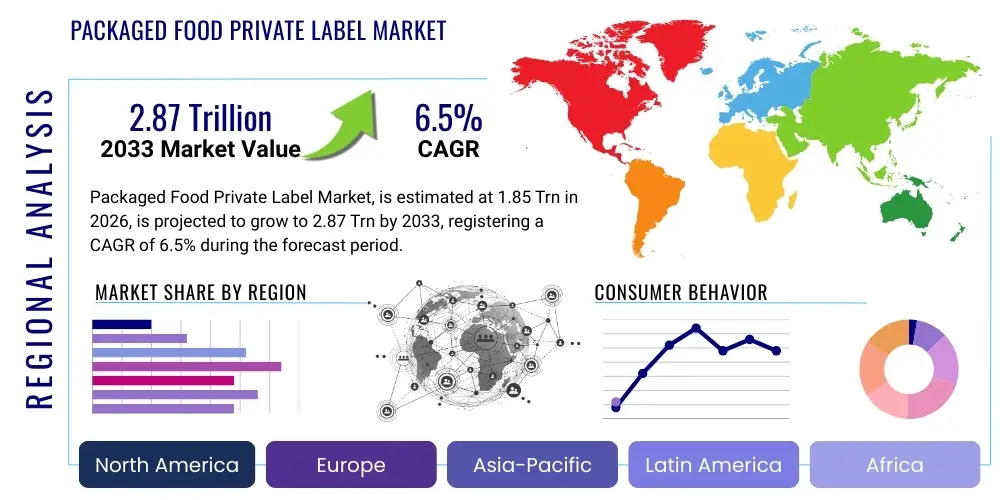

Packaged Food Private Label Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439901 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Packaged Food Private Label Market Size

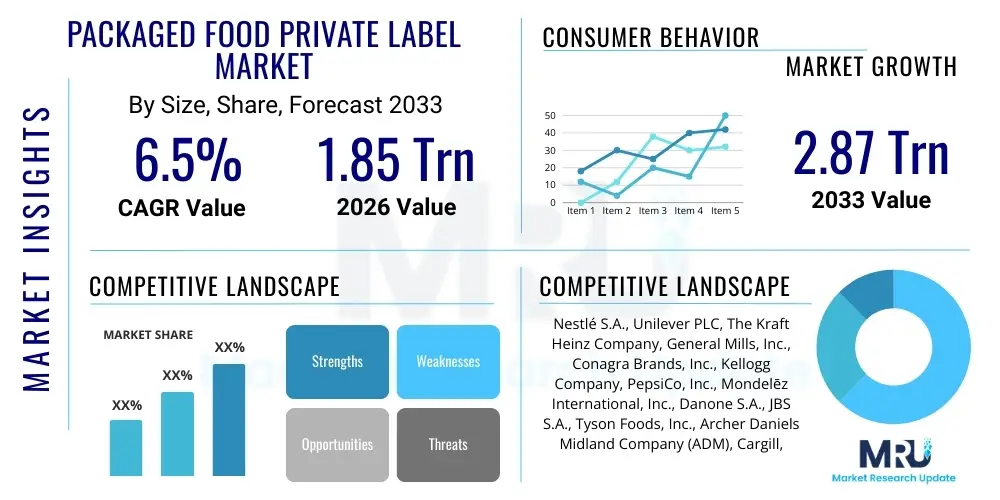

The Packaged Food Private Label Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 trillion in 2026 and is projected to reach USD 2.87 trillion by the end of the forecast period in 2033.

Packaged Food Private Label Market introduction

The Packaged Food Private Label Market encompasses a vast array of food products manufactured by a third party but sold under a retailer's or distributor's own brand name. These products span almost every grocery category, from staple items like bread, milk, and canned goods to specialty items such as organic snacks, gourmet frozen meals, and sophisticated ready-to-eat dishes. The market is characterized by retailers leveraging their brand equity and supply chain control to offer consumers more affordable or uniquely positioned alternatives to national brands. This strategy allows retailers to capture higher profit margins, build stronger customer loyalty, and differentiate their offerings in a highly competitive retail landscape.

Major applications of private label packaged foods are predominantly found within supermarket chains, hypermarkets, convenience stores, and increasingly, online retail platforms. These products serve a diverse consumer base, catering to various needs including budget-consciousness, specific dietary preferences, and the demand for convenience. The inherent benefits for both retailers and consumers are significant; retailers gain greater control over product development, pricing, and merchandising, while consumers often benefit from lower prices without a perceived compromise in quality, especially as private label brands continue to elevate their standards. Furthermore, private labels allow for greater agility in responding to emerging food trends and consumer demands, from plant-based options to sustainable packaging innovations. The driving factors behind this market's robust growth include fluctuating economic conditions that push consumers towards value, enhanced product quality and innovation in private label offerings, the expansion of e-commerce making these products more accessible, and retailers' strategic emphasis on bolstering their own brand portfolios for improved profitability and market positioning.

Packaged Food Private Label Market Executive Summary

The Packaged Food Private Label Market is experiencing dynamic shifts, driven by evolving consumer behaviors, technological advancements, and a competitive retail environment. Business trends indicate a significant move towards premiumization within private labels, with retailers investing in higher-quality ingredients, sophisticated packaging, and niche product development to shed the traditional "budget-only" image. E-commerce platforms are playing an increasingly crucial role, expanding the reach of private label products beyond physical store limitations and enabling targeted marketing strategies. Furthermore, sustainability and ethical sourcing have emerged as pivotal business drivers, with private label brands often leading the charge in offering eco-friendly and transparently sourced options, responding to a growing consumer demand for responsible consumption. Retailers are also leveraging data analytics to understand consumer preferences better, optimize their product assortments, and personalize marketing efforts, thereby enhancing the overall private label brand experience.

Regional trends reveal varied growth trajectories, with mature markets in North America and Western Europe demonstrating a strong presence and continued innovation in the premium and specialty private label segments. Emerging economies in Asia Pacific, Latin America, and Africa are witnessing accelerated growth, fueled by the expansion of organized retail, increasing disposable incomes, and a growing consumer appreciation for value-for-money products. These regions present substantial opportunities for new market penetration and product localization. Within segments, there is a pronounced trend towards health and wellness, with private labels introducing a wider range of organic, gluten-free, plant-based, and functional foods. Convenience foods, driven by busy lifestyles, continue to be a strong segment, alongside a growing emphasis on fresh and minimally processed private label options. The confluence of these trends underscores a market that is not only expanding in volume but also diversifying in its offerings and strategic approaches, reflecting a sophisticated evolution from generic alternatives to formidable competitors against national brands.

AI Impact Analysis on Packaged Food Private Label Market

User questions related to AI's impact on the Packaged Food Private Label Market often revolve around how artificial intelligence can enhance efficiency, reduce costs, improve product development, and personalize the consumer experience, while also raising concerns about data privacy, job displacement, and the ethical implications of algorithmic decision-making. Key themes include the potential for AI to revolutionize supply chain management, optimize inventory, forecast demand with greater accuracy, and drive hyper-personalized marketing campaigns. Consumers and industry stakeholders alike are keen to understand how AI can contribute to more sustainable practices, from ingredient sourcing to waste reduction, and how it might enable retailers to identify and capitalize on emerging food trends more rapidly. Expectations are high for AI to foster innovation in product formulations and packaging, streamline manufacturing processes, and ultimately deliver superior private label offerings that compete effectively with established national brands, thereby reshaping the competitive landscape and consumer value proposition.

- Enhanced Demand Forecasting: AI algorithms analyze vast datasets, including sales history, seasonal trends, weather patterns, social media sentiment, and economic indicators, to predict consumer demand for specific private label products with unparalleled accuracy. This minimizes overstocking and stockouts, reducing waste and optimizing inventory levels across the supply chain.

- Optimized Supply Chain Management: AI systems can monitor and manage complex global supply chains in real-time, identifying potential disruptions, optimizing logistics routes, and improving supplier selection based on performance metrics, sustainability, and cost-effectiveness. This ensures timely delivery of ingredients and finished products, crucial for maintaining freshness and quality in packaged foods.

- Personalized Product Development and Marketing: AI enables retailers to analyze individual consumer purchasing patterns and preferences, allowing for the creation of highly personalized private label product recommendations and targeted marketing campaigns. This extends to identifying gaps in the market for new private label offerings that cater to specific demographic or lifestyle needs.

- Improved Quality Control and Food Safety: AI-powered vision systems and sensors can monitor production lines for anomalies, detect defects, and ensure consistent product quality and adherence to food safety standards at every stage, from raw material inspection to final packaging. Predictive analytics can also identify potential contamination risks before they manifest.

- Automated Manufacturing and Operational Efficiency: Robotics and AI-driven automation in manufacturing facilities can increase production speed, reduce labor costs, and enhance precision in packaging and processing, leading to significant operational efficiencies and cost savings in private label production.

- Sustainable Sourcing and Waste Reduction: AI can help identify sustainable ingredient suppliers, optimize ingredient usage to minimize waste during production, and even inform decisions on eco-friendly packaging materials. By improving demand forecasting, AI inherently contributes to reducing food waste at the retail level.

- Dynamic Pricing Strategies: AI algorithms can analyze market conditions, competitor pricing, and consumer behavior to implement dynamic pricing strategies for private label products, optimizing revenue and competitiveness while maintaining attractive value propositions for consumers.

DRO & Impact Forces Of Packaged Food Private Label Market

The Packaged Food Private Label Market is significantly shaped by a confluence of drivers, restraints, opportunities, and broader impact forces that dictate its growth trajectory and competitive dynamics. Among the primary drivers, the pursuit of enhanced profitability for retailers stands out, as private label products typically offer higher margins compared to national brands, providing a strategic incentive for investment and expansion. Simultaneously, cost-effectiveness for consumers, particularly in periods of economic uncertainty, drives demand for private label alternatives, offering quality products at more accessible price points. The increasing consumer trust in private label quality, often fostered by retailers' significant investments in product development and stringent quality control, further propels market expansion. Moreover, the inherent flexibility in product innovation allows retailers to quickly adapt to emerging food trends and dietary preferences, launching new products or reformulating existing ones with greater agility than larger national brand conglomerates. The rapid growth of e-commerce has also played a pivotal role, providing new channels for private label products to reach a broader audience and facilitating direct-to-consumer strategies that bypass traditional distribution challenges, enhancing visibility and accessibility for these brands. Retailers are strategically leveraging their extensive data on consumer purchasing habits to tailor private label offerings, strengthening their market position and fostering customer loyalty through personalized assortments.

However, several restraints temper the market's full potential. Strong brand loyalty to established national brands remains a significant hurdle, as many consumers continue to prefer the perceived reliability and familiarity of well-known names, often despite price differences. The lingering perception of lower quality associated with some private label products, though steadily diminishing, can still deter certain segments of consumers. Furthermore, the complexities inherent in managing a robust supply chain for a diverse range of private label products, including sourcing raw materials, manufacturing, and distribution, present operational challenges and require substantial logistical expertise and investment. Private labels also typically operate with more limited marketing budgets compared to national brands, making it harder to build widespread brand recognition and consumer engagement through traditional advertising channels. The intense competition within the retail sector, not only from national brands but also among various private label offerings from different retailers, necessitates continuous innovation and differentiation to capture and retain market share. Navigating these restraints requires strategic differentiation, consistent quality, and effective communication of value to consumers.

Opportunities for growth are abundant and diverse. The premiumization of private labels, where retailers focus on offering high-quality, specialty, or gourmet versions of traditional products, allows them to compete in higher-value segments and appeal to more affluent consumers seeking unique or artisanal options. Expansion into functional foods, health and wellness products, and plant-based alternatives represents a significant avenue for growth, aligning with evolving consumer health consciousness and dietary trends. Geographic expansion into burgeoning emerging markets, where organized retail is growing and consumers are increasingly seeking value, offers substantial untapped potential. Leveraging advanced data analytics and artificial intelligence for hyper-personalization, from product recommendations to tailored marketing, can create stronger connections with consumers. Strategic partnerships with specialized manufacturers or ingredient suppliers can enhance product innovation and manufacturing capabilities, allowing retailers to bring novel private label concepts to market more efficiently. Finally, a strong emphasis on sustainable packaging innovations and transparent sourcing aligns with contemporary consumer values, providing a powerful differentiator and fostering brand loyalty among environmentally conscious buyers.

The market is also influenced by broader impact forces. Shifting consumer preferences, particularly the growing demand for convenience, health, sustainability, and value, directly impacts product development and marketing strategies for private labels. Economic conditions, including inflation, disposable income levels, and consumer confidence, significantly affect purchasing power and the inclination towards private label options. The regulatory environment, encompassing food safety standards, labeling requirements, and trade policies, imposes operational constraints and necessitates compliance, influencing production costs and market access. Technological advancements in food processing, packaging, and supply chain management offer continuous opportunities for efficiency gains, cost reduction, and product innovation, allowing private labels to enhance their competitive edge. Lastly, increasing retail consolidation and the growing market power of large retail chains provide private labels with greater leverage in negotiations with manufacturers and enhanced capabilities for market penetration, further solidifying their position in the packaged food landscape.

Segmentation Analysis

The Packaged Food Private Label Market is intricately segmented across various dimensions, providing a granular view of its structure and opportunities. This segmentation allows for targeted strategies by retailers and manufacturers, enabling them to cater to specific consumer needs, distribution channels, and product categories. Understanding these segments is crucial for identifying growth areas, optimizing product portfolios, and developing effective marketing and supply chain initiatives. The market's diverse nature necessitates a multi-faceted approach to segmentation, encompassing product types that range from everyday staples to gourmet specialties, various distribution models that include traditional brick-and-mortar as well as burgeoning online platforms, and packaging innovations that address both consumer convenience and environmental concerns. Furthermore, the segmentation by consumer demographics and product attributes like "organic" or "conventional" highlights the tailored approaches required to capture distinct market niches and respond to evolving lifestyle trends.

- Product Type

- Dairy & Dairy Alternatives: Includes private label milk, yogurt, cheese, butter, and an expanding range of plant-based milks and yogurts (almond, oat, soy).

- Bakery & Confectionery: Encompasses private label bread, pastries, cookies, cakes, biscuits, chocolates, and various sweet and savory baked goods.

- Snacks: Features private label chips, crackers, nuts, fruit bars, dried fruits, pretzels, and other convenient snacking options.

- Beverages: Covers private label juices, soft drinks, bottled water, ready-to-drink coffee and tea, and flavored waters.

- Processed Meat & Seafood: Includes private label deli meats, bacon, sausages, frozen fish fillets, canned tuna, and other value-added meat and seafood products.

- Frozen Foods: Comprises private label frozen meals, vegetables, fruits, pizzas, desserts, and various convenience-oriented frozen items.

- Sauces, Dressings, & Condiments: Features private label ketchup, mayonnaise, mustard, salad dressings, pasta sauces, spices, and cooking oils.

- Ready Meals & Convenience Foods: Includes private label microwaveable meals, instant noodles, canned soups, and other grab-and-go food solutions.

- Baby Food: Covers private label infant formula, purees, cereals, and snacks specifically formulated for babies and toddlers.

- Breakfast Cereals: Encompasses private label oats, granola, cornflakes, and other breakfast cereal varieties.

- Pantry Staples: Includes private label pasta, rice, canned vegetables and fruits, flour, sugar, and other essential grocery items.

- Distribution Channel

- Supermarkets & Hypermarkets: Dominant channel for private label sales, offering broad product assortments and competitive pricing.

- Convenience Stores: Growing channel for grab-and-go private label items, catering to immediate consumption needs.

- Online Retail (E-commerce platforms, Retailer websites): Rapidly expanding channel offering greater accessibility, home delivery, and personalized shopping experiences for private label products.

- Discount Stores: Key channel for budget-conscious consumers, with private labels forming a significant portion of their offerings.

- Specialty Stores: Emerging channel for premium and niche private label products, such as organic or gourmet food stores.

- Packaging Type

- Flexible Packaging: Includes pouches, bags, wraps, and sachets, valued for their lightweight nature, cost-effectiveness, and convenience.

- Rigid Packaging: Covers bottles, jars, cans, tubs, and trays, offering protection, extended shelf life, and often premium perception.

- Semi-rigid Packaging: Encompasses cartons, boxes, and blister packs, providing a balance of protection and design flexibility.

- Consumer Demographics

- Millennials & Gen Z: Consumers seeking value, convenience, ethical sourcing, and often open to trying new private label brands, particularly online.

- Families with Children: Demand for family-sized portions, healthy options, and budget-friendly private label staples.

- Single Households: Preference for single-serve portions and convenience-oriented private label ready meals.

- Elderly Consumers: Focus on easy-to-prepare meals, manageable portion sizes, and trusted, value-oriented private label options.

- Nature

- Organic & Natural: Private label products emphasizing clean labels, natural ingredients, and organic certifications, catering to health-conscious consumers.

- Conventional: Traditional private label products with a primary focus on affordability and broad appeal.

Value Chain Analysis For Packaged Food Private Label Market

The value chain for the Packaged Food Private Label Market is a sophisticated and highly interconnected network, beginning with the upstream sourcing of raw materials and extending through manufacturing, distribution, and ultimately to the end consumer. Upstream analysis reveals a critical dependency on agricultural producers and ingredient suppliers, where quality, consistency, and cost-efficiency are paramount. Retailers, who own the private label brand, often exert significant influence over these early stages, setting specifications for ingredients, ensuring compliance with ethical sourcing standards, and negotiating favorable terms with a diverse range of suppliers, from large agricultural corporations to specialty producers. The ability to establish robust relationships with reliable upstream partners is fundamental to maintaining product quality and supply stability, which are cornerstones of a successful private label program. Furthermore, contract manufacturers play a vital role in this phase, often taking responsibility for sourcing specific components based on the retailer's recipes and quality standards, demanding meticulous oversight and auditing processes.

Moving downstream, the manufacturing phase is typically handled by third-party contract manufacturers or, in some cases, by the retailers themselves through their own production facilities. This phase involves food processing, packaging, and quality control, all executed under the retailer's precise specifications and branding guidelines. The choice between utilizing dedicated contract manufacturers versus internal production hinges on factors such as economies of scale, technological capabilities, and strategic control. Post-manufacturing, the products enter the intricate distribution channel, which can be direct or indirect. Direct distribution involves the retailer transporting goods from the manufacturer directly to their own retail stores or distribution centers, offering maximum control over logistics and inventory management. This approach is common for large retail chains with extensive logistical infrastructures. Conversely, indirect distribution involves leveraging third-party logistics (3PL) providers or wholesalers who handle warehousing, transportation, and delivery to various retail outlets. The efficiency and cost-effectiveness of these distribution channels are critical, as they directly impact product availability, shelf life, and the final price point for the consumer.

The final stage of the value chain focuses on reaching the end consumer through various retail formats, including supermarkets, hypermarkets, convenience stores, and the burgeoning online retail sector. This downstream element is where the private label brand interacts directly with its target audience. Retailers utilize their vast physical store networks and increasingly sophisticated e-commerce platforms to merchandise, market, and sell private label products. The sales and marketing efforts, though typically more subdued than for national brands, focus on communicating value, quality, and brand trust to consumers. Effective shelf placement, in-store promotions, and targeted digital marketing campaigns are crucial for driving sales. The feedback loop from consumer purchasing behavior and preferences at this stage is invaluable, informing future product development, pricing strategies, and supply chain adjustments, thereby completing the cyclical nature of the value chain and reinforcing the retailer's strategic control over their private label portfolio.

Packaged Food Private Label Market Potential Customers

The Packaged Food Private Label Market caters to a remarkably broad and diverse spectrum of potential customers, spanning various demographic segments, income levels, and lifestyle preferences. At its core, a significant portion of the customer base comprises budget-conscious consumers who prioritize value and affordability without compromising on acceptable quality. These individuals or families, particularly during periods of economic constraint or high inflation, actively seek out private label alternatives to reduce their household grocery expenditures. This segment often includes large families, students, and lower to middle-income households who find that private label products offer a cost-effective solution for their everyday food needs, encompassing staples like dairy, bread, canned goods, and basic pantry items. For these customers, the primary drivers are price per unit and the ability to stretch their budget further while still procuring essential packaged food items for daily consumption.

Beyond price sensitivity, the market increasingly appeals to consumers who are health-conscious and seek specific dietary options. This group includes individuals looking for organic, natural, gluten-free, plant-based, or reduced-sugar alternatives, and they are increasingly finding that private label brands offer high-quality, specialty products in these categories at competitive prices compared to their national brand counterparts. Retailers have strategically expanded their private label portfolios to include premium and health-oriented lines, directly targeting consumers who prioritize ingredients, nutritional profiles, and ethical sourcing. This segment is often well-informed and willing to try new brands that align with their personal values and wellness goals, making them prime candidates for private label offerings that innovate in areas like sustainable packaging or allergen-free formulations. Furthermore, convenience seekers, a growing segment driven by busy modern lifestyles, are another key customer group. They gravitate towards private label ready meals, frozen foods, and pre-packaged snacks that offer quick and easy solutions for meal preparation or on-the-go consumption, valuing the time-saving aspect as much as, if not more than, the price.

Specific demographic groups also represent significant potential customer bases. Millennials and Generation Z, for instance, are often more open to trying private label brands, influenced by social media, online reviews, and a desire for authenticity and value. They are also highly responsive to brands that demonstrate corporate social responsibility and sustainable practices, areas where many private label brands are increasingly excelling. On the other hand, elderly consumers often seek trusted, familiar, and easy-to-manage private label products, valuing consistency and straightforward offerings. Furthermore, customers who are loyal to a particular retailer's brand ecosystem often become repeat purchasers of that retailer's private label products, viewing them as an extension of the store's overall value proposition and quality commitment. This group's purchasing decisions are often reinforced by positive shopping experiences and a perceived synergy between the private label and the retail environment. Ultimately, the potential customer base is multifaceted, requiring retailers to develop a nuanced understanding of various consumer segments and tailor their private label strategies to meet a wide array of demands, from basic necessities to premium specialty items.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Trillion |

| Market Forecast in 2033 | USD 2.87 Trillion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Unilever PLC, The Kraft Heinz Company, General Mills, Inc., Conagra Brands, Inc., Kellogg Company, PepsiCo, Inc., Mondelēz International, Inc., Danone S.A., JBS S.A., Tyson Foods, Inc., Archer Daniels Midland Company (ADM), Cargill, Inc., Bunge Limited, Olam Group, Associated British Foods (ABF) PLC, McCain Foods Limited, Dr. Oetker GmbH, Kerry Group plc, Arla Foods amba. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Packaged Food Private Label Market Key Technology Landscape

The Packaged Food Private Label Market is increasingly reliant on a sophisticated technological landscape to drive efficiency, innovation, and competitiveness. One of the most critical areas is advanced manufacturing technologies, which include automation and robotics in production lines. These technologies enable higher production speeds, greater precision in ingredient mixing and portioning, and enhanced consistency in product quality, which is vital for building consumer trust in private labels. Automation also helps in reducing labor costs and minimizing human error, leading to more efficient operations and better profitability. Furthermore, flexible manufacturing systems allow for rapid changeovers between different private label products or packaging formats, enhancing a retailer's ability to respond quickly to market trends and seasonal demands without significant downtime or retooling costs. High-speed packaging machinery, integrated with quality control sensors, ensures product integrity and extends shelf life, which are crucial factors in the packaged food sector.

Another pivotal aspect of the technological landscape is the integration of cutting-edge supply chain technologies. Internet of Things (IoT) sensors are being deployed across the supply chain, from farms and processing plants to transportation and retail shelves, to monitor conditions such as temperature, humidity, and location in real time. This data provides invaluable insights for maintaining product freshness, ensuring food safety, and optimizing logistics routes, significantly reducing waste and operational costs. Blockchain technology is gaining traction for enhancing transparency and traceability, allowing retailers and consumers to track the origin of ingredients and monitor the entire journey of a private label product from farm to fork. This not only builds consumer trust by verifying claims of ethical sourcing or organic status but also facilitates quicker responses in case of product recalls or quality issues. Predictive analytics, powered by artificial intelligence and machine learning, utilizes historical sales data, market trends, and external factors to forecast demand more accurately, enabling optimal inventory management and production planning, thereby reducing both overstocking and stockouts.

Furthermore, data analytics and artificial intelligence are transforming product development and consumer engagement within the private label sector. AI algorithms analyze vast datasets of consumer purchasing behavior, online reviews, social media sentiment, and demographic information to identify emerging food trends, popular flavor profiles, and unmet consumer needs. This data-driven approach allows retailers to develop new private label products that are precisely tailored to consumer preferences, significantly increasing their chances of market success. For instance, AI can help in formulating plant-based alternatives with optimal taste and texture or designing functional foods that address specific health concerns. In terms of packaging, sustainable packaging innovations, driven by new material science and design technologies, are becoming increasingly important. This includes the development of biodegradable, compostable, or recyclable materials, as well as smart packaging solutions that can monitor product freshness or provide consumers with interactive information. These technological advancements collectively empower private label brands to compete more effectively with national brands by offering innovative, high-quality, and cost-efficient products that meet the evolving demands of modern consumers.

Regional Highlights

- North America: The North American market, particularly the United States and Canada, is a mature but highly influential segment for packaged food private labels. Driven by strong retail consolidation and sophisticated consumer demand for value, convenience, and increasingly, premium and specialty private label offerings, the region demonstrates robust growth in segments like organic, plant-based, and ready-to-eat meals. Retailers like Walmart, Kroger, and Costco have significantly invested in expanding and differentiating their private label portfolios, often directly challenging national brands on quality and innovation.

- Europe: Europe represents the largest market for private label packaged foods globally, with high penetration rates across various countries. Western European nations such as the UK, Germany, France, and Spain exhibit strong consumer acceptance and trust in private labels, driven by competitive pricing strategies, stringent quality control, and continuous product innovation from leading retailers like Tesco, Carrefour, Aldi, and Lidl. Eastern Europe is also experiencing rapid growth as organized retail expands and consumer disposable incomes rise, leading to increased adoption of private label options.

- Asia Pacific (APAC): The APAC region is projected to be one of the fastest-growing markets, fueled by urbanization, increasing disposable incomes, and the expansion of modern retail formats in countries like China, India, Japan, and Southeast Asian nations. While national brands traditionally held sway, consumers are increasingly open to private labels for their value proposition and improving quality. Opportunities abound for products catering to local tastes, health and wellness trends, and convenience-driven lifestyles, with significant growth in e-commerce channels.

- Latin America: Countries like Brazil, Mexico, and Argentina are witnessing substantial growth in the private label packaged food sector. Economic volatility often pushes consumers towards more affordable options, benefiting private label penetration. As modern retail infrastructure develops and consumer awareness of private label quality improves, there is significant potential for expansion across various food categories, from basic staples to more value-added items.

- Middle East and Africa (MEA): The MEA region presents a diverse landscape for private label growth. In the Middle East, high-income countries show demand for premium and specialty private labels, while in Africa, the burgeoning middle class and expanding organized retail sectors are driving demand for basic, affordable private label food products. Challenges include fragmented retail landscapes in some areas and varying consumer preferences, but the long-term potential remains significant as market infrastructure develops.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Packaged Food Private Label Market.- Nestlé S.A.

- Unilever PLC

- The Kraft Heinz Company

- General Mills, Inc.

- Conagra Brands, Inc.

- Kellogg Company

- PepsiCo, Inc.

- Mondelēz International, Inc.

- Danone S.A.

- JBS S.A.

- Tyson Foods, Inc.

- Archer Daniels Midland Company (ADM)

- Cargill, Inc.

- Bunge Limited

- Olam Group

- Associated British Foods (ABF) PLC

- McCain Foods Limited

- Dr. Oetker GmbH

- Kerry Group plc

- Arla Foods amba

Frequently Asked Questions

What defines a 'private label' in packaged food and why are they growing?

A private label packaged food product is manufactured by a third party but sold under a retailer's or distributor's own brand name, such as Walmart's Great Value or Kroger's Simple Truth. Their growth is driven by several factors, including higher profit margins for retailers, competitive pricing for consumers, improved product quality, increasing consumer trust, and retailers' ability to quickly adapt to market trends with innovative offerings. These brands often provide a strong value proposition, challenging established national brands.

How do private labels impact consumer choice and market competition?

Private labels significantly broaden consumer choice by offering alternatives to national brands, often at a lower price point but with comparable or even superior quality in some categories. This increased competition forces national brands to innovate, maintain quality, and adjust pricing, benefiting consumers. For retailers, private labels enhance brand loyalty and differentiate their stores, giving them greater control over their product assortment and pricing strategies. They empower consumers by offering more diverse options across various price and quality tiers.

What role does sustainability play in the private label packaged food market?

Sustainability is becoming a crucial differentiating factor for private label packaged foods. Consumers are increasingly seeking eco-friendly and ethically sourced products, and private label brands are responding by investing in sustainable packaging materials (e.g., recyclable, compostable), reducing food waste throughout their supply chains, and ensuring transparent sourcing of ingredients. This focus not only appeals to environmentally conscious consumers but also enhances the brand image and responsible market positioning of retailers.

Are private label packaged foods perceived as lower quality than national brands?

Historically, private label products were often perceived as lower quality or generic alternatives. However, this perception has largely shifted. Retailers have made substantial investments in product development, quality control, and premiumization strategies, leading to significant improvements in taste, nutritional value, and overall product integrity. Many private label brands now compete directly with, and sometimes surpass, national brands in specific categories, fostering greater consumer trust and a preference for their value-for-money offerings.

How is e-commerce influencing the growth and strategy of private label packaged foods?

E-commerce is a transformative force for private label packaged foods. Online platforms provide expanded reach, allowing private labels to bypass traditional shelf space limitations and access a broader consumer base. Retailers leverage data analytics from online shopping to understand consumer preferences better, enabling highly targeted marketing and personalized product recommendations. The convenience of online ordering and home delivery further drives adoption, making it easier for consumers to discover and purchase private label items, thereby accelerating market growth and shaping future retail strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager