Osteoarthritis Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433926 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Osteoarthritis Drugs Market Size

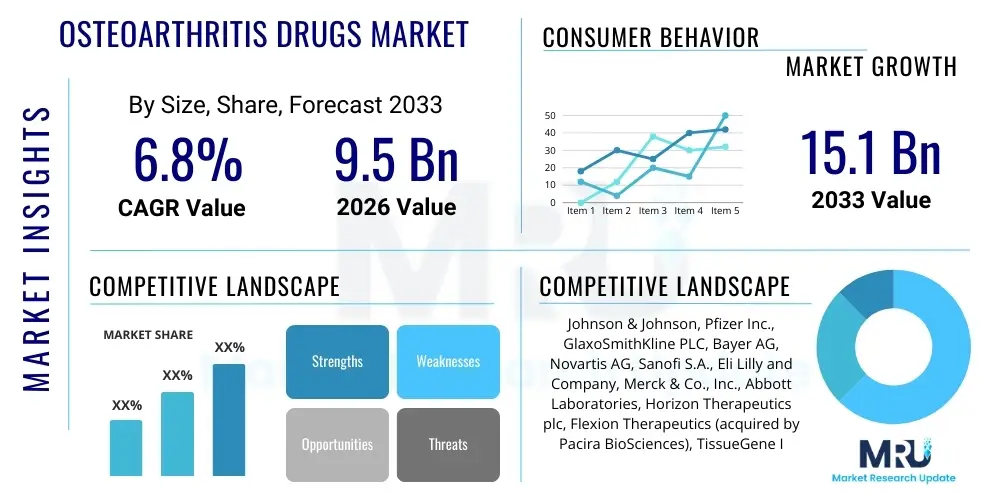

The Osteoarthritis Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 15.1 Billion by the end of the forecast period in 2033.

Osteoarthritis Drugs Market introduction

The Osteoarthritis Drugs Market encompasses pharmaceuticals and therapeutics designed to manage the symptoms and potentially slow the progression of osteoarthritis (OA), a highly prevalent chronic joint disorder characterized by cartilage degradation, joint pain, and stiffness. Osteoarthritis primarily affects the hands, knees, hips, and spine, leading to significant disability and reduced quality of life for millions globally. The primary therapeutic products currently dominating this market include non-steroidal anti-inflammatory drugs (NSAIDs), analgesics suchicides as acetaminophen, corticosteroid injections, and viscosupplementation agents (hyaluronic acid). The rising geriatric population, coupled with increasing rates of obesity and sedentary lifestyles, serves as a fundamental driver for market expansion, necessitating continuous innovation in both symptomatic relief and disease-modifying osteoarthritis drugs (DMOADs).

The product description spans across various routes of administration, including oral medications, topical gels and creams, and intra-articular injections. Major applications are centered around pain management, reducing inflammation, and improving joint mobility in patients diagnosed with all stages of OA, although a significant focus remains on early-stage and moderate disease management. Recent advancements are tilting towards biological agents and targeted therapies that address the underlying pathological mechanisms rather than just the symptoms. These novel approaches, often involving growth factors, small molecules, or cell-based therapies, represent a crucial evolutionary phase in the market, promising potentially curative or disease-modifying outcomes previously unattainable with conventional treatments.

The benefits derived from effective OA drug management include enhanced patient mobility, substantial reduction in chronic pain levels, and delayed necessity for joint replacement surgery. Driving factors for growth include intensive research and development (R&D) activities focused on DMOADs, favorable reimbursement policies in developed economies, and a growing public health awareness regarding early diagnosis and intervention. Furthermore, the market is continually influenced by patent expirations, which pave the way for cost-effective generic alternatives, expanding accessibility across diverse socioeconomic strata. The synergistic effect of these demographic, therapeutic, and economic factors ensures sustained and robust growth for the Osteoarthritis Drugs Market throughout the forecast period.

Osteoarthritis Drugs Market Executive Summary

The Osteoarthritis Drugs Market demonstrates robust growth driven by escalating prevalence of the disease, particularly in rapidly aging populations across North America and Europe, and significant pipeline momentum for next-generation biological therapies. Key business trends indicate a strategic shift by pharmaceutical giants towards collaborations and acquisitions focused on specialized drug delivery systems and non-opioid pain management solutions, addressing the dual challenge of chronic disease management and minimizing addiction risks. Pricing pressure remains a notable factor, especially in mature segments dominated by generics, prompting innovators to concentrate R&D efforts on premium-priced DMOADs that offer superior clinical efficacy. Furthermore, increasing investment in personalized medicine approaches, leveraging biomarkers to identify responders to specific treatments, is beginning to define future commercial strategies.

Regional trends illustrate North America maintaining its leadership position due to high healthcare expenditure, sophisticated diagnostic infrastructure, and high adoption rates of advanced therapeutics, particularly viscosupplementation. However, the Asia Pacific (APAC) region is projected to register the highest CAGR, primarily fueled by massive undiagnosed patient pools in countries like China and India, improving healthcare accessibility, and rising disposable incomes facilitating greater out-of-pocket spending on newer treatments. European markets continue to prioritize cost-effectiveness assessments, often favoring established NSAIDs and generic formulations, though robust regulatory frameworks expedite the approval of targeted injectables and novel therapies aimed at specific patient subpopulations.

Segment trends reveal that the NSAID class, despite being mature, retains the largest market share owing to its widespread prescription and over-the-counter availability. However, the segment categorized under biological and disease-modifying drugs is poised for explosive growth as numerous candidates progress through late-stage clinical trials. By route of administration, intra-articular injections, especially those utilizing high-molecular-weight hyaluronic acid or corticosteroids, show significant uptake due to localized action and reduced systemic side effects. The long-term trajectory of the market is heavily dependent on the successful commercialization of a validated DMOAD, which would fundamentally redefine treatment protocols and market valuation across all geographies.

AI Impact Analysis on Osteoarthritis Drugs Market

User inquiries regarding AI's role in the Osteoarthritis Drugs Market frequently center on its potential to accelerate drug discovery, optimize clinical trial design, and personalize treatment regimens. Users are particularly keen on understanding how AI can sift through vast genomic and proteomic datasets to identify novel therapeutic targets—specifically DMOAD candidates—that traditional methods have overlooked. Key themes include concerns about the accuracy and bias in AI-driven diagnostic tools for early-stage OA, expectations regarding virtual clinical trial simulations to reduce cost and time, and the practical integration of machine learning algorithms for predicting patient response to existing drugs, moving beyond generalized prescribing guidelines toward precision rheumatology.

- AI accelerates the identification of novel molecular targets and pathways involved in cartilage degradation and joint inflammation, leading to faster hit-to-lead times in DMOAD research.

- Machine learning algorithms enhance patient stratification for clinical trials, identifying suitable candidates with specific OA phenotypes, thereby increasing trial success rates and reducing costs.

- AI-powered image analysis (radiomics) provides more objective and quantitative assessment of disease progression than traditional scoring, enabling earlier and more precise diagnosis.

- Implementation of predictive models optimizes personalized treatment plans, forecasting patient response to various NSAIDs, injectables, or biologics based on individual biomarker profiles.

- AI assists in pharmacovigilance by analyzing real-world evidence (RWE) from electronic health records (EHRs) to monitor drug efficacy and safety post-commercialization across diverse patient populations.

DRO & Impact Forces Of Osteoarthritis Drugs Market

The dynamics of the Osteoarthritis Drugs Market are governed by a complex interplay of demographic shifts, technological advancements, regulatory environments, and economic factors, summarized across Drivers, Restraints, and Opportunities. Primary drivers include the global aging population, which inherently increases the incidence of age-related degenerative joint conditions like OA, and the concurrent rise in risk factors such as obesity and sports injuries that accelerate joint wear. The intensifying pursuit of effective Disease-Modifying Osteoarthritis Drugs (DMOADs) fuels substantial investment, promising therapies that could significantly alter the disease trajectory rather than merely masking symptoms. Furthermore, enhanced patient awareness, propelled by digital health platforms and advocacy groups, leads to earlier diagnosis and increased demand for effective pharmaceutical interventions.

Conversely, significant restraints impede market expansion. The high cost associated with R&D for novel biological therapies and DMOADs limits the immediate accessibility of breakthrough treatments, particularly in emerging economies. A major clinical challenge is the lack of a fully validated DMOAD currently on the market, meaning treatment regimens largely remain palliative. Furthermore, reliance on traditional pain management methods, including generic NSAIDs and, controversially, opioids in some regions, suppresses the immediate demand for premium-priced innovative drugs. Regulatory hurdles related to proving structural modification benefits rather than just symptomatic relief often delay the approval timelines for novel therapies.

Opportunities for growth are abundant and center on novel drug delivery systems, such as long-acting injectables and localized drug eluting systems, which enhance compliance and reduce systemic exposure. The rapid development of regenerative medicine, including cell-based therapies and gene therapies aimed at repairing damaged cartilage, presents a paradigm-shifting avenue for market participants. Strategic partnerships between pharmaceutical firms and academic institutions to leverage genomic data for identifying personalized treatment targets offer a significant competitive advantage. The expansion into untapped emerging markets, through establishing robust distribution channels and localized clinical trials, also provides substantial potential for volumetric growth throughout the forecast horizon.

Segmentation Analysis

The Osteoarthritis Drugs Market is comprehensively segmented based on the drug class, the route of administration, and the anatomical location of the disease, allowing for detailed analysis of consumption patterns and therapeutic preferences. Understanding these segments is critical for manufacturers tailoring their R&D and commercial strategies, focusing on areas with unmet clinical needs, particularly long-term pain management and true disease modification. The dominant segments, such as NSAIDs and analgesics, provide immediate revenue stability, while emerging segments, including biologics and cell-based therapies, represent future high-growth areas.

- By Drug Class:

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

- Analgesics (Acetaminophen)

- Corticosteroids

- Viscosupplementation Agents (Hyaluronic Acid)

- Disease-Modifying Osteoarthritis Drugs (DMOADs) (In Pipeline)

- Biologics and Others

- By Route of Administration:

- Oral

- Topical

- Injectable (Intra-Articular and Intravenous)

- By Anatomy:

- Knee Osteoarthritis

- Hip Osteoarthritis

- Hand Osteoarthritis

- Spine and Others

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies and Drug Stores

- Online Pharmacies

Value Chain Analysis For Osteoarthritis Drugs Market

The value chain of the Osteoarthritis Drugs Market is intricate, starting with extensive upstream activities including basic research and discovery, raw material sourcing, and active pharmaceutical ingredient (API) manufacturing. The discovery phase, often involving biotechnology firms and academic research centers, focuses on identifying novel targets related to inflammation and cartilage repair, a high-risk, high-reward endeavor. API manufacturing requires stringent quality control and compliance with Good Manufacturing Practices (GMP), particularly for complex biological agents and specialized injectables. Strategic collaborations in the upstream segment, especially for outsourced clinical research organizations (CROs), are essential to efficiently manage the expensive and protracted drug development cycle from preclinical testing through Phase III trials.

Midstream activities involve formulation, packaging, and regulatory filing, leading up to large-scale commercial production. This stage is dominated by major pharmaceutical companies leveraging proprietary manufacturing technologies to ensure bioavailability and stability of the final product. Distribution channel analysis highlights the critical role of specialized cold-chain logistics for handling temperature-sensitive biological drugs and injectables, necessitating robust infrastructure investments. The primary distribution channels are direct sales to hospitals and specialized clinics, and indirect distribution through wholesale pharmacies and major retail pharmacy chains, which cater significantly to the high volume of chronic oral medications.

Downstream activities primarily focus on market access, sales, marketing, and post-market surveillance. Given the chronic nature of OA, successful market penetration relies heavily on securing favorable reimbursement from public and private payers. Direct marketing targets rheumatologists, orthopedic surgeons, and primary care physicians, emphasizing clinical efficacy and patient quality of life improvements. The direct channel is prominent for high-value injectables requiring physician administration, ensuring controlled inventory and specialized patient education. The indirect channel, serving oral and topical NSAIDs, relies on broad pharmacy coverage and consumer advertising. Effective post-market surveillance ensures continuous compliance and gathering of real-world evidence, crucial for therapeutic differentiation and sustaining market share against generic competition.

Osteoarthritis Drugs Market Potential Customers

The primary customers for the Osteoarthritis Drugs Market are multilayered, encompassing patients suffering from various stages of the disease, the healthcare providers who diagnose and prescribe treatment, and the institutional payers who fund the majority of treatment costs. The end-users, or patients, are typically individuals over the age of 50, although younger patients with predisposing factors such as obesity, joint injury, or genetic predisposition form a growing segment. Patients are increasingly seeking treatments that offer long-term relief and minimal systemic side effects, driving demand for localized therapies (topicals and injectables) and potentially DMOADs. These customers value convenience, efficacy in pain reduction, and maintenance of functional independence.

Healthcare providers, particularly orthopedic surgeons, rheumatologists, and pain specialists, are crucial in driving prescription patterns. Their adoption of specific treatments is heavily influenced by clinical trial data, professional guidelines, therapeutic ease of use, and reimbursement status. Surgeons often favor injectables, such as corticosteroids or hyaluronic acid, as transitional treatments or alternatives to surgery, while rheumatologists manage chronic pharmaceutical regimens. General practitioners serve as gatekeepers, frequently prescribing initial courses of oral NSAIDs and analgesics, defining the entry point for most OA treatments.

Institutional buyers, including national health services (NHS in the UK, specific programs in Europe), managed care organizations (MCOs) in the US, and large hospital systems, represent the largest volume purchasers. Their purchasing decisions are primarily cost-driven, balanced against clinical effectiveness and budget impact. They focus intensively on health economics and outcomes research (HEOR) data to determine formulary inclusion and tiered patient access. The successful market entry of a high-value drug, particularly a DMOAD, requires compelling evidence demonstrating significant savings in long-term care costs, reduction in joint replacement surgeries, and overall societal economic benefits, thus positioning these institutions as the ultimate high-value customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 15.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Pfizer Inc., GlaxoSmithKline PLC, Bayer AG, Novartis AG, Sanofi S.A., Eli Lilly and Company, Merck & Co., Inc., Abbott Laboratories, Horizon Therapeutics plc, Flexion Therapeutics (acquired by Pacira BioSciences), TissueGene Inc., Regeneron Pharmaceuticals, Biogen Inc., AstraZeneca PLC, Teva Pharmaceutical Industries Ltd., Mylan N.V. (Viatris), F. Hoffmann-La Roche Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Osteoarthritis Drugs Market Key Technology Landscape

The technological landscape of the Osteoarthritis Drugs Market is rapidly evolving, moving away from simple symptom management toward complex biological targeting and sustained drug delivery. A core focus is the development of novel formulations for intra-articular injection that provide extended duration of action, reducing the frequency of clinic visits and improving patient compliance. This includes lipid-based carriers, microparticles, and hydrogel technologies designed to slowly release NSAIDs or corticosteroids directly into the joint space over several weeks or months. Furthermore, advanced cell culture and genetic engineering techniques are fundamental to the pipeline development of autologous and allogeneic cell therapies aimed at cartilage regeneration, representing a significant technological leap towards structural repair.

Another crucial technological frontier involves precision medicine enabled by advanced diagnostics. The use of molecular biomarkers, sophisticated magnetic resonance imaging (MRI) techniques, and machine learning models helps in subclassifying OA patients based on the dominant pathophysiological pathway (e.g., inflammatory phenotype vs. metabolic phenotype). This technological capability allows pharmaceutical companies to develop and test drugs specifically targeting defined patient subpopulations, significantly improving the probability of clinical success for DMOADs. The integration of high-throughput screening technologies and computational chemistry facilitates the rapid testing of vast chemical libraries against newly identified biological targets, accelerating the early discovery process.

Finally, the growing adoption of smart drug delivery systems and digital health integration significantly impacts patient monitoring and adherence. Wearable devices and connected health platforms collect real-world data on patient activity levels, pain scores, and treatment adherence, providing valuable feedback for both clinicians and researchers. These technologies support the assessment of drug efficacy outside controlled clinical settings. The technological innovation driving the Osteoarthritis Drugs Market is fundamentally centered on extending therapeutic longevity, enhancing targeting specificity, and personalizing treatment delivery to maximize patient outcomes while minimizing systemic side effects associated with long-term chronic medication use.

Regional Highlights

- North America: Dominates the global market share, driven by high prevalence of OA, sophisticated healthcare infrastructure, rapid adoption of premium viscosupplementation agents and biological injectables, and high per capita expenditure on innovative pharmaceuticals.

- Europe: Characterized by a strong emphasis on cost-effectiveness and formalized treatment guidelines. Western European nations (Germany, UK, France) are major consumers of NSAIDs and intra-articular therapies, with increasing regulatory focus on DMOAD research and market access.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate (CAGR), fueled by expanding aging populations, increasing awareness about OA management, improving public and private healthcare funding, and the swift modernization of hospital infrastructure in economies like China and India.

- Latin America (LATAM): Growth is primarily dependent on improving economic conditions and health insurance penetration. The market is moderately mature for generic NSAIDs but sees slower uptake of high-cost branded biologics and advanced injection therapies.

- Middle East and Africa (MEA): Represents an emerging market with heterogeneous growth. Gulf Cooperation Council (GCC) countries show high adoption of advanced treatments due to high disposable income and favorable healthcare policies, whereas African nations focus largely on essential, low-cost analgesic medications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Osteoarthritis Drugs Market.- Johnson & Johnson

- Pfizer Inc.

- GlaxoSmithKline PLC

- Bayer AG

- Novartis AG

- Sanofi S.A.

- Eli Lilly and Company

- Merck & Co., Inc.

- Abbott Laboratories

- Horizon Therapeutics plc

- Pacira BioSciences (including Flexion assets)

- Regeneron Pharmaceuticals

- Biogen Inc.

- AstraZeneca PLC

- Teva Pharmaceutical Industries Ltd.

- Viatris (formerly Mylan N.V. and Pfizer's Upjohn)

- F. Hoffmann-La Roche Ltd.

- Zimmer Biomet Holdings Inc.

- Ferring Pharmaceuticals

- Organon & Co.

Frequently Asked Questions

Analyze common user questions about the Osteoarthritis Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current market status of Disease-Modifying Osteoarthritis Drugs (DMOADs)?

Currently, no true DMOAD has received full regulatory approval globally; the pipeline is highly active, focusing on therapies that halt or reverse structural joint damage rather than just managing pain. Development challenges remain high, but successful candidates would fundamentally transform the market landscape.

How significant is the role of viscosupplementation in the current treatment paradigm?

Viscosupplementation, primarily involving hyaluronic acid injections, plays a substantial role, particularly for knee OA, providing symptomatic relief and potentially delaying surgery. Its adoption is high in North America and parts of Europe, driven by its localized action and favorable safety profile compared to systemic drugs.

What major trends are driving innovation in osteoarthritis drug delivery?

Innovation is focused heavily on creating long-acting intra-articular formulations, such as sustained-release hydrogels or microparticle technologies, designed to extend the therapeutic effect for several months from a single injection, thereby improving patient compliance and minimizing systemic side effects.

Which geographical region offers the highest growth potential for novel OA therapies?

The Asia Pacific (APAC) region, particularly emerging economies like China and India, offers the highest growth potential due to rapidly aging populations, increasing healthcare expenditure, and substantial unmet clinical needs across large patient demographics.

What are the primary restraints affecting the commercialization of new osteoarthritis drugs?

The primary restraints include the exceptionally high R&D costs required to develop and validate DMOADs, intense generic competition in the established NSAID segment, and persistent regulatory difficulties in proving structural efficacy endpoints necessary for groundbreaking drug approval.

The detailed analysis within this report underscores that the Osteoarthritis Drugs Market is transitioning from reliance on palliative care towards advanced biological interventions and regenerative medicine. The growth trajectory is stable and positive, supported by global demographic trends and sustained investment in precision medicine techniques. The market’s future profitability is contingent upon the successful transition of pipeline DMOADs into commercial reality, potentially resetting market values and therapeutic standards across all major segments.

Further expansion of the market is expected through strategic acquisitions aimed at consolidating specialized technology platforms, particularly those related to localized drug delivery and tissue regeneration. The regulatory environment is gradually adapting to new clinical endpoints related to structural modification, which will streamline the approval pathway for genuinely innovative therapies. Continued analysis of real-world evidence will be critical for payers and providers to assess the long-term value of newer, higher-cost treatments relative to established generics, maintaining a complex but dynamic commercial landscape.

The competitive intensity is likely to increase as biotech startups and large pharmaceutical firms vie for leadership in the DMOAD segment. Companies that successfully leverage Artificial Intelligence for target identification and clinical trial optimization will gain a substantial advantage. Furthermore, addressing the needs of underserved markets through cost-effective generic alternatives and expanding access to diagnosis remains a humanitarian and commercial imperative, ensuring that market growth is both robust and ethically responsible across diverse global patient populations.

Technological advancements in imaging and biomarker discovery are crucial supportive elements for the pharmaceutical market. Non-invasive methods for detecting early-stage cartilage damage allow for intervention before extensive joint destruction occurs, broadening the addressable patient pool for future DMOADs. This convergence of diagnostics and therapeutics marks a mature phase of market development, emphasizing integrated care pathways. The market ecosystem increasingly values holistic approaches that combine pharmaceutical treatments with lifestyle modifications, physical therapy, and digital health tools for comprehensive patient management, reflecting a deeper understanding of chronic disease complexity.

In summary, while symptomatic treatments provide immediate relief and constitute the current bulk of market revenue, the substantial long-term value lies in successful DMOADs and regenerative solutions. The forecast period is expected to be characterized by increasing differentiation between premium, targeted injectable therapies and high-volume oral generics. Strategic focus areas for market participants must include clinical validation of disease modification, optimizing patient stratification through biomarkers, and navigating intricate global reimbursement landscapes to ensure commercial viability and sustained market leadership in this essential therapeutic area.

The shift towards precision medicine models necessitates heavy investment in genetic and molecular research to tailor treatments to specific inflammatory and degenerative phenotypes of OA. This personalized approach reduces treatment failure rates and optimizes healthcare resource utilization. For instance, drugs targeting specific inflammatory cytokines may only be effective in patients exhibiting that specific molecular signature, demanding sophisticated diagnostic co-development alongside therapeutic agents. This technological requirement contributes significantly to the high entry barriers for novel drug classes but promises substantial therapeutic rewards upon market success.

Moreover, the patent cliff phenomenon continues to reshape the market structure. As key branded NSAIDs and some earlier viscosupplementation products lose exclusivity, generic manufacturers gain significant market share based purely on price competition. This economic pressure forces innovator companies to continually invest in proprietary drug delivery systems and novel APIs that are protected by robust intellectual property. The interplay between cost-effective generics and high-value innovations defines the fundamental economic tension within the Osteoarthritis Drugs Market, influencing pricing strategies and market access negotiations globally.

Considering the regional growth dynamics, APAC’s acceleration mandates localized clinical strategies and culturally sensitive patient education campaigns. While Western markets demand sophisticated pharmacoeconomic data, APAC markets often prioritize accessibility and affordability, leading to dual pricing and distribution strategies for global pharmaceutical firms. The long-term success in the Osteoarthritis Drugs Market will thus be determined not only by scientific breakthroughs but equally by effective global market segmentation and adaptive commercial models that address varied healthcare structures and patient purchasing power across the world.

Final note on key competitive strategies: Leading companies are not only pursuing new molecules but are also optimizing existing assets through life-cycle management, such as developing combination therapies or creating extended-release versions of established drugs. This strategy aims to maintain market relevance and defend revenue against the inevitable challenge posed by generic erosion. The emphasis on minimizing systemic risk, particularly given the cardiovascular and gastrointestinal side effects associated with long-term NSAID use, is a powerful driver pushing research toward safer, localized, and potentially curative therapeutic options.

The Osteoarthritis Drugs market faces continuous pressure to reduce the need for surgical interventions, which are costly and invasive. Therefore, any pharmaceutical solution that can reliably delay or completely prevent the necessity of total joint replacement surgery represents massive potential value. This goal justifies the high R&D expenditure currently being channeled into biological agents, which possess the theoretical capability to regenerate or significantly stabilize joint tissues. Regulatory bodies are watching these developments closely, prepared to grant fast-track designation to treatments demonstrating clear evidence of structural benefits.

In terms of patient experience and adherence, the market is benefiting from digital transformation. Telemedicine consultations, remote patient monitoring via apps, and digital platforms providing tailored exercise routines complement pharmaceutical treatment. These digital tools improve patient empowerment and provide crucial behavioral data that can inform treatment adjustments, demonstrating a value-added service beyond the drug itself. Pharmaceutical companies are integrating these digital health solutions into their commercial offerings to enhance brand loyalty and therapeutic outcomes.

The increasing prevalence of co-morbidities associated with OA, such as diabetes and cardiovascular disease, adds complexity to drug development. Novel OA drugs must demonstrate not only efficacy in joint health but also a favorable safety profile concerning systemic conditions. This requirement further elevates the bar for preclinical and clinical testing, necessitating larger, more diverse patient cohorts to ensure drug safety across various vulnerable populations. The pharmaceutical industry is responding by engaging in extensive safety surveillance and data collection post-approval.

The trajectory of the Osteoarthritis Drugs Market underscores a fundamental shift in medical philosophy: transitioning from managing the inevitability of joint degeneration to actively preserving joint function and structure. This paradigm shift ensures sustained financial interest and technological innovation. The forecast confirms that stakeholders who invest strategically in true disease-modifying capabilities, robust clinical evidence, and geographically tailored market access will secure dominant positions in the projected 15.1 Billion USD market by 2033.

Specific attention is being paid to gene therapy applications, which offer the promise of sustained endogenous production of therapeutic proteins or growth factors directly within the joint space, circumventing the need for frequent injections. While currently nascent, this technology represents the pinnacle of localized, long-term intervention. Intellectual property surrounding these complex modalities is highly contested and forms a significant barrier to entry, ensuring that only highly specialized biotech firms and well-funded pharmaceutical giants can compete effectively in this cutting-edge area.

Finally, global healthcare policy changes, particularly those aimed at reducing opioid reliance for chronic pain, indirectly boost the demand for non-narcotic pain management alternatives within the OA drugs category. This regulatory pressure provides a tailwind for novel topical NSAIDs, selective COX-2 inhibitors, and non-opioid injectables, driving market diversification away from riskier systemic painkillers toward safer, localized solutions for managing persistent joint discomfort.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Osteoarthritis Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Knee Osteoarthritis Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager