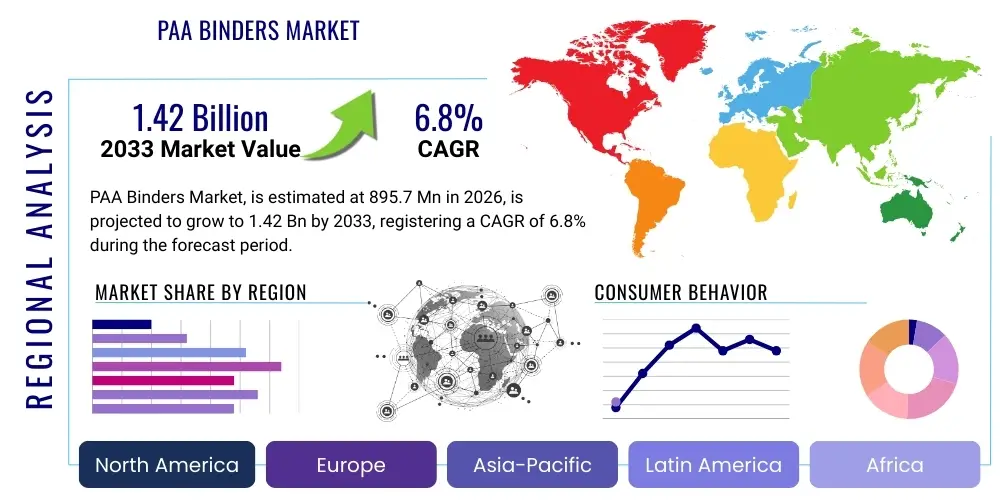

PAA Binders Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440018 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

PAA Binders Market Size

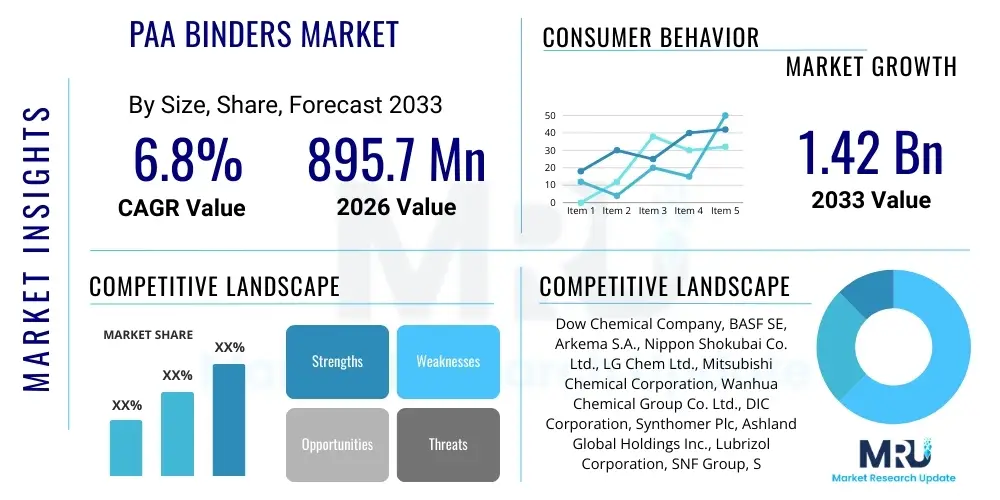

The PAA Binders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 895.7 Million in 2026 and is projected to reach USD 1.42 Billion by the end of the forecast period in 2033.

PAA Binders Market introduction

The PAA Binders market, primarily driven by the versatility of polyacrylic acid and its copolymers, encompasses a broad spectrum of industrial applications where superior binding, dispersion, and rheological properties are crucial. Polyacrylic acid (PAA) binders are synthetic polymers celebrated for their excellent film-forming capabilities, thermal stability, and strong adhesion to various substrates. These polymers are derived from acrylic acid monomers and can be tailored through copolymerization to achieve specific performance characteristics, making them indispensable across diverse sectors. Their chemical structure allows for high water solubility and interaction with metal ions, underpinning their efficacy in complex chemical systems.

Major applications of PAA binders span across industries such as detergents and cleaning agents, where they function as effective dispersants and anti-redeposition agents, preventing the reattachment of soil to surfaces. In water treatment, they are vital scale inhibitors and dispersants, crucial for maintaining system efficiency in cooling towers and boilers. The construction sector leverages PAA binders in cement additives, mortars, and tile adhesives to enhance workability, adhesion strength, and durability. Furthermore, the paints and coatings industry utilizes PAA binders for their excellent binding properties, contributing to improved film formation, gloss, and weather resistance. The textile industry employs them as sizing agents and printing thickeners, while the paper and pulp sector benefits from their role as retention aids and strength enhancers.

The benefits derived from PAA binders are extensive, including enhanced product performance, increased operational efficiency, and cost-effectiveness in numerous industrial processes. Their ability to effectively disperse solid particles, inhibit scale formation, and provide strong adhesive bonds makes them a preferred choice over many conventional alternatives. Key driving factors propelling the growth of this market include the global expansion of the construction industry, particularly in emerging economies, the escalating demand for advanced water treatment solutions due to increasing water scarcity and environmental regulations, and the continuous innovation in detergent and cleaning formulations requiring higher performance additives. Additionally, the growing focus on sustainable and efficient industrial processes further fuels the adoption of PAA binders, as manufacturers seek materials that offer improved functionality with minimal environmental impact.

PAA Binders Market Executive Summary

The PAA Binders market is experiencing robust growth, propelled by a confluence of evolving business trends, significant regional dynamics, and diversified segmentation trends. From a business perspective, manufacturers are increasingly focusing on research and development to introduce innovative PAA binder formulations that offer enhanced performance, biodegradability, and compliance with stringent environmental regulations. There is a notable trend towards customization, where suppliers work closely with end-users to develop tailored solutions for specific application challenges, thereby fostering stronger client relationships and market penetration. Furthermore, strategic partnerships and collaborations among market players, including mergers and acquisitions, are becoming common strategies to consolidate market share, expand geographical reach, and leverage synergistic technological capabilities. The integration of advanced manufacturing technologies, such as continuous processing and automation, is also gaining traction, aiming to improve production efficiency, reduce costs, and ensure consistent product quality.

Regionally, the Asia Pacific continues to emerge as the dominant and fastest-growing market for PAA binders, primarily driven by rapid industrialization, burgeoning construction activities, and increasing investment in water treatment infrastructure in countries like China and India. North America and Europe represent mature markets characterized by a strong emphasis on specialty chemicals, sustainability, and technological advancements, where demand is largely influenced by regulatory frameworks and the adoption of high-performance, eco-friendly products. Latin America and the Middle East & Africa regions are also witnessing steady growth, fueled by urbanization, infrastructure development, and rising industrial output, particularly in sectors such as oil and gas, mining, and agriculture, which require effective water management and processing chemicals. Each region presents unique market dynamics, consumer preferences, and regulatory landscapes that shape the demand and supply patterns of PAA binders.

Segmentation trends within the PAA Binders market highlight significant shifts towards specific product types and application areas. Demand for PAA copolymers, which offer superior performance characteristics over homopolymers, is on the rise due to their enhanced stability, dispersancy, and binding capabilities tailored for complex industrial processes. Application-wise, the water treatment and construction sectors are consistently demonstrating high growth, driven by global concerns over water scarcity and the ever-present need for durable infrastructure. The paints and coatings segment is also experiencing steady demand, spurred by advancements in architectural and industrial coatings requiring improved adhesion and film properties. End-user industries are increasingly seeking PAA binders that contribute to the circular economy, focusing on materials that offer long-term performance and facilitate recycling or reuse. This multi-faceted growth across business, regional, and segmentation fronts underscores the dynamic and expansive nature of the PAA Binders market.

AI Impact Analysis on PAA Binders Market

The advent of Artificial Intelligence (AI) is poised to significantly transform the PAA Binders market, addressing critical user questions regarding efficiency, innovation, and sustainability. Common user inquiries revolve around how AI can accelerate the discovery of novel PAA binder formulations with enhanced properties, optimize manufacturing processes to reduce waste and energy consumption, and improve the predictive capabilities for market demand and supply chain management. There's also a strong interest in AI's role in developing more sustainable and biodegradable PAA binders, ensuring compliance with evolving environmental regulations, and personalizing product offerings to meet specific client needs. Users are keenly looking for solutions that can minimize formulation development time, predict material performance under various conditions, and streamline quality control, ultimately leading to cost reductions and faster market entry for innovative products.

AI's influence in the PAA Binders market is multifaceted, offering unprecedented opportunities for optimization and innovation across the entire value chain. In research and development, AI-driven platforms can analyze vast datasets of chemical compounds and experimental results to predict the properties of new PAA binder formulations, thereby significantly reducing the time and cost associated with traditional trial-and-error methods. This accelerates the identification of binders with superior performance characteristics, such as enhanced adhesion, improved thermal stability, or specific rheological profiles, allowing for rapid iteration and refinement of product designs. Furthermore, machine learning algorithms can model complex interactions between PAA binders and various substrates, predicting optimal concentrations and application methods, which is invaluable for diverse end-use industries like construction and coatings. This capability helps manufacturers tailor products precisely to customer requirements, minimizing material waste and maximizing performance.

Beyond formulation, AI is revolutionizing manufacturing processes for PAA binders by enabling real-time process monitoring, predictive maintenance, and quality control. AI-powered sensors and analytics can detect subtle deviations in production parameters, allowing for immediate adjustments to maintain optimal conditions, prevent defects, and ensure batch consistency. This leads to higher yields, reduced operational downtime, and improved product quality, directly impacting the bottom line. In supply chain management, AI algorithms can forecast demand more accurately by analyzing historical data, market trends, and external factors, optimizing inventory levels and logistics. This minimizes carrying costs and ensures timely delivery of raw materials and finished products. Moreover, AI is instrumental in advancing sustainability initiatives by facilitating the design of greener PAA binders, optimizing resource utilization, and identifying opportunities for waste reduction and recycling throughout the product lifecycle, aligning with global environmental objectives and consumer preferences for eco-friendly solutions.

- Accelerated R&D and Formulation Discovery: AI algorithms analyze vast chemical databases, predicting optimal PAA binder formulations and properties, significantly reducing development time and costs.

- Optimized Manufacturing Processes: Real-time monitoring and predictive analytics improve production efficiency, quality control, reduce energy consumption, and minimize waste.

- Enhanced Quality Control: AI vision systems and data analytics ensure consistent product quality, detecting anomalies and deviations with high precision.

- Predictive Maintenance: AI identifies potential equipment failures in production lines before they occur, minimizing downtime and maintenance costs.

- Supply Chain Optimization: AI-driven demand forecasting and logistics management streamline inventory, reduce lead times, and improve overall supply chain resilience.

- Sustainable Product Development: AI assists in designing eco-friendly PAA binders, optimizing raw material use, and reducing environmental impact by simulating greener synthesis pathways.

- Personalized Product Customization: AI enables manufacturers to quickly develop tailored PAA binder solutions for specific customer requirements and applications.

- Market Trend Analysis: AI tools provide insights into emerging market demands, competitive landscapes, and regulatory changes, guiding strategic business decisions.

DRO & Impact Forces Of PAA Binders Market

The PAA Binders market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, collectively shaping its trajectory and competitive landscape. These impact forces are crucial for understanding the market's current state and its future growth potential. Key drivers include the escalating demand from end-use industries such as construction, water treatment, and detergents, which are experiencing robust growth globally. The inherent properties of PAA binders, such as their excellent dispersing, binding, and scale inhibiting capabilities, make them indispensable in these sectors, ensuring high performance and efficiency in various applications. Furthermore, the increasing focus on water conservation and the need for effective industrial water management solutions are boosting the adoption of PAA-based scale inhibitors and dispersants, particularly in regions facing severe water scarcity. The continuous innovation in product formulations, leading to the development of more efficient and environmentally friendly PAA binders, also acts as a significant market driver.

However, the market also faces several notable restraints that could temper its growth. The volatility in raw material prices, particularly for acrylic acid, which is a petroleum-derived product, poses a significant challenge for manufacturers, impacting production costs and profit margins. Geopolitical instabilities and supply chain disruptions can exacerbate these price fluctuations, making it difficult for companies to maintain stable pricing strategies. Additionally, stringent environmental regulations regarding the use of certain chemicals and the push towards sustainable alternatives can sometimes restrict the adoption of conventional PAA binders, particularly those with higher environmental footprints. Competition from alternative binding agents and dispersants, including natural polymers and other synthetic chemistries, also presents a restraint, compelling PAA binder manufacturers to continuously innovate and demonstrate superior performance-to-cost ratios.

Despite these challenges, substantial opportunities exist within the PAA Binders market that promise to fuel future expansion. The growing demand for biodegradable and bio-based PAA binders presents a lucrative avenue for market players to develop and commercialize sustainable solutions that align with global environmental goals and consumer preferences. Expanding into emerging markets, particularly in Asia Pacific and Latin America, where industrialization and infrastructure development are on the rise, offers significant growth potential. Moreover, advancements in nanotechnology and polymer science can lead to the development of novel PAA binder formulations with enhanced properties, opening up new application areas in high-performance materials. Strategic collaborations, technological advancements in production processes, and the optimization of supply chain networks are also key opportunities that market participants can leverage to strengthen their positions and capitalize on the evolving needs of end-user industries.

- Drivers:

- Rising demand from construction industry for enhanced concrete admixtures and adhesives.

- Increasing need for effective water treatment solutions, including scale inhibitors and dispersants.

- Growing consumption in detergents and cleaning agents for superior stain removal and anti-redeposition.

- Technological advancements leading to high-performance and eco-friendly PAA binder formulations.

- Expansion of the paints and coatings industry requiring improved adhesion and film properties.

- Increased industrial output globally, particularly in emerging economies.

- Restraints:

- Volatility in raw material prices (e.g., acrylic acid) impacting production costs.

- Stringent environmental regulations on chemical usage and waste disposal.

- Competition from alternative binders and dispersants.

- High capital investment required for research and development of advanced PAA binders.

- Supply chain disruptions due to geopolitical factors or natural disasters.

- Opportunities:

- Development and commercialization of bio-based and biodegradable PAA binders.

- Untapped potential in emerging markets due to rapid industrialization and urbanization.

- Innovation in niche applications, such as specialized textiles, agriculture, and oilfield chemicals.

- Strategic collaborations and partnerships for technological advancements and market expansion.

- Adoption of smart manufacturing and AI-driven processes for optimized production.

- Impact Forces:

- Environmental Regulations: Drives innovation towards greener formulations but can also restrict market for conventional types.

- Technological Advancements: Creates new opportunities for superior products and applications, intensifying competition.

- Raw Material Dynamics: Directly influences production costs and market pricing strategies, impacting profitability.

- End-Use Industry Growth: Directly correlates with demand for PAA binders, especially in construction and water treatment.

- Sustainability Initiatives: Pushes manufacturers towards eco-friendly solutions, opening new market segments.

Segmentation Analysis

The PAA Binders market is strategically segmented to provide a granular understanding of its diverse components, allowing for targeted market analysis and strategic planning. These segmentations typically include classifications based on product type, application, and end-use industry, each revealing distinct growth drivers, competitive landscapes, and customer preferences. Analyzing these segments helps stakeholders identify high-growth areas, emerging trends, and potential challenges within specific niches of the market. The versatility of PAA binders allows them to be customized for various performance requirements, making segmentation crucial for both manufacturers and consumers seeking specialized solutions. This detailed breakdown enables market participants to fine-tune their product portfolios, marketing strategies, and distribution channels to maximize their impact and capitalize on specific opportunities.

- By Product Type:

- PAA Homopolymers: Basic polyacrylic acid polymers, widely used for general binding and dispersing applications due to their cost-effectiveness and broad utility. They form the foundational segment of the market, offering consistent performance in less demanding environments.

- PAA Copolymers: Modified polyacrylic acid polymers synthesized with other monomers (e.g., maleic acid, acrylamide, sulfonated monomers) to enhance specific properties like thermal stability, salt tolerance, dispersancy, or adhesion. This segment is experiencing faster growth due to the demand for specialized, high-performance binders in advanced applications.

- Modified PAA Binders: Further functionalized or cross-linked PAA derivatives designed for niche applications requiring superior performance characteristics such as extreme pH stability, enhanced biodegradability, or specific rheological profiles. This segment represents the forefront of innovation within the market.

- By Application:

- Detergents & Cleaners: Used as dispersants to prevent redeposition of soil, scale inhibitors, and rheology modifiers in laundry detergents, dishwashing liquids, and industrial cleaning formulations. This is a mature but consistently growing segment.

- Water Treatment: Crucial for scale inhibition, sludge dispersion, and corrosion control in industrial cooling systems, boilers, and municipal water treatment plants. This segment is driven by increasing environmental regulations and water scarcity concerns.

- Paints & Coatings: Employed as thickeners, dispersants, and binders to improve film formation, adhesion, gloss, and rheological properties in architectural, industrial, and automotive coatings. This segment benefits from construction and infrastructure development.

- Adhesives & Sealants: Utilized to enhance bond strength, flexibility, and water resistance in various adhesive and sealant formulations for construction, packaging, and automotive industries.

- Textiles: Used as sizing agents to improve yarn strength, printing thickeners, and dye auxiliaries. The demand is influenced by the global textile production and innovation in fabric processing.

- Paper & Pulp: Function as retention aids, drainage aids, and strength additives to improve paper quality and production efficiency.

- Construction Chemicals: Integrated into cement admixtures, tile adhesives, grouts, and repair mortars to enhance workability, durability, and adhesion. This is a major growth driver.

- Agriculture: Applied in soil conditioning, controlled-release fertilizers, and pesticide formulations to improve nutrient uptake and reduce environmental impact.

- Others (Oil & Gas, Mining, Personal Care): Niche applications where PAA binders provide specific functionalities such as fluid loss control in drilling, mineral processing aids, or rheology modification in cosmetics.

- By End-Use Industry:

- Consumer Goods: Includes detergents, personal care products, and household cleaners, driven by consumer spending and evolving product preferences.

- Industrial: Encompasses water treatment, textiles, paper & pulp, and industrial coatings, influenced by manufacturing output and regulatory compliance.

- Construction: Directly linked to global infrastructure development, residential, and commercial construction activities, making it a significant and stable segment.

- Automotive: Used in coatings, adhesives, and sealants for vehicle manufacturing and repair, driven by global automotive production trends.

- Agriculture: Focuses on enhancing crop yield and soil health, an emerging but growing segment.

Value Chain Analysis For PAA Binders Market

A comprehensive value chain analysis of the PAA Binders market provides crucial insights into the entire lifecycle of the product, from raw material sourcing to end-user consumption. This analysis delineates the various stages and stakeholders involved, highlighting areas of value addition, cost accumulation, and potential for optimization. Understanding the upstream processes, including the procurement of essential raw materials, is fundamental to assessing supply chain stability and cost structures. The subsequent manufacturing and production phases transform these raw materials into finished PAA binders, involving complex chemical synthesis and quality control measures. Downstream activities focus on distribution, marketing, and sales to reach diverse end-use industries, with both direct and indirect channels playing pivotal roles in market penetration and customer engagement. Each stage presents opportunities for innovation, efficiency improvements, and strategic partnerships, collectively contributing to the overall value proposition of PAA binders in the market.

Upstream analysis in the PAA Binders value chain begins with the sourcing of primary raw materials, predominantly acrylic acid. Acrylic acid is derived from propylene, which is a petrochemical product. Key suppliers in this segment include major chemical companies that produce acrylic acid and its esters. The stability of these raw material supplies and their price volatility significantly impact the production costs of PAA binders. Manufacturers often engage in long-term contracts or vertical integration to mitigate risks associated with raw material fluctuations. Other essential inputs include initiators, chain transfer agents, and solvents, all of which must meet stringent quality standards to ensure the performance and purity of the final PAA binder product. Research and development activities at this stage focus on developing sustainable raw material sources or more efficient synthesis routes to reduce environmental footprint and production expenses. Collaborative efforts with raw material suppliers can lead to innovations in feedstock production, enhancing the overall resilience and sustainability of the value chain.

The downstream analysis primarily concerns the distribution and sales channels through which PAA binders reach their diverse end-user industries. This involves a complex network of direct sales, distributors, and agents. Direct sales are often utilized for large-volume customers and specialized applications where technical support and customized solutions are critical. This allows for direct engagement with clients, fostering stronger relationships and enabling immediate feedback for product development. Indirect channels, primarily through local and regional distributors, are vital for reaching smaller customers, niche markets, and geographical areas where direct presence is not feasible. These distributors often provide warehousing, logistics, and localized technical support, extending the market reach of PAA binder manufacturers. The choice between direct and indirect channels depends on factors such as market size, customer concentration, product complexity, and the level of technical service required. Effective management of these distribution channels ensures efficient market penetration, timely product delivery, and robust customer service, all of which are critical for maintaining a competitive edge in the PAA Binders market. Strategic optimization of these channels can reduce lead times, improve inventory management, and enhance overall market responsiveness.

PAA Binders Market Potential Customers

The PAA Binders market serves a broad and diverse range of potential customers across various industries, each utilizing these versatile polymers for their distinct functional properties. Identifying these end-users and their specific needs is paramount for manufacturers to tailor their product offerings, develop targeted marketing strategies, and optimize distribution networks. Essentially, potential customers are any entities or businesses that require high-performance binding, dispersing, thickening, or scale-inhibiting agents in their manufacturing processes or product formulations. These customers span from large multinational corporations to specialized regional manufacturers, all seeking to enhance the efficiency, durability, and performance of their end products through the incorporation of PAA binders. Understanding the diverse applications and specific requirements of these customer segments is crucial for sustainable market growth and product innovation.

One of the largest segments of potential customers for PAA binders comprises manufacturers within the detergents and cleaning industry. These include producers of laundry detergents, automatic dishwashing detergents, industrial and institutional cleaners, and household cleaning products. For these customers, PAA binders are indispensable as dispersants, anti-redeposition agents, and scale inhibitors, ensuring effective cleaning performance and preventing mineral buildup. The water treatment sector also represents a significant customer base, including municipal water treatment plants, industrial facilities (power plants, refineries, chemical processing plants) that operate cooling towers and boilers, and companies specializing in desalination and wastewater treatment. These customers rely on PAA binders for their exceptional ability to inhibit scale formation, disperse suspended solids, and prevent corrosion, thereby extending the lifespan of equipment and improving operational efficiency.

Furthermore, the construction industry is a major consumer of PAA binders, with customers ranging from cement and concrete manufacturers to producers of tile adhesives, grouts, and repair mortars. In this sector, PAA binders enhance workability, improve adhesion strength, reduce water demand, and increase the overall durability of building materials. The paints and coatings industry also forms a substantial customer segment, including manufacturers of architectural paints, industrial coatings, automotive coatings, and specialty finishes. These customers use PAA binders as rheology modifiers, dispersants, and primary binders to improve film formation, gloss retention, and adhesion to various substrates. Other notable potential customers include companies in the textile industry (for sizing agents and printing pastes), the paper and pulp sector (for retention aids and strength enhancers), and various niche markets like agriculture (for soil conditioners and controlled-release formulations) and oilfield chemicals (for drilling fluid additives). Each of these customer groups has specific technical requirements and performance expectations that PAA binder manufacturers must address to capture and retain market share effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 895.7 Million |

| Market Forecast in 2033 | USD 1.42 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Chemical Company, BASF SE, Arkema S.A., Nippon Shokubai Co. Ltd., LG Chem Ltd., Mitsubishi Chemical Corporation, Wanhua Chemical Group Co. Ltd., DIC Corporation, Synthomer Plc, Ashland Global Holdings Inc., Lubrizol Corporation, SNF Group, Solvay S.A., Sumitomo Seika Chemicals Co. Ltd., Celanese Corporation, Gelest Inc., Kemira Oyj, Kuraray Co. Ltd., Sekisui Chemical Co. Ltd., Evonik Industries AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PAA Binders Market Key Technology Landscape

The PAA Binders market is characterized by a dynamic and evolving technology landscape, continuously driven by the need for enhanced performance, cost efficiency, and environmental sustainability. The core technology revolves around the polymerization of acrylic acid and its co-monomers to synthesize various PAA derivatives. This process involves precise control over reaction conditions, including temperature, pressure, monomer concentration, initiator type, and chain transfer agents, to achieve desired molecular weight, architecture, and functional properties. Advanced polymerization techniques, such as emulsion polymerization, solution polymerization, and suspension polymerization, are routinely employed to produce PAA binders in different physical forms (e.g., powders, liquids, emulsions) to suit diverse application requirements. The ability to fine-tune these parameters is crucial for tailoring PAA binders for specific end-use applications, from high-performance dispersants to strong adhesive components.

Recent technological advancements in the PAA Binders market are largely focused on creating more sustainable and high-performance products. One significant area of innovation is the development of bio-based PAA binders, which utilize renewable feedstocks instead of traditional petroleum-derived acrylic acid. This aligns with global efforts to reduce carbon footprint and enhance product biodegradability. Research is also actively exploring novel copolymerization techniques to introduce new functional groups or modify the polymer backbone, thereby imparting unique properties such as improved salt tolerance, enhanced thermal stability, or superior rheological control for challenging environments. For instance, the incorporation of sulfonated monomers can significantly improve the dispersancy and scale inhibition properties of PAA binders in high-salinity water treatment applications. These advancements extend the utility of PAA binders into more demanding and specialized industrial processes.

Furthermore, the integration of digital technologies, particularly Artificial Intelligence (AI) and Machine Learning (ML), is rapidly transforming the PAA Binders technology landscape. AI-driven computational chemistry is being used to predict the optimal molecular structures and synthesis pathways for new PAA formulations, dramatically accelerating the research and development cycle. Smart manufacturing processes, equipped with real-time sensors and data analytics, enable precise control over polymerization reactions, ensuring consistent product quality, optimizing resource utilization, and reducing waste. Automation and advanced process control systems enhance efficiency and safety in production facilities. Moreover, nanotechnology is being explored to develop hybrid PAA binders that incorporate nanoparticles, leading to composites with superior mechanical strength, barrier properties, or targeted release functionalities. These cutting-edge technologies are not only pushing the boundaries of PAA binder performance but also addressing key industry challenges related to sustainability, cost, and manufacturing efficiency, positioning the market for continued innovation and growth.

Regional Highlights

- North America:

The North American PAA Binders market is characterized by its maturity, strong regulatory framework, and high demand for specialized, high-performance chemical solutions. The region's robust construction sector, coupled with significant investments in water infrastructure and the presence of advanced manufacturing industries, drives the demand for PAA binders. Companies in North America often focus on innovation, developing environmentally compliant and highly efficient PAA formulations to meet stringent environmental regulations and consumer preferences for sustainable products. There is also a strong emphasis on research and development, particularly in areas like bio-based binders and smart chemical solutions.

The United States and Canada are key contributors to the regional market, with a notable presence of major chemical manufacturers and a well-established distribution network. The demand for PAA binders in detergents and cleaning products remains strong, driven by evolving consumer lifestyles and product innovation. Furthermore, the oil and gas industry in North America also utilizes PAA binders in drilling fluids and completion chemicals, adding to the diverse application portfolio. The region's commitment to technological advancement and sustainable practices positions it as a leader in specialty PAA binder development, despite slower growth rates compared to emerging markets.

- Europe:

Europe represents a significant market for PAA binders, defined by stringent environmental regulations, a strong focus on sustainability, and a well-developed chemical industry. The region exhibits high demand for advanced PAA binders in water treatment, industrial cleaning, and specialized paints and coatings applications. European manufacturers are at the forefront of developing innovative, low-VOC (Volatile Organic Compound) and REACH-compliant PAA formulations, catering to the region's strong environmental consciousness and regulatory pressures. The emphasis on circular economy principles also drives the adoption of more resource-efficient and biodegradable PAA binder solutions.

Countries such as Germany, France, the UK, and Italy are major contributors, characterized by their advanced industrial bases and high R&D investments. The automotive and construction sectors also provide substantial demand for PAA binders in adhesives, sealants, and high-performance coatings. While facing challenges from high production costs and competitive global markets, European players often differentiate themselves through product quality, technical expertise, and a commitment to sustainable innovation. The region's strong academic and industrial collaboration further supports the development of next-generation PAA binder technologies.

- Asia Pacific (APAC):

The Asia Pacific region stands as the largest and fastest-growing market for PAA binders, driven by rapid industrialization, urbanization, and significant infrastructure development across its developing economies. Countries like China, India, Japan, South Korea, and Southeast Asian nations are witnessing booming construction activities, expanding manufacturing sectors, and increasing demand for advanced water treatment solutions, all of which fuel the consumption of PAA binders. The region's relatively less stringent environmental regulations in some areas, coupled with lower production costs, also contribute to its attractiveness for PAA binder manufacturing and consumption.

The surging population and improving living standards in APAC translate into higher demand for consumer goods, including detergents and personal care products, where PAA binders are extensively used. Furthermore, the textile and paper & pulp industries in countries like China and India are major consumers. Investment in new industrial capacities and a growing focus on improving industrial efficiency and environmental compliance are further propelling the market. This dynamic growth makes APAC a critical region for global PAA binder manufacturers, attracting significant foreign investment and fostering intense competition among regional and international players.

- Latin America:

The Latin American PAA Binders market is experiencing steady growth, influenced by increasing infrastructure projects, urbanization, and the development of key industrial sectors. Countries such as Brazil, Mexico, and Argentina are leading the demand, particularly in the construction, mining, and water treatment industries. The expanding urban centers require more residential and commercial buildings, driving the need for PAA binders in construction chemicals and paints. The region's rich natural resources also support mining activities, where PAA binders are used for mineral processing and water management.

Investment in public utilities and the need for improved sanitation and water management systems contribute to the demand for PAA binders in water treatment applications. While smaller in scale compared to APAC or Europe, the market in Latin America offers significant untapped potential. Economic stability and foreign direct investment are crucial factors influencing the pace of growth in this region. Local manufacturers and international players are increasingly focusing on establishing strong distribution networks and offering cost-effective solutions tailored to regional needs.

- Middle East and Africa (MEA):

The Middle East and Africa PAA Binders market is characterized by significant investment in infrastructure development, industrial diversification, and increasing concerns over water scarcity. Countries in the GCC (Gulf Cooperation Council) region, particularly Saudi Arabia and UAE, are undertaking massive construction projects and developing their industrial bases beyond oil and gas, driving the demand for PAA binders in construction chemicals, paints, and specialized industrial applications. The pervasive issue of water scarcity across many parts of the MEA region makes water treatment a critical sector, with strong demand for PAA-based scale inhibitors and dispersants for desalination plants and industrial cooling systems.

The growth in industrial manufacturing, including textiles and detergents, also contributes to the market. While parts of Africa remain nascent, increasing urbanization and foreign investment are fostering industrial development, creating new opportunities for PAA binder manufacturers. Challenges in the region include geopolitical instability and varying regulatory landscapes, but the long-term outlook is positive, driven by government initiatives to diversify economies, improve infrastructure, and address critical resource management issues. Manufacturers often focus on providing robust, high-performance solutions capable of operating in harsh environmental conditions prevalent in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PAA Binders Market.- Dow Chemical Company

- BASF SE

- Arkema S.A.

- Nippon Shokubai Co. Ltd.

- LG Chem Ltd.

- Mitsubishi Chemical Corporation

- Wanhua Chemical Group Co. Ltd.

- DIC Corporation

- Synthomer Plc

- Ashland Global Holdings Inc.

- Lubrizol Corporation

- SNF Group

- Solvay S.A.

- Sumitomo Seika Chemicals Co. Ltd.

- Celanese Corporation

- Gelest Inc.

- Kemira Oyj

- Kuraray Co. Ltd.

- Sekisui Chemical Co. Ltd.

- Evonik Industries AG

Frequently Asked Questions

Analyze common user questions about the PAA Binders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are PAA Binders and their primary applications?

PAA Binders, or Polyacrylic Acid Binders, are synthetic polymers used as dispersants, thickeners, adhesives, and scale inhibitors. Their primary applications include detergents and cleaners, water treatment, paints and coatings, construction chemicals, textiles, and paper and pulp industries due to their excellent binding and rheological properties.

What factors are driving the growth of the PAA Binders market?

Key drivers include the global expansion of the construction industry, increasing demand for advanced water treatment solutions, growing consumption in the detergents and cleaning sector, and continuous technological advancements in PAA binder formulations. The push for high-performance and eco-friendly products also contributes significantly to market growth.

What are the main challenges facing the PAA Binders market?

The primary challenges include volatility in raw material prices, particularly for acrylic acid, which impacts production costs. Additionally, stringent environmental regulations on chemical usage and waste disposal, along with increasing competition from alternative binding agents, pose significant restraints on market expansion.

How is Artificial Intelligence (AI) impacting the PAA Binders market?

AI is transforming the PAA Binders market by accelerating R&D for novel formulations, optimizing manufacturing processes for efficiency and quality, enhancing supply chain management, and facilitating the development of sustainable, bio-based binders. It enables predictive analytics for performance and market trends, leading to faster innovation and cost reduction.

Which regions are key players in the PAA Binders market, and why?

Asia Pacific is the largest and fastest-growing region due to rapid industrialization and construction. North America and Europe are mature markets driven by demand for high-performance, compliant products and strong R&D. Latin America and MEA are emerging markets influenced by infrastructure development and water scarcity concerns, offering significant growth potential.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager