Overhead conveyor system Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432180 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Overhead conveyor system Market Size

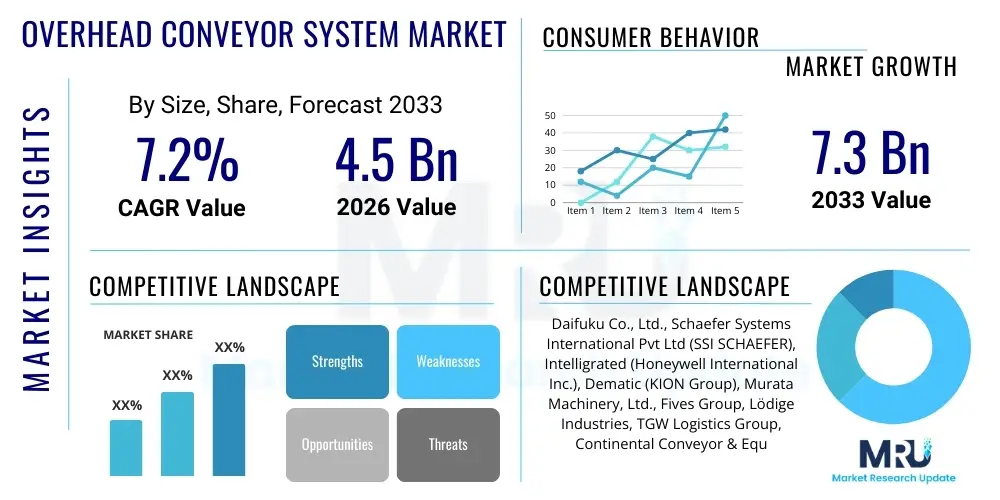

The Overhead conveyor system Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.3 Billion by the end of the forecast period in 2033.

Overhead conveyor system Market introduction

Overhead conveyor systems are critical material handling solutions designed to transport products through various stages of manufacturing, assembly, painting, or warehousing operations, utilizing overhead space to maximize floor utilization. These systems consist primarily of tracks, trolleys, drives, and carriers, providing a continuous flow for goods ranging from lightweight components to heavy automotive chassis. Their inherent ability to navigate complex pathways, including elevation changes and sharp turns, makes them indispensable in industries requiring high throughput and complex routing strategies.

The primary applications of overhead conveyors span highly automated sectors such as automotive manufacturing, where they facilitate painting and assembly lines, as well as logistics and distribution centers demanding efficient sorting and temporary storage capabilities. Key benefits include significant space savings, improved operational safety by keeping materials off the floor, and enhanced productivity through consistent, predictable material flow. The robustness and modularity of modern systems allow for seamless integration into existing infrastructure and adaptability to varying payload requirements, positioning them as a cornerstone of modern industrial automation.

Major driving factors fueling market expansion include the explosive growth of the e-commerce sector requiring sophisticated automated warehousing solutions, the persistent global emphasis on industrial automation (Industry 4.0 initiatives), and the rising cost of labor, which necessitates investment in automated handling systems to maintain competitive pricing and efficiency. Furthermore, technological advancements, particularly the integration of IoT sensors and predictive maintenance features, are extending the life cycle and reliability of these systems, encouraging greater adoption across diversified manufacturing verticals.

Overhead conveyor system Market Executive Summary

The global Overhead conveyor system market is characterized by robust business trends driven by digitalization and increasing manufacturing complexity. A significant trend involves the transition from traditional manual systems to highly automated, Power & Free (P&F) and enclosed track systems, which offer superior flexibility and control over material movement speeds and accumulation. Key market participants are focusing on modular system designs and offering integrated software solutions for real-time monitoring and throughput optimization, catering to the growing demand for customized, scalable automation solutions, particularly in high-volume production environments such as automotive body shops and large-scale apparel manufacturing.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investments in manufacturing infrastructure, rapid industrialization in countries like China and India, and the establishment of vast e-commerce fulfillment networks across Southeast Asia. While North America and Europe remain mature markets, growth here is propelled by the need for system modernization, compliance with stringent safety regulations, and the integration of sophisticated IoT-enabled components to achieve higher operational efficiency in existing facilities. The competitive landscape is moderately consolidated, with leading global players leveraging their extensive service networks and technological expertise to capture large-scale, complex automation projects globally.

In terms of segmentation, the Power & Free segment dominates the market due to its advanced capability to decouple trolleys, allowing carriers to stop, accumulate, or change speed independently, which is vital for complex assembly processes. Among applications, the automotive sector retains the largest market share, given its reliance on continuous, high-precision movement for paint shops and final assembly. However, the fastest growth is anticipated in the logistics and distribution segment, directly linked to the burgeoning global retail and e-commerce supply chain demanding quick installation and reconfiguration capabilities for sorting and storage applications.

AI Impact Analysis on Overhead conveyor system Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Overhead Conveyor System market reveals significant interest centered on operational intelligence, maintenance predictability, and system flexibility. Users frequently inquire about how AI can move beyond simple automation to achieve true optimization, specifically asking about reducing unscheduled downtime, dynamically adjusting conveyor speeds based on real-time production bottlenecks, and enhancing energy efficiency. Key themes include the integration of Machine Learning (ML) algorithms for pattern recognition in equipment wear, the development of self-optimizing routing systems for complex logistical flows, and the overall transformation of static conveyor systems into responsive, intelligent networks capable of autonomous decision-making.

The application of AI is rapidly shifting overhead conveyor systems from fixed, deterministic equipment into adaptive, cognitive assets. AI-powered predictive maintenance utilizes sensor data (vibration, temperature, current draw) from drives and trolleys to forecast component failure with high accuracy, drastically reducing the incidence of catastrophic breakdowns and optimizing maintenance scheduling. This proactive approach ensures maximum uptime and significantly lowers total cost of ownership (TCO). Furthermore, AI algorithms are instrumental in simulating and optimizing system layouts before physical implementation, evaluating millions of operational scenarios to identify the most efficient conveyor paths and accumulation zones, thereby maximizing throughput per hour.

Beyond maintenance and design, AI enhances operational fluidity by integrating with Warehouse Management Systems (WMS) and Manufacturing Execution Systems (MES). This integration allows the conveyor system to dynamically adjust its speed, sequencing, and routing based on immediate material availability and downstream station requirements, avoiding system choke points and ensuring just-in-time delivery within the facility. This level of responsiveness is particularly crucial in highly customized, low-volume production environments where variability is high, representing a major leap forward from traditional fixed-logic controls.

- AI enables predictive maintenance by analyzing sensor data for anomaly detection in motors and bearings, minimizing unplanned downtime.

- Machine Learning algorithms optimize carrier routing and sequencing in real-time based on production load and priority, enhancing flow efficiency.

- Integration with computer vision allows AI to monitor product placement and carrier load balancing, preventing system damage and material loss.

- AI facilitates dynamic speed control (variable frequency drives) to conserve energy during low-demand periods without compromising critical delivery schedules.

- Optimization software uses AI to simulate system performance under various stress conditions, validating complex P&F and monorail designs pre-installation.

DRO & Impact Forces Of Overhead conveyor system Market

The dynamics of the Overhead Conveyor System market are shaped by a potent combination of accelerating industrial automation needs, significant capital investment challenges, and emerging technological opportunities centered on smart manufacturing. Key drivers, such as the relentless expansion of global supply chains and the increasing pressure to reduce operational expenditure by minimizing labor dependency, provide a fundamental impetus for market growth. Conversely, the market faces constraints related to the substantial initial capital investment required for complex, tailored systems and the need for highly skilled technical personnel for installation and long-term maintenance, especially for highly customized Power & Free setups.

Opportunities for significant market penetration lie in the continuous technological evolution towards full integration with the Industrial Internet of Things (IIoT), offering manufacturers the ability to monitor, control, and optimize their entire material flow network remotely. The ongoing modernization of aging infrastructure in developed economies, coupled with burgeoning industrial activity in developing regions, provides a dual pathway for growth. Impact forces, driven by global macroeconomic shifts such as inflation affecting raw material costs (steel, aluminum) and geopolitical stability influencing manufacturing location decisions, further modulate the investment cycles within key end-user sectors like automotive and heavy machinery.

Overall market trajectory is dictated by the fine balance between the ROI realized through automation—namely, efficiency gains and labor savings—versus the inherent costs and complexities of adoption. As manufacturers increasingly prioritize flexible production lines that can quickly adapt to fluctuating consumer demand (e.g., mass customization), systems that offer high adaptability, such as the Power & Free configuration, will experience disproportionate growth, emphasizing the driving force of complexity management in modern industrial environments.

Segmentation Analysis

The Overhead Conveyor System market is broadly segmented based on Type, Component, Control, Application, and Industry Vertical, reflecting the diverse operational requirements across the industrial landscape. The segmentation by Type, distinguishing Monorail, Power & Free, and Enclosed Track systems, is crucial as it determines the fundamental capabilities regarding complexity, accumulation, and throughput capacity, with Power & Free systems typically addressing the most sophisticated material handling needs in assembly lines. Analyzing segments by Component, which includes tracks, trolleys, drives, and controls, helps in understanding the technology adoption rates and maintenance priorities within the installed base.

Segmentation by Application highlights the varied uses of these systems, ranging from painting and finishing processes, which require exceptionally smooth movement and environmental isolation, to basic transport and sorting tasks prevalent in logistics centers. Furthermore, the segmentation by Industry Vertical—such as Automotive, Aerospace, Food & Beverage, and Logistics—is vital for market sizing and strategy formulation, as each sector presents unique payload, speed, and environmental requirements (e.g., cleanroom compatibility in electronics or high-temperature resistance in automotive paint shops).

The ongoing trend shows that while Monorail systems maintain a steady presence for simple, fixed-path transportation, the demand for flexible and modular systems is skewing growth toward Power & Free and Enclosed Track segments, particularly those integrated with advanced computerized controls. This shift underscores the industry's focus on maximizing operational agility and precision in increasingly automated facilities globally.

- By Type:

- Monorail Conveyors

- Power & Free (P&F) Conveyors

- Enclosed Track Conveyors

- I-Beam Trolley Conveyors

- By Component:

- Tracks and Supports

- Trolleys, Carriers, and Hangers

- Drives and Tensioning Units (VFDs)

- Controls and Monitoring Systems (PLC/HMI)

- By Control:

- Manual Control

- Semi-Automatic Control

- Fully Automatic/Computerized Control

- By Application:

- Assembly Line Operations

- Painting and Finishing

- Storage and Sorting (Accumulation)

- Wet Process/Dipping Applications

- Waste Handling

- By Industry Vertical:

- Automotive

- Aerospace and Defense

- Electronics and Semiconductor

- Food & Beverage

- Logistics and Distribution

- Apparel and Textile

- Heavy Machinery

Value Chain Analysis For Overhead conveyor system Market

The value chain for the Overhead Conveyor System market begins with the procurement of raw materials, primarily specialized steel (for tracks and I-beams), aluminum, and high-grade plastics and elastomers for trolleys, bearings, and specialized components. Upstream analysis highlights that raw material pricing volatility, especially for steel commodities, directly impacts the manufacturing cost structure of conveyor system providers. Suppliers in this phase are critical for providing certified, high-tensile materials necessary for systems designed to carry heavy and critical loads, often under continuous operational stress. Quality control and consistency in material specification are paramount, influencing the system’s longevity and safety ratings.

The core manufacturing and assembly phase involves specialized engineering design (CAD/CAM), fabrication of tracks, machining of precision components like trolleys and drives, and the integration of electrical and control systems (PLCs, sensors). System integrators and original equipment manufacturers (OEMs) dominate this middle segment, translating client-specific operational requirements into customized conveyor solutions. This stage requires significant intellectual capital, particularly in developing proprietary control software and modular components that allow for rapid installation and reconfiguration. Differentiation often stems from system reliability, maintenance ease, and advanced control features, such as smart tracking and diagnostics.

Distribution channels are multifaceted, utilizing both direct sales models for large, complex, and customized projects (such as major automotive assembly lines) and indirect models through regional distributors and specialized material handling partners for smaller or standardized systems. Downstream activities involve system installation, rigorous testing, commissioning, and, crucially, long-term maintenance and servicing. End-users rely heavily on service contracts for preventative maintenance and emergency support, making aftermarket services a significant revenue stream for system providers. The continuous demand for spare parts, upgrades, and system modernizations ensures sustained engagement throughout the product lifecycle.

Overhead conveyor system Market Potential Customers

Potential customers for overhead conveyor systems are typically large-scale manufacturing enterprises and industrial logistics operators whose efficiency is directly tied to the automated movement of materials and products through sequential processes. The primary end-users or buyers are often plant managers, engineering procurement teams, or facility planners responsible for designing and optimizing production or distribution layouts. These buyers prioritize systems that offer the highest throughput, maximum spatial utilization (especially floor space), and the greatest flexibility to handle fluctuating production schedules and product variations.

The automotive industry represents the cornerstone customer base, utilizing these systems extensively in body shops, paint lines (where cleanliness and precision are mandatory), and final assembly processes. In these environments, the conveyor system is not merely transportation but an integral part of the production machine itself. Similarly, large distribution centers serving the e-commerce sector are increasing their adoption rates, seeking automated sorting and temporary accumulation capabilities to handle massive volumes of parcels and inventory efficiently within multi-story facilities, valuing speed and integration capability with automated storage and retrieval systems (AS/RS).

Other significant customer groups include producers of electronics and heavy machinery, which require precise handling of delicate or extremely heavy components, respectively, and the apparel industry, which utilizes garment-on-hanger (GOH) systems for efficient storage and transport between cutting, sewing, and distribution centers. Investment decisions for these systems are primarily driven by Return on Investment (ROI) calculations based on projected labor savings, reduced cycle times, and maximized plant footprint utilization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.3 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daifuku Co., Ltd., Schaefer Systems International Pvt Ltd (SSI SCHAEFER), Intelligrated (Honeywell International Inc.), Dematic (KION Group), Murata Machinery, Ltd., Fives Group, Lödige Industries, TGW Logistics Group, Continental Conveyor & Equipment, BEUMER Group, MHS Global, Interroll Holding AG, Viastore Systems GmbH, Dearborn Mid-West Company, Allied Conveyor Systems, Columbus McKinnon Corporation, KUKA AG, Glide-Line, Ultimation Industries LLC, Conveyor Handling Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Overhead conveyor system Market Key Technology Landscape

The technological landscape of the Overhead Conveyor System market is evolving rapidly, moving beyond basic mechanical movement toward integrated, smart automation solutions. A core technological advancement is the widespread adoption of Variable Frequency Drives (VFDs) combined with sophisticated Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs). This integration allows for precise speed adjustments, enabling soft stops and starts, which is crucial for handling fragile goods or achieving tight tolerances in processes like robotic welding or painting. Furthermore, networked sensors (IoT devices) are now standard, gathering real-time data on load, speed, temperature, and vibration, forming the foundation for modern operational intelligence and predictive maintenance regimes.

Another significant development is the enhanced modularity and standardization of track and trolley components. Manufacturers are increasingly utilizing lightweight yet high-strength materials, such as aluminum alloys and specialized composites, to reduce inertia and energy consumption while simultaneously simplifying installation and maintenance procedures. The rise of friction-driven and electric monorail systems (EMS) provides alternatives to traditional chain-based systems, offering quieter operation, higher speeds, and superior positional accuracy, particularly in electronics and cleanroom applications where contamination must be minimized and high precision indexing is essential.

Software and control systems represent the leading edge of innovation. Modern overhead conveyors are often controlled by optimization algorithms that dynamically adjust routing to balance load across multiple production stations, minimizing bottlenecks and maximizing overall throughput. The implementation of digital twin technology is also gaining traction, allowing system operators to simulate changes, test new production schedules, and troubleshoot complex routing logic in a virtual environment before deploying changes to the physical system. This high level of connectivity and algorithmic control defines the next generation of overhead material handling systems.

Regional Highlights

The global Overhead Conveyor System market exhibits distinct regional growth patterns heavily influenced by industrial development levels and investment in automation infrastructure.

- Asia Pacific (APAC): This region dominates the market and is projected to experience the fastest growth due to rapid urbanization, massive government investments in manufacturing (especially automotive and electronics), and the exponential rise of the e-commerce sector, driving demand for new, large-scale distribution centers and factory automation in China, India, and Southeast Asian nations.

- North America: Characterized by a mature industrial base, growth in North America is driven primarily by the modernization and retrofitting of aging facilities, the adoption of advanced, AI-enabled systems for complex logistics, and regulatory pressures emphasizing worker safety, which favors overhead systems over floor-based equipment.

- Europe: The European market demonstrates steady, quality-driven growth, emphasizing sophisticated, energy-efficient, and highly customized systems that comply with stringent EU safety and environmental standards. Germany and Italy are major hubs, particularly for high-precision automotive and specialized machinery manufacturing utilizing advanced Power & Free systems.

- Latin America (LATAM): Growth in LATAM is more nascent but accelerating, particularly in Mexico (due to its proximity to the US automotive supply chain) and Brazil. Investment is often tied to foreign direct investment in manufacturing facilities, focusing on cost-effective, durable conveyor solutions.

- Middle East and Africa (MEA): This region is characterized by substantial infrastructure projects, particularly in Saudi Arabia and the UAE, driving demand for material handling in oil & gas processing, construction logistics, and the development of new, high-tech industrial parks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Overhead conveyor system Market.- Daifuku Co., Ltd.

- Schaefer Systems International Pvt Ltd (SSI SCHAEFER)

- Intelligrated (Honeywell International Inc.)

- Dematic (KION Group)

- Murata Machinery, Ltd.

- Fives Group

- Lödige Industries

- TGW Logistics Group

- Continental Conveyor & Equipment

- BEUMER Group

- MHS Global

- Interroll Holding AG

- Viastore Systems GmbH

- Dearborn Mid-West Company

- Allied Conveyor Systems

- Columbus McKinnon Corporation

- KUKA AG

- Glide-Line

- Ultimation Industries LLC

- Conveyor Handling Company

- Alvey Manufacuring Co.

- Webster Industries, Inc.

- Transnorm System Inc.

- Rexnord Corporation

- Dorner Manufacturing Corp.

- Sankyu Inc.

- ASKO A.S.

- Allied Automation Inc.

Frequently Asked Questions

Analyze common user questions about the Overhead conveyor system market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Overhead Conveyor System market?

The primary factor driving market growth is the exponential expansion of the global e-commerce and logistics sector, necessitating high-speed, space-saving automated material handling solutions to manage increased parcel volume and complexity.

How do Power & Free (P&F) systems differ fundamentally from standard monorail conveyors?

P&F systems offer distinct operational flexibility by using two tracks—one for power (propulsion) and one for free movement—allowing individual carriers to stop, accumulate, change speeds, or reroute independently of the main chain flow, which is not possible with fixed-speed monorails.

Which industry vertical holds the largest market share for overhead conveyor adoption?

The Automotive industry holds the largest market share globally. Overhead conveyors are essential for critical processes like assembly lines, paint shops, and body fabrication due to their precision and ability to handle large, heavy components continuously.

What role does AI play in modern overhead conveyor maintenance?

AI is crucial for predictive maintenance (PdM). By analyzing IoT sensor data on vibration and temperature, AI algorithms can accurately forecast potential component failures (e.g., bearings, drives) before they occur, significantly reducing unplanned downtime and optimizing maintenance schedules.

What is the typical lifespan of a well-maintained overhead conveyor system?

A modern, well-maintained overhead conveyor system can have an operational lifespan ranging from 20 to 30 years, although key components like chains, trolleys, and drives may require scheduled replacement or refurbishment within 5 to 10-year intervals, depending on operational intensity.

Are enclosed track conveyors suitable for cleanroom environments?

Yes, enclosed track conveyors are highly suitable for cleanroom and sensitive manufacturing environments (like electronics) because their design contains moving parts and lubricated chains within the track housing, significantly minimizing the potential for dust and particulate contamination compared to open I-beam systems.

How do overhead conveyor systems contribute to maximizing facility space utilization?

Overhead conveyor systems maximize facility space by utilizing the vertical dimension (ceiling space) for transport, accumulation, and temporary storage, thereby freeing up valuable floor space for production machinery, inventory processing, or pedestrian safety zones.

What are the key considerations when selecting a drive system for a new overhead conveyor?

Key considerations include total system length and weight capacity, desired operating speed and acceleration capabilities, environmental factors (e.g., washdown requirements), and the need for variable speed control, typically dictating the selection between chain pullers, caterpillar drives, or electric monorail units.

What challenges are associated with integrating legacy conveyor systems with Industry 4.0 technologies?

Challenges include the lack of inherent networking capabilities in older systems, the difficulty in retrofitting suitable IoT sensors onto non-standard components, and the need for expensive middleware or specialized gateway devices to translate proprietary legacy control signals into modern communication protocols.

How is sustainability addressed in the design of new overhead conveyor systems?

Sustainability is addressed through the design of energy-efficient drive systems (using VFDs and lighter components), implementing smart controls that power down sections when not in use, and utilizing durable, recyclable materials in tracks and supports to minimize waste over the system's extended operational life.

What is an Electric Monorail System (EMS) and where is it primarily used?

An EMS is an advanced overhead system using independently powered carriers running on an electrified track. It is primarily used in high-precision, high-speed, and complex assembly operations, particularly in automotive sub-assembly and electronics manufacturing, where pinpoint accuracy and quick indexing are paramount.

How do overhead systems handle changes in floor elevation or level changes?

Overhead conveyor systems are specifically designed to manage elevation changes using incline and decline sections, often incorporating banked curves or vertical transfer units. Power & Free systems are particularly adept at handling steep inclines due to their precise control over individual carrier speed and accumulation.

What are the main risks associated with improper loading of overhead carriers?

Improper loading, such as uneven weight distribution or exceeding the rated payload capacity, can lead to increased stress on tracks, premature wear of trolleys and bearings, chain derailment, and catastrophic failure of the system, posing significant safety and operational risks.

What is the significance of the "trolley pitch" in conveyor design?

Trolley pitch refers to the distance between consecutive trolleys on the conveyor chain. It is a critical design parameter that dictates the total carrying capacity, the maximum size of the load (product envelope), and the drive requirements necessary to maintain continuous motion under load.

In the Food & Beverage sector, what specific requirement dictates the type of overhead conveyor used?

In the Food & Beverage sector, the primary requirement is hygiene and washdown capability. Systems must use corrosion-resistant materials (stainless steel) and designs that minimize crevices where contaminants can accumulate, often utilizing specialized carriers and enclosed stainless tracks.

How does the implementation of digital twin technology benefit conveyor system operators?

Digital twin technology creates a virtual replica of the physical conveyor system, allowing operators to run simulations to test changes in routing, volume surges, or maintenance strategies without risking disruption to live production, optimizing efficiency and validating complex system logic.

What is the difference between an I-Beam conveyor and an enclosed track conveyor?

An I-Beam conveyor uses an exposed structural I-beam rail where the trolley wheels run on the bottom flange, offering high capacity but often generating debris. An enclosed track conveyor encloses the chain and moving parts within a compact track, offering a cleaner operation and greater protection from environmental factors.

Why is the integration of the conveyor system with the MES/WMS crucial for highly automated facilities?

Integration with Manufacturing Execution Systems (MES) and Warehouse Management Systems (WMS) is crucial because it allows the conveyor system to receive dynamic instructions regarding product sequencing, destination routing, and production priority in real-time, ensuring just-in-time delivery and seamless coordination with robotic and assembly processes.

What financial factors often restrain small to medium enterprises (SMEs) from adopting overhead conveyors?

SMEs are often restrained by the high upfront capital expenditure (CAPEX) required for design, customization, and installation, coupled with the long payback period compared to simpler, less automated material handling alternatives like forklifts or manually operated carts.

How does the logistics industry utilize overhead conveyors beyond simple transportation?

The logistics industry utilizes overhead conveyors extensively for accumulation buffers (temporary storage), dynamic sorting based on package destination, and sequencing parcels before high-speed sorters or truck loading, acting as a critical dynamic buffer within high-throughput fulfillment centers.

What is the primary maintenance concern for traditional chain-driven overhead conveyors?

The primary maintenance concern is chain wear and lubrication failure. Continuous operation under tension causes chain elongation, requiring frequent tension adjustments and regular lubrication to prevent premature failure, high friction, and excessive energy consumption.

How do safety standards, such as OSHA, influence the design of overhead conveyor systems?

OSHA and similar safety standards mandate specific requirements for load bearing limits, guarding mechanisms to prevent accidental contact, safety stop pull cords along the line, and secure design of suspended components to prevent falling hazards, significantly influencing structural engineering and system implementation protocols.

What are the benefits of using friction drive mechanisms over traditional chain drives in Power & Free systems?

Friction drives offer benefits such as quieter operation, reduced need for lubrication (leading to cleaner environments), higher energy efficiency, and superior control over individual carrier speed and acceleration, enhancing the system's flexibility and reducing maintenance complexity associated with chain wear.

Why is the aerospace industry a key consumer of high-capacity overhead conveyor systems?

The aerospace industry requires high-capacity systems to handle extremely large and heavy components, such as fuselage sections and wings, through complex assembly and finishing processes, demanding systems with high structural integrity and exceptional positional accuracy.

What is the expected impact of lightweighting materials on future overhead conveyor design?

Lightweighting materials, such as advanced composites and aluminum, are expected to significantly reduce the dead weight of the system, lowering energy consumption, reducing the required motor horsepower, and simplifying installation logistics, thereby lowering both operational and capital costs.

How do automated loading and unloading solutions impact the throughput of overhead conveyor systems?

Automated loading and unloading solutions (often robotic arms or specialized fixtures) eliminate manual bottleneck points, ensuring consistent, high-speed material introduction and removal. This reliability is critical for maintaining maximum throughput and maximizing the utilization rate of the expensive conveyor infrastructure.

What geographical region is expected to show the fastest CAGR for overhead conveyor adoption and why?

The Asia Pacific (APAC) region, driven by rapid industrial expansion in China, India, and Southeast Asia, coupled with substantial governmental and private investment in establishing world-class e-commerce and automotive production capacities, is anticipated to record the highest Compound Annual Growth Rate.

What is an 'accumulation zone' and why is it important in P&F conveyor systems?

An accumulation zone is a section of a P&F conveyor where individual carriers can stop and queue without stopping the entire line. This is vital for buffering products ahead of slower workstations (like robotic welding or painting booths) or providing surge capacity, ensuring continuous flow despite process variability.

How does the market address the demand for customization in overhead conveyor solutions?

The market addresses customization through highly modular system designs, specialized fabrication capabilities, and sophisticated system integration engineering. Leading manufacturers employ advanced software tools for layout planning and simulation to tailor standard components to meet highly specific client operational constraints and throughput targets.

Beyond transportation, what secondary functions can an overhead conveyor system perform?

Secondary functions include acting as a mobile work platform (presenting components to workers or robots), serving as a temporary storage buffer, facilitating process exposure (such as curing or cooling in ovens), and performing real-time quality control checks via integrated vision systems as products move.

What is the role of specialized coating systems in high-temperature conveyor applications?

Specialized coating systems, such as high-temperature paints and lubricants, are essential in applications like automotive paint cure ovens. These coatings prevent corrosion, ensure smooth operation of trolleys and bearings under extreme heat, and prevent the system itself from contaminating the processed product.

What key metric do manufacturers use to determine the efficiency of an overhead conveyor system?

Manufacturers primarily use "throughput per hour" (units handled per hour) and "uptime percentage" (availability of the system) as the key metrics to evaluate and benchmark the operational efficiency and reliability of an installed overhead conveyor system.

How do manufacturers ensure the safety and longevity of heavy-duty I-Beam conveyors?

Safety and longevity are ensured through rigorous structural analysis, regular non-destructive testing (NDT) of welds and critical load-bearing joints, periodic calibration of tensioning systems, and mandatory scheduled lubrication procedures to prevent friction wear in heavy-duty applications.

What are the competitive advantages of European conveyor manufacturers in the global market?

European manufacturers typically leverage competitive advantages in offering highly engineered, complex, and customized solutions, focusing on superior long-term reliability, compliance with stringent quality and safety standards (e.g., CE marking), and integration with sophisticated automation software for Industry 4.0 applications.

How is cybersecurity addressed in modern computerized overhead conveyor control systems?

Cybersecurity is addressed by segmenting the Operational Technology (OT) network from the general IT network, implementing robust firewall and intrusion detection systems, and ensuring frequent software patch management for PLCs and HMIs to protect against external access and internal malware threats that could disrupt production flow.

What is the typical energy consumption profile of a large, automated Power & Free system?

The energy consumption profile of a large P&F system is highly variable; energy is predominantly consumed by the drive motors. Consumption can be significantly reduced through the use of regenerative drives, lightweight components, and sophisticated controls that only activate specific drive zones as required, rather than running the entire system continuously at maximum capacity.

Why is accurate weight calculation critical during the initial design phase of a conveyor system?

Accurate weight calculation (including product, carrier, and chain weight) is critical because it directly determines the required structural support for the overhead infrastructure (building design), the necessary horsepower for the drives, and the safety factors required to prevent structural failure or trolley derailment.

What emerging technology is challenging traditional overhead chain conveyor dominance?

The increasing maturation and cost-effectiveness of decentralized, friction-driven Electric Monorail Systems (EMS) and specialized conveyance technologies like Automated Guided Vehicles (AGVs) that can interact directly with overhead drop-off points are challenging the dominance of fixed-path chain conveyors by offering greater flexibility.

In what way does the rising cost of industrial real estate influence market demand for overhead conveyors?

The rising cost of industrial real estate pushes companies to maximize throughput within existing or smaller footprints. Overhead conveyors are essential in this scenario as they unlock the vertical space of the facility, allowing for multi-level operations and maximizing the overall cubic storage and production capacity.

How does the need for rapid reconfiguration in e-commerce logistics affect conveyor system purchasing decisions?

E-commerce demands rapid reconfiguration to adapt to seasonal volume shifts and changing inventory profiles. This drives purchasing decisions towards modular, enclosed track, and lightweight systems that can be quickly disassembled, moved, and reassembled with minimal operational downtime.

What specialized components are required for overhead conveyor systems used in wet processing applications?

Wet processing (e.g., washing, dipping, or chemical treating) requires components made of high-grade stainless steel or corrosion-resistant polymers, specialized sealed bearings, and wash-resistant lubricants to withstand constant exposure to moisture and aggressive cleaning agents without degradation.

How do global economic slowdowns affect the demand curve for overhead conveyor systems?

Economic slowdowns typically lead to a short-term reduction in CAPEX for large, new automation projects. However, the long-term demand remains resilient as companies prioritize investments in automation that generate immediate operational efficiency and labor cost reductions to maintain profitability during lean times.

What are the primary challenges in installing complex Power & Free systems in existing manufacturing facilities?

Primary challenges include navigating existing structural obstacles (columns, ductwork, utility lines), managing tight installation tolerances required for P&F tracks, minimizing production disruption during the installation phase, and integrating the new system with legacy control infrastructure.

What is the significance of the "Base Year" and "Forecast Year" in this market report?

The Base Year (2025) provides the finalized historical data point against which future growth projections are measured. The Forecast Year period (2026-2033) represents the timeframe for which market trends, growth rates (CAGR), and projected size values are analyzed and reported based on established market models.

How does the maintenance of chain-less friction conveyors differ from traditional chain conveyors?

Chain-less friction conveyors require less lubrication and fewer tensioning adjustments than chain systems. Maintenance shifts focus to monitoring the condition and alignment of the friction wheels, belts, or drive units, often relying more heavily on sensor-based monitoring for predictive alerts.

What role does standardization play in reducing the total cost of ownership (TCO) for conveyor systems?

Standardization ensures that components are interchangeable and readily available, reducing the reliance on custom spare parts, simplifying routine maintenance procedures, and shortening repair times, collectively leading to a lower long-term TCO and reduced system lifecycle complexity.

In the context of the Value Chain, why is the aftermarket service segment important for manufacturers?

The aftermarket service segment (spare parts, maintenance, upgrades, servicing) is vital because it provides a high-margin, stable, and recurring revenue stream, deepens customer relationship loyalty, and ensures the continuous operational reliability and longevity of the manufacturer's installed base.

How do technological advancements in sensors specifically benefit overhead conveyor operations?

Advanced sensors (e.g., proximity sensors, encoders, temperature sensors) provide granular data necessary for real-time diagnostics, precise carrier positioning (critical for robot interaction), load monitoring to prevent overloading, and gathering the data required for AI-driven operational optimization and predictive maintenance modeling.

What are the unique challenges of implementing overhead conveyors in the heavy machinery sector?

The heavy machinery sector presents unique challenges related to extreme payload requirements, the need for robust structural design to handle high dynamic loads, and ensuring the stability and safety of massive, often oddly shaped components during transport and assembly operations.

How are environmental regulations influencing the choice of lubricants in overhead conveyor systems?

Environmental regulations, particularly in Europe, are pushing manufacturers towards using biodegradable, non-toxic, or NSF H1 food-grade lubricants, even in general manufacturing. This minimizes environmental impact from leakage and ensures compliance in sensitive processing areas.

Why is the ability to adjust speed dynamically a critical feature in modern assembly line conveyors?

Dynamic speed adjustment is critical because it allows the conveyor to synchronize perfectly with variable-speed workstations (like manual assembly or robotic welding), prevents product accumulation ahead of bottlenecks, and enables precise indexing required for quality control and inspection points.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager