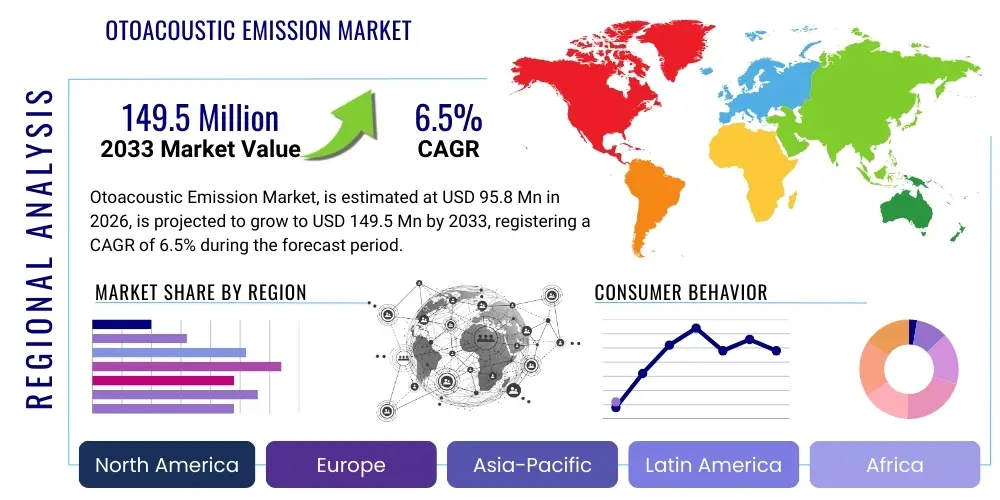

Otoacoustic Emission Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437368 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Otoacoustic Emission Market Size

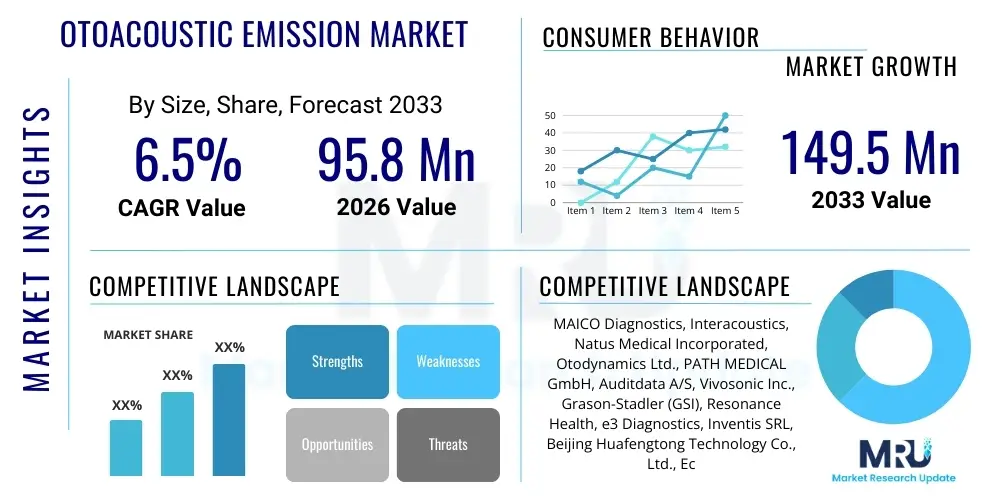

The Otoacoustic Emission Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 95.8 Million in 2026 and is projected to reach USD 149.5 Million by the end of the forecast period in 2033.

Otoacoustic Emission Market introduction

The Otoacoustic Emission (OAE) Market focuses on devices used to measure the faint sounds generated by the inner ear’s cochlea, specifically the outer hair cells, in response to auditory stimulation. These emissions are critical physiological markers utilized primarily for objective hearing assessment, most notably in newborn hearing screening programs globally. OAE testing is non-invasive, quick, and requires minimal cooperation from the patient, making it an ideal first-line diagnostic tool for identifying potential hearing impairments early in life, which significantly aids in timely intervention and improved developmental outcomes.

The core products within this market include handheld screening devices and advanced clinical diagnostic systems capable of conducting various OAE tests, such as Transient-Evoked OAE (TEOAE) and Distortion Product OAE (DPOAE). TEOAE typically uses a brief click sound to stimulate a wide range of frequencies, assessing the general function of the cochlea, while DPOAE uses two simultaneous pure tones to evaluate the cochlear response across specific frequency ranges. The utility of these devices extends beyond newborns to pediatric populations, challenging-to-test adults, and occupational health settings where monitoring for noise-induced hearing loss is essential.

Major driving factors fueling market expansion include the mandatory implementation of Universal Newborn Hearing Screening (UNHS) programs across developed and developing economies, increased incidence of preterm births requiring meticulous auditory monitoring, and rising awareness among healthcare professionals regarding the long-term benefits of early hearing loss detection. Furthermore, technological advancements leading to more portable, user-friendly, and accurate OAE testing equipment are broadening the scope of application from specialized audiology clinics to primary care settings and remote healthcare delivery models.

Otoacoustic Emission Market Executive Summary

The Otoacoustic Emission Market is experiencing robust growth driven by mandated public health initiatives and technological innovation aimed at improving early detection rates of hearing impairment. Business trends indicate a strong focus on integration capabilities, particularly integrating OAE results with electronic health records (EHR) and developing multi-modality screening devices that combine OAE with Automated Auditory Brainstem Response (AABR). The market exhibits consolidation among established players, alongside niche innovation focusing on enhanced signal processing to reduce ambient noise interference, which is a critical challenge in clinical environments.

Regionally, North America and Europe maintain leading market shares due to high healthcare expenditure, established UNHS programs, and quick adoption of advanced medical devices. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, primarily attributed to increasing government investments in pediatric healthcare infrastructure, growing birth rates in populous nations like India and China, and improving regulatory frameworks supporting universal screening protocols. Latin America and MEA are nascent but promising markets, gradually implementing screening mandates and benefiting from low-cost, portable device offerings from global manufacturers.

Segment trends reveal that the Transient-Evoked OAE (TEOAE) segment remains foundational for mass screening efforts due to its speed, while Distortion Product OAE (DPOAE) is increasingly essential in clinical diagnostics for frequency-specific testing and monitoring ototoxicity. The application segment is dominated by newborn hearing screening, though clinical diagnostics and research applications, particularly those focused on underlying cochlear mechanics, are expanding rapidly, fueled by academic and pharmaceutical sector demand for precise auditory functional assessments.

AI Impact Analysis on Otoacoustic Emission Market

User queries regarding the integration of Artificial Intelligence (AI) into the OAE market frequently center on three critical themes: enhancing diagnostic accuracy, automating interpretation, and improving workflow efficiency, particularly in high-volume screening environments. Users are keen to understand if AI can effectively filter out background noise, which often compromises OAE signal quality, and how machine learning algorithms can differentiate subtle OAE patterns indicative of specific cochlear pathologies versus benign variations. Expectations are high that AI can transform raw data into actionable insights, thereby reducing the reliance on highly specialized audiologists for preliminary analysis and accelerating the referral pathway.

AI's primary influence is expected in the preprocessing and interpretation phases of OAE testing. Machine learning models are being developed to optimize the signal-to-noise ratio (SNR) by distinguishing actual OAE responses from physiological and environmental noise, thus reducing the number of 'refer' results caused by technical limitations rather than true hearing loss. Furthermore, AI could potentially develop predictive capabilities, analyzing complex OAE waveforms in conjunction with demographic and clinical data to forecast the prognosis or severity of hearing loss, offering personalized diagnostic refinement beyond simple pass/refer outcomes.

The adoption of AI-driven analytical tools will significantly enhance the scalability and standardization of OAE testing. By standardizing the interpretation of results across different clinical settings and reducing inter-operator variability, AI ensures higher reliability in mass screening programs. This standardization is crucial for developing countries or remote areas where access to specialized audiology expertise is limited. Stakeholders are focused on regulatory approvals for these AI-assisted diagnostic tools, ensuring they meet stringent medical device standards while maximizing the efficiency gains promised by advanced algorithms.

- AI algorithms enhance signal processing, improving the signal-to-noise ratio in noisy screening environments.

- Machine learning models automate the interpretation of complex OAE waveforms, reducing operator dependence and variability.

- Predictive analytics can be applied to OAE data to refine diagnostic accuracy and forecast potential hearing deterioration.

- AI integration facilitates seamless data synchronization and analysis within cloud-based platforms and Electronic Health Records (EHR).

- Optimized workflow through AI reduces screening time and minimizes false positive (refer) rates, optimizing clinical resource allocation.

DRO & Impact Forces Of Otoacoustic Emission Market

The Otoacoustic Emission Market is shaped by a powerful synergy of mandatory health policies, technological progression, and demographic shifts, balanced against inherent clinical challenges and cost considerations. Key drivers include the global expansion of Universal Newborn Hearing Screening (UNHS) programs, which necessitates the procurement of OAE devices at scale, and the increasing global geriatric population susceptible to age-related hearing loss requiring periodic monitoring. These drivers are fundamentally reshaping demand for both portable screening tools and sophisticated clinical diagnostic systems.

Restraints primarily revolve around the clinical sensitivity of OAE testing to ambient noise, which can lead to inconclusive or false 'refer' results, increasing follow-up costs and patient anxiety. Furthermore, the lack of skilled personnel in emerging markets to operate and maintain specialized audiology equipment poses a significant hurdle to widespread adoption. High initial capital expenditure for advanced diagnostic units and the variable reimbursement policies across different healthcare systems also restrict market penetration, particularly in resource-constrained settings.

Opportunities are substantial, centered on developing hybrid devices that combine OAE with AABR for comprehensive screening, creating wireless and miniaturized sensors for home-based monitoring, and integrating OAE data into telehealth platforms for remote diagnostic consultation. The growing focus on early intervention for conditions like auditory neuropathy and cochlear synaptopathy, where OAE provides crucial functional insight, opens new clinical avenues. The collective impact forces indicate that governmental mandates and technological breakthroughs in noise reduction and automation will strongly push market growth, outweighing the restraining factors related to operational limitations and costs.

Segmentation Analysis

The Otoacoustic Emission market is broadly segmented based on the type of emission measured, the application environment, and the primary end-user facility. This segmentation helps manufacturers tailor product development to specific clinical needs and allows healthcare providers to select the most appropriate device based on screening volume, diagnostic depth required, and operational budget. The segmentation highlights the market duality: high-volume, quick screening needs addressed by TEOAE and portable devices, versus high-precision diagnostic needs met by DPOAE and advanced clinical systems.

Analysis of these segments reveals that while TEOAE dominates screening programs, DPOAE is gaining traction in clinical settings where precise, frequency-specific data is necessary for differential diagnosis and tracking the effectiveness of medical interventions, such as those involving ototoxic drugs. The end-user segment remains heavily reliant on hospitals and specialized audiology clinics due to the need for regulated environments and subsequent follow-up care, though penetration into general practitioner clinics for primary screening is a major area of anticipated growth in the forecast period.

- By Product Type:

- Transient-Evoked OAE (TEOAE) Devices

- Distortion Product OAE (DPOAE) Devices

- Spontaneous OAE (SOAE) Devices

- By Application:

- Newborn Hearing Screening (UNHS)

- Clinical Diagnostics (Differential diagnosis, Ototoxicity monitoring)

- Research and Academic Studies

- By End-User:

- Hospitals and Clinics

- Academic and Research Institutes

- Ambulatory Surgical Centers (ASCs)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Otoacoustic Emission Market

The value chain for the OAE market begins with upstream activities focused on the development and procurement of high-precision acoustic components, sophisticated digital signal processors (DSPs), and specialized embedded software necessary for noise reduction and waveform analysis. Key upstream suppliers include component manufacturers specializing in miniature transducers, microprocessors, and proprietary algorithms. The strategic focus here is on miniaturization, enhanced battery life, and cost-effective component sourcing to maintain competitive pricing for portable devices.

Midstream activities involve the design, assembly, and rigorous testing of the OAE devices. Manufacturers must ensure compliance with strict medical device regulations (such as FDA and CE Mark) and maintain high quality control over calibration accuracy. Direct distribution channels, involving manufacturers selling directly to large hospital networks or government screening programs, are common for high-volume sales. Indirect channels rely on specialized medical device distributors and regional representatives who provide localized service, training, and technical support, especially in geographically dispersed markets.

Downstream analysis focuses on the end-users—hospitals, clinics, and government agencies responsible for public health screening. After-sales support, including software updates, calibration services, and comprehensive user training, forms a critical part of the value proposition, influencing customer retention and subsequent purchases. The high reliance on continuous calibration and technical proficiency means that the downstream service network significantly impacts the overall lifecycle value of OAE equipment, necessitating robust service contracts and specialized engineering support.

Otoacoustic Emission Market Potential Customers

Potential customers for Otoacoustic Emission devices primarily comprise institutional healthcare providers mandated or incentivized to perform early objective hearing assessments. Neonatal Intensive Care Units (NICUs) and maternity hospitals represent the most immediate and critical buyer segment due to global mandates for Universal Newborn Hearing Screening (UNHS). These institutions require reliable, fast, and easy-to-use screening tools that can handle high patient volumes while minimizing the need for specialized personnel during the initial screening phase.

A second major segment consists of audiology clinics, private practices, and ear, nose, and throat (ENT) specialists. These end-users require more advanced, comprehensive OAE systems (often DPOAE capable) for clinical diagnostics, differential diagnosis of various hearing pathologies, and precise monitoring of patients receiving ototoxic medications (e.g., chemotherapy or certain antibiotics). Their purchasing decisions are driven by diagnostic accuracy, integration with other audiometric equipment, and features supporting detailed frequency analysis.

Furthermore, government public health agencies are crucial bulk purchasers, especially when implementing nationwide or regional screening programs. Research institutions and academic medical centers also constitute a growing customer base, utilizing OAE technology for fundamental auditory research, clinical trials, and developing novel diagnostic protocols. These buyers prioritize systems with high data output capabilities, customizability, and robust software for detailed scientific analysis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 95.8 Million |

| Market Forecast in 2033 | USD 149.5 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MAICO Diagnostics, Interacoustics, Natus Medical Incorporated, Otodynamics Ltd., PATH MEDICAL GmbH, Auditdata A/S, Vivosonic Inc., Grason-Stadler (GSI), Resonance Health, e3 Diagnostics, Inventis SRL, Beijing Huafengtong Technology Co., Ltd., Echodia, Madsen Acoustics (GN Group), Hearing Diagnostics, Benson Medical Instruments, Welch Allyn (Hill-Rom), Intelligent Hearing Systems (IHS), Micromedical Technologies, Kamplex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Otoacoustic Emission Market Key Technology Landscape

The technological evolution of OAE devices is primarily focused on overcoming the foundational challenge of signal detection in clinical environments, specifically noise interference. Current advancements prioritize advanced digital signal processing (DSP) techniques, including sophisticated filtering algorithms and averaging protocols, which dramatically improve the signal-to-noise ratio (SNR), making screening more reliable, especially in non-soundproofed settings like hospital wards. Manufacturers are also heavily investing in miniaturization and ergonomic design, leading to highly portable, battery-operated, and intuitive handheld devices that simplify usage for non-specialist healthcare staff.

A second crucial area of innovation is the development of combination screening platforms. Modern OAE devices are increasingly integrated with Automated Auditory Brainstem Response (AABR) technology into a single unit. This multi-modality approach allows users to perform both peripheral (cochlear) and brainstem pathway assessments quickly, reducing the need for separate equipment and accelerating the triage process for infants who fail the initial OAE screen. Integration capabilities also extend to wireless data transfer protocols, enabling immediate result archiving and seamless connectivity with hospital information systems (HIS) or specialized audiology databases.

The future technology landscape involves utilizing wider bandwidth transducers for more comprehensive frequency coverage and exploring passive noise cancellation hardware integrated into the ear probe design itself. Furthermore, the introduction of cloud-based software solutions facilitates centralized data management, remote device diagnostics, and automated software updates. This trend towards interconnected and "smart" audiology equipment ensures higher operational efficiency and adherence to calibration standards across large-scale deployment networks, particularly essential for government-funded UNHS initiatives.

Regional Highlights

The global Otoacoustic Emission market shows significant regional disparities in adoption rates and growth trajectories, primarily influenced by healthcare funding, regulatory mandates, and demographic factors. North America, specifically the United States and Canada, holds the largest market share due to established, comprehensive Universal Newborn Hearing Screening laws, high per capita healthcare spending, and rapid adoption of advanced integrated diagnostic platforms. The sophisticated infrastructure and high market penetration of key industry leaders support sustained, stable growth in this region.

Europe represents the second-largest market, benefiting from unified EU directives promoting early detection of hearing loss and strong public health systems in countries like Germany, the UK, and France. However, stringent regulatory requirements for new medical devices and varying reimbursement scenarios across different member states can pose minor complexities. The focus in Europe is on technological precision and incorporating OAE data into national health registries for long-term patient monitoring.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by the massive patient pool and increasing awareness, particularly in high-growth economies like China and India. Government initiatives to improve child health outcomes and substantial investments in upgrading rural healthcare infrastructure are accelerating the procurement of low-cost, portable OAE screeners. Latin America and the Middle East & Africa (MEA) markets are gradually expanding, supported by international aid programs and regional governments initiating pilot screening programs, though device affordability and the availability of specialized training remain critical limiting factors.

- North America: Market dominance driven by mandatory UNHS programs and sophisticated integration of OAE devices into clinical workflows and EHR systems.

- Europe: High adoption rates supported by government healthcare spending and focus on clinical standards, with significant market presence in Germany and the UK.

- Asia Pacific (APAC): Highest CAGR expected, fueled by improving healthcare access, large population base, and increasing government investments in pediatric screening initiatives in nations such as China and India.

- Latin America: Emerging market characterized by increasing implementation of state-level screening mandates and demand for cost-effective, durable screening units.

- Middle East and Africa (MEA): Growth stimulated by international health organizations' funding for early intervention programs and a gradual increase in healthcare modernization projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Otoacoustic Emission Market.- MAICO Diagnostics

- Interacoustics

- Natus Medical Incorporated

- Otodynamics Ltd.

- PATH MEDICAL GmbH

- Auditdata A/S

- Vivosonic Inc.

- Grason-Stadler (GSI)

- Resonance Health

- e3 Diagnostics

- Inventis SRL

- Beijing Huafengtong Technology Co., Ltd.

- Echodia

- Madsen Acoustics (GN Group)

- Hearing Diagnostics

- Benson Medical Instruments

- Welch Allyn (Hill-Rom)

- Intelligent Hearing Systems (IHS)

- Micromedical Technologies

- Kamplex

Frequently Asked Questions

Analyze common user questions about the Otoacoustic Emission market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Otoacoustic Emission Market?

The primary driver is the widespread implementation and enforcement of Universal Newborn Hearing Screening (UNHS) programs globally, often mandated by public health authorities. This necessitates mass procurement of reliable, fast OAE screening devices to ensure early detection of hearing loss in infants.

How do Transient-Evoked OAE (TEOAE) devices differ from Distortion Product OAE (DPOAE) devices?

TEOAE devices use transient sounds (clicks) to assess the overall health of the cochlea across a broad range of frequencies and are primarily used for quick, initial screening. DPOAE devices use two simultaneous pure tones to assess the cochlear response at specific, discrete frequencies, making them essential for detailed clinical diagnostics and monitoring ototoxicity.

Which technology is expected to significantly enhance the accuracy of OAE testing in noisy environments?

Advanced Digital Signal Processing (DSP) techniques and integrated Artificial Intelligence (AI) algorithms are key technologies improving OAE accuracy. These technologies enhance the signal-to-noise ratio (SNR) by effectively filtering out ambient and physiological noise, reducing false ‘refer’ rates.

Is OAE technology used beyond newborn screening, and if so, what are the applications?

Yes, OAE technology is widely used in clinical diagnostics for differential diagnosis of hearing loss (distinguishing cochlear vs. neural issues), monitoring patients exposed to ototoxic medications, assessing challenging-to-test pediatric populations, and in research exploring cochlear mechanics.

Why is the Asia Pacific (APAC) region expected to show the highest growth rate for the OAE market?

APAC’s high growth is attributed to massive population size, rising birth rates, improving government investments in public health infrastructure, and increasing patient awareness regarding the critical importance of early childhood hearing intervention across large developing economies like India and China.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager