Orthopedic Robotics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435988 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Orthopedic Robotics Market Size

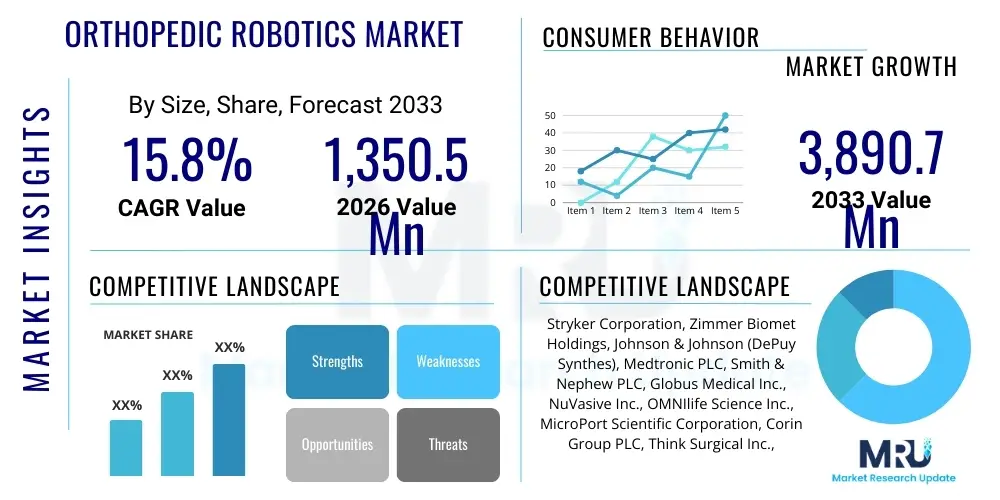

The Orthopedic Robotics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 1,350.5 Million in 2026 and is projected to reach USD 3,890.7 Million by the end of the forecast period in 2033.

Orthopedic Robotics Market introduction

The Orthopedic Robotics Market encompasses the development and utilization of sophisticated robotic systems designed to assist surgeons in performing orthopedic procedures, including total joint replacements, spinal surgeries, and trauma interventions. These systems integrate advanced visualization, navigation, and haptic feedback capabilities to enhance precision, consistency, and surgical outcomes. The core product offering includes robotic arms, specialized instruments, and proprietary software platforms that enable pre-operative planning and intra-operative guidance, moving traditional orthopedic surgery toward a highly personalized and reproducible methodology. This technological integration aims to minimize invasiveness, reduce recovery times, and improve implant longevity, fundamentally redefining patient care standards in musculoskeletal medicine.

Major applications of orthopedic robotics primarily center around high-volume procedures like total knee arthroplasty (TKA), total hip arthroplasty (THA), and increasingly, partial knee replacements and complex spinal fusion operations. The benefits associated with these systems are substantial, offering surgeons sub-millimeter accuracy in bone cutting and implant placement, which is critical for functional recovery and minimizing post-operative complications. The adoption trajectory is accelerated by the growing prevalence of chronic musculoskeletal disorders, an aging global population requiring joint replacements, and the increasing demand for high-quality, precise surgical care in developed and emerging economies. These factors collectively establish a robust foundation for market expansion, pushing innovation boundaries across hardware and software integration.

Driving factors propelling market growth include continuous technological advancements, such as enhanced machine vision and improved haptic feedback mechanisms, coupled with increasing governmental and private investment in healthcare infrastructure modernization. Furthermore, the robust clinical data demonstrating superior outcomes, lower revision rates, and shorter hospital stays compared to conventional methods significantly bolsters surgeon confidence and patient acceptance. As cost-effectiveness models evolve and training pathways become standardized, the integration of robotics shifts from a niche technology to a standard of care in high-complexity orthopedic centers, ensuring sustained market penetration throughout the forecast period.

Orthopedic Robotics Market Executive Summary

The Orthopedic Robotics Market is witnessing significant transformation driven by the integration of artificial intelligence and machine learning into surgical planning and execution platforms, enabling predictive modeling and enhanced operative efficiency. Key business trends include aggressive mergers and acquisitions among established medical device manufacturers to consolidate technological capabilities, and strategic collaborations between robotic firms and academic institutions to accelerate clinical validation and procedural diversification. The shift toward Ambulatory Surgical Centers (ASCs) as preferred settings for routine orthopedic procedures is fundamentally changing distribution strategies, requiring robotic systems to be more portable, cost-effective, and easier to deploy outside large hospital networks. Furthermore, software subscription models are gaining traction, providing stable recurring revenue streams for vendors while lowering the initial capital expenditure barrier for healthcare providers.

Regionally, North America remains the dominant market leader, characterized by high adoption rates, sophisticated healthcare infrastructure, and favorable reimbursement policies for advanced procedures. However, the Asia Pacific region is projected to exhibit the fastest growth, propelled by rapidly improving healthcare access, increasing disposable incomes, rising awareness of advanced surgical options, and a substantial, aging population requiring primary and revision joint replacements. European markets show steady, measured growth, focusing heavily on clinical efficacy data and regulatory compliance before widespread deployment. Investment is heavily concentrated in developing region-specific training centers to ensure adequate workforce skill development to support the complex technology.

In terms of segmentation trends, the Knee Replacement segment currently holds the largest market share due to the high volume of total knee arthroplasty procedures performed globally, but the Spine Surgery segment is anticipated to demonstrate the highest CAGR, spurred by the complexity and high stakes of spinal fusion and deformity correction requiring maximum precision. Regarding technology, semi-active robotic systems are currently leading adoption due to their balance of surgeon control and robotic precision, offering a practical entry point for many surgical centers. The end-user analysis confirms that hospitals, especially high-volume orthopedic centers, continue to be the primary revenue source, though the rapid expansion of ASCs necessitates product redesigns optimized for smaller, less intensive clinical environments.

AI Impact Analysis on Orthopedic Robotics Market

User inquiries regarding the impact of AI on the Orthopedic Robotics Market frequently revolve around optimizing surgical workflow, enhancing diagnostic accuracy pre-operatively, and enabling truly personalized patient outcomes. Common questions focus on how machine learning algorithms improve implant sizing and positioning based on large datasets (predictive planning), whether AI can assist in real-time decision-making during complex revisions (intra-operative guidance), and concerns about data privacy and the integration complexity of AI platforms with existing hospital electronic health records (EHRs). Users are highly optimistic about AI's potential to reduce operative variability and training time for surgeons, but they remain cautious about the regulatory pathways and the required investment in computational infrastructure necessary to support these advanced systems. The consensus highlights that AI is not replacing the surgeon but serving as a powerful, data-driven co-pilot.

The core theme emerging from this analysis is the transition from static, pre-programmed robotic assistance to dynamic, adaptive robotic intelligence. AI algorithms are crucial for processing vast amounts of patient-specific data, including CT scans, MRIs, and medical history, to generate optimal surgical plans that account for biomechanical nuances. This level of customization far surpasses traditional templating methods. For instance, in hip arthroplasty, AI analyzes acetabular orientation and leg length discrepancy simultaneously, providing real-time adjustments during surgery if unexpected anatomical variations are encountered, thereby dramatically increasing the probability of a perfect surgical result and minimizing risks associated with inaccurate implant alignment.

Furthermore, AI is instrumental in accelerating product development and training. Simulation platforms powered by machine learning allow surgeons to practice complex cases in virtual environments, providing instant, quantified feedback on performance metrics. From a market perspective, companies leveraging robust AI capabilities for procedural optimization and outcome prediction are gaining a significant competitive advantage. The regulatory environment is slowly catching up, requiring transparent validation of AI models, especially those used for critical intra-operative tasks. This technological integration is paving the way for the next generation of intelligent orthopedic platforms that learn and refine their guidance capabilities over time.

- AI-driven Predictive Planning: Machine learning models optimize implant selection and positioning based on comprehensive patient data, minimizing outliers in surgical results.

- Intra-operative Dynamic Guidance: Real-time data processing and haptic feedback adjustments based on bone density and soft tissue tension during the procedure.

- Automated Data Capture and Analysis: AI systematically logs every surgical step, creating a rich dataset for performance benchmarking and post-operative quality assessment.

- Enhanced Robotics Training Simulation: Virtual reality and AI combined to create realistic, adaptive training modules for new robotic surgeons, drastically reducing the learning curve.

- Improved Workflow Efficiency: AI streamlines pre-operative workflow, reducing the time required for data preparation and surgical mapping.

- Personalized Biomechanics Modeling: Creating patient-specific digital twins to predict long-term functional outcomes based on proposed surgical alignment.

DRO & Impact Forces Of Orthopedic Robotics Market

The Orthopedic Robotics Market is significantly influenced by a confluence of accelerating drivers (D), persistent restraints (R), emerging opportunities (O), and underlying impact forces. The primary drivers include the global aging demographic, which necessitates an increasing volume of joint replacement surgeries, coupled with overwhelming evidence supporting the superior precision and reduced complications offered by robotic assistance. Furthermore, rising patient expectations for minimally invasive procedures and rapid recovery drive demand for these advanced technologies. Simultaneously, technological maturation, including smaller footprints, enhanced image processing, and integration with navigation tools, makes robotic systems more attractive and accessible to a wider range of healthcare facilities globally, sustaining the upward trajectory of adoption rates across different procedural domains, notably hips, knees, and spine.

Despite strong market momentum, high capital investment remains a substantial restraint, particularly for smaller hospitals and healthcare systems in developing countries, coupled with the considerable cost per procedure due to specialized consumables and software licensing fees. Another critical restraint is the steep learning curve and the need for specialized training and certification for surgical teams, which can slow initial adoption and integration into existing surgical protocols. Furthermore, regulatory hurdles, especially in fragmented global markets, require significant time and resources for technology clearance and post-market surveillance. The necessity for advanced technical infrastructure, including specialized operating rooms and IT support staff, also presents a logistical and financial challenge that inhibits rapid, widespread deployment.

Significant opportunities are emerging from the expansion into underpenetrated surgical specialties, such as trauma, pediatrics, and extremity reconstruction, where precision is paramount. The development of smaller, more mobile, and application-specific robotic systems (e.g., robotic arms optimized only for shoulder or ankle procedures) offers vast growth potential by addressing procedure-specific needs more cost-effectively. Moreover, the shift toward value-based care models, which reward superior clinical outcomes and efficiency, creates a compelling economic argument for robotics. Finally, strategic geographic expansion into high-growth markets like China, India, and Brazil, coupled with localized manufacturing and service support, represents a crucial opportunity for vendors seeking to diversify revenue streams outside established North American and Western European markets. These opportunities are actively shaping long-term investment priorities.

Segmentation Analysis

The Orthopedic Robotics Market is extensively segmented based on Procedure Type, Technology, Application, and End-User, allowing for granular analysis of market penetration and growth vectors within specific clinical and operational niches. This segmentation provides stakeholders with targeted insights into which procedural areas are achieving the fastest technological uptake and where competitive differentiation is most crucial. The Procedure Type segment—covering major applications like knee, hip, and spine—reflects volume demands, while the Technology segment—differentiating between active, semi-active, and passive systems—illustrates the preferences of surgeons regarding autonomy and control. End-user classification is crucial for understanding procurement patterns and the evolving role of Ambulatory Surgical Centers (ASCs) versus traditional hospital settings in the delivery of robotic orthopedic care, all of which are pivotal for strategic market planning.

- Procedure Type

- Knee Replacement (Total Knee Arthroplasty, Partial Knee Arthroplasty)

- Hip Replacement (Total Hip Arthroplasty, Partial Hip Arthroplasty)

- Spine Surgery (Fusion, Deformity Correction, Vertebroplasty)

- Trauma & Extremities (Fracture Fixation, Shoulder and Ankle Surgery)

- Technology

- Active Systems (Autonomous Execution)

- Semi-Active Systems (Haptic Guidance)

- Passive Systems (Navigation & Planning Assistance)

- Application

- Implant Placement

- Bone Resection

- Soft Tissue Balancing

- End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Orthopedic Clinics

- Regional Analysis

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Orthopedic Robotics Market

The value chain for the Orthopedic Robotics Market begins with upstream analysis, which is characterized by intense research and development activities focused on hardware (advanced robotics, sensors, imaging) and proprietary software (navigation, AI algorithms). Key upstream players are technology developers, material suppliers (specializing in lightweight, sterile, and durable materials for robotic arms), and specialized software firms providing core AI and machine vision capabilities. Significant intellectual property protection and heavy investment in clinical trials define this initial stage. Strategic partnerships at the upstream level are vital for integrating next-generation sensing technologies and machine learning components directly into the robotic platform architecture, ensuring systems remain at the technological forefront of surgical precision and automation.

The middle segment of the value chain involves the manufacturing, assembly, and integration of the complex robotic systems. This process requires stringent quality control and adherence to global medical device regulations (e.g., FDA, CE Mark). Manufacturing often involves precision engineering, system calibration, and software installation. Distribution channels are highly specialized, typically relying on direct sales forces and highly trained clinical specialists employed by the robotic system manufacturers (direct channel). Given the high cost and complexity of the product, indirect channels (distributors) are used sparingly, primarily in smaller, geographically dispersed emerging markets, necessitating intensive product training and ongoing technical support, distinguishing this distribution model from commodity medical supplies.

Downstream analysis focuses on installation, surgical team training, post-sale service, maintenance, and the use of specialized consumables (e.g., disposable surgical tools, sensor arrays) which generate recurring revenue. The end-users—hospitals and ASCs—are deeply reliant on comprehensive service contracts and continuous software updates provided by the manufacturers to maximize system uptime and maintain technological parity. Direct sales and service models dominate because manufacturers must maintain direct control over system deployment and clinical support to ensure optimal utilization and rapid troubleshooting, which is essential for patient safety and surgeon confidence in the robotic platform. The effectiveness of the downstream support significantly influences market perception and future procurement decisions.

Orthopedic Robotics Market Potential Customers

The primary end-users and buyers of orthopedic robotic systems are institutional healthcare providers, spanning large university-affiliated hospitals, specialized orthopedic institutes, and increasingly, high-volume Ambulatory Surgical Centers (ASCs). Large hospitals and academic centers typically have the necessary capital budget and infrastructure to absorb the high initial investment of active and semi-active systems, utilizing them for a diverse range of complex procedures, including joint revisions and complex spinal corrections. These institutions are also critical for training the next generation of robotic surgeons and conducting research, making them key opinion leaders and early adopters who influence the wider market acceptance of new robotic platforms and procedural techniques.

Ambulatory Surgical Centers represent the fastest-growing customer segment, particularly in North America, driven by favorable reimbursement shifts and the desire to perform less complex, high-volume procedures (like total joint replacement) in a lower-cost, outpatient setting. ASCs typically favor smaller, more mobile, and cost-effective robotic systems that focus on specific, high-frequency procedures such as total knee and hip replacements. Their procurement decisions are heavily influenced by the return on investment (ROI) derived from increased surgical throughput and reduced hospital stay costs, necessitating efficient workflow integration and minimal downtime, creating demand for subscription-based service models and flexible financing options optimized for outpatient environments.

Additionally, specialty orthopedic clinics that focus exclusively on musculoskeletal treatment represent niche but important customers, especially those affiliated with large group practices that pool resources for capital expenditures. Government and military hospitals also serve as significant customers, often procuring systems through centralized purchasing contracts based on rigorous efficacy and safety standards. These customers value reliability, durability, and comprehensive technical support, ensuring that the technology is robust enough for diverse and challenging surgical environments, often prioritizing systems with strong historical clinical validation and long-term service commitments from the vendor.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,350.5 Million |

| Market Forecast in 2033 | USD 3,890.7 Million |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Zimmer Biomet Holdings, Johnson & Johnson (DePuy Synthes), Medtronic PLC, Smith & Nephew PLC, Globus Medical Inc., NuVasive Inc., OMNIlife Science Inc., MicroPort Scientific Corporation, Corin Group PLC, Think Surgical Inc., Intuitive Surgical Inc., Orthotaxy (part of Johnson & Johnson), Brainlab AG, Curexo Inc., TINAVI Medical Technologies Co., Ltd., MAKO Surgical Corp. (acquired by Stryker), Renishaw PLC, Blue Belt Technologies (acquired by Smith & Nephew). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Orthopedic Robotics Market Key Technology Landscape

The technological landscape of the Orthopedic Robotics Market is characterized by rapid innovation focused on improving intra-operative accuracy, reducing system footprint, and enhancing surgeon-machine interaction. Computer-assisted orthopedic surgery (CAOS) has evolved significantly from simple navigation systems to sophisticated robotic platforms that perform physical tasks. Key technologies deployed include advanced imaging modalities, such as high-resolution optical tracking systems and intra-operative 3D fluoroscopy (O-arm or C-arm), which enable accurate registration of patient anatomy and real-time visualization of surgical adjustments. Furthermore, the integration of haptic feedback technology is pivotal in semi-active systems, allowing the surgeon to feel the boundaries of the pre-defined surgical zone, thereby preventing accidental tissue damage and ensuring precise bone cuts, which is a major driver of clinical confidence and subsequent adoption.

The most transformative technology permeating this market is Artificial Intelligence (AI) and Machine Learning (ML). These computational capabilities are used in pre-operative planning software to analyze vast surgical datasets and anatomical variations, optimizing implant orientation and predicting post-operative stability with greater accuracy than traditional methods. Furthermore, cloud computing infrastructure is increasingly utilized for remote data storage, collaborative planning across different surgical sites, and facilitating rapid software updates and remote maintenance. Miniaturization of robotic components, coupled with advancements in motor technology, is leading to the development of smaller, more mobile robots suitable for deployment in space-constrained operating rooms and the burgeoning ASC environment, addressing one of the major historical drawbacks of first-generation, large footprint robotic systems.

Another crucial area is the development of specialized instrumentation and smart tools that interface directly with the robotic arm. These often include force-sensing devices and disposable cutting guides that ensure optimal surgical efficiency and safety. The convergence of robotics with augmented reality (AR) and virtual reality (VR) is also gaining traction, particularly in providing enhanced visualization overlays during surgery and offering immersive, high-fidelity training simulations. These simulation tools not only improve surgeon proficiency but also serve as powerful marketing and educational tools for manufacturers, demonstrating the systems’ capabilities in a controlled, non-clinical environment, thereby accelerating technology transfer and user adoption. The focus remains on making the technology highly intuitive, reproducible, and seamlessly integrated into the existing surgical workflow.

Regional Highlights

The global orthopedic robotics market exhibits distinct regional dynamics shaped by healthcare spending, regulatory frameworks, demographic trends, and technological readiness. North America, particularly the United States, holds the dominant market position, largely due to high healthcare expenditure, the early and widespread adoption of surgical robotics, favorable reimbursement structures for advanced procedures, and the strong presence of key market players and research institutions. The competitive nature of the North American healthcare market incentivizes hospitals to invest in high-tech robotic systems as a means of marketing differentiation and attracting high-volume orthopedic patient populations. Furthermore, the rapid expansion of total joint replacement procedures into the Ambulatory Surgical Center (ASC) setting is creating significant demand for systems optimized for these specific non-hospital environments, ensuring continued dominance.

Europe represents a mature market characterized by moderate, steady growth. Adoption rates are influenced by varying national health system budgets and stringent health technology assessment (HTA) processes which require strong evidence of cost-effectiveness and clinical superiority before procurement approval. Western European nations (Germany, UK, France) are primary adopters, focusing on systems that demonstrate long-term implant survival and reduced revision rates. The stringent regulatory landscape overseen by the European Medicines Agency (EMA) ensures high safety standards, though sometimes slower market entry compared to the US. Growth in Eastern Europe is slower but accelerating, driven by modernization initiatives and increasing availability of funding from structural and investment funds aimed at upgrading surgical capabilities.

Asia Pacific (APAC) is forecast to be the fastest-growing region, driven by the substantial, rapidly aging populations in countries like Japan, South Korea, and China, coupled with rising healthcare infrastructure investments and increased affordability of advanced medical treatments. While the initial capital cost is still a major barrier in lower-income APAC nations, governments are increasingly investing in specialty hospitals and medical tourism centers, where robotic technology is highly valued. Furthermore, local manufacturing and R&D activities in countries like China and India are focused on developing more cost-competitive, regionally tailored robotic systems, which will be crucial for mass market penetration. Latin America and the Middle East & Africa (MEA) remain emerging markets, where growth is constrained by uneven healthcare access and high import duties, though wealthy Gulf Cooperation Council (GCC) states are rapidly adopting high-end robotic systems for specialized centers.

- North America: Dominant market share due to high surgical volume, advanced reimbursement policies, and robust ASC adoption, particularly in the US.

- Europe: Steady growth driven by demand for clinical efficacy and evidence-based adoption, with Germany and the UK leading technological integration.

- Asia Pacific: Highest growth CAGR expected, fueled by aging populations, improving healthcare spending, and localization of robotic technology development in China and India.

- Latin America: Emerging market characterized by selective adoption in private urban centers; growth potential linked to economic stability and healthcare reform.

- Middle East & Africa (MEA): Limited adoption concentrated in high-income GCC countries, focusing on establishing centers of excellence for medical tourism and specialized care.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Orthopedic Robotics Market, analyzing their product portfolios, geographical presence, recent acquisitions, and strategic initiatives.- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Johnson & Johnson (DePuy Synthes)

- Medtronic PLC

- Smith & Nephew PLC

- Globus Medical Inc.

- NuVasive Inc.

- OMNIlife Science Inc.

- MicroPort Scientific Corporation

- Corin Group PLC

- Think Surgical Inc.

- Intuitive Surgical Inc.

- Orthotaxy (part of Johnson & Johnson)

- Brainlab AG

- Curexo Inc.

- TINAVI Medical Technologies Co., Ltd.

- MAKO Surgical Corp. (acquired by Stryker)

- Renishaw PLC

- Blue Belt Technologies (acquired by Smith & Nephew)

- AOT – Advanced Osteotomy Tools AG

Frequently Asked Questions

Analyze common user questions about the Orthopedic Robotics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high adoption rate of orthopedic robots?

The central driver is the scientifically proven ability of robotic systems to significantly improve surgical precision, particularly in complex bone cutting and implant alignment during knee and hip replacements. This precision minimizes surgical variability, leading to reduced complications, faster patient recovery, and demonstrably better long-term implant survivorship compared to conventional manual techniques, aligning with the industry focus on value-based outcomes.

Are orthopedic robotic procedures more cost-effective than traditional surgery?

While the initial capital expenditure for robotic systems is very high, the long-term cost-effectiveness is increasingly favorable. Robotics can reduce the length of hospital stays, lower the rate of costly revision surgeries, and increase surgical throughput in high-volume centers, which helps offset the high initial investment and disposable instrument costs, leading to improved overall economic efficiency for the healthcare provider over the system's lifespan.

What is the difference between active and semi-active orthopedic robotic systems?

Active systems perform surgical tasks autonomously once the surgeon initiates the procedure, often used for bone milling based on a pre-defined plan. Semi-active systems, such as the MAKO platform, provide haptic guidance, meaning the surgeon maintains physical control over the instrument, but the robot imposes strict limits on the movement to ensure the cutting stays within the pre-defined safe boundaries, providing a balance of precision and surgeon control, which is the most widely adopted model currently.

How is Artificial Intelligence (AI) being utilized within orthopedic robotics platforms?

AI is primarily utilized in pre-operative planning to analyze patient-specific imaging data and large historical outcome datasets, enabling predictive modeling for optimal implant sizing and placement. Intra-operatively, AI algorithms assist in real-time decision support, optimizing soft tissue balancing, and refining surgical paths, transitioning the systems from purely mechanical guides to intelligent, data-driven assistants.

Which geographical region is expected to exhibit the fastest growth in this market?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR). This acceleration is driven by the region's massive aging population, substantial government investments in modernizing healthcare infrastructure, and the growing prominence of local manufacturers developing cost-effective robotic solutions specifically tailored for Asian markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager