PAA Scale Inhibitor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438048 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

PAA Scale Inhibitor Market Size

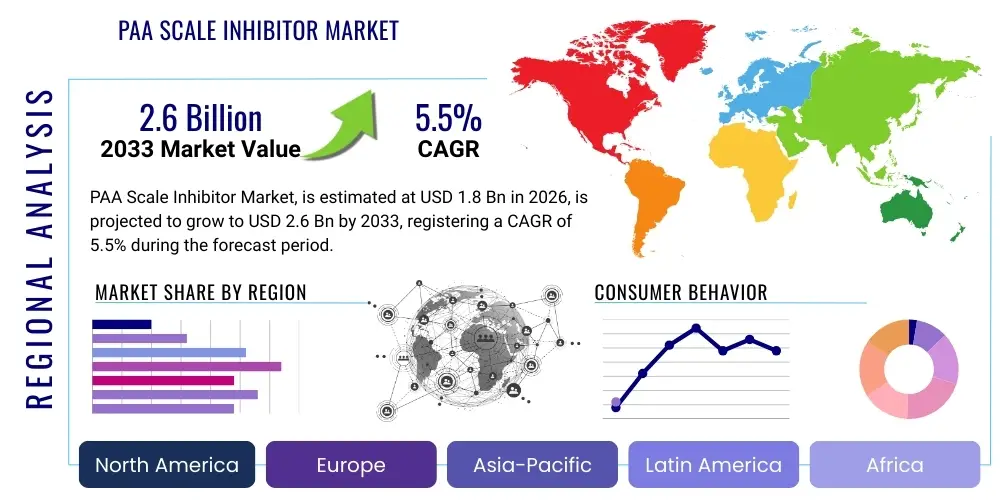

The PAA Scale Inhibitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.6 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for effective water management solutions across key industrial sectors, particularly power generation, oil & gas exploration, and high-density manufacturing, where mineral scaling poses a significant operational and financial threat.

PAA Scale Inhibitor Market introduction

Polyacrylic Acid (PAA) scale inhibitors are specialized chemical compounds utilized primarily in industrial water treatment processes to prevent the precipitation and accumulation of mineral salts—such as calcium carbonate, calcium sulfate, and barium sulfate—on heat transfer surfaces and within pipe systems. PAA functions through sequestration and dispersion mechanisms, ensuring that dissolved minerals remain suspended in the water, thereby mitigating system fouling, reducing energy consumption, and extending the operational lifespan of critical infrastructure. These inhibitors are characterized by their superior thermal stability and compatibility across a wide pH range, making them highly effective in demanding environments like cooling towers and boiler systems.

The primary applications of PAA scale inhibitors span municipal water treatment, desalination plants, power generation (thermal and nuclear), chemical processing, and the upstream oil and gas industry (e.g., enhanced oil recovery and produced water management). The exceptional performance of PAA in low-dosage applications and its relatively favorable cost-effectiveness compared to complex proprietary blends have cemented its position as a dominant chemistry in the global scale inhibitor landscape. Furthermore, the inherent need to comply with increasingly stringent industrial discharge and environmental regulations concerning water reuse and efficiency strongly drives the adoption of high-performance scale control agents like PAA derivatives.

Key driving factors accelerating market expansion include rapid industrialization in emerging economies, particularly in the Asia Pacific region, leading to a surge in water-intensive industrial activities. The perpetual challenge of water scarcity mandates efficient resource utilization and recycling, directly boosting the demand for chemicals that maintain system integrity and operational efficiency. Additionally, continuous innovation in PAA copolymer and terpolymer development, focused on improving performance in hypersaline or high-temperature conditions, ensures the sustained relevance and growth potential of this chemical family within advanced water treatment applications.

PAA Scale Inhibitor Market Executive Summary

The PAA Scale Inhibitor Market is currently undergoing a strategic transformation marked by heightened regulatory scrutiny regarding environmental impact and a concurrent drive towards digital integration for dosing optimization. Business trends indicate a pronounced shift towards customized, lower-molecular-weight PAA formulations and bio-based alternatives, aiming to improve biodegradability and minimize aquatic toxicity while maintaining anti-scaling efficacy. Leading chemical providers are strategically focusing on vertical integration, from raw material supply (acrylic acid) to specialized application services, ensuring supply chain resilience and enhanced customer technical support, particularly in the highly technical oil and gas sector.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructural investments in industrial parks, power plants, and municipal water supply modernization projects across China, India, and Southeast Asia. North America and Europe, while mature, exhibit demand driven by replacement cycles, regulatory compliance (e.g., REACH compliance in Europe), and a continuous requirement for high-purity water systems in sectors such as pharmaceuticals and microelectronics. Segmentation trends consistently show the Industrial Water Treatment segment dominating the market share, attributed to the sheer volume of water utilized and recycled in processes like cooling and boiler operations, which inherently necessitate robust scale control measures.

Furthermore, technology trends emphasize the development of multi-functional PAA chemistries that offer both scale inhibition and corrosion control, enhancing overall system protection. The integration of real-time monitoring sensors and predictive analytics is emerging as a critical competitive differentiator, allowing industrial operators to transition from reactive maintenance to proactive chemical management. This executive overview highlights a market characterized by stable demand, driven by non-discretionary operational requirements, yet strategically navigating pressures related to environmental sustainability and operational efficiency through innovation and digitalization.

AI Impact Analysis on PAA Scale Inhibitor Market

Common user questions regarding AI's impact on the PAA Scale Inhibitor Market center on how artificial intelligence can optimize chemical usage, reduce operating costs, and improve environmental compliance. Users frequently inquire about the integration of predictive maintenance models with water quality sensor data to determine optimal PAA dosage in real-time, moving beyond traditional, fixed-dosing regimes. Concerns also exist regarding the initial capital investment required for implementing AI-driven monitoring systems and the necessary shift in workforce skill sets to manage and interpret complex data outputs related to scaling propensity and inhibition effectiveness.

The overall market consensus is that AI technologies, particularly machine learning (ML) algorithms, are instrumental in driving efficiency and sustainability within industrial water treatment processes. By analyzing multivariate data streams—including water chemistry, temperature fluctuations, flow rates, and historical scaling patterns—AI models can accurately predict the onset of scale formation before critical thresholds are reached. This predictive capability allows for highly precise, dynamic adjustment of PAA inhibitor injection rates, leading to substantial reductions in chemical consumption, minimizing operational expenditures, and ensuring higher performance reliability across diverse industrial environments such as refineries and power plants.

Ultimately, AI and advanced analytics are transforming the PAA scale inhibition market from a chemical supply industry into a sophisticated, service-oriented ecosystem focused on intelligent water management. The implementation of digital twin technology allows operators to simulate the effects of various PAA formulations and dosing strategies under changing operational conditions, optimizing chemical selection and maximizing asset uptime. This shift positions PAA manufacturers who integrate AI solutions into their service offerings at a competitive advantage, delivering superior Total Cost of Ownership (TCO) to end-users.

- AI optimizes PAA dosage and usage based on real-time water quality data.

- Machine learning algorithms predict scale formation probability, enabling proactive inhibition.

- Digital twin technology simulates system dynamics and testing various PAA chemistries virtually.

- Automated monitoring systems reduce human error and minimize chemical discharge/waste.

- Enhanced supply chain visibility and logistics planning for raw materials using prescriptive analytics.

DRO & Impact Forces Of PAA Scale Inhibitor Market

The PAA Scale Inhibitor Market is influenced by a complex interplay of drivers, restraints, and opportunities, underpinned by significant external impact forces. A primary driver is the accelerating pace of global industrial growth, particularly in sectors reliant on massive cooling and boiler operations, such as power generation and metals & mining. These industries inherently produce large volumes of process water prone to scaling, thus mandating chemical intervention to maintain efficiency. Furthermore, global trends toward water recycling and reuse, necessitated by increasing water scarcity, require high-efficacy scale control to prevent fouling in concentrated water streams, bolstering PAA demand.

However, the market faces significant restraints, chiefly related to environmental concerns. Traditional PAA formulations exhibit limited biodegradability, leading to regulatory pressures, especially in regions like Europe, demanding greener chemical alternatives. The volatility of raw material prices, specifically acrylic acid, which is derived from petrochemicals, introduces cost uncertainties and affects manufacturers’ profit margins. These economic and environmental pressures compel industry players to invest heavily in R&D for more sustainable PAA derivatives or entirely new biocide/inhibitor chemistries that offer comparable performance.

Opportunities in the market reside predominantly in the development and commercialization of specialized PAA copolymers and terpolymers designed for extremely challenging conditions, such as high-temperature geothermal operations or hypersaline desalination environments. The growing adoption of advanced monitoring technologies and the integration of PAA sales with specialized technical service contracts offer substantial avenues for revenue growth and differentiation. Impact forces, such as fluctuating global energy prices influencing industrial activity and stringent international water quality standards (e.g., zero liquid discharge policies), exert constant pressure on end-users to optimize their chemical treatment programs, favoring high-performance, compliant PAA solutions.

Segmentation Analysis

The PAA Scale Inhibitor Market is meticulously segmented based on end-use industry, product type, and application method, reflecting the diversity of industrial requirements and operational scales. The segmentation by end-use industry—encompassing Industrial Water Treatment, Oil & Gas, Power Generation, and Mining—is the most critical, as chemical requirements (such as molecular weight, stability, and compatibility) vary significantly between these sectors. For instance, the oil and gas industry demands PAA derivatives capable of functioning under high pressures and extreme temperatures in downhole environments, whereas industrial cooling towers prioritize long-term, low-concentration effectiveness.

Segmentation by product type typically differentiates between standard PAA homopolymers, PAA copolymers (modified with monomers like sulfonate or carboxylate groups to enhance performance), and PAA terpolymers, which offer superior resistance to specific contaminants like iron or zinc. This differentiation is vital for addressing specific scaling challenges—for example, copolymers are frequently favored in applications where high levels of phosphate or iron contamination coexist with scaling salts. The market is also analyzed based on physical form, primarily liquids and powders, though liquid formulations dominate due to ease of handling and dosing in automated systems.

The depth of segmentation analysis is crucial for market participants to tailor their offerings and identify niche growth pockets. The sustained growth in the industrial water treatment segment is primarily volumetric, while the oil and gas sector drives demand for premium, high-specification products. Understanding these nuances allows manufacturers to optimize production capacity and distribution strategies, particularly concerning regional differences in water chemistry and regulatory requirements that dictate the preferred PAA chemistry.

- By End-Use Industry:

- Industrial Water Treatment (Cooling Towers, Boilers)

- Oil & Gas (Downhole, Produced Water Management)

- Power Generation (Thermal, Nuclear)

- Mining & Metallurgy

- Pulp & Paper

- Chemical Processing

- By Product Type:

- PAA Homopolymers

- PAA Copolymers (e.g., PAA-MA, PAA-Sulfonate)

- PAA Terpolymers

- By Form:

- Liquid

- Powder/Solid

Value Chain Analysis For PAA Scale Inhibitor Market

The value chain for the PAA Scale Inhibitor Market initiates with the upstream supply of raw materials, primarily acrylic acid monomers, derived from propylene (a petrochemical product). This phase is capital-intensive and subject to volatility in crude oil and natural gas prices, directly influencing the cost structure of PAA production. Major chemical companies often integrate backwards into monomer production to secure supply and stabilize costs. The subsequent manufacturing phase involves the polymerization of acrylic acid into PAA, followed by formulation and blending with other components (such as dispersants or specialized additives) to create market-ready scale inhibitor products tailored for specific applications.

The midstream component involves logistics, distribution, and storage. Given the classification of many PAA products as specialized chemicals, robust quality control and safe handling protocols are essential. Distribution channels are bifurcated into direct and indirect routes. Large, multinational end-users (e.g., major power companies or international oil firms) often purchase PAA directly from manufacturers under long-term supply contracts, benefitting from volume discounts and dedicated technical service. This direct approach ensures high-touch customer support and tailored chemical dosing strategies, which are critical for complex industrial systems.

The downstream sector is characterized by specialized distributors and local chemical service companies who manage the sales and application of PAA to smaller or regional end-users, such as localized manufacturing facilities or municipal water treatment plants. These indirect channels rely heavily on technical expertise to recommend appropriate dosages and formulations. Value creation at this stage shifts from manufacturing to the provision of comprehensive water treatment services, including continuous monitoring, performance auditing, and regulatory compliance assistance. The ultimate consumer, the end-user (e.g., a refinery or power plant), focuses on maximizing system uptime and minimizing operational costs by effectively utilizing the PAA inhibitor.

PAA Scale Inhibitor Market Potential Customers

Potential customers, or end-users, of PAA scale inhibitors are predominantly industrial entities whose operations involve extensive use of water for cooling, heating, or processing, making them susceptible to mineral scaling and fouling. The largest segment of buyers comprises power generation companies, specifically those operating thermal, coal-fired, or natural gas power plants, where high-pressure boiler systems and massive cooling water circuits require continuous and reliable scale inhibition to maintain thermal efficiency and prevent catastrophic failures due to tube blockage or overheating. These customers purchase PAA in high volumes and often demand performance guarantees and long-term contracts.

Another crucial customer segment is the oil and gas industry, encompassing both upstream exploration and production activities (E&P) and midstream pipeline operations. In E&P, PAA inhibitors are essential for preventing scale formation in downhole equipment and pipelines resulting from mixing incompatible formation waters, which is particularly severe in enhanced oil recovery (EOR) projects. Refineries and petrochemical plants, falling under the chemical processing customer base, also represent significant buyers, utilizing PAA to protect heat exchangers and cooling systems from fouling, ensuring continuous production flow and minimizing costly shutdowns for mechanical cleaning.

Municipal water authorities and desalination plants constitute a growing customer group, utilizing PAA to manage scale in membrane systems (such as Reverse Osmosis plants) and distribution networks. Scale control is paramount here to maintain membrane flux rates and minimize cleaning frequency, which is crucial for reducing the cost of potable water production. Furthermore, the specialized manufacturing sectors, including electronics, food and beverage, and automotive assembly, which demand ultra-pure water and highly reliable cooling systems, represent high-value customers seeking customized, high-purity PAA formulations with minimum environmental impact.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Kemira, SUEZ Water Technologies & Solutions, Ecolab (Nalco Water), Solenis, Arkema, Shandong Taihe Water Treatment Technologies Co. Ltd., Kurita Water Industries Ltd., Dow Inc., AkzoNobel N.V., Wanhua Chemical Group, SNF Group, Clariant AG, BWA Water Additives, Zaozhuang Dongtao Chemical Technology Co., Ltd., China National Petroleum Corporation (CNPC), Shandong IRO Water Treatment Co., Ltd., Fushun Development Zone Tongyi Chemicals Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PAA Scale Inhibitor Market Key Technology Landscape

The PAA Scale Inhibitor market is continually evolving, focusing on technological advancements that enhance performance, tailor specificity, and improve environmental profiles. A major technological focus involves the synthesis of advanced PAA derivatives, moving beyond simple homopolymers to complex copolymers and terpolymers. These specialized molecules incorporate various functional groups—such as phosphonates, sulfonate groups, or specific carboxylic acid derivatives—that improve sequestration capacity and dispersion characteristics under challenging conditions, particularly high hardness, elevated temperatures, and high iron content, which often render standard PAA ineffective. Developing low-molecular-weight PAA is also a core focus, as lower molecular weights generally offer better performance in specific scaling scenarios, such as calcium carbonate inhibition.

Furthermore, technology is rapidly advancing in the field of sustainable chemistry, addressing the biodegradability limitations of conventional PAA. Research efforts are centered on creating bio-based or readily biodegradable scale inhibitors that maintain the functional effectiveness of PAA. This includes exploring novel polycarboxylates derived from renewable resources and incorporating hydrolyzable linkages that facilitate breakdown in the environment. This trend is vital for compliance with regulatory frameworks like the European Union's REACH and is a significant differentiator for market leaders aiming for green chemistry certifications and tenders from environmentally conscious end-users.

Beyond the chemical composition itself, the integration of smart dispensing and monitoring technologies represents a crucial technological shift. The deployment of sophisticated sensors and data analytics platforms allows for real-time monitoring of scaling indices (Langelier Saturation Index, Ryznar Stability Index) and immediate, optimized adjustment of PAA dosing. This technological convergence ensures that the inhibitors are applied only when necessary and at the precise effective concentration, dramatically reducing consumption, minimizing chemical waste, and optimizing the Total Cost of Ownership (TCO) for industrial operators. The shift towards digitized water treatment management is becoming a standard feature offered by leading PAA suppliers.

Regional Highlights

The global PAA Scale Inhibitor market exhibits substantial regional variation in demand drivers, regulatory environments, and product adoption rates. North America remains a significant market, characterized by mature industrial sectors, stringent environmental regulations, and high standards for operational efficiency in sectors like power generation and refining. Demand in this region is driven by the need for reliable, high-performance chemistries and is increasingly focused on digitally integrated solutions for dosage management and predictive maintenance. The replacement market and the specialized requirements of shale oil and gas production contribute heavily to the sustained, stable demand.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This explosive expansion is directly attributed to rapid urbanization, massive infrastructure development, and the escalating number of water-intensive industries established in countries such as China, India, and Indonesia. While price sensitivity remains a factor, the sheer scale of new industrial facilities and the growing mandate for water reuse programs ensure burgeoning demand for effective PAA formulations. Local manufacturers are rapidly expanding capacity to meet this regional volume, often focusing on cost-effective PAA homopolymers, although specialized copolymer demand is also accelerating in high-tech sectors.

Europe, driven by the most rigorous environmental legislation globally, demands innovation in product sustainability. European end-users prioritize PAA formulations with enhanced biodegradability and lower aquatic toxicity to comply with directives like the Water Framework Directive. The market is mature, and growth is primarily stimulated by technological replacement, regulatory necessity, and the optimization of existing industrial processes. The Middle East and Africa (MEA), particularly the GCC states, represent a strong niche market due to extensive desalination operations and intensive oil and gas activity, requiring PAA derivatives that function effectively in extremely high-salinity and high-temperature conditions.

- North America: Focus on technological integration, compliance in mature oil & gas and power sectors.

- Europe: High regulatory standards driving demand for biodegradable and sustainable PAA chemistries.

- Asia Pacific (APAC): Fastest growing market, fueled by large-scale industrialization and infrastructure projects in China and India.

- Latin America: Demand driven by mining operations and chemical processing industry expansion.

- Middle East & Africa (MEA): Significant demand from desalination facilities and high-salinity environment oil & gas operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PAA Scale Inhibitor Market.- BASF SE

- Kemira

- SUEZ Water Technologies & Solutions (a Veolia company)

- Ecolab (Nalco Water)

- Solenis

- Dow Inc.

- Arkema S.A.

- Kurita Water Industries Ltd.

- BWA Water Additives

- SNF Group

- Clariant AG

- AkzoNobel N.V.

- Shandong Taihe Water Treatment Technologies Co. Ltd.

- Wanhua Chemical Group Co., Ltd.

- Zaozhuang Dongtao Chemical Technology Co., Ltd.

- China National Petroleum Corporation (CNPC)

- Aditya Birla Chemicals (Thailand) Ltd.

- Thermax Limited

- Fushun Development Zone Tongyi Chemicals Co., Ltd.

- Shandong IRO Water Treatment Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the PAA Scale Inhibitor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Polyacrylic Acid (PAA) and how does it prevent scale?

PAA is a synthetic polymer used as a scale inhibitor in industrial water systems. It prevents scale by two primary mechanisms: the threshold effect, where low concentrations inhibit crystallization of mineral salts (like CaCO3 or CaSO4), and dispersion, where the polymer binds to microcrystals, keeping them suspended and preventing agglomeration and fouling on surfaces.

Which end-use industries drive the highest demand for PAA Scale Inhibitors?

The Industrial Water Treatment sector, encompassing cooling towers and boiler systems for power generation, manufacturing, and chemical processing, accounts for the highest volume demand. However, the Oil & Gas industry drives significant demand for specialized, high-performance PAA derivatives suitable for extreme downhole and produced water environments.

What are the primary differences between PAA homopolymers, copolymers, and terpolymers?

PAA homopolymers consist only of acrylic acid monomers, offering general scale inhibition. Copolymers and terpolymers incorporate additional functional monomers (e.g., sulfonates, phosphates) to enhance performance in specific conditions, such as improved resistance to high pH, high temperature, or presence of metal oxides (e.g., iron), offering greater application versatility and efficiency.

How do environmental regulations impact the future of the PAA Scale Inhibitor Market?

Environmental regulations, particularly in Europe and North America, are increasingly stringent regarding the biodegradability and aquatic toxicity of chemical discharges. This pressure is driving manufacturers toward developing "green" or bio-based PAA alternatives and lower-molecular-weight formulations to ensure regulatory compliance and meet growing sustainability demands from industrial consumers.

Is the PAA Scale Inhibitor market expected to transition entirely to non-chemical alternatives?

While non-chemical treatments (like magnetic or electronic devices) exist, PAA-based chemical inhibition remains the most cost-effective and functionally reliable method for large-scale, high-load industrial applications. The market is not expected to transition entirely, but rather to integrate smart chemical management (AI-driven dosing) and sustainable PAA chemistries to optimize performance alongside other technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager