Ovarian Cancer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436378 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Ovarian Cancer Market Size

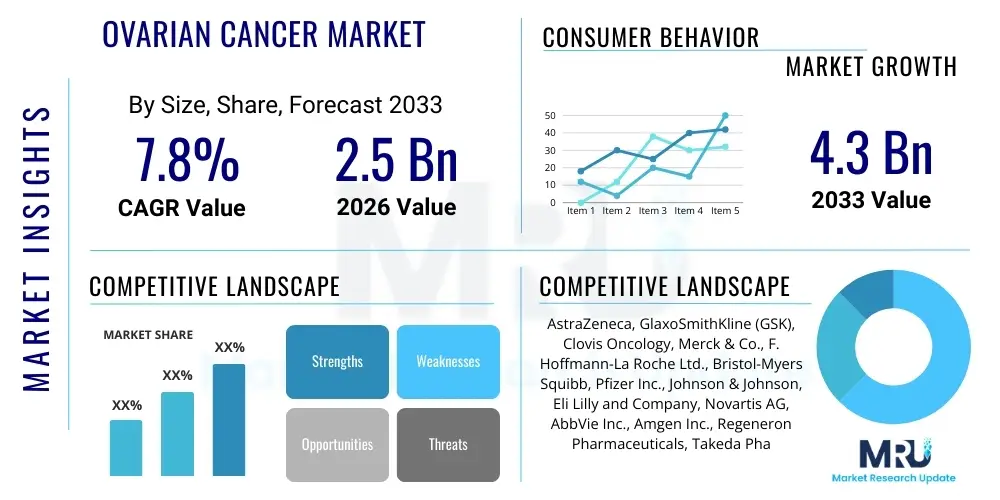

The Ovarian Cancer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.3 Billion by the end of the forecast period in 2033.

This robust growth trajectory is primarily fueled by the increasing prevalence of ovarian cancer globally, coupled with significant advancements in targeted therapeutics, specifically Poly(ADP-ribose) polymerase (PARP) inhibitors. These drugs have fundamentally shifted the treatment landscape for patients with BRCA mutations and homologous recombination deficiency (HRD). The expanding applications of immunotherapy, including checkpoint inhibitors in late-stage recurrent disease, further contribute to market expansion by offering novel treatment paradigms for previously refractory cases. Moreover, enhanced diagnostic screening capabilities and biomarker identification techniques, although still nascent for widespread early detection, are driving increased adoption of sophisticated diagnostic tools, thereby expanding the overall market size.

Market valuation is intrinsically linked to the high cost associated with cutting-edge biological therapies and the extensive research and development activities required to bring these complex molecules to market. The pipeline remains rich with novel agents focusing on overcoming chemotherapy resistance and improving progression-free survival rates. As global healthcare expenditure continues to prioritize oncology, and as regulatory frameworks accelerate approval pathways for breakthrough therapies in areas of high unmet need, the financial size of the ovarian cancer market is expected to surge, reflecting the incorporation of premium-priced specialty drugs and advanced companion diagnostics necessary for their effective deployment.

Ovarian Cancer Market introduction

The Ovarian Cancer Market encompasses pharmaceuticals, diagnostics, and treatment devices used in the management of malignant tumors originating in the ovaries, fallopian tubes, or peritoneum. The market is characterized by a high demand for innovative therapeutic solutions due to the often-late stage diagnosis of the disease, leading to poor prognosis. Key therapeutic products include chemotherapy (e.g., platinum-based agents), targeted therapies (e.g., PARP inhibitors like olaparib, niraparib, and rucaparib; and anti-angiogenic agents like bevacizumab), and emerging immunotherapies (e.g., PD-1/PD-L1 inhibitors). These products are primarily applied in frontline maintenance therapy, recurrent disease settings, and neoadjuvant treatment regimens. The significant benefits provided by modern treatments include prolonged progression-free survival, improved quality of life, and enhanced overall survival for specific patient populations, particularly those with genetic predispositions or advanced disease.

Major driving factors propelling this market include the global increase in the geriatric female population, which is the most susceptible demographic to ovarian cancer; substantial investment in oncology R&D leading to the discovery of novel targets and pathways; and increasing awareness regarding gynecological cancers, promoting earlier consultation and diagnosis, though true early screening remains challenging. Furthermore, the identification and clinical validation of biomarkers, notably BRCA1/2 mutations and HRD status, have necessitated the integration of companion diagnostics, thereby synergistically boosting both the diagnostic and therapeutic segments. The successful commercialization and uptake of maintenance therapies following initial debulking surgery and chemotherapy are critical economic drivers, transforming the management of the disease from acute intervention to long-term chronic management.

The market faces inherent challenges related to the heterogeneity of ovarian cancer subtypes (epithelial being the most common) and the rapid development of resistance to platinum-based chemotherapy, necessitating continuous development of second and third-line options. However, the paradigm shift toward personalized medicine, leveraging genomic profiling to guide treatment selection, presents a powerful opportunity. The core objective of market stakeholders is to develop highly efficacious, low-toxicity agents that can significantly improve the five-year survival rate, which remains critically low for advanced-stage disease. This intense focus on developing tailored treatment strategies is expected to maintain robust market momentum throughout the forecast period.

Ovarian Cancer Market Executive Summary

The Ovarian Cancer Market is experiencing accelerated growth driven predominantly by the successful integration of targeted molecular therapies and improved diagnostic stratification. Business trends indicate a strong shift towards the adoption of maintenance therapies, particularly PARP inhibitors, following first-line response. This shift has extended the duration of patient treatment and significantly increased revenue streams for pharmaceutical companies specializing in personalized oncology. Key pharmaceutical players are aggressively pursuing combination therapies, merging targeted agents with conventional chemotherapy or immunotherapy to overcome resistance mechanisms, fueling high-value licensing and partnership activities globally. Furthermore, the market is characterized by robust M&A activities focused on acquiring innovative diagnostic platforms and novel therapeutic pipeline candidates addressing high-grade serous ovarian carcinoma (HGSOC), the most prevalent and aggressive subtype.

Regionally, North America maintains its market dominance due to high per capita healthcare spending, favorable reimbursement policies for expensive oncology drugs, and a highly established clinical research infrastructure that facilitates rapid adoption of new FDA-approved treatments. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by improving healthcare access, increasing awareness programs, and a growing patient population base, particularly in emerging economies like China and India. European markets, while mature, are seeing sustained growth driven by consensus guidelines from organizations like the European Society for Medical Oncology (ESMO) promoting biomarker testing and maintenance therapy utilization, although pricing and reimbursement hurdles remain a constant negotiating point across different national healthcare systems.

Segment trends reveal that the Therapeutics segment, particularly targeted therapy, holds the largest market share and is expected to exhibit the highest growth, overshadowing traditional chemotherapy. Within the diagnostic segment, advanced techniques such as Next-Generation Sequencing (NGS) and Liquid Biopsy are gaining significant traction as they are essential for identifying actionable mutations (BRCA, HRD status) crucial for determining eligibility for targeted agents. The rising awareness regarding genetic screening for high-risk individuals is also contributing substantially to the growth of the diagnostic market component. Overall, the market landscape is characterized by innovation, high investment in precision medicine, and a concerted global effort to improve survival outcomes for a disease with historically poor prognosis.

AI Impact Analysis on Ovarian Cancer Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Ovarian Cancer Market typically revolve around its ability to revolutionize early detection, personalize complex treatment plans, and accelerate drug discovery timelines. Users frequently inquire about the reliability of AI algorithms in interpreting subtle radiological findings (e.g., distinguishing malignant from benign adnexal masses), the practical implementation of machine learning for predicting treatment resistance or relapse using genomic data, and the potential for AI to dramatically reduce the development cost and time for new PARP inhibitors or immunotherapies. The core themes center on AI's capability to mitigate the high false-negative rates associated with current screening methods and its role in translating vast amounts of multi-omics patient data into clinically actionable insights, offering genuine precision medicine where current diagnostic models fall short. Users expect AI to move beyond academic research into routine clinical practice, significantly impacting patient outcomes and operational efficiencies.

AI's immediate impact is most noticeable in refining diagnostic pathways and optimizing clinical trials. Machine learning models are being developed to analyze large datasets derived from electronic health records, genomic sequencing, and pathology images, enabling researchers to identify novel therapeutic targets and predictive biomarkers with greater speed and accuracy than conventional statistical methods. For instance, deep learning can be trained on pathology slides to automatically grade tumors or predict recurrence risk based on cellular morphology and spatial relationships, offering quantitative precision that surpasses subjective human analysis. This acceleration in target identification helps pharmaceutical companies streamline their R&D efforts, allowing them to focus resources on the most promising candidates, thereby potentially reducing the overall cost of bringing a new ovarian cancer drug to market.

Furthermore, AI-driven predictive analytics are crucial for personalized treatment selection. By analyzing a patient’s unique genetic profile, clinical history, and response patterns of similar historical cases, AI algorithms can recommend the optimal combination and sequence of therapies—be it targeted therapy, chemotherapy, or surgery—that maximize efficacy while minimizing toxicity. This level of treatment personalization is essential in ovarian cancer, given its high biological heterogeneity and tendency to develop treatment resistance. The long-term expectation is that AI tools will become integral decision-support systems for oncologists, standardizing complex treatment protocols and ensuring that patients receive the most evidence-based, individualized care possible, thereby improving population-level survival rates and optimizing healthcare resource utilization.

- AI accelerates the identification of novel drug targets and predictive biomarkers for HGSOC.

- Machine learning models improve the accuracy and speed of radiological image analysis (e.g., CT/MRI scans) for tumor detection and staging.

- Deep learning enhances histopathological diagnosis by automating tumor grading and prognosis prediction from digital slides.

- AI algorithms personalize treatment recommendations by integrating multi-omics data (genomic, transcriptomic, clinical) to predict response to PARP inhibitors and chemotherapy.

- Natural Language Processing (NLP) is utilized for extracting actionable insights from unstructured clinical notes and accelerating patient recruitment for specialized ovarian cancer clinical trials.

- Predictive analytics helps forecast disease recurrence and monitor treatment efficacy, enabling proactive clinical intervention.

DRO & Impact Forces Of Ovarian Cancer Market

The Ovarian Cancer Market is significantly influenced by a powerful interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the demonstrable clinical efficacy of targeted therapies, particularly PARP inhibitors, which have profoundly improved progression-free survival in patients with BRCA mutations, establishing a new standard of care in both maintenance and recurrent settings. The rising global incidence of ovarian cancer, coupled with increased public awareness and subsequent uptake of genetic screening for predisposition (BRCA testing), further accelerates market expansion. However, restraints such as the persistent difficulty in achieving early-stage diagnosis—as symptoms are often vague and non-specific—result in a majority of cases being detected only in advanced stages (III/IV), limiting the efficacy of curative treatments and increasing the cost burden. Furthermore, the high cost of premium biologics and targeted agents, coupled with challenges in achieving broad reimbursement coverage in developing economies, acts as a significant restraint.

Opportunities for growth are heavily concentrated in developing sophisticated diagnostic modalities, such as non-invasive liquid biopsy techniques capable of detecting minimal residual disease (MRD) or early markers like CA-125 variations in conjunction with HE4, offering the potential for true early screening. The development of novel immunotherapeutic approaches, especially T-cell engaging therapies and vaccines targeting tumor-associated antigens, presents a vast untapped market potential. The increasing academic and industry focus on less common ovarian cancer subtypes, such as clear cell and mucinous carcinomas, which are often resistant to standard treatments, also represents a critical area for innovation and commercial opportunity. The integration of advanced computational pathology and AI for drug repositioning and therapeutic efficacy prediction promises to accelerate clinical trials and refine patient selection, thereby maximizing therapeutic impact.

The impact forces shaping the competitive landscape are multifaceted. Regulatory environments, particularly the accelerated approval pathways granted by the FDA for breakthrough oncology therapies, serve as a strong positive force, speeding up market entry for innovative products. Conversely, payer scrutiny and pressure for demonstrable cost-effectiveness pose a restraining force on pricing strategies, particularly in established markets like Europe. Technological impact forces, driven by advancements in genomic sequencing (NGS) and proteomics, continuously redefine the standard of care, making older diagnostic and therapeutic methods obsolete and compelling companies to invest heavily in next-generation platforms. The societal impact of advocacy groups and patient organizations also exerts pressure on governments and pharmaceutical companies to prioritize research funding and improve patient access to cutting-edge treatments, influencing policy and market dynamics favorably towards innovation.

Segmentation Analysis

The Ovarian Cancer Market is systematically segmented based on Type, Treatment Type, and Distribution Channel, reflecting the diverse approaches required for disease management, from initial diagnosis to complex therapeutic interventions. The segmentation by Type focuses primarily on the histological classification of tumors, with epithelial ovarian cancer dominating the market due to its high incidence rate and significant investment in research targeting its molecular complexity. Treatment segmentation is critical, dividing the market into traditional chemotherapy, high-growth targeted therapy, and emerging immunotherapy, which allows for distinct market sizing based on product innovation and clinical adoption rates. Understanding these segments is vital for stakeholders to allocate R&D capital effectively and tailor commercial strategies to specific therapeutic niches, ensuring maximum market penetration for specialized drugs like PARP inhibitors or general chemotherapeutic agents.

The differentiation between segments is increasingly driven by advances in companion diagnostics. For instance, the growth of the Targeted Therapy segment is inextricably linked to the penetration of the Diagnostics segment, as personalized medicine requires precise identification of patients with actionable mutations (BRCA, HRD). This interdependency makes the Diagnostic/Companion Diagnostic segment a crucial lever for growth across all therapeutic areas. Furthermore, the segmentation by Distribution Channel—Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies—reflects the logistical complexity of administering oncology drugs, many of which require specialized handling and infusion centers, thereby solidifying the Hospital Pharmacy segment's leadership position due to the acute care nature of the disease management.

Future market evolution will likely see finer segmentation based on line of treatment (first-line maintenance vs. recurrent setting) and specific molecular targets (e.g., folate receptor alpha, DNA repair pathways). This detailed granularity is necessary because ovarian cancer treatment protocols are highly stage- and mutation-dependent. Strategic planning must account for the rapid obsolescence risk in the Chemotherapy segment due to the rise of less toxic, highly effective targeted agents, and the subsequent high growth potential within the Immunotherapy segment as research unlocks successful combination strategies, especially for platinum-resistant disease. These segment dynamics underscore the shift towards high-value precision oncology interventions.

- By Type:

- Epithelial Ovarian Cancer (High-Grade Serous Carcinoma, Endometrioid, Clear Cell, Mucinous)

- Germ Cell Ovarian Cancer

- Stromal Cell Ovarian Cancer

- By Treatment Type:

- Targeted Therapy (PARP Inhibitors, Anti-Angiogenic Agents)

- Chemotherapy (Platinum-based, Taxanes)

- Immunotherapy (Checkpoint Inhibitors, Vaccines)

- Hormone Therapy

- Radiation Therapy

- Surgery

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- By End-User:

- Hospitals and Clinics

- Cancer Research Centers

- Academic and Research Institutes

Value Chain Analysis For Ovarian Cancer Market

The Value Chain for the Ovarian Cancer Market is highly complex, starting with intensive upstream activities focused on basic science research and drug discovery. The initial stage involves academic institutions and biotechnology firms identifying novel biomarkers, genetic targets (such as those related to DNA repair pathways), and developing monoclonal antibodies or small-molecule inhibitors. This upstream R&D is capital-intensive and high-risk, requiring significant investment in genomics, proteomics, and preclinical testing to validate therapeutic concepts. Successful candidates then enter clinical development, where large pharmaceutical companies often acquire or partner with biotech firms to manage the multi-phase clinical trial process, which represents a crucial value-add step due to regulatory expertise and financial scale required for Phase III trials. The patent protection secured during this upstream phase is the primary source of economic value for innovators.

Midstream activities involve the complex, highly regulated manufacturing of pharmaceuticals, which includes the synthesis of active pharmaceutical ingredients (APIs) and the formulation of finished products, particularly sterile injectables or oral agents for targeted therapies. Quality control and compliance with Good Manufacturing Practices (GMP) are paramount. Downstream activities encompass logistics, distribution, and patient access. The distribution channel for oncology drugs is highly specialized, often involving cold-chain management and secure handling. Direct distribution often occurs for specialized hospital-administered therapies, where pharmaceutical companies manage relationships directly with oncology centers and hospital pharmacies to ensure controlled access and patient support programs. Indirect channels involve specialty distributors who handle the complex financial and logistical aspects of high-cost oncology drugs before they reach the hospital setting.

The final crucial step in the value chain is patient utilization, supported by specialized hospital pharmacies and oncology clinics where treatment is administered and monitored. Payer reimbursement decisions heavily influence the realized value at this stage, creating friction if complex coverage criteria are not met. Therefore, market access teams are critical in the downstream segment, negotiating pricing and demonstrating the pharmacoeconomic value of new treatments. For companion diagnostics, the value chain integrates closely with pharmaceutical distribution, ensuring that diagnostic kits (e.g., NGS panels) are available concurrently with the launch of the corresponding targeted therapeutic agent. The efficiency of this coordination significantly impacts patient onboarding and commercial success, making channel optimization a continuous strategic priority.

Ovarian Cancer Market Potential Customers

The primary potential customers and end-users of ovarian cancer products are sophisticated healthcare institutions and research entities deeply involved in oncology care and therapeutic development. Hospitals and Comprehensive Cancer Centers form the largest purchasing bloc, particularly for high-value targeted therapeutics and complex surgical equipment used in debulking procedures. These institutions necessitate continuous supply of chemotherapeutic agents, PARP inhibitors, supportive care medications, and specialized diagnostic instruments like immunohistochemistry kits and NGS sequencers. Their purchasing decisions are driven by clinical guidelines, favorable patient outcomes data, formulary acceptance, and competitive pricing negotiated through Group Purchasing Organizations (GPOs). Given the acute and chronic nature of ovarian cancer treatment, continuity of care and robust patient support services are crucial components influencing their supplier selection.

Specialty Oncology Clinics and Ambulatory Surgical Centers represent another significant customer segment, particularly focusing on outpatient administration of chemotherapy and targeted maintenance therapies. While they may not utilize the full range of surgical devices found in large hospitals, their high volume of recurring infusion treatments makes them crucial consumers of specialty pharmaceuticals. Furthermore, Clinical Research Organizations (CROs) and Academic Research Institutes are key customers for novel diagnostic tools, research-grade reagents, and early-phase clinical trial materials. These entities drive demand for cutting-edge genomic profiling services and high-throughput screening technologies, fueling the growth of the diagnostic market segment and contributing to the preclinical development pipeline.

Beyond direct medical providers, Private and Government Payers (insurance companies and national health services) are indirect, yet highly influential, customers. While they do not physically use the product, their reimbursement policies dictate patient access and market adoption rates. Their focus is on the cost-effectiveness and demonstrated clinical benefit of treatments, particularly in preventing recurrence and extending survival. Therefore, demonstrating positive health economic outcomes is essential for manufacturers to secure favorable coverage decisions. Finally, patients who require long-term oral maintenance therapies are direct consumers of prescriptions fulfilled through retail and specialty pharmacies, forming the end point of the distribution channel for oral targeted agents.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.3 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AstraZeneca, GlaxoSmithKline (GSK), Clovis Oncology, Merck & Co., F. Hoffmann-La Roche Ltd., Bristol-Myers Squibb, Pfizer Inc., Johnson & Johnson, Eli Lilly and Company, Novartis AG, AbbVie Inc., Amgen Inc., Regeneron Pharmaceuticals, Takeda Pharmaceutical Company Limited, Daiichi Sankyo Company, Limited, BeiGene, Ltd., Seattle Genetics, Inc., Immunogen, Inc., Zai Lab Limited, Puma Biotechnology, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ovarian Cancer Market Key Technology Landscape

The Ovarian Cancer Market is being continuously reshaped by several foundational and emerging technologies critical for both diagnosis and therapeutic delivery. Next-Generation Sequencing (NGS) is a core technology, essential for comprehensive genomic profiling necessary to identify critical mutations like BRCA1/2, assess Homologous Recombination Deficiency (HRD) status, and detect other actionable genomic alterations. The reliable use of NGS drives the personalized medicine segment, as eligibility for targeted therapies, particularly PARP inhibitors, is often contingent upon accurate genetic screening. NGS provides the high-throughput, cost-effective platform required to analyze the heterogeneous tumor landscape, enabling oncologists to select the most appropriate molecularly guided treatment plan. The increasing accessibility and decreasing cost of NGS technology are pivotal forces in expanding its clinical utility from academic research into routine community oncology practice.

Another transformative technology is the development and increasing clinical adoption of Liquid Biopsy. Unlike traditional invasive surgical biopsies, liquid biopsy utilizes blood samples to detect circulating tumor DNA (ctDNA) or circulating tumor cells (CTCs). This technology is highly valuable in ovarian cancer for monitoring treatment response, detecting minimal residual disease (MRD) after surgery or chemotherapy, and identifying emerging mechanisms of resistance (e.g., acquired resistance mutations) in real-time without the need for repeated tissue sampling. The non-invasive nature and ability to provide a comprehensive genetic snapshot make it an indispensable tool for longitudinal monitoring. Furthermore, advancements in robotic-assisted surgical systems are enhancing the precision of cytoreductive surgery (debulking), improving the surgeon’s capability to achieve optimal resection, which is strongly correlated with better patient outcomes in advanced-stage disease.

In the therapeutic domain, targeted drug delivery systems and advanced cell and gene therapies represent key technological innovations. Antibody-Drug Conjugates (ADCs), which link a potent cytotoxic agent to a monoclonal antibody targeting tumor-specific antigens (like folate receptor alpha, frequently overexpressed in ovarian cancer), are gaining significant traction. This technology allows for precise delivery of chemotherapy, minimizing systemic toxicity. Moreover, specialized immunotherapeutic platforms, including the exploration of CAR T-cell therapy targeting ovarian cancer-specific antigens and personalized neoantigen vaccines, are poised to offer groundbreaking treatment options for patients who fail standard care. These technological breakthroughs require highly sophisticated manufacturing and handling capabilities, driving further investment in specialized biotech infrastructure and expertise across the market value chain.

Regional Highlights

Regional dynamics play a significant role in defining the Ovarian Cancer Market, primarily driven by disparities in healthcare infrastructure, patient awareness, regulatory frameworks, and affordability of premium oncology treatments.

- North America (U.S. and Canada): This region dominates the global market, accounting for the largest revenue share. Dominance is attributed to sophisticated healthcare systems, high prevalence of ovarian cancer, robust research and development funding leading to early adoption of novel targeted therapies (e.g., PARP inhibitors) and diagnostic technologies (NGS, HRD testing), and favorable reimbursement policies supporting high-cost specialty drugs and advanced genetic screening services. The presence of major pharmaceutical headquarters and a highly established clinical trial ecosystem further cements its leading position.

- Europe (Germany, U.K., France, Italy, Spain): Europe represents the second-largest market, characterized by stringent yet streamlined regulatory pathways (EMA) and strong government support for cancer research. However, market penetration rates for new drugs often vary significantly across the five major countries due to decentralized national health technology assessment (HTA) bodies determining pricing and reimbursement. The U.K. and Germany are notable for high utilization of advanced targeted therapies, while Eastern Europe faces access barriers related to cost and infrastructure.

- Asia Pacific (APAC) (China, Japan, India, South Korea): APAC is projected to be the fastest-growing regional market. This high growth rate is fueled by the vast and increasing patient population, rapid expansion of healthcare infrastructure, and rising awareness, especially concerning genetic risks and screening. Japan leads in adopting high-tech treatment modalities and diagnostics due to favorable government policies. China and India, while currently lagging in targeted therapy adoption, are rapidly increasing their investment in oncology and local drug manufacturing, creating immense future growth potential driven by medical tourism and improving economic conditions.

- Latin America (LATAM) (Brazil, Mexico): The LATAM market exhibits moderate growth. Challenges include economic volatility and fragmented public healthcare systems leading to heterogeneous patient access. However, Brazil and Mexico are emerging as key markets, demonstrating increasing willingness to invest in specialized oncology care and utilizing global clinical trial networks, driving the demand for advanced therapies in private sectors.

- Middle East and Africa (MEA): This region holds the smallest share but shows potential, particularly in the Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia, UAE) due to high government investment in specialized cancer centers and high expenditure on cutting-edge medical technologies. Infrastructure limitations and lower awareness levels constrain growth in many African nations, though philanthropic efforts and global partnerships are helping to bridge access gaps for essential chemotherapeutic agents.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ovarian Cancer Market.- AstraZeneca PLC

- GlaxoSmithKline (GSK)

- Merck & Co., Inc.

- F. Hoffmann-La Roche Ltd.

- Pfizer Inc.

- Johnson & Johnson

- Eli Lilly and Company

- Novartis AG

- AbbVie Inc.

- Amgen Inc.

- Bristol-Myers Squibb Company

- Clovis Oncology, Inc.

- Regeneron Pharmaceuticals, Inc.

- Takeda Pharmaceutical Company Limited

- Daiichi Sankyo Company, Limited

- BeiGene, Ltd.

- Seattle Genetics, Inc.

- Immunogen, Inc.

- Zai Lab Limited

- Puma Biotechnology, Inc.

Frequently Asked Questions

Analyze common user questions about the Ovarian Cancer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth of the Ovarian Cancer Market?

Market growth is primarily driven by the expanding adoption and clinical success of targeted therapies, notably Poly(ADP-ribose) polymerase (PARP) inhibitors, which significantly extend progression-free survival in patients with BRCA mutations. Increased incidence rates in the aging population and advancements in personalized diagnostics, such as Next-Generation Sequencing (NGS), further contribute to market expansion.

Which treatment segment holds the largest share in the Ovarian Cancer Market?

The Therapeutics segment, specifically Targeted Therapy, holds the largest and fastest-growing share due to the high cost and clinical efficacy of novel agents like PARP inhibitors (e.g., olaparib, niraparib) used in maintenance therapy settings. This segment is displacing traditional high-volume, lower-cost chemotherapy as the preferred standard of care for eligible patients.

How is Artificial Intelligence (AI) impacting the diagnosis of ovarian cancer?

AI is improving ovarian cancer diagnosis by enhancing the interpretation of medical imaging (CT/MRI) and pathology slides, allowing for faster and more accurate staging and tumor grading. Furthermore, AI models are essential in analyzing complex genomic data to identify predictive biomarkers, significantly aiding in patient selection for precision medicine trials.

What are the main regional challenges in the global Ovarian Cancer Market?

The main challenges vary regionally: North America faces high drug pricing scrutiny; Europe contends with fragmented national reimbursement processes (HTA); and emerging regions like APAC and LATAM struggle with infrastructure limitations, affordability, and achieving high levels of early diagnosis due to lack of widespread effective screening programs.

What opportunities exist in the diagnostic segment of the market?

Significant opportunities lie in the development and commercialization of highly sensitive, non-invasive early detection tools, particularly advanced Liquid Biopsy technologies capable of reliably detecting circulating tumor DNA (ctDNA) or specific protein markers (CA-125, HE4) in high-risk populations, offering a potential breakthrough in population-level screening.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ovarian Cancer Treatment Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Epithelial Ovarian Cancer Drugs Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Carboplatin (or cisplatin), Taxane, Others), By Application (Hospital Pharmacies, Drug Stores, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- CA 125 Test Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Spectrometer, Analyzer, Sample collection tubes, isotopic labeled peptides, Others), By Application (Ovarian Cancer Recurrence Monitoring, Assess Pelvic Masses, Endometrial Cancer, Fallopian Tube Cancer, Stomach Cancer, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager