Outdoor Leisure Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438515 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Outdoor Leisure Market Size

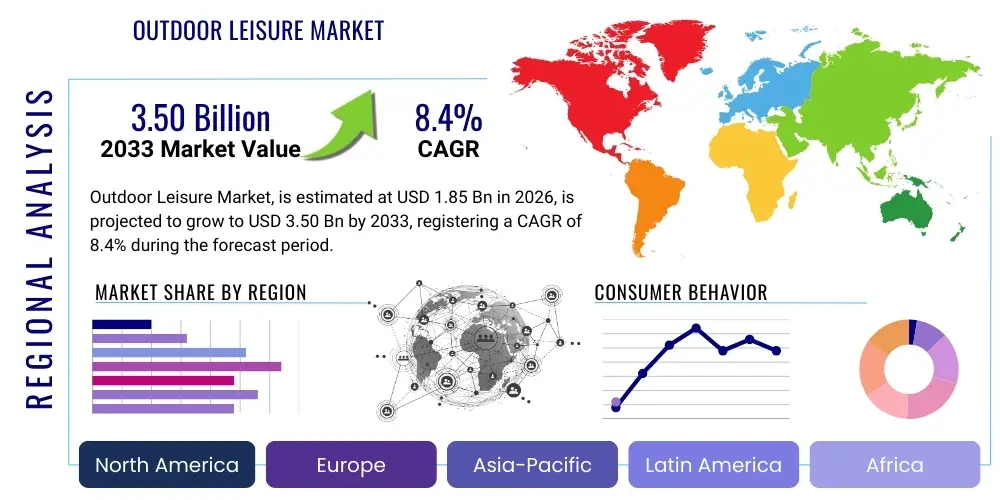

The Outdoor Leisure Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.4% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.50 Billion by the end of the forecast period in 2033.

Outdoor Leisure Market introduction

The Outdoor Leisure Market encompasses a broad spectrum of recreational activities, products, and services centered around non-urban, natural environments. This includes specialized gear for camping, hiking, mountaineering, water sports (kayaking, paddleboarding), cycling, and various forms of adventure tourism. The core offering of this market revolves around facilitating experiences that promote physical health, mental well-being, and connection with nature. Products range from high-performance technical apparel and durable equipment to digital tools for navigation and safety monitoring. The increasing global focus on wellness and the desire for experiential consumption, rather than purely materialistic consumption, are fundamental drivers sustaining the market’s robust expansion across developed and emerging economies.

Major applications of outdoor leisure products span across independent adventure travel, organized guided tours, and recreational activities focused on family and fitness. The versatility of modern outdoor gear allows for seamless transitions between different environments, driving consumer uptake. For instance, multi-functional apparel suitable for urban commuting and rugged trails appeals to the hybrid consumer. Key benefits driving market demand include stress reduction, increased physical fitness, enhanced social interaction through group activities, and educational opportunities related to environmental conservation. The market is increasingly influenced by demographics, particularly the rising participation of Millennials and Generation Z, who prioritize sustainable and authentic travel experiences.

Driving factors are multi-faceted, encompassing improved global infrastructure facilitating access to remote natural areas, technological advancements leading to lighter and safer equipment, and significant shifts in consumer lifestyle preferences following global health events. Furthermore, strategic marketing campaigns by major brands emphasizing environmental stewardship and corporate social responsibility resonate strongly with the target demographic, positioning outdoor leisure not just as an activity but as a lifestyle choice. The integration of digital planning tools, personalized safety features, and augmented reality elements within outdoor experiences further catalyzes market innovation and consumer engagement, ensuring sustained growth across product categories.

Outdoor Leisure Market Executive Summary

The Outdoor Leisure Market is currently experiencing transformative growth driven by a convergence of macro socio-economic trends and specific industry innovations. Business trends highlight a strong movement toward digitalization, where integrated platforms manage everything from booking campsites and guided expeditions to tracking personal performance and ensuring remote safety. Manufacturers are strategically focusing on direct-to-consumer (D2C) models to enhance brand loyalty and capture higher margins, alongside intensive research and development into sustainable material sourcing, such as recycled plastics and bio-based fibers, in response to stringent consumer ethical demands. The industry is characterized by significant mergers and acquisitions, primarily aimed at consolidating niche expertise, particularly in specialized areas like high-altitude climbing gear or advanced cycling technology, thereby creating integrated outdoor lifestyle portfolios.

Regional trends indicate that North America and Europe remain the dominant revenue generators due to high disposable incomes, established outdoor cultures, and extensive national park systems. However, the Asia Pacific (APAC) region is poised for the highest growth trajectory, fueled by rising middle-class affluence in countries like China and India, increasing government investment in eco-tourism infrastructure, and a nascent but rapidly growing interest in Western-style outdoor activities such as hiking and backpacking. Latin America and the Middle East and Africa (MEA) present emerging market opportunities, focusing initially on local adventure tourism and specialized luxury safari experiences, often requiring tailored gear and localized supply chain solutions to manage challenging climates and logistics.

Segmentation trends reveal robust performance in the Equipment segment, specifically lightweight camping gear and advanced navigation devices, reflecting a consumer inclination toward longer, more self-sufficient trips. The Apparel segment is thriving through the incorporation of smart textiles and fashion-forward designs that blur the line between performance wear and casual attire, known as athleisure. Activity type segmentation shows rapid expansion in sustainable eco-tourism and adventure wellness retreats, signaling a consumer desire for experiences that contribute to both personal health and environmental protection. This shift mandates that service providers focus heavily on certification, ethical operations, and minimal environmental impact reporting to remain competitive and attract the discerning modern outdoor enthusiast.

AI Impact Analysis on Outdoor Leisure Market

Common user questions regarding AI’s influence on the Outdoor Leisure Market primarily revolve around how technology can enhance safety, personalize experiences, and streamline logistics without detracting from the natural, unplugged essence of outdoor activities. Users frequently inquire about the reliability of AI-driven predictive analytics for weather and terrain assessment, how personalized gear recommendations can be generated based on individual biometrics and historical activity data, and the role of AI in emergency response systems (e.g., automated distress signal analysis). Furthermore, there is significant interest in how AI can optimize supply chains to ensure gear availability while reducing waste, addressing the consumer desire for sustainable and efficient operations within the industry.

AI’s primary impact manifests in optimizing the user journey and enhancing operational efficiency for service providers. On the consumer front, AI algorithms are crucial for developing highly personalized training programs for endurance sports, calculating optimal hiking routes based on real-time environmental data, and customizing nutritional plans for multi-day excursions. AI-powered chatbots and virtual assistants are becoming standard tools for immediate customer service, providing instant information on product specifications, local trail conditions, and safety protocols. This digital integration removes friction points from the planning phase, making specialized outdoor activities more accessible to novices while providing expert-level detail for seasoned adventurers.

For market players, AI drives advanced inventory management, forecasting demand for seasonal equipment, and automating the monitoring of remote facilities like glamping sites or trail infrastructure, reducing labor costs and improving predictive maintenance schedules. Crucially, AI is integrated into safety equipment through advanced sensor fusion and machine learning models, capable of identifying subtle shifts in physiological metrics indicative of fatigue or altitude sickness, proactively alerting users and support teams. This application of AI transforms the risk profile of high-adventure activities, contributing significantly to market acceptance and growth by making inherently dangerous activities measurably safer and more reliable. This focus on safety assurance through smart technology is a powerful value proposition in attracting and retaining high-value clientele.

- AI-driven personalized itinerary planning and route optimization based on real-time ecological data.

- Predictive maintenance for rental equipment fleets, extending asset lifespan and ensuring safety compliance.

- Enhanced emergency response systems utilizing machine learning for rapid geolocation and distress signal classification.

- AI integration into wearable technology to monitor biometrics, track fatigue levels, and prevent altitude sickness.

- Optimized supply chain logistics and inventory management for seasonal outdoor gear to minimize waste and stockouts.

- Personalized e-commerce recommendations for apparel and equipment based on historical usage and environmental variables.

- Automated analysis of satellite imagery and drone data for trail condition mapping and conservation monitoring.

DRO & Impact Forces Of Outdoor Leisure Market

The Outdoor Leisure Market is shaped by dynamic Drivers, Restraints, and Opportunities (DRO), which collectively define the Impact Forces influencing its trajectory. Primary drivers include the global proliferation of wellness culture, which emphasizes physical activity and mental decompression in natural settings, alongside increased urbanization leading to a greater psychological need for escapism and nature connection. Societal shifts toward flexible work arrangements and early retirement are creating larger blocks of discretionary time, significantly boosting demand for multi-day expeditions and specialized adventure travel. These drivers exert a strong positive impact force, perpetually expanding the consumer base beyond traditional demographics.

Conversely, the market faces significant restraints, principally the escalating threat of climate change, which disrupts seasonal activities (e.g., unpredictable snowfall impacting winter sports) and increases the risk profile of certain environments due to extreme weather events. Furthermore, regulatory hurdles related to land use, permitting for guided tours, and environmental protection mandates can restrict access to prime locations and increase operational complexity and cost for service providers. Economic volatility, particularly inflation affecting travel costs and discretionary spending on high-end equipment, presents a cyclical restraint. These restraining forces necessitate market innovation focused on resilience, sustainable operations, and developing climate-proof leisure options.

Opportunities abound through technological advancements, specifically in material science resulting in ultra-lightweight, durable, and highly sustainable gear, appealing to the environmentally conscious and performance-driven consumer. The digitalization of the adventure travel planning process, including virtual reality previews of trails and augmented reality navigation tools, opens new avenues for market entry and engagement. Moreover, the focus on 'accessible adventure'—designing products and experiences for individuals with physical limitations or different age groups—represents a massive untapped demographic. The confluence of these forces indicates a market trajectory defined by high-tech integration, rigorous sustainability commitment, and enhanced focus on personalized, safe experiences, driving medium-to-high impact forces across all segments.

Segmentation Analysis

Segmentation analysis of the Outdoor Leisure Market is crucial for identifying precise growth pockets and tailoring product offerings effectively. The market is primarily segmented based on Product Type (Equipment, Apparel, Footwear, Accessories), Activity Type (Camping/Hiking, Climbing, Water Sports, Cycling, Skiing), Distribution Channel (Online Retail, Specialty Stores, Departmental Stores), and Geography. This granular breakdown allows stakeholders to focus investment on areas experiencing accelerated demand, such as premium, technical apparel designed for multi-season use, which consistently outperforms standard recreational items.

A detailed examination of the Activity Type segment reveals that Camping and Hiking remain the foundational activities, bolstered by the accessibility and relatively low barrier to entry. However, specialized segments like Adventure Cycling (gravel biking, bike packing) and niche water sports (foil surfing, stand-up paddleboarding) are showing the fastest year-over-year growth, driven by enthusiasts seeking novel, high-engagement experiences. The increasing professionalization of these leisure pursuits necessitates higher investment in specialized, durable equipment, thereby boosting the average transaction value across distribution channels.

The Distribution Channel segmentation highlights a persistent shift towards online retail, driven by consumer preference for convenience, exhaustive product information, and direct access to brand sustainability narratives. While specialty retail stores remain essential for high-touch activities like climbing and technical footwear, where expert fitting and guidance are mandatory, the online segment captures the bulk of volume sales for generic accessories, basic apparel, and entry-level equipment, underscoring the necessity of a sophisticated omnichannel strategy for comprehensive market coverage.

- Product Type:

- Equipment (Tents, Backpacks, Sleeping Bags, Cooking Gear)

- Apparel (Outerwear, Base Layers, Performance Wear)

- Footwear (Hiking Boots, Trail Runners, Water Shoes)

- Accessories (Navigation Devices, Lighting, Safety Gear)

- Activity Type:

- Camping and Hiking

- Mountaineering and Climbing

- Water Sports (Kayaking, Canoeing, Paddleboarding)

- Cycling (Mountain Biking, Road Cycling, Adventure Cycling)

- Winter Sports (Skiing, Snowboarding)

- Adventure Tourism and Wellness Retreats

- Distribution Channel:

- Specialty Stores (Outdoor Gear Retailers)

- Online Retail (Brand Websites, E-commerce Platforms)

- Departmental and Hyper Stores

- Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Outdoor Leisure Market

The Value Chain of the Outdoor Leisure Market is complex, beginning with upstream analysis focused on raw material procurement, which is increasingly dominated by sustainable sourcing mandates, requiring suppliers to provide certified recycled textiles, low-impact dyes, and advanced bio-polymers. Upstream activities involve intensive research and development into material science—especially for lightweight alloys and durable, waterproof membranes—crucial for maintaining performance standards. Key players are establishing vertically integrated supply models or forming exclusive partnerships with specialized material manufacturers to secure ethical and high-quality inputs, mitigating risks associated with supply volatility and regulatory scrutiny concerning environmental impact.

Downstream analysis focuses on the consumer interaction and post-sale services. This includes sophisticated marketing and branding efforts emphasizing the experiential aspect of outdoor life, efficient inventory management across multiple distribution channels, and highly specialized logistics to handle varied product sizes and weights (e.g., tents versus micro-gear). Critical to downstream success is the provision of expert customer service, often through trained outdoor professionals in specialty stores, who offer advice on complex equipment usage, repairs, and customization. The increasing importance of rental services for high-cost or specialized equipment (like mountaineering gear) also forms a significant component of the downstream value delivery.

Distribution channels are bifurcated into direct and indirect methods. Direct channels, primarily brand-owned e-commerce sites and flagship stores, offer manufacturers maximum control over pricing, brand image, and customer data, facilitating personalized marketing and robust loyalty programs. Indirect channels involve collaborations with major outdoor specialty retailers (which provide high-level product knowledge), large sporting goods chains, and international distributors, crucial for penetrating geographically dispersed markets. The emergence of digital marketplaces further complicates this structure, requiring dynamic pricing strategies and seamless inventory synchronization across all sales points to maintain competitive parity and meet AEO standards for quick information retrieval by consumers.

Outdoor Leisure Market Potential Customers

Potential customers for the Outdoor Leisure Market span a diverse range of demographics, extending beyond the traditional male adventurer to encompass families, wellness enthusiasts, eco-tourists, and specialized urban commuters. End-users are increasingly segmented not just by age or income, but by their motivation for engaging with nature: the 'Wellness Seeker' prioritizes activities like yoga retreats and low-impact hiking for mental health benefits, while the 'Performance Enthusiast' demands cutting-edge, high-specification gear for extreme sports like ultra-running or complex alpine climbing. Manufacturers must tailor their product lines and marketing narratives to address these distinct psychological drivers.

A significant buying segment is the environmentally conscious consumer, largely comprised of younger generations (Millennials and Gen Z), who act as crucial buyers demanding transparency and sustainability credentials from gear providers. These customers are willing to pay a premium for certified ethical sourcing, durable products designed for longevity, and brands that actively participate in conservation efforts. This necessitates rigorous reporting on carbon footprints and end-of-life recycling programs for equipment. Furthermore, the burgeoning segment of 'Accessible Adventurers' includes older adults seeking gentle recreational opportunities and individuals with disabilities requiring specialized, adaptive equipment, representing a growing niche ripe for specialized product development and market expansion.

Corporate entities and educational institutions also serve as major institutional buyers. Corporations invest in outdoor team-building exercises and wellness retreats, driving demand for group packages, bulk equipment purchases, and professional guiding services. Educational establishments purchase equipment for outdoor schooling, field trips, and collegiate adventure programs, prioritizing durability and safety certifications. These professional buyers require detailed liability documentation, bulk discounts, and long-term service agreements, fundamentally differing from individual consumers who prioritize brand aesthetics and personal performance gains. Understanding the procurement processes and safety criteria of these institutional buyers is key to capturing large-scale contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.50 Billion |

| Growth Rate | 8.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Columbia Sportswear, The North Face (VF Corp), Patagonia, Inc., Arc'teryx, Black Diamond Equipment, Garmin Ltd., Yeti Holdings Inc., Johnson Outdoors, Marmot Mountain LLC, REI Co-op, Specialized Bicycle Components, Deckers Brands (Hoka), Salewa, Thule Group, Helly Hansen, Adidas AG, Nike, Inc., Jack Wolfskin, L.L.Bean, Mammut Sports Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Outdoor Leisure Market Key Technology Landscape

The technology landscape of the Outdoor Leisure Market is rapidly evolving, driven primarily by advancements in materials science and the proliferation of IoT (Internet of Things) devices. Key technological innovations center around creating products that are lighter, stronger, and more environmentally friendly. Material technologies like Dyneema (ultra-high-molecular-weight polyethylene fiber) and advanced Gore-Tex derivatives are enhancing the performance envelope of outdoor apparel and equipment, offering superior strength-to-weight ratios and unmatched weather protection. Furthermore, sustainable manufacturing technologies, including closed-loop recycling systems for textile production and the adoption of biodegradable components, are becoming standard requirements rather than niche features, impacting everything from tent fabrics to backpack components.

Digital technology integration is transforming safety and navigation. The market heavily utilizes advanced Global Navigation Satellite System (GNSS) devices, high-resolution mapping applications, and satellite communication tools (like personal locator beacons and satellite communicators) that offer connectivity even in remote areas. Wearable technology, often leveraging miniaturized sensors and AI analytics, provides real-time data on physiological status, environmental exposure, and performance metrics, allowing users to make informed decisions regarding rest, hydration, and safety limits. This convergence of durable hardware and sophisticated software creates a digital ecosystem that supports complex, multi-day adventures with unprecedented reliability and information density.

Furthermore, technology is redefining consumer interaction and product customization. Three-dimensional (3D) scanning technology is utilized for precise boot fitting and customized gear design, offering end-users unparalleled comfort and performance benefits. Augmented Reality (AR) applications are being deployed in retail environments, allowing customers to virtually test gear or preview tent setups. On the manufacturing side, automation and precision engineering using CAD/CAM systems ensure high-quality, repeatable construction, especially for technical equipment like cycling frames and climbing hardware. These technological applications streamline product development, enhance consumer decision-making, and significantly elevate the overall safety and performance standards available to the outdoor enthusiast.

Regional Highlights

North America: North America, particularly the United States and Canada, represents a mature and dominant market segment in outdoor leisure, characterized by high consumer spending on discretionary items and a deeply ingrained cultural appreciation for nature and wilderness exploration. The region benefits from vast expanses of protected lands, including national and state parks, which serve as primary hubs for camping, hiking, and specialized extreme sports. Current growth is largely driven by the premiumization trend, where consumers are replacing aging gear with high-performance, technologically advanced, and ethically sourced alternatives, pushing market value upwards despite steady participation rates. The focus is heavily on integrated technology, safety features, and products designed for multi-sport use, reflecting the dynamic lifestyles of consumers in this region.

Europe: The European Outdoor Leisure Market is highly fragmented but robust, driven by diverse geographic landscapes, from the Alpine mountain ranges to extensive coastal areas, supporting intense interest in climbing, skiing, and water sports. European consumers exhibit a strong preference for brands demonstrating clear commitments to sustainability, circular economy models, and rigorous durability standards, largely influenced by stringent EU environmental regulations and a strong eco-conscious consumer base, particularly in Northern and Western Europe. Germany, France, and the Scandinavian countries are key revenue contributors, emphasizing quality over quantity and showing a marked increase in demand for eco-certified travel and localized adventure holidays, minimizing long-haul travel.

Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid urbanization, substantial growth in disposable income, and the adoption of Western recreational activities, particularly among the middle-class populations of China, Japan, South Korea, and Australia. While Japan and Australia possess established outdoor cultures, the emerging markets are seeing explosive growth in entry-level and mid-range gear for activities like basic camping and city-adjacent hiking. Government initiatives promoting domestic tourism and health and wellness are fueling infrastructure development (trails, campsites). The market challenge lies in adapting global products to diverse climate conditions (tropical humidity vs. high altitude) and educating nascent consumer segments about safety protocols and specialized gear usage.

- North America: Dominant market share; strong focus on premium, integrated technology, and high-end gear replacement cycles; driven by high disposable income and established park infrastructure.

- Europe: High demand for sustainable, durable, and ethically produced products; regional strength in specialized sports like climbing and skiing; significant influence from strict environmental standards.

- Asia Pacific (APAC): Highest CAGR forecast; rapid expansion driven by middle-class growth, urbanization stress, and investment in eco-tourism infrastructure; focus on basic to intermediate-level equipment.

- Latin America (LATAM): Emerging market concentrated around eco-tourism and guided adventure travel; growth tied to infrastructure improvements and political stability; demand for durable gear suitable for tropical and high-altitude environments.

- Middle East and Africa (MEA): Growth centered on luxury adventure tourism (safaris, desert excursions) and localized wellness retreats; high demand for climate-specific protective gear and guided services; potential expansion in urban outdoor activities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Outdoor Leisure Market.- Columbia Sportswear Company

- The North Face (VF Corporation)

- Patagonia, Inc.

- Arc'teryx (Amer Sports)

- Black Diamond Equipment (Clarus Corporation)

- Garmin Ltd.

- Yeti Holdings Inc.

- Johnson Outdoors Inc.

- Marmot Mountain LLC

- REI Co-op

- Specialized Bicycle Components

- Deckers Brands (Hoka One One)

- Salewa

- Thule Group

- Helly Hansen (Canadian Tire Corporation)

- Adidas AG (Terrex)

- Nike, Inc. (ACG)

- Jack Wolfskin

- L.L.Bean

- Mammut Sports Group AG

Frequently Asked Questions

Analyze common user questions about the Outdoor Leisure market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Outdoor Leisure Market?

Market growth is predominantly driven by the global convergence of health and wellness trends, increased disposable income allocated to experiential travel, and the psychological need for nature connection resulting from increased urbanization. Furthermore, technological innovations providing lighter, safer, and more specialized gear significantly expand participation.

How is sustainability influencing purchasing decisions within the Outdoor Leisure Market?

Sustainability is a crucial purchasing determinant, particularly among younger consumers. Buyers actively seek products made from recycled or bio-based materials, demand transparency regarding supply chain ethics, and prefer brands that implement circular economy practices, viewing environmentally responsible products as having higher inherent value.

Which technological advancements are most critical for safety in outdoor leisure activities?

Critical safety technology includes the integration of GNSS and satellite communication devices for remote connectivity, AI-powered wearables that monitor physiological stress and environmental risks, and high-performance material science ensuring gear resilience under extreme weather conditions.

What is the projected fastest-growing region for the Outdoor Leisure Market?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR, primarily fueled by the rapid expansion of the middle class, government investment in regional eco-tourism, and the growing adoption of Western outdoor activities in densely populated countries such as China and India.

How does the shift towards direct-to-consumer (D2C) channels affect traditional outdoor retailers?

The D2C shift allows manufacturers to control pricing and brand narrative while collecting valuable customer data, putting pressure on traditional retailers. Specialty stores must counter this by focusing on providing expert advice, high-touch services (e.g., gear customization and repairs), and localized community engagement to maintain relevance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager