Packaging Ultrasonic Welder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436918 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Packaging Ultrasonic Welder Market Size

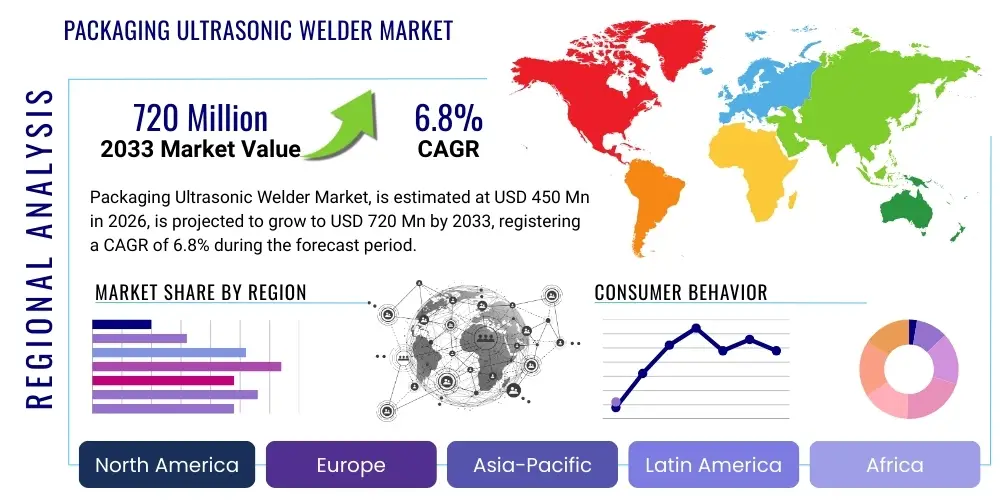

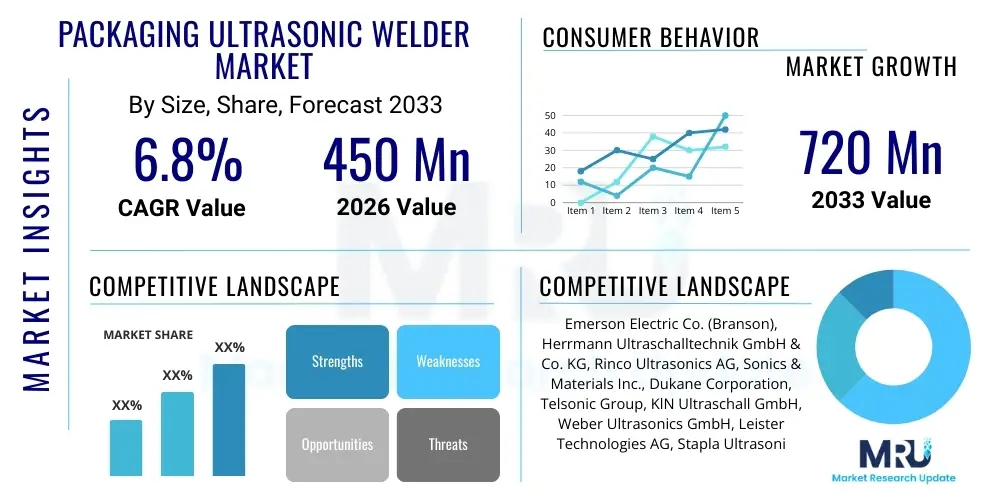

The Packaging Ultrasonic Welder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033.

Packaging Ultrasonic Welder Market introduction

The Packaging Ultrasonic Welder Market encompasses specialized industrial equipment designed to join thermoplastic packaging materials using high-frequency acoustic vibrations. This non-contact welding method generates localized heat through molecular friction, resulting in robust, hermetic seals without the need for adhesives or external heat sources. These welders are essential across fast-moving consumer goods (FMCG), medical devices, food and beverage, and cosmetics sectors where seal integrity and aesthetic quality are paramount. The technology offers high throughput and precise energy delivery, making it highly efficient for continuous packaging operations.

Product descriptions typically revolve around key technical specifications such as operating frequency (e.g., 20 kHz, 35 kHz), power output, tooling design (sonotrodes and anvils), and integration capability with automated packaging lines. Modern ultrasonic welders feature advanced digital controls for monitoring amplitude, pressure, and weld time, ensuring repeatability and facilitating compliance with stringent quality standards, particularly in pharmaceutical and sterile medical packaging. The primary application involves sealing films, pouches, blisters, cups, and tubes made from various polymers like PP, PE, PET, and multilayer laminates, focusing heavily on sustainability and reduced material waste.

Major driving factors fueling market growth include the escalating global demand for flexible packaging solutions, the inherent benefits of ultrasonic welding such as superior seal strength, faster cycle times compared to thermal sealing, and the critical advantage of sealing through contamination, particularly relevant in food packaging. Furthermore, the increasing adoption of sustainable mono-material packaging and the global push towards reduced energy consumption in manufacturing processes significantly enhance the appeal of ultrasonic technology. The need for precise, reliable, and hygienic packaging in sensitive industries continues to solidify the market position of advanced ultrasonic welding systems.

Packaging Ultrasonic Welder Market Executive Summary

The global Packaging Ultrasonic Welder Market is experiencing sustained growth driven primarily by advancements in automation and the evolving demand for sustainable packaging formats. Key business trends indicate a shift towards modular and integrated welding systems that can be seamlessly incorporated into high-speed, multi-format packaging lines. Manufacturers are investing heavily in R&D to enhance system intelligence, introducing features like predictive maintenance, real-time quality monitoring via sensors, and advanced human-machine interfaces (HMIs) to optimize operational efficiency and reduce downtime. Strategic alliances between ultrasonic equipment providers and large-scale packaging machinery OEMs are becoming common, aiming to offer turnkey solutions that address complex manufacturing challenges.

Regionally, Asia Pacific (APAC) dominates the market, propelled by rapid industrialization, massive expansion of the food processing and pharmaceutical industries, particularly in China and India, and increasing foreign direct investment in manufacturing capabilities. North America and Europe, characterized by stringent regulatory environments and a strong emphasis on automation and labor cost reduction, demonstrate robust demand for high-specification, automated systems optimized for complex medical and high-end consumer goods packaging. The push for localized manufacturing and resilient supply chains post-2020 has further accelerated the adoption of advanced welding technologies globally, ensuring regional stability and self-sufficiency in key sectors.

Segment trends underscore the prominence of the film and pouch sealing segment, reflective of the explosive growth in flexible packaging globally. Furthermore, the segment defined by higher frequency systems (e.g., 35 kHz and 40 kHz) is witnessing rapid expansion due to their ability to handle thinner, sensitive materials with greater precision and minimal thermal impact, critical for non-woven fabrics and delicate medical packaging films. The integration of advanced diagnostics and networking capabilities (Industry 4.0 readiness) across all power levels and frequency ranges remains a core developmental focus, driving premiumization within the high-performance welder category and ensuring long-term operational resilience for end-users.

AI Impact Analysis on Packaging Ultrasonic Welder Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can move ultrasonic welding beyond simple automation to predictive performance and intelligent quality control. Common questions center on AI's ability to analyze complex acoustic signatures during the welding process to instantly detect subtle imperfections, predict equipment failure before it occurs, and dynamically optimize weld parameters based on material inconsistencies (e.g., variations in film thickness or temperature). The prevailing expectation is that AI integration will drastically reduce scrap rates, minimize reliance on manual setup adjustments, and enhance the overall adaptability of welding systems to handle diverse packaging materials efficiently, addressing concerns related to labor dependency and stringent quality compliance in sensitive industries.

AI is poised to transform the calibration and operational lifespan of ultrasonic welding machinery. By continuously processing high-dimensional data streams—including amplitude feedback, pressure profiles, vibration frequency, and resulting acoustic emission signatures—AI algorithms can learn the optimal parameters for virtually every material combination and environmental condition. This results in 'self-optimizing' welders that automatically adjust power levels and cycle times in real-time to maintain flawless seal integrity, a capability far exceeding traditional static process control mechanisms. This shift ensures not only superior weld quality but also significant energy savings through precise power delivery.

Furthermore, AI-driven predictive maintenance represents a major value proposition, moving operations from reactive repairs to proactive scheduling. Machine learning models analyze historical operational data alongside real-time sensor inputs to identify subtle degradation patterns in critical components like the transducer, booster, or sonotrode. By accurately forecasting the remaining useful life (RUL) of these parts, AI minimizes unexpected catastrophic failures, drastically improving overall equipment effectiveness (OEE), maximizing production uptime, and lowering the total cost of ownership for high-volume packaging manufacturers reliant on 24/7 operation.

- Real-time Quality Monitoring: AI analyzes acoustic and vibrational signatures during welding to instantly detect anomalies, ensuring 100% seal integrity verification.

- Predictive Maintenance: ML algorithms forecast component failure (transducer wear, tooling degradation) based on historical and real-time operational data.

- Dynamic Parameter Optimization: AI automatically adjusts weld amplitude, pressure, and time in response to minor variations in packaging material thickness or temperature.

- Enhanced Process Traceability: AI systems document and correlate weld parameters with resulting package quality for enhanced regulatory compliance and audit trails.

- Reduced Setup Time: ML models rapidly learn optimal starting parameters for new packaging formats, significantly cutting down on manual calibration and material waste during changeovers.

- Energy Efficiency Optimization: AI algorithms fine-tune power output to the exact requirement needed for a perfect weld, minimizing unnecessary energy expenditure.

DRO & Impact Forces Of Packaging Ultrasonic Welder Market

The Packaging Ultrasonic Welder Market is primarily propelled by the stringent requirements for hermetic seals in sensitive packaging (e.g., medical devices, unit-dose pharmaceuticals) and the global trend toward sustainable packaging materials that are often difficult to seal using traditional thermal methods. Drivers include the increasing adoption of flexible packaging formats, which demand fast and reliable sealing solutions, and the high throughput capabilities of ultrasonic systems essential for mass production environments. Conversely, restraints involve the high initial capital investment required for ultrasonic equipment compared to basic heat sealers and the technical complexity related to sonotrode design and material compatibility testing for novel polymers. Opportunities lie in developing advanced tooling for handling complex geometries, integrating Industry 4.0 capabilities for remote diagnostics, and expanding applications into high-barrier films and bio-based polymers, all contributing to a strong market growth trajectory.

The core drivers are deeply rooted in efficiency and quality assurance. The rapid cycle times afforded by ultrasonic technology directly translate into higher productivity, a critical factor for manufacturers struggling with rising labor and operational costs. Furthermore, the ability of ultrasonic systems to create seals that are not only strong but also visually cleaner and capable of handling minor contamination (e.g., dust or product residue near the seal area) makes them indispensable in hygiene-sensitive industries like medical and food packaging. The push for material reduction and lightweight packaging further favors ultrasonic welding, as it minimizes the width required for a secure seal compared to wide heat-sealed seams, saving material over millions of units.

Impact forces currently shaping the market include technological advancements in frequency modulation, allowing for superior control over the welding process, and the competitive pressure to offer highly modular and customizable systems. The major restraining force remains the steep learning curve associated with implementing and maintaining these precision machines, necessitating specialized training for technicians. However, this restraint is being gradually mitigated by improved user interfaces and AI-driven diagnostic tools. Opportunities are exceptionally strong in developing markets seeking automation upgrades and in mature markets prioritizing environmental compliance, particularly the transition from rigid containers to flexible, recyclable pouches, where ultrasonic welding proves superior for creating consistent seals on monomaterial structures.

Segmentation Analysis

The Packaging Ultrasonic Welder Market is comprehensively segmented based on technology type, material sealed, application area, and power output, reflecting the diverse needs across various end-user industries. Understanding these segments provides critical insights into market penetration and growth opportunities, particularly as packaging trends shift towards specific polymer types and complex, high-precision applications. The segmentation by application, especially the division between food/beverage and medical/pharmaceutical, dictates the required level of automation, validation standards, and frequency specifications of the welding machinery employed, demonstrating significant divergence in product specifications and market value.

- By Technology Type:

- Standard Ultrasonic Welders

- High-Frequency Precision Welders (35 kHz, 40 kHz)

- Rotary Ultrasonic Welders

- Continuous Ultrasonic Sealing Systems

- By Power Output:

- Low Power (500 W - 1500 W)

- Medium Power (1500 W - 3000 W)

- High Power (Above 3000 W)

- By Material Sealed:

- Thermoplastic Films and Foils (PP, PE, PET)

- Laminates and Multilayer Films

- Non-woven Materials (Medical/Hygiene)

- Rigid Thermoplastic Components (Caps, Valves)

- By Application:

- Food and Beverage Packaging (Pouches, Trays, Cups)

- Medical and Pharmaceutical Packaging (Blister Packs, Vials, Sterile Pouches)

- Cosmetics and Personal Care Packaging (Tubes, Dispensers)

- Consumer Goods and Others

Value Chain Analysis For Packaging Ultrasonic Welder Market

The value chain for the Packaging Ultrasonic Welder Market begins with upstream component manufacturers specializing in high-frequency power supplies, piezoelectric ceramics (for transducers), and sophisticated metal tooling (sonotrodes and anvils). These highly specialized suppliers dictate the performance limits and reliability of the final welding system. Key activities at this stage involve precision engineering, material science expertise to ensure acoustic efficiency, and rigorous quality control of electronic components. The competitive edge here often belongs to those suppliers capable of integrating advanced digital signaling and modulation technologies into their power generators.

Midstream activities involve the primary ultrasonic welding equipment manufacturers who assemble these components, design the mechanical frames, integrate software controls, and develop application-specific tooling solutions. This stage is critical for adding value through system engineering, automation integration expertise, and providing application support (testing material compatibility and optimizing weld parameters). Distribution channels for these high-value capital goods are complex, often relying on a hybrid approach including direct sales teams for major integrated packaging line projects and a network of highly knowledgeable technical distributors who handle sales, installation, and localized technical support for smaller or regional end-users.

Downstream analysis focuses on the end-users—the packaging operations across various sectors (food, medical, consumer goods). The direct channel is preferred for complex, high-value projects requiring deep customization and long-term service agreements, particularly in pharmaceutical and high-speed food packaging lines. The indirect channel, leveraging distributors, is crucial for market penetration in geographically diverse regions and for reaching smaller packaging converters or contract manufacturers who require faster delivery and localized immediate support. Service and maintenance—including replacement tooling and recalibration—represent a significant, recurring revenue stream in the downstream segment, heavily dependent on the quality and longevity of the original equipment.

Packaging Ultrasonic Welder Market Potential Customers

Potential customers for Packaging Ultrasonic Welders span the entire spectrum of high-volume manufacturing industries that utilize thermoplastic materials for containment and protection. The primary end-users are large multinational food and beverage corporations requiring high-speed sealing of flexible pouches, containers, and cups, prioritizing efficiency and contamination resistance. Equally critical are the pharmaceutical and medical device manufacturers (MDMs) who require validated, sterile, and tamper-evident seals for blister packs, IV bags, and sterile barrier systems, where the reliability and lack of thermal stress offered by ultrasonic technology are indispensable requirements.

Beyond these core sectors, cosmetic and personal care manufacturers are significant buyers, utilizing ultrasonic welding for sealing plastic tubes and assembling complex dispensing mechanisms, prioritizing aesthetic quality and leakage prevention. Furthermore, contract packaging organizations (CPOs) and packaging converters, who service multiple industries and must remain agile to handle various material specifications and format changes, represent a rapidly growing customer base. These CPOs seek versatile, quick-change tooling ultrasonic systems that offer maximum flexibility and minimal setup time to efficiently manage diverse production runs.

In essence, the buyer profile is characterized by companies seeking to minimize operational downtime, reduce material waste, and achieve superior seal integrity, particularly when dealing with complex or temperature-sensitive products. The adoption decision is typically driven by quality assurance departments, production engineering teams, and sustainability initiatives, often necessitating a high degree of technical consultation and collaboration with the ultrasonic equipment manufacturer to tailor the solution precisely to the material and speed requirements of the packaging line.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co. (Branson), Herrmann Ultraschalltechnik GmbH & Co. KG, Rinco Ultrasonics AG, Sonics & Materials Inc., Dukane Corporation, Telsonic Group, KlN Ultraschall GmbH, Weber Ultrasonics GmbH, Leister Technologies AG, Stapla Ultrasonics Corporation, Sonobond Ultrasonics, Schunk Sonosystems GmbH, Nippon Tsubaki Co., Ltd., MP-SONIC GmbH, MS Ultrasonic Technology Group, Forward Technology, Shanghai Donghe Ultrasonic Equipment Co., Ltd., Sonotronic Nagel GmbH, Mecasonic, Sonomatic. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Packaging Ultrasonic Welder Market Key Technology Landscape

The contemporary technology landscape of the Packaging Ultrasonic Welder Market is defined by the migration from analog systems to highly sophisticated digital platforms. Digital welding generators offer precise control over the energy input, amplitude profiling, and frequency tracking, allowing the welding system to compensate automatically for minor variances in material properties or environmental factors. This digital precision is essential for modern high-speed packaging lines where consistency across thousands of cycles per minute is non-negotiable. Furthermore, advanced digital systems facilitate networking and data logging, making them fully compliant with Industry 4.0 requirements for centralized monitoring and remote diagnostics, which significantly enhances operational transparency and quality compliance, particularly under strict regulatory regimes.

A critical technical focus area is the optimization of sonotrode (tooling) design and material science. Sonotrodes, responsible for transmitting the ultrasonic vibrations directly to the material, are increasingly engineered using Finite Element Analysis (FEA) to ensure uniform amplitude distribution across the sealing surface, preventing hot spots and uneven weld quality. The development of specialized coatings and materials for sonotrodes enhances their durability and reduces wear, crucial when sealing abrasive or highly filled polymer materials. Furthermore, the adoption of higher frequencies (e.g., 35 kHz and 40 kHz) is gaining traction, as higher frequency allows for lower amplitude vibrations, resulting in more delicate and precise welds, ideal for very thin films, non-wovens, and small-format packaging used in medical applications.

The shift towards continuous ultrasonic sealing, utilizing rotating wheels instead of traditional plunge welders, represents another major technological advancement, specifically targeting high-volume production of continuous seals like those found on stand-up pouches or laminated tubes. These rotary systems significantly increase linear sealing speed and improve efficiency, offering a substantial competitive advantage over static systems for long seals. Complementary technologies, such as advanced pressure control mechanisms utilizing proportional valves and high-resolution sensors, ensure the application of consistent clamping force, which is fundamental to achieving high-quality, reproducible hermetic seals across a variety of complex packaging geometries.

Regional Highlights

Geographical analysis reveals that market growth is unevenly distributed, heavily favoring regions with robust manufacturing bases and high adoption rates of advanced automation technologies. Asia Pacific (APAC) stands out as the highest growth region, driven by explosive demand in consumer goods and food processing across densely populated emerging economies like China, India, and Southeast Asian nations. The region benefits from lower manufacturing costs and increasing foreign investment, leading to massive scaling up of packaging production capacity, necessitating reliable and high-speed sealing solutions like ultrasonic welders. Furthermore, the rising middle class in APAC drives demand for single-serve and convenience packaging, a segment ideally suited for ultrasonic sealing.

North America and Europe represent mature markets characterized by replacement demand, stringent quality regulations (especially in medical packaging), and a strong focus on automation to counteract high labor costs. In these regions, the demand leans towards high-precision, validated, and networked ultrasonic systems that integrate seamlessly into complex production lines compliant with standards such as FDA and ISO requirements. European growth is particularly propelled by sustainability mandates, pushing manufacturers toward monomaterial and recyclable packaging formats, for which ultrasonic welding often provides the superior sealing solution compared to conventional thermal methods which struggle with narrow processing windows.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets experiencing moderate growth. Growth in LATAM is spurred by industrial modernization, particularly in food and beverage processing in countries like Brazil and Mexico. The MEA region, while smaller, is witnessing adoption driven by increasing local pharmaceutical manufacturing and investments in regional food security initiatives. However, market penetration in these emerging regions is often hindered by infrastructure limitations and the higher initial investment cost of sophisticated ultrasonic equipment compared to basic sealing methods, requiring sustained effort from manufacturers to demonstrate the long-term OEE benefits and energy efficiency gains.

- North America: Focus on high-precision medical device packaging and aerospace/automotive component sealing; strong regulatory push for quality assurance.

- Europe: Driven by sustainability targets (monomaterials, recyclability) and high levels of automation integration (Industry 4.0); Germany and Switzerland are key manufacturing hubs.

- Asia Pacific (APAC): Leading market in terms of volume and growth; fueled by FMCG, food processing, and emerging pharmaceutical production scaling in China and India.

- Latin America (LATAM): Growing adoption tied to modernization of food packaging infrastructure and increasing demand for consumer packaged goods (CPG).

- Middle East & Africa (MEA): Gradual expansion in specialized sectors like healthcare and regional food processing; influenced by government industrialization policies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Packaging Ultrasonic Welder Market.- Emerson Electric Co. (Branson)

- Herrmann Ultraschalltechnik GmbH & Co. KG

- Rinco Ultrasonics AG

- Sonics & Materials Inc.

- Dukane Corporation

- Telsonic Group

- KlN Ultraschall GmbH

- Weber Ultrasonics GmbH

- Leister Technologies AG

- Stapla Ultrasonics Corporation

- Sonobond Ultrasonics

- Schunk Sonosystems GmbH

- Nippon Tsubaki Co., Ltd.

- MP-SONIC GmbH

- MS Ultrasonic Technology Group

- Forward Technology

- Shanghai Donghe Ultrasonic Equipment Co., Ltd.

- Sonotronic Nagel GmbH

- Mecasonic

- Sonomatic

Frequently Asked Questions

Analyze common user questions about the Packaging Ultrasonic Welder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using ultrasonic welding over traditional thermal sealing in packaging?

Ultrasonic welding offers significantly faster cycle times, consumes less energy, creates highly reliable and hermetic seals, and crucially, allows sealing through product residue or contamination, which is often impossible with traditional heat sealing methods. It also minimizes thermal impact on sensitive contents.

Is ultrasonic welding suitable for sustainable or monomaterial packaging formats?

Yes, ultrasonic welding is highly effective for monomaterial structures (like 100% PE or PP), which are favored for recyclability, as it manages the narrow processing window of these materials better than heat sealing, ensuring strong, consistent seals without additives.

What is the typical lifespan and maintenance requirement for a sonotrode?

The lifespan of a sonotrode (the welding horn) varies greatly based on material, complexity, and application intensity, typically ranging from several months to a few years. Maintenance involves periodic inspection for wear, cleaning, and recalibration, often managed proactively through sensor data and predictive maintenance systems.

Which industries are the major adopters of high-frequency (35 kHz+) ultrasonic welders?

High-frequency welders are primarily adopted by the medical and pharmaceutical industries for sealing delicate materials such as sterile barrier systems, non-woven fabrics, and small-format blister packs, where maximum precision, minimal heat stress, and exceptional seal aesthetics are required.

How does Industry 4.0 integration affect the efficiency of packaging ultrasonic welders?

Industry 4.0 integration allows welders to transmit real-time operational data (weld statistics, diagnostics, quality metrics) to centralized systems (SCADA, MES), enabling remote monitoring, dynamic optimization via AI, predictive maintenance scheduling, and comprehensive process traceability, significantly boosting overall equipment effectiveness (OEE).

The extensive analysis of the Packaging Ultrasonic Welder Market underscores its vital role in modern manufacturing, driven by regulatory demands for quality and industry push for automation and sustainability. The market trajectory is firmly positive, underpinned by continuous technological innovation, especially in digital control systems and AI integration, ensuring that ultrasonic welding remains the preferred method for critical and high-speed sealing applications worldwide. Future growth will be highly dependent on successful adaptations to emerging compostable and complex high-barrier film technologies, further expanding its application scope across the global packaging value chain.

The dominance of the APAC region in terms of production volume contrasts with the strong regulatory-driven demand for precision systems in North America and Europe, creating distinct opportunities for both high-volume standardized machines and highly customized, validated systems. Key players in this fragmented but rapidly consolidating market are focusing on developing turnkey solutions that minimize integration hurdles for end-users and maximize long-term return on investment (ROI) through enhanced operational diagnostics and reduced material waste. The strategic outlook suggests sustained investment in R&D targeting greater energy efficiency and higher frequency capabilities to handle the next generation of lightweight and sustainable packaging materials effectively.

In conclusion, the competitive landscape necessitates continuous adaptation. Suppliers must focus on providing comprehensive after-sales support and specialized tooling expertise to maintain a strong market presence. The critical need for hermetic and tamper-evident seals in key end-use segments—particularly medical and food packaging—insulates the market from cyclical downturns, ensuring its resilience. As global supply chains continue to optimize efficiency and minimize ecological footprint, ultrasonic welding stands as a foundational technology enabling these macro trends, projected to meet and exceed forecast growth expectations through 2033 by delivering unparalleled sealing integrity and production speed across diverse packaging applications.

The inherent advantages of ultrasonic bonding—specifically its ability to join materials without relying on external heat or adhesives—make it uniquely suitable for sensitive materials and high-speed applications where thermal degradation or prolonged cooling times are prohibitive. This technological superiority ensures its position as a premium sealing solution, especially for complex geometries like spouts, valves, and specialized closures. The ongoing development of acoustic systems that minimize noise levels and integrate sophisticated noise cancellation features further enhances the ergonomic appeal and compliance with industrial health and safety standards in advanced manufacturing environments, addressing crucial operational concerns of major end-users.

Moreover, the integration of advanced materials science into sonotrode manufacturing is continuously pushing performance boundaries. Manufacturers are exploring exotic alloys and composite structures to improve acoustic efficiency, reduce mass, and extend the tooling life, thereby reducing recurring costs for the end-user. The precision control offered by digital generators is now allowing for 'weld profiling'—where power and pressure are modulated dynamically throughout the welding cycle—to achieve optimized molecular fusion tailored precisely to the characteristics of multi-layer or challenging polymer films, setting a new benchmark for seal quality assurance and repeatability in mission-critical applications.

Market penetration into new application areas, such as the assembly of complex electronic consumer product housings or specialized industrial filters, also contributes significantly to overall revenue growth. The versatility of ultrasonic technology allows manufacturers to pivot quickly, offering customized solutions that go beyond traditional flexible packaging. This diversification hedges against potential saturation in mature packaging segments and establishes new, high-margin revenue streams. Successful market players are those that can effectively leverage simulation software and rapid prototyping techniques to deliver tailored tooling solutions faster than their competitors, solidifying their position as technical consultants rather than just equipment vendors.

The regulatory environment, particularly concerning food contact and medical device manufacturing, acts as a continuous driver for innovation in process validation and traceability. Ultrasonic equipment manufacturers are responding by embedding advanced data logging and validation software compliant with regulations such as 21 CFR Part 11 (in the US) and similar global standards. This commitment to compliance and data integrity makes the technology indispensable for companies operating in heavily regulated spaces, reinforcing the barriers to entry for simpler, less sophisticated sealing alternatives. This focus on regulatory readiness is a key factor sustaining the premium pricing structure and high-value proposition of advanced ultrasonic welding systems.

Finally, the growing industrial focus on lean manufacturing and waste reduction aligns perfectly with the operational efficiency of ultrasonic welders. By producing seals that are typically narrower and require less material overlap than heat seals, ultrasonic technology directly contributes to material savings. Additionally, the high reliability of the seal significantly lowers rejection and rework rates, dramatically improving material utilization. These tangible cost-saving benefits, coupled with the long-term energy efficiency, provide a compelling financial justification for adopting ultrasonic technology, even given the higher initial investment, proving its fundamental value proposition in the evolving landscape of resource-conscious global manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager