Package Checkweighers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435325 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Package Checkweighers Market Size

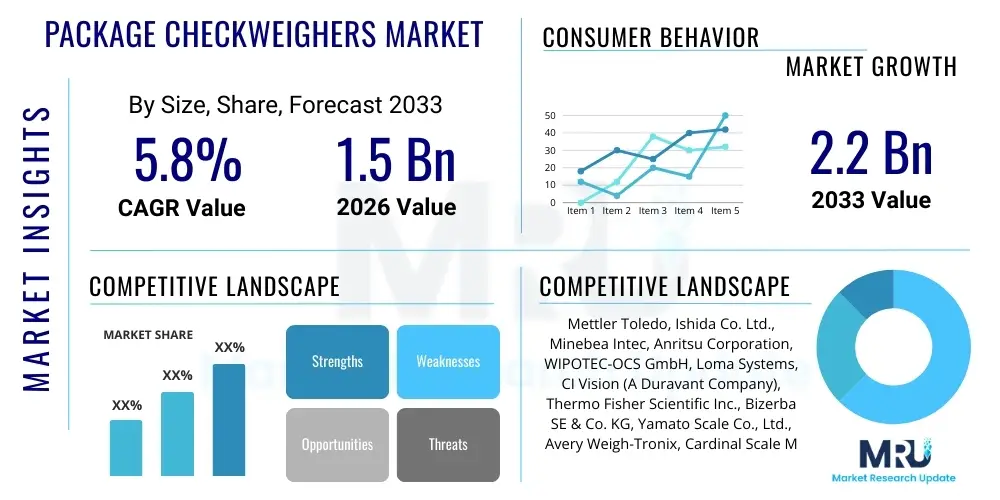

The Package Checkweighers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033.

Package Checkweighers Market introduction

The Package Checkweighers Market encompasses the supply and demand for automated industrial weighing systems designed to verify the weight of packaged products, ensuring they meet legally defined standards and consumer expectations. These precision instruments are critical components of production lines across numerous sectors, functioning primarily at high speeds to reject under-filled or over-filled packages without interrupting the flow of operations. The core objective is not only regulatory compliance, particularly regarding Minimum Weight Legislation in many jurisdictions, but also maintaining brand integrity by guaranteeing consistent product quality and minimizing costly material giveaway. These machines range from simple static models to complex dynamic systems integrated with metal detection and X-ray inspection capabilities, offering comprehensive quality control solutions in modern manufacturing environments.

The adoption of package checkweighers is intrinsically linked to the expanding global demand for packaged goods, driven by urbanization, changing consumer lifestyles, and the proliferation of e-commerce. Key applications span the food and beverage industry (where accurate portion control is paramount for products like snacks, meat, and dairy), pharmaceuticals (critical for dose accuracy and regulatory traceability), and cosmetics and chemicals. The benefits realized by manufacturers include enhanced throughput, significant reduction in product recalls due to non-conforming weights, and optimization of packaging materials, leading to improved operational efficiency and a stronger competitive position in highly regulated global supply chains. Furthermore, advanced checkweighers now feature sophisticated software for data collection and analysis, allowing for proactive process adjustments rather than reactive quality control.

Driving factors for this market’s sustained growth involve stringent global regulations requiring 100% weight inspection, coupled with an increasing focus on automation and smart factory initiatives (Industry 4.0). Manufacturers are continuously seeking technologies that offer higher accuracy, faster speeds, and improved ease of integration with existing production machinery. The rising cost of raw materials makes minimizing product giveaway a financial necessity, positioning checkweighers as essential tools for cost management. Moreover, the pharmaceutical sector's rapid expansion, particularly in high-potency drugs and serialized packaging, mandates the use of highly accurate, validated weighing systems, further accelerating market penetration in this high-value segment.

Package Checkweighers Market Executive Summary

The Package Checkweighers Market is experiencing robust growth fueled by converging trends in regulatory pressure, industrial automation, and consumer demand for consistent quality. Business trends indicate a strong move toward systems offering integrated solutions, combining checkweighing with complementary inspection technologies like X-ray inspection and metal detection, offering manufacturers a unified quality control checkpoint. This integration enhances line efficiency and reduces the physical footprint required on the production floor. Furthermore, the shift towards modular and customizable checkweighing solutions allows companies to tailor equipment precisely to specific product types and packaging formats, addressing the complexity introduced by SKU proliferation in fast-moving consumer goods (FMCG).

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by massive investments in new manufacturing infrastructure, particularly in emerging economies like China, India, and Southeast Asia, aimed at modernizing food processing and pharmaceutical facilities. North America and Europe remain mature markets characterized by high replacement rates and a strong demand for advanced, high-speed, and validated systems that comply with strict governmental regulations, such as those imposed by the FDA and EFSA. In these developed regions, the focus is less on initial adoption and more on implementing smart, networked checkweighers capable of real-time data exchange (IoT integration) to optimize Overall Equipment Effectiveness (OEE).

Segment trends reveal that the dynamic checkweighers segment, designed for high-speed continuous operations, dominates the market due to its necessity in automated lines. Application-wise, the food and beverage sector holds the largest market share, consistently demanding higher throughput and sanitation standards (IP69K-rated equipment). However, the pharmaceutical segment is projected to exhibit the highest CAGR, driven by intense scrutiny over drug weight uniformity, the increasing global production of generic and biologics drugs, and the mandatory need for precise data logging and audit trails mandated by global regulatory bodies. Technology segmentation shows a rising preference for systems utilizing electromagnetic force restoration (EMFR) load cells for ultra-high precision, especially in pharmaceutical and high-value chemical applications.

AI Impact Analysis on Package Checkweighers Market

User queries regarding the impact of Artificial Intelligence (AI) on the Package Checkweighers Market primarily revolve around how AI can enhance predictive maintenance, improve measurement accuracy under variable conditions, and integrate quality control data across the enterprise. Common concerns include the complexity of implementing AI algorithms on existing legacy equipment, the need for standardized data protocols for machine learning training, and the tangible return on investment (ROI) derived from AI-enhanced weighing systems. Expectations are high, focusing on leveraging AI for real-time calibration adjustments and sophisticated anomaly detection that goes beyond simple overweight/underweight thresholds, targeting subtle manufacturing variations that current static algorithms might miss. Users anticipate AI will transform checkweighers from mere measurement devices into intelligent, self-optimizing process control hubs.

The integration of AI into checkweighing technology is moving the industry toward 'cognitive quality control.' AI algorithms are now being utilized to analyze high-frequency weight data streams, identifying patterns correlated with upstream manufacturing defects (such as filler machine drift or temperature fluctuations) before they lead to major weight deviations. This predictive capability significantly reduces material waste and maximizes line uptime by enabling preventative intervention. Moreover, in complex packaging scenarios, such as irregularly shaped products or flexible packaging (pouches), AI-driven systems can improve weighing accuracy by compensating for environmental noise and subtle conveyor vibrations more effectively than traditional filter settings, thus reducing false rejects and improving operational efficiency across challenging applications.

Furthermore, AI plays a crucial role in enhancing the audit and compliance functions of checkweighers. By processing vast amounts of logged weight data alongside operational parameters, AI tools can generate automated, comprehensive compliance reports, ensuring adherence to regulatory standards like Measurement in Pre-packed Goods (MID) directives or pharmaceutical validation requirements. This level of integrated data analysis simplifies regulatory audits, provides granular traceability, and offers deep business intelligence regarding material utilization efficiency. The ability of AI to self-diagnose mechanical issues, scheduling maintenance proactively rather than reactively, ensures the longevity and sustained accuracy of the checkweighing assets throughout their operational lifespan.

- Enhanced predictive maintenance and fault diagnosis through pattern recognition.

- Improved measurement accuracy in dynamic and variable operating environments.

- Real-time automated calibration and self-optimization of weighing parameters.

- Sophisticated anomaly detection to identify subtle manufacturing process drifts.

- Integration of weight data with ERP/MES systems for holistic process control.

- Reduced false reject rates, increasing overall line efficiency and throughput.

- Automated compliance reporting and simplified regulatory audit trails.

DRO & Impact Forces Of Package Checkweighers Market

The Package Checkweighers Market dynamics are dictated by a powerful combination of legislative requirements (Drivers) that mandate precision, technological limitations (Restraints) related to speed and material handling, and the continuous need for efficiency improvements (Opportunities). The primary driver remains the increasing global enforcement of minimum weight regulations and fair trade practices, especially in developed economies, forcing manufacturers to adopt 100% inline inspection. Conversely, the high initial capital investment required for high-precision, validated checkweighing equipment, particularly in developing markets, acts as a restraint, coupled with the technical challenge of maintaining extreme accuracy at ultra-high production speeds, especially when handling complex or flexible packaging. These internal and external forces significantly shape investment decisions and technological innovation within the industry.

Impact forces currently driving market evolution include the pervasive trend of Industry 4.0 adoption, which necessitates checkweighers that are not just measurement tools but networked data generators, capable of communicating weight information in real-time for immediate process adjustments. The opportunity lies in providing modular, scalable systems that can be easily integrated into diverse production environments, alongside offering comprehensive service contracts leveraging remote diagnostics and IoT connectivity. Furthermore, the rapid growth in the nutraceutical and medical device packaging sectors presents niche growth opportunities demanding specialized, sanitary, and ultra-high-accuracy machines. The market is also witnessing pressure to reduce the footprint of equipment, forcing manufacturers to design more compact yet powerful checkweighing solutions.

The key challenge, or restraint, often stems from the diversity of packaged goods—from delicate, lightweight products to heavy, bulky containers—requiring highly specialized material handling solutions (conveyors, reject mechanisms). Achieving consistent accuracy across this product spectrum requires significant engineering specialization, often increasing the cost and complexity of the system. Successfully navigating the market requires vendors to focus on developing integrated solutions (combining metal detection and vision systems) that justify the high capital expenditure by maximizing the return on investment through comprehensive quality assurance. The overall impact of these forces is pushing the market toward smarter, faster, and more integrated quality control platforms.

Segmentation Analysis

The Package Checkweighers Market is meticulously segmented based on the system type (dynamic vs. static), technology utilized (load cell type), end-user industry (pharmaceuticals, food and beverage, etc.), and the application (high speed, medium speed). This granular segmentation helps in understanding the varying needs of different industrial sectors, ranging from the requirement for extremely high throughput in beverage canning lines to the need for microscopic precision and validation protocols in the pharmaceutical sector. Dynamic checkweighers represent the dominant segment, essential for modern continuous manufacturing, while the growth trajectory is heavily influenced by the expansion of the Food and Beverage sector and the stringent regulatory demands of the Healthcare industry.

- By Type:

- Dynamic Checkweighers

- Static Checkweighers

- By Technology:

- Strain Gauge Load Cells

- Electromagnetic Force Restoration (EMFR) Load Cells

- By Capacity:

- Up to 1,000 Grams (Low Capacity)

- 1,000 Grams to 10,000 Grams (Medium Capacity)

- Above 10,000 Grams (High Capacity)

- By Application/End-Use Industry:

- Food and Beverage (Bakery, Dairy, Meat/Poultry, Snacks)

- Pharmaceutical and Healthcare (Tablets, Vials, Syringes)

- Cosmetics and Personal Care

- Chemical and Material Processing

- Automotive Parts

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Package Checkweighers Market

The value chain for the Package Checkweighers Market begins with upstream activities centered on the procurement and manufacturing of highly specialized components, most notably precision load cells (strain gauge or EMFR) and high-speed conveyor components. Key upstream activities involve R&D focused on sensor technology, software development for advanced data processing, and securing high-quality stainless steel and hygienic construction materials, particularly for sanitary applications in food and pharma. Manufacturers often rely on specialized third-party suppliers for core electronic components and automation interfaces, striving for vertical integration in software and system assembly to maintain competitive differentiation and intellectual property regarding calibration algorithms.

The primary manufacturing stage involves system design, assembly, calibration, and rigorous factory acceptance testing (FAT). This midstream segment is characterized by customization, where standard weighing platforms are adapted with specific material handling systems, reject mechanisms (e.g., air blast, pusher, drop down), and integration interfaces tailored to the client’s existing production line architecture. System validation, especially for pharmaceutical clients, adds significant value and complexity at this stage. Effective cost management here hinges on optimizing modular design to reduce lead times and engineering complexity while ensuring adherence to strict quality standards and certification requirements (e.g., OIML, CE).

Downstream activities focus on distribution, installation, commissioning, and, most critically, after-sales service. Distribution channels are typically a mix of direct sales forces (especially for high-value, complex projects and large multinational accounts) and indirect distribution through specialized industrial machinery distributors and system integrators who handle localized sales and support. Post-installation services, including periodic calibration, preventative maintenance, and provision of spare parts, represent a significant and profitable revenue stream. The trend toward remote diagnostics and predictive maintenance (enabled by IoT connectivity) is enhancing the efficiency of these downstream services, ensuring minimal downtime for end-users, which is a critical factor in maintaining high OEE scores.

Package Checkweighers Market Potential Customers

Potential customers for Package Checkweighers are concentrated across highly regulated and high-volume manufacturing industries where product weight consistency is a legal, operational, and commercial necessity. The largest cohort of buyers resides in the Food and Beverage sector, encompassing everything from major multinational packaged food corporations (Coke, Nestlé) to regional contract packagers and specialized organic food processors. These buyers require high-speed, durable, and washdown-capable (IP65/IP69K) systems to handle diverse packaging formats like cans, bottles, flexible pouches, and cartons, prioritizing speed and sanitation above all else to maintain compliance with labeling laws and prevent product recalls.

The pharmaceutical and healthcare industry represents the second most critical customer segment, demanding systems of the highest precision and validation rigor. Buyers here include global pharmaceutical giants, biopharma manufacturers, and medical device assemblers. Their purchasing criteria are heavily skewed towards data integrity, 21 CFR Part 11 compliance, and the utilization of extremely precise EMFR load cell technology to ensure precise dosage accuracy (e.g., verifying tablet counts or liquid fill weights in vials). For these customers, the checkweigher acts as a crucial quality gateway, and reliability, traceability, and validation documentation are non-negotiable purchasing prerequisites, often justifying a higher capital expenditure.

Additional significant buyers include cosmetic and personal care manufacturers (requiring aesthetic package integrity and fill level control), chemical and agricultural processors (dealing with bulk materials and precise formulation), and logistics/e-commerce fulfillment centers. The latter group utilizes checkweighers increasingly for verifying shipping weight against declared weight to prevent revenue loss from inaccurate dimensional weight calculations and to detect potential tampering or mis-shipments. The common thread among all potential customers is the need to transform weight measurement from a manual sampling process into an integrated, automated, 100% inspection quality gate, essential for maintaining operational excellence and mitigating risk.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mettler Toledo, Ishida Co. Ltd., Minebea Intec, Anritsu Corporation, WIPOTEC-OCS GmbH, Loma Systems, CI Vision (A Duravant Company), Thermo Fisher Scientific Inc., Bizerba SE & Co. KG, Yamato Scale Co., Ltd., Avery Weigh-Tronix, Cardinal Scale Manufacturing Company, OCS Checkweighers, Sesotec GmbH, Multivac Group, Premier Tech, Eagle Product Inspection, PFM Packaging Machinery, Tsubaki Nakashima Co., Ltd., Krones AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Package Checkweighers Market Key Technology Landscape

The technological landscape of the Package Checkweighers Market is dominated by advancements in load cell sensing technology and the integration of sophisticated digital control systems. The primary sensing mechanisms are Strain Gauge Load Cells, which are cost-effective and robust for high-capacity, general-purpose checkweighing, and Electromagnetic Force Restoration (EMFR) Load Cells. EMFR technology represents the high-end segment, offering superior speed, accuracy, and temperature stability, making it essential for precision applications, particularly in pharmaceuticals and cosmetics where microgram level accuracy is often necessary. The ongoing trend is to enhance the performance of both technologies, focusing on vibration suppression algorithms and faster signal processing to maintain accuracy even at extreme line speeds exceeding 600 packages per minute.

Beyond the core weighing component, the convergence of Industry 4.0 principles is revolutionizing checkweigher functionality. Modern systems are equipped with integrated Process Analytical Technology (PAT) capabilities, utilizing advanced connectivity protocols (e.g., OPC UA, Ethernet/IP) to link weight data directly to manufacturing execution systems (MES) and enterprise resource planning (ERP) systems. This digitalization enables real-time feedback loops that automatically adjust upstream machinery (like filling equipment) based on measured weight trends, driving a paradigm shift from simple quality control to proactive process optimization. Furthermore, human-machine interfaces (HMIs) are evolving, offering intuitive, touch-based operation and multi-language support, simplifying changeovers and reducing reliance on specialized technicians.

A critical technological advancement involves the development of hybrid inspection systems, where checkweighing is seamlessly integrated with metal detection, X-ray inspection, and optical character verification (OCV) onto a single, synchronized platform. This multi-functional approach saves space, reduces integration complexity, and lowers overall capital expenditure for manufacturers seeking comprehensive quality assurance. Material handling technology is also advancing, with servo-driven conveyors and sophisticated timing gates replacing traditional mechanical systems. This enables smoother, more controlled product handling, which is crucial for maximizing accuracy when weighing unstable or irregularly shaped packages, directly addressing a key historical limitation of dynamic checkweighing.

Regional Highlights

- Asia Pacific (APAC): Characterized by high growth, APAC is the epicenter of new manufacturing establishment, especially in food processing and generic drug manufacturing in China and India. The demand is driven by rapid urbanization, rising disposable incomes leading to increased consumption of packaged goods, and government initiatives promoting food safety and manufacturing modernization. The region primarily requires robust, cost-effective, and scalable solutions for high-volume production.

- North America: A mature market defined by stringent FDA regulations, high labor costs, and an immediate need for smart factory integration. Demand is centered on high-speed, fully automated systems with advanced data logging capabilities (IoT enabled) and integrated technologies (checkweigher/X-ray combo) to ensure compliance and maximize OEE. Replacement cycles are a major market driver, focusing on adopting the latest AI-enhanced systems.

- Europe: Similar to North America, Europe is governed by strict regulations (e.g., the Average Weight System under the MID Directive), mandating precision and traceability. The market prioritizes hygienic design (EHEDG compliance), modularity, and systems that offer superior energy efficiency. Germany, Italy, and the UK are key countries, focusing heavily on pharmaceutical and specialized food sector applications, driving the demand for high-accuracy EMFR technology.

- Latin America (LATAM): Showing moderate growth, particularly in Brazil and Mexico, driven by foreign direct investment in consumer goods manufacturing. The market often seeks standardized, reliable checkweighers with strong local service support, balancing accuracy requirements with investment costs. Economic volatility can sometimes slow down large capital expenditure decisions.

- Middle East and Africa (MEA): An emerging market segment seeing increased investment in local food production facilities to enhance regional food security. Adoption is still accelerating, focusing initially on basic dynamic checkweighing solutions, with future potential for advanced integration as quality standards and regulatory frameworks mature across key Gulf nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Package Checkweighers Market.- Mettler Toledo

- Ishida Co. Ltd.

- Minebea Intec

- Anritsu Corporation

- WIPOTEC-OCS GmbH

- Loma Systems

- CI Vision (A Duravant Company)

- Thermo Fisher Scientific Inc.

- Bizerba SE & Co. KG

- Yamato Scale Co., Ltd.

- Avery Weigh-Tronix

- Cardinal Scale Manufacturing Company

- OCS Checkweighers

- Sesotec GmbH

- Multivac Group

- Premier Tech

- Eagle Product Inspection

- PFM Packaging Machinery

- Tsubaki Nakashima Co., Ltd.

- Krones AG

Frequently Asked Questions

Analyze common user questions about the Package Checkweighers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a dynamic package checkweigher in a production line?

A dynamic package checkweigher automatically measures the weight of every product passing over its conveyor at high speeds without stopping the line. Its primary function is ensuring 100% compliance with pre-defined weight tolerances, immediately rejecting non-conforming packages to prevent costly product recalls and minimize product giveaway, thereby protecting brand integrity and adhering to legal metrology requirements.

How does Industry 4.0 affect the functionality of modern checkweighers?

Industry 4.0 integration transforms checkweighers into smart, networked data hubs. Modern systems utilize IoT connectivity (like OPC UA) to communicate real-time weight statistics directly to MES/ERP systems and upstream filling machines, enabling predictive maintenance, remote diagnostics, and automated process adjustments for continuous optimization of Overall Equipment Effectiveness (OEE).

Which end-use industry drives the highest demand for high-accuracy Electromagnetic Force Restoration (EMFR) checkweighers?

The Pharmaceutical and Healthcare industry drives the highest demand for EMFR technology. Due to regulatory requirements concerning dosage accuracy and precise fill weights for high-value compounds (e.g., vials, tablets), EMFR load cells are favored over standard strain gauges because they offer superior precision and stability required for validation and audit trails under 21 CFR Part 11 compliance.

What are the key differences between dynamic and static checkweighers?

Dynamic checkweighers weigh packages in continuous motion at high speeds, providing 100% inline inspection and rejection for fully automated lines. Static checkweighers require the package to be temporarily stopped for measurement, making them suitable only for low-volume, manual, or semi-automated applications where high throughput is not the primary requirement.

What major challenges exist in implementing checkweighers for flexible packaging?

Implementing checkweighers for flexible packaging (such as pouches and bags) is challenging due to product instability and irregular shapes. This requires specialized material handling, often utilizing highly precise timing screws and optimized conveyor belt surfaces, combined with advanced software algorithms to suppress vibration and maximize accuracy while maintaining the product's orientation through the weighing zone.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager