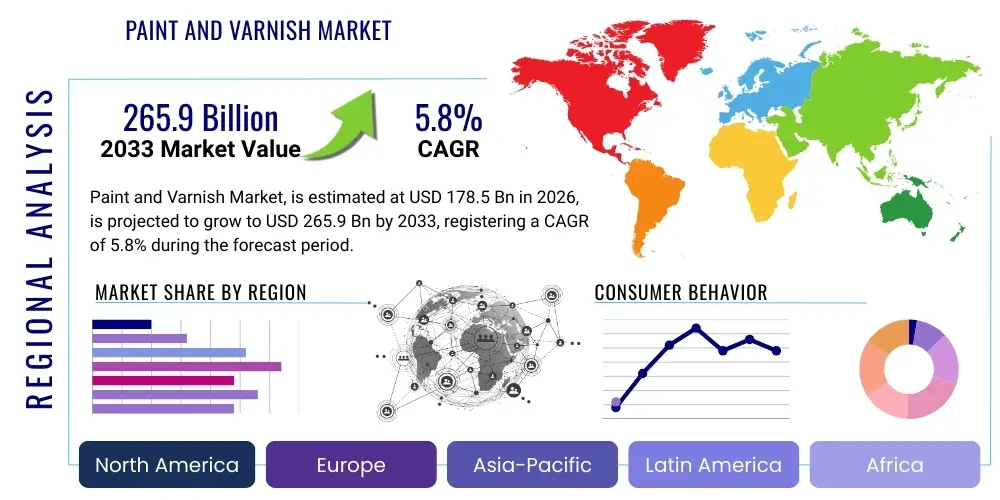

Paint and Varnish Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437879 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Paint and Varnish Market Size

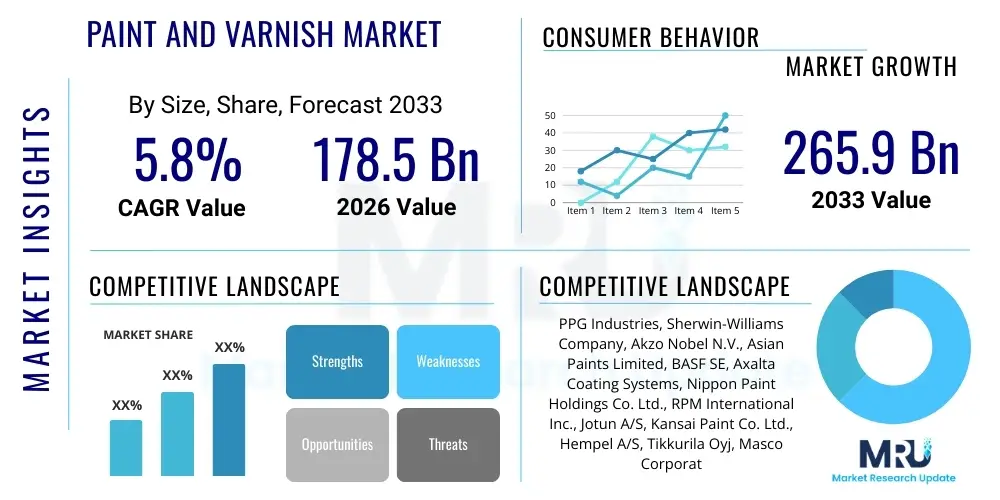

The Paint and Varnish Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 178.5 Billion in 2026 and is projected to reach USD 265.9 Billion by the end of the forecast period in 2033.

Paint and Varnish Market introduction

The Paint and Varnish Market encompasses a diverse range of chemical coatings applied to surfaces for protection, aesthetics, and specialized functional purposes. These products, which include architectural coatings, industrial coatings, automotive coatings, and marine coatings, form an essential component of the global construction, manufacturing, and maintenance sectors. Market growth is fundamentally tied to urbanization rates, infrastructure development in emerging economies, and the increasing demand for high-performance, sustainable coating solutions that offer enhanced durability and environmental compliance. Furthermore, the robust activity in the residential and non-residential construction segments, particularly in the Asia Pacific region, drives substantial volume growth for decorative paints and protective varnishes.

Paint and varnish products serve critical functions beyond mere decoration; they provide essential protection against corrosion, abrasion, UV damage, and extreme weather conditions. Major applications span across residential buildings, commercial structures, automotive original equipment manufacturers (OEMs) and refinishing, aerospace components, marine vessels, and industrial machinery. The benefits derived from these coatings include prolonged asset lifespan, improved safety characteristics (e.g., fire retardancy, anti-slip properties), enhanced hygiene (anti-microbial coatings), and compliance with stringent environmental regulations regarding Volatile Organic Compound (VOC) emissions. The shift towards water-borne, powder, and radiation-curable coatings represents a significant technological trend aimed at meeting these environmental standards.

The primary driving factors sustaining the market's trajectory include escalating global construction expenditure, especially government investment in public infrastructure such as bridges, roads, and utilities. Technological innovations focusing on smart coatings—such as self-healing, temperature-regulating, and conductive paints—are creating new high-value segments. Moreover, rapid industrialization, coupled with continuous refurbishment activities in mature economies, maintains a steady demand. The rise of DIY (Do-It-Yourself) culture, alongside increasing consumer disposable income, particularly impacts the decorative coatings sector, emphasizing premium finishes and specialized effects.

Paint and Varnish Market Executive Summary

The Paint and Varnish Market is experiencing robust growth driven primarily by a surge in construction and infrastructure projects across Asia Pacific and technological advancements centered on sustainability in North America and Europe. Business trends indicate a strong move towards consolidation, with major players aggressively pursuing mergers and acquisitions to capture regional market share and integrate specialized coating technologies, such as nano-coatings and bio-based resins. The market structure is shifting towards higher-margin, specialized functional coatings over traditional decorative paints, prompted by stricter regulations demanding low-VOC and lead-free formulations globally. Supply chain resilience remains a key focus area, particularly concerning the fluctuating costs and availability of critical raw materials like titanium dioxide and petrochemical derivatives.

Regionally, Asia Pacific maintains its dominance, fueled by massive infrastructural spending in China, India, and Southeast Asian nations, positioning it as the primary engine for volume expansion, particularly in architectural and general industrial coatings. North America and Europe, while slower in volume growth, lead in innovation and value, specializing in high-performance coatings for aerospace, protective, and automotive sectors, strictly adhering to sophisticated environmental and health standards. Emerging markets in Latin America and the Middle East and Africa are demonstrating accelerating demand, driven by nascent urbanization cycles and diversification efforts away from resource dependence, necessitating significant investment in commercial and residential construction.

Segment trends reveal that the water-borne segment is rapidly displacing solvent-borne coatings due to environmental mandates and end-user preference for safer products. Application-wise, the architectural segment holds the largest market share, but the protective and marine coatings sectors are projected to exhibit higher growth rates, attributed to increased emphasis on asset protection and maintenance against harsh industrial and maritime environments. Furthermore, within the raw material segment, the focus is heavily shifting toward bio-based polymers and recycled content to enhance the overall sustainability profile of coating manufacturers, catering to eco-conscious consumers and corporate sustainability mandates.

AI Impact Analysis on Paint and Varnish Market

Common user questions regarding AI's impact on the Paint and Varnish Market frequently revolve around topics such as "How can AI optimize R&D for new coating formulations?", "What is the role of machine learning in predicting raw material price volatility?", and "Can AI enhance quality control and reduce waste in paint manufacturing?". Users are concerned about integrating complex AI algorithms into traditional chemical processes and the potential for AI to rapidly accelerate the development of specialized functional coatings, like smart materials. The general expectation is that AI will revolutionize supply chain management, improving demand forecasting and inventory optimization, thereby addressing historical inefficiencies related to raw material procurement and fluctuating market needs. Key themes summarizing user expectations suggest AI will primarily drive predictive maintenance solutions, expedite product discovery by simulating material interactions, and significantly enhance operational efficiency across the entire value chain from pigment grinding to finished product application.

- AI-driven optimization of coating formulations, reducing time-to-market for specialized products.

- Predictive maintenance analytics applied to manufacturing equipment, minimizing downtime and increasing plant utilization rates.

- Machine learning algorithms enhancing quality control by analyzing spectroscopic data for defect detection during production.

- Advanced demand forecasting and supply chain optimization using AI to manage volatile raw material costs (e.g., TiO2, resins).

- Robotics and AI vision systems improving precision and uniformity in automated coating application processes (e.g., automotive refinishing).

- Development of digital twins for simulating coating performance under various environmental stresses, aiding material selection.

- Personalization of decorative paint recommendations based on interior design trends and user preferences (AI in retail).

DRO & Impact Forces Of Paint and Varnish Market

The Paint and Varnish Market is propelled by robust global infrastructure spending and continuous technological innovation, particularly in sustainable and functional coatings. However, its growth trajectory is constrained by the inherent volatility in raw material pricing and increasingly stringent environmental regulations, which mandate costly shifts in manufacturing processes. Key opportunities emerge from the expansion of emerging economies' middle class, driving demand for premium decorative paints, and the necessity for specialized protective coatings in energy (oil, gas, and renewables) and marine sectors. These intertwined factors—Drivers, Restraints, and Opportunities (DRO)—determine market competitiveness and strategic investment focus, highlighting the impact of material science advancements and regulatory frameworks as primary forces shaping market evolution and profitability margins.

Major drivers include the accelerated pace of urbanization, particularly in Asia, which necessitates massive residential and commercial construction, serving as the largest consumer base for architectural coatings. Furthermore, the automotive sector's recovery and the growth of electric vehicle manufacturing demand highly specialized, lightweight, and durable coatings. Continuous R&D investment is leading to the development of novel chemistries, such as fluoropolymers and polyurethane coatings, which offer superior performance characteristics, thereby replacing traditional, less effective options. The necessity to preserve aging infrastructure across developed nations also guarantees a sustained demand for anti-corrosion and protective coatings.

Conversely, the market faces significant restraints. The dependence on petrochemical derivatives makes raw material costs susceptible to crude oil price fluctuations, compressing profit margins for manufacturers. Regulatory bodies, such as the EPA in North America and REACH in Europe, impose strict limits on VOC and heavy metal content, forcing companies to invest heavily in reformulation, which can be technically challenging and capital intensive, especially for small and medium-sized enterprises. Furthermore, the inherent maturity of certain segments, such as traditional decorative paints in developed regions, limits exponential growth, making market penetration increasingly reliant on innovation rather than volume.

Opportunities are abundant in the transition towards sustainable products. The increasing demand for bio-based resins, recyclable powder coatings, and water-borne technologies presents a vast growth area, attracting significant venture capital and strategic partnerships. The development of functional coatings (e.g., anti-microbial, self-cleaning, energy-saving reflective coatings) creates high-value niche markets that offer better margins than commodity products. Finally, the rapid digitization of the construction industry, including the adoption of Building Information Modeling (BIM), allows coating manufacturers to better integrate their products into design specifications early in the project lifecycle, creating captive demand.

Segmentation Analysis

The Paint and Varnish Market is primarily segmented by resin type, technology, application, and end-user. This layered segmentation allows for a granular understanding of demand patterns and strategic allocation of R&D resources. Resin segmentation—including epoxy, acrylic, polyurethane, and alkyd—differentiates products based on their performance properties, dictating suitability for various industrial and architectural environments. Technology segmentation is crucial, distinguishing between solvent-borne, water-borne, powder coatings, and high-solids coatings, reflecting the industry's shift towards minimizing environmental impact and maximizing application efficiency. The detailed analysis of these segments helps stakeholders identify high-growth sub-sectors, such as high-solids epoxy coatings in marine environments or acrylic water-borne paints in residential construction.

Application segmentation categorizes the market into architectural (decorative and protective), industrial (OEM, heavy duty, general), automotive (OEM and refinish), and marine coatings. The architectural segment remains the volume leader, but industrial and protective coatings are major drivers of value due to their stringent performance requirements and higher unit pricing. End-user analysis further refines this view, separating demand generated by construction, automotive manufacturing, aerospace, oil and gas, and consumer goods sectors. Understanding these segments is paramount for tailored marketing strategies, as the purchasing criteria and regulatory landscape differ significantly between, for example, a residential DIY user and a large-scale marine vessel manufacturer requiring specialized anti-fouling coatings.

The ongoing trend of segment specialization is evident, particularly in the rapid expansion of functional and smart coatings that address specific environmental or performance challenges. For instance, in the consumer electronics sector, coatings providing electromagnetic interference (EMI) shielding are witnessing exponential demand. Similarly, the aerospace industry requires lightweight coatings with extreme temperature resistance. This specialization necessitates continuous innovation in resin chemistry and pigment technology, making segmentation analysis critical for forecasting market shifts and identifying investment opportunities beyond traditional volume growth areas.

- By Resin Type:

- Acrylic

- Epoxy

- Polyurethane

- Alkyd

- Polyester

- Fluoropolymer

- By Technology:

- Water-Borne Coatings

- Solvent-Borne Coatings

- Powder Coatings

- High-Solids Coatings

- Radiation Cured Coatings (UV/EB)

- By Application:

- Architectural Coatings (Residential, Non-Residential)

- Industrial Coatings (General Industrial, Coil & Packaging, Protective)

- Automotive Coatings (OEM, Refinish)

- Marine Coatings

- Aerospace Coatings

- By End-User Industry:

- Construction

- Automotive

- Aerospace

- Oil & Gas

- Marine

- Consumer Goods

- Energy & Power

Value Chain Analysis For Paint and Varnish Market

The Paint and Varnish Market value chain is a complex, multi-tiered structure beginning with raw material extraction and culminating in final application. The upstream segment involves the production of critical components: petrochemicals (used for solvents and resins), pigments (like titanium dioxide and iron oxides), and functional additives (rheology modifiers, dispersants, biocides). Raw material suppliers often possess significant bargaining power due to the specialized nature and occasional supply concentration of materials like TiO2. Manufacturers must manage strong upstream relationships to ensure stable supply and mitigate pricing volatility, often engaging in backward integration or long-term procurement contracts to secure vital feedstock.

The core manufacturing stage involves blending, dispersion, and grinding, transforming raw materials into finished coatings. This midstream phase is highly capital-intensive and requires sophisticated process control, quality assurance (QC), and adherence to strict regulatory standards. Product differentiation heavily relies on R&D investment during this stage, particularly focusing on improving application properties (e.g., flow, leveling, cure time) and long-term durability. Downstream activities involve distribution and final application. Products are distributed through various channels, including direct sales to large industrial end-users (e.g., automotive OEM assembly plants), specialized distributors serving B2B contractors, and retail chains and wholesalers for the architectural/DIY market.

Distribution channels are critical for market reach and customer service. Direct distribution is preferred for complex industrial and protective coatings where technical support and customized formulations are necessary. Indirect channels, encompassing authorized dealers and large home improvement retailers, dominate the consumer and contractor segments for decorative paints. This channel strategy significantly impacts profitability; while indirect channels offer broad market exposure, direct sales often yield higher margins due to reduced intermediary costs and customized service provision. The increasing use of e-commerce platforms represents a recent disruption, particularly in the DIY segment, offering consumers direct access to specialized products and technical information, thereby shortening the traditional supply chain slightly.

Paint and Varnish Market Potential Customers

The primary end-users or buyers in the Paint and Varnish Market are broadly categorized into four major groups: professional contractors and construction firms, large industrial OEMs, maintenance and infrastructure organizations, and individual consumers (DIY market). Professional contractors and construction companies represent the largest volume purchasers, requiring architectural coatings for new builds and renovation projects, prioritizing bulk pricing, consistent quality, and efficient delivery logistics. This segment is highly sensitive to construction cycles and regulatory demands regarding environmental performance and fire safety standards.

Industrial Original Equipment Manufacturers (OEMs), particularly in the automotive, aerospace, and general manufacturing sectors, constitute the highest value segment. These customers require highly specialized, technologically advanced coatings that meet rigorous performance specifications related to corrosion resistance, aesthetic requirements, and weight minimization. Their purchasing decisions are driven by performance guarantees, integration with manufacturing processes (e.g., robot application capabilities), and long-term strategic partnerships with coating suppliers capable of global supply chain synchronization.

Maintenance and infrastructure organizations, including governmental bodies responsible for bridges, roads, utilities, and marine fleet operators, are consistent buyers of protective and heavy-duty industrial coatings. These end-users prioritize maximum service life, chemical resistance, and ease of application in demanding environments, often adhering to specific industry standards (e.g., NACE standards for corrosion protection). Finally, individual consumers and small-scale professional painters form the DIY and renovation market, characterized by brand loyalty, ease of application, color trends, and increasing preference for low-odor, zero-VOC decorative paints available through retail channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 178.5 Billion |

| Market Forecast in 2033 | USD 265.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PPG Industries, Sherwin-Williams Company, Akzo Nobel N.V., Asian Paints Limited, BASF SE, Axalta Coating Systems, Nippon Paint Holdings Co. Ltd., RPM International Inc., Jotun A/S, Kansai Paint Co. Ltd., Hempel A/S, Tikkurila Oyj, Masco Corporation, DAW SE, Chugoku Marine Paints, Wacker Chemie AG, Arkema S.A., Dow Inc., Evonik Industries AG, specialty chemicals players. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paint and Varnish Market Key Technology Landscape

The technological landscape of the Paint and Varnish Market is rapidly evolving, driven primarily by sustainability mandates and the pursuit of enhanced functional performance. A major ongoing shift is the transition from conventional solvent-borne systems to high-performance, low-VOC alternatives, namely water-borne, powder, and high-solids coatings. Water-borne technology offers excellent environmental credentials, low odor, and improved safety, making it the preferred choice for architectural and certain industrial applications. Powder coatings, utilized extensively in automotive parts and appliances, eliminate the need for solvents entirely, yielding near-zero VOC emissions and excellent material utilization, although they require specialized curing equipment.

Innovation is intensely focused on developing smart and functional coatings. This includes the integration of nanotechnology to create coatings with self-healing properties, enhanced scratch resistance, and improved barrier performance against moisture and gases. For instance, nano-sized additives like carbon nanotubes or silica are being incorporated to modify mechanical and thermal properties. Furthermore, the development of anti-microbial and anti-viral coatings has accelerated significantly, finding applications in healthcare facilities, public transport, and high-traffic residential areas, driven by global hygiene concerns and regulatory pressures following public health crises.

The application technology is also undergoing radical transformation through digitization and automation. Advanced robotic spray systems are being deployed in large-scale industrial settings (e.g., aerospace and shipbuilding) to ensure highly uniform coating thickness and minimize material waste. Digital color matching and formulation software, often powered by AI, reduce manual error and allow for rapid customization of color palettes, catering efficiently to consumer trends. Additionally, the increasing use of radiation-curable (UV/EB) coatings, which cure almost instantly using ultraviolet light or electron beams, allows for faster production lines and lower energy consumption, particularly critical in packaging and wood finishing sectors where speed and efficiency are paramount.

In terms of resin synthesis, the focus is increasingly on bio-based and recycled monomers to reduce dependence on fossil fuels. Researchers are exploring the use of renewable resources like plant oils and agricultural waste to formulate sustainable resins without compromising performance characteristics such as adhesion and chemical resistance. This move is supported by significant corporate sustainability commitments and governmental incentives aimed at promoting a circular economy within the chemical industry. The integration of advanced polymer chemistry with materials science is enabling the development of coatings that are not only environmentally safer but also functionally superior, offering multifunctional benefits such as heat reflection (cool coatings) for energy efficiency in buildings, or specialized conductivity for electronics.

Furthermore, technology related to surface preparation remains a crucial area, as the longevity of any coating application depends heavily on the quality of the substrate. Innovations here include more efficient, environmentally benign surface treatment chemicals and processes that eliminate hazardous preparation steps, enhancing worker safety and minimizing overall project environmental footprint. The synergy between material innovation, such as utilizing graphene to enhance strength and electrical properties, and process innovation, such as supercritical fluid technology for cleaner pigment dispersion, defines the current competitive edge. Companies investing heavily in these niche, performance-enhancing technologies are better positioned to capture market share in high-value segments, distinguishing themselves from commodity producers.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by massive infrastructure investments, rapid urbanization, and a surging manufacturing base in China, India, and Southeast Asia. India, in particular, is experiencing a boom in architectural and automotive sectors, supported by governmental initiatives encouraging housing and manufacturing (e.g., 'Make in India'). While environmental standards are becoming stricter, the sheer volume of new construction ensures high demand for all coating types. Manufacturers are focusing on expanding production capacity and localizing supply chains to meet the diverse needs of this massive, heterogeneous market, particularly emphasizing affordable, yet high-quality decorative paints and protective industrial coatings necessary for new factories and energy projects.

- North America: Characterized by stringent environmental regulations (particularly regarding VOC emissions) and a mature market, North America focuses on high-value, high-performance coatings. Growth is driven by renovation activity, the automotive refinish sector, and protective coatings for aging public infrastructure (bridges, pipelines). The region is a leader in adopting sustainable technologies, including advanced powder coatings and low-VOC liquid systems. High R&D expenditure is concentrated on smart coatings, aerospace-grade paints, and digital tools for color matching and application efficiency.

- Europe: Europe is highly regulated by REACH and other directives, pushing manufacturers towards advanced water-borne and bio-based systems. The market is mature, with growth relying heavily on the automotive OEM segment, specialized industrial coatings, and maintenance/refurbishment of commercial and residential properties. Western Europe leads in sustainable innovation, while Eastern European markets offer higher growth rates due to modernization and construction expansion. Political stability and supply chain disruptions post-Brexit and during recent global crises have necessitated localized production strategies across the continent.

- Latin America (LATAM): LATAM presents significant growth potential, though often hampered by economic volatility and political instability. Brazil and Mexico are the dominant markets, driven by residential construction and significant automotive manufacturing capacity. Demand is generally focused on functional, durable coatings that can withstand diverse climatic conditions. Infrastructure projects are intermittently driving demand for protective coatings, but the market structure is often fragmented, with strong regional brand loyalty influencing purchasing patterns.

- Middle East and Africa (MEA): Growth in the MEA region is strongly correlated with construction activities tied to large-scale government visions (e.g., Saudi Arabia's Vision 2030, UAE's diversification efforts). High-performance protective coatings are essential for the region's dominant oil, gas, and petrochemical infrastructure, as well as marine environments. The demand for cool coatings and architectural finishes that can withstand extreme heat and UV exposure is substantial. While specific African markets face logistical challenges, high urbanization rates promise long-term demand expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paint and Varnish Market.- PPG Industries

- The Sherwin-Williams Company

- Akzo Nobel N.V.

- BASF SE

- Axalta Coating Systems

- Nippon Paint Holdings Co. Ltd.

- RPM International Inc.

- Asian Paints Limited

- Jotun A/S

- Kansai Paint Co. Ltd.

- Hempel A/S

- Masco Corporation

- Chugoku Marine Paints

- Diamond Vogel

- Wacker Chemie AG

- Dow Inc.

- Evonik Industries AG

- Arkema S.A.

- Kelly-Moore Paints

- DAW SE

Frequently Asked Questions

Analyze common user questions about the Paint and Varnish market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards water-borne coatings over traditional solvent-borne systems?

The primary driver is stringent environmental regulation, particularly focused on reducing Volatile Organic Compound (VOC) emissions, which are harmful to human health and the atmosphere. Water-borne coatings offer low-VOC, low-odor, and safer application alternatives, meeting mandatory compliance standards in mature markets like Europe and North America and appealing to eco-conscious consumers and contractors globally.

How is the volatility of titanium dioxide (TiO2) pricing impacting paint manufacturers?

TiO2 is the most crucial pigment for opacity and brightness in paints, representing a significant portion of raw material costs. Price volatility due to supply chain disruptions and mining concentration severely compresses manufacturer profit margins, forcing companies to implement frequent price adjustments, invest in pigment alternatives, or streamline operational efficiencies to mitigate financial risk.

Which application segment is expected to exhibit the highest growth rate during the forecast period?

While architectural coatings hold the largest volume share, the Industrial and Protective Coatings segment, particularly for infrastructure, marine, and energy assets (including renewables), is forecast to achieve the highest Compound Annual Growth Rate (CAGR). This is due to increasing global investment in asset protection against harsh environments and specialized performance requirements demanded by industrial end-users.

What role do smart coatings play in the future of the Paint and Varnish Market?

Smart coatings integrate advanced functionalities like self-healing, thermal regulation (cool coatings), anti-corrosion monitoring, and conductivity. They represent a high-value niche critical for innovation, offering enhanced durability and efficiency, especially in automotive, aerospace, and energy conservation applications, signaling a major shift from passive to active surface protection technologies.

How do global economic trends, such as inflation and interest rates, affect the demand for paints and varnishes?

Rising inflation increases the cost of raw materials and operational expenses, necessitating higher product prices. Elevated interest rates tend to slow down new construction projects (especially residential and commercial real estate) by increasing borrowing costs, thereby dampening demand for large-volume architectural coatings. However, renovation and maintenance activities often remain resilient, supporting the refinish and protective segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial Washing Machines and Distillers for the Printing, Paint and Varnish Industries Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Industrial Washing Machines, Distillers), By Application (Printing Industry, Paint and Varnish Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Paint and Varnish Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Paints and varnishes (non-aqueous, polyester based), Paints and varnishes (non-aqueous, acrylic/vinyl polymer based), Paints and varnishes (non-aqueous, other polymer based), Paints and varnishes (aqueous, acrylic/vinyl polymer based), Paints and varnishes (aqueous, other polymer based), Other paints and varnishes), By Application (Construction, Industry, Transportation, Packaging, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager