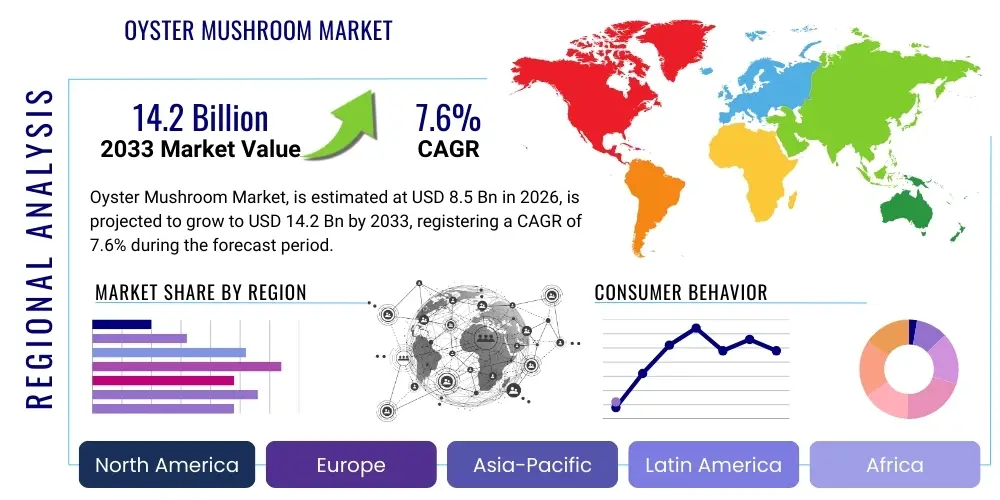

Oyster Mushroom Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438075 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Oyster Mushroom Market Size

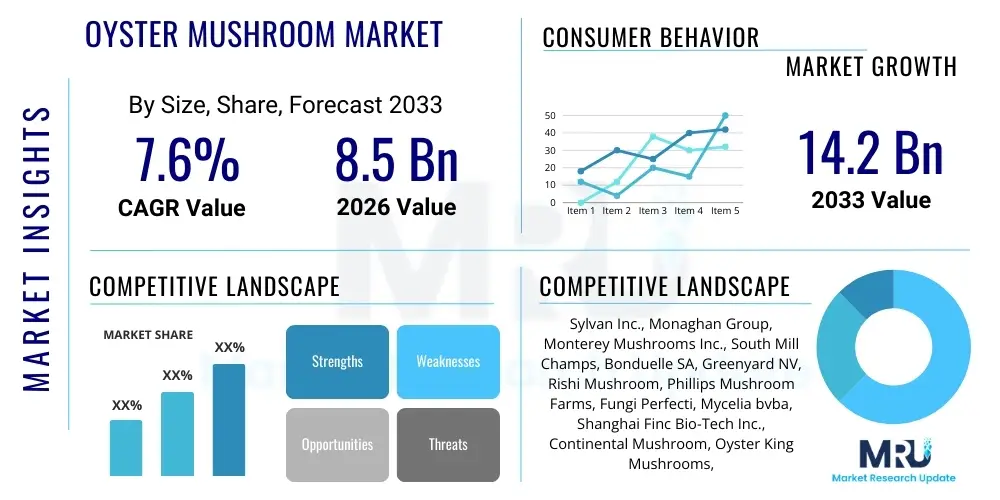

The Oyster Mushroom Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.6% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $14.2 Billion by the end of the forecast period in 2033.

Oyster Mushroom Market introduction

The Oyster Mushroom Market encompasses the global trade, cultivation, and consumption of various species of oyster mushrooms (genus Pleurotus). These fungi are highly valued globally for their distinct texture, delicate flavor, and significant nutritional profile, positioning them as a critical segment within the specialty food and functional food sectors. The product description highlights their characteristic fan-shaped cap and short or absent stem, growing naturally on dead and decaying wood, though commercially cultivated primarily on substrates like sawdust, straw, and agricultural waste. Major applications span fresh consumption, processed food products (including dried and powder forms), and utilization in the pharmaceutical and nutraceutical industries due to their high content of proteins, B vitamins, dietary fiber, and bioactive compounds like beta-glucans. The market's robust expansion is fundamentally driven by the escalating global demand for plant-based proteins and the increasing consumer awareness regarding the immune-boosting and cholesterol-lowering benefits attributed to medicinal mushrooms.

Oyster mushrooms are celebrated not only for their culinary versatility but also for their ecological efficiency, as their cultivation requires minimal resources and effectively repurposes agricultural byproducts, aligning perfectly with global sustainability trends. The primary benefits driving consumer adoption include their low caloric content coupled with a high density of essential nutrients and antioxidants, making them attractive to health-conscious consumers and those adhering to specific dietary regimes such as veganism or keto. Furthermore, technological advancements in controlled environment agriculture (CEA) and vertical farming methodologies have significantly improved yield predictability and reduced the cultivation cycle, ensuring a steady, high-quality supply throughout the year, independent of traditional seasonal constraints. These innovations are crucial for maintaining market momentum and addressing the rising consumption rates across developing and developed economies alike.

Key driving factors propelling the market forward include the rapid urbanization and concurrent shift in consumer dietary habits towards healthier, convenient foods. The increasing penetration of international cuisine in local markets, particularly Asian and European culinary traditions where oyster mushrooms are staples, further enhances demand. Moreover, sustained research demonstrating the pharmacological potential of oyster mushroom extracts in managing chronic diseases such as diabetes and hypertension is opening new, lucrative avenues in the functional ingredient space. Government support in various regions for sustainable agriculture and waste valorization, which directly benefits mushroom farming as a method of utilizing agro-waste, provides an enabling regulatory environment for continued market growth and capacity expansion.

Oyster Mushroom Market Executive Summary

The Oyster Mushroom Market exhibits strong growth momentum, underpinned by favorable business trends such as technological advancements in substrate sterilization and automated climate control systems, enabling large-scale, cost-efficient production across varied geographies. Business trends emphasize vertical integration among key players, from substrate preparation to retail distribution, ensuring stringent quality control and maximizing profit margins. Regional trends show Asia Pacific maintaining dominance, driven by deep-rooted cultural consumption patterns and extensive traditional cultivation infrastructure, while North America and Europe register the highest growth rates, fueled by the adoption of exotic mushrooms in mainstream diets and significant investment in sustainable indoor farming technologies. Segment trends highlight the fresh form segment’s superiority in terms of volume, although the processed segment (especially powders and extracts) is accelerating rapidly, primarily due to rising applications in nutraceuticals and dietary supplements, catering to the preventive healthcare movement globally. Overall, the market remains highly fragmented yet intensely competitive, with a discernible shift towards certified organic and specialty varieties like Pink and Yellow Oyster mushrooms to command premium pricing and capture niche consumer attention.

The competitive landscape is characterized by strategic alliances between established agricultural firms and specialized biotech companies aiming to optimize strain selection for yield and shelf-life enhancement. A significant trend observed is the commitment to sustainable practices, where producers are actively seeking certifications like organic and non-GMO, appealing directly to the environmentally conscious consumer base, particularly in Western markets. Furthermore, the expansion of e-commerce platforms and sophisticated cold chain logistics has significantly broadened the distribution reach, allowing high-perishability fresh products to access distant consumer bases swiftly. This modernization of the supply chain is critical to addressing the quality maintenance challenges inherent to mushroom logistics, thereby boosting consumer confidence and market penetration.

From a product diversification perspective, the market is experiencing increasing experimentation beyond the standard Grey Oyster mushroom. Specialty varieties such as King Oyster (Eryngii) are gaining traction due to their meaty texture and suitability as a vegan meat substitute, particularly within the burgeoning food service sector focused on innovative plant-forward menus. Segmentation analysis confirms that applications within the household consumer sector remain foundational, but the institutional food service segment—including hospitals, corporate cafeterias, and fine dining—is witnessing substantial purchasing growth, reflecting the broader acceptance and incorporation of oyster mushrooms as a nutritious and gourmet ingredient. These convergent trends—technological efficiency, sustainable sourcing, and product premiumization—are collectively sculpting the market trajectory towards higher value and greater operational sophistication globally.

AI Impact Analysis on Oyster Mushroom Market

User inquiries concerning AI's integration into the Oyster Mushroom Market predominantly revolve around optimizing cultivation efficiency, predicting disease outbreaks, and enhancing supply chain resilience. Users frequently ask how AI-driven climate control systems can increase yields (maximizing growth cycles and minimizing energy usage), whether machine learning can accurately detect early fungal contamination (reducing costly crop losses), and how predictive analytics can refine inventory management and shelf-life forecasting (improving profitability). The key themes emerging from this analysis confirm that stakeholders are primarily concerned with operational risk mitigation, precision agriculture implementation, and leveraging data for competitive advantage. There is a strong expectation that AI will transition mushroom farming from a labor-intensive, experience-driven practice to a data-centric, highly automated industrial process, necessitating specialized agricultural software and smart sensors.

The application of Artificial Intelligence within oyster mushroom cultivation promises a fundamental shift towards precision farming, moving beyond generalized environmental controls. AI systems, fed by high-frequency sensor data monitoring temperature, humidity, CO2 levels, and substrate moisture content, can dynamically adjust the growing environment in real-time, optimizing conditions for specific mushroom strains and growth phases. This level of granular control ensures peak biological efficiency, leading to higher yields per square meter and a reduced reliance on manual intervention. Furthermore, generative models are being explored to synthesize optimal substrate formulations based on localized agricultural waste availability, balancing nutritional content for the fungi with cost-effectiveness for the producer, thus enhancing both economic and environmental sustainability.

Beyond the farm gate, AI is proving transformative in managing the complexities of the oyster mushroom supply chain, particularly addressing the product’s inherent short shelf life and susceptibility to damage. Machine learning algorithms analyze historical sales data, seasonal variations, and external market factors to generate highly accurate demand forecasts, reducing overproduction and minimizing post-harvest losses. In logistics, AI optimizes cold chain routes and monitors product condition during transit using IoT sensors, immediately flagging anomalies that could compromise quality. This integration of predictive maintenance and intelligent logistics systems ensures that fresh oyster mushrooms arrive at the consumer in optimal condition, drastically cutting down spoilage and reinforcing brand reputation for quality and reliability.

- AI-driven climate control systems optimize environmental variables (humidity, temperature, CO2) dynamically, maximizing cultivation yields and reducing energy consumption.

- Machine learning algorithms enable early disease and pest detection through image recognition and spectroscopic analysis, significantly lowering contamination risks and chemical usage.

- Predictive analytics optimize substrate composition, utilizing localized agro-waste more effectively while ensuring the highest nutritional value for the fungal biomass.

- Demand forecasting using AI models enhances supply chain efficiency, reducing inventory holding costs and minimizing post-harvest waste due to overproduction or misallocation.

- Automated quality control systems utilize computer vision to grade mushrooms based on size, color, and physical integrity during processing, ensuring consistent product standards.

- Robotics guided by AI are increasingly used in delicate harvesting and packaging processes, mitigating labor shortages and reducing physical damage to the fragile fungi.

DRO & Impact Forces Of Oyster Mushroom Market

The Oyster Mushroom Market is primarily driven by the burgeoning global demand for healthy, sustainable, and functional foods, capitalizing on the mushroom's status as a high-protein, low-fat source rich in bioactive compounds. However, the market faces significant restraints, notably the short shelf life of fresh oyster mushrooms, which complicates long-distance logistics, requiring substantial investment in advanced cold chain infrastructure. Another critical restraint is the high initial capital expenditure required for setting up controlled environment farming facilities, which acts as a barrier to entry for smaller enterprises. Opportunities are abundant, centering on the vast potential of nutraceutical applications, the development of value-added products (like mushroom snacks and functional beverages), and geographical expansion into untapped consumer markets in Latin America and Africa. These factors converge to create a market environment where technological innovation and strategic investment in sustainable supply chain management will determine success and shape the competitive landscape.

The primary drivers encompass several interconnected socioeconomic shifts. The increasing prevalence of vegetarian and vegan diets globally necessitates readily available and palatable plant-based protein alternatives, a role perfectly filled by oyster mushrooms. Furthermore, rising disposable incomes in emerging economies are enabling consumers to purchase specialty food items, moving beyond staple vegetables. The technological driver is equally impactful; innovations in specialized substrates, utilizing materials like coffee grounds or recycled paper pellets, not only reduce cultivation costs but also enhance the sustainability narrative, making the product highly appealing to environmentally conscious consumers. These drivers exert a strong positive impact force, perpetually expanding the consumer base and increasing frequency of purchase.

Conversely, market growth is tempered by critical restraints that necessitate substantial operational mitigation strategies. The short duration of freshness necessitates air freight and highly specialized refrigerated transport, dramatically increasing the cost of goods sold, especially for international trade. This logistical fragility is compounded by the high susceptibility of mushroom crops to contamination from molds and pests, requiring rigorous sanitation protocols and continuous monitoring, thereby escalating operational complexity and overheads. Nevertheless, these restraints simultaneously give rise to significant opportunities, particularly in research and development aimed at extending shelf life through advanced packaging technologies (e.g., modified atmosphere packaging—MAP) and the breeding of strains naturally resistant to environmental stress and pathogens. Exploring these technological solutions is a high-priority opportunity for achieving market differentiation and sustained growth.

Segmentation Analysis

The Oyster Mushroom Market segmentation provides a granular view of demand patterns, identifying key growth areas based on type, form, application, and distribution channel. Segmentation by type differentiates common varieties like Pleurotus ostreatus (Grey Oyster), King Oyster, and Pink/Yellow varieties, each commanding different price points and market niche penetration. Segmentation by form—fresh versus processed (dried, powder, extracts)—reveals distinct trends between culinary consumption and industrial use in pharmaceuticals and supplements. Application segmentation critically divides the market between Household Consumption, Food Service (restaurants, catering), and Industrial/Nutraceutical use, reflecting the diverse utility of the mushroom. Analyzing these segments is essential for strategic market entry and resource allocation for producers aiming to maximize returns by catering precisely to specific consumer needs and channel requirements.

Analysis of the Type segment shows that Grey Oyster mushrooms dominate in volume due to their ease of cultivation and broad consumer acceptance, serving as the foundational commodity product. However, the King Oyster mushroom segment is rapidly gaining market value, often commanding a premium price due to its superior texture and size, making it a favorite in high-end culinary applications and specialized vegan recipes. The shift towards exotic varieties suggests a maturing market where consumers are increasingly seeking sensory novelty and greater culinary versatility, compelling producers to diversify their genetic stock and cultivation practices to accommodate these specialized demands.

The Form segmentation highlights the divergence between immediate consumption and functional use. While fresh mushrooms remain the largest revenue generator, the processed segment is experiencing the highest CAGR, propelled by the booming functional food industry. Oyster mushroom powder, valued for its concentrated beta-glucans and convenience, is integrated into protein shakes, health bars, and encapsulated supplements. This growth signifies a transition in market value from pure agricultural commodity to a specialized industrial ingredient, requiring advanced processing capabilities, including freeze-drying and standardized extraction techniques, to ensure potency and purity for pharmaceutical-grade applications.

- By Type:

- Grey Oyster Mushroom (Pleurotus ostreatus)

- King Oyster Mushroom (Pleurotus eryngii)

- Pink Oyster Mushroom (Pleurotus djamor)

- Yellow Oyster Mushroom (Pleurotus citrinopileatus)

- Other Species

- By Form:

- Fresh

- Processed

- Dried

- Powder/Flour

- Extracts

- By Application:

- Food Service (Hotels, Restaurants, Cafes)

- Household/Retail Consumption

- Industrial Use (Nutraceuticals & Pharmaceuticals)

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- Direct Sales (Farm-to-Consumer)

Value Chain Analysis For Oyster Mushroom Market

The value chain for the Oyster Mushroom Market is intensive and highly susceptible to variations in raw material quality and post-harvest handling efficiency. The upstream segment is dominated by the sourcing and preparation of cultivation substrates, which typically involves agricultural byproducts like straw, sawdust, or cottonseed hulls, along with supplement materials like gypsum and bran. Efficient management of this upstream phase, including proper sterilization techniques and quality control of the spawn (mycelium), is paramount for maximizing yield and minimizing contamination risks. The downstream activities focus heavily on processing, packaging, and cold chain logistics, which are critical given the product's short shelf life. The distribution channel structure is multi-layered, encompassing direct sales, conventional retail channels (supermarkets), and specialized B2B distribution for the food service and nutraceutical industries, demanding highly specialized transportation and storage facilities.

The upstream process begins with spawn production, a highly specialized, controlled biotechnology process requiring sterile labs and quality-tested parent cultures. Following this, the preparation and sterilization of the substrate are crucial and often represent the largest variable cost component, dependent on local availability and processing complexity. Advances in cultivation technology, such as automated bagging and controlled climate rooms, enhance efficiency at this stage. Integration within the value chain often sees large producers managing both substrate and spawn production in-house to secure consistency and proprietary genetic strains. This high degree of technical dependency at the initial stages highlights the necessity of specialized expertise and significant capital investment to ensure a reliable, high-yield product output capable of meeting commercial demands.

Downstream activities involve rapid harvesting, typically done manually to prevent bruising, followed by immediate chilling and packaging. Direct and indirect distribution routes cater to distinct end-users. Direct sales, often via farmers' markets or dedicated online portals, cater to premium, local consumers seeking the freshest product, yielding higher margins but limiting scalability. Indirect distribution, leveraging major retailers and wholesale distributors, necessitates robust quality agreements and efficient cold chain management to handle large volumes and extended transportation distances. The increasing importance of the nutraceutical segment requires an additional layer of processing (drying, extraction) and certification compliance, making the downstream segment highly diverse and requiring tailored logistical solutions for each product form.

Oyster Mushroom Market Potential Customers

The primary end-users and buyers of oyster mushrooms span three major categories: individual consumers (Household), institutional purchasers (Food Service), and industrial buyers (Nutraceutical and Pharmaceutical sectors). Household consumers, particularly those focused on healthy eating, plant-based diets, and gourmet cooking, are the largest volume purchasers of fresh mushrooms via retail channels. The Food Service industry, including high-end restaurants, corporate caterers, and institutional kitchens, values oyster mushrooms for their culinary versatility and ability to function as a premium ingredient or meat substitute. Industrial buyers represent the fastest-growing segment, utilizing mushroom extracts and powders as functional ingredients in dietary supplements, due to established research validating their health benefits, thereby creating a sustained, high-value demand for processed forms.

Within the Household segment, millennials and Generation Z are particularly influential customers, often driving demand for specialty and ethically sourced products, preferring organic or locally grown options. These consumers often utilize online retail channels and seek products with clear labeling regarding sustainability and nutritional claims. Their purchasing decisions are highly sensitive to social media trends and dietary recommendations emphasizing immune support and gut health, areas where oyster mushrooms are particularly well-positioned due to their fiber and beta-glucan content. Catering to this segment requires effective digital marketing and transparency in sourcing and cultivation methods.

The industrial customer base, comprising nutraceutical manufacturers and compounding pharmacies, necessitates consistent supply volumes and standardized extracts. These buyers demand products meeting strict regulatory standards (e.g., GMP certifications), focusing intensely on the concentration of active compounds, such as polysaccharides and triterpenoids. The relationship with these industrial clients is typically long-term and contract-based, rewarding suppliers who can ensure purity, traceability, and consistency across batches. The growth of this segment signifies a substantial opportunity for producers willing to invest in advanced extraction and quality assurance technologies, moving the market value proposition significantly up the technological scale.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $14.2 Billion |

| Growth Rate | 7.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sylvan Inc., Monaghan Group, Monterey Mushrooms Inc., South Mill Champs, Bonduelle SA, Greenyard NV, Rishi Mushroom, Phillips Mushroom Farms, Fungi Perfecti, Mycelia bvba, Shanghai Finc Bio-Tech Inc., Continental Mushroom, Oyster King Mushrooms, Modern Mushroom Farms, Agro Dutch Industries Ltd., Weikfield, Fujian Xianzhilou Biological Science and Technology Co., Ltd., Scelta Mushrooms, Oakshire Mushroom Farm, Highline Mushrooms. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oyster Mushroom Market Key Technology Landscape

The technological landscape in the Oyster Mushroom Market is rapidly advancing, moving away from traditional labor-intensive outdoor farming towards sophisticated, controlled environment agriculture (CEA) systems. Central to this technological shift is the adoption of automated climate control systems, utilizing IoT sensors and computerized feedback loops to precisely manage temperature, humidity, ventilation, and CO2 levels throughout the cultivation cycle. These systems are crucial for optimizing growth parameters, especially during the critical pinning and fruiting stages, leading to standardized quality and predictable yields, which is paramount for industrial buyers. Furthermore, innovations in substrate preparation, including high-pressure steam sterilization and specialized composting techniques, ensure the microbiological purity of the growing medium, drastically reducing crop loss due to competing fungi and bacteria, thereby enhancing operational reliability and sustainability within the entire production cycle.

Another significant technological advancement involves genetic selection and spawn production. Biotechnological firms are continually isolating and breeding proprietary strains of Pleurotus species to enhance desirable traits such as faster colonization, higher biological efficiency (yield relative to substrate mass), improved nutritional content (e.g., higher beta-glucan concentration), and crucially, extended post-harvest shelf life. This scientific approach to strain optimization directly addresses the market's primary logistical challenge—perishability—and opens doors for premium product positioning. The implementation of vertical farming structures, often integrated with hydroponic or aeroponic principles (though adjusted for fungi), maximizes space utilization, making production viable in urban or constrained environments and shortening the farm-to-table distance.

Post-harvest technology is equally critical, focusing heavily on preservation and processing. Modified Atmosphere Packaging (MAP) technology is becoming standard practice, altering the internal gas composition of packaging to slow down the fungal respiratory rate, thereby significantly extending freshness and reducing spoilage during transit. For the processed segment, advanced drying technologies like vacuum freeze-drying are employed to preserve the bioactive compounds and sensory properties of the mushrooms, essential for high-value nutraceutical applications where ingredient integrity is non-negotiable. The integration of robotics in harvesting and packaging, though nascent, represents a future technology aimed at lowering labor costs and ensuring delicate handling of the fragile produce, signaling the industry’s long-term commitment to automation and precision agriculture techniques across the entire supply chain footprint.

Regional Highlights

The Oyster Mushroom Market exhibits strong regional disparities in terms of production volume, consumption patterns, and technological maturity. Asia Pacific (APAC) dominates the global market, accounting for the largest share in both production and consumption, driven primarily by China, which is the world's leading producer of specialty mushrooms, including oyster varieties. The region benefits from traditional culinary incorporation of mushrooms, vast agricultural resources providing affordable substrates, and established large-scale, often decentralized, cultivation practices. Governments in countries like China, South Korea, and Japan actively support mushroom farming through subsidies and research grants, recognizing its role in rural economic development and sustainable agriculture. While APAC leads in volume, production methods can sometimes lag behind Western standards in terms of environmental control and certification, offering a growth opportunity for modern, CEA-focused entrants.

North America and Europe represent the fastest-growing regional markets, characterized by high per capita consumption value and a preference for organically certified and locally sourced products. In these regions, growth is fueled by sophisticated consumer demand for functional foods and the rise of the specialized food service industry utilizing gourmet mushroom varieties. European countries, particularly the Netherlands, Poland, and the UK, have heavily invested in high-tech, vertically integrated indoor farms, minimizing transportation costs and maximizing product freshness. The regulatory environment in Europe is stringent regarding food safety and traceability, which necessitates advanced cultivation and quality assurance technologies, thereby favoring large, technologically adept producers who can meet these exacting standards consistently.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but offer substantial untapped growth potential. In Latin America, Brazil and Mexico are emerging as significant producers, driven by favorable climates in certain regions and a growing awareness of nutritional benefits. The MEA region, particularly South Africa and UAE, is witnessing increasing localized production, largely driven by food security initiatives and the necessity of cultivating high-value crops in controlled environments due to arid conditions. While infrastructural limitations, such as inconsistent cold chain logistics, pose challenges, the rising health consciousness among the urban middle class in these regions is expected to stimulate demand for both locally grown and imported processed oyster mushroom products over the forecast period, making them critical targets for future market expansion strategies.

- Asia Pacific (APAC): Dominates the market in volume; driven by China, cultural integration into local cuisine, and large traditional cultivation infrastructure. High growth in health supplement applications in Japan and South Korea.

- North America: Rapid growth fueled by increased demand for vegan and specialty ingredients; significant investment in high-tech indoor vertical farming systems (CEA) to ensure year-round supply and premium quality.

- Europe: High adoption of organic certification; strong market for processed extracts in the nutraceutical industry; strict regulatory environment driving technological improvements in traceability and safety.

- Latin America: Emerging market with increasing awareness of functional food benefits; expansion of cultivation in countries like Brazil and Mexico utilizing local agricultural waste.

- Middle East and Africa (MEA): Growth centered around food security and controlled environment agriculture projects, particularly in urban centers of UAE and South Africa; nascent but expanding consumer base for health-focused products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oyster Mushroom Market.- Sylvan Inc.

- Monaghan Group

- Monterey Mushrooms Inc.

- South Mill Champs

- Bonduelle SA

- Greenyard NV

- Rishi Mushroom

- Phillips Mushroom Farms

- Fungi Perfecti

- Mycelia bvba

- Shanghai Finc Bio-Tech Inc.

- Continental Mushroom

- Oyster King Mushrooms

- Modern Mushroom Farms

- Agro Dutch Industries Ltd.

- Weikfield

- Fujian Xianzhilou Biological Science and Technology Co., Ltd.

- Scelta Mushrooms

- Oakshire Mushroom Farm

- Highline Mushrooms

Frequently Asked Questions

Analyze common user questions about the Oyster Mushroom market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Oyster Mushroom Market?

The market is primarily driven by the escalating global consumer shift toward plant-based, nutritious, and functional foods, coupled with increased awareness of oyster mushrooms' high protein content and immune-boosting beta-glucans, appealing to health-conscious consumers worldwide.

Which geographical region dominates the global oyster mushroom production and why?

Asia Pacific (APAC), particularly China, dominates the global market due to established traditional consumption patterns, extensive and cost-effective cultivation infrastructure, and favorable policies supporting agricultural growth and substrate sourcing from local agricultural byproducts.

What are the major challenges related to the distribution and logistics of fresh oyster mushrooms?

The main challenge is the inherent short shelf life and fragility of fresh oyster mushrooms, necessitating immediate chilling, significant investment in specialized, expensive cold chain logistics, and the use of technologies like Modified Atmosphere Packaging (MAP) to minimize spoilage during long-distance transit.

How is technology impacting the efficiency of oyster mushroom cultivation?

Technology, specifically Controlled Environment Agriculture (CEA) and IoT-enabled monitoring, is crucial for standardizing quality and maximizing yield. Automated systems precisely control environmental parameters (temperature, humidity, CO2), transitioning cultivation from an experience-based practice to a data-driven, highly efficient industrial process.

Beyond culinary use, what are the most significant high-growth applications for processed oyster mushrooms?

The most significant high-growth applications are in the nutraceutical and pharmaceutical sectors. Processed forms, such as powders and extracts, are highly valued for their concentrated bioactive compounds (beta-glucans), utilized in dietary supplements and functional foods aimed at improving immune health and managing chronic conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager