Outbuildings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433745 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Outbuildings Market Size

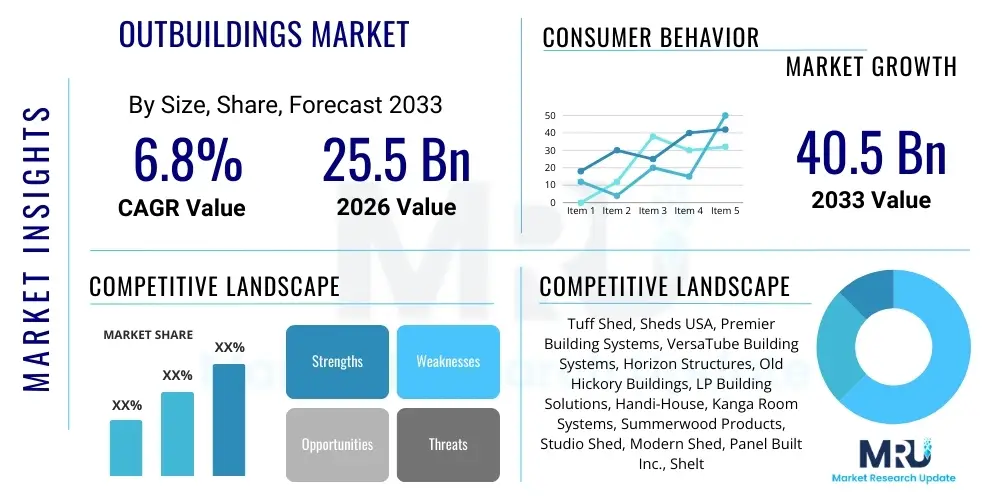

The Outbuildings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $25.5 Billion in 2026 and is projected to reach $40.5 Billion by the end of the forecast period in 2033.

Outbuildings Market introduction

The Outbuildings Market encompasses the design, manufacturing, and installation of detached, non-habitable structures secondary to a main residence or commercial property. These structures, ranging from sheds, garages, workshops, and barns to specialized structures like Accessory Dwelling Units (ADUs), home offices (Shedquarters), and recreational spaces, serve highly functional and increasingly aesthetic purposes. Product description centers on modular, prefabricated, and custom-built solutions, utilizing diverse materials such as wood, metal, composite, and advanced structural insulated panels (SIPs). Major applications span residential storage and workspace expansion, agricultural needs (equipment storage, livestock shelter), commercial storage, and remote/hybrid working solutions, driven primarily by the escalating demand for optimizing property utilization and enhancing lifestyle amenities. The primary benefits include increased property value, flexibility in design, rapid installation times inherent in prefabricated models, and the ability to effectively separate work, hobby, and storage areas from the main dwelling.

Market growth is substantially driven by macroeconomic factors, including robust residential real estate activity and the paradigm shift toward remote work, necessitating dedicated, quiet workspaces separate from the main household. Furthermore, regulatory environments in many metropolitan and suburban areas are becoming more permissive regarding the construction of Accessory Dwelling Units (ADUs), recognizing them as critical components of urban density solutions, thereby expanding the potential application and scale of outbuildings. The increasing consumer focus on outdoor living spaces and enhanced functionality post-pandemic has cemented outbuildings as essential investments rather than mere optional additions. These structures now frequently integrate smart technology, advanced insulation, and sustainable materials, transforming them into high-performance, climate-controlled environments that significantly extend the usable footprint of a property, fueling continuous demand across all demographic segments.

Outbuildings Market Executive Summary

The Outbuildings Market is characterized by vigorous growth, largely propelled by shifting consumer behaviors toward home-centric activities and the sustained momentum of the remote work economy, which has established dedicated outbuildings as a necessity rather than a luxury. Business trends indicate a strong move towards modular and prefabricated construction methodologies, emphasizing customization, speed of deployment, and quality control, leading to improved project margins and accelerated market penetration. Segment trends reveal the most significant growth in the "Dedicated Office/Studio" and "Accessory Dwelling Unit (ADU)" categories, far outpacing traditional storage sheds, reflecting a premiumization of the market where outbuildings are increasingly viewed as specialized architectural spaces rather than utilitarian boxes. Regionally, North America maintains market dominance due to large property sizes, favorable zoning laws regarding ADUs, and high consumer spending on home improvement, while the Asia Pacific region is showing the fastest expansion, driven by urbanization and the adoption of compact, highly functional prefabricated structures to maximize limited space and rapid infrastructural deployment.

AI Impact Analysis on Outbuildings Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Outbuildings Market center predominantly on themes of automated design, structural integrity optimization, efficient material usage, and integration of smart building systems. Users seek confirmation on whether AI can democratize complex architectural design, allowing non-specialist consumers to easily configure bespoke outbuildings that comply instantly with local zoning regulations and structural requirements. There is significant interest in how AI-driven predictive analytics can optimize construction schedules and supply chains, minimizing waste and reducing overall project timelines, particularly for modular units manufactured off-site. Concerns often revolve around the upfront cost of implementing these technologies and ensuring that AI-designed structures maintain high standards of aesthetic appeal and energy efficiency, moving beyond purely functional automation to deliver superior personalized design outcomes.

The deployment of AI tools is fundamentally changing the initial design phase of outbuildings, allowing for rapid iteration and visualization based on parameters such as site topography, solar orientation, and intended use. Machine learning algorithms analyze vast datasets of local building codes and material performance characteristics, automatically generating optimal structural blueprints that maximize material efficiency and minimize regulatory non-compliance risks, significantly streamlining the permitting process which historically represents a major constraint. Furthermore, AI is increasingly utilized in the manufacturing phase of prefabricated outbuildings, where robotic assembly guided by computer vision ensures precise cuts and joins, reducing human error and enhancing the overall structural quality and consistency of the delivered units, thereby accelerating the scaling capability for manufacturers.

AI also plays a critical role in the smart integration of outbuildings once installed. For instance, predictive maintenance models use sensor data to monitor environmental factors, structural strain, and energy usage within the outbuilding, flagging potential issues before they become critical failures, enhancing the lifespan and sustainability of the structure. This level of intelligent operation, particularly relevant for high-value applications like ADUs or climate-controlled specialized labs, transforms the outbuilding from a passive structure into an active, intelligent extension of the main property, offering superior operational efficiency and user experience through personalized environmental controls and adaptive security protocols.

- AI-powered Generative Design for customized, code-compliant outbuilding plans.

- Machine learning optimization of material cutting and assembly in modular manufacturing processes.

- Predictive supply chain management reducing lead times and material waste.

- Enhanced structural analysis and simulation ensuring long-term durability under varied climate conditions.

- Integration of intelligent security and climate control systems (Smart Outbuildings).

DRO & Impact Forces Of Outbuildings Market

The Outbuildings Market is primarily driven by the escalating demand for supplementary functional spaces, catalyzed by remote work adoption and the increasing necessity for dedicated storage solutions, coupled with favorable regulatory shifts concerning ADUs in major metropolitan areas, making property densification a feasible option for homeowners. Restraints include the high initial capital investment required for high-quality, fully finished outbuildings (especially ADUs), potential supply chain volatility affecting construction materials (lumber, steel), and restrictive local zoning ordinances in certain conservative municipalities that limit size, placement, or use. Opportunities are abundant in the integration of sustainable building practices (solar power, rainwater harvesting, recycled materials) and the expansion of the 'Shedquarters' concept into highly specialized commercial applications, targeting small businesses needing flexible satellite offices or secure data storage facilities. These drivers and opportunities exert a strong upward impact force, mitigating the effect of restraints, thereby projecting sustained, aggressive market expansion focused on highly customized, prefabricated solutions offering rapid deployment and enhanced long-term value to the property owner.

Segmentation Analysis

The Outbuildings Market is extensively segmented across dimensions including product type, material used, intended application, and construction method, reflecting the diversity of functional needs these structures fulfill. Product type segmentation distinguishes between basic storage sheds and high-utility structures like garages, workshops, and complex, self-contained units such as ADUs. The core differentiator lies in the complexity of utility integration (plumbing, electrical, HVAC) and the structural requirements for human habitation or specialized equipment. Segmentation by application highlights the shift from purely utilitarian needs (agricultural storage) to lifestyle enhancements (home gyms, offices, recreational cabins), demonstrating the market's premiumization trend where aesthetics and integration with the main property's design are paramount. The increasing preference for modular and prefabricated construction methods, compared to traditional stick-built structures, further defines the market landscape, driven by efficiency and speed.

- By Product Type: Sheds, Garages, Workshops, Barns, Accessory Dwelling Units (ADUs), Pool Houses/Cabanas, Greenhouses/Hobby Spaces.

- By Material: Wood/Timber, Metal (Steel/Aluminum), Vinyl/Plastic, Composites, Structural Insulated Panels (SIPs).

- By Construction Method: Stick-Built (On-site), Modular/Prefabricated, Kit/DIY.

- By Application: Residential Storage, Home Office/Studio (Shedquarters), Recreational/Fitness, Agricultural, Commercial/Industrial Storage.

Value Chain Analysis For Outbuildings Market

The Outbuildings Market value chain begins with upstream activities dominated by raw material procurement, encompassing lumber mills, steel manufacturers, and specialized providers of advanced composite and panel materials (like SIPs). Key dynamics at this stage involve managing commodity price volatility and ensuring sustainable sourcing, particularly for wood products, which face increasing scrutiny regarding environmental certifications. Major players in the upstream sector often engage in long-term supply contracts with manufacturers to stabilize pricing and ensure consistent quality necessary for prefabricated and modular components. The efficiency of the upstream segment is critical, as any delays or price spikes in essential materials directly impact the final cost and delivery schedule of the finished outbuilding, necessitating robust risk management strategies by core manufacturers.

The central segment of the value chain involves design, manufacturing, and assembly. Manufacturers specializing in modular construction leverage optimized factory processes, often integrating automation and Computer Numerical Control (CNC) machinery to achieve precise, high-volume production runs, which contrasts sharply with traditional site-built construction. Downstream activities focus heavily on distribution channels, which primarily include direct-to-consumer models (e.g., specialized dealers or manufacturer-owned sales forces), large home improvement retailers (offering standardized kits and basic sheds), and professional installation services. The choice of distribution channel heavily influences the degree of customization offered and the speed of delivery, with modular ADUs typically requiring highly specialized manufacturer sales and installation teams due to complexity.

The ultimate delivery and installation phase is crucial for customer satisfaction. Direct and indirect distribution channels play distinct roles. Direct channels enable manufacturers to maintain complete control over quality and pricing, providing highly customized solutions and complex installations. Indirect channels, such as big-box retailers, focus on efficiency and scalability, serving the mass market with standardized products and DIY kits. The rising popularity of turnkey solutions, where the manufacturer manages everything from permitting and site preparation to final utility connection, highlights the growing importance of the service component within the value chain. Maximizing efficiency across the design-to-installation lifecycle is essential for market competitors aiming to capitalize on the demand for rapid, high-quality supplemental space.

Outbuildings Market Potential Customers

The primary end-users and buyers in the Outbuildings Market can be broadly categorized into residential, commercial, and agricultural sectors, with the residential segment experiencing the most diversified growth and presenting the highest revenue potential. Within the residential category, potential customers include established homeowners seeking to maximize property function, typically driven by lifestyle needs such as the need for dedicated remote workspaces (Shedquarters), specialized hobby rooms, or supplemental living space for aging relatives or rental income (ADUs). These customers often prioritize architectural integration, insulation quality, and smart home technology integration, viewing the outbuilding as a premium extension of their main dwelling. Demographic shifts, such as multi-generational living arrangements and the permanent shift toward hybrid work models, continuously replenish this customer base, requiring sophisticated, customizable products.

The commercial segment represents a rapidly growing customer base, specifically businesses requiring flexible, rapidly deployable satellite offices, secure storage for specialized equipment, or temporary retail spaces. Small to medium enterprises (SMEs) often utilize prefabricated outbuildings as cost-effective alternatives to traditional lease agreements for minor expansions or temporary project offices on construction sites. These buyers prioritize durability, rapid installation, ease of relocation, and robust security features, focusing on structures built with metal or highly durable composite materials to withstand heavy industrial use and meet commercial regulatory standards. Furthermore, institutional buyers, such as schools or healthcare facilities, utilize modular units for temporary classroom expansion or specialized testing centers, demanding high safety standards and compliance.

Agricultural customers constitute a stable, foundational segment, primarily requiring large-scale, durable structures such as barns, equipment shelters, and specialized climate-controlled units for crop storage or livestock housing. Functionality, structural strength against harsh weather conditions, and low maintenance are the key purchase criteria for these end-users. The rising adoption of precision agriculture technology further drives demand for secure, climate-controlled outbuildings to house sensitive monitoring and automation systems. Regardless of the sector, the modern potential customer values sustainability, demanding structures built with minimal environmental impact and high energy efficiency, influencing purchasing decisions toward manufacturers offering green building certifications and renewable energy integration options.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.5 Billion |

| Market Forecast in 2033 | $40.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tuff Shed, Sheds USA, Premier Building Systems, VersaTube Building Systems, Horizon Structures, Old Hickory Buildings, LP Building Solutions, Handi-House, Kanga Room Systems, Summerwood Products, Studio Shed, Modern Shed, Panel Built Inc., ShelterLogic Group, Lifetime Products, R&B Storage Barns, Rhino Building Systems, United Steel Buildings, Strong Build Structures, Backyard Discovery. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Outbuildings Market Key Technology Landscape

The technological evolution within the Outbuildings Market is primarily characterized by advancements in off-site construction methods, leading to higher quality, faster deployment, and improved sustainability. The most impactful technology is the utilization of Building Information Modeling (BIM) software, which allows manufacturers to create highly detailed, data-rich digital models of the outbuilding components before manufacturing commences. BIM facilitates clash detection, optimizes material lists, and streamlines the permitting submission process by generating precise technical specifications, significantly reducing errors during both design and on-site assembly. This digital precision is essential for complex structures like ADUs that must meet stringent residential codes and requires seamless coordination between architectural, structural, and utility elements.

Furthermore, material science advancements, particularly in Structural Insulated Panels (SIPs) and engineered wood products (like cross-laminated timber or CLT), are crucial. SIPs offer superior insulation and structural strength compared to traditional stick framing, contributing directly to the energy efficiency and longevity of the outbuilding. The application of durable, low-maintenance exterior finishes, such as advanced composite siding and metal roofing systems designed for longevity, reduces the lifecycle cost of the structure, appealing strongly to both residential and commercial buyers. These material innovations enable manufacturers to offer robust warranties and comply with increasing consumer demand for sustainable, net-zero ready structures, particularly when paired with integrated photovoltaic (PV) systems.

The integration of smart technology constitutes the third major technological pillar. Modern outbuildings are increasingly fitted with sophisticated pre-wired electrical systems, smart locks, climate control sensors, and integrated network infrastructure optimized for remote work and high-bandwidth activities. For example, prefabricated home offices often include acoustically engineered panels and specialized lighting systems controllable via smart devices. Manufacturers are exploring modular utility pods—pre-plumbed and pre-wired units that drop into place—to simplify and accelerate the connection of water, sewer, and electrical services on site, drastically cutting down installation time and the need for highly specialized trades during the final phase of construction, thereby making high-utility outbuildings more accessible and faster to deploy.

Regional Highlights

- North America: Dominates the global market, driven by high disposable income, large property sizes, and the widespread adoption of remote work. The region benefits from increasing acceptance and legalization of ADUs in major states like California and Oregon, leading to significant investment in highly finished, premium modular units.

- Europe: Characterized by strong demand for specialized garden rooms, sheds, and recreational outbuildings, particularly in the UK and Germany. The focus here is heavily skewed toward energy efficiency and aesthetic integration with existing heritage properties, driving the use of high-performance insulation and sustainable materials.

- Asia Pacific (APAC): Exhibits the fastest growth rate, fueled by rapid urbanization and the necessity for flexible, compact prefabricated structures in highly dense urban centers. Demand is high for storage solutions and modular employee housing, with key growth centered in China, Japan, and Australia, where prefabrication technology is highly advanced.

- Latin America (LATAM): Growth is primarily driven by agricultural applications and commercial storage needs. The market is highly price-sensitive, leading to strong demand for metal and lower-cost modular kits, although residential demand for basic storage is steadily increasing.

- Middle East and Africa (MEA): Emerging market characterized by strong demand for climate-controlled industrial storage and workforce housing outbuildings, necessitated by major infrastructure and oil/gas projects. The need for structures that can withstand extreme heat drives the adoption of advanced metal and composite structures with superior thermal properties.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Outbuildings Market.- Tuff Shed

- Sheds USA

- Premier Building Systems

- VersaTube Building Systems

- Horizon Structures

- Old Hickory Buildings

- LP Building Solutions

- Handi-House

- Kanga Room Systems

- Summerwood Products

- Studio Shed

- Modern Shed

- Panel Built Inc.

- ShelterLogic Group

- Lifetime Products

- R&B Storage Barns

- Rhino Building Systems

- United Steel Buildings

- Strong Build Structures

- Backyard Discovery

Frequently Asked Questions

Analyze common user questions about the Outbuildings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for Accessory Dwelling Units (ADUs) in the Outbuildings Market?

Demand for ADUs is primarily driven by the need for flexible housing solutions, the ongoing remote work trend requiring dedicated office space, and regulatory easing in numerous metropolitan areas that permit property densification to address housing shortages. ADUs offer significant potential for rental income and multi-generational living arrangements.

How does modular construction impact the total cost and installation time of an outbuilding?

Modular construction significantly reduces on-site installation time, often from months to weeks, due to concurrent site preparation and factory manufacturing. While the upfront material cost for a high-quality modular unit may be comparable to or slightly higher than stick-built, reduced labor costs and faster deployment generally result in lower total project costs and quicker realization of the structure's value.

Which material segment currently dominates the Outbuildings Market and why is wood still prevalent?

Wood remains the dominant material segment, especially in the residential storage and traditional shed categories, due to its cost-effectiveness, ease of use in construction, and aesthetic appeal. However, metal and Structural Insulated Panels (SIPs) are gaining market share rapidly in higher-end applications like ADUs and commercial structures due to their superior durability, fire resistance, and long-term energy efficiency.

What are the most significant technological advancements influencing the energy efficiency of modern outbuildings?

Key technological advancements include the widespread adoption of Structural Insulated Panels (SIPs) for superior thermal performance, integration of photovoltaic (solar) roofing systems, and smart HVAC controls. These technologies collectively enable modern outbuildings to achieve near net-zero energy standards, critical for climate-controlled offices and living spaces.

What key challenges must manufacturers address regarding zoning and permitting for complex outbuildings?

Manufacturers must address highly localized and variable zoning regulations concerning height restrictions, setbacks, maximum coverage area, and utility connection requirements. Utilizing Building Information Modeling (BIM) and offering specialized permitting assistance are crucial strategies for streamlining the approval process and ensuring that complex ADU designs comply with municipal codes from the initial design phase.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Outbuildings Market Size Report By Type (Garages, Sheds, Greenhouses, Others), By Application (Household Use, Commercial Use), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Outbuildings Market Statistics 2025 Analysis By Application (Household Use, Commercial Use), By Type (Garages, Sheds, Greenhouses), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager