Overlay Welding Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434267 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Overlay Welding Service Market Size

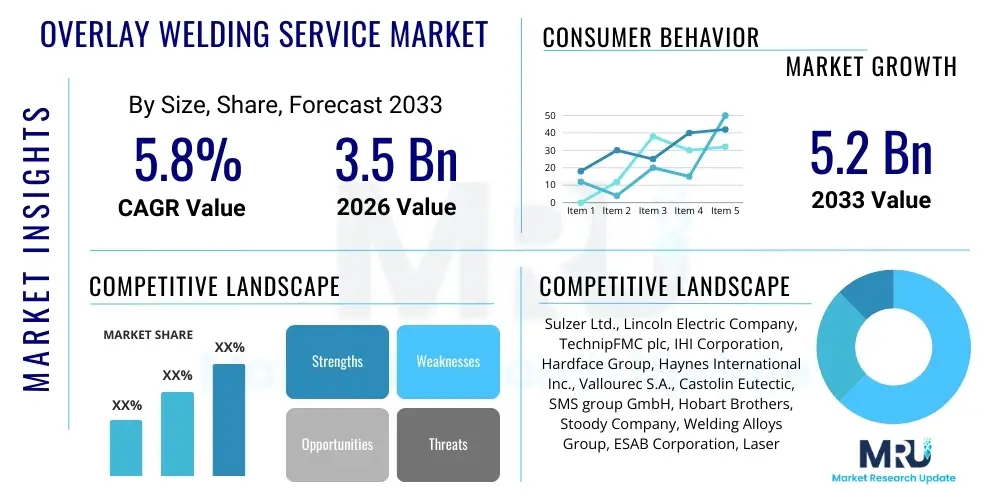

The Overlay Welding Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.2 Billion by the end of the forecast period in 2033.

Overlay Welding Service Market introduction

The Overlay Welding Service Market encompasses specialized processes designed to deposit layers of corrosion-resistant or wear-resistant materials onto base metal components, significantly extending their operational lifespan in harsh environments. This technique, also known as cladding or hardfacing, is crucial across heavy industries where equipment is exposed to high temperatures, abrasive wear, erosion, or chemical degradation. Key applications include the protection of boiler tubes, valve seats, turbine components, and drilling tools, ensuring structural integrity and minimizing downtime associated with material failure.

Major applications of overlay welding services are concentrated in sectors like oil and gas, power generation, chemical processing, and mining, where component reliability is paramount. The primary benefit derived from these services is enhanced resistance to surface degradation, allowing industries to utilize less expensive base materials while achieving superior performance characteristics through the overlay layer. This cost-effective maintenance and protection strategy drives market demand globally.

Driving factors for market expansion include the increasing demand for energy infrastructure maintenance, the aging of existing industrial assets requiring refurbishment rather than replacement, and the growing complexity of operational environments (such as sour gas extraction or high-pressure chemical reactions) which necessitate advanced material protection solutions. Furthermore, stringent safety regulations and the focus on operational efficiency compel industries to invest in reliable overlay welding services.

Overlay Welding Service Market Executive Summary

The Overlay Welding Service Market is undergoing significant evolution driven by technological advancements in material science and automation, which are collectively enhancing the quality, speed, and cost-effectiveness of cladding operations. Current business trends indicate a strong move toward highly specialized service providers offering tailored solutions using advanced metallic alloys, such as high-nickel and cobalt-based overlays, necessary for increasingly corrosive applications in deep-sea oil drilling and advanced chemical refining. Consolidation among smaller service providers and larger engineering firms is also a notable trend, aiming to achieve economies of scale and integrate services covering everything from non-destructive testing (NDT) to final surface finishing. The push towards sustainable manufacturing practices also favors overlay welding, as it facilitates the repair and reuse of components, aligning with circular economy principles.

Regionally, the market dynamics are characterized by mature, high-value demand in North America and Europe, focusing heavily on maintaining existing, complex energy infrastructure and adopting stringent quality control standards. Conversely, the Asia Pacific (APAC) region is demonstrating the fastest growth, fueled by massive investments in new power generation facilities (both fossil fuel and renewable), expansion of petrochemical plants, and large-scale infrastructural projects in rapidly industrializing nations like China, India, and Southeast Asia. Latin America, particularly Brazil and Mexico, presents substantial opportunities, driven by renewed activities in offshore oil and gas exploration requiring specialized subsea overlay welding services.

Segment trends highlight the dominance of the Oil & Gas segment, which consumes the largest volume of overlay services due to the necessity of protecting downhole tools and pipeline components from extreme pressures and highly corrosive media. Within welding processes, Plasma Transferred Arc Welding (PTAW) and Laser Cladding are gaining momentum, offering high precision, low heat input, and superior metallurgical bond quality compared to traditional methods like Submerged Arc Welding (SAW). Furthermore, the trend toward automated and robotic welding systems is accelerating, addressing the persistent challenge of skilled labor shortages and simultaneously ensuring highly repeatable and verifiable quality standards, thereby mitigating operational risks for end-users.

AI Impact Analysis on Overlay Welding Service Market

User queries regarding the integration of Artificial Intelligence (AI) in the Overlay Welding Service Market frequently center on the potential for autonomous quality control, optimization of complex welding paths, and predictive maintenance schedules for sophisticated welding equipment. Key concerns often revolve around the initial capital expenditure required for AI infrastructure, the accuracy and reliability of real-time defect detection algorithms in diverse material conditions, and the ultimate impact of automation on the existing skilled workforce. Users express high expectations regarding AI’s ability to standardize quality across large-scale projects, reduce material waste, and significantly decrease the need for human intervention in hazardous welding environments, particularly in processes like automatic cladding of large internal diameters.

AI is primarily influencing the market by enhancing process control and decision-making capabilities far beyond traditional programmable logic controllers (PLCs). Machine learning algorithms are being trained on vast datasets of welding parameters, non-destructive testing results, and material performance characteristics to predict optimal heat inputs, feed rates, and oscillation patterns necessary to achieve perfect metallurgical properties for specific overlay alloys. This predictive capability minimizes porosity, dilution, and cracking, which are common and costly defects in specialized cladding work. Furthermore, computer vision systems coupled with deep learning are now capable of real-time monitoring of the weld pool, instantly identifying anomalies and automatically adjusting robot movements or process variables.

The long-term impact of AI is expected to transition the overlay welding service from a highly manual skill-dependent craft to a data-driven engineering discipline. AI tools will support human welders and supervisors by providing augmented reality feedback, simulating performance under various conditions, and automating routine inspection tasks. This shift will ultimately reduce operational variability, decrease rework rates, and increase the overall throughput of high-integrity overlay welding services required by demanding industries such as nuclear power and aerospace, positioning AI as a critical enabler of next-generation material protection solutions.

- AI enhances quality control through real-time defect detection and analysis using computer vision.

- Predictive analytics optimize welding parameters (heat input, deposition rate) to minimize material dilution and defects.

- Machine learning algorithms enable predictive maintenance of specialized welding equipment, reducing unplanned downtime.

- AI facilitates complex path planning and robot trajectory optimization for internal diameter cladding and irregular geometries.

- Generative AI tools assist engineers in selecting optimal overlay materials and processes based on specified operational criteria (temperature, corrosion type).

- Automated data logging and reporting simplify regulatory compliance and traceability for critical components.

- AI-driven simulation tools reduce physical prototyping and testing costs for new cladding applications.

DRO & Impact Forces Of Overlay Welding Service Market

The dynamics of the Overlay Welding Service Market are significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and investment decisions. The key driving force remains the global necessity for maintaining and extending the life of critical infrastructure across energy and processing sectors, particularly the aging fleet of power generation plants, refineries, and oil pipelines constructed decades ago. The prohibitive costs and extended timelines associated with replacing large industrial components make overlay welding a highly compelling, cost-effective solution for asset preservation, thereby accelerating market growth. Furthermore, the relentless pursuit of materials that can withstand increasingly aggressive operating environments, such as high-sulfur content oil and supercritical steam conditions, mandates the use of specialized overlay materials and corresponding expert service providers.

Despite robust demand, the market faces notable restraints, chiefly the severe global shortage of certified and highly skilled overlay welders and welding engineers capable of executing complex, high-specification cladding projects. Specialized overlay welding often requires advanced certification and deep metallurgical knowledge, making it difficult to scale operations quickly. Moreover, the high initial capital investment required for automated welding equipment, such as large-scale robotic manipulators and advanced PTAW or Laser Cladding systems, acts as a significant barrier to entry for smaller firms and can deter adoption in developing markets. Concerns related to regulatory complexity and the need for meticulous documentation and traceability in highly regulated sectors also pose operational challenges.

Opportunities for sustained market expansion are abundant, particularly driven by global investments in new energy infrastructure, including offshore wind platforms and hydrogen processing facilities, which demand novel corrosion protection techniques. The development and commercialization of new, high-performance overlay materials, such as amorphous metals and nanostructured carbides, present opportunities for service providers who can master their application. Geographically, emerging economies undergoing rapid industrialization offer untapped potential for establishing specialized service centers. The overall impact forces are therefore weighted towards growth, contingent upon the successful adoption of automation technologies to mitigate labor restraints and the ability of market players to rapidly deploy new material science innovations.

Segmentation Analysis

The Overlay Welding Service Market is systematically segmented based on the method of execution (Type), the composition of the protective material (Overlay Material), the specific welding technique employed (Welding Process), and the industry utilizing the service (End-User Industry). This segmentation is crucial for understanding specific demand characteristics and technological preferences across different industrial verticals. The segmentation by welding process often dictates the quality and cost profile of the service, with advanced methods like Laser Cladding commanding premium prices due to their superior precision and minimal heat-affected zone (HAZ). Understanding these segments allows market participants to tailor their service offerings and investment strategies effectively, targeting high-growth niche areas like complex internal diameter cladding or large-scale component refurbishment for power generation assets.

The complexity of service requirements is reflected in the segmentation by overlay material, where demand is shifting from traditional stainless steels towards high-performance nickel and cobalt-based alloys (Stellite) due to their superior resistance to high-temperature oxidation and severe abrasion, particularly in chemical and petrochemical facilities. Geographic market analysis often reveals that different regions show preference for specific segment combinations; for instance, North America heavily favors automated PTAW using nickel-based alloys in oil and gas, while APAC may see stronger growth in FCAW for general construction and maintenance due to lower operational costs. Successful market strategy involves recognizing these interdependencies between segments and positioning core competencies to serve the highest value intersections, such as automated orbital welding using duplex stainless steels for critical pipeline infrastructure.

- By Type:

- Automated Welding/Robotic Welding

- Semi-Automated Welding

- Manual Welding

- By Overlay Material:

- Nickel-based Alloys (e.g., Inconel)

- Cobalt-based Alloys (e.g., Stellite)

- Stainless Steel (e.g., Duplex, Austenitic)

- Carbide Overlays (e.g., Tungsten Carbide, Chromium Carbide)

- Other Alloys (e.g., Copper Alloys, Titanium Alloys)

- By Welding Process:

- Submerged Arc Welding (SAW)

- Gas Metal Arc Welding (GMAW/MIG)

- Flux-Cored Arc Welding (FCAW)

- Plasma Transferred Arc Welding (PTAW)

- Gas Tungsten Arc Welding (GTAW/TIG)

- Laser Cladding

- By End-User Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Power Generation (Thermal, Nuclear, Renewables)

- Chemical & Petrochemical

- Mining & Construction

- Pulp & Paper

- Marine & Shipbuilding

- Others (Aerospace, General Manufacturing)

Value Chain Analysis For Overlay Welding Service Market

The value chain for the Overlay Welding Service Market begins with upstream suppliers who provide the essential raw materials, specifically the welding consumables such as specialized alloy wires, powders, and flux materials. These materials are highly critical, as their chemical composition determines the protective performance of the final overlay; therefore, raw material procurement and quality control are foundational stages. Key upstream activities involve metallurgical research and development to create advanced, application-specific alloys capable of withstanding extreme service conditions, meaning the innovation within the material suppliers directly influences the capabilities of the downstream service providers.

The midstream of the value chain is dominated by the welding service providers, which encompass specialized workshops, field service contractors, and engineering, procurement, and construction (EPC) firms that integrate welding services. These entities invest heavily in sophisticated capital equipment, including large-scale manipulators, automated welding heads (PTAW, Laser Cladding), and necessary non-destructive testing (NDT) infrastructure. The distribution channel in this market is primarily direct for large projects, where end-users contract specialized service firms based on technical capability and certifications. However, for smaller or standardized maintenance tasks, indirect distribution through industrial maintenance contractors or third-party refurbishment facilities may occur.

Downstream activities involve the end-users—large industrial facilities across Oil & Gas, Power, and Chemical sectors—where the overlay components are installed and utilized. The value delivered at this stage is the extended life and reliability of critical assets, resulting in reduced operational expenditure and enhanced safety. The efficiency of the value chain relies heavily on close collaboration between material developers, service providers, and end-users to ensure the overlay process meets precise specifications required for regulatory compliance and operational effectiveness in challenging industrial environments. Traceability and documentation throughout the chain are mandatory for high-integrity components.

Overlay Welding Service Market Potential Customers

Potential customers for Overlay Welding Services are entities operating high-value, critical infrastructure that are highly susceptible to material degradation from corrosion, erosion, or extreme thermal cycles. The primary end-users are large multinational corporations and state-owned enterprises within the energy sector, including operators of crude oil and natural gas pipelines, petrochemical refineries, and offshore drilling platforms. These segments require continuous maintenance and component refurbishment for items such as valve components, pump impellers, subsea manifolds, and heat exchanger tubes, making them the most substantial buyers of specialized overlay services.

The power generation sector, encompassing nuclear, coal, and gas-fired power plants, constitutes another significant customer base. Components like boiler tubes, turbine blades, and coal pulverizer parts frequently undergo overlay welding to withstand high-temperature erosion and steam corrosion, extending their operating life and improving overall plant efficiency. In addition to operational companies, large Engineering, Procurement, and Construction (EPC) firms that build new industrial facilities are also major buyers, contracting overlay services to ensure newly fabricated components meet the specified standards for long-term durability before commissioning.

Furthermore, heavy industry sectors such as mining and construction machinery maintenance also represent a steady customer segment, although often requiring less sophisticated material overlays focused primarily on abrasion resistance (hardfacing) for excavator buckets, conveyor systems, and crushing equipment. The common characteristic among all potential customers is the high cost of component replacement and the catastrophic consequences of failure, which drive their reliance on high-quality, certified overlay welding service providers to mitigate operational risks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sulzer Ltd., Lincoln Electric Company, TechnipFMC plc, IHI Corporation, Hardface Group, Haynes International Inc., Vallourec S.A., Castolin Eutectic, SMS group GmbH, Hobart Brothers, Stoody Company, Welding Alloys Group, ESAB Corporation, Laser Cladding Services Inc., Oceaneering International, BWX Technologies, Inc., TWI Ltd., Precision Surfacing Solutions, Kennametal Inc., Messer Group GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Overlay Welding Service Market Key Technology Landscape

The technology landscape within the Overlay Welding Service Market is continuously evolving, focusing on achieving higher deposition rates, minimizing the Heat-Affected Zone (HAZ), and ensuring superior metallurgical quality. Plasma Transferred Arc Welding (PTAW) remains a cornerstone technology, offering high material utilization and excellent control over dilution, making it ideal for applying costly, high-performance alloys like Stellite and Inconel. However, the market is increasingly seeing the adoption of advanced, high-energy density methods, particularly Laser Cladding. Laser Cladding provides the lowest heat input, resulting in minimal distortion of the base material and a finer grain structure in the overlay, which is highly advantageous for thin-walled or precision components in aerospace and nuclear applications. These technological improvements are critical for meeting the stringent specifications required by modern industrial applications.

Automation and robotics represent another fundamental technological driver. Automated overlay systems, often integrating six-axis robots or specialized orbital welding heads, are essential for achieving repeatable quality and consistency, especially for complex geometries such as internal bore cladding of pipes and valves. The integration of advanced sensor technology, including infrared cameras and acoustic monitoring systems, allows for real-time process control and instantaneous feedback, ensuring that the welding parameters are constantly optimized to prevent defects like lack of fusion or cracking. This level of automation not only improves technical quality but also significantly boosts productivity, mitigating the rising costs associated with highly skilled labor.

Furthermore, material innovation heavily influences the technology landscape. The use of specialized composite materials and powder metallurgy is expanding the range of protective properties available. Techniques such as thermal spraying, while distinct from traditional fusion welding, often compete or complement overlay welding by offering alternatives for deposition of ceramics and carbides. The development of advanced wire and powder feeders capable of accurately dispensing precise blends of materials is crucial for utilizing complex matrix alloys. Service providers must invest heavily in training personnel on these sophisticated technologies to maintain a competitive edge, emphasizing precision control systems and post-weld processing technologies like stress relieving and specialized machining necessary for final component preparation.

Regional Highlights

The regional distribution of the Overlay Welding Service Market reflects global industrialization patterns, energy infrastructure maturity, and differing regulatory environments. North America, specifically the United States and Canada, holds a substantial market share characterized by mature infrastructure in the oil, gas, and power sectors. Demand here is driven largely by maintenance, repair, and overhaul (MRO) activities for aging refineries, pipelines, and nuclear facilities, requiring high-specification, automated overlay services, particularly using nickel-based alloys to combat severe internal corrosion in sour service environments. The region benefits from robust adoption of advanced technologies like Laser Cladding and PTAW, supported by high regulatory standards promoting component integrity and safety.

Europe represents a stable market focused on industrial refurbishment and the transition toward green energy infrastructure. Key countries like Germany, the UK, and France show steady demand, particularly in chemical processing and specialized power generation (e.g., concentrated solar power and offshore wind), where protective coatings against maritime corrosion and thermal fatigue are essential. European market players often emphasize sustainability and life-cycle extension, favoring precision repair over replacement. The Middle East and Africa (MEA) region, dominated by substantial oil and gas production, is a critical growth region where massive investments in new extraction and processing capacity necessitate extensive overlay services for high-pressure valves, pipelines, and downhole tools, often demanding field services under challenging logistical conditions.

Asia Pacific (APAC) stands out as the fastest-growing region, driven by rapid industrial expansion, urbanization, and significant government spending on new power plants and chemical complexes in countries such as China, India, and South Korea. This growth is characterized by high volume demand, often utilizing more cost-effective processes like FCAW and GMAW initially, but with increasing adoption of advanced automated welding systems to meet rising quality standards mandated by new infrastructure projects. The sheer scale of new construction and the high potential for industrial corrosion in coastal and heavily industrialized zones ensures APAC will be the primary driver of new service capacity deployment over the forecast period, positioning it as the key strategic focus area for global service providers.

- North America: Dominance in oil and gas MRO, high adoption of PTAW and Laser Cladding, stringent regulatory environment drives demand for certified, high-integrity services.

- Europe: Focus on industrial longevity, sustainable maintenance practices, significant demand from chemical plants and renewable energy components (offshore wind).

- Asia Pacific (APAC): Highest growth rate fueled by new industrial construction, power plant expansion, and rapidly increasing quality requirements in manufacturing and petrochemicals.

- Middle East & Africa (MEA): Strong demand tied to large-scale oil and gas capital projects (CAPEX) requiring extensive corrosion protection for pipelines and extraction equipment.

- Latin America: Emerging market with opportunities in mining equipment hardfacing and specialized subsea services, particularly in Brazilian and Mexican offshore sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Overlay Welding Service Market.- Sulzer Ltd.

- Lincoln Electric Company

- TechnipFMC plc

- IHI Corporation

- Hardface Group

- Haynes International Inc.

- Vallourec S.A.

- Castolin Eutectic

- SMS group GmbH

- Hobart Brothers

- Stoody Company

- Welding Alloys Group

- ESAB Corporation

- Laser Cladding Services Inc.

- Oceaneering International

- BWX Technologies, Inc.

- TWI Ltd.

- Precision Surfacing Solutions

- Kennametal Inc.

- Messer Group GmbH

Frequently Asked Questions

Analyze common user questions about the Overlay Welding Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of specialized overlay welding services in the Oil & Gas sector?

The primary factor driving the adoption of specialized overlay welding services in the Oil & Gas sector is the increasing severity of operational environments, characterized by high pressure, extreme temperatures, and particularly, the presence of corrosive agents such as hydrogen sulfide (H2S) and carbon dioxide (CO2). These conditions necessitate superior material protection for critical components, including valve bodies, pipelines, and drilling tools, which are susceptible to stress corrosion cracking, erosion, and pitting corrosion. Replacing these high-cost, high-specification components is significantly more expensive and time-consuming than employing advanced overlay welding (cladding) using specialized nickel-based alloys (like Inconel) or cobalt-based alloys (like Stellite). Overlay welding ensures the components meet necessary service life extensions and regulatory requirements for safety and environmental protection, thereby minimizing non-productive time (NPT) and associated financial losses. Furthermore, the push towards deeper and more unconventional reserves requires materials and services capable of enduring these enhanced stresses, making overlay welding a non-negotiable requirement for asset integrity management, especially in subsea and sour service applications where conventional materials rapidly degrade under load. The focus is on preventing catastrophic failures and maintaining the operational lifespan of extremely costly fixed assets, often extending component life by decades rather than years, offering a compelling return on investment through preventative maintenance strategies.

How do the different overlay welding processes, such as PTAW and Laser Cladding, compare in terms of cost and performance?

Plasma Transferred Arc Welding (PTAW) and Laser Cladding represent two of the most advanced overlay welding processes, offering distinct trade-offs in terms of cost, deposition rate, and performance characteristics. PTAW generally offers a higher deposition rate and is suitable for thicker cladding layers and larger components. It provides excellent metallurgical bonding and is highly versatile across a range of alloys, often striking a good balance between speed and quality, leading to moderate operational costs per kilogram of deposited material. However, PTAW involves a greater heat input compared to laser processes, which can sometimes lead to a slightly larger Heat-Affected Zone (HAZ) and higher base material dilution, potentially compromising the integrity of sensitive base metals. Conversely, Laser Cladding offers superior precision and the lowest heat input of any fusion-based cladding technique. This results in minimal base material dilution (often less than 5%), minimal thermal distortion, and a highly refined, defect-free overlay layer, making it ideal for thin, high-precision components or thermally sensitive materials. While Laser Cladding systems require significantly higher initial capital investment and may have a lower deposition rate than PTAW for very thick layers, the long-term cost-effectiveness stems from the exceptional material quality, reduced post-weld machining, and superior performance life, justifying its premium cost in highly demanding aerospace, nuclear, and high-tolerance industrial applications where component integrity cannot be compromised. The choice between the two is therefore dictated by the component geometry, required thickness, material compatibility, and critical service requirements.

What role does automation and robotics play in overcoming the skills gap challenge in the overlay welding market?

The skills gap, characterized by a declining availability of highly certified and experienced manual welders capable of specialized overlay tasks, is a persistent constraint on market growth. Automation and robotics serve as the critical technological solution to mitigate this challenge by transferring the precision and repeatability requirements from the human operator to the machine. Automated systems, including robotic manipulators and custom orbital welding machines integrated with advanced vision and sensing technologies, ensure that once a welding procedure specification (WPS) is validated, the cladding process is executed with extremely high consistency, regardless of individual operator skill variations. This ability to maintain constant speed, torch angle, and material feed eliminates common human errors that lead to costly defects like porosity, incomplete fusion, or excessive dilution. Robotics also enables continuous, high-volume operation, significantly boosting throughput and efficiency, which is crucial for large-scale industrial projects like cladding massive pressure vessels or thousands of linear feet of pipe. Furthermore, automation improves workforce utilization by allowing skilled welders to focus on programming, quality assurance, and supervision, rather than the repetitive manual labor, thereby leveraging their expertise more effectively. This strategic integration of robotics is transforming the market, enhancing quality control metrics, reducing operational risk, and providing a scalable solution to the long-term demographic challenges faced by the heavy industrial maintenance sector, ultimately making high-quality overlay welding services more accessible and reliable globally.

Which segments of the Overlay Welding Service Market are expected to exhibit the fastest growth over the forecast period?

The segments expected to exhibit the fastest growth over the forecast period are Laser Cladding within the Welding Process segment and the Power Generation (specifically renewable and advanced thermal) segment within the End-User Industries. Laser Cladding is projected for rapid expansion due to its intrinsic technical advantages, including minimal heat input, high precision, and superior metallurgical properties, which align perfectly with the increasing demand for high-integrity components in next-generation industrial facilities. As material specifications become more rigorous, particularly for high-value components requiring minimal distortion, the superior control offered by laser technology will drive its adoption over conventional fusion methods, even with a higher initial service cost. Similarly, the Power Generation segment is accelerating its demand, driven both by the global energy transition and the need to retrofit existing facilities. Investments in supercritical and ultra-supercritical coal plants require extremely durable materials to handle higher operating temperatures and pressures, while the growing construction of waste-to-energy facilities and large-scale offshore wind farms necessitates specialized corrosion and erosion protection for turbine components and structural elements. The demand for services protecting against turbine blade erosion, boiler tube corrosion, and high-wear pump components in these advanced energy projects ensures that the power sector will be a primary engine for market revenue growth, focusing specifically on high-performance alloys and automated repair techniques.

What are the key technical challenges service providers face when performing internal diameter (ID) cladding on pipelines and cylindrical components?

Internal Diameter (ID) cladding poses some of the most complex technical challenges in the overlay welding service market due to inherent accessibility and control limitations. Key challenges include maintaining a perfectly consistent arc distance and travel speed within confined spaces, which is essential for ensuring uniform bead width and penetration. Achieving consistent quality is difficult because the welding operation is often performed blind or relies heavily on remote visualization systems. Furthermore, managing the heat dissipation within the restricted ID area is challenging; inadequate cooling can lead to excessive heat buildup, increasing the risk of base material distortion, cracking, and unacceptable levels of dilution, potentially compromising the overlay effectiveness. Service providers must invest heavily in highly specialized, custom-designed orbital welding equipment and internal manipulator systems equipped with advanced sensors for monitoring process variables in real-time. Another significant hurdle is post-weld inspection and Non-Destructive Testing (NDT) within the narrow ID bore, which often requires miniature, specialized probes and robotic crawlers to verify the overlay integrity, thickness, and absence of defects like porosity. Successfully overcoming these challenges necessitates rigorous procedural qualification, specialized operator training, and reliance on highly automated systems engineered specifically for internal geometries, which is why ID cladding services command a significant price premium in the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager