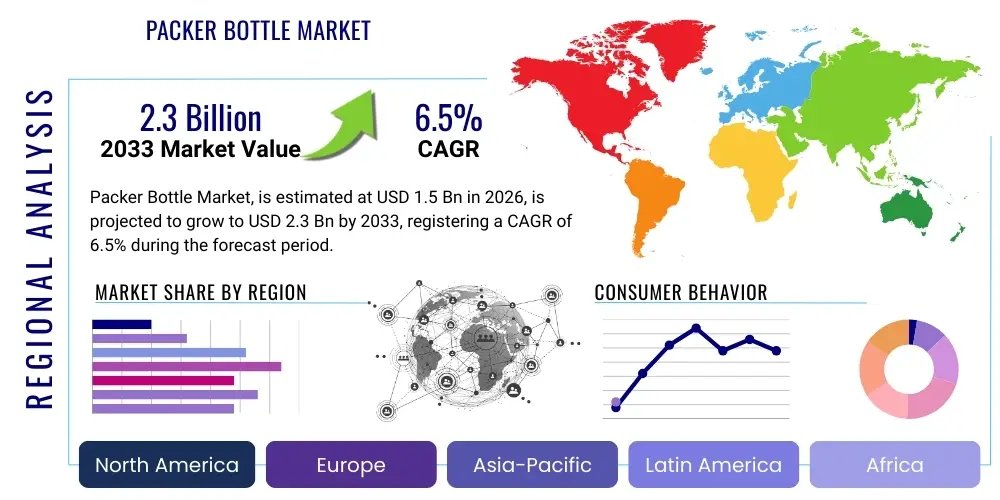

Packer Bottle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435419 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Packer Bottle Market Size

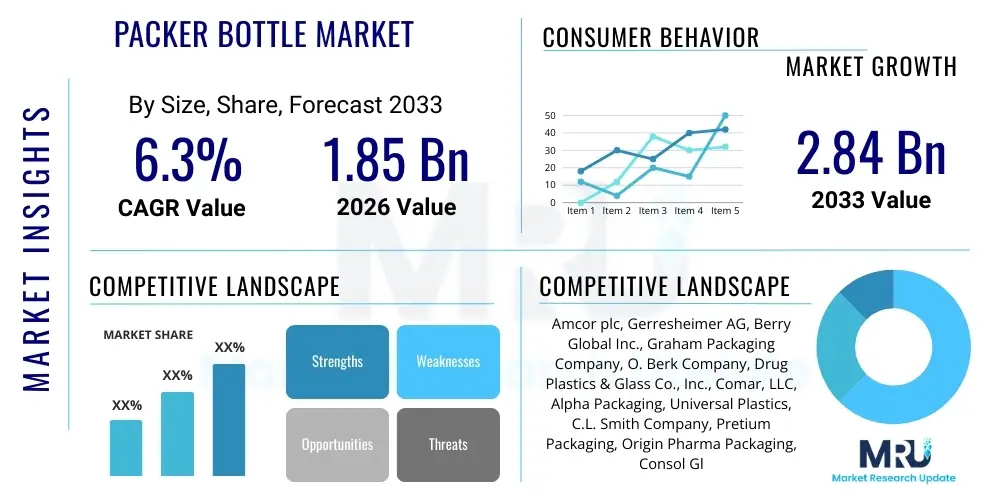

The Packer Bottle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% CAGR between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.84 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the persistent growth of the global pharmaceutical and nutraceutical sectors, which rely heavily on these durable, standardized containers for solid dose medications and supplements. Increasing consumer focus on preventative healthcare and the subsequent rise in over-the-counter (OTC) medication consumption are core accelerators of market valuation.

Packer bottles, primarily manufactured from high-density polyethylene (HDPE), polyethylene terephthalate (PET), and glass, are essential components in the pharmaceutical supply chain due to their robust barrier properties, regulatory compliance, and ease of automated filling. The market size is heavily influenced by factors such as the standardization of packaging across global regulatory bodies, leading to streamlined manufacturing processes. Furthermore, demand is continually bolstered by the rapid expansion of generic drug manufacturing in developing economies, necessitating high volumes of cost-effective and reliable packaging solutions.

Packer Bottle Market introduction

The Packer Bottle Market encompasses the global production and distribution of specific containers designed primarily for packaging solid dose pharmaceuticals, including tablets, capsules, and caplets, as well as nutraceuticals, vitamins, and certain veterinary products. These bottles are characterized by their wide-mouth design, facilitating high-speed automated filling processes and easy dispensing by the end-user. Key materials utilized include HDPE, preferred for its excellent moisture barrier properties and affordability; PET, valued for its transparency and lightweight nature; and high-quality glass, often chosen for sensitive formulations requiring superior chemical inertness and oxygen barrier protection.

Major applications of packer bottles span human and animal health sectors. In pharmaceuticals, they are indispensable for both prescription (Rx) and over-the-counter (OTC) medications. The nutraceutical segment, experiencing exponential growth due to increased health consciousness, utilizes these bottles extensively for dietary supplements, herbal remedies, and specialized sports nutrition products. The design mandate for packer bottles includes strict adherence to regulatory standards set by bodies like the FDA and EMA, particularly concerning material safety, child-resistance (CR) closures, and tamper-evident features, ensuring product integrity and consumer safety from the point of manufacture through consumption.

The market benefits significantly from several driving factors, including global population aging, which increases the prevalence of chronic diseases requiring long-term medication management. Technological advancements in packaging materials, such as the development of sustainable bioplastics and enhanced barrier coatings, further spur market evolution. Key benefits of packer bottles include cost-effectiveness, high production throughput capability, robust protection against environmental factors (moisture, light, oxygen), and universal acceptance within clinical and consumer environments. This stability and versatility cement the packer bottle’s position as a cornerstone of solid dose drug packaging globally.

Packer Bottle Market Executive Summary

The Packer Bottle Market Executive Summary highlights robust growth projected through 2033, primarily propelled by favorable business trends in the global healthcare and wellness industries. Current business trends indicate a strong shift towards sustainable packaging materials, prompting manufacturers to invest in post-consumer recycled (PCR) plastics and bio-based polymers to meet corporate sustainability goals and consumer expectations. Furthermore, mergers and acquisitions among major packaging providers are optimizing production capacities and expanding global distribution networks. Regulatory compliance, particularly concerning child-resistant and senior-friendly closure systems, remains a critical investment area, ensuring market entry and retention in highly regulated regions like North America and Europe.

Regionally, Asia Pacific (APAC) stands out as the highest growth engine, fueled by vast population bases, improving healthcare infrastructure, and the explosive growth of domestic pharmaceutical manufacturing in countries like India and China. North America and Europe retain significant market share, driven by high per capita expenditure on patented and generic drugs, alongside stringent quality standards that favor premium materials like specialty glass. Conversely, Latin America and MEA are experiencing steady growth, largely dependent on increasing access to essential medicines and expansion of local nutraceutical companies seeking standardized, durable packaging solutions.

Segment trends reveal that High-Density Polyethylene (HDPE) maintains market dominance due to its cost efficiency and superior moisture barrier properties, vital for moisture-sensitive drugs. However, the PET segment is gaining traction, particularly for clear vitamin and supplement packaging where visual appeal is a marketing asset. The end-use segment is characterized by rapid diversification, with the nutraceutical category exhibiting the fastest expansion rate, largely outpacing the mature pharmaceutical sector. Manufacturers are focusing on differentiating their offerings through innovative closure technologies, including induction-sealed liners and specialized dispensing mechanisms, which enhance both safety and user convenience.

AI Impact Analysis on Packer Bottle Market

User queries regarding the impact of Artificial Intelligence (AI) on the Packer Bottle Market center predominantly on how AI can enhance manufacturing efficiency, ensure quality consistency, and optimize the complex pharmaceutical supply chain. Key concerns include the feasibility of deploying AI in high-volume, low-margin packaging operations, the integration challenges with legacy machinery, and the use of machine learning (ML) for predictive failure analysis in highly automated bottling lines. Users are particularly keen on understanding how AI-driven vision systems can detect minute defects in bottle molding or printing at speeds previously impossible, thereby reducing waste and improving batch compliance. Expectations focus on AI transforming demand forecasting, especially for seasonal supplements and newly launched pharmaceuticals, leading to better inventory management and minimized stockouts or oversupply.

The direct application of AI is primarily concentrated in two areas: intelligent manufacturing and supply chain resilience. In manufacturing, AI algorithms analyze real-time sensor data from injection and blow molding equipment to predict tooling wear and material flow anomalies, allowing for proactive maintenance and consistent product weight and dimension adherence. This dramatically reduces downtime and boosts overall equipment effectiveness (OEE). Furthermore, integrating ML models with Enterprise Resource Planning (ERP) systems allows for sophisticated demand sensing, factoring in variables like seasonal sales data, regulatory changes, and prescription trends to generate highly accurate forecasts, thereby optimizing raw material procurement (polymers, glass cullet) and inventory holding costs.

AI also plays a transformative role in regulatory compliance and quality assurance. AI-powered visual inspection systems, trained on millions of images, can identify subtle flaws in bottle geometry, color consistency, and label application far more reliably than human inspectors, ensuring every bottle meets pharmacopoeial standards. Looking forward, the integration of AI with smart packaging initiatives—such as track-and-trace systems utilizing embedded sensors—will enhance anti-counterfeiting efforts, allowing for instant authentication of medicine packaging throughout the distribution chain, bolstering consumer trust and regulatory oversight.

- AI-driven predictive maintenance optimizes blow molding and injection equipment uptime, reducing operational costs.

- Machine Learning enhances demand forecasting for specialized nutraceuticals and pharmaceuticals, minimizing packaging stock volatility.

- Advanced AI vision systems enable high-speed, hyper-accurate quality control checks for dimensional and aesthetic defects.

- Natural Language Processing (NLP) assists in rapid analysis of global regulatory changes impacting packaging material standards.

- AI integration with serialization and track-and-trace technologies strengthens anti-counterfeiting measures within the supply chain.

- Optimization of raw material blend ratios (e.g., PCR content) using AI to maintain mechanical performance and barrier properties.

DRO & Impact Forces Of Packer Bottle Market

The dynamics of the Packer Bottle Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces influencing market growth trajectory. Key drivers include the demographic shift toward an aging global population, substantially increasing the demand for chronic disease medications and geriatric care supplements, all requiring secure, standardized packaging. Concurrently, the robust expansion of the global nutraceutical industry, driven by proactive health management trends, necessitates high-volume supply of functional and aesthetically pleasing packer bottles. Furthermore, continuous innovation in drug delivery systems and pharmaceutical R&D generates consistent demand for customized bottle designs with specialized barrier properties or novel closure systems.

However, the market faces significant restraints that temper growth rates. Volatility in the prices of key raw materials, specifically petrochemical-derived polymers (HDPE, PET) and specialized glass components, directly impacts manufacturing costs and profit margins, particularly in cost-sensitive generic packaging segments. Furthermore, the market operates under extremely stringent regulatory scrutiny (FDA, EMA, WHO). Compliance with complex rules regarding material traceability, extractables and leachables (E&L), and mandatory child-resistance features requires substantial investment in R&D and quality assurance, often acting as a barrier to entry for smaller manufacturers and prolonging product validation cycles.

Opportunities for expansion lie predominantly in the realm of sustainable packaging and technological integration. The increasing demand for environmentally friendly options creates a clear pathway for manufacturers specializing in Post-Consumer Recycled (PCR) plastics and biodegradable materials, offering a premium positioning in the market. The rise of smart packaging—incorporating RFID tags, QR codes, or near-field communication (NFC) chips for authentication and patient engagement—presents a high-value opportunity, shifting the bottle from a mere container to a functional component of the medication regimen. These forces combined drive strategic decisions toward automation, sustainability, and enhanced security features.

Segmentation Analysis

The Packer Bottle Market is extensively segmented based on material, capacity, closure type, and end-use application, providing a granular view of market dynamics and specialized demand centers. Segmentation is critical for manufacturers to tailor production capabilities and marketing strategies, ensuring optimal product specifications meet the diverse requirements of the pharmaceutical and nutraceutical sectors. Analyzing these segments helps identify high-growth areas, such as the preference for specific materials based on drug sensitivity and the burgeoning requirement for smaller, unit-dose packaging formats driven by personalized medicine trends. The complexity of regulatory requirements often dictates material choice; for instance, light-sensitive drugs mandate amber glass or high-barrier opaque plastics.

- By Material Type:

- High-Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Glass (Amber, Clear)

- Polypropylene (PP)

- By Capacity:

- Up to 50cc

- 51cc to 150cc

- 151cc to 300cc

- Above 300cc

- By Closure Type:

- Child-Resistant (CR) Closures

- Continuous Thread (CT) Closures

- Tamper-Evident Closures

- Dispensing Closures

- By End-Use Application:

- Pharmaceuticals (Rx, OTC, Generics)

- Nutraceuticals and Dietary Supplements

- Veterinary Medicines

- Others (Chemicals, Lab Reagents)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Packer Bottle Market

The Value Chain for the Packer Bottle Market begins with upstream analysis, focusing on the sourcing and processing of core raw materials, predominantly petrochemical resins (HDPE, PET) and high-quality silica for glass manufacturing. This stage involves complex logistics and quality control to ensure the materials adhere to pharmacopoeial requirements, such as FDA Title 21 compliance. Key upstream activities include polymerization, plastic compounding, and the refinement of additives (e.g., colorants, stabilizers). Price volatility and the push for sustainable sourcing, particularly the integration of recycled polymers (PCR content), significantly influence this foundational stage of the value chain. Strategic partnerships with primary chemical and polymer suppliers are essential for maintaining supply stability and cost competitiveness.

The midstream segment involves the core manufacturing process, where raw materials are converted into finished packer bottles using high-speed techniques like injection molding (for preforms and closures) and extrusion blow molding (for the bottles themselves). This stage is capital-intensive and heavily reliant on automation, requiring sophisticated cleanroom environments (ISO classifications) to prevent contamination, especially for pharmaceutical-grade containers. After molding, processes include annealing (for glass), secondary treatments (e.g., fluorination for chemical resistance), and quality inspection (often leveraging AI vision systems). Efficiency in this stage directly determines unit cost and production throughput.

The downstream analysis focuses on distribution and integration into the final product manufacturing cycle. Distribution channels are highly specialized, often involving cold-chain logistics or secure, climate-controlled warehousing. Direct sales models involve large-scale contracts between major bottle manufacturers and multinational pharmaceutical companies (Pfizer, GSK), ensuring just-in-time delivery for high-volume filling operations. Indirect distribution utilizes specialized pharmaceutical packaging distributors who cater to smaller generic companies and regional nutraceutical producers, providing diverse inventory and customized logistical support. The ultimate downstream function involves the aseptic or sterile filling and sealing of the bottles at the end-user’s facility, followed by tertiary packaging and final distribution to pharmacies or consumers.

Packer Bottle Market Potential Customers

The primary consumers and end-users of packer bottles are organizations operating within highly regulated healthcare and consumer wellness sectors. Pharmaceutical manufacturers, encompassing both branded innovator drug companies and generic drug producers, represent the largest customer segment. These companies require vast quantities of certified, compliant containers for packaging solid dosage forms (tablets, capsules) for both prescription and over-the-counter markets. Key purchasing criteria for this segment revolve around regulatory documentation, long-term stability data, compliance with child-resistant standards, and the manufacturer’s ability to guarantee aseptic production and supply chain security for track-and-trace requirements.

The second major customer base comprises nutraceutical and dietary supplement producers. Driven by rising consumer interest in preventative health, this segment demands high volumes of transparent PET or specialty HDPE bottles for vitamins, minerals, and herbal supplements. While regulatory standards in this sector might be slightly less stringent than pharmaceuticals, brand presentation, shelf appeal, and sustainability (e.g., PCR content) are paramount. These buyers often favor customized shapes, vibrant colors, and advanced sealing technologies to ensure product freshness and differentiation in competitive retail environments. The procurement cycle here is often faster and more focused on visual marketing and bulk pricing.

Additional potential customers include specialized groups such as veterinary medicine manufacturers, contract packaging organizations (CPOs) that manage packaging for multiple brands, and companies producing specialized laboratory reagents or fine chemicals that require highly inert and tamper-evident primary packaging. These end-users typically require smaller, more specialized batch sizes and frequently demand glass or PP materials with specific chemical compatibility characteristics. CPOs, in particular, serve as essential intermediaries, aggregating demand from various small to mid-sized supplement and generic companies, thus driving flexibility and diversity in the required bottle specifications and quantities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.84 Billion |

| Growth Rate | 6.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Gerresheimer AG, Berry Global Inc., Graham Packaging Company, O. Berk Company, Drug Plastics & Glass Co., Inc., Comar, LLC, Alpha Packaging, Universal Plastics, C.L. Smith Company, Pretium Packaging, Origin Pharma Packaging, Consol Glass, SGD Pharma, Alpack Ltd., Plastic Bottle Corporation, US Plastics, MJS Packaging, Kaufman Container Company, CL Smith. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Packer Bottle Market Key Technology Landscape

The technology landscape governing the Packer Bottle Market is defined by advanced manufacturing precision, quality assurance protocols, and the integration of sustainability practices. Core manufacturing technologies include specialized blow molding, specifically Extrusion Blow Molding (EBM) and Injection Blow Molding (IBM), which are optimized for high-volume production of HDPE and PET containers, ensuring minimal wall thickness variation and superior structural integrity necessary for pharmaceutical compliance. Advanced tooling design and quick mold change systems are crucial for minimizing downtime and facilitating agile production of various bottle capacities and neck finishes. Furthermore, aseptic production environments, often featuring HEPA filtration and controlled atmosphere technology, are mandatory to prevent microbial or particulate contamination, meeting cGMP standards.

Barrier technology represents a significant area of innovation, particularly as manufacturers strive to protect highly sensitive solid doses from oxygen and moisture without relying solely on traditional glass packaging. Key advancements involve multi-layer co-extrusion techniques, where different polymers are combined to create a superior barrier structure, and the application of internal surface treatments, such as plasma fluorination or silicone dioxide coatings (SiOx), which enhance chemical inertness and reduce moisture vapor transmission rates (MVTR). These technological enhancements allow plastic packer bottles to compete effectively with glass in terms of product protection, while offering advantages in terms of reduced weight and break resistance.

In addition to manufacturing, the implementation of Industry 4.0 principles, including high-speed serialization and aggregation equipment, is paramount for global regulatory compliance. All packer bottles destined for pharmaceutical use must be integrated into comprehensive track-and-trace systems, requiring advanced laser coding or ink-jet printing systems capable of applying unique identifiers (UIDs) instantly and reliably. Furthermore, the adoption of specialized closure technology, involving precise torque application sensors and complex, interlocking Child-Resistant mechanisms, ensures that the safety features are consistently functional across millions of units, maintaining both regulatory integrity and end-user safety.

Regional Highlights

The regional analysis of the Packer Bottle Market reveals distinct growth drivers and dominance across key geographical areas, influenced by local regulatory frameworks, population dynamics, and healthcare spending patterns. North America currently holds the largest market share, driven by a highly mature pharmaceutical industry, significant expenditure on patented and specialty drugs, and strict packaging regulations that mandate premium, compliant materials (e.g., extensive use of CR closures). The presence of major pharmaceutical innovators and a robust nutraceutical sector ensures consistent, high-value demand for complex and standardized packer bottle solutions, with sustainability mandates (PCR content) rapidly gaining traction.

Asia Pacific (APAC) is projected to exhibit the highest CAGR during the forecast period. This accelerated growth is primarily attributed to the massive scale of generic drug production in countries like India (often referred to as the "pharmacy of the world") and the booming domestic demand for over-the-counter medicines and vitamins across China and Southeast Asia. Improving healthcare access, expanding disposable incomes, and less stringent regulatory requirements compared to Western markets allow for rapid capacity expansion in APAC. Investment in state-of-the-art packaging facilities to meet global export standards is a key regional trend.

Europe represents a substantial and stable market, characterized by stringent environmental regulations (driving circular economy initiatives) and a strong focus on high-quality packaging for biotech and specialty pharmaceuticals. European demand is highly concentrated on sustainable options, driving faster adoption of bio-based plastics and high-quality amber glass. Latin America and the Middle East and Africa (MEA) are emerging markets, where growth is currently linear but steady. Market expansion in these regions is closely tied to increasing government investment in public health infrastructure and the localization of pharmaceutical production, replacing reliance on imported finished products, thereby increasing demand for essential, locally sourced packer bottles.

- North America: Market leader, driven by stringent regulatory framework (FDA), high healthcare expenditure, and major presence of multinational pharma and nutraceutical firms.

- Asia Pacific (APAC): Fastest-growing region, fueled by massive generic drug manufacturing capabilities and rapidly expanding consumer base for OTC medicines and supplements in China and India.

- Europe: Mature market focused heavily on environmental sustainability, driving adoption of recycled polymers and specialized barrier glass for sensitive pharmaceutical products.

- Latin America (LATAM): Emerging growth driven by regional healthcare infrastructure development and increasing demand for cost-effective packaging solutions.

- Middle East and Africa (MEA): Growth tied to local pharmaceutical production initiatives and diversification away from reliance on imported finished goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Packer Bottle Market.- Amcor plc

- Gerresheimer AG

- Berry Global Inc.

- Graham Packaging Company

- O. Berk Company

- Drug Plastics & Glass Co., Inc.

- Comar, LLC

- Alpha Packaging

- Universal Plastics

- C.L. Smith Company

- Pretium Packaging

- Origin Pharma Packaging

- Consol Glass

- SGD Pharma

- Alpack Ltd.

- Plastic Bottle Corporation

- US Plastics

- MJS Packaging

- Kaufman Container Company

- CL Smith

Frequently Asked Questions

Analyze common user questions about the Packer Bottle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary materials are used for pharmaceutical packer bottles and why?

The primary materials are High-Density Polyethylene (HDPE), Polyethylene Terephthalate (PET), and Glass (usually amber). HDPE is preferred for its excellent moisture barrier and cost-effectiveness. PET is used for its clarity and lightness, particularly in nutraceuticals. Amber glass offers superior inertness and light protection for sensitive drugs.

How do regulatory standards impact the design of packer bottles?

Regulatory bodies like the FDA and EMA mandate specific design features to ensure patient safety and product integrity. This critically includes Child-Resistant (CR) closures, tamper-evident seals, and material certification to guarantee containers do not leach harmful substances into the medication.

Which geographic region is expected to show the fastest growth in the Packer Bottle Market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by the rapid expansion of generic drug manufacturing and the massive growth in the consumption of nutraceuticals across countries like India and China.

What role does sustainability play in the future of the Packer Bottle Market?

Sustainability is a core driver, pushing manufacturers toward adopting Post-Consumer Recycled (PCR) plastics, bio-based polymers, and lightweight designs. This trend is crucial for meeting corporate environmental goals and consumer preferences, particularly in mature markets like Europe and North America.

How is technology, such as AI, being applied to the production of packer bottles?

AI is primarily used for optimizing manufacturing efficiency and quality control. This includes using machine learning for predictive maintenance on blow molding equipment and employing AI-powered vision systems for high-speed, accurate detection of subtle defects and ensuring consistent quality assurance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager