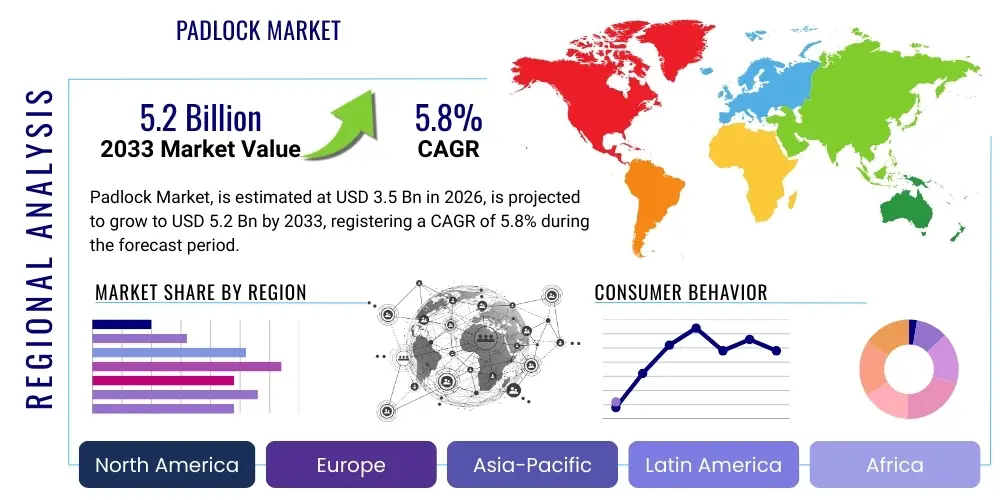

Padlock Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437416 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Padlock Market Size

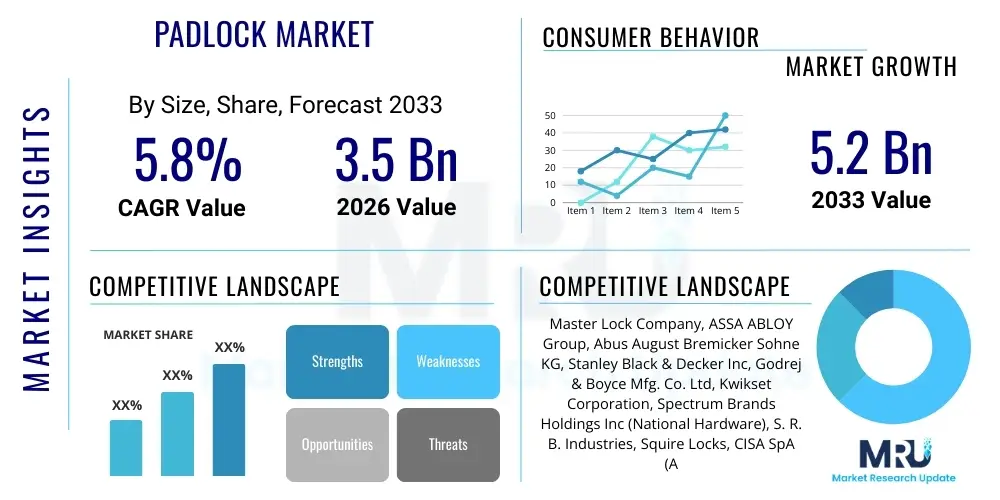

The Padlock Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Padlock Market introduction

The Padlock Market encompasses a diverse range of mechanical and electronic locking devices designed for portable security applications across residential, commercial, and industrial sectors. These devices serve as a fundamental barrier against unauthorized access, ranging from simple brass and laminated steel locks used in consumer settings to highly sophisticated, hardened steel, weather-resistant, and smart padlocks utilized in critical infrastructure and high-security environments. The market landscape is continually evolving, driven primarily by escalating global security concerns, increased infrastructure development, and the rapid integration of Internet of Things (IoT) technologies which necessitate enhanced accessibility control and monitoring capabilities.

Padlocks historically relied solely on physical keys or mechanical combinations; however, the contemporary market is witnessing a significant pivot towards digital and smart locking solutions. These advanced products offer features such as biometric authentication, remote monitoring, and tamper alerts, positioning padlocks not merely as static security tools but as integrated components of broader security management systems. Major applications span securing personal belongings, storage units, gates, utility meters, transportation containers, and hazardous material storage areas. The primary benefit derived from these products is deterrence against theft and vandalism, alongside the assurance of asset protection across highly distributed physical locations.

Key driving factors propelling market expansion include global urbanization leading to higher demand for residential security products, stringent regulatory requirements for securing critical infrastructure assets, and technological advancements focusing on durability, weather resistance, and connectivity. Furthermore, the proliferation of e-commerce and logistics services has increased the need for robust container and cargo security solutions, directly fueling demand for high-grade industrial padlocks. The market remains competitive, characterized by established manufacturers focusing on continuous material science improvements and digital integration strategies to capture consumer interest in convenience and robust security simultaneously.

Padlock Market Executive Summary

The Padlock Market is poised for stable expansion, supported by robust growth in the smart locking segment and persistent demand from industrial end-users seeking enhanced asset protection and accountability. Current business trends indicate a strong move away from low-security, commodity-grade padlocks towards durable, digitally integrated security solutions, characterized by advanced materials like boron alloy steel and complex electronic mechanisms. Manufacturers are heavily investing in research and development to improve resistance against sophisticated intrusion methods, including shimming and cutting, while also enhancing product usability through features like long-life batteries and standardized communication protocols. Mergers and acquisitions focusing on integrating IoT software capabilities are becoming commonplace as companies seek to consolidate expertise in physical security hardware and digital access management platforms.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely attributable to massive infrastructure projects, burgeoning industrialization, and rapid urbanization, particularly in countries like China and India, which are driving massive volume demand for both traditional and industrial-grade padlocks. North America and Europe maintain substantial market shares, primarily characterized by high adoption rates of premium and smart padlocks, driven by consumer preference for convenience and higher disposable incomes enabling investment in advanced home security ecosystems. Regulatory compliance related to health and safety (e.g., lockout/tagout procedures in industrial settings) also sustains consistent demand in mature Western markets, ensuring a stable revenue stream for specialized industrial product lines.

Segment trends demonstrate that while traditional keyed padlocks still dominate in terms of volume, the combination and smart padlock segments are experiencing significantly higher revenue growth rates. The commercial and industrial end-user segments remain the primary revenue generators, driven by requirements for centralized access control and stringent security protocols. Within material segmentation, hardened steel padlocks are gaining traction over conventional brass, particularly where extreme weather resistance and superior cutting protection are mandatory. This structural shift towards higher-value, technology-enabled products is improving overall market profitability, despite persistent competitive pricing pressures in the baseline consumer segment.

AI Impact Analysis on Padlock Market

User queries regarding AI's influence on the Padlock Market predominantly center on three core themes: the integration of predictive maintenance and failure analysis in smart locks, enhancing biometric security accuracy, and optimizing the supply chain and manufacturing processes. Users are concerned about how AI algorithms can improve the reliability and lifespan of complex electronic padlocks, asking questions about predictive failure rates based on usage patterns and environmental factors. Furthermore, there is significant interest in how machine learning improves the accuracy and speed of biometric scanners integrated into smart padlocks, reducing false positives and negatives, thereby enhancing user experience and security efficacy. The overarching expectation is that AI will transform padlocks from passive security devices into proactive, intelligent access control nodes.

In manufacturing, AI and machine learning models are being leveraged to optimize material usage, reduce defects in the casting and machining of shackle and body components, and improve quality control through automated visual inspection systems. This adoption leads to higher manufacturing consistency and lower production costs for high-volume traditional padlocks, while simultaneously accelerating the prototyping and iterative design process for new smart lock technologies. Furthermore, AI contributes significantly to cybersecurity within smart lock ecosystems, employing behavioral analytics to detect anomalous access patterns or attempted network intrusions, thus adding another layer of defense beyond physical hardening.

The implementation of AI algorithms also extends to market strategy and personalization. Analysis of real-time usage data from connected padlocks allows manufacturers to gain deep insights into specific security needs across various geographies and end-user types (e.g., residential vs. logistics). This data-driven approach enables highly targeted product development and marketing efforts, ensuring that new products address genuine security vulnerabilities and user needs, such as developing specialized weatherproofing algorithms for specific climates or optimizing battery management based on localized temperature fluctuations. AI integration is thus not just a product feature but a fundamental driver of operational and security performance improvements throughout the product lifecycle.

- AI-enhanced biometric recognition reduces false rejection rates in smart padlocks.

- Predictive maintenance algorithms monitor electronic lock health and forecast potential hardware failures.

- Optimized supply chain planning using AI minimizes inventory holding costs for diverse product lines.

- Machine learning models detect and flag anomalous access attempts, improving smart lock cybersecurity.

- Automated visual inspection systems driven by AI enhance quality control during padlock manufacturing.

- Behavioral analytics improve user profiling for personalized access control management in commercial deployments.

DRO & Impact Forces Of Padlock Market

The Padlock Market's trajectory is determined by a complex interplay of driving forces (D), restrictive challenges (R), and strategic opportunities (O), all culminating in significant market impact forces. Key drivers include the relentless rise in global theft rates and the corresponding consumer demand for stronger physical security measures, particularly in dense urban areas. Furthermore, industrial regulatory compliance, such as OSHA requirements for lockout/tagout (LOTO) procedures in manufacturing and energy sectors, mandates the use of highly specific, durable padlocks, ensuring stable demand from high-value enterprise clients. The increasing adoption of IoT and the convenience offered by smart locking technologies also act as a crucial catalyst, pushing consumers to upgrade older, purely mechanical devices.

Conversely, the market faces notable restraints. The primary challenge for smart padlocks is the relatively high initial cost compared to traditional mechanical versions, which can deter price-sensitive consumers and smaller businesses. Moreover, vulnerability to cyberattacks, battery life dependency, and the potential for technological obsolescence pose significant security and operational risks that manufacturers must continuously mitigate. For traditional padlocks, market maturity and the proliferation of low-quality, cheap imitations from unbranded Asian manufacturers lead to intense price compression in the entry-level segment, challenging established brands' profitability margins. Material shortages and supply chain volatility also intermittently impact the production of essential components like hardened steel and specialized alloys.

Opportunities for growth are concentrated in the continuous development of novel, ultra-secure materials and the expansion of smart features into industrial applications, such as remote access control for distributed infrastructure (e.g., telecommunication towers, public utilities). Emerging markets, characterized by rapid urbanization and infrastructure investment, present vast, untapped demand for both basic and advanced locking solutions. The rise of shared economy models (e.g., peer-to-peer storage, bike sharing) also creates a niche opportunity for specialized, trackable, and robust smart padlocks. The impact forces generally favor innovation; while price sensitivity constrains mechanical lock growth, the market momentum is shifting towards value-added, technologically sophisticated security solutions that justify a premium price point, reshaping competitive dynamics.

Segmentation Analysis

The Padlock Market segmentation provides crucial insight into consumer preferences, end-user security requirements, and technological adoption patterns. The market is primarily categorized based on Type (Keyed, Combination, Smart/Electronic), Material (Brass, Steel, Aluminum, Others), and End-Use (Residential, Commercial, Industrial). This structure reflects the varied needs of customers, ranging from simple personal security (residential) to heavy-duty, tamper-proof asset protection (industrial). The analysis confirms that while traditional keyed padlocks remain dominant by unit sales, the smart padlock segment is driving significant revenue growth due to higher average selling prices (ASPs) and enhanced functionalities like remote monitoring and keyless convenience.

Within the material segments, the preference is moving towards hardened steel and specialized alloys, particularly in commercial and industrial applications where resistance to bolt cutters and extreme environmental conditions is paramount. Brass and aluminum padlocks continue to serve the general consumer market, valued for their corrosion resistance and lighter weight, although their security profile is often lower. Understanding these material preferences is critical for manufacturers to align production capabilities with sector-specific durability requirements, such as supplying weather-resistant, non-sparking padlocks for hazardous industrial environments.

The End-Use segmentation highlights the significant revenue contribution from the industrial sector, encompassing applications like LOTO devices, freight container security, and securing hazardous storage areas. This segment demands specialized certifications, high traceability, and complex master key systems, offering higher profitability compared to the volume-driven residential segment. Commercial applications, including retail security, schools, and offices, present a steady middle ground, increasingly adopting combination and smart locks for managing employee access control efficiently. Strategic market penetration requires manufacturers to develop distinct product portfolios tailored to the regulatory, durability, and convenience expectations specific to each end-use category.

- By Type

- Keyed Padlocks (Traditional and High-Security)

- Combination Padlocks (Dial and Pushbutton)

- Smart/Electronic Padlocks (Bluetooth, Wi-Fi, Biometric)

- By Material

- Brass Padlocks

- Steel Padlocks (Laminated, Hardened Alloy)

- Aluminum Padlocks

- Others (Plastic/Nylon for LOTO, Specialized Alloys)

- By End-Use

- Residential

- Commercial (Retail, Institutional, Hospitality)

- Industrial (Manufacturing, Oil & Gas, Transportation & Logistics)

- By Shackle Type

- Standard Shackle

- Long Shackle

- Hidden Shackle (Hasp)

Value Chain Analysis For Padlock Market

The Padlock Market value chain begins with the upstream sourcing of raw materials, primarily specialized metals such as brass, laminated steel, hardened steel alloys, and aluminum, alongside essential electronic components (e.g., PCBs, sensors, batteries) for smart locks. Raw material procurement is crucial, as the quality and grade of the metal directly dictate the final product's security rating, durability, and weather resistance. Suppliers must adhere to stringent quality standards, particularly for high-security applications, leading to strategic, long-term relationships between large manufacturers and certified metal suppliers. Price volatility in global commodity markets, particularly steel and copper (brass), frequently impacts manufacturing costs, requiring sophisticated hedging and inventory management strategies from major players.

The midstream involves manufacturing and assembly, which includes processes such as casting, forging, stamping, precision machining of internal locking mechanisms (cylinders, tumblers), and the integration of electronic components. Traditional lock manufacturers focus heavily on robust engineering to prevent picking, shimming, and drilling. In contrast, smart lock manufacturers emphasize clean assembly environments for electronics, software integration, and rigorous testing for connectivity and battery performance. Efficiency in manufacturing scale, particularly in APAC, allows for competitive pricing in high-volume segments, whereas specialized, high-security manufacturers focus on customized small-batch production adhering to international security standards (e.g., CEN grades).

Downstream activities center on distribution and sales. The distribution channel is bifurcated into direct sales to large industrial customers (e.g., utility companies, logistics firms) and indirect sales through a vast network comprising hardware stores, home improvement centers, specialized security distributors, and, increasingly, e-commerce platforms. E-commerce has fundamentally reshaped the consumer market, offering greater price transparency and direct-to-consumer models, demanding efficient logistics and digital marketing capabilities. Direct sales often include value-added services such as key management systems design, installation consultation, and bulk order customization, ensuring that the supply chain extends beyond the physical product to comprehensive security management solutions.

Padlock Market Potential Customers

Potential customers for the Padlock Market are diverse, spanning individual consumers seeking basic security to large multinational corporations requiring advanced access management systems. The residential end-user segment represents the largest volume base, purchasing padlocks for securing garden sheds, garages, perimeter gates, and personal storage units, often prioritizing convenience and moderate security at an affordable price point. This segment is increasingly adopting smart padlocks due to the ease of shared access management for family members and service providers, alongside the benefit of keyless operation.

The commercial segment constitutes businesses such as retail stores, offices, hotels, hospitals, and educational institutions. These customers require padlocks for securing storage rooms, fleet vehicles, equipment cabinets, and employee lockers. Their procurement often involves master key systems or centralized electronic access control, focusing on durability, ease of administration, and adherence to internal security protocols. The transition to smart and combination locks in this segment is driven by the necessity to manage high employee turnover and eliminate the costs and risks associated with physical key replacement.

The industrial and infrastructure segment represents the most crucial revenue stream for high-security products. Key buyers include utility companies (securing electrical substations, pipelines, and telecommunication infrastructure), manufacturing plants (LOTO devices), transportation and logistics companies (securing cargo containers, trailers, and shipping yards), and government/military facilities. These end-users demand padlocks offering extreme physical resistance, stringent environmental durability, high resistance to tampering, and often require compliance with ISO or country-specific standards. Purchases in this segment are typically large-scale, strategic, and often involve long-term contracts for maintenance and system integration, prioritizing reliability and certifications over marginal cost savings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Master Lock Company, ASSA ABLOY Group, Abus August Bremicker Sohne KG, Stanley Black & Decker Inc, Godrej & Boyce Mfg. Co. Ltd, Kwikset Corporation, Spectrum Brands Holdings Inc (National Hardware), S. R. B. Industries, Squire Locks, CISA SpA (Allegion), DOM Security, Schlage (Allegion), Tuffy Security Products, U-Tec Group, and Sentinel Security Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Padlock Market Key Technology Landscape

The technology landscape of the Padlock Market is characterized by the convergence of traditional mechanical engineering excellence and advanced digital connectivity. In the mechanical domain, innovations center on proprietary material compositions, such as boron carbide shackles and hardened steel alloys, designed to resist increasingly sophisticated cutting and prying attacks. Keying technology continues to evolve, featuring complex pin tumbler mechanisms, dimple keys, and patented keyways that restrict unauthorized key duplication, effectively addressing the traditional vulnerability of mechanical locks. Manufacturers are constantly refining internal components, including anti-drill plates and anti-pick features, ensuring that physical resilience remains the bedrock of product differentiation across all price points.

The electronic segment represents the most dynamic area of technological development. Smart padlocks leverage various communication protocols, primarily Bluetooth Low Energy (BLE) and Wi-Fi, to facilitate keyless entry via smartphone apps, remote access granting, and real-time monitoring. Biometric technology, including fingerprint recognition, is becoming standardized, offering rapid and secure authentication without the need for physical keys or codes. Energy efficiency is a key technological focus, with manufacturers striving to maximize battery life, sometimes reaching multiple years on a single charge, utilizing sophisticated power management integrated circuits and low-power consuming sensors to maintain connectivity without draining the power source quickly.

Furthermore, software and cloud technology are integral to the modern padlock ecosystem. The utility of smart padlocks is significantly enhanced by cloud-based platforms that enable centralized audit trails, granular user access scheduling, and automatic firmware updates, crucial for maintaining security integrity over time. Geofencing and GPS tracking capabilities are also integrated into high-end logistics and industrial padlocks, providing real-time location data and alerting users if the padlock moves outside a designated secure area. These technological advancements transform the padlock from a simple locking device into a data-generating asset management tool, driving higher enterprise value and streamlining operational security processes across distributed physical infrastructure.

Regional Highlights

The regional analysis of the Padlock Market reveals distinct market maturity levels, consumption patterns, and technological adoption rates across the globe. North America holds a substantial share of the market, primarily driven by high consumer spending on advanced security systems and a mature commercial sector readily adopting IoT-enabled smart padlocks. The region benefits from stringent security standards and high-profile logistics and infrastructure sectors that require premium, high-security products. Consumer preference here strongly favors convenience features such as keyless entry and integration with existing smart home ecosystems, fueling the growth of Bluetooth and Wi-Fi enabled devices.

Europe represents another mature market characterized by strong regulatory frameworks, especially concerning workplace safety (LOTO compliance) and data privacy related to smart devices. Countries like Germany and the UK exhibit high demand for high-grade mechanical padlocks certified under strict European standards (e.g., CEN grades). However, Southern and Eastern Europe are increasingly transitioning towards electronic access solutions in commercial properties. Manufacturers in this region focus intensely on sustainable manufacturing practices and material longevity, aligning with broader European Union environmental and quality regulations, often leading to a higher average product quality but sometimes slower integration of cutting-edge smart features compared to North America.

Asia Pacific (APAC) is identified as the region with the highest growth potential, propelled by explosive urbanization, massive government investment in infrastructure (roads, ports, utilities), and a rapidly expanding industrial base. While price sensitivity remains high in the general consumer segment, leading to mass production of affordable traditional padlocks, the need for robust container security and asset protection in manufacturing and logistics centers drives significant demand for specialized, heavy-duty locks. China, India, and Southeast Asian nations are central to both manufacturing output and domestic consumption growth, marking APAC as the primary driver of global volume sales and a burgeoning adopter of mid-range smart locking technology in urban residential areas.

Latin America and the Middle East and Africa (MEA) currently hold smaller market shares but offer long-term growth prospects. Growth in MEA is largely tied to oil and gas infrastructure security, as well as rapid construction projects in the Gulf Cooperation Council (GCC) states, requiring high-specification industrial padlocks. Latin America’s market growth is more fragmented, reliant on improving economic stability and increasing awareness of security vulnerabilities. In both regions, traditional mechanical locks still dominate sales, but there is a clear rising interest in affordable, basic electronic combination locks and entry-level smart devices as connectivity infrastructure improves.

- North America: High adoption of smart locks, strong commercial and industrial demand, driven by sophisticated security requirements and high spending capacity.

- Europe: Focus on CEN-certified high-security mechanical locks, steady LOTO market, increasing shift towards smart solutions in commercial real estate.

- Asia Pacific (APAC): Fastest growing region, dominated by infrastructure development, massive manufacturing sector, high volume sales of traditional padlocks, and growing smart lock adoption in urban centers.

- Latin America: Emerging market characterized by price sensitivity, slow but steady growth, traditional locks dominate, increasing focus on basic access control.

- Middle East and Africa (MEA): Growth tied to infrastructure projects, energy sector security (oil and gas), and construction booms requiring durable, weather-resistant industrial solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Padlock Market.- Master Lock Company

- ASSA ABLOY Group

- Abus August Bremicker Sohne KG

- Stanley Black & Decker Inc

- Godrej & Boyce Mfg. Co. Ltd

- Kwikset Corporation

- Spectrum Brands Holdings Inc (National Hardware)

- S. R. B. Industries

- Squire Locks

- CISA SpA (Allegion)

- DOM Security

- Schlage (Allegion)

- Tuffy Security Products

- U-Tec Group

- Sentinel Security Products

- Lishi Tools

- Tri-Circle Lock

- Zhejiang Zhongzheng Lock Industry Co. Ltd.

- Anvil International Inc.

- SecureMAX Security Solutions

Frequently Asked Questions

Analyze common user questions about the Padlock market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from mechanical padlocks to smart padlocks?

The primary driver is the demand for enhanced convenience, remote access management, and improved accountability. Smart padlocks offer keyless entry, allow owners to grant temporary access digitally, and provide detailed audit trails of usage, features that are highly valued in both residential and commercial sectors for streamlined security operations and eliminating the need for physical key control.

Which material offers the best security against physical attack?

Padlocks manufactured with hardened boron alloy steel or proprietary corrosion-resistant steel offer the best protection against cutting, drilling, and prying attempts. These high-grade materials, combined with anti-shim and anti-pick cylinder technology, are essential for high-security applications in industrial and infrastructure environments where asset protection is critical and vandalism attempts are frequent.

How significant is the impact of cyber security vulnerabilities on the smart padlock segment?

Cyber security is a critical factor influencing consumer trust and adoption. While physical tampering remains a concern, smart locks face the added risk of digital hacking, unauthorized access via network breaches, or vulnerabilities in associated mobile applications. Manufacturers are addressing this by implementing robust encryption protocols, ensuring mandatory regular firmware updates, and securing cloud communication channels, which is essential for sustained market growth.

What role does the Lockout Tagout (LOTO) procedure play in industrial padlock demand?

LOTO procedures, often mandated by safety regulations like OSHA, require specialized industrial padlocks to ensure that hazardous equipment is properly de-energized and locked before maintenance, preventing accidental startup and protecting workers. This regulatory requirement ensures consistent and non-cyclical demand for highly durable, often color-coded, non-conductive, and unique keying padlocks in the manufacturing, energy, and heavy industries globally.

Where is the highest growth potential for the Padlock Market geographically?

Asia Pacific (APAC) represents the region with the highest projected growth potential, primarily due to unprecedented levels of infrastructure development, rapid industrial expansion, and mass urbanization, particularly across Southeast Asia, India, and China. This growth is fueling enormous demand for both high-volume commodity locks and advanced logistics security solutions required for securing new supply chain infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Padlock Market Size Report By Type (Key Padlock, Password Padlock), By Application (Commercial, Household, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Padlock Set Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Key Padlock, Password Padlock), By Application (Home Safety, Public Safety, Individual Goods), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Padlock Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Key Padlock, Password Padlock), By Application (Commercial, Household, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager