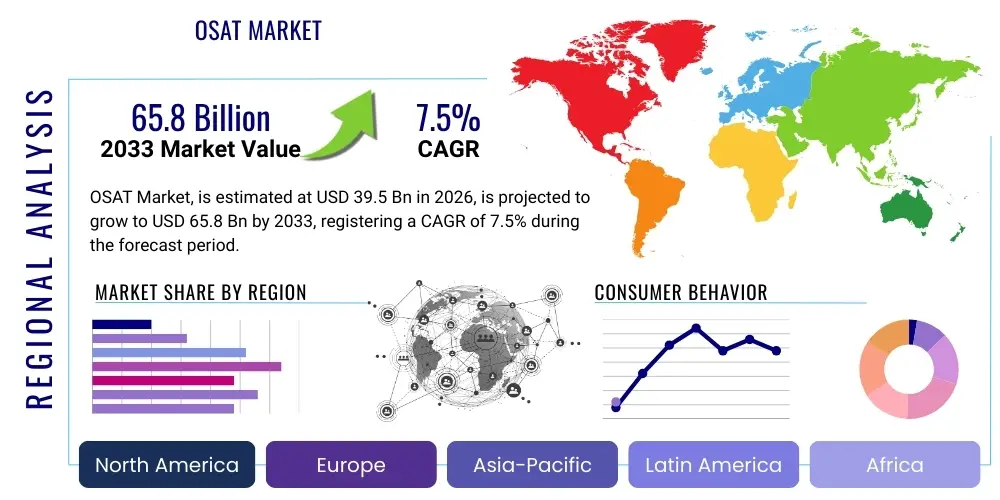

OSAT Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437648 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

OSAT Market Size

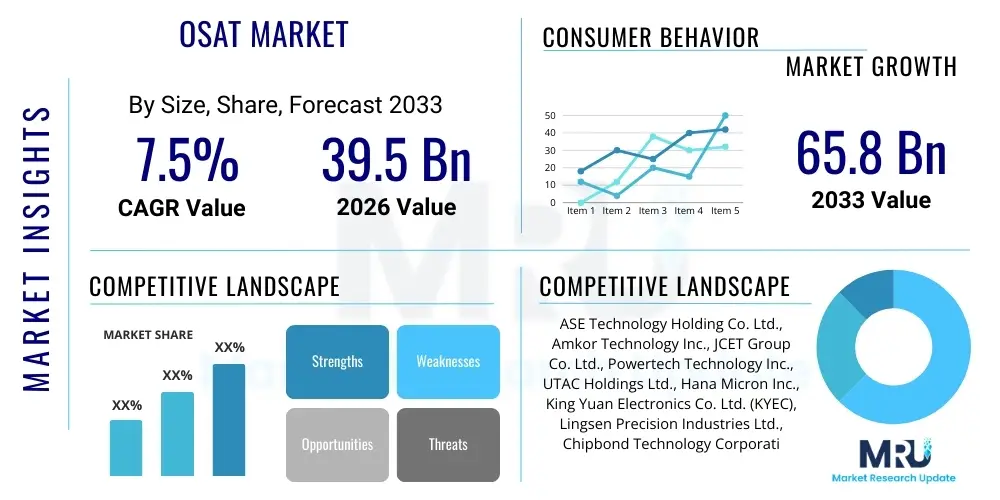

The OSAT Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 39.5 Billion in 2026 and is projected to reach USD 65.8 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for advanced semiconductor packaging solutions necessitated by high-performance computing (HPC), 5G infrastructure deployment, and the rapid proliferation of artificial intelligence (AI) and machine learning (ML) applications across diverse end-use industries, particularly automotive and consumer electronics. The shift towards fabless and asset-light manufacturing models by Integrated Device Manufacturers (IDMs) further solidifies the role of OSAT providers as essential partners in the semiconductor supply chain.

OSAT Market introduction

The Outsourced Semiconductor Assembly and Test (OSAT) market encompasses third-party services dedicated to the packaging, assembly, and final testing of silicon wafers processed by fabrication facilities (fabs). These services are crucial for transforming silicon dies into functional integrated circuits (ICs) ready for system integration. The core processes handled by OSAT providers include wire bonding, flip chip assembly, wafer-level packaging (WLP), and highly sophisticated advanced packaging techniques such as 2.5D and 3D stacking. This outsourcing model allows fabless semiconductor companies and IDMs to optimize capital expenditure, accelerate time-to-market, and focus their internal resources primarily on core competencies like chip design and research and development, leveraging the OSAT sector’s specialized expertise and massive capacity.

Major applications of OSAT services span a broad spectrum of electronic products, including smartphones, automotive control units, enterprise servers, industrial internet of things (IIoT) devices, and data center hardware. The benefits of utilizing OSAT services are manifold: cost efficiency due to economies of scale, access to cutting-edge packaging technologies that require significant specialized investment, and improved supply chain flexibility. Furthermore, OSAT companies often lead the innovation curve in thermal management and miniaturization, critical aspects for modern high-density and power-efficient electronics. The relentless pursuit of higher data throughput and lower power consumption in end-user devices mandates continuous advancements in packaging complexity, directly fueling the demand for OSAT expertise.

Driving factors for sustained market growth include the transition to smaller geometry nodes (e.g., 7nm, 5nm, and below), which increases the complexity and criticality of the packaging process, and the increasing trend of heterogeneous integration. Heterogeneous integration involves combining different types of chips (e.g., logic, memory, sensors) into a single package to maximize performance and efficiency, a highly specialized service predominantly handled by leading OSAT providers. The global expansion of semiconductor manufacturing capacity, particularly in regions aiming for supply chain resilience, coupled with robust investments in advanced packaging R&D, ensures that the OSAT market remains a dynamic and high-growth component of the overall semiconductor ecosystem.

OSAT Market Executive Summary

The OSAT market is currently characterized by intense technological competition and strategic capacity expansions, driven primarily by mega-trends in digitalization and data center build-outs. Business trends show a distinct movement towards advanced packaging methodologies, specifically Fan-Out Wafer-Level Packaging (FO-WLP) and 2.5D/3D stacking, shifting the industry away from traditional wire bonding, which now primarily serves mature and low-cost applications. Major OSAT players are aggressively investing in advanced technology capabilities to secure long-term contracts with major IDMs and large fabless entities, aiming to capture the high-margin market segments associated with AI accelerators, high-bandwidth memory (HBM), and sophisticated System-in-Package (SiP) solutions. Furthermore, supply chain diversification strategies post-pandemic are leading to cautious capacity expansions in regions outside of traditional East Asia hubs, though APAC remains the undisputed manufacturing core.

Regional trends highlight Asia Pacific (APAC) as the epicenter of OSAT activity, hosting the majority of the world's assembly and test capacity, predominantly led by Taiwan, China, and South Korea. This dominance is sustained by geographical proximity to key foundries (fabs) and a mature, vertically integrated supply chain infrastructure. While North America and Europe primarily focus on high-end design and R&D, strategic governmental initiatives in these regions are pushing for localized semiconductor manufacturing, which may introduce niche OSAT capabilities, particularly in automotive and defense sectors, though not expected to significantly shift the global capacity balance in the short term. The growth in Southeast Asia, notably Vietnam and Malaysia, is also gaining momentum as companies seek regional risk mitigation and alternative manufacturing sites, capitalizing on cost advantages and increasing local skilled labor availability.

Segment trends underscore the rising prominence of flip-chip technology over traditional packaging methods due to its superior electrical performance and thermal dissipation characteristics, making it essential for high-performance applications like CPUs and GPUs. The fastest-growing segment, however, is advanced packaging, which includes complex integration techniques necessary for AI and 5G processing units. Within end-use industries, the automotive segment exhibits significant future potential, fueled by the accelerating adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), which demand high reliability and thermal stability from packaged chips. Conversely, the mature wire bonding segment is facing pricing pressure but maintains steady volume due to its necessity in low-cost consumer and industrial applications, serving as a critical volume driver while advanced packaging drives value expansion and technological leadership for market participants.

AI Impact Analysis on OSAT Market

Common user questions regarding AI's influence on the OSAT market revolve around its dual impact: how AI drives demand for advanced packaging, and how AI technologies are utilized within OSAT operations to enhance efficiency. Users frequently ask if current OSAT capacities can handle the intense packaging demands of future AI accelerators, which require unprecedented thermal management and die-to-die connectivity (such as HBM integration and chiplet architectures). A primary concern is the required shift from conventional packaging lines to highly automated, precision-driven processes capable of handling 2.5D interposers and 3D stacking with extremely tight tolerances. Furthermore, there is significant interest in how AI and machine learning are being deployed for automated visual inspection, predictive maintenance of complex assembly equipment, and optimization of test procedures, aiming for zero-defect output and maximized throughput in sophisticated advanced packaging lines.

The core demand driver for OSAT providers stems from the necessity of high-performance packaging for AI and Machine Learning hardware. Training AI models requires massive parallel processing capabilities provided by specialized processors (like GPUs and custom ASICs), which, in turn, mandate high-density interconnects, efficient power delivery, and superior thermal dissipation—features that only advanced packaging technologies can deliver. Technologies such as high-bandwidth memory (HBM) integration and sophisticated multi-chip modules (MCMs) are becoming standard for AI accelerators, placing significant technological burdens and opportunities onto OSAT leaders capable of mastering these complex, high-yield assembly processes. This shift translates directly into higher average selling prices (ASPs) for OSAT services and necessitates continuous capital investment in specialized equipment for handling interposers, through-silicon vias (TSVs), and micro-bumps, further consolidating market leadership among technologically advanced OSAT firms.

Operationally, the integration of AI is revolutionizing internal OSAT workflows. AI-powered algorithms are increasingly utilized for real-time monitoring and anomaly detection during the assembly process, significantly improving quality control, especially in tasks requiring microscopic precision such as flip-chip attachment and micro-bump alignment. Predictive maintenance, utilizing ML models trained on sensor data from complex machinery (e.g., wire bonders and die attach equipment), minimizes unexpected downtime, a critical factor given the high utilization rates of advanced assembly lines. Furthermore, AI optimizes the highly complicated automated test process, generating more efficient test patterns and reducing overall test time while maintaining rigorous quality standards, ultimately enhancing the throughput and cost-effectiveness of OSAT operations and providing a competitive edge through improved operational efficiency and reduced human error.

- AI necessitates advanced packaging (2.5D/3D, HBM integration) for accelerators and data center GPUs, driving high-value demand.

- AI optimizes manufacturing processes through enhanced automated visual inspection (AVI) for quality control and defect detection.

- Machine learning models enable highly accurate predictive maintenance, reducing equipment downtime and improving utilization rates.

- AI algorithms are employed to optimize and accelerate complex final test procedures, reducing overall cost of test (COT).

- The development of chiplet architecture, heavily driven by AI computing needs, mandates specialized OSAT services for multi-die integration (heterogeneous integration).

DRO & Impact Forces Of OSAT Market

The OSAT market is subject to dynamic forces encompassing significant growth drivers, structural restraints, and emerging opportunities, all collectively shaping its trajectory and competitive landscape. The primary driver is the pervasive demand for high-performance and miniaturized electronic devices across consumer, enterprise, and industrial sectors, alongside the fundamental architectural shifts in semiconductor design, particularly the adoption of chiplet technology and heterogeneous integration. This technological necessity compels IDMs and fabless firms to outsource complex packaging tasks, which requires massive, continuous capital expenditure and specialized process know-how, areas where OSAT companies excel. However, the market faces acute restraints, most notably the requirement for extremely high initial capital investments to acquire and maintain advanced packaging equipment (e.g., TSV tools, high-precision lithography), which creates significant entry barriers and limits competition to a few major, financially robust players. Furthermore, maintaining stringent quality standards and intellectual property security across a global manufacturing footprint poses continuous operational challenges, particularly as packaging complexity increases.

Opportunities for growth are largely centered around emerging technological frontiers. The explosive growth of 5G infrastructure, edge computing, and high-level autonomous driving necessitates highly reliable, thermally efficient, and ruggedized packaged semiconductors, opening substantial new revenue streams, especially in the automotive and industrial segments where certification requirements are particularly strict. Furthermore, strategic opportunities exist in diversification, moving beyond traditional logic packaging into specialized niche areas such as microelectromechanical systems (MEMS) packaging, advanced sensor integration, and optical packaging, which cater to specialized markets like healthcare and sophisticated defense systems. Geopolitical shifts also offer opportunities, as global customers seek to de-risk their supply chains by demanding assembly and test capacity outside of the dominant manufacturing centers, potentially spurring investment and expansion into North America, Europe, and Southeast Asia, diversifying the global manufacturing base.

The impact forces influencing the market are multifaceted and include intense price erosion pressure in mature, traditional packaging segments, offset by substantial margin expansion in advanced packaging. Technological momentum favors those OSAT players who are first-to-market with proven, high-yield solutions for 3D stacking and chiplet assembly. Moreover, consolidation among key players is an ongoing force, driven by the need for economies of scale, technological acquisition, and securing massive customer contracts that often require global redundancy and extensive capital backing. The increasing complexity of the packaging process means that the assembly and test phase is becoming more critical to final product performance and yield than ever before, positioning OSAT providers as strategic, irreplaceable partners rather than just low-cost service providers, shifting the power dynamic within the semiconductor supply chain toward these specialized manufacturing experts.

Segmentation Analysis

The OSAT market is fundamentally segmented based on the type of service offered, the packaging technology utilized, and the application of the packaged devices. This segmentation reflects the wide range of complexity and value associated with different assembly and test requirements. Services range from basic assembly (die attach and wire bonding) to highly complex system integration (SiP and module assembly) and rigorous final testing. Technological differentiation is critical, separating volume-driven traditional packaging from high-margin, innovation-driven advanced packaging solutions. Understanding these segments is vital for market participants, as technological investment and geographical capacity deployment must be aligned with the growth trajectories of specific packaging types and target end-user applications.

- By Service Type:

- Assembly & Packaging

- Testing

- By Packaging Technology:

- Ball Grid Array (BGA)

- Chip Scale Package (CSP)

- Multi-Chip Package (MCP)

- Quad Flat Package (QFP)

- Small Outline Package (SOP)

- Advanced Packaging (Fan-Out WLP, 2.5D/3D Integration, Flip Chip)

- Wafer Level Package (WLP)

- By Application:

- Communication (5G infrastructure, mobile devices)

- Computing & Networking (Data Centers, AI Accelerators, Servers)

- Automotive (ADAS, Infotainment, Power Electronics)

- Consumer Electronics (Smartphones, Wearables, Tablets)

- Industrial & Others (Medical, Defense, IoT)

- By End-User:

- Fabless Companies

- Integrated Device Manufacturers (IDMs)

Value Chain Analysis For OSAT Market

The OSAT value chain begins upstream with equipment manufacturers and material suppliers. Upstream analysis focuses on vendors providing high-precision capital equipment necessary for assembly, such as wire bonders, die bonders, lithography tools for advanced packaging, and sophisticated inspection systems. Material suppliers provide crucial components like bonding wire (gold, copper, silver), molding compounds, substrates (organic and ceramic), and solder materials, the quality and availability of which directly influence the final yield and reliability of the packaged ICs. Given the extreme precision required in advanced packaging, relationships with specialized material providers offering high-performance interposers and micro-bumps are strategic imperatives. Pricing volatility and supply chain resilience for materials, particularly noble metals and advanced substrates, are critical upstream considerations impacting OSAT profitability and operational stability.

In the midstream, OSAT providers manage the core transformation process, receiving tested wafers from foundries and executing the assembly and test functions before shipping the packaged chips. This stage involves significant investment in automation, process control, and intellectual property development related to proprietary packaging architectures. The OSAT sector acts as a technological bridge, translating foundry output into system-ready components. Distribution channels for OSAT services are predominantly direct, involving long-term, highly customized contracts with IDMs and major fabless companies like Qualcomm, Nvidia, and AMD. This direct relationship is necessitated by the tailored nature of packaging requirements (thermal, mechanical, electrical specifications) unique to each customer's specific silicon design. Indirect channels are negligible, though some smaller OSAT firms might occasionally utilize third-party logistics providers for final shipment, the core business relationship remains strictly B2B direct engagement.

The downstream segment consists of the Original Equipment Manufacturers (OEMs) and Electronic Manufacturing Services (EMS) companies that integrate the packaged semiconductors into final electronic products. End-users span the automotive, telecommunications, computing, and consumer sectors, driving demand specifications back up the chain. Downstream requirements dictate packaging choice; for instance, automotive customers require specialized packaging for extreme temperature ranges and shock tolerance, while high-performance computing (HPC) customers demand superior thermal dissipation capabilities. The performance metrics of the OSAT provider directly influence the reliability and market success of the final electronic device, establishing a symbiotic relationship where failure in assembly or test can lead to significant reputational and financial damage downstream, underscoring the criticality of maintaining stringent quality throughout the OSAT value proposition.

OSAT Market Potential Customers

The primary and largest segment of potential customers for the OSAT market consists of Fabless Semiconductor Companies. These companies, such as Nvidia, Broadcom, and AMD, focus entirely on IC design and intellectual property development, outsourcing 100% of their manufacturing process, including wafer fabrication (to foundries like TSMC or Samsung) and subsequent assembly and testing (to OSAT providers). This strategic model allows fabless firms to maintain high agility and low fixed costs, making OSAT partnerships absolutely crucial for their operational success. As chip designs become increasingly complex and feature-rich (e.g., integrating advanced memory and logic components), fabless firms rely on OSAT providers not just for capacity, but for specialized R&D collaboration on advanced packaging solutions like 2.5D and 3D integration, demanding high technical expertise and stringent IP protection measures from their chosen OSAT partners.

Another major customer segment includes Integrated Device Manufacturers (IDMs), such as Intel and Samsung, which historically managed their own assembly and test operations internally. However, global competitive pressures and the astronomical cost of upgrading internal facilities for the latest advanced packaging technologies have driven many IDMs to adopt a "fab-lite" or hybrid approach, selectively outsourcing assembly and test functions, particularly for high-volume or technologically challenging components that require specialized expertise. Outsourcing allows IDMs to manage peak demand fluctuations, allocate internal capital expenditure towards core foundry operations (wafer fabrication), and quickly access the leading-edge packaging nodes offered by market-leading OSAT firms without incurring prohibitive investment risk. This selective outsourcing trend is a major factor contributing to the overall market growth and sophistication of OSAT offerings.

The third significant group of potential customers is the rapidly growing Automotive and Industrial Electronics sectors. Companies producing components for electric vehicles (EVs), Advanced Driver-Assistance Systems (ADAS), industrial automation, and high-reliability IoT modules require packaged chips that meet rigorous quality and lifespan standards (AEC-Q100 certification). These customers demand exceptional thermal performance, mechanical robustness, and long-term supply stability. While traditional consumer electronics prioritize low cost and miniaturization, automotive customers emphasize zero defects and extreme reliability. This specialization means OSAT providers must tailor their process flows and testing protocols specifically for these high-reliability applications, viewing automotive and industrial companies not merely as volume buyers but as strategic partners requiring specialized, resilient manufacturing services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 39.5 Billion |

| Market Forecast in 2033 | USD 65.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASE Technology Holding Co. Ltd., Amkor Technology Inc., JCET Group Co. Ltd., Powertech Technology Inc., UTAC Holdings Ltd., Hana Micron Inc., King Yuan Electronics Co. Ltd. (KYEC), Lingsen Precision Industries Ltd., Chipbond Technology Corporation, Nepes Corporation, Tianshui Huatian Technology Co. Ltd., Walton Advanced Engineering Inc., Carsem, Terascale Technologies, Siliconware Precision Industries Co., Advanced Semiconductor Engineering Inc. (ASE), Tongfu Microelectronics Co., Signetics Corp., Unisem (M) Berhad. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

OSAT Market Key Technology Landscape

The OSAT market is fundamentally defined by continuous technological innovation, driven by the need to integrate more functionality into smaller form factors while managing higher power consumption and thermal dissipation. A pivotal technology is advanced packaging, which includes complex methods such as 2.5D integration (using silicon interposers to connect multiple dies side-by-side) and true 3D stacking (connecting dies vertically using Through-Silicon Vias or TSVs). These technologies are essential for creating high-performance components like AI accelerators and sophisticated network processors, facilitating heterogeneous integration where dissimilar chips, such as high-bandwidth memory (HBM) and logic processors, are assembled into a single functional unit. The mastery of micro-bumping, precise die placement, and thermal compression bonding are non-negotiable prerequisites for players competing in this high-value technology space.

Wafer-Level Packaging (WLP) represents another crucial technological segment, further subdivided into Fan-In WLP and the rapidly growing Fan-Out WLP (FO-WLP). Fan-Out technology allows for greater input/output (I/O) density and improved electrical performance compared to traditional methods by redistributing the I/O contacts over a larger area outside the original chip size. FO-WLP is increasingly replacing traditional flip-chip and package-on-package (PoP) solutions in mobile devices and smaller form-factor applications due to its thin profile and superior integration capabilities, driving significant shifts in manufacturing floor layout and equipment requirements. The complexity of these processes demands exceptionally clean room environments and highly specialized lithography and redistribution layer (RDL) fabrication equipment within the OSAT facility itself, blurring the lines between traditional assembly and front-end foundry processes.

Furthermore, the test technology landscape is evolving rapidly to keep pace with increased chip complexity and high-speed interfaces (e.g., PCIe 5.0/6.0, DDR5). Advanced testing involves implementing high-throughput automated test equipment (ATE) capable of extremely fast signal processing and sophisticated failure analysis. Burn-in testing, often integrated into the assembly process, is becoming more rigorous, especially for automotive and mission-critical applications to ensure long-term reliability. Integration of machine learning for optimized test vector generation and analysis of test results (to improve assembly yield loops) represents the forefront of technological advancement in the test segment, emphasizing that the 'T' in OSAT is as technologically demanding and strategically important as the 'AS' components, especially in the context of advanced chiplet-based designs that require comprehensive inter-die functional validation.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global OSAT market, primarily due to the concentration of major semiconductor manufacturing hubs in Taiwan, China, South Korea, and Southeast Asia (Malaysia, Philippines, Vietnam). Taiwan, home to industry giants like ASE and SPIL, holds the largest market share, driven by its integrated ecosystem that provides proximity to leading foundries (TSMC) and access to highly skilled engineering talent specializing in advanced packaging. China is rapidly expanding its capacity, backed by substantial government support aimed at achieving self-sufficiency in semiconductor production, focusing heavily on both traditional and increasingly, advanced packaging technologies. This region benefits immensely from economies of scale and established, complex logistics networks necessary for global distribution.

- North America (NA): North America represents a crucial, albeit capacity-limited, market for OSAT, characterized primarily by high-value chip design and extensive R&D activities conducted by major fabless companies and IDMs. While assembly and test capacity remains relatively low compared to APAC, the demand drivers—high-performance computing (HPC), defense, and cutting-edge AI chips—are immense. Recent government initiatives, such as the CHIPS and Science Act, are encouraging major OSAT players to establish or expand advanced packaging facilities within the US to secure domestic supply chains for strategic components, potentially leading to localized, high-tech niche packaging centers focused on security and advanced integration.

- Europe: Europe's OSAT market is smaller but strategically important, focusing on specific high-reliability applications, especially automotive and industrial automation. The region's strong presence in automotive manufacturing necessitates local expertise in robust, high-reliability packaging that meets stringent European quality standards. European initiatives, particularly the European Chips Act, are aimed at increasing regional semiconductor production, including assembly and test capabilities, often targeting specialized areas like power semiconductors and specialized sensors rather than broad-scale commodity chip packaging. The emphasis here is on quality, reliability, and security over sheer volume.

- Latin America, Middle East, and Africa (MEA): These regions hold marginal shares in the global OSAT market, primarily serving local demand or acting as emerging sites for low-cost, mature technology packaging. Growth in MEA is highly dependent on regional governmental push for digitalization and the development of local electronics manufacturing bases. While current capacity is minimal, the increasing establishment of regional data centers and growing penetration of consumer electronics signal potential future opportunities for localized assembly and test operations focused on regional markets, though requiring significant initial infrastructure and skill development investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the OSAT Market.- ASE Technology Holding Co. Ltd.

- Amkor Technology Inc.

- JCET Group Co. Ltd.

- Powertech Technology Inc.

- UTAC Holdings Ltd.

- Hana Micron Inc.

- King Yuan Electronics Co. Ltd. (KYEC)

- Lingsen Precision Industries Ltd.

- Chipbond Technology Corporation

- Nepes Corporation

- Tianshui Huatian Technology Co. Ltd.

- Walton Advanced Engineering Inc.

- Carsem

- Terascale Technologies

- Siliconware Precision Industries Co. (SPIL)

- Tongfu Microelectronics Co.

- Signetics Corp.

- Unisem (M) Berhad

- Shenzhen Fastprint Circuit Tech Co., Ltd.

- STATS ChipPAC Pte. Ltd.

Frequently Asked Questions

Analyze common user questions about the OSAT market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from traditional to advanced packaging in OSAT?

The transition is driven by the performance demands of modern chips, particularly those used in AI, 5G, and high-performance computing (HPC). Advanced packaging (e.g., 2.5D/3D integration, Fan-Out WLP) is necessary to achieve higher transistor density, improved thermal dissipation, superior electrical signaling, and enables heterogeneous integration of chiplets, which is impossible with traditional wire bonding or basic flip-chip methods.

How does the rise of chiplet architecture affect OSAT providers?

The chiplet architecture significantly increases the complexity and value proposition for OSAT providers. It shifts the focus from single-die packaging to multi-die integration, requiring specialized assembly processes like micro-bumping, interposer handling, and advanced test procedures (e.g., known good die validation) to ensure reliable communication between various chiplets within a single package.

Which geographic region dominates the OSAT market and why?

The Asia Pacific (APAC) region, specifically countries like Taiwan and China, dominates the OSAT market. This dominance is due to established, mature supply chain ecosystems, geographical proximity to major foundries, extensive infrastructure investment, availability of specialized talent, and competitive cost structures, enabling high-volume, complex manufacturing operations.

What are the primary restraints hindering rapid growth in the OSAT sector?

Primary restraints include the extremely high capital expenditure required for acquiring and maintaining advanced assembly and test equipment necessary for 5nm and smaller nodes. Furthermore, managing technological complexity, ensuring high yield rates for 3D integrated products, and navigating geopolitical risks associated with global supply chain dependencies pose significant challenges for market expansion.

What role does the automotive sector play in OSAT market demand?

The automotive sector is a critical growth area, demanding highly reliable, robust, and thermally stable packaging solutions for components used in electric vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS). Automotive applications drive specialized OSAT requirements, often involving rigorous burn-in testing and adherence to demanding quality standards like AEC-Q100, commanding premium services and high-reliability capacity from providers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager