Organic Spirulina Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435015 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Organic Spirulina Powder Market Size

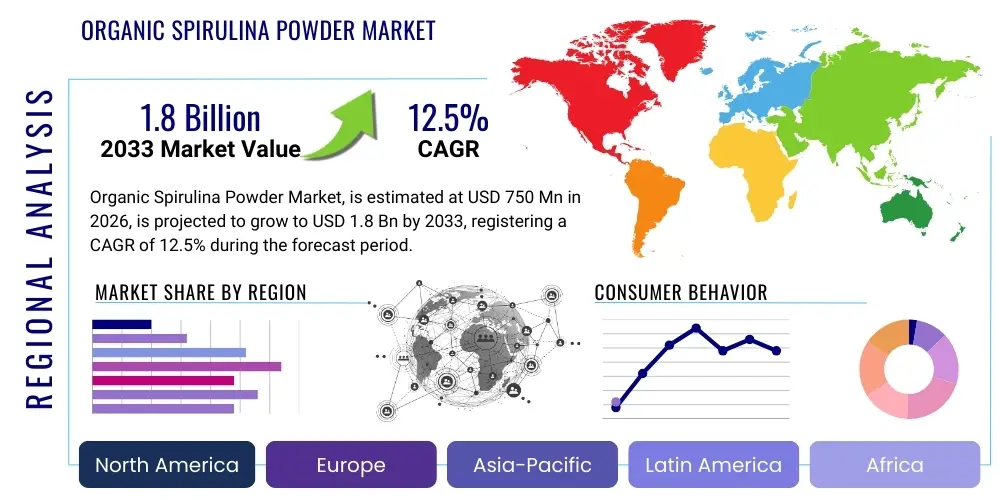

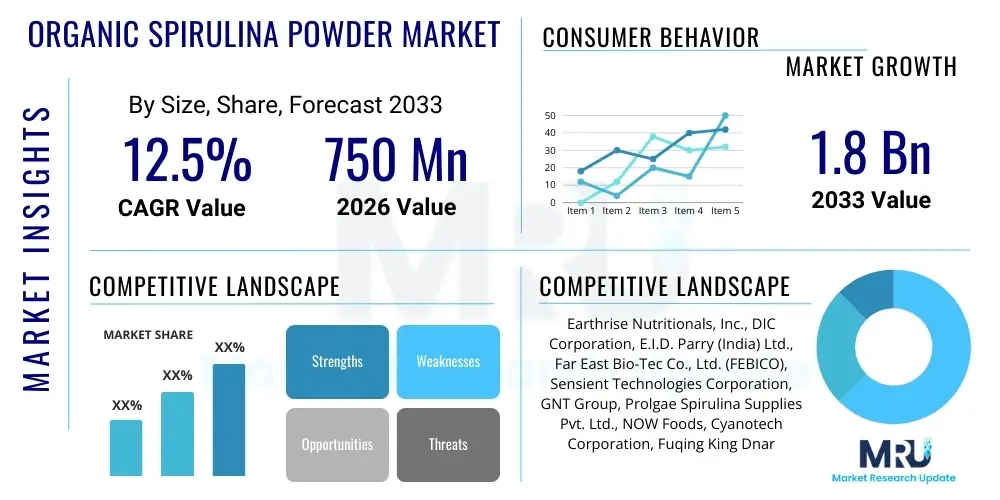

The Organic Spirulina Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1.8 Billion by the end of the forecast period in 2033.

Organic Spirulina Powder Market introduction

The Organic Spirulina Powder Market encompasses the production, distribution, and sale of dried, pulverized biomass derived from the cyanobacterium Arthrospira platensis, cultivated strictly under certified organic standards, adhering to rigorous governmental and international guidelines regarding soil composition, pesticide usage, water quality, and nutrient source purity. This adherence ensures a final product free from synthetic inputs, meeting the growing consumer demand for clean-label superfoods. The core product, organic spirulina powder, is highly valued for its exceptional nutritional density, including high levels of protein (up to 70% by weight), essential amino acids, B vitamins, and powerful antioxidants such as phycocyanin.

Major applications for organic spirulina powder span the functional food and beverage industry, dietary supplements, animal nutrition, and increasingly, the cosmetics sector. In the food sector, it is utilized as a natural colorant, nutritional fortifier in smoothies, protein bars, and functional snacks. The pharmaceutical and nutraceutical industries leverage its immune-boosting and anti-inflammatory properties, integrating it into specialized supplements targeting overall wellness and chronic disease prevention. The robust demand is primarily driven by shifting consumer preferences towards preventative health measures and plant-based protein sources, particularly in developed economies in North America and Europe.

Key benefits driving market growth include spirulina’s documented ability to improve cholesterol levels, boost energy, detoxify heavy metals, and support gut health. The organic certification itself acts as a powerful market differentiator, signaling transparency and sustainability to ethically conscious consumers. Furthermore, ongoing research into spirulina's role in addressing malnutrition, especially in developing regions, further expands its potential market reach. Cultivation advancements, focusing on controlled environment agriculture (CEA) and sustainable water usage, are critical factors supporting the market's trajectory.

Organic Spirulina Powder Market Executive Summary

The Organic Spirulina Powder Market is characterized by robust expansion, fueled primarily by the global shift toward plant-based diets, heightened awareness of functional ingredients, and the premiumization associated with certified organic status. Business trends indicate significant investment in vertical integration, with major players controlling the cultivation process from pond to powder to ensure purity and consistency, crucial for maintaining organic certification credibility. Strategic mergers and acquisitions are observed as companies seek to expand geographical footprint, particularly penetrating the lucrative Asia Pacific market where traditional knowledge of algae-based supplements is high, alongside Western markets demanding rigorous quality control.

Regionally, North America and Europe command the largest market shares due to high disposable income, strong regulatory support for organic labeling, and advanced consumer acceptance of superfoods. However, the Asia Pacific region, led by China and India, is poised to demonstrate the fastest growth rate, driven by increasing health consciousness, domestic production capacity expansion, and government initiatives promoting sustainable aquaculture. This regional dynamic is leading to a dual market structure: high-value, niche organic products dominating Western shelves, and large-scale, cost-effective production scaling up in APAC to meet global bulk demands.

Segmentation trends highlight the dominance of the powder form, preferred for its versatility in blending and formulation within the functional food sector. However, tablets and capsules are gaining traction in the dietary supplement category due to convenience and accurate dosing. End-user analysis shows that Nutraceuticals remain the primary revenue source, though the Food and Beverage segment is rapidly expanding as organic spirulina is integrated into mainstream packaged goods, moving beyond niche health stores. Supply chain integrity and sustainable sourcing are becoming non-negotiable segment requirements, influencing pricing and market positioning significantly.

AI Impact Analysis on Organic Spirulina Powder Market

Common user questions regarding AI's impact on the Organic Spirulina Powder Market often center on optimizing cultivation yield, ensuring organic compliance through advanced monitoring, and enhancing supply chain traceability. Users frequently ask if AI can lower the production cost of certified organic spirulina, which is inherently higher than conventional methods, or how machine learning algorithms can predict and mitigate contamination risks in open pond systems. There is also significant interest in how AI can personalize dosage recommendations based on individual health data and improve consumer transparency regarding sourcing and processing. The key themes revolve around leveraging AI to bridge the gap between high organic production costs and scalable output while maintaining the stringent quality required for premium health products.

The application of Artificial Intelligence and machine learning models is revolutionizing key aspects of organic spirulina production. Specifically, AI-driven sensor technologies are used for real-time monitoring of growth parameters such as temperature, pH, light intensity, and nutrient concentrations within the bioreactors or cultivation ponds. This predictive analytics capability allows producers to dynamically adjust conditions to maximize biomass yield and ensure optimal nutritional profiles, while simultaneously detecting subtle deviations that might compromise the organic certification standards, thereby significantly reducing batch failure rates which are costly in organic production.

Furthermore, AI is instrumental in enhancing the efficiency of the post-harvest process, including filtration, drying, and milling, ensuring the retention of thermosensitive phytonutrients like phycocyanin. In the supply chain, blockchain integrated with AI algorithms provides immutable records of organic certification compliance at every stage, offering unparalleled transparency to consumers and regulators. This enhanced traceability not only builds trust but also acts as a powerful marketing tool, satisfying the AEO demands of consumers seeking authenticated sourcing information. AI-powered inventory management and demand forecasting also help organic producers manage the shorter shelf life and fluctuating global demand for this high-value ingredient.

- AI optimizes organic cultivation parameters (light, pH, nutrients) via real-time sensor data, maximizing yield.

- Machine learning predicts and prevents contamination risks, safeguarding organic integrity and reducing batch losses.

- Blockchain integration with AI provides immutable supply chain traceability, validating organic claims to end-users.

- Automated vision systems enhance quality control during harvesting and drying, preserving nutritional value.

- AI-driven demand forecasting improves inventory management for highly perishable, certified organic products.

DRO & Impact Forces Of Organic Spirulina Powder Market

The Organic Spirulina Powder market dynamics are shaped by a complex interplay of high consumer demand for superior nutritional profiles (Drivers), stringent regulatory hurdles associated with organic certification (Restraints), and immense potential in specialized functional food formulation (Opportunities). These factors collectively exert significant Impact Forces on pricing, market entry barriers, and technological adoption. The fundamental driver remains the escalating global preference for plant-based proteins and functional superfoods, catalyzed by widespread internet access to nutritional information and increasing prevalence of lifestyle-related diseases, prompting consumers to seek preventative health solutions.

Major restraints largely stem from the cultivation challenges inherent to certified organic production. Achieving organic status requires specialized, high-cost inputs, highly controlled, contaminant-free water sources, and often necessitates closed or semi-closed bioreactor systems, driving up capital expenditure compared to conventional open-pond methods. Furthermore, the inherent susceptibility of algae cultivation to environmental changes, coupled with the necessity for highly skilled personnel trained in maintaining organic compliance throughout the lengthy growth and harvesting cycle, creates significant operational barriers to scale and market entry. Regulatory variances across regions regarding what constitutes 'organic' further complicate international trade.

Significant opportunities exist in product diversification, particularly moving beyond simple powders into high-value extracts, such as purified organic phycocyanin, which commands a premium in the nutraceutical and cosmetic industries. Furthermore, the application of organic spirulina in sustainable animal feed for organic aquaculture and poultry presents a nascent but highly promising revenue stream. Strategic partnerships with major food manufacturers to integrate organic spirulina into mainstream products (e.g., pasta, baked goods) offer opportunities for massive volume expansion, capitalizing on the clean-label trend. The core impact force is the power of buyer preference, as consumers are demonstrably willing to pay a premium (often 20-50% higher) for certified organic products, forcing producers to prioritize quality assurance over cost cutting.

- Drivers:

- Surging global demand for plant-based, sustainable protein sources.

- Increasing consumer awareness regarding the immune-boosting and detoxifying properties of spirulina.

- Growing preference for certified clean-label and non-GMO functional ingredients.

- Expanding adoption in the nutraceutical and functional food industries as a natural colorant and fortifier.

- Restraints:

- High cost and complexity associated with maintaining rigorous organic certification standards and avoiding contamination.

- Variability in biomass yield and quality due to sensitivity to climate and environmental factors.

- Challenges in scaling up production while ensuring consistent organic input sourcing.

- Lack of standardized global regulatory frameworks for organic algae products.

- Opportunities:

- Development of premium, high-value derivative products like organic phycocyanin extracts.

- Penetration into emerging markets, especially sustainable animal and aquaculture feed sectors.

- Technological advancements in closed-loop organic cultivation systems (bioreactors) reducing contamination risk.

- Strategic collaborations with major food & beverage corporations for mass market application.

- Impact Forces:

- Bargaining Power of Buyers (High): Driven by high competition and access to detailed product information, pushing producers toward premium quality.

- Bargaining Power of Suppliers (Moderate): Specialized suppliers for organic nutrients and certified input materials maintain moderate leverage.

- Threat of New Entrants (Moderate to High): High capital requirement for organic certification mitigates threat, but technological advancements lower the barrier.

- Threat of Substitutes (High): Competition from other superfoods like chlorella, moringa, and wheatgrass constantly challenges market share.

Segmentation Analysis

The Organic Spirulina Powder Market segmentation is primarily analyzed based on Form, Application, and Distribution Channel, reflecting the diverse routes this superfood takes from cultivation facilities to the final consumer. The granular nature of these segments allows stakeholders to identify high-growth pockets and tailor their marketing and product development strategies effectively. The classification by Form (Powder, Tablet, Capsule) is critical as it dictates the immediate end-use, with powder dominating due to its versatility in blending and bulk processing, while pre-dosed formats like tablets cater to the direct consumer supplement market.

Analysis by Application reveals the maturity and potential of various industrial consumers. The nutraceutical segment currently holds the largest revenue share, leveraging spirulina’s high concentration of bio-active compounds for targeted health supplements. Conversely, the Food and Beverage application segment is poised for the highest growth, driven by product innovation that incorporates organic spirulina into everyday food items, appealing to a broader demographic seeking easy nutritional boosts. The feed segment, although smaller, represents a vital future growth area tied to the organic farming movement.

The distribution channel segmentation highlights the importance of B2B relationships (direct sales to manufacturers) versus B2C models (online retail and pharmacies). The burgeoning e-commerce channel is particularly vital for organic products, as consumers often rely on detailed online information and certifications to justify the premium price point. Understanding these segment dynamics is essential for market players to optimize their logistics, pricing strategies, and certification verification processes, ensuring AEO compliance by making certification status transparent and easily accessible to search engines and users.

- By Form: Powder, Tablets and Capsules, Liquid/Extracts

- By Application: Nutraceuticals, Food and Beverages, Cosmetics and Personal Care, Animal Feed and Aquaculture, Pharmaceuticals

- By Distribution Channel: Direct Sales (B2B), Indirect Sales (Retail, E-commerce, Pharmacies)

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Value Chain Analysis For Organic Spirulina Powder Market

The value chain for organic spirulina powder is uniquely complex, centered on maintaining organic integrity throughout multiple processing stages, making traceability paramount. Upstream analysis involves the procurement of certified organic inputs, specifically the nutrient medium (often consisting of certified organic mineral sources) and highly pure, often geothermal or filtered, water sources. High capital investment in cultivation facilities, whether open pond systems optimized for organic standards or sophisticated closed photobioreactors, characterizes this upstream phase. The stringent requirements for preventing cross-contamination and environmental monitoring significantly increase operational costs compared to conventional spirulina farming.

The midstream process involves meticulous harvesting, washing, and drying techniques, crucial for retaining the nutritional profile, particularly the heat-sensitive components like phycocyanin. Organic certification mandates specific, non-chemical sterilization and drying methods (e.g., low-temperature spray drying or freeze-drying), which requires specialized, energy-intensive equipment. Following drying, the material is milled into powder. Downstream activities include packaging, often requiring specialized, airtight packaging to prevent oxidation, and rigorous quality testing by third-party organic certifiers before distribution. The integrity of the organic label is the primary value-add at this stage.

Distribution channels for organic spirulina powder bifurcate into direct and indirect routes. Direct distribution involves bulk sales (B2B) to large food manufacturers, nutraceutical companies, and major feed producers who then integrate the powder into their final products. Indirect distribution channels primarily cater to the consumer market, utilizing health food stores, pharmacies, specialized organic retail chains, and, most significantly, e-commerce platforms. E-commerce facilitates direct consumer engagement, allowing producers to showcase their organic certification documentation and sustainability efforts, which are key drivers of premium pricing. The chain's resilience is highly dependent on effective cold chain logistics for certain high-value extracts and robust documentation management for audits.

Organic Spirulina Powder Market Potential Customers

The core end-users and buyers of organic spirulina powder are diverse, ranging from large multinational corporations to individual consumers focused on holistic health. The largest consumer segment consists of Nutraceutical Manufacturers, who utilize the powder as a primary ingredient in dietary supplements, specialized health capsules, and functional ingredients targeting specific health outcomes such as immune support, detoxification, and athletic performance. These customers demand high-purity, standardized extracts, and rigorous batch testing verification compliant with cGMP and organic standards.

Another major buying group is the Functional Food and Beverage Industry. This segment integrates organic spirulina into products like protein bars, nutritional drink mixes, ready-to-drink smoothies, and health-focused baked goods, leveraging its natural green/blue colorant properties in addition to its nutritional value. These buyers prioritize solubility, flavor neutrality (or masking capability), and consistent supply volume. The clean-label trend dictates that these buyers must ensure that the organic status of the spirulina is clearly transferable and verifiable to their consumers.

Emerging but highly valuable customer groups include Organic Aquaculture and Animal Feed Manufacturers, who seek sustainable, non-GMO, and organic protein alternatives to traditional soy or fish meal, aiming to improve the health and coloration of farm animals while maintaining their own organic certification. Lastly, the Cosmetics and Personal Care sector represents a niche, premium customer base, utilizing organic spirulina extracts in high-end anti-aging serums, masks, and skin detox products, focusing on its antioxidant strength and anti-inflammatory benefits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1.8 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Earthrise Nutritionals, Inc., DIC Corporation, E.I.D. Parry (India) Ltd., Far East Bio-Tec Co., Ltd. (FEBICO), Sensient Technologies Corporation, GNT Group, Prolgae Spirulina Supplies Pvt. Ltd., NOW Foods, Cyanotech Corporation, Fuqing King Dnarmsa Spirulina Co., Ltd., Dongtai City Spirulina Bio-engineering Co., Ltd., BlueBioTech GmbH, Vimergy LLC, Solgar Inc., Nutrex Hawaii, Inner Mongolia Guanghua Algae Industry Co., Ltd., Tianjin Norland Biotech Co., Ltd., Algene Biotech, Algenol Biofuels Inc., and Algae Health Sciences. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Spirulina Powder Market Key Technology Landscape

The technological landscape of the Organic Spirulina Powder market is defined by continuous innovation focused on overcoming the challenges of contamination and high cost inherent in organic large-scale production. A critical technological evolution is the transition from traditional, large open-pond raceway systems to advanced Closed Photobioreactors (PBRs) and specialized semi-closed systems. PBRs offer a highly controlled environment, minimizing the risk of heavy metal contamination and cross-species intrusion, which is essential for maintaining strict organic purity standards mandated by certifying bodies like USDA Organic and European Union Organic Regulation. These systems optimize light delivery and carbon dioxide exchange, dramatically increasing yield density and consistency.

Furthermore, advancements in separation and harvesting technologies are crucial. Techniques such as membrane filtration and specialized flocculation methods are being refined to ensure efficient harvesting without compromising the organic integrity of the biomass. Given that chemical flocculants are strictly forbidden, companies are investing in natural, food-grade precipitation agents or mechanical harvesting innovations that minimize cell damage and energy usage. Post-harvest processing also relies heavily on specialized drying techniques; while standard spray drying is common, the use of vacuum freeze-drying is increasing for high-value organic phycocyanin extracts, as it better preserves the thermal-sensitive bio-active compounds, justifying a higher market price.

Digital technology integration, particularly the adoption of IoT sensors and AI-driven monitoring systems, is fundamentally changing operational efficiency. These systems provide real-time data on environmental parameters and nutritional content, enabling producers to proactively manage environmental stress and confirm organic compliance through continuous data logging. Furthermore, the implementation of blockchain technology across the supply chain is gaining traction. This technology provides an immutable record of the organic certification status, processing parameters, and geographic origin, fulfilling the modern consumer’s demand for radical transparency and bolstering the credibility of the premium organic positioning. This integration directly supports AEO by providing verifiable trust signals.

Regional Highlights

The global distribution and consumption patterns of Organic Spirulina Powder are highly segmented, primarily driven by consumer wealth, regulatory environment, and regional health trends. North America and Europe currently represent the most lucrative markets, characterized by high consumer awareness regarding superfoods, robust spending power, and sophisticated regulatory frameworks that clearly define and protect the 'organic' label. These regions are primarily demand-driven, relying heavily on imports from cost-effective producing regions in Asia Pacific, while focusing on value-added products like functional beverages and certified organic supplements.

Conversely, the Asia Pacific (APAC) region is pivotal due to its dual role as both a major consumption hub and the dominant global production center. Countries like China, India, and Taiwan possess optimal climatic conditions, advanced microalgae cultivation expertise, and large-scale infrastructure, allowing them to produce bulk organic spirulina powder at relatively competitive costs. The consumption growth in APAC is accelerating rapidly, fueled by rising middle-class disposable income, increasing preference for traditional herbal and natural remedies, and government support for large-scale aquaculture projects aimed at addressing nutritional deficiencies.

Latin America, the Middle East, and Africa (MEA) currently hold smaller market shares but are exhibiting promising growth trajectories. Latin American growth is driven by local initiatives promoting organic farming and increasing exports to North America, particularly from countries like Mexico and Chile. The MEA region's growth is more nascent, tied to increasing urbanization, the proliferation of international retail chains stocking organic health foods, and growing concerns over food security, which spirulina production can partially address through highly efficient nutrient production.

- North America (Dominant Revenue Share):

- High consumer acceptance of dietary supplements and superfoods, underpinned by strong purchasing power.

- Stringent organic certification standards (USDA Organic) create high trust in the product quality.

- Key markets are the U.S. and Canada, focusing on premium, finished functional food products and nutraceutical formulations.

- Strong presence of major market players and dedicated health food retail channels.

- Europe (Second Largest Market, Focus on Sustainability):

- High regulatory emphasis on sustainability, quality, and rigorous EU Organic certification standards.

- Strong consumer demand driven by clean-label movement and anti-GMO sentiments.

- Significant utilization in the natural cosmetics industry and specialized diet formulations (e.g., keto, vegan).

- Germany, France, and the UK are primary consumers, with Italy and Spain developing advanced closed cultivation facilities.

- Asia Pacific (Fastest Growth Rate, Production Hub):

- Largest global producer region, benefiting from favorable climate and large-scale aquaculture expertise (China, India).

- Rapidly expanding domestic consumption driven by rising middle-class income and increasing health awareness.

- Traditional use of algae and seaweed in local diets facilitates easy market acceptance.

- Investment in production technology aims at efficiency and scaling up organic certification adherence.

- Latin America (Emerging Production & Export Base):

- Growing cultivation activities, especially in warm climate zones (e.g., Mexico, Brazil).

- Focus on organic certification primarily to serve lucrative North American and European export markets.

- Domestic consumption rising due to increasing health trends and concerns over obesity and malnutrition.

- Emphasis on sustainable farming practices and local indigenous sourcing credibility.

- Middle East & Africa (Niche but High Potential):

- Market expansion is linked to increasing urbanization and greater exposure to global health trends via imports.

- Potential for local cultivation in regions with abundant sunlight and controlled water sources (e.g., UAE, Israel).

- Demand centered on premium, imported health supplements appealing to high-income consumer segments.

- Security of food supply and sustainable farming initiatives drive long-term interest in local microalgae projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Spirulina Powder Market.- Earthrise Nutritionals, Inc.

- E.I.D. Parry (India) Ltd.

- DIC Corporation

- Far East Bio-Tec Co., Ltd. (FEBICO)

- Sensient Technologies Corporation

- GNT Group

- Prolgae Spirulina Supplies Pvt. Ltd.

- NOW Foods

- Cyanotech Corporation

- Fuqing King Dnarmsa Spirulina Co., Ltd.

- Dongtai City Spirulina Bio-engineering Co., Ltd.

- BlueBioTech GmbH

- Vimergy LLC

- Solgar Inc.

- Nutrex Hawaii

- Inner Mongolia Guanghua Algae Industry Co., Ltd.

- Tianjin Norland Biotech Co., Ltd.

- Algene Biotech

- Algenol Biofuels Inc.

- Algae Health Sciences

Frequently Asked Questions

Analyze common user questions about the Organic Spirulina Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the premium pricing of Organic Spirulina Powder?

The premium pricing is primarily driven by the stringent certification requirements (e.g., USDA Organic, EU Organic). These certifications mandate high-cost, specialized inputs, contaminant-free water sources, and energy-intensive closed/semi-closed cultivation systems to ensure the product is free from pesticides, synthetic fertilizers, and heavy metals, significantly increasing production overhead compared to conventional spirulina.

Which application segment accounts for the highest revenue share in the market?

The Nutraceuticals application segment currently holds the highest revenue share. Spirulina’s dense nutritional profile, particularly its high protein and phycocyanin content, makes it a favored ingredient for targeted dietary supplements aimed at immune support, athletic performance, and general wellness, often sold in convenient tablet or capsule form.

How is AI technology influencing the sustainability of organic spirulina production?

AI improves sustainability by enabling precision farming. Machine learning optimizes cultivation conditions in real-time, reducing waste of nutrient inputs and water, maximizing biomass yield per cycle, and proactively identifying and mitigating contamination, thus minimizing resource expenditure and ensuring reliable organic batch quality.

What are the main regional differences in the Organic Spirulina Powder market?

The main differences lie in market function: Asia Pacific dominates as the primary production hub, focusing on bulk supply and export, while North America and Europe dominate consumption and revenue generation, focusing on high-value, finished products, driven by superior consumer awareness and strong, well-defined organic regulatory frameworks.

What are the major alternatives (substitutes) to Organic Spirulina Powder?

Major substitutes include other highly nutritious superfoods and microalgae like Organic Chlorella Powder, wheatgrass, barley grass, and moringa powder. These alternatives compete directly for market share in the functional food and supplement sectors, posing a constant threat to pricing and market positioning.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager