Orthopedic Trauma Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434907 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Orthopedic Trauma Devices Market Size

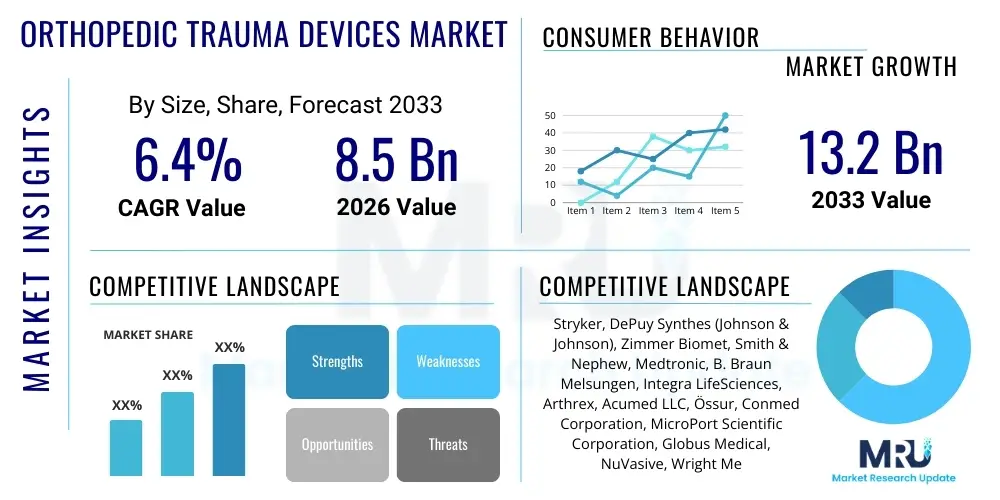

The Orthopedic Trauma Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.4% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $13.2 Billion by the end of the forecast period in 2033.

Orthopedic Trauma Devices Market introduction

The Orthopedic Trauma Devices Market encompasses a wide array of specialized implants and instruments crucial for the surgical management and stabilization of bone fractures and associated soft tissue injuries resulting from acute physical trauma. These devices are essential for achieving anatomical reduction, stable fixation, and facilitating accelerated patient recovery. The primary categories of products include internal fixation devices such as plates, screws, intramedullary nails, and wires, and external fixation systems used temporarily or permanently to stabilize complex or open fractures. The market is fundamentally driven by the rising global incidence of high-energy trauma, notably road traffic accidents and sports-related injuries, alongside the demographic shift towards an aging population inherently prone to fragility fractures.

These specialized implants are designed for use across various skeletal sites, including the upper extremities (e.g., forearm, humerus), lower extremities (e.g., femur, tibia, ankle), and the pelvis and spine. Major applications include fracture repair, reconstructive surgery following severe trauma, and corrective procedures for non-union or malunion. Technological advancements, such as the development of locking plate systems, bioabsorbable materials, and patient-specific instrumentation (PSI), have significantly enhanced surgical outcomes, improving fixation strength and minimizing soft tissue damage. The consistent innovation cycle ensures that devices are becoming less invasive, highly biocompatible, and tailored to specific fracture patterns, thereby strengthening market viability.

Key benefits derived from the utilization of advanced orthopedic trauma devices include accelerated weight-bearing capabilities, reduced hospital stay duration, improved functional outcomes, and a lower overall rate of complications suchisation. Driving factors contributing to the market expansion include increased healthcare expenditure in emerging economies, greater accessibility to advanced surgical interventions, and the shift from traditional casting methods to definitive internal fixation. Furthermore, intense research and development focused on optimizing material composition, such as transitioning from pure stainless steel to titanium and specialized polymer composites, are pivotal in sustaining market momentum and meeting the demanding requirements of trauma surgeons globally.

Orthopedic Trauma Devices Market Executive Summary

The Orthopedic Trauma Devices Market is exhibiting robust growth, propelled primarily by global demographic trends, specifically the expanding elderly demographic susceptible to fragility fractures, and the increasing volume of trauma cases stemming from urbanization and vehicular traffic worldwide. Business trends indicate a strong move toward consolidation among major industry players aiming to capture synergistic benefits across product lines, particularly in high-growth segments like locking plate technology and specialized extremity fixation systems. There is a palpable shift in the procurement landscape, favoring high-quality, evidence-based devices that minimize revision rates and improve long-term patient mobility, driving premium pricing for technologically advanced implants. Furthermore, manufacturers are increasingly focusing on comprehensive solution portfolios that include advanced surgical planning software and instrument sets designed for minimally invasive surgery (MIS) techniques, which are becoming the standard of care in many high-income regions.

Regional trends highlight North America and Europe as mature markets characterized by stringent regulatory environments and high rates of technological adoption, acting as critical revenue hubs due to established healthcare infrastructure and high reimbursement rates. Conversely, the Asia Pacific (APAC) region is forecasted to display the highest Compound Annual Growth Rate (CAGR), driven by rapidly improving healthcare access, substantial government investments in trauma care facilities, and a large, untapped patient pool needing affordable, high-volume trauma solutions. China and India, in particular, are emerging as significant growth engines, attracting both global investment and localized manufacturing efforts. The competitive landscape is also seeing localized companies in these emerging markets rapidly improving product quality, creating pricing pressure for international conglomerates.

Segmentation trends reveal that the internal fixation segment, particularly plates and screws, maintains the largest market share owing to its widespread applicability and established clinical effectiveness in managing a vast majority of fractures. Within internal fixation, locking plates are demonstrating superior growth compared to conventional plating systems due to enhanced angular stability, which is vital in osteoporotic bone. End-user trends show hospitals remaining the largest segment; however, Ambulatory Surgical Centers (ASCs) are projected to grow faster, primarily due to cost-efficiency and increasing patient preference for outpatient procedures, particularly for less complex, localized trauma injuries. Material segmentation emphasizes titanium and titanium alloys due to their superior biocompatibility and mechanical strength, though bioabsorbable implants are gaining traction, especially in pediatric applications where implant removal is often required.

AI Impact Analysis on Orthopedic Trauma Devices Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Orthopedic Trauma Devices market frequently center on three critical areas: enhanced diagnostic accuracy and predictive modeling, optimization of surgical procedures using AI-driven planning, and improvements in post-operative monitoring and implant success rates. Users are keenly interested in how AI can move beyond basic imaging analysis to provide predictive risk assessment for patients, particularly those with complex comorbidities or severe osteoporosis, thus influencing the choice of implant material and fixation construct. A significant theme is the expectation that AI integration will mitigate common surgical errors, particularly concerning screw length and placement, thereby improving clinical consistency and reducing costly complications like non-union or hardware failure. Furthermore, there are underlying concerns about data privacy, regulatory clearance for AI-assisted devices, and the necessary integration of these tools into existing hospital IT infrastructure and surgeon workflow.

The immediate impact of AI is visible in pre-operative planning, where sophisticated algorithms process patient-specific CT scans and radiographs to generate optimal surgical plans, including precise measurements for implant size and trajectory, significantly streamlining the preparation phase. This predictive planning minimizes intraoperative uncertainty and exposure time, which is highly valued in trauma settings where speed and precision are paramount. In the manufacturing sector, AI is being deployed for design optimization, utilizing machine learning to analyze clinical data from millions of fixation cases to inform iterative improvements in implant geometry and material stress distribution, resulting in stronger, more reliable devices. This data-driven approach accelerates the R&D cycle and helps tailor device characteristics to meet real-world biomechanical demands.

Looking ahead, AI will increasingly inform inventory and supply chain management within the trauma sector, predicting the demand for specific types of fixation sets based on regional injury patterns and seasonal variations, ensuring that specialized implants are available precisely when needed. Moreover, the long-term impact involves AI-powered diagnostic tools integrated into mobile platforms or point-of-care devices, providing rapid, accurate assessments of fracture severity in remote or emergency settings, leading to quicker decision-making regarding immediate treatment protocols and referral logistics. The convergence of AI with robotics in the operating room further promises enhanced precision in minimally invasive placement of screws and rods, particularly for difficult anatomical locations like the spine or pelvis, ultimately boosting overall efficacy and patient safety within the orthopedic trauma domain.

- AI-Assisted Surgical Planning: Optimizing implant size, trajectory, and placement based on patient-specific bone morphology and fracture pattern recognition.

- Predictive Modeling: Analyzing patient data (age, bone density, comorbidities) to forecast fracture risk and estimate the probability of hardware failure or non-union.

- Enhanced Imaging Analysis: Using deep learning algorithms for faster and more accurate automated detection and classification of complex fracture types from radiographic images.

- Robotics Integration: Powering robotic systems to achieve sub-millimeter precision during drilling and screw insertion, crucial for minimally invasive procedures.

- Supply Chain Optimization: Predicting regional demand for specialized trauma sets based on epidemiological injury data, reducing inventory waste and improving kit availability.

- Post-operative Monitoring: Utilizing AI to analyze sensor data from smart implants or wearables to monitor healing progress and detect early signs of infection or loosening.

DRO & Impact Forces Of Orthopedic Trauma Devices Market

The dynamics of the Orthopedic Trauma Devices Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), underpinned by significant Impact Forces. Key drivers include the escalating global burden of trauma injuries due to vehicular accidents, industrial incidents, and violent crime, necessitating immediate surgical intervention using advanced fixation devices. The rapidly expanding geriatric population worldwide, coupled with the increasing prevalence of osteoporosis, generates a massive need for devices specialized in managing low-energy fragility fractures, particularly in the hip and spine. The shift towards technologically sophisticated products, such as bioabsorbable and customized implants, provides substantial opportunities for market differentiation and premium pricing, while the growing adoption of minimally invasive surgical techniques reduces patient morbidity and promotes faster recovery, thereby driving demand for corresponding specialized instrumentation. However, these growth catalysts are often mitigated by several systemic restraints.

Major restraints impeding faster market expansion include the high cost of advanced trauma implants, which presents significant barriers to adoption in low- and middle-income countries (LMICs), often leading to the use of older, less effective conventional systems. Furthermore, intense regulatory scrutiny and lengthy approval processes, particularly in highly regulated markets like the United States and Europe, delay the commercialization of novel, sophisticated devices. The risks associated with implant failure, infection, and subsequent revision surgeries also remain critical concerns that influence purchasing decisions and can negatively impact public confidence, placing pressure on manufacturers to ensure impeccable quality control and extensive clinical testing. Addressing these restraints requires manufacturers to pursue streamlined regulatory pathways and invest heavily in post-market surveillance to demonstrate long-term device safety and efficacy across diverse patient demographics.

Opportunities for expansion are abundant, particularly in emerging Asia-Pacific markets where infrastructure development and increased insurance penetration are rapidly expanding access to high-quality trauma care. Specific product opportunities lie in the development of antimicrobial coatings for implants to drastically reduce surgical site infection rates, and the creation of standardized, high-quality, and cost-effective external fixation systems suitable for immediate stabilization in disaster zones or remote areas. The integration of 3D printing and Additive Manufacturing allows for personalized trauma devices, offering a superior fit and potentially reduced operating room time, representing a long-term transformative opportunity. The primary impact forces shaping the market include competitive intensity driven by pricing pressure from Group Purchasing Organizations (GPOs), the rising influence of evidence-based medicine necessitating extensive clinical data for product validation, and the powerful influence of technological substitution (e.g., bioabsorbable materials replacing metals), which necessitates continuous research investment to maintain market relevance.

Segmentation Analysis

The Orthopedic Trauma Devices Market is comprehensively segmented based on product type, material, fixation type, and end-user, providing a granular view of market dynamics and specialized revenue streams. Product type segmentation is crucial as it reflects the primary clinical applications, differentiating between devices used for internal stabilization versus external temporary or definitive fixation. Internal fixation, comprising plates, screws, nails, and rods, dominates the market due to its wide range of applications and proven efficacy in load-bearing scenarios, while the external fixation segment caters to complex fractures, open injuries, and limb salvage procedures. Material segmentation is vital for assessing biocompatibility and mechanical longevity, with titanium leading the market due to superior strength-to-weight ratio and low incidence of rejection, though stainless steel remains important for cost-conscious applications.

The segmentation by fixation type (internal and external) reflects fundamental surgical methodologies. Internal fixation involves placing the implant directly at the fracture site under the skin, allowing for early mobilization and potentially better long-term functional results, making it the preferred method for stable and closed fractures. Conversely, external fixation, while generally reserved for temporary stabilization or highly complex fracture patterns where internal fixation is contraindicated due to soft tissue damage or contamination, still represents a specialized and indispensable segment for acute trauma management and correction of deformities. This dual segmentation allows manufacturers to target specific surgical communities with tailored products and training programs.

End-user segmentation clearly defines the primary points of consumption, with hospitals, especially Level I and Level II trauma centers, holding the dominant share due to the requirement for complex operative infrastructure and the high volume of severe trauma cases handled. However, the rapidly expanding role of Ambulatory Surgical Centers (ASCs) for treating less severe, extremity-based trauma, driven by lower costs and higher procedural efficiency, signifies a key growth segment. Understanding these segment dynamics is paramount for market players to effectively allocate resources, develop targeted marketing strategies, and optimize distribution channels to meet the diverse needs of trauma surgeons and procurement specialists across different healthcare settings.

- By Product Type:

- Internal Fixation Devices

- Plates and Screws (Standard, Locking)

- Intramedullary (IM) Nails

- Rods and Wires (K-wires, Cerclage wires)

- Cannulated Screws

- External Fixation Devices

- Unilateral Fixation Systems

- Circular Fixation Systems (e.g., Ilizarov, Spatial Frames)

- Hybrid Fixation Systems

- Accessories and Consumables (Drill bits, Guide wires, Instruments)

- Internal Fixation Devices

- By Material:

- Metallic Implants (Titanium and Titanium Alloys, Stainless Steel, Cobalt-Chrome)

- Bioabsorbable Materials (Polylactic Acid (PLA), Poly(L-lactide) (PLLA))

- PEEK (Polyetheretherketone)

- By Fixation Type:

- Internal Fixation

- External Fixation

- By End-User:

- Hospitals and Trauma Centers

- Ambulatory Surgical Centers (ASCs)

- Orthopedic Clinics

Value Chain Analysis For Orthopedic Trauma Devices Market

The value chain for the Orthopedic Trauma Devices Market is complex, beginning with raw material sourcing and culminating in patient usage, requiring strict adherence to quality and regulatory standards at every step. Upstream analysis focuses heavily on the procurement of high-grade, medically certified raw materials, primarily titanium and stainless steel alloys, and advanced polymers. Since the performance and biocompatibility of the final implant are directly tied to the quality of the raw material, relationships with certified metal and polymer suppliers are strategic and highly regulated. Research and Development (R&D) forms a crucial part of the upstream segment, driving innovation in implant design, coating technology, and surgical instrument development, often involving close collaboration with leading orthopedic surgeons and research institutions to ensure clinical relevance and efficacy. Manufacturing and precision engineering, which involve sophisticated processes like forging, machining, surface finishing, and sterilization, represent the highest value-add activities within the upstream phase, demanding substantial capital investment in state-of-the-art facilities compliant with global manufacturing standards (e.g., ISO 13485).

Midstream activities involve extensive clinical trials, regulatory submissions (FDA, CE Mark), and quality assurance processes, which are critical cost and time determinants in this highly regulated industry. This stage ensures that the finished trauma devices meet performance specifications and are safe for human implantation. The subsequent distribution channel strategy dictates market reach and logistical efficiency. Major manufacturers often utilize a mix of direct sales forces for large hospital systems and specialized distributors for smaller clinics and international markets. The direct channel offers greater control over pricing and customer relationships, especially for complex or newly launched products, while the indirect channel leverages the local expertise and established networks of third-party distributors, particularly vital in geographically dispersed or emerging economies where market penetration is challenging.

Downstream analysis focuses on the end-users—hospitals, trauma centers, and ASCs—where the final product is consumed. Key downstream factors include effective surgical training and education for orthopedic specialists on new systems and techniques, ensuring optimal device usage. After-sales support, inventory management (especially consignment stock), and managing product recalls are also critical components. The final segment involves patient care and reimbursement mechanisms, where the device’s cost-effectiveness and demonstrated clinical benefits influence its ultimate adoption and usage patterns. Successful companies excel at integrating their R&D insights with downstream clinical feedback, creating a continuous loop of product improvement and market responsiveness. The direct channel fosters closer surgeon feedback loops, whereas the indirect channel relies on robust distributor reporting systems to maintain market intelligence.

Orthopedic Trauma Devices Market Potential Customers

The primary consumers and end-users of Orthopedic Trauma Devices are specialized healthcare facilities dedicated to acute injury management and surgical orthopedics. Hospitals and dedicated trauma centers represent the largest customer base. Within these facilities, the primary buyers include orthopedic surgeons, trauma specialists, and procurement departments (often overseen by Group Purchasing Organizations or GPOs). Level I and Level II trauma centers are crucial customers as they handle the highest volume of complex and severe multi-system trauma requiring the most advanced and diverse range of fixation devices, including specialized pelvic and spinal implants. Their purchasing decisions are heavily influenced by clinical evidence, established relationships with key opinion leaders, and the availability of comprehensive, high-quality instrumentation sets that minimize operative time and reduce complications.

A rapidly expanding segment of potential customers includes Ambulatory Surgical Centers (ASCs) and specialized orthopedic clinics. While ASCs typically do not handle life-threatening multi-system trauma, they are increasingly performing elective or less complex trauma procedures, such as distal radius fractures, ankle fractures, and other localized extremity injuries. These buyers prioritize cost-effectiveness, ease of use, and quick turnover of instrument trays, favoring streamlined fixation systems that support efficient outpatient workflows. Manufacturers targeting ASCs must offer competitive pricing and excellent logistical support, including just-in-time inventory solutions tailored to high-volume, standardized procedures, focusing on product reliability and minimizing the need for complex, highly specialized instrumentation.

Beyond traditional healthcare institutions, government entities and military organizations also represent significant potential customers, often purchasing large volumes of standardized external fixation kits and robust internal fixation systems for deployment in remote or conflict zones. Furthermore, academic medical centers and university teaching hospitals are key purchasers, driven not only by clinical need but also by their role in research and surgical training, often adopting cutting-edge, novel technologies first. Successful market engagement requires manufacturers to segment their customer outreach based on facility type, volume capability, budget constraints, and the specific mix of trauma cases handled, ensuring that the appropriate product portfolio and support services are delivered efficiently to each distinct customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $13.2 Billion |

| Growth Rate | 6.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker, DePuy Synthes (Johnson & Johnson), Zimmer Biomet, Smith & Nephew, Medtronic, B. Braun Melsungen, Integra LifeSciences, Arthrex, Acumed LLC, Össur, Conmed Corporation, MicroPort Scientific Corporation, Globus Medical, NuVasive, Wright Medical Group, Teleflex Incorporated, Orthofix Medical Inc., DJO Global, ATEC Spine, Inc., CrossRoads Extremity Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Orthopedic Trauma Devices Market Key Technology Landscape

The Orthopedic Trauma Devices Market is characterized by intense technological evolution aimed at enhancing stability, reducing invasiveness, and improving long-term patient outcomes. A cornerstone of modern trauma fixation is the widespread adoption of Locking Plate Technology. Unlike conventional plates that rely on friction between the plate and the bone, locking plates feature threaded screw holes that securely lock the screw head into the plate, creating a fixed-angle construct. This design is highly advantageous in osteoporotic bone, metaphyseal fractures, and complex articular injuries, as it minimizes plate slippage and avoids compressing the periosteum, thereby preserving blood supply and promoting faster healing. Advancements in this technology focus on variable angle locking mechanisms, allowing surgeons greater flexibility in screw placement while maintaining the stability benefits of a fixed-angle system, representing a critical competitive differentiator in the internal fixation segment.

The material science landscape is continuously shifting, with a strong emphasis on developing alternatives to permanent metal implants. Bioabsorbable (or bioresorbable) materials, typically polymers like PLLA or PLA, are gaining significant traction, particularly in pediatric and hand/foot trauma applications. These implants provide temporary fixation and then gradually dissolve within the body over months or years, eliminating the need for a secondary removal surgery and mitigating risks associated with long-term implant retention, such as stress shielding. Furthermore, surface modification technologies, including plasma coatings and treatments designed to enhance osseointegration or impart antimicrobial properties, are becoming standard features in premium devices. The integration of antimicrobial agents directly into implant surfaces addresses the critical industry concern of Surgical Site Infections (SSIs), a high-cost complication that profoundly affects patient recovery and hospital metrics.

The convergence of digital tools and trauma surgery is rapidly transforming procedural execution. Key technologies include intraoperative navigation systems and robotics, which utilize advanced imaging (e.g., fluoroscopy, CT) and tracking software to guide the precise placement of intramedullary nails and screws, particularly in complex pelvic and spinal fractures where anatomical variability is high. Furthermore, Additive Manufacturing (3D Printing) is becoming instrumental in the personalization of trauma care, enabling the rapid creation of patient-specific instrumentation (PSI) for complex deformity correction or highly fragmented fractures. This customization capability reduces operative time and potentially improves fit and stability, offering a decisive competitive advantage to manufacturers investing heavily in these personalized medicine platforms, ensuring that the technology landscape remains dynamic, highly specialized, and focused on precision trauma management.

Regional Highlights

The global Orthopedic Trauma Devices market demonstrates distinct regional dynamics influenced by healthcare maturity, regulatory frameworks, accident rates, and population demographics.

- North America (Dominant Market): Characterized by high trauma incidence, advanced reimbursement mechanisms, and early adoption of premium technologies such as bioabsorbable devices and robotic-assisted surgery. The U.S. remains the single largest market, driven by sophisticated trauma networks and the presence of major global industry leaders. High healthcare expenditure and a large volume of elective orthopedic procedures contribute significantly to sustained growth, despite mature market status.

- Europe (Second Largest Market): Exhibits steady growth, largely due to an aging population prone to osteoporotic fractures and standardized healthcare systems that ensure widespread access to trauma care. Germany, France, and the UK are key revenue contributors. Market expansion is supported by robust R&D activities and strong regulatory guidance from the European Medicines Agency (EMA), although price containment policies in several member states present a moderate restraint.

- Asia Pacific (APAC) (Fastest Growing Region): Poised for explosive growth, fueled by rapid infrastructural development, urbanization leading to increased road traffic accidents, and government initiatives to modernize healthcare facilities (especially in China and India). Increasing disposable incomes and medical tourism are boosting the demand for high-quality, advanced implants, encouraging manufacturers to establish localized manufacturing and distribution hubs to capture this immense, price-sensitive customer base.

- Latin America (Emerging Market): Growth is primarily driven by improving economic conditions, increased healthcare investment, and a high rate of traumatic injuries in countries like Brazil and Mexico. Market penetration is often challenging due to volatile currency and fragmented distribution networks, but demand for reliable, cost-effective fixation solutions is high.

- Middle East and Africa (MEA) (Niche Growth): Characterized by significant disparities; the GCC nations (e.g., UAE, Saudi Arabia) possess world-class trauma centers and high purchasing power for premium devices, while Africa struggles with infrastructure gaps, creating demand predominantly for basic, durable external fixation devices and low-cost internal fixation solutions in humanitarian or governmental healthcare programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Orthopedic Trauma Devices Market.- Stryker

- DePuy Synthes (Johnson & Johnson)

- Zimmer Biomet

- Smith & Nephew

- Medtronic

- B. Braun Melsungen

- Integra LifeSciences

- Arthrex

- Acumed LLC

- Össur

- Conmed Corporation

- MicroPort Scientific Corporation

- Globus Medical

- NuVasive

- Wright Medical Group (acquired by Stryker)

- Teleflex Incorporated

- Orthofix Medical Inc.

- DJO Global

- ATEC Spine, Inc.

- CrossRoads Extremity Systems

Frequently Asked Questions

Analyze common user questions about the Orthopedic Trauma Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Orthopedic Trauma Devices Market?

Market growth is primarily driven by the increasing incidence of high-energy trauma (e.g., road traffic accidents), the expanding global geriatric population prone to fragility fractures, and continuous technological advancements in fixation systems like locking plates and bioabsorbable implants, enhancing surgical outcomes and reducing recovery times.

Which product segment holds the largest share in the Orthopedic Trauma Devices Market?

The Internal Fixation Devices segment, particularly plates and screws, holds the largest market share due to its wide clinical applicability in stabilizing a vast majority of simple and complex fractures across the human skeleton, offering definitive long-term stabilization.

How is the integration of 3D printing technology impacting trauma device manufacturing?

3D printing, or Additive Manufacturing, is revolutionizing the market by enabling the rapid production of patient-specific instrumentation (PSI) and customized implants. This technology allows for superior anatomical fit, potentially shorter operating times, and improved fixation stability in highly complex or irregular fractures.

What are the key materials used in the manufacture of orthopedic trauma devices?

The key materials include metallic implants, predominantly titanium and its alloys (favored for strength and biocompatibility) and stainless steel (used for cost-effectiveness), alongside an increasing use of advanced polymers like PEEK and bioabsorbable materials (e.g., PLLA) to eliminate the need for subsequent implant removal surgery.

Which regional market is projected to exhibit the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly improving healthcare infrastructure, substantial increases in healthcare expenditure, and a large, underserved patient population in developing economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager