Osteotomy Guide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433828 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Osteotomy Guide Market Size

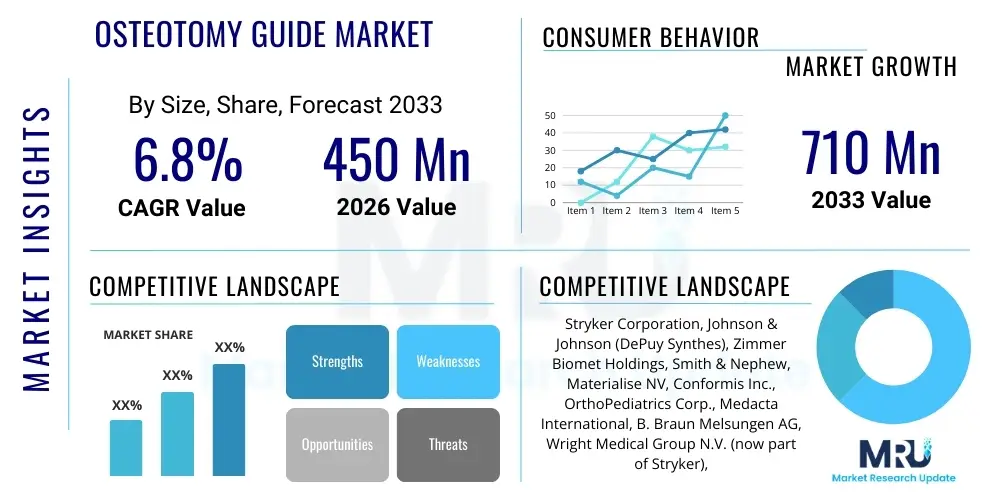

The Osteotomy Guide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Osteotomy Guide Market introduction

The Osteotomy Guide Market encompasses products and systems utilized during osteotomy procedures—surgical operations that involve cutting and reshaping bone, primarily for correcting deformities, managing arthritis, or treating trauma. Osteotomy guides, often custom-designed using advanced imaging and 3D printing technologies, ensure precise cutting planes, minimizing surgical errors and improving post-operative outcomes. These guides are critical in orthopedic surgery, particularly in knee, hip, jaw, and foot corrections, providing the surgeon with an accurate template for bone manipulation, which is essential for successful realignment and weight bearing correction.

Major applications of osteotomy guides span high tibial osteotomy (HTO), distal femoral osteotomy (DFO), and various complex maxillofacial and craniofacial reconstructions. The primary benefit these guides offer is enhanced surgical precision, which translates directly into reduced operating time, decreased risk of neurovascular complications, and accelerated patient recovery. Furthermore, the shift towards patient-specific instrumentation (PSI) driven by computed tomography (CT) and magnetic resonance imaging (MRI) data allows for highly personalized surgical planning, making complex bone cuts predictable and reproducible across diverse patient anatomies.

Driving factors for the market include the global increase in the incidence of musculoskeletal disorders, particularly osteoarthritis among aging populations, and the growing preference for minimally invasive surgical techniques that demand higher accuracy. Technological advancements in medical imaging, computational modeling, and additive manufacturing (3D printing) have significantly reduced the cost and time associated with producing customized guides. The increasing adoption of robotic-assisted surgery platforms, which often integrate with and validate the use of pre-operative planning tools like osteotomy guides, further fuels market expansion by emphasizing accuracy and digitization in the operating room.

Osteotomy Guide Market Executive Summary

The Osteotomy Guide Market is poised for robust expansion, driven primarily by the global rise in orthopedic procedures necessitated by sports injuries and degenerative joint diseases. Business trends indicate a strong move toward personalization, with manufacturers investing heavily in developing comprehensive patient-specific instrumentation (PSI) kits that integrate cutting guides, drilling guides, and placement jigs. Strategic mergers and acquisitions among large orthopedic device manufacturers and specialized 3D printing service providers are reshaping the competitive landscape, aiming to offer end-to-end surgical planning solutions. Furthermore, the integration of surgical navigation and robotics is becoming a key differentiator, influencing procurement decisions in major hospital systems across developed economies.

Regionally, North America and Europe maintain dominance due to established healthcare infrastructure, high reimbursement rates for orthopedic surgeries, and rapid adoption of advanced surgical technologies. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by increasing healthcare expenditure, a rapidly expanding elderly population, and improving access to specialized orthopedic care in countries like China and India. Regulatory harmonization and expanding clinical validation studies are critical trends supporting global market acceptance of these devices, especially in emerging economies where standardization is vital for clinical confidence.

Segment trends reveal that the Patient-Specific Guides category holds a leading market share due to superior precision and outcomes compared to conventional, off-the-shelf instruments. By Material type, polymers and biocompatible plastics, often used in 3D printed guides, are showing the highest growth rates, displacing traditional metal-based guides due to lower cost, disposability, and excellent imaging compatibility. By application, knee osteotomies, particularly High Tibial Osteotomy (HTO) for treating unicompartmental knee osteoarthritis, constitute the largest segment, driven by the increasing desire among younger patients to postpone total joint replacement surgery.

AI Impact Analysis on Osteotomy Guide Market

Common user inquiries regarding AI’s influence on the Osteotomy Guide Market frequently revolve around how artificial intelligence can enhance pre-operative planning accuracy, optimize guide design for complex anatomies, and predict patient outcomes based on surgical parameters. Users are highly concerned about AI's potential role in streamlining the often time-consuming customization process, specifically asking if AI algorithms can automatically generate optimal resection planes faster and more efficiently than manual surgeon input, thereby reducing the turnaround time for patient-specific guides. Key expectations center on using AI for predictive analytics regarding bone density and biomechanical load post-surgery, ensuring the guide design leads to long-term successful realignment and stability, minimizing revision rates, and ultimately democratizing access to highly precise orthopedic planning tools.

- AI-Driven Surgical Planning: Utilizing machine learning algorithms to analyze large datasets of patient anatomies and surgical outcomes, optimizing the geometry and placement of osteotomy cuts for improved precision and stability, automating the generation of complex patient-specific guide designs.

- Enhanced Imaging Segmentation: Employing deep learning models for faster and more accurate segmentation of CT and MRI scans, reducing the manual effort required to delineate bone structures and pathological areas, which is the foundational step for guide creation.

- Predictive Biomechanics: AI models forecast the biomechanical consequences of planned osteotomies, assessing potential stress shielding or load redistribution, allowing surgeons to virtually test guide designs before physical manufacturing.

- Manufacturing Optimization: Integrating AI into the 3D printing workflow to optimize material usage, print orientation, and quality control for patient-specific guides, ensuring guides meet strict dimensional accuracy standards economically.

- Robot Integration and Validation: AI systems validate the compatibility of the generated osteotomy guide files with robotic platforms, ensuring seamless execution of the pre-planned cuts and providing real-time feedback during the procedure.

DRO & Impact Forces Of Osteotomy Guide Market

The Osteotomy Guide Market is primarily driven by the increasing prevalence of orthopedic conditions, the demand for precision in complex surgical procedures, and continuous innovation in personalized medicine. These drivers, coupled with technological advancements in 3D printing and medical imaging, create a compelling positive force on market trajectory, establishing patient-specific guides as a standard of care in many institutions. However, market growth faces restraints, most notably the high initial cost associated with customized guides and the complex regulatory approval processes required for patient-specific devices, which can slow down market entry and widespread adoption, especially in price-sensitive regions.

Opportunities for expansion lie in penetrating emerging markets, developing cost-effective manufacturing techniques (such as improved additive manufacturing scalability), and expanding the clinical application spectrum beyond knees and jaws into areas like spinal deformity correction and complex trauma fixation. The ongoing trend of integrating cutting guides with augmented reality (AR) and virtual reality (VR) surgical simulation offers significant potential to enhance surgeon training and procedural confidence, thereby increasing the acceptance and utilization rates of these advanced tools. These opportunities necessitate strategic partnerships between technology developers and orthopedic surgeons to ensure clinical relevance and usability.

Impact forces indicate that while technological sophistication (Driver) exerts a high positive influence, especially in developed markets, the challenge of achieving favorable reimbursement policies (Restraint) acts as a moderate dampener on global acceleration. The shift towards outpatient surgical centers, enabled by precise, standardized procedures facilitated by guides, further solidifies the market's positive outlook. Ultimately, the ability of manufacturers to demonstrate superior clinical efficacy and long-term cost-effectiveness compared to traditional methods will be the decisive factor determining the magnitude of growth throughout the forecast period.

Segmentation Analysis

The Osteotomy Guide Market is comprehensively segmented based on its complexity, application, material used, and end-user base, providing a multi-dimensional view of market dynamics. Understanding these segments is crucial for strategic planning, as market growth is highly dependent on the adoption rate of patient-specific solutions across various orthopedic subspecialties. The primary segments reflect the evolution from generic, instrument-based templates to highly personalized, digitally designed surgical tools, catering to the increasing demand for precision in complex bone realignment surgeries.

The dominance of the Patient-Specific segment highlights the industry's commitment to optimizing surgical outcomes by accounting for individual anatomical variations, which standard guides cannot address effectively. Material segmentation is also critical, reflecting the industry's preference for biocompatible polymers due to their cost-efficiency, disposability, and superior characteristics during intraoperative imaging (minimizing artifact). Geographically, segmentation reveals significant differences in technology adoption, heavily influenced by regional healthcare spending, regulatory frameworks, and demographic factors, such as the prevalence of age-related orthopedic conditions.

- By Product Type:

- Patient-Specific Osteotomy Guides (PSIGs)

- Standard Osteotomy Guides (Off-the-shelf)

- By Application:

- Knee Osteotomy (High Tibial Osteotomy, Distal Femoral Osteotomy)

- Hip Osteotomy (Periacetabular Osteotomy)

- Maxillofacial and Craniofacial Osteotomy

- Spinal Osteotomy

- Foot and Ankle Osteotomy

- By Material:

- Polymer Guides (e.g., Nylon, Polyamide)

- Metal Guides (e.g., Stainless Steel, Titanium)

- By End User:

- Hospitals and Surgical Centers

- Ambulatory Surgical Centers (ASCs)

Value Chain Analysis For Osteotomy Guide Market

The value chain for the Osteotomy Guide Market is highly complex, starting from upstream activities involving specialized medical imaging and computational design and extending through advanced manufacturing processes to final delivery and integration into the operating room. Upstream analysis focuses heavily on the acquisition of high-resolution patient data (CT/MRI), crucial software providers for 3D modeling and surgical planning (CAD/CAM), and the specialized firms that translate raw anatomical data into functional, executable surgical plans. Key suppliers include providers of advanced polymers and bio-inks necessary for high-precision 3D printing, which form the material foundation for most patient-specific guides today.

The midstream stage is dominated by specialized medical device manufacturers or contracted additive manufacturing bureaus responsible for the physical production of the guides. This stage requires rigorous quality control, sterilization, and packaging processes to meet regulatory standards (e.g., FDA, CE Mark). The move towards localized manufacturing capabilities, often supported by partnerships between large orthopedic companies and regional 3D printing hubs, is a defining trend aimed at reducing lead times for patient-specific instruments. Efficient digital workflow management, connecting the planning surgeon directly to the manufacturing facility, is paramount for success in this segment.

Downstream analysis covers the distribution channels, which are segmented into direct sales (for large, integrated orthopedic companies) and indirect sales through specialized medical distributors and agents. Direct distribution ensures tight control over product handling and clinical support, while indirect channels provide wider geographical reach, especially in nascent markets. Final consumers are hospitals and Ambulatory Surgical Centers (ASCs). The successful market penetration relies heavily on effective surgeon education and training provided by the sales teams, demonstrating the clinical utility and efficiency gains associated with the guides in a high-stakes surgical environment, thus driving adoption through demonstrated clinical superiority.

Osteotomy Guide Market Potential Customers

The primary end-users and buyers in the Osteotomy Guide Market are institutions performing high-volume orthopedic, trauma, and complex maxillofacial procedures, seeking to enhance surgical precision and optimize patient recovery trajectories. Hospitals, particularly large university teaching hospitals and specialized orthopedic centers, represent the largest customer base due to their handling of complex cases requiring patient-specific planning, their ability to invest in advanced surgical technology (including navigation and robotics), and their commitment to training residents using the latest methodologies. These institutions prioritize precision, reduced operative time, and demonstrable improvements in clinical outcomes to manage costs and maintain competitive positioning within the healthcare landscape.

Ambulatory Surgical Centers (ASCs) are rapidly increasing their adoption rate, driven by the shift towards performing less complex but still precision-demanding procedures, such as routine High Tibial Osteotomies, in an outpatient setting. ASCs are focused heavily on efficiency and cost-effectiveness, favoring guides that are easy to use, disposable, and drastically reduce sterilization and setup time compared to large, reusable conventional instrument trays. Their procurement decisions are often influenced by bundled pricing models offered by manufacturers that integrate the osteotomy guide into the overall implant and surgical kit cost.

Furthermore, military and trauma centers represent niche but high-value customers, requiring specialized guides for highly complex reconstructive procedures resulting from severe trauma, where maximum precision is critical for limb salvage and functional recovery. Academic research institutions also constitute a minor customer segment, utilizing these advanced guides for surgical simulation, training modules, and clinical research focusing on new osteotomy techniques and biomechanical studies, thereby influencing future clinical practice guidelines and guide design standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Johnson & Johnson (DePuy Synthes), Zimmer Biomet Holdings, Smith & Nephew, Materialise NV, Conformis Inc., OrthoPediatrics Corp., Medacta International, B. Braun Melsungen AG, Wright Medical Group N.V. (now part of Stryker), OsteoRemedies, LLC, EOS GmbH, 3D Systems Corporation, EnvisionTEC, Custom Orthopaedic Implants |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Osteotomy Guide Market Key Technology Landscape

The technology landscape of the Osteotomy Guide Market is dominated by the synergistic application of advanced medical imaging, sophisticated computer-aided design and manufacturing (CAD/CAM), and additive manufacturing (3D printing). Modern patient-specific guides rely fundamentally on high-resolution imaging modalities, primarily CT scans and occasionally MRI, to generate accurate 3D representations of the patient's unique bone structure. This data is then imported into specialized software environments, where surgeons and biomedical engineers collaborate virtually to define the optimal osteotomy plane, correct alignment deformities, and finalize the guide's external geometry, ensuring maximum fit and bone contact.

The CAD/CAM process is essential for translating the digital surgical plan into a physical prototype. Key advancements include finite element analysis (FEA) integrated into the design software, allowing engineers to predict the structural integrity and fit accuracy of the guide under surgical stress. This digital precision drastically reduces the iterative design phase. Following design finalization, the most critical technology is 3D printing, specifically techniques like Selective Laser Sintering (SLS) or Stereolithography (SLA), using biocompatible polymers such as Nylon PA 12 or medical-grade resins. These methods enable the rapid, cost-effective production of geometrically complex, porous, or contoured guides that are sterile, disposable, and perfectly matched to the patient's anatomy.

The emerging technological frontier involves integrating these planning and manufacturing technologies with intraoperative navigation systems and robotic surgical platforms. Technologies such as haptic feedback devices and augmented reality overlays are beginning to validate the correct placement of the osteotomy guides in real-time, further minimizing the potential for human error during the procedure. This integration not only enhances precision but also provides a quantifiable record of surgical accuracy, linking pre-operative planning directly to procedural execution and thereby strengthening the value proposition of these high-tech surgical guides in modern orthopedic practice.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share, driven by high disposable income, sophisticated healthcare infrastructure, and favorable reimbursement policies for advanced orthopedic procedures. The region is characterized by early and widespread adoption of patient-specific instrumentation (PSI) and robotic surgery, often led by large university and research hospitals. Furthermore, the strong presence of major orthopedic device manufacturers and specialized 3D printing service providers creates a robust ecosystem for continuous innovation and rapid commercialization of new guide technologies. The high prevalence of osteoarthritis and sports-related injuries necessitating joint realignment procedures ensures sustained demand.

- Europe: Europe is the second-largest market, exhibiting steady growth, especially in Western European countries such as Germany, the UK, and France. The market is fueled by an aging population, robust public healthcare systems supporting access to advanced orthopedic care, and stringent quality standards (CE marking) that ensure high product reliability. European regulatory bodies, while cautious, tend to encourage clinically validated precision tools, promoting the use of custom osteotomy guides. The emphasis here is on cost-effectiveness and demonstrating long-term clinical superiority to justify the investment in patient-specific technology within centralized healthcare models.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, projected to witness the highest CAGR during the forecast period. This rapid expansion is primarily attributed to improving healthcare access in populous nations like China and India, increasing healthcare expenditure, and the modernization of hospital infrastructure. Although still dominated by standard guides in many areas, the patient-specific segment is gaining significant traction among private hospitals and major metropolitan surgical centers seeking to attract medical tourism and improve surgical outcomes. Market growth is heavily dependent on regulatory streamlining and the establishment of local manufacturing partnerships to reduce logistics costs and lead times.

- Latin America (LATAM): The LATAM market represents a moderate growth opportunity. Market penetration is often constrained by economic volatility and varying levels of healthcare investment across different countries. However, increasing awareness among orthopedic specialists regarding the benefits of personalized surgical planning, coupled with improving infrastructure in countries like Brazil and Mexico, is slowly driving the adoption of osteotomy guides, predominantly through imported solutions and local distributors representing global device manufacturers.

- Middle East and Africa (MEA): The MEA region offers specialized growth pockets, particularly in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) which boast highly funded and modern healthcare systems focused on clinical excellence and advanced medical technology acquisition. In contrast, the African continent remains challenged by infrastructure limitations and lower affordability, with adoption limited mostly to major private hospitals. The focus in MEA is often on high-quality solutions for complex trauma and reconstructive cases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Osteotomy Guide Market.- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet Holdings

- Smith & Nephew

- Materialise NV

- Conformis Inc.

- OrthoPediatrics Corp.

- Medacta International

- B. Braun Melsungen AG

- Wright Medical Group N.V.

- OsteoRemedies, LLC

- EOS GmbH

- 3D Systems Corporation

- EnvisionTEC

- Custom Orthopaedic Implants

- LimaCorporate S.p.A.

- Globus Medical Inc.

- Integra LifeSciences Holdings Corporation

- NuVasive, Inc.

- Additive Orthopaedics, LLC

Frequently Asked Questions

Analyze common user questions about the Osteotomy Guide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Patient-Specific Osteotomy Guides (PSIGs)?

The primary factor driving PSIG adoption is the necessity for enhanced surgical precision in complex joint realignment and trauma cases. PSIGs minimize surgical error, significantly reduce operating room time, and demonstrably improve post-operative patient outcomes by ensuring highly accurate execution of the pre-planned bone cuts, particularly in knee and maxillofacial procedures.

How does 3D printing technology influence the cost and efficiency of osteotomy guide manufacturing?

3D printing technology is critical as it enables rapid, cost-effective production of highly complex, customized geometries that are impractical or impossible to achieve with traditional subtractive manufacturing. It reduces material waste and drastically shortens the design-to-delivery lead time for patient-specific instruments, thus increasing market efficiency and accessibility.

Which application segment holds the largest share in the Osteotomy Guide Market?

The Knee Osteotomy segment, specifically procedures like High Tibial Osteotomy (HTO) and Distal Femoral Osteotomy (DFO), dominates the market. This leadership is due to the high global prevalence of knee osteoarthritis requiring realignment to preserve the joint and postpone the need for total knee arthroplasty, particularly in younger, active patients.

What are the main regulatory challenges faced by manufacturers in the Osteotomy Guide Market?

Manufacturers face stringent regulatory hurdles related to the classification of patient-specific devices. Custom guides require rigorous documentation proving dimensional accuracy, material biocompatibility, and clinical efficacy, often demanding lengthy review processes from bodies like the FDA and CE, particularly when guides integrate with new digital planning platforms.

How is Artificial Intelligence (AI) expected to transform surgical planning for osteotomies?

AI is set to transform planning by leveraging machine learning to analyze anatomical data and surgical outcomes, enabling automated optimization of bone resection planes. This speeds up the customization process, improves the precision of the guide design, and provides surgeons with predictive biomechanical analysis to forecast long-term stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager