Packaging Primers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432326 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Packaging Primers Market Size

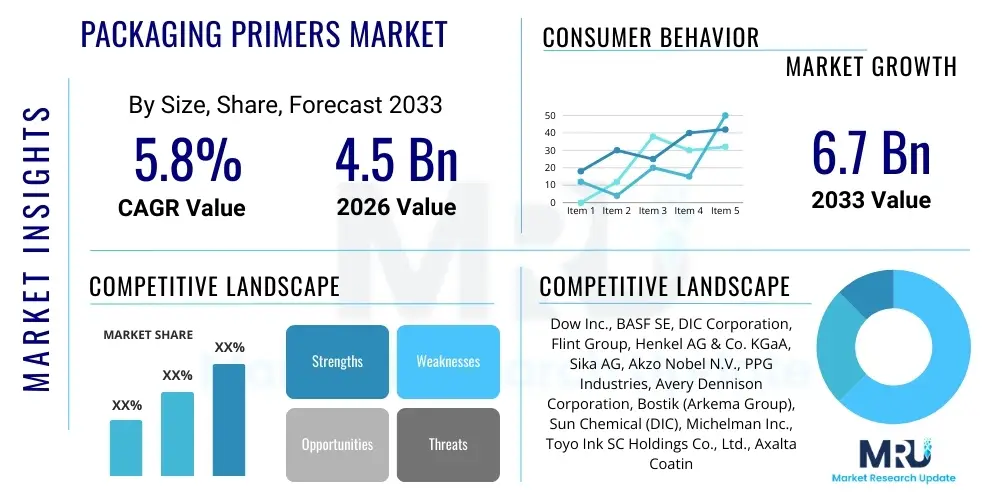

The Packaging Primers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.7 Billion by the end of the forecast period in 2033.

Packaging Primers Market introduction

Packaging primers are highly specialized chemical formulations applied to packaging substrates—such as plastics, metals, paperboard, and films—before the application of inks, adhesives, or coatings. Their primary function is to enhance adhesion properties, ensuring the structural integrity and aesthetic quality of the final packaged product. These intermediary layers are crucial for improving surface energy, blocking migration of components from the substrate, and ensuring robust lamination or printing outcomes, particularly in demanding applications like flexible food packaging where heat sealing and retort processes are involved. The chemical composition of primers varies widely, encompassing formulations like polyurethanes, acrylics, and specialized vinyl copolymers, designed to interface effectively between dissimilar materials.

The product is indispensable across the fast-moving consumer goods (FMCG) sector, driven by the escalating demand for high-performance packaging solutions that prioritize sustainability, extended shelf life, and complex graphical designs. Major applications span food and beverage packaging, pharmaceutical blistering and sachets, cosmetic tubes, and industrial bulk containers. The necessity for primers stems from the inherent difficulty in adhering to low-surface-energy substrates, such as polyethylene and polypropylene, without chemical modification. Primers facilitate this critical bond, preventing delamination and ensuring regulatory compliance regarding food contact materials and migration standards.

Driving factors in this market include the global expansion of flexible packaging over rigid alternatives due to lower material usage and reduced transportation costs, coupled with regulatory pressure pushing for sustainable and recyclable mono-material structures. Primers are essential in bridging the performance gap when transitioning to these new, often challenging, sustainable substrates, allowing brand owners to maintain product safety and visual appeal. The continuous innovation in printing technologies, such as digital printing, also mandates specialized primers to ensure ink receptivity and long-term durability on diverse packaging formats.

Packaging Primers Market Executive Summary

The Packaging Primers Market is characterized by robust growth, primarily fueled by the accelerating shift towards flexible packaging formats globally and stringent regulatory requirements mandating enhanced adhesion and barrier functionalities, particularly in the food and pharmaceutical sectors. Key business trends indicate significant investment in research and development focused on sustainable and environment-friendly formulations, specifically water-based and UV-curable primers, moving away from conventional solvent-based systems to comply with VOC reduction targets. Mergers and acquisitions remain a central strategy for major chemical suppliers seeking to consolidate market share and acquire specialized technology portfolios, particularly in emerging high-growth segments like high-speed digital printing primers.

Regionally, the Asia Pacific (APAC) market leads in terms of consumption volume, spurred by massive industrialization, rapid urbanization, and the corresponding growth of the organized retail sector, particularly in populous nations like China and India. North America and Europe, while mature, are driving value growth through technological innovation, focusing heavily on circular economy initiatives which necessitate primers compatible with recycling processes, such as deinking and chemical recycling. Regulatory divergence among regions regarding food contact compliance and solvent use continues to shape product development, requiring globally operating manufacturers to maintain diversified product lines tailored to specific jurisdictional needs.

Segmentation trends highlight the dominance of the Water-based technology segment due to increasing environmental awareness and regulatory mandates, although Solvent-based primers maintain stronghold in applications requiring superior performance and high-speed processing, especially in specialized lamination. The flexible packaging segment is the dominant application area, driven by convenience and cost-effectiveness. In terms of end-use, the Food & Beverage industry constitutes the largest demand pool, where the critical need for barrier protection, heat seal integrity, and print durability makes primers an essential material component, further bolstered by the increasing sophistication of multi-layer coextruded films.

AI Impact Analysis on Packaging Primers Market

User inquiries regarding AI's influence on the Packaging Primers Market primarily center on how AI can optimize formulation processes, enhance quality control, predict material performance under varying environmental conditions, and streamline supply chain logistics for specialized chemicals. Users express interest in AI-driven material informatics for rapid screening of novel bio-based raw materials suitable for primer synthesis, aiming to accelerate the shift towards sustainability without compromising adhesion strength. A core concern is whether machine learning algorithms can minimize batch-to-batch variability in primer production, which is crucial for maintaining consistent output in high-speed packaging lines. Furthermore, stakeholders anticipate that AI could significantly reduce waste generation during the coating process by optimizing application parameters (e.g., coating weight, speed, temperature) in real-time, integrating seamlessly with smart factory initiatives.

The integration of artificial intelligence tools is transforming the R&D pipeline for packaging primers, moving away from traditional, lengthy trial-and-error methods towards predictive modeling. AI algorithms can analyze vast datasets concerning substrate properties, chemical interactions, cure profiles, and end-use requirements (such as retort resistance or chemical resistance). This predictive capability allows chemists to simulate thousands of potential primer formulations virtually, identifying the most promising candidates that meet specific performance criteria, cost constraints, and regulatory profiles, dramatically shortening the time-to-market for specialized adhesion promoters needed for challenging new substrates like compostable films or rigid mono-materials.

In manufacturing and quality assurance, AI leverages sensor data collected from coating and printing lines to implement sophisticated predictive maintenance and quality assurance protocols. For instance, computer vision systems, powered by AI, can detect microscopic coating defects or inconsistencies in primer application thickness that human operators might miss, ensuring that only high-quality substrates proceed to lamination or printing stages. This real-time feedback loop allows manufacturers to dynamically adjust process variables, reducing material scrap rates and ensuring optimal primer curing, thereby minimizing production downtime and enhancing overall operational efficiency, which is critical given the high costs associated with specialized chemical manufacturing.

- Accelerated R&D through material informatics for sustainable formulations.

- Optimized coating weight and application parameters via real-time process control.

- Predictive quality control eliminating batch variability and defects detection.

- Enhanced supply chain visibility and demand forecasting for specialized raw materials.

- Simulation of adhesion performance on complex multi-layer and mono-material substrates.

- Implementation of smart sensors for environmental monitoring and regulatory compliance tracking.

DRO & Impact Forces Of Packaging Primers Market

The Packaging Primers Market is fundamentally shaped by the twin forces of escalating consumer demand for packaged goods and stringent environmental regulations demanding sustainable material transitions. The primary drivers include the exponential growth of e-commerce, which necessitates durable, protective, and tamper-evident packaging, often relying on high-performance adhesives and primers. Opportunities arise particularly in developing primers tailored for emerging bio-plastics and advanced recyclable substrates, providing manufacturers a competitive edge. However, the market faces significant restraints, chiefly the volatile cost and supply chain vulnerability of petrochemical-derived raw materials, alongside the technical complexity and high investment required to transition production lines from solvent-based systems to sophisticated water-based or UV-curable alternatives. These dynamics create a high-impact environment where innovation in formulation science is the key differentiator for market survival and expansion.

Key drivers center around the shift towards mono-material flexible packaging, which requires exceptionally strong, yet removable or compatible, primers to facilitate easy recycling or de-lamination during recovery processes. Furthermore, the increasing complexity of packaging designs, involving multi-color printing, complex laminates, and enhanced barrier properties (e.g., oxygen or moisture barriers), dictates the use of advanced chemical coupling agents, often supplied as specialized primers, to ensure long-term performance stability. The pharmaceutical sector's strict regulations regarding drug integrity and barrier function in primary packaging also drive demand for ultra-high-performance, non-migratory primers that comply with stringent FDA and EMA guidelines. The global movement towards eliminating solvent-based substances due to VOC emission concerns acts as a significant regulatory accelerator for sustainable technology adoption.

Restraints are primarily rooted in material and operational complexities. The high initial capital expenditure needed to install UV curing systems or specialized ovens for water-based primers creates barriers for smaller converters. Furthermore, the specialized nature of these chemical formulations means that substitution risk from generic coatings is low, but the reliance on a limited number of specialty chemical suppliers for key raw ingredients introduces supply chain fragility. Opportunities, conversely, lie in leveraging the current technological gap in achieving high-speed, high-performance, sustainable primers. Specifically, primers that enable efficient de-inking processes for paperboard recycling or enhance the mechanical strength of compostable films without negatively impacting compostability present substantial avenues for market penetration, driven by mandates in regions like the European Union and progressive corporate sustainability pledges.

Segmentation Analysis

The Packaging Primers Market is comprehensively segmented based on technology type, application format, and the primary end-use industry, reflecting the diverse functional requirements across the packaging value chain. The technological segmentation is critical, defining the primer’s environmental footprint and processing characteristics, with the major categories being water-based, solvent-based, and UV-curable systems. Water-based systems are seeing the fastest uptake due to regulatory pressures favoring low VOC emissions, while solvent-based options retain niche relevance where extreme adhesion or high-speed curing is necessary. UV-curable primers represent a technologically advanced segment offering instant curing and superior chemical resistance, driving growth in premium rigid packaging and specialized labeling.

Application segmentation focuses on the physical format of the packaged product, namely flexible packaging, rigid packaging, and labels and tapes. Flexible packaging, encompassing pouches, films, and sachets, dominates the market share, driven by its lightweight nature and prevalence in the food sector. Rigid packaging, including bottles and containers, requires primers for printing decoration and protective coatings. Labels and tapes necessitate specialized primers to ensure durable ink adhesion and strong bonding to diverse surface types, especially for track-and-trace applications and industrial identification. Each application area demands specific performance attributes from the primer, leading to continuous customization and formulation tailoring by manufacturers.

The end-use industry segmentation delineates consumption patterns based on industry-specific regulations and functional needs. The Food & Beverage sector is the largest consumer, requiring food-contact-safe primers for lamination and printing to ensure barrier integrity and non-migration. Pharmaceuticals demand highly certified, inert primers for sterility and stability of drug packaging. Cosmetics and Personal Care necessitate primers for aesthetic appeal, ensuring print durability on complex substrates like high-density polyethylene (HDPE) or glass, while the Industrial Goods segment utilizes primers for heavy-duty adhesive applications, large bulk containers, and anti-corrosion requirements.

- By Technology:

- Water-based Primers

- Solvent-based Primers

- UV-curable Primers

- Others (e.g., Hot-melt Primers)

- By Application:

- Flexible Packaging (Films, Pouches, Wraps)

- Rigid Packaging (Bottles, Containers, Trays)

- Labels and Tapes

- Folding Cartons

- By End-Use Industry:

- Food & Beverage

- Pharmaceuticals and Healthcare

- Cosmetics & Personal Care

- Industrial and Chemical Goods

- Other Consumer Goods

- By Substrate:

- Plastics (PP, PE, PET, PVC)

- Paper and Paperboard

- Metals and Foils

- Glass

Value Chain Analysis For Packaging Primers Market

The value chain for the Packaging Primers Market begins with the upstream sourcing of specialized raw materials, primarily petrochemical derivatives and specialty chemicals such as polyisocyanates, acrylic monomers, resins, and various solvents or water-based dispersants. This upstream segment is highly concentrated, involving large multinational chemical companies that dictate material costs and availability, profoundly impacting the final cost structure of the primer. Fluctuations in crude oil prices and regulatory constraints on specific chemical intermediates, such as restrictions on bisphenol A (BPA) or certain volatile organic compounds (VOCs), necessitate continuous reformulation and supply chain vigilance by primer manufacturers.

The midstream involves the core activities of formulation and manufacturing, where specialty chemical companies synthesize and blend these raw materials into functional primer products. This stage requires significant technical expertise, capital investment in reaction vessels, mixing equipment, and rigorous quality control testing to ensure consistency in adhesion, viscosity, and curing speed. Primer manufacturers must align their product development closely with both adhesive/ink manufacturers and packaging converters to ensure compatibility with high-speed printing and lamination equipment. Direct sales channels are often utilized for large, specialized converters or global brand owners requiring bespoke formulations, providing technical support and customized logistical solutions.

The downstream distribution channel primarily involves two routes: direct sales to large packaging converters (printers, laminators, coaters) who integrate the primer into their production lines, and indirect sales through specialized chemical distributors and agents, who manage smaller volume requirements and inventory for mid-sized players across diverse geographical locations. End-users, such as major food companies or pharmaceutical corporations, exert significant pull on the value chain, dictating performance specifications and sustainability requirements. The efficacy of the primer directly impacts the quality of the final package, making the relationship between the primer supplier and the converter critical for successful product deployment.

Packaging Primers Market Potential Customers

The primary customers and end-users of packaging primers are the various entities involved in the conversion and decoration of packaging substrates before the final filling process. These include large-scale flexible packaging converters, such as those specializing in snack food wrappers and multi-layer films, who utilize primers for lamination adhesion and rotogravure or flexographic printing preparation. Additionally, manufacturers of labels and pressure-sensitive tapes are significant buyers, requiring specialized primers to ensure permanent or removable adhesion to diverse product surfaces, particularly in challenging environments (e.g., cold storage or exposure to moisture).

A secondary, yet crucial, customer segment comprises rigid packaging manufacturers, including producers of metal cans for beverages, plastic bottles for personal care items, and paperboard cartons. These entities utilize primers as pre-treatment coatings to enhance the durability and adhesion of external decorative inks or internal barrier coatings. Furthermore, global brand owners, although not direct purchasers of the primer chemical itself, significantly influence purchasing decisions by imposing stringent performance specifications, regulatory compliance mandates (like food contact certification), and sustainability criteria on their contract packaging suppliers, thereby driving demand for certified, high-performance primer solutions.

The core demand originates from the major packaging consuming industries. The Food & Beverage sector, encompassing dairy, processed foods, and beverages, represents the largest customer base due to the high volume of packaged goods and the critical need for safe, long-lasting seals and barriers. The Pharmaceutical sector represents a high-value customer segment, characterized by stringent quality demands for blister packs and sterile packaging, where primer reliability is non-negotiable for patient safety and regulatory adherence. Contract manufacturers and co-packers, acting as intermediaries for various brand owners, also constitute a growing potential customer base, seeking versatile primer solutions compatible with high-throughput, multi-product manufacturing lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Inc., BASF SE, DIC Corporation, Flint Group, Henkel AG & Co. KGaA, Sika AG, Akzo Nobel N.V., PPG Industries, Avery Dennison Corporation, Bostik (Arkema Group), Sun Chemical (DIC), Michelman Inc., Toyo Ink SC Holdings Co., Ltd., Axalta Coating Systems, Wacker Chemie AG, ALTANA AG, H.B. Fuller Company, Trelleborg AB, Momentive Performance Materials Inc., Lubrizol Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Packaging Primers Market Key Technology Landscape

The technology landscape of the Packaging Primers Market is undergoing a rapid transition driven by environmental mandates and evolving substrate demands. Historically dominated by solvent-based systems (utilizing toluene, ethyl acetate, or MEK), which offer superior wetting and fast drying times, the market is now aggressively pivoting towards sustainable alternatives. Water-based primer technology is the current focus of innovation, leveraging complex emulsification techniques and high-performance resins (like specialized polyurethanes or modified acrylics) to achieve comparable adhesion and barrier properties while drastically reducing volatile organic compound (VOC) emissions. Manufacturers are developing multi-functional water-based primers that not only promote adhesion but also provide barrier properties against moisture, oil, or oxygen, simplifying the packaging structure.

A second crucial area of technological advancement is UV-curable and Electron Beam (EB) curable primers. These systems offer immediate curing upon exposure to high-intensity light or radiation, eliminating the need for thermal drying ovens and significantly reducing energy consumption and production cycle times. UV/EB technology is highly favored in high-end applications, particularly for rigid plastic containers, glass, and high-speed label printing, where superior abrasion resistance and chemical durability are required. The development focus here is on improving flexibility and reducing the migration risk of photoinitiators, especially for food contact applications, which remains a key regulatory hurdle for broader adoption.

Furthermore, technology development is concentrated on the molecular engineering of adhesion promoters specifically designed for challenging, non-conventional substrates crucial for the circular economy. This includes primers for polylactic acid (PLA) and other bio-based or compostable polymers, which inherently possess low surface energy and often require specialized chemical coupling agents to achieve adequate bond strength with conventional inks and adhesives. The use of nano-technology and advanced polymer grafting techniques is being explored to create ultra-thin, highly effective primer layers that do not compromise the recyclability or compostability certifications of the final package, thus aligning technological innovation with mandated sustainability goals across global markets.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for packaging primers, primarily driven by explosive growth in manufacturing, urbanization, and a corresponding surge in demand for processed and packaged foods, particularly in China and India. The region benefits from lower operating costs, attracting significant foreign investment in packaging conversion infrastructure. While cost-effectiveness often favors solvent-based primers in some emerging economies, regulatory tightening in countries like China is accelerating the adoption of high-performance water-based solutions, especially in sophisticated export-oriented packaging industries. This region is critical for high-volume consumption, particularly in flexible packaging for snack foods and personal care items.

- North America: North America is characterized by high adoption rates of advanced primer technologies, including UV-curable and specialized formulations for digital printing. Market growth is stable and driven by stringent food safety regulations and a strong emphasis on brand integrity, necessitating superior print quality and lamination durability. The regional market demands primers compatible with sustainable and recycled plastic content (PCR materials), leading to significant R&D spending focused on maximizing adhesion to substrates with varying surface characteristics due to their recycled origin. The increasing market penetration of e-commerce packaging also drives demand for specialized primers used in protective tapes and mailer bags.

- Europe: Europe is the global leader in sustainability mandates, heavily influencing the primer technology trajectory. The EU’s directive on reducing plastic waste and improving recycling rates has created a massive demand for primers compatible with mono-material packaging (e.g., all-PE or all-PP structures) and chemical recycling processes. Consequently, the European market shows the highest penetration of water-based and bio-based primer systems. Regulatory pressure regarding migration testing (especially under REACH and specific food contact regulations) ensures that manufacturers in this region focus intensely on high-purity, low-migration chemical components, driving value-added product development over pure volume.

- Latin America (LATAM): The LATAM market shows moderate growth, primarily fueled by expanding food and beverage production and the modernization of local packaging industries, particularly in Brazil and Mexico. Price sensitivity remains a significant factor, leading to a steady, though gradually declining, preference for cost-effective conventional primer systems. However, increasing export activities and the entry of multinational brand owners are slowly introducing demand for higher performance and environmentally compliant primers, particularly those utilized for premium cosmetic and beverage labeling.

- Middle East and Africa (MEA): Growth in the MEA region is fragmented, with the UAE and Saudi Arabia leading in sophisticated packaging due to high disposable income and infrastructure investment. The market is primarily influenced by imports of advanced packaging technology. Demand is centered around flexible packaging for perishable food items due to challenging climatic conditions, requiring high-barrier properties achieved through lamination primers. Investment in local manufacturing capabilities is gradually increasing, pushing demand for robust and reliable primer systems suitable for hot and humid operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Packaging Primers Market.- Dow Inc.

- BASF SE

- DIC Corporation

- Flint Group

- Henkel AG & Co. KGaA

- Sika AG

- Akzo Nobel N.V.

- PPG Industries

- Avery Dennison Corporation

- Bostik (Arkema Group)

- Sun Chemical (DIC)

- Michelman Inc.

- Toyo Ink SC Holdings Co., Ltd.

- Axalta Coating Systems

- Wacker Chemie AG

- ALTANA AG

- H.B. Fuller Company

- Trelleborg AB

- Momentive Performance Materials Inc.

- Lubrizol Corporation

Frequently Asked Questions

Analyze common user questions about the Packaging Primers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a packaging primer in flexible packaging?

The primary function of a packaging primer is to enhance the surface energy and chemical affinity of low-energy substrates (like polyolefins) to promote superior adhesion between the film and subsequently applied layers, such as printing inks, protective varnishes, or laminating adhesives, ensuring structural integrity and print durability.

How are environmental regulations affecting the development of new packaging primers?

Environmental regulations, particularly those targeting Volatile Organic Compounds (VOCs) and promoting packaging recyclability, are accelerating the market shift away from traditional solvent-based systems toward low-VOC water-based and zero-VOC UV-curable primer technologies. Manufacturers are intensely focused on developing solutions that enable mono-material structures compatible with mechanical and chemical recycling processes.

What is the fastest-growing technology segment in the packaging primers market?

The water-based primers technology segment is experiencing the fastest growth globally due to governmental mandates and corporate sustainability pledges requiring reduced VOC emissions. Continuous advancements have improved the performance of water-based systems, enabling their use in demanding applications previously dominated by solvent-based formulations.

Which end-use industry drives the highest demand for packaging primers?

The Food & Beverage end-use industry drives the highest volume demand for packaging primers. Primers are essential in this sector to ensure robust lamination integrity, barrier performance (crucial for extended shelf life), and compliance with strict food contact safety standards (non-migration requirements).

What challenges do primers face when adhering to recycled content (PCR) substrates?

Primers face challenges adhering to Post-Consumer Recycled (PCR) substrates due to inherent variations in the substrate's chemical composition, surface contamination, and fluctuating surface energy levels, which necessitate specialized, highly reactive primer chemistries designed to maintain consistent adhesion despite material variability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager