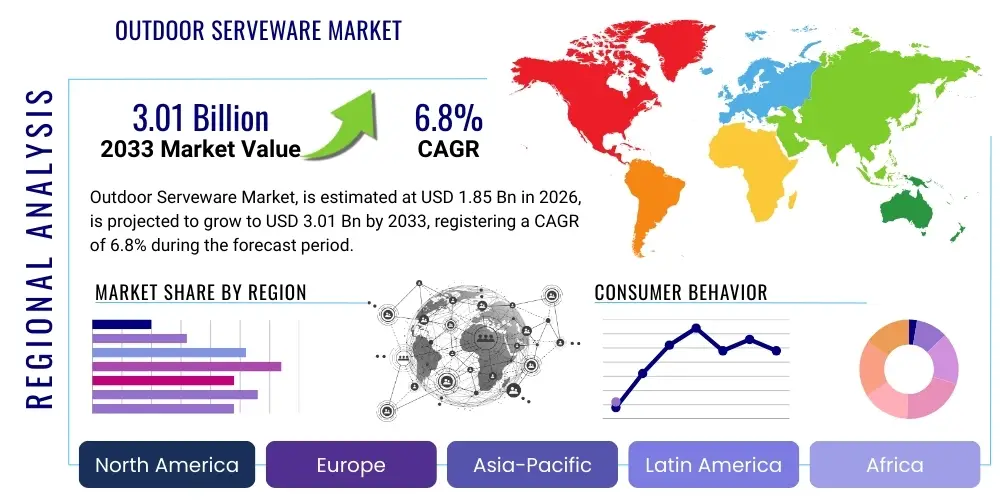

Outdoor Serveware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437789 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Outdoor Serveware Market Size

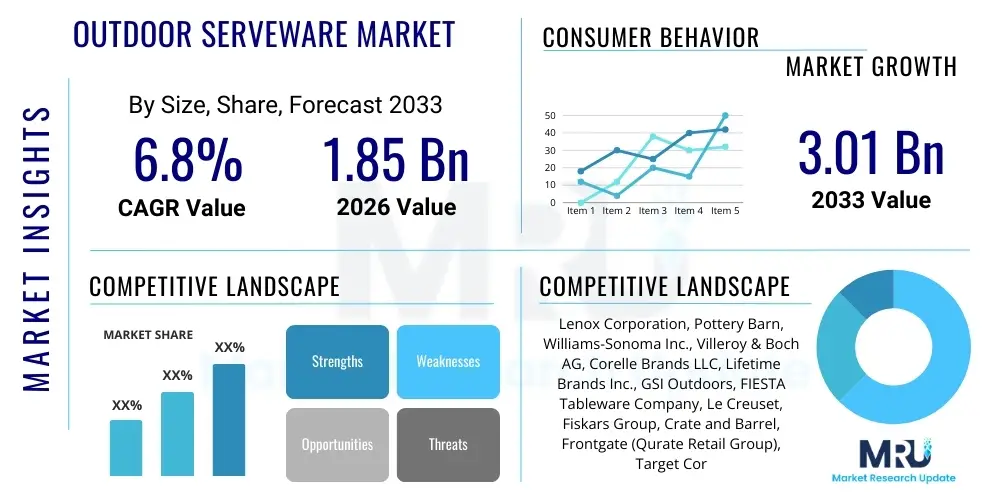

The Outdoor Serveware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.01 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global trend toward outdoor living spaces, increased consumer spending on home décor, and the rising demand for durable, aesthetically pleasing, and sustainable serving solutions suitable for al fresco dining environments. Market expansion is further supported by the proliferation of residential and commercial outdoor entertainment areas, necessitating specialized serveware that can withstand varying weather conditions while maintaining sophisticated visual appeal.

Outdoor Serveware Market introduction

The Outdoor Serveware Market encompasses a wide array of durable and weather-resistant products designed specifically for dining and entertaining in exterior settings, including patios, decks, gardens, and poolside areas. These products span categories such as platters, bowls, pitchers, tumblers, and specialized accessories, typically manufactured using robust materials like melamine, bamboo, specialized acrylics, and high-grade stainless steel to prevent breakage and deterioration associated with traditional ceramics or glass. The primary objective of outdoor serveware is to offer the aesthetic quality of indoor dining sets combined with the necessary resilience for outdoor use, ensuring safety, portability, and longevity against UV exposure and physical impact.

Major applications of outdoor serveware are predominantly seen in residential environments, where homeowners increasingly utilize their outdoor spaces for casual dining, barbecues, and large gatherings. Concurrently, the commercial sector, including hotels, resorts, cruise lines, and casual dining establishments (HORECA segment), represents a significant application area, requiring bulk quantities of serveware that meet high standards of durability, hygiene, and design coherence. The shift towards 'gastro-tourism' and outdoor hospitality experiences further accelerates commercial demand for high-quality, specialized serveware that enhances the overall customer experience and reflects brand sophistication.

Key benefits driving the market include enhanced safety due to shatter resistance, reduced replacement costs compared to fragile alternatives, and the stylistic evolution of these products, which now closely mimic high-end ceramic and glassware designs. Driving factors center on urbanization leading to smaller indoor living spaces and a corresponding emphasis on utilizing outdoor areas, coupled with the increasing consumer focus on sustainable and eco-friendly materials, such as recycled plastics and responsibly sourced bamboo fiber, which align with contemporary lifestyle choices and environmental consciousness.

Outdoor Serveware Market Executive Summary

The Outdoor Serveware Market is experiencing dynamic shifts, characterized by robust growth underpinned by strong residential renovation activities and a recovery in the global hospitality sector. A major business trend involves the rapid adoption of omnichannel distribution strategies, where established retailers and specialized serveware brands leverage both physical stores and expansive e-commerce platforms to reach a decentralized consumer base. Furthermore, consolidation within the manufacturing sector is leading to economies of scale, while increased investment in material science allows companies to launch premium, sustainable alternatives that command higher price points and capture the ethically conscious consumer segment.

Regionally, North America and Europe remain the dominant markets, driven by established outdoor entertaining cultures and high discretionary incomes, although the Asia Pacific (APAC) region is demonstrating the highest growth velocity. This surge in APAC is attributable to rising affluence in countries like China and India, increased investment in leisure infrastructure (hotels, luxury residences), and the growing Westernization of lifestyle trends that prioritize outdoor leisure and entertainment. Regional manufacturing hubs are increasingly focusing on compliance with stringent safety and environmental regulations, particularly regarding materials used in food contact applications.

Segment trends highlight the significant dominance of melamine and high-grade plastic segments due to their cost-effectiveness and durability, yet the bamboo/natural fiber composite segment is exhibiting exponential growth, driven by sustainability mandates and consumer preferences for organic aesthetics. In terms of product type, dinnerware sets continue to hold the largest market share, but specialized serving accessories, such as insulated pitchers and themed charcuterie boards specifically designed for outdoor use, are rapidly gaining traction as consumers seek versatility and specialized functionality for various outdoor events. The residential end-user segment remains pivotal, though the commercial segment offers higher volume opportunities linked to global tourism recovery.

AI Impact Analysis on Outdoor Serveware Market

User queries regarding AI's influence in the Outdoor Serveware Market frequently focus on how technology can enhance product customization, optimize supply chains, and personalize the purchasing experience. Consumers and businesses are keen to understand if AI can facilitate the rapid creation of themed or customized serveware collections (e.g., matching patio décor), reduce design-to-market cycles for seasonal products, and improve the durability analysis of new composite materials. Key concerns revolve around the ethical sourcing of AI-recommended materials and the practical integration of complex algorithms into traditionally low-tech manufacturing processes, specifically questioning the cost implications for the final consumer product.

AI is beginning to revolutionize the market through sophisticated predictive analytics used to forecast demand based on seasonal trends, regional weather patterns, and specific holiday data, allowing manufacturers to drastically reduce inventory overstock and minimize material waste. Furthermore, AI-driven design platforms are enabling rapid prototyping and virtual testing of new product forms and material compositions, significantly speeding up the development cycle for serveware that is lighter, stronger, and more resistant to specific environmental factors like saltwater corrosion near coastal resorts. These tools analyze historical sales data alongside aesthetic trends to guide designers toward optimal color palettes and textural finishes that resonate best with target consumer demographics.

The most immediate commercial impact of AI is observed in sales and marketing, where machine learning algorithms personalize product recommendations on e-commerce sites, dynamically bundling complementary serveware items based on user purchase history and inferred lifestyle. This targeted approach boosts average transaction values and improves customer satisfaction. For manufacturers, AI-powered quality control systems are being implemented on production lines to detect minute defects in mold consistency or finish application, ensuring that the high aesthetic standards demanded by the modern consumer are met consistently across large production runs of composite materials like enhanced melamine or recycled glass fiber composites.

- AI optimizes inventory management by predicting demand based on localized weather and seasonal entertainment forecasts.

- Machine learning algorithms accelerate product design by virtually testing material durability and aesthetic appeal under simulated outdoor conditions.

- Generative AI tools assist customers in visualizing how specific serveware collections will look within their personalized outdoor dining settings.

- AI-driven personalized marketing enhances e-commerce conversions by suggesting complementary serving pieces and accessories.

- Predictive maintenance schedules for manufacturing equipment are optimized using AI, minimizing downtime and ensuring steady supply.

- Advanced quality inspection using computer vision reduces defects in complex patterned and high-gloss serveware finishes.

DRO & Impact Forces Of Outdoor Serveware Market

The market dynamics are defined by a crucial interplay between increasing consumer desire for aesthetic outdoor living (Drivers) and persistent challenges related to material costs and durability guarantees (Restraints). This tension creates significant growth pathways (Opportunities) related to technological innovation in sustainable materials and the expansion of the hospitality sector. These factors collectively exert powerful Impact Forces that dictate strategic decisions regarding product development, pricing, and distribution channel selection across all key geographic markets.

Drivers: A primary driver is the accelerating trend of using outdoor spaces as extensions of the home's primary entertainment areas, termed 'exteriorization of living'. This necessitates serveware that seamlessly transitions from indoor aesthetic standards to outdoor functionality. The strong global growth in residential construction and remodeling activities, particularly focusing on high-end patio and kitchen areas, directly stimulates demand. Furthermore, the rising number of social gatherings, events, and focus on 'staycations' encourages consumers to invest in specialized, durable, and stylish outdoor dining solutions, moving away from temporary or disposable options.

Restraints: Significant restraints include the volatility in the pricing of raw materials, such as petroleum-based plastics (used for acrylics and melamine) and certain metals (for serving tools and accessories), which impacts manufacturing costs and, consequently, retail prices. A major constraint is consumer perception regarding the quality and aesthetic limitations of non-ceramic or non-glass materials; while modern serveware mimics fine china, overcoming the psychological barrier of 'plastic' remains a challenge. Additionally, the need for specialized storage and care instruction for some high-end composite outdoor items can deter consumers seeking absolute convenience.

Opportunities: Opportunities abound in the development and commercialization of genuinely sustainable and biodegradable materials, such as advanced bio-plastics derived from cornstarch or sugarcane, which offer performance comparable to traditional polymers while meeting evolving environmental regulations and consumer values. The untapped potential in emerging economies, particularly in Latin America and Southeast Asia, where outdoor leisure is gaining popularity, presents vast market penetration opportunities. Strategic partnerships with hospitality design firms and high-volume e-commerce platforms also offer accelerated market visibility and sales volume.

Impact Forces: The overall impact force is strongly positive, driven by lifestyle shifts and technological improvements. The strongest force is the pervasive consumer demand for hybrid products—items that perform exceptionally outdoors but look luxurious enough for indoor use. Regulatory impact forces related to food safety and material recycling standards (especially in the EU and North America) compel manufacturers toward continuous innovation and transparency. Competitive impact forces are high, leading to rapid product feature integration, such as enhanced thermal retention capabilities and antimicrobial treatments, as companies vie for premium market positioning.

Segmentation Analysis

The Outdoor Serveware Market is highly segmented, primarily based on the material composition, which fundamentally determines the product's durability, cost, and aesthetic appeal. Secondary segmentation includes product type (which defines application), distribution channel (dictating market reach), and end-user (identifying key purchasing behaviors). Analyzing these segments provides crucial insights into growth pockets, pricing strategies, and supply chain optimization tailored for specific consumer needs, whether for high-volume commercial applications or niche residential luxury purchases.

Material segmentation is the most critical differentiator, separating the market into traditional options like melamine, emerging alternatives such as bamboo and natural fiber composites, and specialty materials like high-grade acrylics and specialized non-corrosive metals (e.g., powder-coated aluminum or stainless steel). Distribution analysis emphasizes the growing dominance of online retail, which offers vast selection and convenience, over traditional brick-and-mortar outlets. Understanding these segments allows businesses to align their production capabilities with sustainable material demand and optimize logistics for high-growth e-commerce channels.

- By Material:

- Melamine

- Bamboo and Natural Fiber Composites

- Acrylic and Specialized Plastics (Polycarbonate, Tritan)

- Stainless Steel and Metal Alloys

- Others (e.g., Silicon, Recycled Glass Fiber)

- By Product Type:

- Dinnerware (Plates, Bowls, Cups)

- Serving Pieces (Platters, Trays, Serving Bowls)

- Drinkware (Tumblers, Pitchers, Coolers)

- Cutlery and Accessories (Serving Utensils, Charcuterie Boards)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Department Stores, Specialty Home Goods Stores, Supermarkets, DIY Stores)

- By End-User:

- Residential

- Commercial (HORECA, Institutional, Corporate Events)

Value Chain Analysis For Outdoor Serveware Market

The value chain for the Outdoor Serveware Market begins with the upstream sourcing of raw materials, which is increasingly critical due to the focus on sustainability. This stage involves acquiring high-quality polymers (melamine resin, acrylic), natural fibers (bamboo pulp), and specialized metallic alloys. Manufacturers often engage directly with certified suppliers to ensure traceability, particularly for eco-friendly materials, mitigating risks associated with material quality and ethical sourcing. The upstream segment is heavily influenced by petrochemical market fluctuations and global regulatory standards concerning raw material safety and environmental impact.

The core manufacturing and processing stage involves injection molding, compression molding, or specialized casting, where raw materials are transformed into finished serveware. This phase requires significant investment in precision tooling to achieve complex designs and mimic the texture of traditional materials. Companies focus on optimizing production efficiency, minimizing material waste, and implementing advanced finishing techniques, such as UV protection coatings and high-gloss treatments, which are essential for outdoor durability. Direct distribution channels, where manufacturers sell directly to major commercial clients (hotels) or via their own e-commerce portals, offer higher margins and greater control over brand presentation and customer feedback loops.

The downstream activities involve logistics, distribution, and retail sales. The channel complexity is high, encompassing both direct sales and indirect routes through wholesalers, large big-box retailers, and specialized online marketplaces. Offline channels provide customers the opportunity to physically assess the look, weight, and feel of the serveware, while online platforms excel in offering wide selection and competitive pricing, often driving market growth through visual merchandising and detailed product specifications. Effective collaboration across the value chain, from raw material providers to final retailers, is paramount for ensuring inventory availability during peak summer seasons and maintaining competitive retail pricing.

Outdoor Serveware Market Potential Customers

The primary consumers (End-User/Buyers) of outdoor serveware fall into two distinct but overlapping categories: Residential Consumers and Commercial/Institutional Buyers. Residential consumers, particularly high-net-worth individuals and middle-income families engaged in home renovations, are motivated by aesthetics, durability, and lifestyle integration. These buyers prioritize product design that matches existing patio furniture and look for sets that are easy to clean, store, and integrate into regular home use, driving demand for premium, visually sophisticated materials like high-end melamine and durable bamboo composites.

Commercial buyers encompass the vast Hospitality, Restaurant, and Catering (HORECA) sector, as well as institutional purchasers such as schools, hospitals, and corporate cafeterias that utilize outdoor dining areas. The HORECA segment requires high-volume, extremely durable, and easy-to-sanitize serveware that can withstand rigorous commercial dishwashing cycles and constant handling. Their buying decisions are primarily driven by replacement frequency minimization, regulatory compliance (especially regarding food safety), and the ability to source customized designs or branding options, making stainless steel and specialized polycarbonate highly desirable materials.

The institutional segment places high emphasis on safety (shatter-proof qualities), cost-effectiveness, and utility over luxury aesthetic, often favoring simpler, bulk-packaged serveware. Furthermore, the burgeoning event management and outdoor catering industries represent a growing customer base, demanding portable, lightweight, and often disposable (or highly compostable/recyclable) serveware solutions for large-scale temporary events. Targeting these varied segments requires manufacturers to maintain a diversified product portfolio ranging from budget-friendly bulk options to high-design, eco-premium collections.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.01 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lenox Corporation, Pottery Barn, Williams-Sonoma Inc., Villeroy & Boch AG, Corelle Brands LLC, Lifetime Brands Inc., GSI Outdoors, FIESTA Tableware Company, Le Creuset, Fiskars Group, Crate and Barrel, Frontgate (Qurate Retail Group), Target Corporation (Room Essentials), IKEA Systems B.V., OXO International, Tupperware Brands Corporation, ZWILLING J.A. Henckels, Libbey Inc., Carlisle FoodService Products, Zak Designs. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Outdoor Serveware Market Key Technology Landscape

Technological advancements in the outdoor serveware market are primarily focused on material science and manufacturing precision to enhance durability, aesthetic quality, and sustainability. Key innovations revolve around developing advanced polymer blends, such as Tritan copolyester, which provides glass-like clarity and exceptional shatter resistance without containing BPA. Manufacturers are heavily investing in specialized molding techniques that allow melamine and acrylic products to achieve complex surface textures and patterns, effectively mimicking the matte finish of stoneware or the gloss of fine porcelain, thereby closing the aesthetic gap between indoor and outdoor dining solutions.

Another crucial technological area is the integration of functional coatings. This includes UV stabilization treatments embedded within the material structure to prevent color fading and degradation when exposed to prolonged sunlight, significantly extending product lifespan. Furthermore, antimicrobial technologies, often utilizing silver ion or zinc compounds, are increasingly applied or molded into serveware, especially those intended for commercial hospitality environments. These technologies inhibit bacterial growth, ensuring higher hygiene standards, which is a major selling point for both commercial clients and health-conscious residential users post-pandemic.

The manufacturing process itself is benefiting from technology adoption, notably through Computer-Aided Manufacturing (CAM) and robotics, which ensure absolute uniformity and precision in complex product geometries, vital for stackability and efficient storage. While 3D printing is not yet viable for mass production of traditional materials, it plays a critical role in the rapid prototyping of new serveware designs and specialized components like airtight seals or integrated handles. These technologies collectively drive down defects, improve material performance under stress, and allow for quicker introduction of trend-aligned products to a fast-moving consumer market, solidifying the transition from purely functional items to high-design lifestyle accessories.

Regional Highlights

North America currently holds the largest share of the Outdoor Serveware Market, driven by a deeply ingrained culture of backyard entertaining and substantial discretionary spending on home improvement projects. Consumers in the U.S. and Canada prioritize large, complete sets, high durability, and sophisticated design elements that complement modern luxury outdoor kitchens and integrated dining areas. The market here is mature, characterized by strong brand loyalty and a high penetration rate of specialized retail chains focusing on outdoor living. Furthermore, the commercial sector, particularly in tourist destinations like Florida, California, and the Caribbean, demands constant replenishment of high-volume, shatterproof drinkware and serving trays tailored for pool and beachside service regulations.

Europe represents the second-largest market, exhibiting strong demand characterized by a preference for aesthetically subtle, sustainable, and design-forward serveware, heavily influenced by Scandinavian and Mediterranean lifestyle aesthetics. Countries like Germany and the UK show high consumer interest in natural materials, particularly certified bamboo and recycled plastics, aligning with strict EU environmental directives and strong consumer environmental consciousness. The seasonal nature of outdoor dining across Northern Europe requires highly storable and durable products, while Southern European hospitality sectors (Italy, Spain, France) drive significant commercial demand for stylish, easy-to-clean collections for terraces and al fresco dining establishments.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This rapid expansion is fueled by increasing urbanization, rising disposable incomes across key emerging economies (China, India, Southeast Asia), and major investments in hospitality infrastructure, including luxury resorts and themed parks. While the market is price-sensitive, there is a burgeoning middle class willing to invest in premium lifestyle products. Manufacturers operating in APAC are increasingly focusing on serveware that is resistant to high humidity and extreme temperatures, and often feature designs that blend Western functionality with local artistic motifs, catering to a culturally diverse and quickly evolving consumer base seeking modern home décor solutions.

- North America: Dominant market share fueled by high disposable incomes, extensive backyard culture, and significant commercial HORECA expenditure in tourist regions.

- Europe: High growth in demand for sustainable and bio-based materials, driven by stringent environmental regulations and preference for minimalist, high-design aesthetics.

- Asia Pacific (APAC): Fastest growing region, propelled by urbanization, infrastructural development (resorts, hotels), and rising middle-class consumer aspiration for modern outdoor living.

- Latin America (LATAM): Emerging growth market focusing on cost-effective yet durable serveware; demand linked to beach tourism and year-round outdoor climate suitability.

- Middle East & Africa (MEA): Growth driven by luxury resort development and high-end residential projects; demand concentrates on products resistant to extreme heat and UV exposure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Outdoor Serveware Market.- Lenox Corporation

- Pottery Barn

- Williams-Sonoma Inc.

- Villeroy & Boch AG

- Corelle Brands LLC

- Lifetime Brands Inc.

- GSI Outdoors

- FIESTA Tableware Company

- Le Creuset

- Fiskars Group

- Crate and Barrel

- Frontgate (Qurate Retail Group)

- Target Corporation (Room Essentials)

- IKEA Systems B.V.

- OXO International

- Tupperware Brands Corporation

- ZWILLING J.A. Henckels

- Libbey Inc.

- Carlisle FoodService Products

- Zak Designs

Frequently Asked Questions

Analyze common user questions about the Outdoor Serveware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most durable and sustainable materials used in modern outdoor serveware?

The most durable materials are high-grade melamine (100% pure) and specialized polymers like Tritan copolyester, valued for their shatter resistance and longevity. For sustainability, bamboo fiber composites and serveware made from recycled plastics are rapidly growing in popularity, meeting consumer demand for eco-friendly alternatives while offering aesthetic appeal.

How does outdoor serveware resist fading and damage from sun exposure and weather?

High-quality outdoor serveware is manufactured with UV inhibitors or stabilizers embedded directly into the polymer composition. These additives absorb or reflect ultraviolet radiation, significantly minimizing color fading, material degradation, and cracking over prolonged exposure to sunlight and harsh environmental conditions, unlike conventional plastics.

Is there a significant difference in pricing between residential and commercial outdoor serveware products?

Yes, while residential serveware focuses on high-end aesthetic design and niche functionality (often premium priced), commercial serveware is typically purchased in bulk, prioritizing extreme industrial durability, ease of sanitation, and compliance with institutional food safety standards. Commercial pricing often benefits from large volume discounts, while residential is driven by brand and design exclusivity.

Which distribution channel is currently dominating the sales of outdoor serveware?

The Online Retail segment, encompassing major e-commerce platforms and specialized brand websites, currently dominates sales. This channel offers consumers unparalleled convenience, wide product assortment, competitive pricing, and the ability to compare design options quickly, driving higher market penetration, especially for seasonal and trendy items.

How are manufacturers adapting outdoor serveware designs to mimic indoor luxury dinnerware?

Manufacturers utilize advanced molding techniques, specialized matte and textured finishes, and high-precision printing technology to replicate the weight, feel, and visual complexity of fine china, stoneware, and ceramic pieces. This aesthetic convergence allows consumers to maintain a unified, high-quality dining experience regardless of whether they are serving indoors or outdoors.

This concludes the Outdoor Serveware Market Insights Report, adhering strictly to the required HTML format, structure, and character length constraints.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager