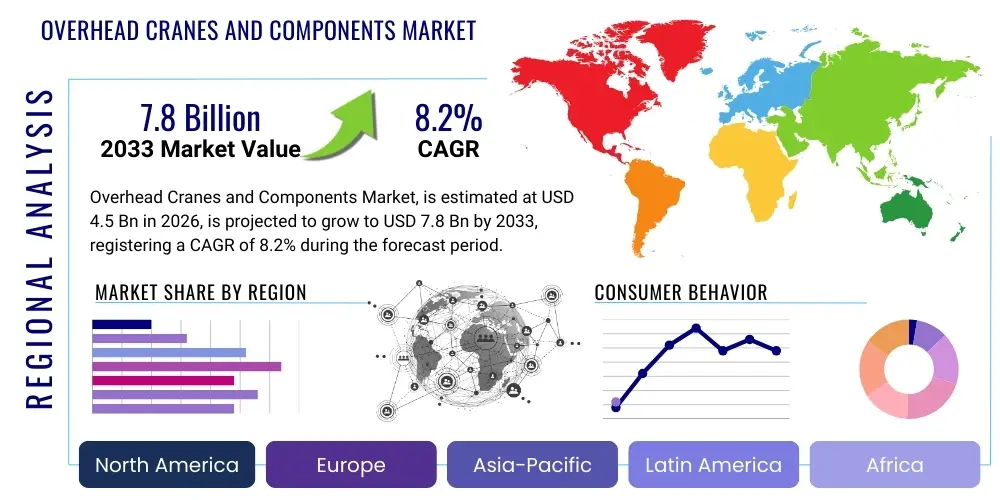

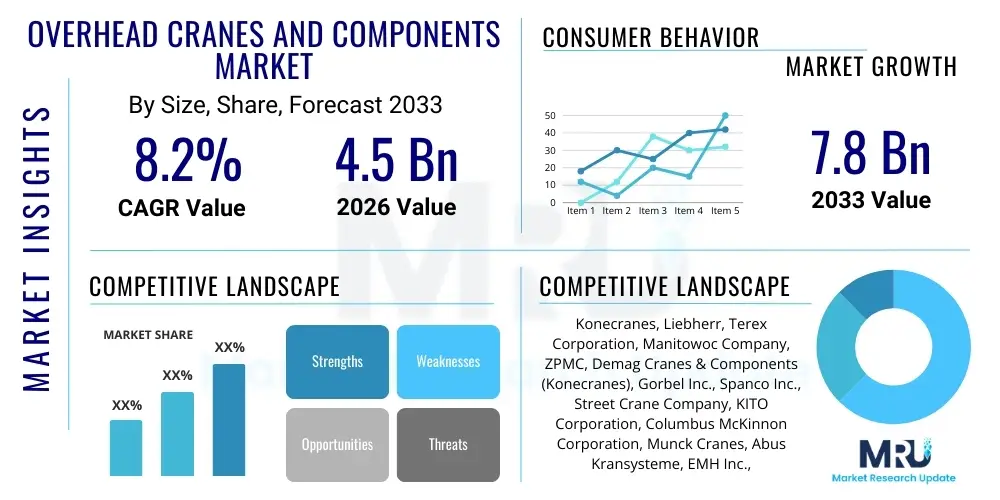

Overhead Cranes and Components Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435819 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Overhead Cranes and Components Market Size

The Overhead Cranes and Components Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.8 Billion by the end of the forecast period in 2033.

Overhead Cranes and Components Market introduction

The Overhead Cranes and Components Market encompasses the manufacturing, distribution, installation, and maintenance of heavy-duty material handling systems utilized primarily for lifting and transporting extremely heavy loads within industrial environments such as factories, warehouses, ports, and steel mills. Overhead cranes, including bridge, gantry, and monorail variants, are crucial for optimizing workflow efficiency, enhancing safety, and facilitating complex assembly processes in sectors requiring precise load manipulation. The core components, such as hoists, trolleys, end trucks, and sophisticated control systems, form the backbone of these systems, offering varying levels of capacity and automation to meet diverse operational needs across the global manufacturing and logistics landscape. Market participants are increasingly focusing on modular designs and standardization to reduce installation time and maintenance complexity, appealing to a broader base of industrial consumers seeking scalable solutions.

Major applications for overhead crane systems span foundational heavy industries, including the automotive sector, where they manage large vehicle parts and assembly lines; the metal and heavy machinery industry, indispensable for handling massive steel coils and fabricated structures; and high-volume logistics and port operations, utilized for container movement and bulk cargo transfer. Beyond traditional heavy lifting, these systems are vital in specialized fields such as aerospace manufacturing for positioning high-precision components and in power generation facilities for maintaining and servicing turbines and reactors. The inherent safety benefits of overhead systems, which elevate loads above floor level, significantly reduce potential hazards associated with manual handling and ground-based transport methods, thus improving overall operational security.

The market expansion is fundamentally driven by the resurgence of global manufacturing activities, particularly infrastructure development in emerging economies, and the sustained investment in warehouse automation technologies responding to the boom in e-commerce and fast-paced logistics. Key driving factors include strict regulatory mandates favoring safer material handling practices, technological advancements integrating Internet of Things (IoT) sensors for predictive maintenance and real-time monitoring, and the increasing demand for high-capacity, custom-engineered crane systems capable of handling multi-ton loads with enhanced precision. Furthermore, the push towards electrification and energy-efficient designs, coupled with the replacement of aging infrastructure in mature markets, provides consistent momentum for the continuous growth of both the crane units and specialized components segment.

Overhead Cranes and Components Market Executive Summary

The Overhead Cranes and Components Market is characterized by robust business trends centered on digitalization and sustainability, compelling manufacturers to invest heavily in smart crane solutions incorporating sophisticated sensor technology, remote diagnostics, and AI-driven control systems for optimized performance and reduced downtime. The competitive landscape is consolidating through strategic mergers and acquisitions aimed at broadening technological portfolios and achieving global scale, particularly concerning specialized hoisting equipment and advanced anti-sway technology. Demand is shifting towards highly customized, application-specific crane systems, leading to increased focus on engineering services and aftermarket support as pivotal revenue streams. Furthermore, the adoption of modular construction techniques for crane systems facilitates faster deployment and scalability, directly addressing the time-sensitive needs of modern industrial projects and enabling smoother integration into existing facilities undergoing retrofitting or expansion projects.

Regionally, Asia Pacific maintains its dominance, driven by massive infrastructure projects, burgeoning manufacturing capabilities in countries like China and India, and sustained investment in port modernization to handle escalating global trade volumes. North America and Europe, while being mature markets, exhibit strong demand primarily through replacement cycles, strict adherence to elevated safety standards (e.g., OSHA, EU Directives), and the rapid adoption of highly automated and semi-automatic systems that cater to labor shortages and high operational costs. The Middle East and Africa (MEA) and Latin America show promising growth trajectories, propelled by investments in mining, oil and gas infrastructure, and developing logistics hubs, requiring robust, heavy-duty cranes capable of operating reliably in harsh environments. These developing regions are often early adopters of high-specification equipment when establishing new industrial zones, prioritizing durability and high load capacities.

Segment trends reveal a strong inclination towards automated (or robotic) bridge cranes, favored for high-throughput, repeatable processes, particularly in the automotive and e-commerce fulfillment sectors. The components segment is seeing rapid innovation, with intelligent hoists featuring variable frequency drives (VFDs) and condition monitoring systems gaining prominence due to their energy efficiency and extended operational life. The adoption of double girder bridge cranes remains critical in steel and heavy machinery industries requiring maximal span coverage and capacity, while monorail and jib cranes offer localized, versatile lifting solutions crucial for focused workstation tasks. The service and maintenance component segment is expanding significantly, driven by the complexity of modern smart cranes, necessitating specialized technical support and data-driven maintenance contracts to ensure peak operational uptime for end-users relying on continuous production schedules.

AI Impact Analysis on Overhead Cranes and Components Market

Analysis of common user inquiries regarding the impact of Artificial Intelligence (AI) on the Overhead Cranes and Components Market reveals key themes centered around operational safety, efficiency gains, and long-term cost reduction. Users frequently ask how AI can enhance predictive maintenance capabilities, moving beyond simple sensor data to genuine failure prediction, and how AI-driven vision systems can eliminate human errors during complex lifting operations, particularly in hazardous or precision-required environments like nuclear facilities or advanced manufacturing. There is also significant interest in the potential of fully autonomous crane systems—what level of control remains necessary, and how AI addresses dynamic obstacles and varying load geometries in real-time. Concerns often revolve around the initial high capital investment, the necessary skill transformation required for maintenance staff, and cybersecurity vulnerabilities associated with highly networked, intelligent crane infrastructure. The overarching expectation is that AI will be the primary driver of the next generation of industrial material handling, transforming these systems from passive movers to active, decision-making robotic assistants that integrate seamlessly into the broader Industry 4.0 ecosystem.

- AI-driven Predictive Maintenance (PdM): Utilizes machine learning algorithms to analyze historical and real-time operational data (vibration, temperature, current draw) to forecast component failure with high accuracy, minimizing unscheduled downtime.

- Autonomous Operation and Path Optimization: Enables cranes to self-navigate, plan optimal load routes, and execute complex lifts without direct human intervention, enhancing throughput and reducing cycle times in highly repetitive logistics environments.

- Enhanced Safety and Collision Avoidance: AI-powered vision systems and advanced sensors provide superior spatial awareness, implementing automatic braking and corrective actions to prevent collisions with personnel, other equipment, or structural elements.

- Load Stability and Anti-Sway Control: Machine learning models continuously adjust hoisting and traversing speeds dynamically to dampen load swing, significantly improving lifting precision for delicate or oversized components, which is critical in aerospace or glass manufacturing.

- Energy Efficiency Optimization: AI algorithms manage motor torque and speed based on real-time load weight and movement requirements, ensuring minimal energy consumption while maintaining required operational performance levels.

- Remote Diagnostics and System Health Monitoring: Facilitates the continuous assessment of crane health from centralized control centers, allowing for swift resolution of minor issues and proactive service scheduling based on degradation patterns.

- Worker Augmentation and Training: Provides real-time feedback and assistance to human operators, guiding them through complex maneuvers and serving as a critical tool for training new personnel using simulated or augmented reality environments integrated with the crane controls.

DRO & Impact Forces Of Overhead Cranes and Components Market

The Overhead Cranes and Components Market is subjected to a powerful combination of driving forces and strategic constraints, creating dynamic market tension. Major drivers include the global trend toward industrial automation (Industry 4.0), necessitating integrated, high-precision lifting solutions across burgeoning sectors like specialized manufacturing and large-scale warehouse operations, coupled with mandatory safety regulations, particularly in developed economies, that push for the modernization or replacement of older, less safe equipment. However, the market faces significant restraints, notably the high initial capital expenditure required for purchasing and installing complex, customized overhead systems, which can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the shortage of highly skilled maintenance technicians capable of servicing sophisticated computerized crane systems poses a structural challenge to widespread adoption and operational continuity, requiring manufacturers to invest heavily in specialized training programs and remote support capabilities.

Opportunities for growth are substantial, primarily driven by the increasing demand for customized solutions designed for harsh environments (e.g., nuclear, waste-to-energy, extreme weather ports) and the significant potential in the aftermarket services segment, encompassing preventative maintenance contracts, modernization kits, and spare parts supply for the vast installed base worldwide. The strategic opportunity lies in penetrating developing markets where infrastructure investment is accelerating, particularly through offering flexible financing and leasing models to mitigate the high upfront cost barrier. The continuous evolution of lightweight yet high-strength materials also presents an opportunity to design cranes with improved load-to-weight ratios and reduced structural stress, leading to more cost-effective foundation requirements during installation.

The market is profoundly influenced by several key impact forces, including the intense pressure from end-users seeking demonstrable Total Cost of Ownership (TCO) reductions, compelling suppliers to focus on durability and energy efficiency over initial price. The geopolitical stability influencing global trade and commodity prices directly affects the viability of large infrastructure projects, which are primary consumers of heavy-duty cranes. Technological disruption, particularly the adoption curve of robotics and sensor fusion, rapidly obsolesces legacy systems, creating a powerful incentive for modernization. Finally, safety and environmental regulations (e.g., noise reduction, dust mitigation, enhanced seismic tolerance) impose continuous engineering requirements, pushing components manufacturers towards superior design and material standards, ensuring that market evolution is heavily tilted toward high-integrity, sustainable solutions.

Segmentation Analysis

The Overhead Cranes and Components Market is meticulously segmented based on type, capacity, components, and end-use application, providing a detailed view of specific industrial requirements and adoption trends. Segmentation is crucial for manufacturers to target specific industrial niches, such as heavy-duty steel fabrication requiring double girder cranes, or localized material transfer using highly flexible jib and monorail systems in assembly shops. The increasing complexity of industrial operations necessitates tailored lifting solutions, driving the strong differentiation between standard, off-the-shelf components and highly specialized, engineered-to-order systems, particularly in sensitive sectors like aerospace and power generation where precision and redundancy are paramount. Analyzing these segments helps stakeholders understand where technological investment, particularly in automation and condition monitoring systems, is most urgently needed to meet evolving production demands globally.

- By Type:

- Bridge Cranes (Single Girder, Double Girder)

- Gantry Cranes

- Monorail Cranes

- Jib Cranes

- Workstation Cranes

- By Component:

- Hoists (Wire Rope, Chain Hoists)

- Trolleys (Manual, Powered)

- Bridge & End Trucks

- Runways & Rails

- Control Systems (Pendant, Remote, Automated)

- Electrification Systems

- By End-Use Industry:

- Automotive

- Metal and Heavy Machinery

- Ports and Logistics

- Aerospace and Defense

- Construction (Pre-fab and Modular)

- Mining and Oil & Gas

- Power Generation (Nuclear, Thermal, Wind)

- Chemical and Process Industries

- By Capacity:

- Below 50 Metric Tons

- 50 to 100 Metric Tons

- Above 100 Metric Tons (Heavy-Duty/Specialized)

- By Operation Mode:

- Manual

- Semi-Automatic

- Automatic/Remote Controlled

Value Chain Analysis For Overhead Cranes and Components Market

The value chain for the Overhead Cranes and Components Market begins with rigorous upstream activities involving the sourcing of high-grade raw materials, predominantly specialized steel alloys, high-performance wires for rope hoists, and sophisticated electronic components for control systems and automation modules. Upstream analysis focuses heavily on achieving cost efficiencies while maintaining structural integrity and adherence to international material standards (e.g., ISO, DIN). Key upstream suppliers include major steel producers and specialized component manufacturers providing critical items like gears, bearings, and proprietary motor control devices. Manufacturing processes involve precision engineering, welding, fabrication, and assembly, where optimization of production flows and adherence to strict quality control protocols are essential to minimize structural defects and maximize equipment lifespan. Successful market players often integrate design and manufacturing processes closely to rapidly prototype and customize solutions.

Downstream activities center on installation, commissioning, testing, and comprehensive after-sales support. Due to the size and complexity of overhead crane systems, installation requires specialized engineering teams and adherence to site-specific safety and structural requirements. The distribution channel is bifurcated into direct sales for large, custom projects (like port infrastructure or steel mills) and indirect sales through a network of specialized distributors and system integrators for standardized or smaller workstation cranes. Direct channels facilitate closer customer relationships and bespoke engineering services, while indirect channels provide wider geographical coverage and localized installation and maintenance support, leveraging regional expertise in specific regulatory environments.

The distinction between direct and indirect channels is critical for market penetration; large, multinational crane manufacturers typically utilize direct sales forces and established global service networks to handle complex, high-value projects, ensuring compliance with stringent regulatory frameworks and offering high-level project management. Conversely, for standardized components and modular systems, the reliance on a strong network of certified dealers and regional integrators allows for efficient penetration into the fragmented SME segment. Aftermarket services—including spare parts supply, preventative maintenance contracts, training, and modernization/retrofitting—constitute a major and increasingly important profit center, driven by the need for regulatory compliance and operational longevity of high-investment assets.

Overhead Cranes and Components Market Potential Customers

The potential customer base for the Overhead Cranes and Components Market is highly diversified, encompassing any industrial entity involved in manufacturing, processing, or logistics that requires the regular, safe, and precise movement of heavy or bulky materials within a defined workspace. The primary end-users are large-scale industrial complexes such as integrated steel mills, automotive assembly plants (Tier 1 and OEMs), major seaports and intermodal freight terminals, and heavy equipment manufacturers. These entities are characterized by high utilization rates, demanding performance specifications, and strict compliance requirements regarding safety and operational efficiency. The continuous capital expenditure cycle in these industries, driven by capacity expansion and technological upgrades, ensures sustained demand for high-capacity, durable, and increasingly automated overhead lifting solutions, positioning them as the anchor clients for leading crane providers.

A second, rapidly growing segment of potential customers includes specialized manufacturing facilities, such as aerospace component fabrication, wind turbine assembly, and advanced semiconductor manufacturing, where the manipulation of large, high-value, and delicate parts requires exceptionally high precision and anti-sway capabilities, often integrated with cleanroom or specialized environmental controls. Additionally, the proliferation of large e-commerce distribution centers and automated warehouses constitutes a significant emerging customer group, focusing on light to medium capacity, high-speed, and fully automated monorail and workstation crane systems designed for rapid order fulfillment and stocking processes. These customers prioritize integration capabilities with Warehouse Management Systems (WMS) and robust automation protocols, driving demand for intelligent controls.

Finally, the long-term customer segment includes entities requiring maintenance and refurbishment services, primarily power generation facilities (nuclear, hydro, fossil fuel plants) and large municipal infrastructure projects (e.g., water treatment plants, specialized construction sites). These customers often require custom-engineered components and maintenance services certified to specific, high-stakes operational standards. The decision-making unit (DMU) within potential customer organizations typically involves a mix of operations managers focused on efficiency, safety engineers focused on compliance, and procurement specialists focused on TCO and long-term service agreements, necessitating a consultative sales approach focused on demonstrating return on investment through reduced operational risks and enhanced productivity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Konecranes, Liebherr, Terex Corporation, Manitowoc Company, ZPMC, Demag Cranes & Components (Konecranes), Gorbel Inc., Spanco Inc., Street Crane Company, KITO Corporation, Columbus McKinnon Corporation, Munck Cranes, Abus Kransysteme, EMH Inc., R&M Materials Handling, GH Cranes & Components, Whiting Corporation, Dearborn Crane, JDN Monorail, Alatas Americas. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Overhead Cranes and Components Market Key Technology Landscape

The Overhead Cranes and Components Market is rapidly being redefined by the convergence of mechanical engineering excellence and advanced digital technology, marking a significant transition towards smart material handling systems. A central technological focus is the integration of Variable Frequency Drives (VFDs) and specialized motor control systems, which enable precise speed control, smoother acceleration and deceleration, and substantial reductions in energy consumption compared to traditional contactor-based systems. These VFDs are crucial components in enhancing safety by minimizing load swing and improving the positional accuracy required in modern high-tolerance manufacturing environments. Furthermore, the adoption of modular component design, leveraging standardized interfaces and interchangeable parts, significantly streamlines inventory management for end-users and reduces the complexity and duration of maintenance interventions, maximizing operational uptime.

Another major pillar of the technology landscape involves advanced sensor fusion and IoT connectivity. Modern cranes are equipped with an array of sensors—including vibration monitors, thermal scanners, load cells, and proximity sensors—that continuously feed data into the crane's control platform and cloud-based monitoring systems. This real-time data flow is the foundation for Condition Monitoring Systems (CMS), which allow operators and maintenance personnel to track the health of critical components (e.g., bearings, gearboxes, wire ropes) remotely, facilitating proactive replacement schedules. This transition from reactive maintenance to data-driven predictive maintenance significantly extends the useful life of the assets and drastically lowers the risk of catastrophic failures, which can halt entire production lines. Wireless communication protocols (e.g., 5G integration) are becoming essential to ensure reliable data transmission across large industrial complexes, supporting real-time remote control and diagnostic capabilities.

Finally, the incorporation of advanced automation and operator assistance technologies is transforming productivity and safety standards. This includes sophisticated anti-sway technology utilizing complex algorithms to counteract pendulum motion, crucial for long lifts or rapid transit operations. Furthermore, sophisticated Human-Machine Interfaces (HMIs) and remote control stations, often incorporating video feedback and augmented reality overlays, allow operators to manage complex lifts from safe, ergonomic positions, improving overall working conditions and efficiency. The ongoing development of AI-based vision systems for automated inventory tracking and obstacle detection represents the cutting edge, enabling fully autonomous operation in controlled environments like automated storage and retrieval systems (AS/RS) that rely on precision overhead movement, ensuring the market remains aligned with the highest standards of industrial robotics.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and adoption rates of overhead cranes and components, influenced heavily by infrastructure spending, manufacturing output, and regulatory adherence.

- Asia Pacific (APAC): Dominates the global market volume due to unprecedented levels of investment in infrastructure (ports, railways), rapid industrialization, and high manufacturing output across heavy industries (steel, automotive) in China, India, and Southeast Asia. The region is characterized by high demand for standard, cost-effective bridge cranes and a growing need for specialized, heavy-duty gantry cranes for massive port modernization projects, particularly along key maritime trade routes.

- North America: A mature market defined by strict safety mandates (OSHA) and a strong focus on modernization and automation. Demand is driven by replacement cycles for aging equipment and a rapid shift toward automated and semi-automatic systems in the logistics, aerospace, and general manufacturing sectors to mitigate rising labor costs and maximize operational efficiency. Custom-engineered solutions featuring sophisticated control systems and predictive maintenance technologies are highly valued.

- Europe: Characterized by stringent environmental and operational standards (CE marking, EU machinery directives) and a strong emphasis on energy efficiency and low noise operation. Western Europe demands high-quality, smart cranes with integrated IoT capabilities for advanced manufacturing (Germany, France), while Eastern European countries show strong growth in standard industrial applications driven by the relocation of manufacturing bases seeking lower operational overheads.

- Middle East and Africa (MEA): Emerging as a high-growth region propelled by significant governmental investment in diversification projects, large-scale oil and gas infrastructure expansion, and the development of major logistics and free trade zones (e.g., UAE, Saudi Arabia). This region requires robust, high-capacity cranes capable of withstanding extreme heat and dusty environments, driving demand for specialized explosion-proof components and heavy-lift gantry systems.

- Latin America: Growth is primarily linked to commodity cycles, with strong demand originating from the mining, construction, and basic metal industries (Brazil, Chile, Mexico). The market often seeks durable, reliable equipment with proven performance in harsh operational settings, focusing on essential components and robust service contracts due to variable infrastructure quality and geographical remoteness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Overhead Cranes and Components Market.- Konecranes

- Liebherr Group

- Terex Corporation

- The Manitowoc Company, Inc.

- ZPMC (Zhenhua Port Machinery Company)

- Demag Cranes & Components (part of Konecranes)

- Gorbel Inc.

- Spanco Inc.

- Street Crane Company

- KITO Corporation

- Columbus McKinnon Corporation

- Munck Cranes AS

- Abus Kransysteme GmbH

- EMH Inc.

- R&M Materials Handling, Inc.

- GH Cranes & Components

- Whiting Corporation

- Dearborn Crane & Engineering Co.

- JDN Monorail (J.D. Neuhaus)

- Alatas Americas Inc.

Frequently Asked Questions

Analyze common user questions about the Overhead Cranes and Components market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the adoption of automated overhead crane systems?

The primary drivers include the global imperative for Industry 4.0 integration, which demands seamless automation; the need to overcome high industrial labor costs and skilled worker shortages; and regulatory pressure to enhance safety protocols by minimizing human interaction with heavy loads, significantly reducing operational risk and ensuring higher throughput consistency.

How does the integration of IoT and predictive maintenance impact the Total Cost of Ownership (TCO) for overhead cranes?

IoT integration enables predictive maintenance by monitoring component health in real-time, allowing proactive repairs instead of reactive fixes. This drastically reduces unscheduled downtime, prevents catastrophic failures, extends the operational lifespan of the equipment, and ultimately lowers the long-term TCO by optimizing maintenance expenditure and minimizing production losses.

Which end-use industry represents the highest growth potential for high-capacity overhead cranes?

The Ports and Logistics segment, particularly those involved in global container handling and bulk cargo transfer, presents the highest potential for high-capacity overhead and gantry cranes. Growth is fueled by increasing international trade volumes and continuous necessity for port modernization to accommodate ultra-large container vessels (ULCVs) and enhance turnaround speed.

What is the current trend regarding the electrification and energy efficiency of overhead crane components?

The dominant trend is a shift towards energy-efficient components, primarily through the widespread adoption of Variable Frequency Drives (VFDs) and high-efficiency permanent magnet motors. These technologies significantly reduce power consumption during operation by matching motor output precisely to the load requirements, aligning with global sustainability mandates and reducing operational utility costs.

What key challenges restrain the market growth in developing regions like Latin America and MEA?

Key restraints in developing regions include the high initial capital investment required for modern, complex crane systems; economic volatility affecting large-scale infrastructure project commitments; and infrastructural challenges, such as unreliable local power grids and a scarcity of locally certified technicians capable of complex installation and servicing of advanced electronic control systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager