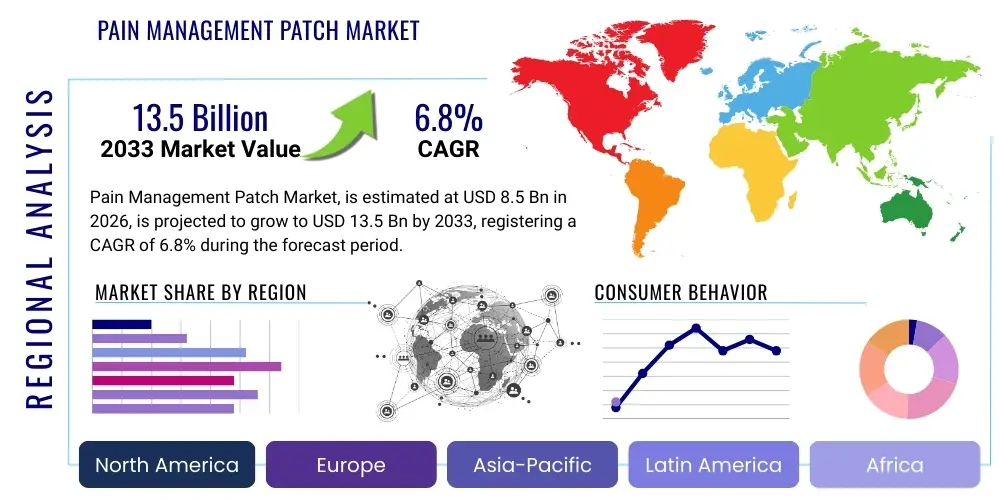

Pain Management Patch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437013 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Pain Management Patch Market Size

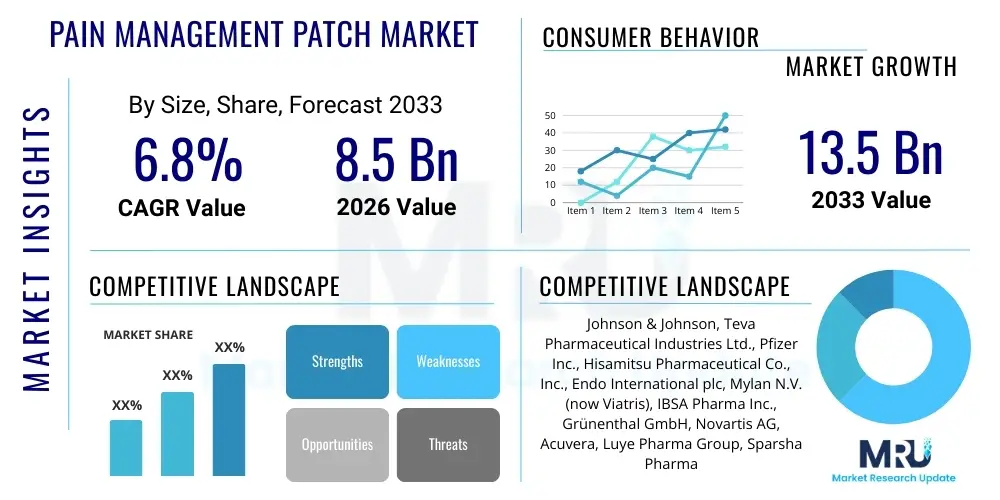

The Pain Management Patch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033.

Pain Management Patch Market introduction

The Pain Management Patch Market encompasses the global sales and distribution of transdermal drug delivery systems specifically designed to administer analgesic compounds directly through the skin, providing localized or systemic relief from various types of pain. These patches offer a non-invasive, controlled-release mechanism, which significantly enhances patient compliance and reduces the first-pass metabolism associated with oral medication. The primary products include patches containing opioids, such as fentanyl and buprenorphine, and non-opioids, primarily lidocaine and diclofenac, catering to both acute and chronic pain conditions.

Major applications of pain management patches span a wide clinical spectrum, including post-operative pain, musculoskeletal disorders, neuropathic pain (such as postherpetic neuralgia), and cancer-related pain. The benefits of these systems are substantial, offering sustained drug levels, minimized systemic side effects, and enhanced convenience compared to multiple daily oral doses. The ability to titrate drug delivery and the reduced risk of accidental overdose with certain patch designs further contribute to their clinical adoption.

The market is primarily driven by the escalating global prevalence of chronic pain disorders, particularly among the aging demographic, coupled with a growing preference for non-invasive drug delivery methods. Technological advancements, such as the development of microneedle arrays and enhanced polymer matrices for better skin permeability, are continually expanding the efficacy and application range of these devices. Furthermore, the rising awareness regarding the dangers and abuse potential of traditional oral opioids is fostering the adoption of controlled-release transdermal options, positioning the patch market for robust expansion.

Pain Management Patch Market Executive Summary

The Pain Management Patch Market is witnessing dynamic shifts driven by evolving regulatory landscapes, focused particularly on opioid abuse mitigation, and significant advancements in non-opioid pharmaceutical formulations. Business trends indicate a strong move toward Over-The-Counter (OTC) lidocaine and diclofenac patches, reflecting a consumer inclination toward self-medication for mild to moderate musculoskeletal pain. Prescription patches, particularly those for chronic neuropathic and severe cancer pain, maintain their dominant market share in terms of value, yet face increasing scrutiny and restricted prescription guidelines in many developed economies. Strategic collaborations between pharmaceutical companies and advanced drug delivery technology firms are defining the competitive landscape, aiming to improve drug bioavailability and reduce skin irritation issues.

Regionally, North America remains the leading market owing to high healthcare expenditure, established reimbursement policies, and a substantial burden of chronic pain conditions, especially among the geriatric population. However, the Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by improving healthcare infrastructure, rising disposable incomes, and increasing patient access to advanced pain management therapies in populous countries like China and India. Europe maintains a steady growth trajectory, supported by robust regulatory standards that encourage innovation in transdermal technologies, though market fragmentation across different national healthcare systems presents certain challenges.

Segment-wise, the Non-Opioid patch segment is poised for accelerated growth, largely attributed to the increasing availability and recommendation of NSAID-based and local anesthetic patches as first-line therapies. Within the application segment, chronic pain management, encompassing arthritis and lower back pain, dominates the market due to the long-term nature of these conditions requiring continuous, sustained drug delivery. Furthermore, the distribution channel is seeing a pronounced shift, with online pharmacies and e-commerce platforms experiencing rapid expansion, offering greater accessibility and convenience for patients managing long-term conditions.

AI Impact Analysis on Pain Management Patch Market

User queries regarding AI's influence on the Pain Management Patch market center primarily on personalized dosing, improved clinical trial efficiency, and the potential for AI-driven monitoring of patient adherence and localized drug absorption. Users frequently ask how machine learning can optimize patch formulations to minimize side effects, such as skin sensitization, and how real-time data analysis might tailor drug release profiles based on individual metabolic rates. Key concerns revolve around the ethical deployment of AI in pain assessment, the security of patient data collected via smart patches, and the regulatory challenges associated with validating AI-designed drug delivery systems.

Based on these concerns, AI and machine learning are fundamentally transforming research and development (R&D) in transdermal systems. AI algorithms are proving invaluable in predicting the permeability of novel compounds through the stratum corneum, allowing researchers to rapidly screen potential excipients and penetration enhancers, thereby drastically shortening the preclinical development phase. This computational approach allows for the creation of sophisticated mathematical models that simulate drug kinetics in the skin, ensuring optimized loading and release characteristics before physical prototyping, leading to faster time-to-market for effective and safe pain relief solutions.

Beyond R&D, AI is extending its impact into clinical practice and manufacturing. Smart patches integrated with sensors can collect continuous data on physiological parameters (e.g., movement, skin temperature, localized inflammation markers), which, when analyzed by AI, provide objective metrics for pain severity and therapeutic efficacy. This level of granularity enables clinicians to adjust treatment regimens in real-time, moving beyond subjective patient reporting. In manufacturing, predictive maintenance, quality control using computer vision, and optimized supply chain logistics, all powered by AI, ensure high fidelity in patch production and reliable delivery to patients globally, further reducing operational costs and material waste.

- Accelerated identification of optimal transdermal enhancers via machine learning.

- Personalized dosing strategies based on predictive modeling of patient metabolism and absorption rates.

- AI-driven interpretation of sensor data from smart patches for objective pain assessment.

- Enhanced quality control and waste reduction in large-scale patch manufacturing.

- Optimization of clinical trial design through predictive analytics, speeding up regulatory approval.

DRO & Impact Forces Of Pain Management Patch Market

The dynamics of the Pain Management Patch market are shaped by a complex interplay of clinical necessity, regulatory stringentness, and technological innovation. Key drivers include the global epidemic of chronic diseases, the strong demand for non-invasive drug delivery, and the inherent advantages patches offer in terms of sustained relief and improved patient adherence, particularly in long-term care scenarios. Restraints primarily involve the significant cost associated with advanced transdermal formulations and the potential for severe localized skin irritation or contact dermatitis, which can limit long-term use for sensitive patients. Furthermore, stringent regulatory pathways, especially for schedule II controlled substances like fentanyl patches, impose high barriers to entry and require extensive post-market surveillance.

Opportunities in this sector are concentrated on developing sophisticated reservoir and matrix systems that incorporate novel, non-opioid analgesics and specialized biological agents (e.g., peptides or monoclonal antibodies for inflammation). The increasing acceptance and utility of microneedle technology represent a significant growth avenue, promising enhanced drug bioavailability and the ability to deliver macromolecular drugs currently restricted by conventional transdermal methods. Expansion into emerging economies, where access to non-oral controlled pain management is limited, also represents a vital market opportunity, requiring localized production and optimized cold chain logistics.

The impact forces are substantial, particularly regarding public health policies aimed at curtailing opioid dependency. This force pushes pharmaceutical R&D heavily toward non-narcotic alternatives (Diclofenac, Lidocaine, Capsaicin), shifting market focus from high-value controlled substances to high-volume OTC and prescription non-opioids. The continuous advancement in material science, allowing for thinner, more comfortable, and bio-compatible patches, is also a powerful force enhancing consumer preference and driving product differentiation in a competitive landscape. Ultimately, the market trajectory is strongly influenced by the ability of manufacturers to deliver sustained, effective, and irritation-free pain relief while navigating increasingly complex global drug control regulations.

Segmentation Analysis

The Pain Management Patch Market segmentation provides a granular view of market dynamics based on pharmacological content, product category, application, and distribution channel, which are crucial for strategic planning. The core segmentation is defined by the type of drug incorporated, dividing the market into Opioid and Non-Opioid categories. Non-Opioids, including local anesthetics (Lidocaine) and Non-Steroidal Anti-Inflammatory Drugs (NSAIDs like Diclofenac), are rapidly gaining traction due to lower abuse potential and broader OTC accessibility, offsetting the regulatory pressure faced by Opioid patches.

Further categorization by product type distinguishes between Prescription-based and Over-The-Counter (OTC) patches. While prescription patches (mainly high-potency opioids and high-concentration lidocaine) command higher revenue per unit, the OTC segment is experiencing faster volume growth due to their use in managing common conditions such as sports injuries, mild back pain, and arthritis. The application spectrum is dominated by chronic pain management, but the acute pain segment, particularly post-surgical and trauma-related pain, is seeing specialized product development focusing on rapid onset and limited duration delivery systems.

Understanding these segments is essential for stakeholders to optimize product portfolio strategies and target marketing efforts. For instance, companies focusing on chronic pain will prioritize patient comfort and long wear duration, while those targeting acute pain will emphasize efficacy and speed. The shift toward digital healthcare is also influencing the distribution segmentation, requiring robust e-commerce and direct-to-consumer strategies alongside traditional hospital and retail pharmacy channels.

- By Type:

- Opioid Patches (e.g., Fentanyl, Buprenorphine)

- Non-Opioid Patches (e.g., Lidocaine, Diclofenac, Methyl Salicylate, Capsaicin)

- By Product:

- Prescription Patches

- Over-The-Counter (OTC) Patches

- By Application:

- Chronic Pain (Neuropathic Pain, Cancer Pain, Arthritis Pain)

- Acute Pain (Post-operative Pain, Trauma Pain, Musculoskeletal Injuries)

- By Distribution Channel:

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies/E-commerce

- By Technology:

- Matrix Patches

- Reservoir Patches

- Micro-needle Patches

Value Chain Analysis For Pain Management Patch Market

The value chain for the Pain Management Patch Market is intricate, starting with the synthesis and procurement of Active Pharmaceutical Ingredients (APIs), followed by specialized formulation and manufacturing processes. Upstream activities involve R&D for novel drug molecules and the development of advanced polymer technologies, bio-adhesives, and penetration enhancers crucial for transdermal delivery. Key upstream suppliers are specialty chemical and pharmaceutical ingredient manufacturers who must meet stringent Good Manufacturing Practice (GMP) standards for purity and consistency. The success at this stage hinges on minimizing API degradation and ensuring high skin permeability.

The manufacturing phase, a critical midstream activity, involves precision coating, lamination, and die-cutting of the patches, which are often highly automated processes requiring specialized cleanroom environments. Quality control is paramount to ensure the correct drug loading and consistent release profile throughout the patch’s intended wear duration. Following manufacturing, patches are packaged, often in foil or barrier pouches to maintain stability, and then moved into the distribution system. Direct distribution channels involve sales forces marketing prescription patches directly to hospitals and pain clinics, while indirect channels utilize large wholesalers and distributors to supply retail and online pharmacies.

Downstream analysis focuses on market access, reimbursement strategies, and end-user uptake. For prescription patches, strong relationships with Payers and Managed Care Organizations are vital to ensure favorable formulary placement. End-users, including chronic pain patients and healthcare providers, drive demand based on clinical efficacy, ease of use, and cost-effectiveness. The increasing prominence of online retail platforms signifies a major shift in the distribution landscape, offering direct access and comparative shopping capabilities for OTC products, thereby streamlining the final link between producer and consumer.

Pain Management Patch Market Potential Customers

The primary consumers and buyers of pain management patches are diverse, encompassing both institutional healthcare providers and individual patients managing various pain conditions. Hospitals and surgical centers represent significant bulk purchasers, utilizing patches, particularly prescription opioids and post-operative lidocaine patches, for managing acute pain immediately following surgical procedures or trauma. Pain management clinics and oncology centers are also crucial institutional buyers, relying heavily on high-dose prescription patches for long-term chronic and severe pain relief, such as in late-stage cancer patients or individuals with intractable neuropathy.

The largest segment, however, comprises individual consumers, particularly the geriatric population, who are often managing chronic conditions like osteoarthritis, rheumatoid arthritis, and chronic back pain. These individuals purchase both prescription products, obtained through specialized physician prescriptions, and a rapidly expanding array of Over-The-Counter (OTC) patches directly from retail and online pharmacies. Patients with needle phobia or those who experience gastrointestinal side effects from oral NSAIDs show a marked preference for transdermal systems, making them key demographic targets.

Furthermore, athletic trainers and sports medicine facilities constitute a growing niche customer base, frequently stocking and recommending OTC NSAID patches (like diclofenac) for the localized management of soft tissue injuries, strains, and sprains. Insurance providers and governmental health programs are also indirect, but highly influential, buyers, as their reimbursement decisions dictate patient accessibility and overall market volume. Targeted marketing efforts must therefore address the needs of clinicians (efficacy and safety), patients (comfort and adherence), and payers (cost-effectiveness and appropriate utilization).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Teva Pharmaceutical Industries Ltd., Pfizer Inc., Hisamitsu Pharmaceutical Co., Inc., Endo International plc, Mylan N.V. (now Viatris), IBSA Pharma Inc., Grünenthal GmbH, Novartis AG, Acuvera, Luye Pharma Group, Sparsha Pharma International, Allergan plc (now AbbVie), Purdue Pharma L.P., Amneal Pharmaceuticals, BioDelivery Sciences International, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pain Management Patch Market Key Technology Landscape

The technology landscape for pain management patches is characterized by continuous innovation aimed at overcoming the primary biological barrier, the stratum corneum, to ensure effective and consistent drug delivery. The dominant current technologies are the Matrix and Reservoir systems. Matrix patches integrate the drug uniformly within an adhesive layer that controls the release rate, offering simplicity, low cost, and a thin, flexible design highly favored for OTC products like diclofenac patches. Reservoir patches, conversely, store the drug in a separate layer (the reservoir) often behind a rate-controlling membrane, providing highly controlled and consistent delivery over extended periods, making them essential for potent prescription drugs like fentanyl.

The most transformative recent development is the emergence of Microneedle Patches. These systems use arrays of microscopic needles (typically silicon or polymers) to temporarily puncture the skin barrier, enabling the transport of drugs that would otherwise be too large or polar for conventional transdermal delivery. Microneedles offer rapid onset of action and significantly enhanced bioavailability, particularly for biologics or high molecular weight analgesics, while remaining virtually painless. This technology is viewed as the future for patches targeting deep tissue pain and localized inflammation where conventional patches struggle to achieve therapeutic concentration.

Furthermore, technology is advancing in the area of passive and active enhancement methods. Passive enhancers include chemical agents like sulfoxides or terpenes that temporarily disrupt the skin lipids. Active enhancement techniques, such as Iontophoresis and Phonophoresis, use mild electrical currents or ultrasonic waves, respectively, to push drug molecules across the skin. While these active systems require specialized, slightly more complex devices, they offer on-demand control over the drug release profile, allowing for potentially personalized pain management and immediate cessation of delivery if adverse effects occur, boosting both efficacy and safety profiles.

Regional Highlights

The global Pain Management Patch Market exhibits distinct regional maturity levels and growth trajectories, heavily influenced by regulatory policies, demographic structures, and healthcare spending habits. North America, comprising the United States and Canada, currently holds the largest market share due to the high incidence of chronic pain (particularly musculoskeletal and neuropathic conditions), high adoption rates of advanced prescription transdermal systems, and strong reimbursement coverage for specialized pain therapies. The opioid crisis has critically impacted this region, driving substantial investment into non-opioid patch development and restrictive utilization management for fentanyl and buprenorphine patches, yet the high patient volume ensures continued market dominance.

Europe represents a mature market characterized by stringent quality standards and a strong focus on clinical validation. Major countries such as Germany, France, and the UK are primary consumers, with high penetration of non-opioid NSAID patches. Growth across Europe is steady, driven by an aging population and increasing efforts to manage chronic conditions outside hospital settings. However, market growth is often tempered by heterogeneous national healthcare systems and pricing controls, requiring manufacturers to adopt nuanced market entry strategies tailored to specific country requirements and payer expectations.

Asia Pacific (APAC) is forecast to be the fastest-growing regional market globally. This exponential growth is attributable to significant improvements in healthcare access and infrastructure across emerging economies, a rapidly urbanizing population adopting Western lifestyles leading to increased chronic pain disorders, and rising governmental focus on providing adequate pain relief. Countries like Japan and South Korea are early adopters of advanced patch technologies, while populous nations like China and India present vast untapped markets for both generic and innovative patch formulations, provided local manufacturing and affordable pricing strategies are implemented effectively. Latin America and the Middle East & Africa (MEA) remain emerging markets, where market penetration is slowly increasing, constrained primarily by lower healthcare budgets and limited access to specialized pain clinics, though urbanization and rising health awareness are slowly improving market conditions.

- North America: Market leader; driven by high chronic pain prevalence, advanced technology adoption, and robust reimbursement systems. Facing intense regulatory pressure regarding opioid patch utilization.

- Europe: Stable growth; high adoption of NSAID patches; strong regulatory framework favoring quality; growth constrained by national pricing controls.

- Asia Pacific (APAC): Fastest growing region; propelled by rising healthcare expenditure, large patient pool, increasing awareness, and infrastructure development in China and India.

- Latin America (LATAM): Emerging market; growth tied to expanding private healthcare insurance and improving economic stability; localized production is key.

- Middle East & Africa (MEA): Developing market; demand primarily focused in GCC countries; growth challenged by fragmented healthcare systems and reliance on imports for specialized products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pain Management Patch Market.- Johnson & Johnson

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Hisamitsu Pharmaceutical Co., Inc.

- Endo International plc

- Mylan N.V. (now Viatris)

- IBSA Pharma Inc.

- Grünenthal GmbH

- Novartis AG

- Acuvera

- Luye Pharma Group

- Sparsha Pharma International

- AbbVie (formerly Allergan plc)

- Purdue Pharma L.P.

- Amneal Pharmaceuticals

- BioDelivery Sciences International, Inc.

- Aveva Drug Delivery Systems

- 3M Company

- DURECT Corporation

- Kowa Pharmaceutical Europe Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Pain Management Patch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from Opioid to Non-Opioid Pain Management Patches?

The primary driver is the global public health crisis related to opioid addiction and abuse. Non-opioid patches, such as those containing lidocaine and diclofenac, offer effective localized pain relief without the high risk of systemic dependency, making them preferred alternatives for managing chronic and acute non-severe pain in regulatory environments focused on reducing narcotic prescriptions.

How do Microneedle Patches differ from traditional Matrix and Reservoir systems?

Microneedle patches utilize arrays of microscopic projections to bypass the stratum corneum, the outermost layer of the skin, enabling the rapid and efficient delivery of large molecule drugs (like peptides) that traditional patches cannot penetrate. In contrast, Matrix and Reservoir patches rely solely on passive diffusion through the intact skin barrier, limiting the range of applicable analgesics.

Which geographical region shows the highest growth potential for pain management patches?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is due to rising healthcare investment, improving access to advanced medical treatments, and a large, aging population base in countries like China and India that require accessible long-term pain management solutions.

What is the main restraint impacting the long-term adoption of pain management patches?

A major restraint is the occurrence of localized cutaneous adverse effects, such as skin irritation, erythema, and contact dermatitis, particularly with prolonged wear. These reactions can significantly reduce patient compliance, necessitating continuous research into more bio-compatible adhesives and less irritating chemical penetration enhancers for sustained use.

How is technology, specifically AI, influencing transdermal patch development?

AI is critically influencing transdermal patch R&D by enabling the rapid simulation and prediction of drug permeability and release kinetics, optimizing patch formulation ingredients, and accelerating the identification of novel, effective chemical enhancers. This reduces development time and enhances the precision of dosing for personalized pain therapy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager