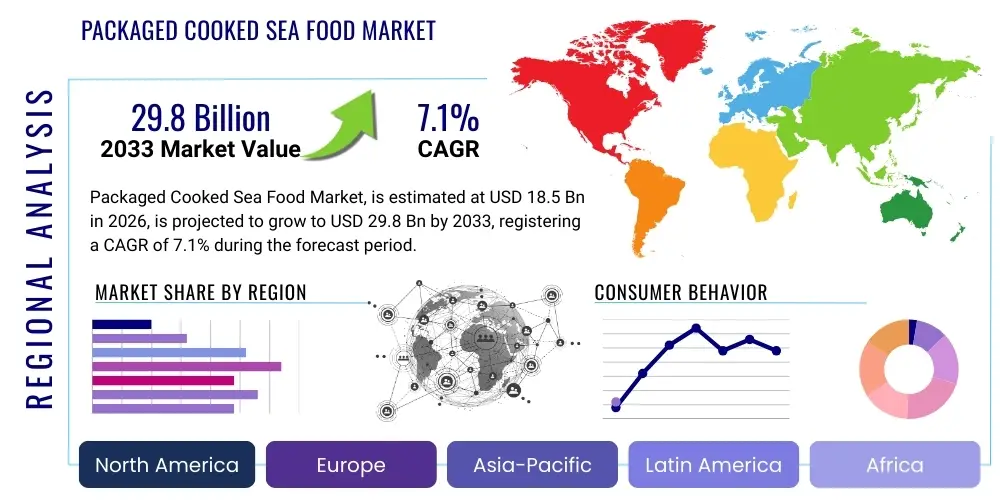

Packaged Cooked Sea Food Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436255 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Packaged Cooked Sea Food Market Size

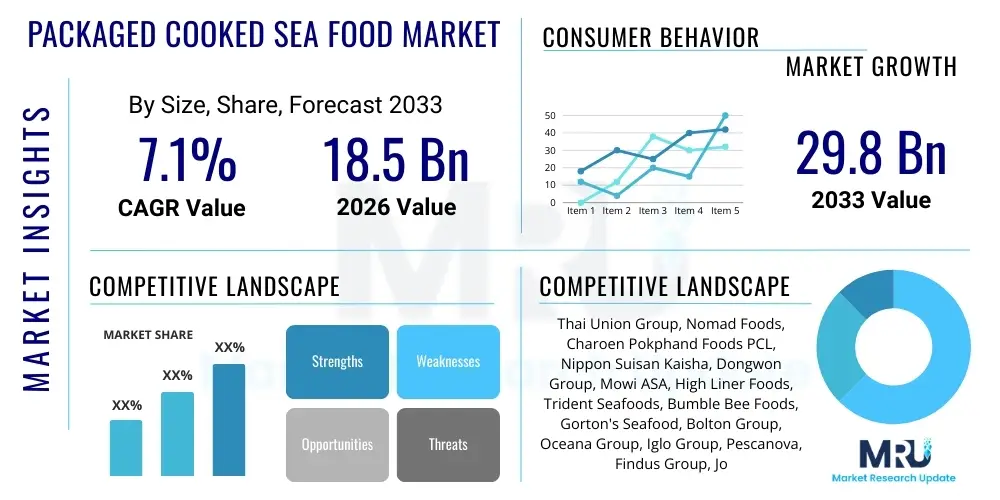

The Packaged Cooked Sea Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 29.8 Billion by the end of the forecast period in 2033.

The robust growth trajectory of the packaged cooked seafood sector is primarily driven by escalating consumer demand for convenient, protein-rich, and healthy meal solutions. Urbanization, coupled with increasingly hectic lifestyles across developed and emerging economies, necessitates quick-to-prepare food options. Packaged cooked seafood, which retains nutritional value and offers extended shelf life compared to fresh alternatives, perfectly addresses this modern consumer need. Innovations in packaging technology, such as modified atmosphere packaging (MAP) and retort pouches, further contribute to market expansion by ensuring product quality, safety, and enhancing visual appeal at the point of sale.

Furthermore, global supply chain optimization and standardized production processes are stabilizing raw material sourcing and reducing operational costs, making packaged cooked seafood more accessible across diverse demographic groups. The rising awareness regarding the health benefits associated with regular seafood consumption—particularly the intake of Omega-3 fatty acids—is a significant underlying factor boosting sales. As regulatory bodies enforce stricter quality and sustainability standards (like MSC certification), consumer trust in packaged options grows, distinguishing high-quality market players and fostering a premium segment within the broader market structure, thereby contributing substantial value growth.

Packaged Cooked Sea Food Market introduction

The Packaged Cooked Sea Food Market encompasses ready-to-eat or heat-and-eat seafood products that have undergone processing and cooking, subsequently sealed in various packaging formats such as cans, pouches, trays, or frozen containers, designed for consumer convenience and extended shelf stability. These products span a wide range of marine species, including tuna, salmon, shrimp, crab, and various mollusks, catering to diverse culinary preferences globally. Major applications include quick meal preparation at home, institutional feeding (hospitals, schools), and integration into food service offerings where preparation time is critical. The primary benefit lies in the seamless balance between high nutritional value—rich in protein, vitamins, and healthy fats—and unparalleled preparation convenience. Driving factors include changing dietary habits favoring high-protein diets, continuous advancements in food preservation techniques, and the expansion of organized retail chains that facilitate wider product distribution and visibility to the end consumer.

Packaged Cooked Sea Food Market Executive Summary

The Packaged Cooked Sea Food Market is characterized by vigorous growth, spearheaded by robust business trends focusing on sustainable sourcing and technological modernization. Key manufacturers are heavily investing in vertical integration, controlling the supply chain from aquaculture/fishing to packaging, thereby ensuring consistent quality and mitigating supply risks. There is a discernible trend towards premiumization, driven by consumer willingness to pay more for ethically sourced (e.g., traceable, certified) and health-focused products, often incorporating functional ingredients or specialized flavor profiles. Regional trends indicate that North America and Europe remain mature, high-value markets focused on innovation in shelf-stable and refrigerated prepared meals, while the Asia Pacific region exhibits the highest growth potential, fueled by rapid urbanization, increasing disposable incomes, and the modernization of cold chain logistics, particularly in countries like China and India.

Regarding segment trends, the Crustacean segment (especially pre-cooked shrimp and crab meat) dominates in value due to its high demand in prepared meal kits and specialized cuisine. However, the Shelf-Stable segment (canned and pouched fish like tuna and salmon) holds the largest volume share, benefiting from its long shelf life and affordability, making it a staple food item globally. Distribution channel analysis highlights the continued dominance of Supermarkets and Hypermarkets, which offer expansive refrigerated and frozen sections, but e-commerce and specialized online grocery platforms are rapidly gaining momentum, especially post-pandemic, offering consumers convenience and direct access to niche or specialty seafood products. These market dynamics necessitate that companies adopt agile production models and diversified distribution strategies to maintain competitive advantage.

AI Impact Analysis on Packaged Cooked Sea Food Market

Common user questions regarding AI's impact revolve around supply chain transparency, quality control automation, and predictive demand forecasting. Users are keenly interested in how AI can verify the authenticity of origin (preventing fraud and mislabeling), monitor processing temperatures and sanitation standards in real-time, and optimize logistics to reduce spoilage, especially for chilled and frozen products. The consensus among consumers and industry stakeholders is that AI will be transformative in achieving verifiable sustainability goals and personalized product recommendations. The key themes summarized are optimization of yield post-harvest using computer vision, dynamic pricing strategies based on machine learning, and enhanced food safety surveillance, moving the industry toward 'Smart Seafood' production systems that reduce waste and boost operational efficiency significantly across the entire value chain.

- AI-driven Predictive Analytics for Demand Forecasting: Optimizing inventory levels and reducing waste associated with perishable stock.

- Computer Vision Systems: Automated quality grading of cooked seafood (texture, color, size) prior to packaging, ensuring consistent product specification.

- Supply Chain Traceability via Blockchain and AI: Instant verification of sustainable sourcing, catching location, and processing history for consumer trust.

- Robotics and Automation in Processing: AI-guided automated cooking and packaging lines, enhancing hygiene and throughput while lowering labor costs.

- Optimized Shelf-Life Modeling: Machine learning algorithms predicting optimal packaging methods and temperatures to maximize product longevity.

DRO & Impact Forces Of Packaged Cooked Sea Food Market

The Packaged Cooked Sea Food Market is primarily propelled by evolving consumer preferences for nutritious convenience food, coupled with technological advancements in preservation and packaging. However, the market faces significant restraints, chiefly concerning volatile raw material pricing due to dependence on wild catches and strict global regulatory pressures regarding sustainable fishing practices and traceability. Opportunities are vast, particularly in penetrating untapped emerging markets and developing novel, ready-to-eat meal kits featuring exotic or high-value seafood species. The impact forces are characterized by high substitution threat from alternative packaged protein sources (e.g., chicken, plant-based meats), moderate buyer bargaining power due to market fragmentation, and increasing regulatory complexity, necessitating continuous investment in compliance and certified sourcing to maintain market access and consumer confidence.

Segmentation Analysis

The Packaged Cooked Sea Food Market is comprehensively segmented based on product type, packaging format, distribution channel, and processing state, reflecting the diverse consumer demands and operational capabilities of the industry. Segmentation is crucial for market participants to tailor their strategies, ranging from optimizing shelf life through specific packaging formats (canned vs. frozen) to targeting specific consumer groups through specialized retail or online channels. The segmentation reveals a dynamic interplay between convenience-driven segments (e.g., ready-to-eat pouches) and health-conscious segments (e.g., low-sodium, omega-3 fortified options), dictating R&D focus and marketing investments across the major players.

- By Product Type:

- Fish (Tuna, Salmon, Cod, Mackerel, Sardines)

- Crustaceans (Shrimp, Crab, Lobster)

- Mollusks (Squid, Clams, Mussels, Oysters)

- Others (Surimi, Mixed Seafood)

- By Packaging Type:

- Canned

- Pouches (Retort & Non-Retort)

- Trays & Containers (MAP)

- Boxes/Cartons (Frozen)

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- By Processing State:

- Frozen

- Refrigerated

- Shelf-Stable

Value Chain Analysis For Packaged Cooked Sea Food Market

The value chain for packaged cooked seafood is intricate, starting with upstream activities involving either fishing fleets or aquaculture farms, followed by primary processing where raw seafood is sorted, cleaned, and often pre-cooked or frozen rapidly. Midstream activities involve specialized secondary processing, including marinating, cooking (e.g., steaming, grilling), portioning, and final packaging using high-tech methods like retort processing or vacuum sealing, ensuring microbiological safety and extended shelf life. Downstream analysis focuses heavily on distribution channels, which include direct sales to large retailers, indirect distribution through wholesalers and food brokers, and increasingly, direct-to-consumer (D2C) models via specialized e-commerce platforms focused on frozen or shelf-stable goods. Direct distribution ensures better margin control and inventory management for large integrated players, whereas indirect channels are crucial for reaching fragmented retail markets and institutional buyers globally. The efficiency of the cold chain logistics is paramount for maintaining product integrity across all distribution modalities, particularly for high-value refrigerated and frozen segments.

Upstream risks include climate change impacts on fish stocks, disease outbreaks in aquaculture, and fluctuations in fuel costs for fishing vessels. Mitigating these risks often requires companies to diversify sourcing geographically and invest in sustainable aquaculture practices. The shift towards certified sustainable sourcing (e.g., Marine Stewardship Council - MSC) adds complexity but is essential for brand reputation and market access in developed regions. Effective control over the cooking and packaging stage, facilitated by advanced automation and quality control sensors, is key to minimizing processing loss and ensuring compliance with stringent international food safety standards (HACCP).

The role of distribution channels is evolving rapidly. While traditional brick-and-mortar retailers (Supermarkets/Hypermarkets) still constitute the backbone of sales, offering crucial visibility and immediate access, the accelerated adoption of online grocery shopping is forcing companies to re-evaluate packaging robustness for delivery and optimize digital merchandising strategies. Success in the downstream market hinges on effective trade marketing, cold chain integrity, and swift responsiveness to fluctuating consumer demand signals captured through point-of-sale data analytics, requiring seamless integration between manufacturing and logistics operations to capitalize on market opportunities.

Packaged Cooked Sea Food Market Potential Customers

Potential customers for the Packaged Cooked Sea Food Market are highly diverse, spanning individual consumers seeking convenient, healthy meal options, large retail chains stocking extensive product ranges, and the massive Food Service sector. The primary end-users are working professionals, millennials, and busy families in developed and rapidly urbanizing regions who prioritize time efficiency and nutritional quality over traditional home cooking preparation time. Retail consumers are increasingly segmented based on health consciousness (seeking low-sodium, high-Omega 3 options) and ethical sourcing concerns (demanding MSC/ASC certified products). Institutional buyers, such as schools, airlines, and catering companies, represent significant volume opportunities due to the need for standardized, easy-to-prepare, and safe food solutions. Targeting these diverse buyers requires tailored product formulations—from high-volume, cost-effective canned products for budget-conscious consumers to premium, ready-to-heat gourmet meals for affluent households.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 29.8 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thai Union Group, Nomad Foods, Charoen Pokphand Foods PCL, Nippon Suisan Kaisha, Dongwon Group, Mowi ASA, High Liner Foods, Trident Seafoods, Bumble Bee Foods, Gorton's Seafood, Bolton Group, Oceana Group, Iglo Group, Pescanova, Findus Group, John West Foods, C.P. Foods, StarKist Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Packaged Cooked Sea Food Market Key Technology Landscape

The technology landscape for packaged cooked seafood is focused heavily on ensuring food safety, extending shelf life without compromising nutritional integrity, and improving processing efficiency. Advanced processing technologies include High-Pressure Processing (HPP), which allows for sterilization and preservation without excessive heat, thereby better retaining the fresh flavor and texture of delicate seafood items like shrimp and crab. For shelf-stable products, Retort Technology, involving hermetically sealed containers subjected to high temperatures, remains crucial. Innovations in this area focus on reducing processing time and temperature profiles to minimize nutrient degradation while meeting rigorous safety standards.

Packaging technology represents a major competitive battleground. Modified Atmosphere Packaging (MAP) and vacuum skin packaging (VSP) are widely adopted for refrigerated and chilled cooked seafood, controlling the gaseous environment around the product to slow bacterial growth and oxidation, significantly extending the display life in retail environments. Furthermore, smart packaging solutions are gaining traction; these include time-temperature indicators (TTIs) that visually alert consumers or retailers if the product has been subjected to temperature abuse during transport or storage, reinforcing brand trust and reducing potential foodborne risks associated with highly perishable goods.

In manufacturing, automation and robotics are essential for handling raw and cooked products hygienically and rapidly. Advanced freezing technologies, such as cryogenic freezing using liquid nitrogen, are employed for premium frozen seafood to lock in quality and structure instantly. The integration of sensors and Internet of Things (IoT) devices across the cooking, cooling, and packaging lines provides real-time data on temperature, moisture content, and yield, allowing for immediate process adjustments. This technological integration is critical for maintaining consistency, minimizing human error, and achieving the large-scale production volumes required by the expanding global packaged food industry, adhering simultaneously to increasing sustainability metrics and quality demands.

Regional Highlights

Regional dynamics play a crucial role in shaping the packaged cooked seafood market, driven by distinct culinary traditions, disposable income levels, and varying regulatory environments concerning import/export and sustainability. North America and Europe currently represent the highest revenue generating regions, characterized by mature consumer markets that demand premium, traceable, and convenience-focused products, such as ready-to-heat gourmet salmon portions and certified sustainable canned tuna. These regions also possess highly developed cold chain logistics and sophisticated retail infrastructure, facilitating the distribution of both frozen and refrigerated cooked seafood.

The Asia Pacific (APAC) region is poised for the most rapid growth during the forecast period. This acceleration is fueled by vast populations, shifting towards Westernized dietary patterns, increasing penetration of modern retail formats, and substantial expansion of indigenous aquaculture capabilities, particularly in Southeast Asia and China. While consumption patterns are diverse, there is robust demand for shelf-stable cooked fish and crustacean products used in traditional dishes, alongside a growing urban appetite for imported, high-quality frozen seafood. Investments in cold chain infrastructure and efficient packaging solutions are vital for capitalizing on the volume potential within APAC.

Latin America, the Middle East, and Africa (MEA) currently hold smaller market shares but offer significant long-term growth potential. Growth in MEA is often concentrated in high-income urban centers, driven by expatriate populations and increased tourism demanding globally standardized food options. In Latin America, improving economic conditions and the expansion of supermarkets are making packaged seafood products more accessible to mass consumers. However, these regions often face challenges related to inconsistent cold chain reliability and regulatory complexities, requiring manufacturers to prioritize shelf-stable formats and robust, localized distribution partnerships to ensure product integrity and reach.

- North America: High demand for convenience meals, focus on premium, traceable products (salmon, shrimp). Strong presence of private label brands and advanced frozen food infrastructure.

- Europe: Strict regulatory environment regarding sustainability (MSC/ASC certification). Dominance of shelf-stable segments (canned fish) in Southern Europe and frozen/chilled ready meals in Western Europe.

- Asia Pacific (APAC): Fastest growth region driven by urbanization, increasing income, and mass consumption of canned tuna and locally sourced cooked crustaceans. Rapid adoption of e-commerce channels.

- Latin America: Increasing penetration of organized retail; focus remains balanced between affordability and convenience, with potential growth in locally produced shelf-stable seafood.

- Middle East and Africa (MEA): Growth concentrated in GCC nations due to high import reliance and affluent consumers seeking global standards of quality and variety.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Packaged Cooked Sea Food Market.- Thai Union Group

- Nomad Foods

- Charoen Pokphand Foods PCL (CPF)

- Nippon Suisan Kaisha (Nissui)

- Dongwon Group

- Mowi ASA

- High Liner Foods

- Trident Seafoods

- Bumble Bee Foods

- Gorton's Seafood

- Bolton Group (Rio Mare, Saupiquet)

- Oceana Group

- Iglo Group

- Pescanova (Nueva Pescanova)

- Findus Group

- John West Foods

- StarKist Co.

- Pacific Seafood Group

- Klaas Puul B.V.

- Maruha Nichiro Corporation

Frequently Asked Questions

Analyze common user questions about the Packaged Cooked Sea Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Packaged Cooked Sea Food Market?

The market is primarily driven by escalating demand for healthy, convenient meal solutions, rapid urbanization accelerating demand for ready-to-eat options, and continuous innovations in advanced packaging technologies that ensure longer shelf life and product safety.

Which packaging segment holds the largest volume share in the market?

The Shelf-Stable segment, encompassing traditional Canned and modern Pouched packaging (primarily tuna and salmon), holds the largest volume share globally due to its affordability, extreme convenience, and ability to be distributed without reliance on cold chain logistics.

How is sustainability impacting consumer choice for packaged seafood?

Sustainability is a crucial factor; consumers, particularly in North America and Europe, increasingly prefer products with verifiable certifications such as MSC (Marine Stewardship Council) or ASC (Aquaculture Stewardship Council), compelling manufacturers to adopt rigorous traceability and ethical sourcing practices.

What technological advancements are shaping the future of packaged cooked seafood?

Key technologies include the adoption of High-Pressure Processing (HPP) for preservation, integration of AI for real-time quality control and demand forecasting, and smart packaging solutions like Time-Temperature Indicators (TTIs) to enhance product safety and consumer trust.

Which geographical region exhibits the highest growth potential for this market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by increasing disposable incomes, modernization of retail infrastructure, and a growing consumer shift towards convenient, processed food consumption patterns.

The Packaged Cooked Sea Food Market is undergoing a fundamental transformation, shifting from a primarily shelf-stable commodity market to a high-value sector increasingly defined by quality, traceability, and convenience. The imperative for sustainability is no longer a niche requirement but a core operational necessity, influencing investment in aquaculture and advanced sourcing technologies. Companies that successfully leverage AI for predictive logistics and quality assurance, while simultaneously expanding their digital distribution footprint, are best positioned to capture significant market share.

Consumer engagement strategies are also evolving, moving beyond simple nutritional claims to encompass detailed narratives about the origin, processing standards, and ethical treatment of resources. The integration of consumer feedback loops through social media and digital platforms allows manufacturers to rapidly customize product offerings, leading to a proliferation of specialized products catering to niche dietary needs (e.g., low-salt, keto-friendly) and specific culinary tastes (e.g., global flavor profiles). This responsiveness ensures continued relevance in a fast-paced retail environment.

Furthermore, the competition between traditional seafood giants and innovative food tech startups introducing highly realistic plant-based seafood alternatives poses a looming challenge. While packaged cooked natural seafood retains a strong advantage based on nutritional superiority, the industry must continuously innovate in flavor delivery, texture preservation, and ethical messaging to maintain dominance against synthetic substitutes. Capital investment in R&D focusing on flavor stability post-retort processing and novel cooking techniques that maximize bioavailability of omega-3s will be critical for long-term segment differentiation and value retention in high-income markets.

The regulatory framework governing international trade in packaged cooked seafood is becoming increasingly complex, driven by concerns over illegal, unreported, and unregulated (IUU) fishing, as well as stricter labeling requirements concerning allergens and nutritional content. Compliance necessitates robust internal verification systems and international collaboration among processors, distributors, and governmental agencies. Failure to meet these escalating global standards can result in significant market access restrictions, particularly in lucrative markets like the European Union and the United States, thereby functioning as a powerful non-tariff barrier for smaller or less vertically integrated players.

In terms of distribution, the synergy between physical retail and e-commerce is essential. While supermarkets provide the necessary cold storage infrastructure and consumer impulse visibility, online channels facilitate subscription models and bulk purchases, especially for frozen items. Manufacturers must design packaging optimized for both environments—durable enough for parcel delivery and visually appealing enough for traditional shelf display. This dual-channel optimization requires flexible supply chain management and precise inventory controls to prevent stock-outs or excessive spoilage, particularly when dealing with refrigerated, short-shelf-life products.

Technological advancement is also enabling personalization at scale. Utilizing customer data gathered from online purchases and loyalty programs, companies can offer tailored product recommendations and promotions, enhancing customer lifetime value. For instance, a consumer frequently purchasing canned tuna might be targeted with new, high-protein tuna snack packs, while a buyer of frozen shrimp might receive offers on ready-to-cook paella kits. This data-driven marketing approach allows for more efficient allocation of promotional spend compared to broad, traditional advertising campaigns, significantly improving ROI in a highly competitive food category.

The future resilience of the Packaged Cooked Sea Food Market hinges on addressing the inherent limitations of seafood supply—namely, vulnerability to environmental changes and pressure on wild stocks. Strategic acquisitions and partnerships focused on strengthening aquaculture technology, especially closed-loop systems and sustainable feed development, are paramount. These vertical integration efforts not only secure raw material stability but also provide the necessary narrative for sustainable brand positioning, which is increasingly valued by the modern consumer who equates ethical production with premium quality and trustworthiness in their packaged food choices.

This comprehensive market view suggests that sustained success in the packaged cooked seafood sector will depend less on merely offering convenience and more on delivering a holistic value proposition encompassing health, sustainability, technology-backed transparency, and seamless multichannel availability. The industry is fundamentally restructuring to meet the demands of a globally interconnected, health-conscious, and environmentally aware consumer base.

The continuous focus on flavor innovation, particularly in the refrigerated and frozen prepared meal segments, is driven by culinary trends that favor global cuisines. Manufacturers are introducing products infused with regional spices, marinades, and cooking styles (e.g., Thai curry shrimp, Mediterranean seasoned salmon, Peruvian ceviche-style mixes). This expansion of flavor profiles helps packaged seafood compete directly with fresh food alternatives and gourmet takeout options. Investment in specialized R&D kitchens and sensory testing panels is necessary to ensure that these complex flavor profiles survive the cooking, preservation, and reheating processes inherent to packaged food formats, distinguishing high-quality offerings from standard, mass-market products.

Furthermore, the rise of private label brands across major retail chains represents a critical dynamic in the market. Retailers are increasingly leveraging their control over shelf space and shopper data to introduce competitively priced, high-quality private labels, often sourcing from the same manufacturers that produce national brands. This intensifies price-based competition, particularly in the core shelf-stable segments like canned tuna, pressuring national brand profit margins and necessitating strong brand loyalty programs and continuous product differentiation through superior ingredients or functional benefits to justify a higher price point.

The utilization of sophisticated cold chain monitoring technologies, including real-time GPS tracking and temperature logging (IoT sensors), is moving from a best practice to a standard requirement, especially for sensitive products like cooked crustaceans and ready-to-eat sushi mixes. Ensuring temperature integrity from the processing plant to the retailer’s freezer case minimizes microbial risk and prevents the costly consequences of product recalls or quality deterioration. This enhanced technological oversight not only protects the consumer but also provides detailed auditable data essential for fulfilling stringent international quality certifications and demonstrating supply chain accountability.

In response to evolving dietary trends, the market is witnessing growth in packaging formats tailored for portion control and on-the-go snacking. Single-serve pouches of flavored tuna or salmon, high-protein seafood sticks, and ready-to-mix salad toppers are highly attractive to younger consumers and those following macro-nutrient focused diets. This shift necessitates investment in flexible packaging machinery capable of producing smaller, highly customized pack sizes efficiently. These smaller format innovations open up new distribution points outside of traditional grocery stores, such as vending machines, corporate cafeterias, and convenience retail outlets.

Finally, labor challenges in primary processing and packaging facilities, exacerbated by global geopolitical instability and demographic shifts, are accelerating the adoption of industrial automation and robotics. Robotics are now commonly used for delicate tasks such as precise de-shelling of cooked crustaceans or automated packaging into trays, reducing reliance on manual labor, improving operational speed, and minimizing the risk of contamination. These long-term investments in automation are essential for maintaining competitive unit costs while consistently meeting the escalating volumes demanded by a growing global market that increasingly relies on reliable packaged seafood products.

The combination of these market drivers, technological advancements, and consumer-led demands places the Packaged Cooked Sea Food Market in a sustained growth phase, but one that requires strategic agility, robust capital investment in sustainable sourcing, and an uncompromising commitment to food safety and transparency across all operational levels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager