Oscillograph Recorders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432179 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Oscillograph Recorders Market Size

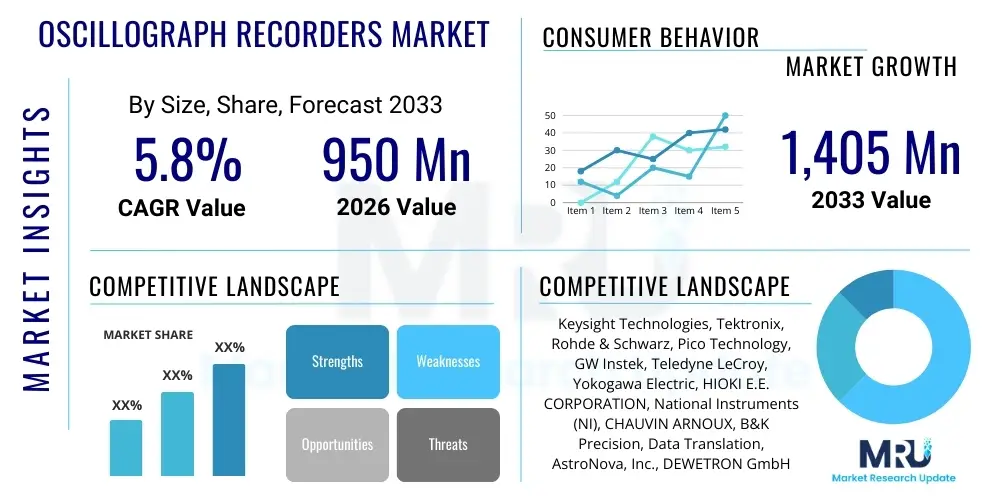

The Oscillograph Recorders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1,405 million by the end of the forecast period in 2033.

Oscillograph Recorders Market introduction

The Oscillograph Recorders Market encompasses devices designed to capture, display, and record electrical signals, typically voltage or current, over time. These sophisticated instruments are crucial for analyzing transient events, performing compliance testing, and monitoring complex electronic systems in various industrial and scientific settings. Oscillograph recorders, particularly the advanced digital storage oscilloscopes (DSOs) and high-speed data acquisition systems (DAS), provide high-fidelity signal capture capabilities, enabling engineers and researchers to diagnose problems and optimize system performance efficiently. Their evolution has shifted from analog storage to digital solutions offering enhanced processing power, larger memory depths, and integration with software analysis platforms, driving their adoption across high-reliability sectors.

The primary applications of oscillograph recorders span critical sectors such as aerospace and defense, where they are vital for validating communication systems and radar performance; the automotive industry, utilized extensively for testing Electronic Control Units (ECUs) and analyzing vehicular bus systems; and the power generation and distribution sector, where they monitor grid stability, analyze fault transients, and ensure regulatory compliance. The versatility and precision of these devices position them as indispensable tools in research and development labs globally. They facilitate the rigorous testing required for next-generation technologies, from semiconductor development to advanced material testing, requiring instruments that can handle increasingly faster signal speeds and higher channel counts.

Key driving factors for market growth include the rapid proliferation of IoT devices requiring extensive sensor testing, the continuous demand for higher bandwidth measurement solutions in telecommunications (such as 5G/6G deployment), and stringent quality control mandates in mission-critical industries. Furthermore, the rising complexity of electronic systems, driven by miniaturization and integration, necessitates more advanced troubleshooting and verification tools. The shift towards renewable energy sources and smart grid infrastructure also creates significant demand for robust oscillograph recorders capable of monitoring intermittent power transients and ensuring system resilience, contributing substantially to the market's positive trajectory.

Oscillograph Recorders Market Executive Summary

The Oscillograph Recorders Market is characterized by robust growth, primarily fueled by technological advancements introducing higher sampling rates, deeper memory, and integrated software analytics capabilities, moving the industry towards intelligent, connected measurement systems. Business trends indicate a strong focus on modular designs and platform-based solutions, allowing users to customize instruments for specific testing environments, particularly in automotive and aerospace R&D. Strategic alliances and mergers among leading vendors are intensifying competition, driving innovation in areas like real-time spectral analysis and automated compliance testing. Key manufacturers are prioritizing the development of portable, rugged devices to cater to field testing requirements in remote industrial and power infrastructure settings, ensuring operational continuity and facilitating quick diagnostics.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market due to massive investments in electronics manufacturing, expanding telecommunication infrastructure (especially in China, South Korea, and India), and aggressive governmental support for local aerospace and defense programs. North America and Europe maintain leading positions, characterized by mature R&D ecosystems and high adoption rates of premium, high-performance oscillograph recorders for advanced semiconductor design and complex signal integrity analysis. These regions are also early adopters of AI-enhanced measurement tools, aiming for faster data processing and predictive maintenance capabilities across industrial assets. The regulatory environment, particularly concerning electromagnetic compatibility (EMC) and signal integrity standards, continues to drive mandatory upgrading cycles for testing equipment globally.

Segment trends reveal a pronounced shift from analog to Digital Oscillograph Recorders (DORs), which dominate the market due to their superior signal processing, storage capacity, and remote accessibility features. Within the DOR segment, mixed-signal oscilloscopes (MSOs) are gaining traction, providing the combined analysis of analog, digital, and protocol data critical for embedded system development. The Power Generation & Distribution application segment is witnessing accelerated growth, driven by global efforts to modernize power grids and integrate sustainable energy sources, requiring specialized high-voltage, isolated-channel recorders. Furthermore, service models emphasizing calibration, repair, and software updates are becoming increasingly important revenue streams for market players, enhancing customer lifetime value and ensuring consistent equipment performance over extended periods.

AI Impact Analysis on Oscillograph Recorders Market

User queries regarding the impact of Artificial Intelligence (AI) on the Oscillograph Recorders Market frequently center on automation capabilities, enhanced signal anomaly detection, and the future role of human operators. Key concerns revolve around whether AI integration will simplify complex measurements to the point of displacing highly specialized engineers, or if it will primarily serve as an augmentation tool for faster diagnostics. Users are highly interested in how AI-driven algorithms can automatically distinguish between normal noise and critical signal anomalies in high-speed data streams—a task currently time-intensive for human analysis. The expectation is that AI will drastically cut down testing and validation cycle times, particularly in compliance testing and long-duration monitoring applications, leading to higher efficiency and reduced operational costs for end-users across telecom and automotive industries.

The integration of machine learning (ML) and deep learning (DL) models is fundamentally transforming the utility and efficiency of modern oscillograph recorders. AI enables recorders to perform tasks previously impossible or impractical, such as autonomous calibration adjustments, predictive failure analysis based on subtle signal deviations, and adaptive sampling techniques that prioritize data capture during critical events. This paradigm shift means the oscilloscope transitions from a passive measurement device to an active, intelligent system capable of making real-time analytical decisions. Manufacturers are embedding specialized AI hardware acceleration units (e.g., FPGAs or custom ASICs) into high-end recorders to handle the computational load required for real-time AI processing of massive datasets captured at gigasamples per second.

The commercial implication of AI integration is the creation of 'Smart Oscilloscopes' that offer superior value propositions, particularly for complex R&D environments and high-volume manufacturing testing. These systems can learn the normal behavior of a circuit or system, thereby significantly improving the accuracy and speed of deviation reporting. This capability is vital in fields like semiconductor failure analysis, where minute signal differences can indicate major manufacturing flaws. Furthermore, AI facilitates better user interaction through natural language processing (NLP) interfaces, streamlining setup and configuration, and ultimately lowering the barrier to entry for performing complex measurements while ensuring expert-level results, broadening the market appeal.

- Automated anomaly detection and classification using machine learning models.

- Real-time data reduction and signal denoising through adaptive AI filtering.

- Predictive maintenance capabilities for integrated electronic systems.

- Autonomous instrument configuration and optimization based on measurement objectives.

- Enhanced compliance testing automation, reducing human intervention and error.

- Accelerated processing of massive captured waveforms (deep memory analysis).

- Improved waveform visualization and feature extraction through deep learning algorithms.

DRO & Impact Forces Of Oscillograph Recorders Market

The dynamics of the Oscillograph Recorders Market are governed by a confluence of accelerating drivers (D), persistent restraints (R), emerging opportunities (O), and structural impact forces. Key drivers include the relentless pursuit of high-speed data transmission technologies, such as 5G/6G and PCIe standards, which demand measurement instruments with ever-increasing bandwidths and lower intrinsic noise levels. The pervasive digitization across all industrial sectors, promoting Industry 4.0 standards, necessitates robust data logging and transient analysis capabilities, solidifying the recorder’s essential role in modern monitoring and control systems. Conversely, significant restraints include the exceptionally high initial cost of ultra-high-performance oscilloscopes (in the multi-GHz range), which limits adoption among smaller R&D firms, alongside the complexity associated with integrating and operating highly sophisticated software analysis tools, necessitating specialized training.

Major opportunities are predominantly found in the expansion of electric vehicle (EV) technology and autonomous driving systems, which require rigorous, multi-channel testing of power electronics, battery management systems, and sensor fusion components under diverse operating conditions. Furthermore, the burgeoning demand for specialized, ruggedized oscillograph recorders tailored for extreme environments, such as aerospace flight testing or deep-sea energy exploration, represents a profitable niche market. The growing trend of modular instrumentation (PXI and AXIe platforms) also presents an opportunity, allowing vendors to offer cost-effective, scalable solutions that integrate seamlessly with existing lab equipment, lowering total cost of ownership (TCO) for large corporate customers seeking flexibility and longevity in their test benches.

Impact forces structure the competitive landscape and technological direction. Technological advancement is the primary accelerating force, forcing continuous innovation in sampling technology (e.g., Equivalent Time Sampling vs. Real-Time Sampling) and specialized probe design to ensure signal integrity at higher frequencies. Competitive intensity remains high, particularly between major established players who leverage vast patent portfolios and global service networks, and agile niche players specializing in specific high-demand features like high resolution (HR) or high channel count systems. Economic forces, particularly global semiconductor shortages and supply chain volatility, periodically influence production lead times and input costs, placing pressure on manufacturers to optimize component sourcing and internal efficiencies while maintaining competitive pricing strategies in a high-value market segment.

Segmentation Analysis

The Oscillograph Recorders Market is segmented based on the core operational technology, functional capabilities, and specific application areas, reflecting the diverse requirements of end-user industries. Technology-based segmentation differentiates between older Analog Oscillograph Recorders (AORs), which are increasingly niche or legacy; Digital Storage Oscillograph Recorders (DORs), which form the market majority due to advanced features like memory depth and processing power; and Mixed Signal Oscillograph Recorders (MSORs), which are crucial for embedded systems development requiring synchronous analog and digital domain analysis. Functional segmentation often includes high-end (above 10 GHz bandwidth), mid-range (1-10 GHz), and entry-level portable devices, addressing varied performance and budget constraints globally. This granular segmentation allows vendors to tailor product development and marketing strategies towards distinct high-growth verticals requiring specialized testing environments, ensuring optimized resource allocation and maximizing market penetration across varied technological maturity levels.

- By Type:

- Analog Oscillograph Recorders

- Digital Oscillograph Recorders (DOR)

- Mixed Signal Oscillograph Recorders (MSOR)

- By Bandwidth:

- Low-Bandwidth (Below 1 GHz)

- Mid-Bandwidth (1 GHz to 10 GHz)

- High-Bandwidth (Above 10 GHz)

- By Application:

- Aerospace & Defense

- Automotive Testing (EV and ADAS)

- Power Generation & Distribution (Smart Grids)

- Telecommunications (5G/6G Testing)

- Research & Development (R&D)

- Semiconductor Testing

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Oscillograph Recorders Market

The value chain for the Oscillograph Recorders Market begins with the upstream suppliers providing highly specialized components, including high-speed Analog-to-Digital Converters (ADCs), Field-Programmable Gate Arrays (FPGAs), custom high-bandwidth silicon, and specialized memory modules. The quality and performance of these upstream components directly determine the final instrument's bandwidth, sample rate, and measurement accuracy, making reliable sourcing and quality control paramount. Manufacturers engage in complex research and development to integrate these components, focusing on minimizing signal noise, maximizing data throughput, and designing user-friendly software interfaces. Key activities at this stage include proprietary ASIC design, rigorous calibration procedures, and extensive software validation to ensure compliance with international measurement standards, establishing high barriers to entry for new market entrants not possessing strong intellectual property in signal processing.

Midstream activities involve the production, assembly, and integration of the final oscillograph recorder hardware and accompanying software suite. Efficient manufacturing processes, robust quality assurance protocols, and effective supply chain management are critical here, especially given the global nature of component sourcing and the complexity of assembling high-precision electronic instruments. Distribution channels are varied, incorporating direct sales models for large governmental or Tier 1 corporate customers (ensuring personalized support and deep technical consultation), and indirect channels through authorized distributors, value-added resellers (VARs), and system integrators. Indirect channels are crucial for reaching smaller enterprises and educational institutions, providing localized support and rapid delivery capabilities, especially in fast-growing emerging markets where physical presence is highly valued by customers.

The downstream segment centers on installation, application support, calibration services, and post-sales maintenance, which are critical differentiators in a high-stakes capital equipment market. Due to the precision required, routine, accredited calibration services are mandatory for many end-users (like aerospace and defense contractors) to maintain measurement traceability and regulatory compliance. Direct distribution often allows manufacturers to maintain closer relationships with end-users, facilitating immediate feedback loops critical for continuous product improvement and customized solutions development. The proliferation of software licenses and subscription-based analysis tools also creates significant recurring revenue streams, shifting the focus from purely hardware sales to integrated service solutions that enhance the total lifecycle value of the oscillograph recorder.

Oscillograph Recorders Market Potential Customers

The core customer base for Oscillograph Recorders consists of highly technical professionals and organizations requiring precise signal measurement and analysis capabilities across various specialized engineering domains. Primary buyers include design verification engineers in the semiconductor industry who use high-bandwidth recorders to test chip performance and signal integrity; R&D teams in telecommunications focusing on validating high-speed communication protocols (like optical networking components and 5G base stations); and automotive engineers developing advanced driver-assistance systems (ADAS) and power electronics for electric vehicles. These users typically demand instruments that offer multi-channel synchronized measurements, deep memory for long acquisitions, and specialized application-specific analysis software packages to expedite complex validation cycles, often prioritizing performance specifications over cost constraints.

Secondary, but rapidly growing, customer segments include industrial maintenance and field service technicians, particularly those operating in the power sector (utilities and grid operators) and heavy manufacturing. These buyers often prioritize ruggedness, portability, and ease of use in highly volatile or remote operational environments, favoring handheld or compact oscillograph recorders capable of quick fault isolation and regulatory compliance checks. Academic and governmental research institutions also represent a substantial and consistent customer base, utilizing these instruments for fundamental physics research, advanced material science studies, and military equipment development. The purchasing decisions in these sectors are frequently influenced by grant cycles, budget availability, and the requirement for open architecture systems that support custom programming and integration with proprietary lab equipment, leading to long-term procurement relationships with established vendors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 1,405 million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Keysight Technologies, Tektronix, Rohde & Schwarz, Pico Technology, GW Instek, Teledyne LeCroy, Yokogawa Electric, HIOKI E.E. CORPORATION, National Instruments (NI), CHAUVIN ARNOUX, B&K Precision, Data Translation, AstroNova, Inc., DEWETRON GmbH, ADLINK Technology Inc., VTI Instruments (A Rohde & Schwarz Company), HEINZINGER electronic GmbH, OMEGA Engineering Inc., Fluke Corporation, Sefelec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oscillograph Recorders Market Key Technology Landscape

The technological landscape of the Oscillograph Recorders Market is defined by relentless innovation focused on increasing capture fidelity, bandwidth, and processing speed, moving far beyond traditional measurement techniques. A cornerstone technology driving performance gains is the advancement in high-speed Analog-to-Digital Converters (ADCs), which dictate the maximum sampling rate and effective number of bits (ENOB). Manufacturers are continuously pushing the boundaries of real-time sampling to multiple tens of Giga-samples per second (GS/s) to accurately capture fleeting transient signals prevalent in modern high-speed digital communication protocols. Furthermore, deep memory architecture is crucial, allowing recorders to capture long-duration events at maximum sample rates without aliasing, supported by custom Field-Programmable Gate Arrays (FPGAs) or Application-Specific Integrated Circuits (ASICs) optimized for rapid data manipulation and sophisticated real-time signal processing.

The development of specialized probing solutions is another critical technology area, as the performance of the probe often limits the overall system bandwidth and signal integrity. Active probes, differential probes, and high-voltage isolated probes are essential for specific applications like power electronics testing and advanced RF measurements. Recent innovations include coherent, multi-channel oscillography, enabling the precise synchronization of numerous input channels across distributed systems, highly valued in complex testing scenarios like phased-array radar validation or large-scale automotive ECU interaction testing. This enhanced capability allows for the precise measurement of timing skew and correlation between hundreds of simultaneous data streams, providing a holistic view of system behavior under dynamic operating conditions.

Software and integration capabilities form the third pillar of the technological landscape. Modern oscillograph recorders rely heavily on proprietary analytical software, often featuring built-in compliance test suites for standards like USB, Ethernet, and PCIe. The growing integration of MATLAB, Python, and other programmatic interfaces allows users to automate complex measurement sequences and integrate the recorder seamlessly into larger automated test environments (ATEs). The current technological trend favors instruments that are inherently networked and cloud-compatible, facilitating remote operation, collaborative data sharing among global R&D teams, and secure, centralized management of calibration and firmware updates, contributing significantly to operational efficiencies across large organizations.

Regional Highlights

North America holds a significant share of the Oscillograph Recorders Market, driven by the presence of major technology hubs, extensive military and aerospace R&D expenditure, and a highly mature semiconductor industry. The demand here is concentrated on ultra-high-end, multi-GHz bandwidth devices necessary for cutting-edge signal integrity analysis, data center technology development, and high-speed memory interface testing. Furthermore, rigorous regulatory environments and a strong emphasis on maintaining high standards in mission-critical applications ensure a continuous replacement cycle for precision testing equipment. The early adoption of advanced technologies, including AI-enhanced measurement tools and modular PXI-based systems, distinguishes the North American market, often setting global benchmarks for performance and application complexity.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, primarily attributable to exponential expansion in electronics manufacturing in countries like China, Taiwan, South Korea, and Vietnam. Government initiatives supporting local R&D in automotive (especially EV manufacturing) and telecommunications (5G/6G rollout) are boosting the procurement of mid-to-high-range oscillograph recorders. China, in particular, represents a massive market due to its focus on building independent domestic supply chains for semiconductors and advanced industrial machinery, leading to substantial investment in local testing infrastructure. While price sensitivity exists for general-purpose devices, the demand for high-performance units for strategic technology development remains consistently high across key economic centers in the region.

Europe represents a stable and mature market, characterized by strong demand from the automotive sector, particularly Germany's premium car manufacturers, and a well-established industrial automation and power utility base. European manufacturers prioritize high-quality, reliable, and energy-efficient measurement solutions, often demanding compliance with strict environmental and safety standards. The deployment of smart grid technologies and renewable energy infrastructure across the European Union further stimulates demand for specialized power quality and transient recorders capable of handling high voltages and maintaining accurate measurements in electrically noisy environments. The presence of leading multinational Test & Measurement companies and specialized industrial research institutes ensures steady investment in advanced oscillograph technology, maintaining Europe's position as a key global consumer of these high-precision instruments.

- North America: Leading market for high-bandwidth (>30 GHz) oscilloscopes; strong demand from Defense, Aerospace, and Silicon Valley R&D centers.

- Asia Pacific (APAC): Highest growth trajectory fueled by mass electronics manufacturing, 5G infrastructure deployment, and increasing automotive electrification (EV).

- Europe: Stable market driven by robust automotive testing (ADAS, ECU), industrial automation (Industry 4.0), and stringent energy sector monitoring requirements.

- Latin America (LATAM): Emerging market characterized by infrastructural development and expanding telecommunication networks; increasing adoption of mid-range portable recorders for field service.

- Middle East and Africa (MEA): Growth driven by investments in oil & gas infrastructure monitoring and modernization of power generation facilities; focus on ruggedized, high-reliability equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oscillograph Recorders Market.- Keysight Technologies

- Tektronix

- Rohde & Schwarz

- Pico Technology

- GW Instek

- Teledyne LeCroy

- Yokogawa Electric

- HIOKI E.E. CORPORATION

- National Instruments (NI)

- CHAUVIN ARNOUX

- B&K Precision

- Data Translation

- AstroNova, Inc.

- DEWETRON GmbH

- ADLINK Technology Inc.

- VTI Instruments (A Rohde & Schwarz Company)

- HEINZINGER electronic GmbH

- OMEGA Engineering Inc.

- Fluke Corporation

- Sefelec

- S. L. D. Lasers, Inc.

- Sensidyne, LP

- Evertz Microsystems Ltd.

- Viavi Solutions Inc.

- Anritsu Corporation

- Good Will Instrument Co., Ltd.

- Rigol Technologies, Inc.

- Tabor Electronics Ltd.

- TDK-Lambda Corporation

- Transcat, Inc.

- Applied Test Systems

Frequently Asked Questions

Analyze common user questions about the Oscillograph Recorders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a digital oscilloscope and an oscillograph recorder?

While often used interchangeably in modern contexts, an oscillograph recorder traditionally emphasizes long-duration data capture and storage of transient events, often across multiple channels, making it crucial for monitoring power grids or mechanical tests. A digital oscilloscope (DSO) primarily focuses on displaying and analyzing repetitive, high-frequency waveforms in real time, though modern DSOs often incorporate deep memory for recording functions.

Which application segment drives the highest demand for high-bandwidth oscillograph recorders?

The Telecommunications and Semiconductor Testing segments consistently drive the highest demand for ultra-high-bandwidth recorders (above 10 GHz). This is essential for validating high-speed communication standards like 5G/6G, PCIe Gen 5/6, and complex memory interfaces where accurate signal integrity analysis is mandatory for performance validation.

How is AI changing the functionality of modern oscillograph recorders?

AI integration is enabling advanced functions such as automated anomaly detection, real-time waveform classification, and autonomous instrument configuration. AI-enhanced recorders can rapidly process deep memory datasets to identify subtle faults that human operators might miss, significantly accelerating diagnostics and testing cycles in complex R&D environments.

Why is the Asia Pacific (APAC) region experiencing the fastest market growth?

APAC’s rapid growth is driven by substantial government and private sector investments in electronics manufacturing, expansive 5G infrastructure deployment across countries like China and India, and the accelerating adoption of electric vehicle (EV) technology, all requiring massive volumes of testing and measurement equipment.

What are the key technical specifications potential buyers should prioritize?

Key specifications include Bandwidth (determining the highest frequency captured), Sample Rate (Gigasamples per second), and Memory Depth (allowing long duration captures at high sample rates). For power applications, Isolation Voltage and Channel Count are also critical, while for digital systems, Mixed Signal Capabilities (MSOs) are highly valued.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager