportunities exist in expanding the use of organic soymeal in burgeoning markets, particularly in organic aquaculture (fish and shrimp farming), which requires high-quality, sustainable protein sources to meet stringent regulatory standards. Furthermore, continuous technological advancements in solvent-free processing methods and seed genetics for higher-yield organic soybeans present opportunities to enhance production efficiency and reduce costs. The key Impact Forces influencing the market structure include strict governmental regulations on organic standards (a powerful external force), the bargaining power of major feed manufacturers (driving procurement strategy), and the strong influence of organic certification bodies (controlling market access and product integrity).

Segmentation Analysis

The Organic Soymeal Market is segmented primarily based on end-use application, product type, and geographical region, reflecting the diverse requirements of the organic livestock and feed industries globally. This market bifurcation allows stakeholders to focus on specialized requirements, such as high-protein content for poultry versus specific fiber requirements for dairy cattle. The segmentation by application reveals critical areas of current consumption dominance and future growth potential, while segmentation by region underscores the maturity and regulatory environment governing organic feed consumption across different continents, facilitating targeted marketing and strategic investment decisions.

The dominant segment remains the application in organic poultry feed, attributed to the immense size of the organic poultry industry globally and the high protein requirement for broiler and layer productivity under organic standards. However, the organic aquaculture segment is projected to exhibit the fastest growth rate, signaling a market shift toward sustainable protein sourcing in fisheries. Furthermore, the segmentation by product type typically focuses on meal forms, such as high-protein soymeal (typically 48% protein) versus standard soymeal (44% protein), driven by specific animal nutritional needs and feed formulation complexity, reflecting the specialized nature of the organic feed industry.

- By Application:

- Organic Poultry Feed

- Organic Swine Feed

- Organic Cattle Feed (Dairy and Beef)

- Organic Aquaculture Feed

- Other Organic Animal Feed (Pet Food, Equine)

- By Product Type:

- High-Protein Organic Soymeal (48% Protein)

- Standard Organic Soymeal (44% Protein)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Organic Soymeal Market

The value chain for the Organic Soymeal Market begins with the Upstream analysis, involving certified organic seed production and organic soybean cultivation, which is highly capital-intensive and regulatory-dependent, requiring strict adherence to land transition periods and non-GMO assurance. Midstream activities encompass the critical steps of organic crushing and processing, where physical extraction methods (expeller pressing) must be utilized to produce the soymeal while strictly avoiding cross-contamination with conventional or chemically treated soybeans. This phase requires specialized, segregated processing infrastructure, adding complexity and cost compared to conventional processing, but ensuring product integrity that is vital for organic certification.

Downstream analysis focuses on the distribution channels and end-use manufacturing, primarily involving specialized organic feed formulators and large-scale integrated livestock operations. The distribution channel is often characterized by shorter, more direct routes or specialized logistics providers due to the high value and need for strict traceability of the organic product. Direct sales often occur between specialized organic crushers and large feed mills, while indirect channels involve specialized organic ingredient distributors who manage smaller volumes for regional organic farms and independent feed mixers, maintaining meticulous records required for audit trails and ensuring the integrity of the 'organic' claim throughout the entire supply chain to the final consumer product.

Organic Soymeal Market Potential Customers

The primary customer base for the Organic Soymeal Market is concentrated within the certified organic livestock farming and feed manufacturing sectors, driven by the necessity to comply with specific regulatory standards requiring organic feed inputs. Key end-users include large-scale integrated organic poultry and egg producers, as poultry requires a high-protein diet for rapid growth and efficient egg production, making soymeal an indispensable ingredient. Organic dairy farms constitute another significant customer group, utilizing soymeal as a supplemental protein source to optimize milk yield and quality, especially during lactation periods, adhering to strict rotational grazing and feed guidelines.

Furthermore, the expanding organic swine industry, particularly in European markets, represents a strong customer segment, utilizing organic soymeal for growing and finishing pigs. The fastest-growing customer segment, however, is the organic aquaculture sector, encompassing farms producing certified organic fish (like salmon and trout) and shrimp, as global regulatory pressure mandates the use of sustainable, organic protein sources in aquatic feed to protect environmental health and ensure consumer safety. Additionally, the premium organic pet food industry is an emerging customer niche, seeking high-quality, traceable protein sources to meet the demands of affluent pet owners focused on natural and organic pet diets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Incorporated, Perdue AgriBusiness LLC, ADM (Archer Daniels Midland Company), SunOpta Inc., The Scoular Company, Bunge Ltd., Zeeland Farm Services Inc., SB&B Foods Inc., Natural Products Inc., Midwest Organic Farmers Cooperative, Clarkson Grain Company, Puris, Organic Partners International, Grain Millers Inc., Northern Lights Organic Grains, Louis Dreyfus Company, AgMotion Inc., Stonebridge Grain, Hensall Co-op, FeedX Organics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Soymeal Market Key Technology Landscape

The technology landscape in the Organic Soymeal Market is distinctively focused on methods that ensure compliance with organic certification standards, primarily emphasizing solvent-free extraction and advanced traceability systems. Since organic standards prohibit the use of chemical solvents like hexane, the market heavily relies on mechanical oil extraction techniques, most notably expeller pressing. Recent technological advancements involve optimizing the efficiency and throughput of these expeller presses, utilizing variable frequency drives and advanced temperature control mechanisms to maximize oil yield while maintaining the nutritional integrity and quality of the residual soymeal, ensuring high palatability and protein digestibility for livestock.

Furthermore, digital technologies are playing an increasingly critical role, particularly in establishing robust traceability platforms. These systems, often leveraging blockchain technology, provide an immutable record of the soybean’s journey, verifying its organic status from the certified farm to the processing facility and finally to the feed manufacturer. This technological implementation addresses major industry concerns regarding fraud and cross-contamination, offering transparency necessary for regulators and trust for end-consumers. Finally, near-infrared (NIR) spectroscopy technology is widely deployed at feed mills to rapidly and accurately analyze the protein content, moisture, and amino acid profile of the delivered organic soymeal, ensuring quality control and precise formulation adjustments.

Regional Highlights

The geographical analysis of the Organic Soymeal Market reveals significant variations in maturity, regulatory influence, and growth potential across major global regions. North America, led by the United States, represents one of the most mature markets, characterized by extensive organic certification infrastructure, high consumer spending on organic products, and established supply chains dominated by large agricultural conglomerates. This region faces increasing pressure to expand domestic organic soybean acreage to meet rising demand and reduce reliance on imports, which currently account for a substantial portion of the organic soymeal supply, leading to high import scrutiny and supply risk management strategies.

Europe stands as the second-largest market, driven by powerful governmental support for organic farming (e.g., the EU’s Farm to Fork strategy) and rigorous animal welfare standards. European demand is robust, especially in Germany, France, and the Netherlands, fueled by strong organic dairy and poultry sectors. However, Europe also exhibits substantial reliance on organic soybean imports, prompting strategic investments in finding alternative, locally sourced organic protein crops to diversify feed portfolios and reduce logistical footprints, which impacts the long-term demand forecast for organic soymeal in this region.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, although starting from a smaller base. Growth is concentrated in countries like China, India, and Australia, propelled by rising awareness of food quality, increasing disposable incomes, and supportive government policies aimed at promoting organic agriculture and food security. While regulatory frameworks are still developing compared to Western counterparts, the sheer potential size of the consumer base, coupled with the rapid industrialization of organic livestock operations, positions APAC as the critical growth engine for organic soymeal consumption in the latter half of the forecast period.

- North America: Dominant market share owing to high consumer acceptance of organic products and established distribution networks; faces challenges related to domestic organic soybean supply shortages.

- Europe: High growth driven by strict EU organic regulations and powerful policy support for sustainable agriculture; emphasis on reducing reliance on external protein sources through localized organic feed crops.

- Asia Pacific (APAC): Expected highest CAGR, fueled by rapid expansion of middle-class consuming high-value organic meat and dairy; emerging production hub focused on export opportunities (e.g., Australia).

- Latin America: Important source region for organic soybean production (e.g., Brazil, Argentina), supplying international markets; domestic consumption growth is moderate but increasing, focusing primarily on cattle and poultry sectors.

- Middle East and Africa (MEA): Emerging market characterized by niche, high-value organic sectors; growth linked to high-end supermarket chains and luxury food imports, relying almost entirely on international trade for supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Soymeal Market.- Cargill Incorporated

- ADM (Archer Daniels Midland Company)

- Perdue AgriBusiness LLC

- SunOpta Inc.

- The Scoular Company

- Bunge Ltd.

- Zeeland Farm Services Inc.

- SB&B Foods Inc.

- Natural Products Inc.

- Midwest Organic Farmers Cooperative

- Clarkson Grain Company

- Puris

- Organic Partners International

- Grain Millers Inc.

- Northern Lights Organic Grains

- Louis Dreyfus Company

- AgMotion Inc.

- Stonebridge Grain

- Hensall Co-op

- FeedX Organics

Frequently Asked Questions

Analyze common user questions about the Organic Soymeal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between organic soymeal and conventional soymeal production?

The core difference lies in regulatory compliance and processing methods. Organic soymeal is derived from soybeans grown without synthetic fertilizers or pesticides, is strictly non-GMO, and must be processed using mechanical (solvent-free) extraction, whereas conventional soymeal typically involves chemical solvents (like hexane) and GMO soybeans.

Which application segment holds the largest share in the Organic Soymeal Market?

The Organic Poultry Feed segment currently commands the largest market share. This dominance is due to the large scale of organic broiler and layer operations globally, which require high volumes of digestible, high-protein feed ingredients like soymeal to meet nutritional standards and efficient growth targets.

What are the main factors driving the high price premium of organic soymeal?

The high price premium is driven by several factors, including the lower yields inherent in organic soybean farming compared to conventional farming, the increased complexity and cost of securing organic certification, the strict supply chain segregation required to prevent contamination, and the mandatory use of specialized, often less efficient, mechanical extraction processes.

How does the global demand for plant-based diets affect the Organic Soymeal industry?

While organic soymeal is primarily used in animal feed, the rising global interest in plant-based ingredients indirectly supports the market by increasing investment and innovation in organic soybean cultivation and processing technologies, which benefits both feed and human consumption sectors, although organic soymeal itself is primarily a feed ingredient.

Which region is expected to demonstrate the highest growth rate for organic soymeal consumption?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly increasing consumer awareness of organic food standards, supportive governmental efforts to localize organic production, and rising disposable incomes fueling demand for premium, certified organic livestock products across countries like China and India.

What role does traceability technology play in the Organic Soymeal supply chain?

Traceability technologies, including blockchain and advanced digital ledger systems, are essential for maintaining market integrity. They provide auditable proof of the product's non-GMO and organic status from the farm to the processor, crucial for meeting stringent organic regulatory requirements and mitigating the high risk of cross-contamination inherent in commodity markets.

Are there significant restraints related to organic certification costs?

Yes, certification costs present a major restraint, particularly for smaller farmers. The expense of the transition period, annual renewal fees, and the meticulous record-keeping required for compliance with multiple international organic standards create substantial financial barriers, limiting the global supply base of certified organic soybeans.

How are key players mitigating supply chain volatility in the organic soymeal market?

Major market players are mitigating volatility primarily through strategic vertical integration, acquiring or partnering with large organic soybean growers and certified crushers. This ensures a stable, dedicated supply of high-quality organic inputs and provides greater control over pricing and processing standards, reducing reliance on fragmented open market sourcing.

What is the impact of climate change on organic soybean yield?

Climate change introduces increased volatility through unpredictable weather patterns, such as severe droughts or excessive rainfall, which disproportionately affect organic yields. Since organic farming relies on natural ecological systems without synthetic chemical buffers, yield stability is more susceptible to climate extremes, thus impacting the consistent supply of organic soymeal feedstock.

Does organic soymeal require specific storage conditions?

Yes, organic soymeal requires strict storage conditions, including maintaining low moisture content and segregation from conventional feed ingredients. Proper storage management is vital to prevent spoilage, mold development, and cross-contamination, ensuring the finished product maintains its organic certification integrity and nutritional value upon delivery to feed manufacturers.

What are the emerging opportunities in organic aquaculture?

The organic aquaculture sector offers significant opportunities as regulatory bodies tighten environmental standards for farmed fish, necessitating the use of certified organic and sustainable feed ingredients. Organic soymeal is well-positioned to serve this market due to its high protein content and non-GMO, traceable status, catering to premium consumer segments in seafood.

What is the general nutritional profile of High-Protein Organic Soymeal?

High-Protein Organic Soymeal typically contains approximately 48% crude protein and boasts a favorable amino acid balance, making it an excellent source of essential amino acids like lysine and methionine, crucial for the healthy development and performance of organic livestock, particularly poultry and swine.

How are advancements in seed genetics influencing the market?

Advancements in organic seed genetics are focusing on developing non-GMO soybean varieties with naturally higher yields, increased disease resistance, and improved protein content specifically tailored for organic cultivation systems. This research aims to address the yield gap between organic and conventional farming, potentially lowering the production costs of organic soymeal in the long term.

Is the use of chemical preservatives permitted in organic soymeal production?

No, the use of synthetic chemical preservatives, colorings, or artificial additives is strictly prohibited under organic certification standards. The focus is on natural methods, such as proper drying and temperature control, to ensure the stability and shelf life of the organic soymeal while maintaining product purity and compliance.

What regulatory frameworks primarily govern the Organic Soymeal Market?

The market is primarily governed by international frameworks such as the USDA National Organic Program (NOP) in the US and the European Union’s Organic Regulation (EC 834/2007). These regulations define the standards for cultivation, processing, handling, and labeling of organic products, ensuring uniformity and consumer trust across major consuming regions.

How does the organic soymeal market address concerns regarding deforestation?

The organic soymeal sector increasingly emphasizes sourcing soybeans from regions certified as deforestation-free. Traceability systems and required land-use history verification within organic certification standards help assure buyers that the feedstock cultivation adheres to sustainable land management practices, addressing global environmental concerns associated with conventional soybean production.

What is the role of technology in ensuring solvent-free extraction compliance?

Technology ensures compliance through advanced mechanical press systems (expeller pressing) that eliminate the need for chemical solvents. Monitoring systems track temperature and pressure throughout the process, providing verifiable data to auditors that chemical extraction methods were entirely avoided, maintaining the organic integrity of the resulting meal.

Which segments are utilizing organic soymeal for specialized nutritional needs?

Organic soymeal is crucial for specialized needs in organic swine and young animal feed, where highly digestible protein and a specific amino acid profile are essential for rapid, healthy growth without relying on prohibited growth promoters. It is also used in high-performance organic dairy rations for protein supplementation.

Are small and medium-sized enterprises (SMEs) prominent in the organic soymeal market?

SMEs play a significant role, especially in the upstream segment (organic farming and regional processing), often forming cooperatives to achieve scale. However, the downstream market (large feed formulation and international trade) is increasingly dominated by large integrated corporations due to the high capital required for processing and strict compliance management.

What is the projected long-term impact of regulatory harmonization efforts?

Long-term regulatory harmonization between major markets (like the US and EU) is expected to significantly reduce trade barriers, simplify certification processes, and lower costs associated with exporting organic soymeal. This will ultimately increase global market liquidity, enhance supply stability, and potentially moderate the high premium pricing.

How is the organic pet food industry influencing soymeal demand?

The premium organic pet food industry represents a niche but rapidly growing demand segment. As consumers prioritize human-grade and organic ingredients for their pets, manufacturers increasingly seek certified organic soymeal as a high-quality, plant-based protein component to comply with stringent organic pet food standards.

What are the primary logistical challenges facing organic soymeal distributors?

Logistical challenges are centered around maintaining strict segregation (identity preservation) throughout transportation and storage to prevent commingling with conventional soybeans. This often requires dedicated, thoroughly cleaned transport units and storage facilities, adding complexity and cost compared to standard commodity logistics.

Does organic soymeal face competition from other organic protein sources?

Yes, organic soymeal faces increasing competition from organic alternatives such as organic sunflower meal, organic canola meal, and organic pulse crops (e.g., peas and beans). This competition is often driven by regional efforts to diversify protein sources and reduce dependency on imported organic soybeans.

What defines the 'Identity Preservation' mandate in this market?

Identity Preservation (IP) is a critical mandate ensuring the genetic purity and organic status of the soybeans are maintained from planting through final processing. It requires detailed documentation, physical segregation of crops and products, and strict cleaning protocols for all equipment to guarantee the traceability and non-GMO, organic claim.

How does the market address consumer skepticism regarding organic labeling?

The market addresses skepticism through enhanced transparency and third-party verification. Utilizing technologies like blockchain for immutable records and undergoing rigorous, frequent audits by internationally recognized certification bodies ensures that the 'organic' claim is trustworthy and verifiable at every stage of the supply chain, bolstering consumer confidence.

What impact does non-GMO verification have on the organic soymeal market?

Non-GMO verification is foundational, as organic certification inherently prohibits GMOs. The increasing consumer demand for non-GMO feed beyond just the organic market further solidifies the strategic advantage of organic soymeal, driving its premium pricing and dedicated supply chains.

What are the current trends in sustainable packaging for organic soymeal?

Current trends emphasize sustainable, recyclable packaging materials that also ensure product integrity and moisture control. Initiatives focus on using bio-based plastics or paper sacks certified for organic materials handling, aligning the packaging with the overall sustainability goals of the organic product.

How do currency fluctuations affect organic soymeal trade?

Since organic soymeal is a globally traded commodity, currency fluctuations significantly impact import costs and export competitiveness. Importers in regions like Europe face higher procurement costs when their local currency weakens against the US dollar, which is the standard trading currency for major agricultural commodities.

What are the key risks associated with sourcing organic soybeans internationally?

Key risks include inconsistent quality standards across different supplier countries, variable enforcement of organic regulations, long shipping times increasing the risk of spoilage, and geopolitical instability in major exporting regions, all contributing to supply chain vulnerability and price surges.

How is innovation in processing leading to improved soymeal quality?

Innovation in processing, particularly in advanced mechanical pressing techniques, focuses on optimizing heat treatment during extraction. This ensures maximum anti-nutritional factors (ANFs) reduction while preserving the lysine and other essential amino acids, resulting in a higher quality, more digestible organic soymeal product for sophisticated feed formulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager