Padfoot Roller Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433713 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Padfoot Roller Market Size

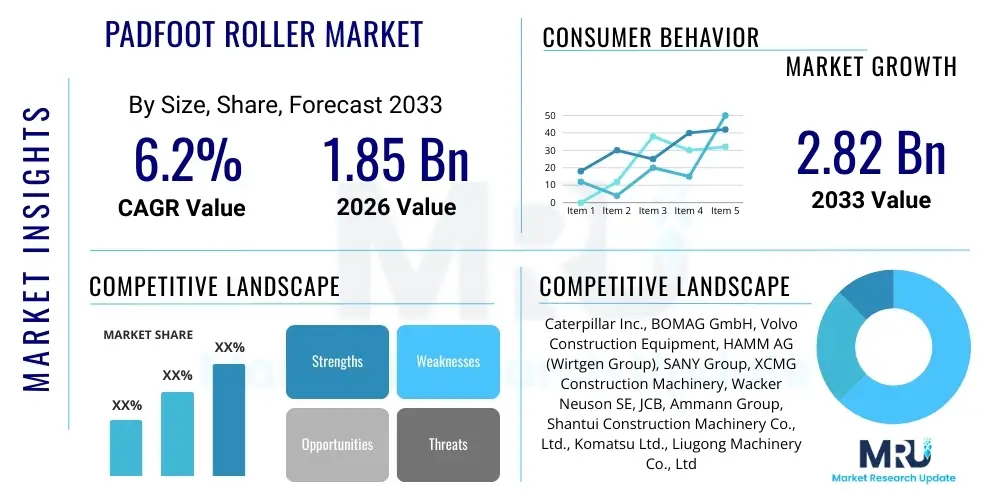

The Padfoot Roller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 2.82 billion by the end of the forecast period in 2033.

Padfoot Roller Market introduction

The Padfoot Roller Market encompasses the manufacturing, distribution, and utilization of specialized compaction equipment designed primarily for cohesive and semi-cohesive soil types. Also known as sheep's foot rollers or tamping rollers, these machines feature drums covered in lugs, or pads, which penetrate the soil layers, kneading and compacting the material from the bottom up. This mechanical process is essential in large-scale civil engineering projects, including highway construction, dam building, and landfill preparation, where achieving specified density and moisture content in clay-rich soils is crucial for structural integrity and longevity.

The core application of Padfoot Rollers lies in achieving optimal soil stabilization and reducing voids, thereby minimizing the risk of settling and structural failure in foundation layers. Key benefits include superior deep compaction compared to smooth drum rollers, effective homogenization of soil moisture, and the ability to work efficiently on softer, stickier materials. These rollers are indispensable assets in modern infrastructure development, as inadequate compaction leads to substantial project delays and long-term maintenance costs. The robust design and high tractive effort make them suitable for challenging terrains and high-volume earthmoving operations.

Driving factors for the market include massive governmental investments in infrastructure upgrades globally, particularly in developing economies prioritizing road networks and housing projects. Furthermore, stringent regulatory standards concerning compaction efficiency and environmental safety in construction are compelling contractors to adopt specialized equipment like Padfoot Rollers. The continuous introduction of technologically advanced models featuring telematics, better fuel efficiency, and optimized vibration control further stimulates market growth and replacement cycles within the global construction machinery sector.

Padfoot Roller Market Executive Summary

The Padfoot Roller Market is characterized by steady growth driven predominantly by the escalating global demand for infrastructure, particularly road, rail, and port development across Asia Pacific and specific regions in North America and Europe. Business trends indicate a strong shift towards intelligent compaction (IC) technologies, where rollers are equipped with sensors and GPS mapping capabilities to provide real-time feedback on soil stiffness and density. This technological integration not only enhances efficiency but also ensures compliance with complex engineering specifications, making these high-tech rollers premium offerings in the competitive heavy machinery landscape. Key manufacturers are focusing on mergers and acquisitions and strategic alliances to consolidate market share and expand their geographic reach, especially in high-growth emerging markets.

Regionally, Asia Pacific maintains the dominant position, fueled by unprecedented urbanization and state-funded mega-projects, especially in China, India, and Southeast Asian nations. North America and Europe represent mature markets, where demand is primarily driven by fleet replacement, stringent emission regulations (Tier 4 Final/Stage V), and the adoption of advanced automation features. Segment trends show increasing preference for heavier operating weight categories (above 15 tons) due to the need for faster completion of large-scale embankment projects. Furthermore, rental fleets are playing an increasingly significant role, offering construction firms flexible access to specialized padfoot roller models without significant capital investment, thereby accelerating market penetration across smaller contractors.

The market faces challenges related to high capital costs and volatile raw material prices, but these are generally mitigated by the growing demand and the essential nature of the equipment in large civil works. The future outlook remains positive, hinged upon continued global infrastructure spending and the incorporation of sustainable practices, such as optimizing compaction cycles to reduce fuel consumption. Manufacturers are also exploring alternative power sources, including hybrid and electric drive systems, although diesel remains the dominant power source due to the strenuous duty cycles required of compaction equipment.

AI Impact Analysis on Padfoot Roller Market

Common user questions regarding AI's impact on Padfoot Rollers center on how artificial intelligence can optimize compaction patterns, predict maintenance needs, and enhance job site safety. Users frequently inquire about the integration of AI-driven control systems that automatically adjust vibration frequency and amplitude based on real-time soil feedback, thereby achieving optimal density with fewer passes, and subsequently reducing wear, fuel consumption, and operational time. Concerns are often raised about the cost of retrofitting existing machinery and the requirement for specialized training for operators to manage these sophisticated systems. Furthermore, there is significant interest in how predictive maintenance algorithms, powered by machine learning, can analyze telematics data (engine temperature, vibration hours, hydraulic pressure) to forecast component failure, moving the industry towards truly proactive servicing rather than reactive repairs.

The synthesis of user queries highlights key expectations: improved operational efficiency, reduced environmental footprint through optimized fuel use, and enhanced data reliability for project documentation. AI is expected to transition Padfoot Rollers from purely mechanical devices into highly intelligent, data-generating assets crucial for project management. While full autonomy remains a long-term goal, current applications focus on prescriptive analytics and automated assistance, ensuring that inexperienced operators can achieve expert-level compaction quality. The industry recognizes that AI integration is not just about automation but primarily about maximizing soil mechanics understanding through continuous learning and feedback loops processed by machine learning algorithms embedded in the roller's control unit.

- AI-powered Intelligent Compaction (IC) systems optimize pass counting and coverage mapping, ensuring uniform compaction density across the entire work area.

- Predictive maintenance schedules utilizing machine learning reduce unplanned downtime and extend the lifespan of high-cost components such as drum bearings and hydraulic pumps.

- Integration with site-wide planning software allows AI to dynamically suggest optimal roller speed, amplitude, and frequency based on real-time soil moisture and stiffness data.

- Enhanced operator assistance features use AI to monitor operator input and environmental conditions, providing warnings or automatic adjustments to prevent over-compaction or damage to the subgrade.

- Improved safety through proximity sensing and AI-driven object detection, aiding in autonomous stopping or maneuvering in complex construction site environments.

DRO & Impact Forces Of Padfoot Roller Market

The Padfoot Roller Market is propelled by robust drivers centered on global urbanization and critical infrastructure renewal, particularly in regions requiring substantial soil stabilization for large dams, high-speed rail corridors, and massive logistical parks. Restraints largely involve the high initial capital expenditure required for purchasing advanced machinery and the cyclical nature of the construction industry, which can cause intermittent demand fluctuations. Opportunities exist in the rapid uptake of rental services, which democratize access to sophisticated equipment, and the development of niche segments, such as remote-controlled or autonomous padfoot rollers designed for hazardous or inaccessible compaction sites. These forces collectively shape the market's trajectory, emphasizing the necessity of technological innovation to overcome cost barriers and address regulatory pressures regarding emission control.

The primary impact force driving current operational changes is the regulatory environment, specifically emission standards (like EU Stage V and US Tier 4 Final), which necessitate continuous investment in engine technology, increasing the overall unit cost but improving environmental performance. Economic volatility, particularly in emerging markets, acts as a restraint, affecting the financing capabilities of local contractors. Conversely, the continuous advancement in compaction monitoring technologies serves as a strong driver, offering tangible return on investment (ROI) through verified compaction quality and reduced fuel consumption, incentivizing fleet owners to upgrade their machinery rapidly. Geopolitical stability also impacts global material supply chains and project timelines, influencing the pace of adoption of new compaction technologies.

Segmentation Analysis

The Padfoot Roller market segmentation provides crucial insights into the diverse requirements of the global construction and earthmoving industry, allowing manufacturers to tailor their product offerings effectively. Segmentation is primarily based on operating weight, which dictates the machine's application scope, ranging from light utility work to heavy-duty primary compaction on large infrastructure projects. Further division by drum type, drive mechanism (e.g., single drum or double drum), and technology level (standard versus intelligent compaction enabled) helps delineate distinct market sub-categories. The analysis reveals that the segment of vibratory padfoot rollers with operating weights exceeding 15 tons currently commands the largest market share globally due to the scale and intensity of modern earthworks required for major highway construction and airport runways.

Technological segmentation is becoming increasingly vital, separating conventional mechanical systems from modern hydrostatic drive and telematics-equipped machines. Hydrostatic transmission offers better maneuverability, precise control, and enhanced climbing capability, making it preferred for complex terrains, thereby driving growth in this segment. Application segmentation highlights the dominance of road construction and maintenance, followed by the significant demand emanating from residential and commercial infrastructure development, including utilities and foundations. Understanding these nuances is critical for forecasting, as government focus shifts between vertical (building) and horizontal (transport) infrastructure spending.

- By Operating Weight:

- Light Duty (Below 10 Metric Tons)

- Medium Duty (10 – 15 Metric Tons)

- Heavy Duty (Above 15 Metric Tons)

- By Drum Type:

- Single Drum Padfoot Rollers

- Double Drum Padfoot Rollers (Tandem)

- By Compaction Mechanism:

- Vibratory Padfoot Rollers

- Static Padfoot Rollers

- By Drive Type:

- Self-Propelled Rollers

- Towed Rollers

- By Application:

- Road and Highway Construction

- Dam and Embankment Construction

- Airport and Port Infrastructure

- Landfills and Waste Management

- Commercial and Residential Construction

Value Chain Analysis For Padfoot Roller Market

The value chain for the Padfoot Roller Market begins with upstream activities involving the sourcing of critical raw materials, primarily high-grade steel for the drum, chassis, and pads, along with specialized components such as diesel engines, hydraulic systems, and advanced electronic controls. Manufacturers often rely on a concentrated base of global suppliers for engines (e.g., Cummins, Caterpillar) and hydraulic pumps, requiring strong long-term relationships to mitigate supply chain risks and ensure compliance with emission regulations. R&D and design form a crucial part of the upstream segment, focusing on developing intelligent compaction systems and optimizing drum geometry for maximum efficiency on cohesive soils. High reliance on proprietary intellectual property related to vibration control and pad design defines competitive advantage at this stage.

Midstream activities encompass the manufacturing, assembly, and quality assurance processes. Production facilities utilize advanced automation and robotic welding to ensure the structural integrity of the high-stress components like the roller drum and frame. The integration of complex electronic control units (ECUs) and telematics hardware necessitates skilled labor and specialized calibration processes during assembly. Distribution channels bridge the gap between manufacturers and end-users, involving a mix of direct sales forces for large governmental or multinational contractors and indirect sales through authorized, exclusive dealer networks. Dealers typically manage sales, financing, warranty services, and critical aftermarket support, acting as the primary point of contact for routine maintenance and spare parts supply.

Downstream analysis focuses on the end-users—large construction contractors, specialized compaction rental companies, and government public works departments—who utilize the rollers on site. The critical factor in this stage is the robust provision of aftermarket support, including rapid parts availability and specialized technician training, which often dictates repeat purchase decisions. Rental channels, in particular, play a crucial indirect role, ensuring high utilization rates of the equipment and minimizing capital commitment for smaller firms. The value chain is constantly being optimized through digitization, with telematics data flowing back upstream to manufacturers, informing design improvements and refining predictive maintenance strategies, creating a highly interconnected ecosystem.

Padfoot Roller Market Potential Customers

The primary customers for Padfoot Rollers are large-scale civil engineering and construction firms specializing in foundational work and earthmoving, particularly those undertaking governmental contracts for extensive horizontal infrastructure development. These companies require high-capacity, reliable compaction equipment to meet demanding project deadlines and strict quality specifications regarding soil density. Given the high cost of the machinery, these customers often have significant capital resources or access to specialized equipment financing. Their purchasing decisions are heavily influenced by machine uptime, fuel efficiency, and the integration of advanced features such as Intelligent Compaction (IC) systems, which provide verifiable results essential for contract compliance.

Another crucial customer segment consists of specialized equipment rental agencies. These agencies serve the needs of smaller and medium-sized contractors who cannot justify the full capital outlay of purchasing a Padfoot Roller but require temporary access to specialized compaction capabilities. Rental companies prioritize machines that are durable, easy to maintain, and possess high resale value, often leading them to purchase standard, robust models from top-tier manufacturers. Their influence on the market is substantial, as they often dictate the prevailing fleet standards and drive demand for flexible utilization options and comprehensive service contracts offered by OEMs (Original Equipment Manufacturers).

Finally, government agencies and municipal public works departments constitute a direct and stable customer base, particularly in developed nations where infrastructure maintenance and renewal are continuous processes. These entities often procure machines for landfill operations, flood control projects (dams and levees), and internal road projects. Their procurement processes are often characterized by rigorous bidding requirements focusing on lifetime operational costs, regulatory compliance (especially emission standards), and long-term service agreements. Their demand profiles tend to favor heavy-duty, reliable machines capable of meeting environmental criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 billion |

| Market Forecast in 2033 | USD 2.82 billion |

| Growth Rate | CAGR 6.2% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., BOMAG GmbH, Volvo Construction Equipment, HAMM AG (Wirtgen Group), SANY Group, XCMG Construction Machinery, Wacker Neuson SE, JCB, Ammann Group, Shantui Construction Machinery Co., Ltd., Komatsu Ltd., Liugong Machinery Co., Ltd., Dynapac (Fayat Group), CNH Industrial N.V. (Case CE), Zoomlion Heavy Industry Science and Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Padfoot Roller Market Key Technology Landscape

The technological landscape of the Padfoot Roller Market is rapidly evolving, driven primarily by the mandate for efficiency, precision, and sustainability on modern construction sites. The most impactful technology is Intelligent Compaction (IC), which integrates GPS positioning, accelerometers, and advanced data processing units into the roller controls. These systems provide real-time feedback on the stiffness of the compacted material (measured in units like CMV - Compaction Meter Value), allowing operators to ensure uniform density and prevent over or under-compaction. IC technology drastically reduces the number of required passes, leading to substantial savings in fuel, time, and wear and tear, and provides verifiable data reports essential for quality control documentation in major projects. The widespread adoption of telematics further complements IC systems, enabling remote monitoring of machine performance, location, and maintenance needs.

Beyond compaction monitoring, power train technologies are undergoing a significant transformation. Compliance with stringent global emission standards has spurred the development of advanced diesel engines featuring Selective Catalytic Reduction (SCR) and Diesel Particulate Filters (DPF). Furthermore, hydrostatic drive systems have largely replaced mechanical transmissions in high-performance padfoot rollers, offering superior torque, smoother operation, and enhanced tractive effort, which is critical when working on steep slopes or loose material. Research and development are currently focused on hybridization and electrification, though full-electric Padfoot Rollers face challenges due to the high energy demands of sustained vibration and heavy-duty operation over long work cycles.

In terms of physical design, technological advancements include modular pad designs that allow for easier replacement and customization for specific soil conditions, and isolation systems that minimize vibration transfer to the machine frame and operator, enhancing ergonomics and component longevity. Manufacturers are utilizing advanced simulation software during the design phase to optimize drum shell thickness, pad dimensions, and vibration characteristics to achieve maximum penetration and energy transfer efficiency. Automation is also emerging, with several leading manufacturers testing semi-autonomous and remote-controlled padfoot rollers, aimed at improving safety and efficiency in potentially hazardous compaction environments, although wide commercial deployment is still in early stages.

Regional Highlights

The regional dynamics of the Padfoot Roller Market are heavily influenced by governmental expenditure on infrastructure and varying levels of industrial development across continents. The Asia Pacific (APAC) region stands out as the primary growth engine, fueled by rapid urbanization, massive state-backed infrastructure programs (such as China's Belt and Road Initiative and India's highway development push), and the resulting surge in demand for fundamental earthmoving and compaction machinery. Countries like China, India, and Indonesia are witnessing high sales volumes, driven both by new fleet purchases and the retirement of older, less efficient equipment. The competitive landscape in APAC is characterized by the strong presence of local manufacturers offering cost-effective alternatives alongside international premium brands.

North America (NA) and Europe represent mature markets defined by rigorous quality standards, stringent emission regulations, and a high reliance on rental fleets. Demand in these regions is less about greenfield expansion and more focused on replacement cycles, integrating technologically advanced machines (equipped with IC and telematics), and ensuring compliance with Tier 4 Final/Stage V emission standards. Contractors in NA prioritize reliability and the availability of strong dealer support, while European firms often lead in adopting innovative sustainability features and automated functions. The preference in these regions is heavily skewed towards high-performance, fuel-efficient models that minimize environmental impact.

Latin America (LATAM), and the Middle East and Africa (MEA) offer high growth potential but are subject to greater economic and political volatility. MEA, particularly the GCC countries, drives demand through mega-project investments in smart cities, energy infrastructure, and logistical hubs, where robust compaction is essential for desert and coastal reclamation projects. LATAM markets are more fragmented, with demand fluctuating based on governmental budget allocation for public works. However, both regions show a growing appetite for durable, heavy-duty Padfoot Rollers as infrastructure build-out continues to accelerate, offering significant market opportunities for manufacturers capable of navigating local logistical and regulatory hurdles.

- Asia Pacific (APAC): Dominates the market share and growth trajectory, driven by extensive road, rail, and urban development projects, particularly in India, China, and Southeast Asia.

- North America: Mature market focused on replacement demand, intelligent compaction technology adoption, and adherence to strict Tier 4 Final emission regulations.

- Europe: Characterized by sophisticated fleet management, strong emphasis on sustainability (Stage V compliance), and high penetration of advanced features and rental services.

- Middle East & Africa (MEA): High growth potential fueled by large-scale government-funded infrastructure projects and the necessity for robust machines suitable for extreme operating environments.

- Latin America: Emerging market with increasing infrastructural needs, though market stability and investment levels are highly susceptible to regional economic fluctuations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Padfoot Roller Market.- Caterpillar Inc.

- BOMAG GmbH

- Volvo Construction Equipment

- HAMM AG (Wirtgen Group)

- SANY Group

- XCMG Construction Machinery

- Wacker Neuson SE

- JCB

- Ammann Group

- Shantui Construction Machinery Co., Ltd.

- Komatsu Ltd.

- Liugong Machinery Co., Ltd.

- Dynapac (Fayat Group)

- CNH Industrial N.V. (Case CE)

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Doosan Infracore (now Hyundai Doosan Infracore)

- Terex Corporation

- Kawasaki Heavy Industries, Ltd.

- Apollo Earthmovers (Action Construction Equipment Ltd.)

- Maschinenfabrik BERNARD KRONE GmbH

Frequently Asked Questions

Analyze common user questions about the Padfoot Roller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and advantage of a Padfoot Roller over a Smooth Drum Roller?

The primary function of a Padfoot Roller is to achieve deep compaction and stabilization in cohesive soils (like clay). Its lugs, or pads, penetrate the soil, kneading it from the bottom up, which is significantly more effective for achieving uniform density in clay than the surface compaction provided by a smooth drum roller.

What is Intelligent Compaction (IC) and how does it relate to Padfoot Rollers?

Intelligent Compaction is a technology that uses GPS, accelerometers, and real-time mapping to monitor and control the compaction process. For Padfoot Rollers, IC systems provide real-time feedback on soil stiffness, ensuring optimal density is reached in the minimum number of passes, thereby reducing time and fuel consumption.

Which geographical region dominates the demand for Padfoot Rollers?

The Asia Pacific (APAC) region currently dominates the demand for Padfoot Rollers, primarily driven by massive government investments in infrastructure development, road construction, and rapid urbanization across major economies like China and India.

What is the typical operating weight range for heavy-duty Padfoot Rollers?

Heavy-duty Padfoot Rollers, typically utilized for large embankment and highway projects, generally fall into the operating weight category of above 15 metric tons. This weight range provides the necessary static and dynamic forces for deep compaction.

What are the key technological restraints affecting the Padfoot Roller market?

Key restraints include the high initial capital cost of machines, particularly those equipped with advanced IC and telematics, and the ongoing challenge of meeting increasingly strict global emission regulations (such as Tier 4 Final/Stage V), which requires significant R&D investment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager