Outdoor Cat House and Furniture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432267 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Outdoor Cat House and Furniture Market Size

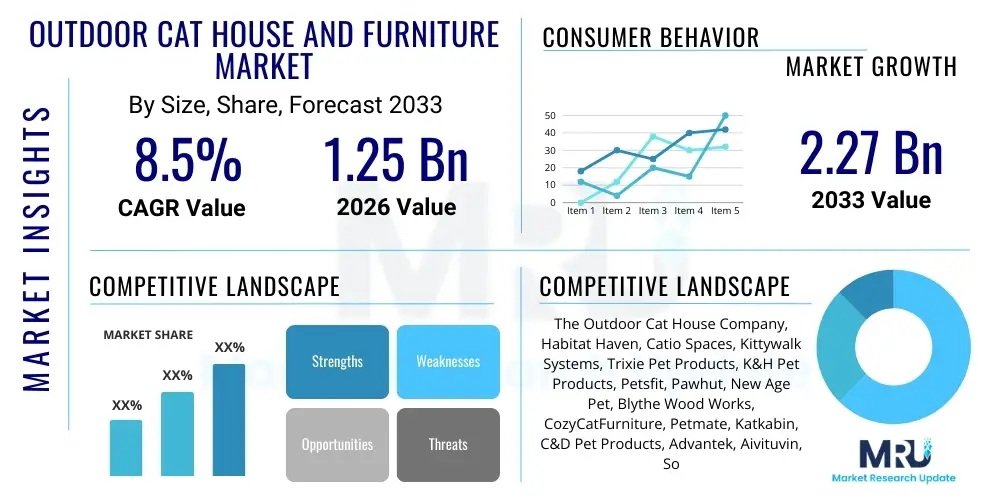

The Outdoor Cat House and Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.27 Billion by the end of the forecast period in 2033.

Outdoor Cat House and Furniture Market introduction

The Outdoor Cat House and Furniture Market encompasses a specialized subset of the broader pet care industry, focusing on durable, weather-resistant structures and accessories designed to enhance the welfare and comfort of cats in outdoor environments, including patios, gardens, and semi-enclosed spaces like catios. This market segment has experienced robust growth driven primarily by the escalating trend of pet humanization, where owners are increasingly viewing their feline companions as family members and are willing to invest significantly in their quality of life and safety, even when outdoors. Products range from insulated, heated cat shelters for cold climates and multi-story cat condos to modular cat runs (catios) and specialized outdoor feeding stations. The primary objective of these products is to provide safe, stimulating, and environmentally protected spaces that cater to the cat’s natural instincts for climbing, scratching, and seeking shelter while mitigating risks associated with outdoor exposure.

The core product offerings within this market are characterized by their emphasis on weather durability and structural integrity, utilizing materials such as treated wood, high-density polyethylene (HDPE) plastics, and waterproof composite materials to ensure longevity and resistance to UV damage and moisture. Major applications include providing secure outdoor housing for feral or community cats through dedicated rescue organizations, offering enrichment and safe play areas for domesticated indoor cats, and supplying protective resting spots in gardens or agricultural settings. The benefits derived from these structures are multi-fold, including improved feline mental and physical health through increased environmental stimulation, enhanced safety from predators or traffic, and superior thermal regulation compared to standard domestic furniture. The market is also heavily influenced by aesthetic considerations, with modern designs often blending seamlessly into contemporary residential landscaping and outdoor decor.

Key driving factors fueling the market expansion include the rising disposable incomes in developed economies, allowing for premium purchases in the pet segment, and the global increase in pet adoption rates, particularly accelerated during and after the pandemic. Furthermore, growing urbanization has led to smaller indoor living spaces, prompting owners to utilize outdoor areas for pet enrichment, thereby driving demand for efficient, space-saving, and highly functional outdoor cat furniture. Technological advancements in insulation and climate control features, such as self-heating pads and automated ventilation systems integrated into cat houses, are also increasing the perceived value and necessity of these products, securing continued consumer investment in high-end outdoor solutions for feline companions.

Outdoor Cat House and Furniture Market Executive Summary

The Outdoor Cat House and Furniture Market is currently defined by significant business trends focusing on premiumization, modularity, and sustainability. Manufacturers are increasingly shifting towards Direct-to-Consumer (DTC) models, leveraging e-commerce platforms to showcase customizable and high-end catio systems, minimizing reliance on traditional brick-and-mortar pet store distribution channels for complex, bulky items. A notable business trend involves the incorporation of sustainable and ethically sourced materials, such as recycled plastics and certified sustainably harvested wood, responding directly to environmentally conscious consumer demand. Moreover, companies are focusing heavily on intellectual property protection concerning modular design patents and specialized weatherproofing technologies, seeking to differentiate their offerings in an increasingly competitive landscape. The market exhibits strong fragmentation, although key players are pursuing strategic acquisitions to consolidate manufacturing capabilities and expand geographical reach, particularly across North America and Europe.

Regional trends highlight North America as the dominant market share holder, primarily due to the established culture of pet humanization, high pet expenditure per household, and robust regulatory standards concerning pet welfare, which encourage investment in high-quality outdoor shelters. Europe follows closely, driven by stringent animal welfare legislation and a high concentration of specialized pet furniture brands, with significant growth projected in countries like Germany and the United Kingdom where cat ownership rates are exceptionally high. The Asia Pacific (APAC) region is poised for the fastest growth, although starting from a lower base, fueled by rapidly increasing middle-class populations in China and India who are adopting Western pet ownership patterns and investing in specialty pet products, creating substantial opportunities for entry-level and mid-range, scalable outdoor furniture solutions.

Segment trends underscore the rising demand for Catio Systems (enclosed outdoor patios) as the fastest-growing product category, reflecting the desire of owners to provide safe outdoor access without allowing cats to roam freely. The materials segment is trending towards composite and eco-friendly plastics over traditional wood due to superior weather resistance and lower maintenance requirements, offering better return on investment over the product lifecycle. Furthermore, the technology segment is witnessing rapid integration of smart features, including battery-operated temperature monitoring, motion-activated lighting, and self-cleaning litter box modules within outdoor enclosures. This push towards functionality and connectivity is transforming traditionally static products into dynamic, high-tech habitats, elevating the average selling price and improving consumer engagement with the outdoor furniture category significantly.

AI Impact Analysis on Outdoor Cat House and Furniture Market

User queries regarding AI in the Outdoor Cat House and Furniture Market predominantly focus on how intelligent systems can enhance pet safety, optimize environmental control, and revolutionize manufacturing and design processes. Common questions revolve around the use of AI-driven sensors for predicting weather conditions impacting thermal regulation within shelters, the efficacy of integrated cameras utilizing computer vision for monitoring cat health and behavior patterns, and how AI generative design can create optimized, complex furniture shapes that maximize comfort and structural integrity while minimizing material waste. Users are particularly concerned about ensuring AI systems maintain privacy, offer reliable long-term operation in outdoor environments, and justify the increased cost associated with smart integration. The overarching theme is the expectation that AI will move these products beyond simple shelter towards predictive, personalized, and proactive feline wellness platforms.

- AI-driven generative design accelerates the creation of complex, ergonomic, and material-efficient cat house structures.

- Predictive maintenance analytics, based on sensor data, notify owners of potential component failure or necessary climate adjustments within the enclosure.

- Computer vision algorithms enable automated monitoring of feline health (e.g., tracking activity levels, detecting signs of distress, identifying pests).

- Optimized supply chain and inventory management using AI forecasting models to match seasonal demand spikes for outdoor housing components.

- Personalized product recommendations on e-commerce platforms tailored to the user's climate, cat breed, and garden layout using AI customer profiling.

- Enhanced security features through AI integration, such as facial recognition for restricted entry into multi-cat or community shelters.

DRO & Impact Forces Of Outdoor Cat House and Furniture Market

The market dynamics are shaped by powerful forces encompassing elevated consumer spending on premium pet care, structural challenges related to material procurement and complex modular assembly, and the untapped potential of smart habitat integration and customization. Drivers are strongly centered on the emotional bond between owners and pets, necessitating investment in high-quality, durable outdoor solutions that mirror indoor comforts. Restraints primarily involve the logistical complexity and high transportation costs associated with large, prefabricated outdoor structures, alongside consumer perception of these items as discretionary luxury purchases rather than necessities. Opportunities are vast, focusing on leveraging smart home technology compatibility, utilizing advanced material science for superior durability, and expanding into niche markets such as specialized rescue shelters or luxury pet hotels. These forces collectively dictate the market trajectory, prioritizing innovation in material science and operational efficiency to mitigate high production costs.

Drivers: The increasing rate of pet adoption globally, especially among millennials and Generation Z, significantly boosts demand. Furthermore, the expanding understanding of feline behavior emphasizes the critical need for environmental enrichment, driving the purchase of complex furniture like multi-tier catios and scratching systems. Regulations and advocacy from animal welfare organizations promoting safe outdoor access for cats, particularly for those living in apartments or high-density urban areas, mandate secure, enclosed outdoor solutions. Economic factors such as sustained growth in disposable income in major Western and Asian markets enable consumers to afford premium, high-specification products that include insulation, heating, and superior aesthetic design, moving beyond basic shelter provision to luxury habitats.

Restraints: Significant restraints include the substantial initial capital investment required for high-quality, weather-resistant outdoor cat furniture, which can deter price-sensitive consumers. The bulky nature of many outdoor cat houses and catios poses significant logistical and storage challenges for both manufacturers and retailers, often leading to high shipping costs passed on to the consumer. Additionally, durability and maintenance concerns remain a restraint; despite marketing claims of weather resistance, premature material degradation (e.g., wood warping, plastic fading) in extreme climates can lead to negative consumer reviews and perceived poor value. Limited backyard or patio space in highly urbanized areas also restricts the purchase of larger, more elaborate modular catio systems, capping potential sales volume in dense metropolitan regions.

Opportunities: Major opportunities lie in the development of lightweight, foldable, and easy-to-assemble structures, utilizing advanced composite materials to simplify logistics and assembly for the end-user. The integration of smart technology offers a significant avenue for growth, allowing manufacturers to differentiate products with features such as solar-powered ventilation, app-controlled heating, and integrated webcams for remote monitoring. Expansion into the commercial sector, targeting animal shelters, veterinary clinics, and pet boarding facilities that require durable, scalable outdoor housing solutions, presents a stable B2B revenue stream. Finally, the customization market, allowing customers to specify size, color, material, and feature integration via online configuration tools, taps into the consumer desire for unique, personalized outdoor living spaces that seamlessly match existing home aesthetics.

Segmentation Analysis

The Outdoor Cat House and Furniture Market is systematically segmented based on product type, material composition, distribution channel, and application, providing granular insights into consumer preferences and market maturity across different product categories. Product type segmentation distinguishes between shelters providing basic refuge (houses, igloos) and complex, enriching environments (catios, climbing systems), with the latter driving innovation. Material segmentation reflects the ongoing balance between cost, durability, and sustainability, heavily influencing price points and target consumer demographics. Distribution channels are rapidly shifting, reflecting the logistical challenges and the need for comprehensive product visualization inherent in selling large, complex outdoor furniture. Understanding these segments is crucial for strategic positioning, allowing manufacturers to align production capabilities with evolving consumer demands for personalized, durable, and easily accessible outdoor solutions.

- By Product Type:

- Outdoor Cat Houses/Shelters (Insulated, Heated, Standard)

- Catio Systems (Modular, Fixed, DIY Kits)

- Outdoor Cat Furniture (Climbing Towers, Scratching Posts, Feeding Stations)

- Outdoor Play Equipment (Tunnels, Agility Sets)

- By Material:

- Wood (Cedar, Treated Lumber)

- Plastic/HDPE (Recycled and Virgin Polymers)

- Metal (Aluminum, Steel Mesh for Catios)

- Composite Materials

- Fabric/Canvas (Temporary Shelters)

- By Application:

- Residential (Household Pet Owners)

- Commercial (Boarding Facilities, Veterinarians)

- Animal Welfare Organizations (Rescues, Shelters)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Company Websites)

- Offline Retail (Pet Specialty Stores, Home Improvement Stores, Mass Merchants)

Value Chain Analysis For Outdoor Cat House and Furniture Market

The value chain for the Outdoor Cat House and Furniture Market begins with the highly fragmented upstream segment, involving the sourcing of raw materials such as sustainable lumber, specialized weather-resistant plastics, and durable hardware components like galvanized wire and non-toxic paints. Upstream activities require stringent quality control, especially concerning moisture resistance and thermal properties of materials used for insulation, ensuring compliance with global safety and environmental standards (e.g., FSC certification for wood). Manufacturers are increasingly integrating backward to secure consistent supply chains for specialized materials and reduce dependency on volatile commodity markets, particularly post-pandemic supply chain disruptions. Efficiency in this phase directly impacts the final product's durability and cost competitiveness.

The middle segment involves manufacturing, assembly, and quality assurance. Due to the size and complexity of products like modular catios, manufacturing often requires advanced CNC machining for precision cutting and specialized processes for weatherproofing treatments. Companies employ detailed design principles focusing on ease of assembly for the consumer, necessitating pre-drilled components and standardized modular connections. The distribution channel is bifurcated into direct and indirect routes. Direct sales (DTC via company websites) allow for higher margins, better brand control, and the ability to handle high levels of customization but necessitate robust internal logistics networks capable of handling large freight. Indirect channels, primarily large e-commerce marketplaces and specialty pet retailers, provide wider reach but involve margin erosion due to retailer and distributor markups.

The downstream segment focuses on retail, marketing, and installation services. E-commerce platforms dominate the sale of large, complex items, utilizing enhanced visualization tools, augmented reality (AR) features, and detailed instructional videos to overcome the challenge of in-person inspection. Customer service and post-sale support, especially regarding assembly troubleshooting and warranty fulfillment, are critical components in maintaining brand reputation. Installation services, particularly for high-end, large catio systems, represent a burgeoning downstream opportunity, sometimes offered directly by the manufacturer or through partnerships with local contractors, ensuring proper setup and long-term product efficacy. Consumer feedback mechanisms also play a vital role, driving iterative improvements in design and material selection, ensuring the product meets the demanding requirements of outdoor use.

Outdoor Cat House and Furniture Market Potential Customers

The primary customer base for the Outdoor Cat House and Furniture Market consists of affluent, dual-income pet-owning households in urban and suburban areas who prioritize their pet's health and enrichment, aligning perfectly with the trend of pet humanization. These customers are typically digitally native, conduct extensive online research, and are willing to pay a premium for products offering superior durability, aesthetic quality, and specialized features such as heating or modularity. They view outdoor enclosures not just as shelters but as integrated extensions of their home and landscaping, demanding designs that blend seamlessly with high-end garden aesthetics. This segment is highly responsive to marketing that emphasizes safety, psychological enrichment (catered to natural feline behaviors), and sustainability credentials.

A significant secondary customer segment includes animal welfare organizations, rescue shelters, and non-profit groups requiring durable, easy-to-clean, and often stackable or scalable outdoor housing solutions for feral cat colonies or high-volume temporary accommodation. These institutional buyers focus less on aesthetic customization and more on operational factors such as cost-per-unit, longevity, ease of sanitization, and compliance with local animal housing regulations. Their purchasing decisions are often driven by grant funding cycles and requires B2B sales strategies focusing on bulk discounts, institutional warranties, and standardized, heavy-duty designs. This segment provides a stable, volume-based revenue stream, particularly for manufacturers specializing in durable plastics and metal mesh constructions designed for heavy wear and tear.

The tertiary customer segment comprises individuals located in extreme climates (very cold or very hot) who necessitate highly specialized, thermally regulated outdoor shelters. This niche group drives demand for innovative materials such as specialized insulation (e.g., proprietary foam cores) and integrated climate control systems (solar vents, thermostatically controlled heaters). These customers require substantial technical specification verification and are highly focused on the functional performance aspects of the product, requiring robust warranties against climate-related product failure. Marketing efforts targeting this segment must focus on demonstrating measurable performance metrics, such as R-value ratings for insulation and successful operation under specific temperature extremes, ensuring confidence in the product’s ability to protect their pets year-round.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.27 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Outdoor Cat House Company, Habitat Haven, Catio Spaces, Kittywalk Systems, Trixie Pet Products, K&H Pet Products, Petsfit, Pawhut, New Age Pet, Blythe Wood Works, CozyCatFurniture, Petmate, Katkabin, C&D Pet Products, Advantek, Aivituvin, Somerzby, Feline Furniture, Midwest Homes for Pets, Keter. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Outdoor Cat House and Furniture Market Key Technology Landscape

The technological landscape of the Outdoor Cat House and Furniture Market is rapidly evolving, driven by advancements in material science, smart home integration, and modern manufacturing processes. Material innovation is crucial, focusing on composite lumber and high-grade, UV-stabilized plastics that offer superior durability and reduced maintenance compared to traditional wood, addressing the perennial consumer complaint of weather degradation. Manufacturers are employing vacuum lamination and pressure treatment technologies to enhance the structural longevity and insulation properties of houses, making them suitable for extreme temperatures. Furthermore, the development of lightweight yet highly rigid aluminum frames allows for the construction of large, modular catio systems that are easier to assemble and transport, significantly reducing logistical friction in the supply chain.

A major focus is the integration of low-voltage and battery-powered smart technologies designed specifically for outdoor environments. This includes thermostatically controlled heating pads that automatically adjust temperature based on ambient conditions, ensuring optimal thermal comfort without manual intervention, and solar-powered ventilation fans that prevent moisture build-up and overheating during summer months. Connectivity is established through Wi-Fi modules integrated into monitoring systems, allowing owners to check internal conditions and activate features remotely via dedicated smartphone applications. This adoption of IoT (Internet of Things) principles transforms the basic shelter into a monitored, proactive habitat, significantly increasing the product's perceived value and differentiation in the high-end segment, justifying the premium price points.

Manufacturing technologies, particularly Computer Numerical Control (CNC) machining and 3D modeling, play a vital role in enabling customization and precision. CNC cutting ensures precise component fit, minimizing assembly complexity for the end-user and optimizing material yield during production, contributing to sustainability goals by reducing scrap. Furthermore, the use of water-resistant, non-toxic finishes and specialized sealants applied through high-pressure spray systems ensures that the final product maintains its aesthetic integrity and structural soundness against prolonged exposure to elements like rain, snow, and intense sunlight. The confluence of these technologies enables the mass production of highly customized, durable, and functionally sophisticated outdoor environments that meet the exacting standards of the modern pet owner.

Regional Highlights

Regional dynamics heavily influence product design, material selection, and pricing strategies in the Outdoor Cat House and Furniture Market, reflecting diverse climate challenges and varying levels of pet expenditure.

- North America (NA): Dominates the market share due to high discretionary spending on pets and a strong consumer preference for large, elaborate Catio Systems and luxury, insulated shelters. The U.S. and Canada drive demand for climate-specific products, such as insulated and heated houses necessary for harsh winters. The region benefits from established e-commerce infrastructure supporting the sale and delivery of bulky items, leading to high sales volume for modular kits and professional installation services.

- Europe: Characterized by stringent animal welfare laws, particularly in countries like Germany and the UK, mandating high standards for pet housing, which fuels demand for durable, ethically sourced, and aesthetically pleasing wooden or composite shelters. Space constraints in densely populated European cities favor compact, multi-functional outdoor furniture and vertical catios, emphasizing design efficiency and integration into limited garden or balcony spaces.

- Asia Pacific (APAC): Exhibits the fastest growth, primarily driven by rapid urbanization, rising middle-class disposable incomes in China, Japan, and South Korea, and the increasing adoption of Western pet care standards. While currently focused on basic and mid-range functional housing, there is burgeoning demand for high-tech features like air conditioning and sophisticated monitoring systems to combat humid and hot climates prevalent in Southeast Asia.

- Latin America (LA): Represents an emerging market where demand is highly concentrated in urban centers like Brazil and Mexico. Price sensitivity is higher, leading to strong demand for cost-effective, durable plastic or treated wood basic shelters. Growth is constrained by inconsistent distribution networks and economic volatility, though increasing affluence suggests future opportunities for modular and mid-range product expansion.

- Middle East and Africa (MEA): A highly segmented market where the Middle East focuses on high-end, bespoke solutions featuring advanced cooling and sun protection technologies due to extreme heat. Africa remains largely underdeveloped, with demand concentrated around functional, robust housing for rescue operations and essential shelters in milder climate zones, offering opportunities for manufacturers specializing in low-cost, durable plastic units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Outdoor Cat House and Furniture Market.- The Outdoor Cat House Company

- Habitat Haven

- Catio Spaces

- Kittywalk Systems

- Trixie Pet Products

- K&H Pet Products

- Petsfit

- Pawhut

- New Age Pet

- Blythe Wood Works

- CozyCatFurniture

- Petmate

- Katkabin

- C&D Pet Products

- Advantek

- Aivituvin

- Somerzby

- Feline Furniture

- Midwest Homes for Pets

- Keter

Frequently Asked Questions

Analyze common user questions about the Outdoor Cat House and Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials offer the best longevity for outdoor cat houses in extreme weather conditions?

The best materials are high-density polyethylene (HDPE) plastic and composite lumber, known for superior resistance to moisture, UV damage, and rot compared to standard treated wood. Insulated models often use specialized foam cores to achieve high thermal R-values for temperature regulation.

How are modular catio systems improving feline safety and enrichment?

Modular catio systems improve safety by providing secure, enclosed outdoor access that prevents predation and traffic accidents while catering to natural instincts like climbing and scratching. Their modular design allows owners to customize size and layout to maximize environmental stimulation within specific space constraints.

Is it worth investing in a heated outdoor cat house, and what are the associated energy costs?

Investing in a heated outdoor cat house is highly recommended for cold climates, ensuring feline welfare and preventing hypothermia. Modern models typically use low-voltage, thermostatically controlled heating pads that operate efficiently, resulting in minimal associated energy costs, usually less than a standard incandescent light bulb per hour.

What is the primary difference between products sold through online retailers versus specialty pet stores?

Online retailers, particularly DTC brand websites, typically offer the largest selection of customizable, bulky, and high-end Catio Systems and houses, often at competitive prices due to reduced overhead. Specialty pet stores generally focus on smaller, pre-assembled, and standard-sized shelters and basic outdoor furniture.

How is sustainability affecting the manufacturing and consumer choices within this market?

Sustainability is a major trend, driving manufacturers toward using recycled plastic composites, certified sustainable wood (FSC), and non-toxic, low-VOC finishes. Consumers increasingly prefer and actively seek out products with proven sustainability credentials, prioritizing environmentally responsible sourcing and manufacturing processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager