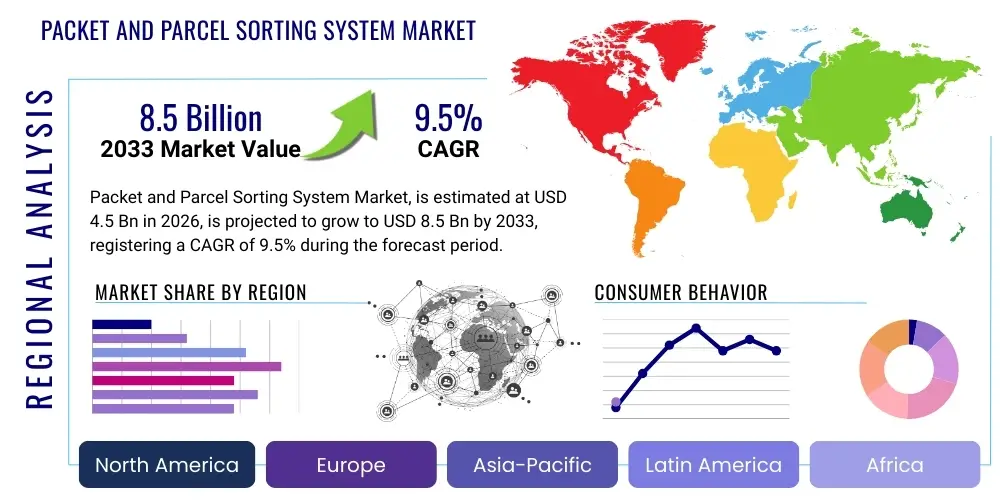

Packet and Parcel Sorting System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437783 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Packet and Parcel Sorting System Market Size

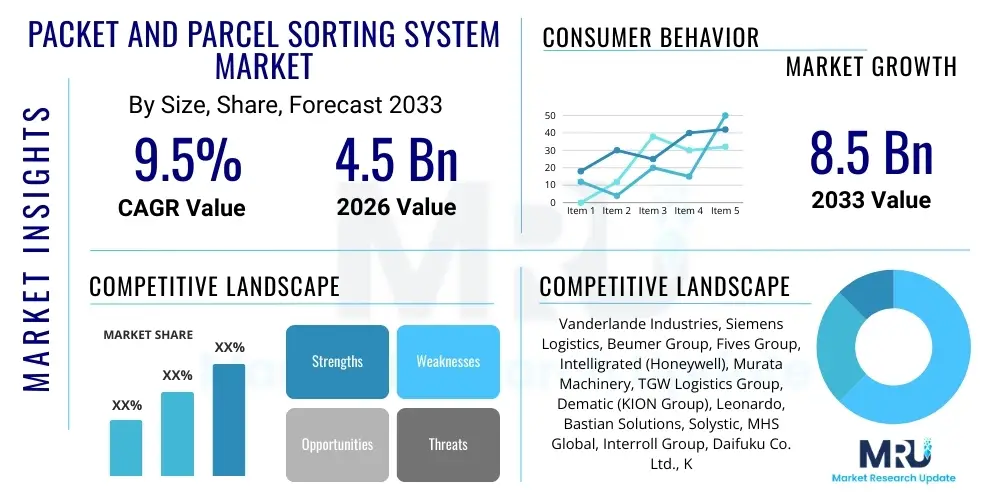

The Packet and Parcel Sorting System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $8.5 Billion by the end of the forecast period in 2033.

Packet and Parcel Sorting System Market introduction

The Packet and Parcel Sorting System Market encompasses sophisticated automation technologies designed to efficiently handle, route, and dispatch high volumes of diverse mail items, packets, and parcels within logistics hubs, postal services, and e-commerce fulfillment centers. These systems are critical infrastructure components, enabling rapid transit times and minimizing operational bottlenecks inherent in the exponential growth of global e-commerce. Modern sorting solutions integrate conveyor belts, optical character recognition (OCR), barcode scanners, dimensioning systems, and complex software algorithms to achieve high throughput rates and accuracy, significantly reducing the reliance on manual labor and mitigating human error in the sorting process. The core functionality revolves around identifying an item’s destination and mechanically diverting it to the correct outbound chute or loading area, often handling tens of thousands of items per hour.

Product descriptions within this market range from small, flexible tilting tray sorters suitable for delicate items and small packets, to large cross-belt and shoe sorters capable of managing heavy, bulky parcels at high speeds. Major applications span courier, express, and parcel (CEP) services, third-party logistics (3PL) providers, dedicated e-commerce warehouses, and postal operations upgrading legacy infrastructure. The primary benefits derived from adopting these systems include dramatic reductions in processing time, enhanced delivery speed and accuracy, lower overall operating costs per package, and improved traceability throughout the supply chain. Furthermore, advanced systems incorporate modular designs allowing easy scalability to adapt to fluctuating peak season demands.

Driving factors sustaining this market expansion are multifaceted, primarily centered on the sustained global shift toward online retail and direct-to-consumer delivery models, necessitating robust last-mile infrastructure. Coupled with increasing labor costs and persistent labor shortages in many developed economies, automation investment becomes essential for maintaining competitive operational efficiency. Technological advancements in machine vision, robotics, and software control systems further enhance the appeal of next-generation sorting solutions, making them faster, more reliable, and capable of handling an increasingly complex mix of package sizes and weights characteristic of modern fulfillment operations.

- Market Intro: Automation solutions for high-volume handling, routing, and dispatch of packets and parcels in logistics and e-commerce.

- Product Description: High-speed conveyor systems, cross-belt sorters, tilt-tray sorters, shoe sorters, integrated with OCR, barcode scanning, and advanced control software.

- Major Applications: Courier, Express, and Parcel (CEP) services, postal organizations, large-scale e-commerce fulfillment centers, and 3PL providers.

- Benefits: Increased throughput, reduced operational costs, enhanced sorting accuracy, improved labor utilization, and faster delivery times.

- Driving factors: Explosive growth of e-commerce, rising labor expenses, demand for rapid delivery services, and modernization of logistics infrastructure.

Packet and Parcel Sorting System Market Executive Summary

The Packet and Parcel Sorting System Market is experiencing robust growth driven by irreversible structural shifts in retail and logistics globally. Business trends highlight a significant move toward flexible automation systems that can handle both small packets (critical for international e-commerce) and large, irregular parcels (typical in furniture or appliance delivery). Key investment areas include integrating sophisticated software platforms that offer predictive maintenance, real-time data analytics, and seamless integration with Warehouse Management Systems (WMS). The competitive landscape is characterized by established material handling giants acquiring specialized robotics and software firms to offer integrated, end-to-end solutions, positioning them as single-source suppliers for large-scale automation projects. Furthermore, sustainability requirements are influencing design, pushing manufacturers to develop energy-efficient motors and compact footprints.

Regional trends indicate that Asia Pacific (APAC) remains the fastest-growing market segment, underpinned by massive domestic e-commerce markets in China, India, and Southeast Asia, necessitating rapid deployment of new sorting hubs. North America and Europe, characterized by high labor costs and mature logistics networks, focus primarily on retrofitting existing facilities with high-speed, space-saving sorters and incorporating advanced robotics for sortation induction and singulation processes. Regulatory environments, particularly concerning labor safety and operational standards, also drive regional variations in system specifications. For instance, European facilities often prioritize ergonomic design and noise reduction alongside throughput efficiency.

Segmentation trends show that the Cross-Belt Sorter segment dominates in revenue due to its versatility and high speed, capable of handling a wide range of item types effectively. However, the Tilt-Tray Sorter segment is gaining traction, especially in automated postal services and small parcel handling hubs, recognized for its gentleness and sorting density. By component, the software and services segment is projected to grow faster than hardware installations, reflecting the increasing complexity of control systems, the need for continuous optimization through software updates, and the rising demand for service contracts covering maintenance and operational support. The E-commerce segment remains the largest application area, significantly outpacing traditional postal services growth.

- Business Trends: Shift towards flexible, modular, and high-throughput systems; increased M&A activity focused on integrating software and robotics; demand for predictive maintenance solutions.

- Regional Trends: APAC leading growth due to exponential e-commerce volume; North America and Europe focusing on retrofitting, high-speed applications, and robotic integration.

- Segments trends: Cross-Belt Sorters maintain dominance; software and services segment exhibits the highest growth trajectory; E-commerce application remains the primary revenue driver.

AI Impact Analysis on Packet and Parcel Sorting System Market

Common user questions regarding AI's impact on the Packet and Parcel Sorting System Market often revolve around how artificial intelligence improves sorting accuracy, whether it can handle damaged or irregularly shaped packages, its role in optimizing hub utilization, and the timeframe for widespread adoption of fully autonomous sorting decisions. Users frequently inquire about the feasibility of predictive sorting, where AI uses historical data and real-time network conditions to dynamically adjust package routing before items even enter the sorting hub, minimizing transit time and optimizing load balancing across the network. A core concern is the capital investment required for AI integration and the expertise needed to manage and train these sophisticated systems within traditional logistics environments.

The integration of Artificial Intelligence (AI) is rapidly transforming packet and parcel sorting from purely mechanical processes into intelligent, data-driven operations. AI enhances system performance primarily through advanced machine vision and predictive analytics. Machine learning algorithms are trained on vast datasets of package images, enabling systems to accurately identify damaged labels, recognize handwriting, and correctly read smeared or partially obscured barcodes and destinations (OCR enhancement). This significantly reduces the rate of mis-sorts and the need for manual intervention at exceptions handling stations, driving operational efficiency and throughput reliability. Furthermore, AI optimizes the physical flow of packages by dynamically adjusting induction rates and chute assignments based on real-time downstream congestion, maximizing system utilization during peak periods.

Beyond visual recognition and flow control, AI is crucial in predictive maintenance and system diagnostics. By analyzing vibration sensors, motor performance data, and package throughput metrics, AI algorithms can accurately predict equipment failure weeks in advance, allowing for scheduled maintenance rather than disruptive, costly breakdowns. This shifts maintenance strategy from reactive to proactive, drastically improving system uptime. The long-term impact involves autonomous sorting hubs where AI orchestrates all material flow, inventory buffers, and loading processes, leading to fully self-optimizing distribution networks capable of handling unprecedented levels of package variability and volume fluctuation with minimal human input.

- Enhancing optical character recognition (OCR) reliability and accuracy for damaged or irregular labels.

- Implementing predictive analytics to forecast equipment failures, minimizing unexpected downtime and optimizing maintenance schedules.

- Enabling dynamic sort plan optimization based on real-time congestion, carrier capacity, and delivery deadlines.

- Facilitating the integration of robotic arms for autonomous induction and singulation, improving upstream efficiency.

- Processing complex, high-dimensional sensor data to manage and adapt to package weight, dimension, and shape variability.

- Developing sophisticated digital twins of sorting hubs for simulation and optimization of layout and operational parameters.

DRO & Impact Forces Of Packet and Parcel Sorting System Market

The Packet and Parcel Sorting System Market dynamics are fundamentally shaped by the interplay of strong economic drivers, high initial investment restraints, vast technological opportunities, and the intense competitive forces arising from the e-commerce boom. The demand for next-day and same-day delivery mandates continuous investment in automation (Driver). However, the massive capital expenditure required for large-scale integrated sorting facilities and the accompanying long ROI period pose significant barriers, especially for smaller logistics firms (Restraint). The opportunity lies in modular, scalable solutions leveraging AI and IoT, which can be deployed incrementally and adapted to evolving regulatory and volume requirements (Opportunity). These factors collectively intensify the competitive landscape, forcing market participants to innovate rapidly and focus on reliability and software integration, forming the core Impact Forces.

Drivers: The dominant driver is the unprecedented growth trajectory of the global e-commerce sector, which necessitates rapid scaling of logistics capacity to handle immense package volumes and heightened customer expectations for delivery speed. Simultaneously, escalating labor costs across industrialized nations make the economic case for automation compelling, ensuring operational continuity despite workforce shortages. Government initiatives supporting infrastructure modernization and the development of smart cities also channel investment into advanced logistics technology. Furthermore, the requirement for improved tracking and transparency across the supply chain compels logistics providers to adopt automated systems that generate reliable, real-time data points for every package.

Restraints: Significant restraints include the substantial upfront capital investment and the inherent complexity associated with installing, integrating, and commissioning large-scale sorting systems. Integration challenges, particularly when connecting new automated systems with legacy IT infrastructure and Warehouse Management Systems (WMS), can delay deployment and increase costs. Technical risks related to system reliability, especially when handling a highly diverse mix of package types, can also deter investment. Additionally, the increasing scarcity of large, geographically strategic land plots suitable for developing mega-hubs restricts physical expansion in dense urban areas.

Opportunity: Key opportunities are found in the development of flexible automation tailored for micro-fulfillment centers and urban logistics hubs, addressing the complexity of last-mile delivery. The refinement of AI and robotic induction systems offers scalable solutions for labor-intensive upstream processes. Furthermore, there is a substantial market opportunity in offering Sorting-as-a-Service (SaaS) or subscription models, lowering the initial investment barrier for medium-sized logistics providers. The growth of specialized sorting needs, such as temperature-controlled logistics or high-security item handling, opens niche markets for customized system providers.

- Drivers: E-commerce expansion, rising labor costs, consumer demand for expedited shipping, need for accurate real-time package tracking.

- Restraints: High initial CAPEX and long ROI cycles, complexity of systems integration, space constraints for large hubs, reliance on specialized technical maintenance expertise.

- Opportunity: Development of modular and scalable systems for urban logistics, AI-driven optimization services, market penetration in emerging economies, and specialized sorting solutions (e.g., cold chain).

- Impact Forces: Intense competitive pressure driving technological innovation, regulatory demands influencing safety and environmental standards, and the imperative for cross-industry IT integration.

Segmentation Analysis

The Packet and Parcel Sorting System Market is comprehensively segmented based on the component type, the specific sorting technology employed, the throughput capacity of the system, and the diverse end-use applications it serves. This granular analysis allows stakeholders to target investment effectively, understanding that different segments exhibit distinct growth patterns driven by regional labor costs, e-commerce maturity levels, and specific operational needs (e.g., postal vs. 3PL). Component segmentation distinguishes between the hardware infrastructure (sorters, conveyors, scanners) and the high-growth software and services necessary for complex system operation and optimization, reflecting a market trend where value increasingly shifts toward intelligent control systems.

Technological segmentation is critical, reflecting the suitability of various sorters for different package characteristics; cross-belt and shoe sorters are ideal for high throughput and mixed items, while tilt-tray and bomb-bay sorters cater better to smaller, flatter items and high-density sorting requirements. Capacity segmentation dictates the size of the target customer, ranging from small-scale regional operations requiring systems under 5,000 items per hour (IPH) to major international hubs demanding ultra-high capacity solutions exceeding 30,000 IPH. Understanding these differences is paramount for manufacturers to align product portfolios with varying customer needs and regional logistics development stages.

The application segment clearly highlights the E-commerce and CEP sectors as the most significant demand drivers, contrasting sharply with the slower, more stable demand from traditional Postal Services and the niche requirements of airports and food logistics. The rapid adoption rate in E-commerce is forcing systems to become more flexible and adept at handling unpredictable surges in volume and highly irregular package shapes, accelerating innovation across all underlying segments, particularly in sensing and control technologies.

- By Component:

- Hardware (Sorters, Conveyors, Barcode Scanners, Cameras/Vision Systems)

- Software & Services (Control Software, WMS Integration, Maintenance Contracts, Consulting)

- By Technology:

- Cross-Belt Sorters

- Shoe Sorters

- Tilt-Tray Sorters

- Bomb-Bay Sorters

- Pouch Sorters

- By Capacity:

- Low Capacity (Up to 5,000 Items per Hour)

- Medium Capacity (5,000 to 15,000 Items per Hour)

- High Capacity (15,000 Items per Hour and Above)

- By Application/End-Use:

- E-commerce & Retail

- Courier, Express, and Parcel (CEP) Services

- Postal Services

- Third-Party Logistics (3PL)

- Airport Logistics & Baggage Handling

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Packet and Parcel Sorting System Market

The value chain for packet and parcel sorting systems starts upstream with raw material sourcing and the manufacturing of specialized components. Upstream activities involve procuring high-grade metals, plastics, motors, sensors, and electronic control units from specialized industrial suppliers. Key suppliers often focus on precision engineering, providing components like high-speed drives, reliable bearings, advanced machine vision cameras, and proprietary Programmable Logic Controllers (PLCs). The competitive advantage in the upstream segment often depends on global supply chain efficiency, cost management, and maintaining high quality standards for components critical to system longevity and speed.

The core manufacturing stage involves system design, assembly, integration, and software development. Major OEMs (Original Equipment Manufacturers) leverage in-house engineering expertise to design scalable, modular sorting systems. This phase includes extensive R&D into robotics, AI integration, and control software that dictates the system’s overall performance. Once manufactured, the system moves through distribution channels, which are typically direct sales channels for large, complex, multi-million dollar projects. Direct interaction allows OEMs to offer highly customized solutions, site surveys, and specialized technical support during the critical installation and commissioning phases. Indirect channels, involving system integrators or authorized regional partners, are often utilized for smaller projects or maintenance services in geographically distant markets.

Downstream activities center on installation, commissioning, maintenance, and long-term service contracts provided directly to the end-users (logistics companies, postal services, etc.). The value derived downstream is heavily dependent on the quality of service support, the availability of spare parts, and the provision of continuous software updates that enhance system efficiency over its operational lifespan. Post-sales services, particularly sophisticated data analytics and predictive maintenance provided via cloud-based platforms, represent a growing area of profitability and customer retention, transforming the relationship from a hardware sale to a long-term service partnership focused on maximizing system uptime and throughput.

Packet and Parcel Sorting System Market Potential Customers

Potential customers for packet and parcel sorting systems are primarily enterprises managing large, centralized flows of physical goods requiring rapid identification and routing. The most prominent segment is the Courier, Express, and Parcel (CEP) industry, including global giants and regional players who operate large sorting hubs necessary to sustain their time-definite delivery guarantees. These customers demand extremely high throughput (30,000+ IPH) and 24/7 reliability, making investment in state-of-the-art cross-belt and shoe sorters a continuous necessity to maintain competitive service levels. The complexity of international shipping also drives demand for systems capable of handling multi-sort destinations and integrated customs documentation.

The second major buying group comprises e-commerce and large retail fulfillment centers, driven by the need to quickly process returns (reverse logistics) and manage peak season volumes efficiently. These customers often require a balance of speed and gentleness, favoring tilt-tray or specific robotic sorting solutions for handling smaller, diverse, and often fragile consumer goods. The integration requirement here is highly focused on WMS and order management systems (OMS) to ensure seamless flow from order placement to final dispatch. As e-commerce shifts toward localized, rapid fulfillment, the demand for smaller, modular systems suitable for urban micro-hubs is growing rapidly within this customer segment.

Traditional national and international Postal Services remain significant, albeit often government-funded, customers. While their packet volumes are increasingly dominated by e-commerce deliveries, they also require systems optimized for traditional mail sorting alongside parcel processing, often demanding robust OCR capabilities for handling legacy envelope formats and unique governmental mail streams. Other potential buyers include large 3PL providers managing outsourced logistics for multiple clients, where system flexibility and multi-client capability are key purchasing criteria, and airport logistics divisions seeking high-speed baggage handling and cargo sortation capabilities that mirror parcel logistics standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $8.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vanderlande Industries, Siemens Logistics, Beumer Group, Fives Group, Intelligrated (Honeywell), Murata Machinery, TGW Logistics Group, Dematic (KION Group), Leonardo, Bastian Solutions, Solystic, MHS Global, Interroll Group, Daifuku Co. Ltd., Knapp AG, Sick AG, Opex Corporation, SSI Schaefer, KUKA Group, Eurosort Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Packet and Parcel Sorting System Market Key Technology Landscape

The technological landscape of the Packet and Parcel Sorting System market is characterized by a rapid evolution toward intelligent and highly flexible material handling solutions. Core technologies include sophisticated high-speed mechanical sorting systems like the widely adopted cross-belt and shoe sorters, which utilize electromagnetic or linear motor propulsion to achieve extremely high throughput rates while minimizing wear and tear. These systems rely heavily on precision engineering to maintain operational stability under continuous, intense usage. Crucially, the newest innovations focus on increasing the system's ability to handle package inconsistency, driven by the "ship-in-own-container" trend where standard cartons are replaced by bags, poly-mailers, and irregular shapes.

The most transformative technologies are rooted in data capture and processing. Advanced Machine Vision Systems, integrating high-resolution cameras, depth sensors, and 3D imaging, are replacing traditional 1D and 2D barcode scanners to quickly capture package dimensions, weight, and critical identifying information instantaneously as the item moves. This vision data feeds into complex sorting algorithms optimized by Artificial Intelligence (AI) and Machine Learning (ML). These algorithms not only confirm destination but also monitor belt integrity, detect anomalies, and inform real-time system adjustments, substantially reducing the likelihood of manual reroutes and maximizing the effective utilization rate of the system capacity.

Furthermore, robotic systems are playing an increasingly important role, particularly in the labor-intensive induction and singulation processes—the initial stages where mixed packages are placed onto the sorter conveyor system. Collaborative robots (cobots) and high-speed pick-and-place robots are being integrated to automate these tasks, improving efficiency and reducing reliance on human labor during repetitive loading cycles. The convergence of IoT sensors across the conveyor network enables predictive maintenance, while advanced simulation software (Digital Twins) allows logistics providers to model various package flow scenarios, optimizing hub layout and sortation logic before physical deployment, ensuring investments are maximized from day one of operation.

Regional Highlights

Regional dynamics heavily influence the type and scale of sorting systems deployed, reflecting variations in e-commerce penetration, labor costs, and existing logistics infrastructure maturity. The Asia Pacific (APAC) region stands out as the epicenter of market growth, fueled by the massive volumes generated by e-commerce giants and rapid cross-border trade. Countries like China, India, and Japan are heavily investing in mega-hubs requiring ultra-high capacity cross-belt and shoe sorters to handle peak demand, often emphasizing the ability to process extremely small packets characteristic of C2C and international light parcel shipping. Government support for infrastructure modernization further accelerates adoption in this region, prioritizing speed and scalability.

North America and Europe represent mature markets characterized by high labor costs and established, dense logistics networks. Investment here is focused less on building greenfield sites and more on modernization and enhancing existing facilities. Demand is strong for high-speed, compact solutions that fit within existing building footprints, such as vertical sorters or advanced pouch sorting systems, which offer high density. A key focus is on integrating robotics for labor-intensive tasks like truck loading/unloading and induction, aiming for higher automation levels to counter chronic labor shortages and sustain fast, reliable delivery services, particularly in urban areas.

Latin America and the Middle East & Africa (MEA) are emerging markets exhibiting high growth potential, albeit from a lower base. Growth in these regions is primarily driven by expanding middle classes, increasing internet penetration, and the burgeoning local e-commerce markets. Investment in these regions tends to be focused on medium-capacity, modular systems that offer flexibility and scalability as infrastructure develops. MEA, particularly the GCC countries, is seeing significant government-backed investment in creating global logistics gateways, driving demand for modern hub equipment, while Latin American markets face greater logistical challenges requiring robust systems capable of operating in diverse environmental and regulatory conditions.

- Asia Pacific (APAC): Highest growth rate; driven by massive e-commerce volumes (China, India); focus on large-scale mega-hubs and small packet sorting capabilities; key market for high-capacity cross-belt systems.

- North America: Mature market; driven by high labor costs and demand for same/next-day delivery; emphasis on robotics integration, AI optimization, and retrofitting existing facilities with high-density sorters.

- Europe: Focus on sophisticated, high-density, and energy-efficient systems; strong emphasis on tilt-tray and bomb-bay technology for postal and small item handling; strict regulatory environment influencing safety and noise standards.

- Latin America: Emerging market; growing middle class and increasing e-commerce penetration; demand for modular, scalable medium-capacity systems; faces challenges related to infrastructure development.

- Middle East and Africa (MEA): Focus on building strategic logistics gateways (UAE, Saudi Arabia); significant government investment; demand for robust systems to handle regional trade routes and international parcel flow.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Packet and Parcel Sorting System Market.- Vanderlande Industries

- Siemens Logistics

- Beumer Group

- Fives Group

- Intelligrated (Honeywell)

- Murata Machinery

- TGW Logistics Group

- Dematic (KION Group)

- Daifuku Co. Ltd.

- Knapp AG

- MHS Global

- Bastian Solutions

- Solystic

- Interroll Group

- Opex Corporation

- SSI Schaefer

- Eurosort Systems

- Grenzebach Group

- Vitronic GmbH

- Keyence Corporation

Frequently Asked Questions

Analyze common user questions about the Packet and Parcel Sorting System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving investment in high-speed parcel sorting systems?

The primary driver is the exponential and sustained growth of global e-commerce, which necessitates logistics providers to process unprecedented volumes of packets and parcels accurately and rapidly, often under tight delivery deadlines like same-day or next-day shipping requirements. High-speed automation is essential for operational scalability and competitive differentiation.

How are AI and machine learning currently improving parcel sorting accuracy?

AI and machine learning significantly enhance sorting accuracy by utilizing advanced machine vision systems to reliably read damaged, obscured, or handwritten labels (OCR enhancement). Furthermore, AI algorithms perform real-time system diagnostics and dynamically adjust package flow, minimizing mis-sorts caused by operational bottlenecks or equipment deviations, leading to higher first-pass read rates.

Which sorting technology is currently dominant in terms of market revenue?

Cross-Belt Sorters currently dominate the market revenue segment. They are favored by large logistics and CEP providers due to their high throughput capacity, versatility in handling a wide range of package sizes and weights (from small flats to large boxes), and robust reliability necessary for continuous 24/7 operation in centralized mega-hubs.

What are the main financial challenges associated with implementing automated sorting systems?

The main financial challenge is the high initial Capital Expenditure (CAPEX) required for purchasing, installing, and integrating the complex hardware and control software. Additionally, the Return on Investment (ROI) cycle can be long, and the systems require ongoing specialized maintenance and software updating contracts, contributing to significant operational expenditure (OPEX) over the system lifecycle.

How is regional growth distributed in the Packet and Parcel Sorting System Market?

The Asia Pacific (APAC) region exhibits the highest growth rate, driven by massive domestic e-commerce markets (e.g., China and India) and rapid infrastructure development. North America and Europe show robust demand primarily focused on replacing or upgrading existing systems with advanced robotics and software integration to combat high labor costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager