Organizational Culture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433203 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Organizational Culture Market Size

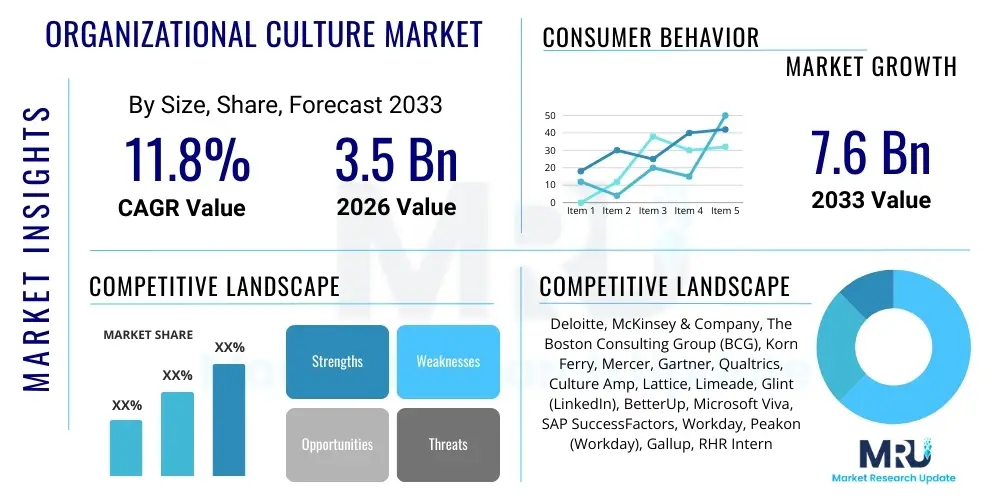

The Organizational Culture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033. This growth trajectory reflects the increasing recognition among global enterprises that robust, positive, and adaptive organizational culture is not merely a soft HR function but a critical driver of business performance, talent retention, and successful transformation initiatives.

Organizational Culture Market introduction

The Organizational Culture Market encompasses a range of specialized consulting services, technological solutions, and training programs designed to assess, define, align, and transform the shared values, beliefs, behaviors, and norms within an organization. Product offerings include comprehensive cultural audits, leadership development focused on cultural stewardship, implementation of internal communication platforms, and development of frameworks for Diversity, Equity, and Inclusion (DE&I) that are intrinsically linked to core organizational values. These services help businesses navigate complexities such as digital transformation, mergers and acquisitions (M&A), and the shift towards permanent remote or hybrid work models, ensuring cultural cohesion remains intact and supports strategic goals.

Major applications of organizational culture interventions span critical business areas, including enhancing employee engagement, reducing voluntary turnover rates, improving decision-making processes, and strengthening brand reputation. Benefits derived from investing in organizational culture are tangible, manifesting as increased productivity, higher profitability, and greater resilience to economic fluctuations. A well-defined culture acts as an internal compass, guiding employees’ autonomous actions in alignment with organizational purpose, thereby fostering innovation and minimizing internal friction that often hampers large-scale projects or change management efforts across multinational corporations and high-growth startups alike.

Key driving factors accelerating the expansion of this market include the global war for talent, which necessitates unique employee value propositions heavily reliant on positive workplace environments; the proliferation of distributed workforces demanding intentional cultural communication and reinforcement; and the rising regulatory and public scrutiny regarding corporate governance and ethical behavior. Furthermore, the growing trend of complex M&A activities mandates culture integration services to prevent value destruction resulting from incompatible workplace norms. Organizations are now viewing culture as a competitive advantage that must be strategically managed and measured, thereby fueling demand for advanced analytical and diagnostic tools provided by market vendors.

Organizational Culture Market Executive Summary

The Organizational Culture Market is characterized by robust business trends centered on the integration of data science and psychology to provide measurable cultural insights, moving away from purely qualitative assessments. Current trends indicate a significant shift towards "Culture as a Service" (CaaS), where subscription models offer continuous monitoring and real-time intervention capabilities, primarily driven by specialized HR technology firms. The demand is heavily skewed towards services addressing hybrid work culture complexities, emphasizing asynchronous communication norms, psychological safety in virtual teams, and ensuring equitable treatment irrespective of location. Consulting remains a crucial segment, focusing on bespoke transformation projects for large enterprises undergoing major shifts, such as ESG integration or large-scale digital overhauls, requiring deep cultural alignment.

Regionally, North America maintains market dominance due to early adoption of advanced HR technologies, the presence of major consulting houses, and a highly competitive labor market driving continuous cultural investment. Europe follows, with growth particularly strong in Western European countries where stringent labor laws and a focus on employee well-being (driven by strong regulatory frameworks) necessitate culturally sensitive strategies. The Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by rapid industrialization, the establishment of regional headquarters for global companies, and a significant need for standardization of cultural practices across diverse, multi-ethnic workforces, particularly in burgeoning economies like India and Southeast Asia.

In terms of segments, the market sees high traction in the technology and financial services sectors, which face acute talent shortages and rapid technological disruption demanding agile organizational structures supported by resilient cultures. Within the service type, predictive cultural analytics, utilizing AI and Natural Language Processing (NLP) to gauge employee sentiment from internal communications, is emerging as a high-growth segment, offering objective metrics previously unavailable. Moreover, the focus is increasingly shifting from mere compliance-driven culture training to deep, pervasive behavioral change management programs targeting senior leadership and middle management as the primary cultural carriers, ensuring sustainability and longevity of cultural initiatives across the corporate hierarchy.

AI Impact Analysis on Organizational Culture Market

Common user questions regarding AI’s impact on organizational culture frequently revolve around themes such as the automation of HR processes leading to dehumanization, the potential for AI algorithms to introduce or reinforce bias, and the use of sophisticated monitoring tools affecting trust and psychological safety. Users are keenly interested in how AI can be leveraged for positive cultural change—specifically, personalized coaching at scale, real-time sentiment analysis for early identification of cultural fractures, and facilitating unbiased resource allocation. The core concern centers on balancing the efficiency gains offered by AI, such as automating feedback loops and measuring engagement metrics, against maintaining the human connection and empathy necessary for a healthy organizational environment. The consensus is that AI will redefine cultural management, shifting the human role from data collection to strategic interpretation and high-touch intervention, demanding new ethical guidelines for automated decision-making related to people management.

AI tools, particularly generative AI and advanced machine learning models, are rapidly becoming integral components of the culture management ecosystem. They allow organizations to move beyond static annual surveys by continuously analyzing vast quantities of unstructured data—including internal communication transcripts, meeting minutes, performance reviews, and employee feedback forms—to generate a comprehensive, real-time index of cultural health. This capability enables predictive modeling, identifying which cultural factors (e.g., communication style, risk tolerance, collaboration patterns) correlate most strongly with key business outcomes like innovation speed or project success rates. This analytical depth moves culture management from subjective interpretation to objective, data-driven strategy, significantly enhancing the credibility and measurability of cultural investments for executive stakeholders.

However, the ethical deployment of AI remains paramount for cultural integrity. If AI-driven monitoring or analysis is perceived by employees as intrusive or opaque, it can severely erode the foundational culture of trust and autonomy that most progressive organizations strive to build. Therefore, market solutions are increasingly focusing on explainable AI (XAI) and ensuring strict data anonymization and privacy protocols. Furthermore, AI is crucial in scaling personalized culture training and DE&I initiatives, by identifying micro-patterns of exclusion or bias in communication and providing individualized, just-in-time feedback to managers, fostering a more inclusive and psychologically safe environment without relying solely on large, standardized, and often ineffective group training sessions.

- AI facilitates real-time cultural diagnostics through sentiment analysis of internal communications.

- Generative AI supports personalized leadership coaching aligned with organizational values at scale.

- Machine learning models predict cultural risks such as impending turnover or low engagement in specific teams.

- Automation of administrative tasks frees up HR staff to focus on high-touch cultural interventions.

- AI aids in identifying and mitigating unconscious bias in performance evaluation and hiring processes, enhancing DE&I objectives.

- New AI governance policies must be established to maintain employee trust and ensure data privacy within cultural monitoring tools.

DRO & Impact Forces Of Organizational Culture Market

The Organizational Culture Market is fundamentally shaped by powerful interconnected forces: the intensifying competition for high-value talent globally (Driver), the inherent complexity and resistance associated with large-scale human behavioral change (Restraint), and the technological opportunity to apply predictive analytics to previously unmeasurable cultural attributes (Opportunity). These factors interact dynamically, forcing organizations to prioritize cultural investment as a strategic necessity rather than an optional expense. The primary impact force driving current expenditures is the sustained, pervasive shift to hybrid and remote work models, which demands continuous, intentional cultural reinforcement to prevent fragmentation and maintain organizational coherence across disparate physical locations and asynchronous work schedules.

Drivers: Key market drivers include the imperative for digital and cultural transformation synergy; the rising importance of Environmental, Social, and Governance (ESG) criteria, where robust ethics and compliance culture is mandatory; and the proven link between positive culture, employee well-being, and superior financial performance. Organizations recognize that successful innovation hinges on a culture that embraces calculated risk-taking and psychological safety, accelerating the adoption of culture frameworks designed to support agility and rapid iteration. Furthermore, increasing globalization and M&A activities necessitate standardized culture integration frameworks to ensure smooth transitions and synergy realization, preventing cultural clashes that derail strategic objectives.

Restraints: Significant restraints impede market growth, most notably the difficulty in demonstrating clear, quantifiable Return on Investment (ROI) for cultural initiatives to skeptical financial leadership. Cultural transformation efforts are often long-term, expensive, and meet with deep-seated institutional resistance from entrenched leadership or managerial layers comfortable with the status quo, slowing implementation speed. Data privacy concerns related to advanced sentiment analysis tools and resistance to intrusive monitoring techniques also pose challenges, potentially undermining the very trust that cultural programs aim to build. The market also suffers from a lack of standardized metrics and definitions, making comparative analysis and objective performance measurement difficult across different consulting providers.

Opportunity: The market presents substantial opportunities in leveraging advanced technologies such as virtual reality (VR) for immersive cultural training simulations, applying blockchain for transparent feedback mechanisms, and integrating culture management tools directly into Enterprise Resource Planning (ERP) and Human Resource Information System (HRIS) platforms. There is a growing niche for ‘Culture-Tech’ solutions focused on specific demographic shifts, such as bridging generational divides (Gen Z vs. Boomers) in the workplace or designing cultures optimized for neurodiversity. Furthermore, the emerging focus on integrating organizational purpose and societal impact into daily operational culture offers new avenues for consulting services aimed at ethical governance and sustainability alignment, tapping into the burgeoning market for conscious capitalism.

Segmentation Analysis

The Organizational Culture Market is primarily segmented based on the type of offering (Services and Software), application across various industry verticals (BFSI, IT & Telecom, Healthcare, Manufacturing), and the size of the organization (SMEs and Large Enterprises). This segmentation allows vendors to tailor their solutions, recognizing that the cultural needs of a large, regulated financial institution differ significantly from those of a fast-growing, agile technology startup. The 'Services' segment currently dominates the market share due to the bespoke nature of cultural transformation requiring expert consultation, change management planning, and high-touch leadership coaching, often spanning 12 to 24 months for complete implementation across global operations.

However, the 'Software/Platform' segment is projected to grow at the highest CAGR, driven by the democratization of culture management tools, including pulse survey platforms, engagement score dashboards, and sophisticated NLP-driven feedback systems that provide managers with actionable, real-time data without the ongoing expense of traditional consulting projects. These platforms are particularly appealing to Small and Medium Enterprises (SMEs) seeking cost-effective, scalable solutions, moving culture monitoring from an annual event to a continuous process. Furthermore, the convergence of HR technology with culture tools is blurring traditional lines, as HRIS providers integrate cultural analytics directly into their core employee lifecycle management suites.

In terms of application, the Information Technology and Telecommunications sector remains a critical consumer, driven by intense competition for highly specialized engineers and the need for cultures that support rapid product development cycles and intellectual property protection. The Healthcare sector is also accelerating adoption, focusing on improving patient safety culture, reducing clinician burnout, and standardizing ethical practices across complex hospital systems. The regulatory environment and the specific demands for empathy, precision, and collaboration define the nuances in cultural solutions required for each major vertical, necessitating industry-specific expertise from market vendors to effectively address inherent organizational challenges.

- By Offering Type:

- Consulting Services (Strategy, Audit, Training, Change Management)

- Software/Platform (Culture Analytics Tools, Pulse Survey Systems, Engagement Platforms, Feedback Management)

- By Deployment Type:

- Cloud-based

- On-premise

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By End-User Industry:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecommunications

- Healthcare and Pharmaceuticals

- Manufacturing and Automotive

- Retail and Consumer Goods

- Government and Public Sector

Value Chain Analysis For Organizational Culture Market

The value chain for the Organizational Culture Market begins with upstream activities focused heavily on intellectual property and knowledge creation. This stage involves psychological research, developing proprietary assessment methodologies (such as specific cultural dimensions or typologies), creating large comparative data sets (benchmarking), and talent acquisition of specialized consultants in organizational development, behavioral economics, and data science. The quality of the upstream research and the expertise of the personnel directly determine the efficacy and credibility of the cultural solutions offered downstream. Investment in R&D for predictive modeling and developing validated, non-biased diagnostic instruments is crucial in this initial phase of the value delivery process, providing the foundational tools necessary for cultural intervention and measurement.

Midstream activities involve the customization, delivery, and implementation of cultural solutions. This includes conducting organizational culture audits (diagnosis), facilitating executive workshops to define desired values, designing specific behavioral training programs, and deploying culture monitoring software platforms integrated within the client’s existing HR technology ecosystem. Distribution channels are varied, incorporating direct sales (large, long-term consulting engagements) and indirect channels, primarily through strategic partnerships with HRIS vendors, specialized technology integrators, and regional training franchises. Effective project management and rigorous change management are critical at this stage, as successful delivery relies entirely on the consultant’s ability to interact effectively with client leadership and gain internal buy-in across all organizational levels for sustainable adoption.

Downstream analysis focuses on impact measurement and continuous cultural maintenance. This involves rigorous evaluation of the cultural transformation effort through quantifiable metrics, such as employee net promoter score (eNPS), turnover reduction, compliance incident rates, and correlation with financial performance indicators. Feedback loops are established to ensure continuous improvement and adaptation of cultural initiatives in response to internal and external changes (e.g., market shifts, new leadership). Long-term value is captured through recurring contracts for maintenance services, annual cultural reviews, and subscription renewals for culture tech platforms. The focus downstream is on demonstrating the sustained ROI, ensuring that the implemented culture becomes institutionalized and self-sustaining, rather than a temporary project that dissipates once the consulting engagement concludes.

Organizational Culture Market Potential Customers

Potential customers for organizational culture solutions span nearly every industry and organization size, although the needs and budgetary constraints vary significantly. Large enterprises, defined as those with over 1,000 employees, represent the most significant segment by revenue. These organizations typically have complex matrix structures, geographically dispersed operations, and often operate in highly regulated environments (e.g., BFSI, Healthcare). Their demand is driven by high-stakes events like post-merger integration, large-scale digital transformation initiatives, or recovery from public cultural failures (e.g., ethical breaches). They require comprehensive, high-cost consulting services capable of handling scale and complexity, along with advanced analytics platforms for continuous, globally consistent monitoring and benchmarking.

The second major customer segment includes Small and Medium Enterprises (SMEs), particularly high-growth technology and consumer goods startups. For these companies, the initial investment in culture is critical for scaling successfully without losing their unique identity or entrepreneurial spirit. Their needs are generally focused on defining core values early, implementing basic engagement tools, and providing foundational leadership training aligned with desired cultural norms. Due to budget constraints, SMEs are primary consumers of scalable, subscription-based Culture-Tech software, favoring ease of deployment and lower upfront capital expenditure over bespoke, large-scale consulting interventions, illustrating a significant opportunity for indirect distribution models.

Specific industries exhibit unique cultural needs that dictate their customer profile. The Banking, Financial Services, and Insurance (BFSI) sector is a major consumer, focusing heavily on risk culture, compliance, and ethical behavior following global financial regulations. The Healthcare sector seeks cultures that enhance patient safety, clinical collaboration, and address chronic issues like burnout among medical staff. Technology companies require cultures optimized for innovation, rapid decision-making, and psychological safety to foster intellectual risk-taking. Government and Public Sector entities increasingly utilize culture services to address efficiency, bureaucratic inertia, and employee motivation, particularly in environments facing staff shortages and demands for enhanced public service delivery and trust.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deloitte, McKinsey & Company, The Boston Consulting Group (BCG), Korn Ferry, Mercer, Gartner, Qualtrics, Culture Amp, Lattice, Limeade, Glint (LinkedIn), BetterUp, Microsoft Viva, SAP SuccessFactors, Workday, Peakon (Workday), Gallup, RHR International, Senn Delaney, PwC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organizational Culture Market Key Technology Landscape

The Organizational Culture Market is undergoing significant technological disruption, moving from static survey tools to dynamic, integrated platforms leveraging cutting-edge analytics. The primary technological advancements center on the convergence of behavioral science with big data processing, specifically utilizing Natural Language Processing (NLP) and Machine Learning (ML). NLP is employed to analyze vast amounts of unstructured text data—including 360-degree feedback, performance narratives, chat communications, and meeting transcripts (with consent and appropriate anonymization)—to detect sentiment, identify communication bottlenecks, and map informal power structures, providing a granular, data-driven assessment of the 'culture in practice' versus the 'stated culture.' This allows organizations to move from reactive interventions to proactive cultural risk management.

Furthermore, the integration of dedicated Culture-Tech platforms with established Human Resource Information Systems (HRIS) like SAP SuccessFactors, Workday, and Microsoft Viva is defining the current landscape. This integration ensures that cultural insights are not siloed but are directly linked to operational metrics such as employee lifecycle data, tenure, performance ratings, and compensation, allowing for sophisticated correlation analysis. For instance, data can reveal if specific cultural dimensions (e.g., risk aversion) are significantly correlated with higher staff turnover in certain departments. The rise of sophisticated dashboarding and visualization tools makes complex cultural data digestible for non-HR executives, embedding culture management into operational decision-making processes across the organization.

Emerging technologies also include the use of Virtual Reality (VR) and Augmented Reality (AR) for immersive training. These technologies facilitate high-impact simulations for ethical decision-making, practicing inclusive behaviors, and experiencing leadership challenges in diverse scenarios, allowing employees to rehearse crucial cultural behaviors in a safe, scalable environment. Additionally, personalized nudging technologies, utilizing AI to send targeted behavioral prompts (nudges) to managers based on their team’s current sentiment data, are becoming commonplace. This enables ‘just-in-time’ cultural reinforcement, ensuring managers are actively promoting desired values daily rather than relying solely on periodic, generalized training sessions, thereby accelerating the sustainability and internalization of cultural change across dispersed global teams.

Regional Highlights

The Organizational Culture Market exhibits strong regional disparities in maturity, adoption drivers, and preferred solution types. North America (U.S. and Canada) holds the largest market share, characterized by high technological penetration, a highly mobile workforce, and fierce competition for skilled labor, particularly in the tech and professional services sectors. Organizations in this region are advanced users of AI-driven culture analytics, prioritizing psychological safety, diversity, and innovation culture to attract and retain top-tier talent. The region benefits from a robust ecosystem of consulting heavyweights and disruptive Culture-Tech startups, driving continuous innovation in measurement methodologies and intervention strategies.

Europe demonstrates significant growth, largely driven by regulatory mandates and a strong societal emphasis on employee well-being, fairness, and governance (ESG). Countries in Western Europe, such as Germany, the UK, and France, invest heavily in strengthening ethical culture, anti-harassment policies, and ensuring strong worker representation aligns with organizational values. The European market often favors consulting services focused on complex cross-border labor relations and integrating local cultural nuances into global corporate frameworks. Adoption is increasingly focused on quantifiable metrics related to environmental and social impact, reflecting a broader stakeholder-centric approach to corporate culture management.

The Asia Pacific (APAC) region is projected to register the fastest CAGR. This explosive growth is attributed to rapid economic expansion, massive urbanization, and the significant challenge of managing rapidly diversifying workforces and multi-generational teams across disparate regulatory environments (e.g., China, India, Japan, Australia). APAC companies are focused on standardization—creating a unified corporate culture while respecting deep local cultural traditions. Market demand centers on scaling basic cultural audits, implementing standardized global behavior codes, and utilizing mobile-first platforms for training and engagement, reflecting the region's reliance on mobile technology for internal communication across large geographical distances.

- North America: Market leader; early adopter of AI analytics; high demand driven by intense talent competition and focus on innovation and psychological safety.

- Europe: High growth driven by strong regulatory requirements, focus on ESG, employee well-being, and complex cross-border cultural integration projects.

- Asia Pacific (APAC): Highest projected CAGR; fueled by economic expansion, standardization efforts across diverse workforces, and heavy reliance on mobile-first culture management solutions.

- Latin America (LATAM): Developing market; adoption focused on leadership development and establishing compliance cultures in growing multinational operations.

- Middle East & Africa (MEA): Nascent market, strong growth driven by diversification strategies (e.g., Saudi Vision 2030), emphasizing national talent development and ethical governance culture.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organizational Culture Market, spanning major management consulting firms and specialized Culture-Tech platform providers.- Deloitte

- McKinsey & Company

- The Boston Consulting Group (BCG)

- Korn Ferry

- Mercer

- Gartner

- Qualtrics

- Culture Amp

- Lattice

- Limeade

- Glint (LinkedIn)

- BetterUp

- Microsoft Viva (Integration Platform)

- SAP SuccessFactors (HRIS Integration)

- Workday (HRIS Integration)

- Peakon (Workday)

- Gallup

- RHR International

- Senn Delaney

- PwC

- EY

- Accenture

Frequently Asked Questions

Analyze common user questions about the Organizational Culture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Organizational Culture Market?

The Organizational Culture Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 11.8% during the forecast period from 2026 to 2033, driven by the global necessity for employee retention and successful digital transformation efforts.

How does organizational culture impact business performance and ROI?

Strong organizational culture directly correlates with improved business performance by boosting employee engagement, reducing voluntary turnover, enhancing innovation capacity, and increasing operational efficiency, thereby providing a measurable Return on Investment (ROI) through sustained profitability and market resilience.

Which segment dominates the Organizational Culture Market by offering type?

Consulting Services currently dominates the market share due to the complex, bespoke nature of cultural transformation and the need for expert change management strategy and high-touch leadership alignment programs across large enterprises.

What role does AI play in modern organizational culture management?

AI utilizes Natural Language Processing (NLP) and machine learning to conduct real-time sentiment analysis on internal communications and feedback, providing proactive, data-driven insights into cultural health and identifying behavioral risks that require immediate intervention, shifting culture management from reactive to predictive.

Which regions are leading the adoption of organizational culture services?

North America is the dominant market due to early technological adoption and intense talent competition, while the Asia Pacific (APAC) region is projected to experience the fastest growth, driven by rapid economic expansion and the imperative to standardize corporate culture across diverse workforces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager