Paint Sprayer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432058 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Paint Sprayer Market Size

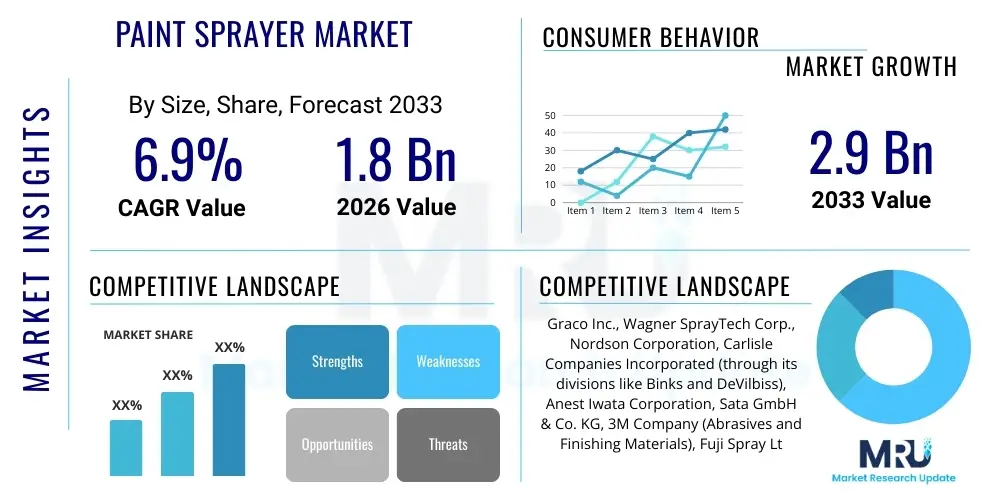

The Paint Sprayer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033.

Paint Sprayer Market introduction

The Paint Sprayer Market encompasses specialized equipment designed to apply coatings and paints efficiently and uniformly onto various surfaces. These tools, ranging from high-volume, low-pressure (HVLP) systems used for fine finishing to powerful airless sprayers preferred in large-scale construction, have fundamentally changed how protective and aesthetic coatings are applied across industrial, commercial, and DIY sectors. The primary goal of a paint sprayer is to atomize liquid coating material into fine droplets, ensuring faster application speeds, superior coverage, and a smoother finish compared to traditional brushing or rolling methods. The evolution of this market is strongly tied to advancements in material science, focusing on reducing overspray and improving transfer efficiency, driven by increasing regulatory scrutiny on volatile organic compounds (VOCs) and environmental sustainability. The shift towards higher-viscosity, often water-based, coatings necessitates the high pressure and precise control offered by modern spraying equipment, reinforcing their essential role in contemporary finishing processes.

Paint sprayers find major applications across diverse industries. In the automotive sector, they are crucial for achieving factory-grade finishes and for repair work, demanding high precision, minimal defects, and rapid application cycles. The construction and infrastructure industry relies heavily on large airless systems for quickly applying primers, sealants, and topcoats to walls, roofs, and structural steel, significantly accelerating project timelines while ensuring durable protection against environmental factors. Furthermore, woodworking and furniture manufacturing utilize specialized HVLP and electrostatic systems to achieve detailed, high-quality finishes on cabinets, trim, and bespoke items, capitalizing on the superior control these systems offer for intricate shapes and smooth surfaces. The functional benefits extend beyond speed to material consistency, which is vital for warranty-backed industrial coatings.

The principal benefits derived from using paint sprayers include significant labor cost reduction, enhanced productivity due to rapid application, and superior finish quality characterized by uniformity and lack of brush strokes. Key driving factors include the revitalization of the global construction sector, particularly in emerging economies where infrastructure spending is surging; technological innovations leading to lighter, more portable, and more energy-efficient equipment, such as high-performance cordless airless sprayers; and the increasing demand for high-performance coatings that require specialized application methods for optimal performance and longevity. Market growth is further supported by the increasing accessibility and ease-of-use of consumer-grade sprayers, which have lowered the entry barrier for home renovation enthusiasts, creating a high-volume DIY segment.

Paint Sprayer Market Executive Summary

The Paint Sprayer Market is experiencing robust expansion fueled by several interconnected business trends, technological shifts, and regional demand dynamics. A critical business trend involves continued consolidation among leading manufacturers, who are focusing on strategic mergers and acquisitions to integrate advanced coating application technologies, such as sophisticated electrostatic systems and robotic integration software, into their core offerings. Furthermore, manufacturers are heavily prioritizing the development of high-voltage battery-powered (cordless) sprayers, addressing the paramount need for mobility and efficiency among professional contractors who require powerful tools without the constraints of fixed power sources. This emphasis on portability and power density is reshaping product design and differentiating market leaders. Sustainability mandates are also reshaping the market, driving significant investment toward high transfer efficiency (HTE) technologies and systems optimized for environmentally friendly, lower-VOC coatings, positioning efficiency and ecological compliance as core competitive advantages.

Regionally, the market demonstrates varied maturity levels and growth trajectories. North America and Europe, characterized by stringent environmental regulations, high adherence to safety standards, and elevated labor costs, exhibit strong adoption of advanced, high-efficiency equipment like precise HVLP systems and sophisticated robotic application cells, particularly within demanding sectors such as automotive finishing, aerospace, and high-end cabinetry. Conversely, the Asia Pacific (APAC) region, dominated by booming large-scale infrastructure projects and rapid, expansive industrialization in nations like China, India, and Indonesia, represents the highest growth potential for both professional and high-throughput airless sprayers designed for architectural and large industrial coatings. The increasing discretionary spending power of the middle-class population in APAC is concurrently fueling the fastest growth in the DIY segment, necessitating localized manufacturing and optimized distribution channels focused on cost-effective, durable consumer units.

Segmentation trends highlight the continued dominance of the Airless segment in terms of overall revenue, owing to its superior speed and capability in handling the high-viscosity materials required in construction and protective coatings. However, the HVLP segment is rapidly gaining traction in value-driven sectors, particularly precision applications, driven by its superior control, exceptional finish quality, and minimal material waste. The shift in end-user preference is marked; while the Professional and Industrial segments remain the largest revenue contributors, the DIY segment is exhibiting the fastest growth rate, propelled by easily accessible product designs and robust online educational resources supporting first-time users. Technologically, smart sprayers featuring integrated diagnostics, precise electronic pressure control, and IoT connectivity for remote monitoring and predictive maintenance scheduling are emerging as the standard in high-end equipment, signifying the market’s decisive move towards digitalization and proactive asset management across all major application areas.

AI Impact Analysis on Paint Sprayer Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the paint sprayer domain primarily center on three sophisticated application areas: real-time application optimization, seamless integration with industrial robotics, and automated quality control leveraging computer vision. Users are highly interested in understanding how sophisticated AI algorithms can analyze input data—such as ambient temperature, humidity levels, surface texture mapping, and coating viscosity—to instantaneously adjust critical application parameters, including material pressure, flow rates, and fan pattern geometry. This potential for dynamic, closed-loop adjustment promises to minimize material overspray, optimize film build consistency, and ensure a perfect finish regardless of minor variations in the application environment or surface complexity. Concerns frequently raised revolve around the high initial capital investment required for these AI-driven systems and the necessary technical expertise needed to calibrate and maintain such complex, sensor-heavy equipment, particularly for smaller independent contractors.

The application of AI in the Paint Sprayer Market is transitioning decisively from theoretical potential to practical, high-value integration, primarily achieved through software-defined application protocols and sophisticated data analytics platforms. AI algorithms are crucial in developing highly responsive, closed-loop feedback systems for advanced robotic painting cells, which are common in automotive and aerospace manufacturing. In these setups, high-speed vision sensors continuously detect minute surface imperfections, subtle variations in the distance between the spray gun and the workpiece, and changes in material dispersion. The AI system processes this vast dataset instantaneously, commanding the robotic arm and the integrated fluid delivery system to make fractional adjustments to the spray angle, speed, or fluid output. This precision, which vastly exceeds manual capability, fundamentally boosts the repeatability, transfer efficiency, and overall quality consistency of the industrial coating process, resulting in lower rework rates and superior utilization of expensive coating materials.

Future implications suggest that the integration of generative design principles and machine learning models will revolutionize the physical design of the equipment itself. By simulating millions of fluid dynamics and atomization scenarios, AI can assist engineers in designing next-generation spray gun nozzles and fluid passages that produce superior particle atomization and highly efficient fan patterns using less energy or lower air pressure. This leads to inherent efficiency gains built into the hardware. Furthermore, post-application quality assurance is being profoundly impacted; AI-powered image recognition systems are deployed to automatically scan finished surfaces for minuscule defects such as runs, sags, pinholes, or textural irregularities like orange peel, classifying the severity and exact location of the fault with speeds and accuracy that significantly surpass traditional human inspection methods. While implementation costs present a considerable hurdle for broad adoption in entry-level segments, the profound operational improvements in precision and throughput establish AI integration as a critical technological differentiator for market leaders focused on high-precision, high-volume industrial coating lines.

- AI-driven real-time optimization of spray parameters (pressure, flow, pattern) based on sensor data.

- Enhanced quality control through AI computer vision systems automatically detecting surface defects with high accuracy.

- Predictive maintenance scheduling for complex robotic and industrial spray equipment, maximizing operational uptime.

- Seamless integration into robotic painting systems for improved precision, consistency, and repeatability in mass production.

- Optimization of nozzle design and internal fluid handling geometries through machine learning simulations to improve atomization efficiency.

DRO & Impact Forces Of Paint Sprayer Market

The market dynamics of the Paint Sprayer sector are intrinsically governed by a complex and powerful combination of driving forces, significant structural restraints, emerging opportunities, and compelling external impact factors that fundamentally shape strategic investment and product development cycles. Key drivers accelerating market growth include the substantial global rebound in construction activity, particularly large-scale infrastructure and residential development across Asia and Latin America, creating immense demand for high-throughput airless equipment. Concurrently, rigorous, globally harmonized environmental regulations, specifically those tightening controls on VOC emissions and air quality, mandate the increased adoption of high transfer efficiency (HTE) spraying technologies, compelling professionals to upgrade existing conventional systems to compliant HVLP or electrostatic units. This regulatory push ensures a sustained demand for technologically advanced, energy-efficient equipment capable of handling modern, environmentally friendly coatings.

However, the market’s trajectory is moderated by several significant restraints. The high initial capital expenditure associated with purchasing professional-grade industrial equipment, such as sophisticated robotic spraying cells or large-scale hydraulic airless pumps, often poses a substantial barrier to entry, particularly for small and medium-sized enterprises (SMEs). This cost concern is compounded by the necessity for highly specialized training required to operate, calibrate, and maintain sophisticated electronic and automated spraying systems effectively and safely. Additionally, the inherent volatility in the global supply chain for crucial raw materials—including specialized high-tolerance steel components, advanced polymers, and critical electronic parts—introduces manufacturing uncertainty and fluctuating costs, which directly impact the final retail price and profitability margins across all segments of the market.

Opportunities for sustained and dynamic growth are extensive and multi-faceted. A primary avenue lies in the continued democratization of coating technology through the expansion of the DIY market segment, which seeks affordable, easy-to-use electric and battery-powered sprayers for routine home improvement and small-scale projects. Furthermore, the increasing global adoption of specialized protective coatings—such as robust marine epoxies, fire-resistant intumescent paints, and heavy-duty polyurethanes—requires highly robust, high-performance spray equipment capable of precisely handling higher viscosities and highly abrasive components. The most transformative impact forces are relentless technological innovation, pushing development towards complete cordless freedom and sophisticated electronic control, and the continuous pressure from global environmental standards. These forces collectively dictate the future direction of product development, shifting the competitive emphasis from maximizing simple horsepower to optimizing precision, maximizing efficiency, ensuring compliance, and delivering measurable sustainability benefits to the end-user.

Segmentation Analysis

The Paint Sprayer Market is meticulously segmented across several key dimensions, including the underlying application technology, the power source utilized, the specific end-user category, and the intended material handling capacity, collectively reflecting the diverse and often highly specialized requirements of industrial, commercial, and consumer users globally. Analyzing these detailed segments is critical for gaining a comprehensive understanding of the market structure, mapping competitive territories, and identifying specific high-growth niche areas. The foundational technology segments—Airless, High Volume Low Pressure (HVLP), Conventional (or compressed air), and Electrostatic—each cater to fundamentally different viscosity requirements, desired finish quality expectations, and transfer efficiency goals. While powerful Airless systems dominate the heavy-duty commercial and infrastructure sectors due to their inherent speed, the HVLP and Electrostatic segments reign supreme in precision applications like automotive refinishing and fine woodworking where exceptional finish quality and maximum material conservation are the paramount drivers. This segmentation analysis confirms a clear overarching trend towards sophisticated systems that offer enhanced adaptability across the increasingly complex spectrum of coating types, encompassing waterborne, high-solids solvent-borne, and advanced powder coatings.

The market is currently experiencing pronounced segmentation growth driven by the evolution of power sources, specifically the rapidly expanding battery-powered (cordless) segment. Cordless sprayers, powered by high-capacity lithium-ion battery platforms, offer professional contractors unparalleled convenience, exceptional mobility, and enhanced job site productivity by completely eliminating the logistical complexities associated with power cords and fixed air lines. Although the market has traditionally been heavily dominated by corded electric and large pneumatic systems, the significant advancements in battery technology, including increases in power density and robustness, now allow modern cordless systems to deliver performance fully comparable to many corded professional models. This crucial segmentation shift necessitates a sophisticated dual product strategy for major manufacturers, focusing on designing professional cordless models for maximum runtime and rugged power delivery, while simultaneously optimizing consumer lines for lighter weight, simplified operation, and intuitive user experiences.

End-user segmentation clearly delineates the market into two major revenue streams: Professional/Industrial users and DIY/Consumer users. Professional users, encompassing large painting contractors, specialized industrial finishers, and high-throughput manufacturing facilities, prioritize absolute durability, maximum throughput capacity, and the critical ability to consistently handle high-performance, specialized, multi-component coatings. Consequently, this segment accounts for the vast majority of the overall market revenue and demands direct technical support and specialized equipment servicing. Conversely, the DIY segment, driven by price sensitivity and convenience, values simplicity, high portability, and low maintenance requirements, driving consistent demand for entry-level electric airless and consumer-grade HVLP units. Strategic segmentation allows vendors to optimize their specialized distribution channels—leveraging direct sales and expert industrial suppliers for professional tools and capital equipment, while capitalizing on the scale of large home improvement retail chains and high-traffic e-commerce platforms for high-volume consumer model sales, ensuring effective market penetration across the entire spectrum of coating needs and user requirements.

- By Technology Type:

- Airless Paint Sprayers (Hydraulic and Electric Piston/Diaphragm)

- High Volume Low Pressure (HVLP) Paint Sprayers (Turbine and Conversion Guns)

- Conventional Paint Sprayers (Compressed Air)

- Electrostatic Sprayers (Manual and Automatic)

- By Power Source:

- Electric (Corded, Standard and Heavy Duty)

- Pneumatic (Air-Powered Systems)

- Hydraulic (Large Industrial and Protective Coating Applications)

- Battery-Powered (Cordless, High-Voltage Lithium-Ion)

- By Application:

- Residential & Commercial Construction (Architectural Coatings)

- Automotive & Transportation (OEM and Refinish)

- Woodworking & Furniture (Fine Finishing)

- General Industrial (Machinery, Heavy Equipment, Appliances)

- Marine, Aerospace, and Protective Coatings

- By End-User:

- Professional (Contractors, Trade Finishers)

- Industrial (Automated Lines, Factories)

- DIY (Consumer and Home Improvement)

Value Chain Analysis For Paint Sprayer Market

The value chain for the Paint Sprayer Market is initiated by crucial upstream activities focused on the meticulous sourcing and processing of specialized high-grade raw materials. This includes procuring corrosion-resistant metals, primarily stainless steel and hardened aluminum, necessary for manufacturing durable, high-pressure pumps, fluid manifolds, and spray components designed to withstand abrasive coatings. It also involves the sourcing of advanced, impact-resistant engineered polymers and robust electronic components, such as sophisticated motor controllers, pressure transducers, and high-density lithium-ion cells for cordless units. Key upstream suppliers are highly specialized component manufacturers providing high-tolerance machined parts and proprietary seals required for reliable high-pressure operation. Effective sourcing management, including securing consistent quality and mitigating exposure to volatile global commodity prices, is paramount at this foundational stage, as raw material costs significantly dictate the final manufacturing expense and, consequently, the market competitiveness of the final product.

The crucial midstream segment encompasses the core activities of research and development, primary manufacturing, precision assembly, and rigorous quality assurance processes executed by Original Equipment Manufacturers (OEMs). R&D efforts are heavily focused on optimizing fluid dynamics, developing innovative nozzle designs for superior atomization, improving pump durability, and seamlessly integrating smart electronics for better user control and diagnostic capabilities. Manufacturing facilities are often strategically segregated by technology type, with specialized assembly lines dedicated to the high-precision tolerances required for HVLP air caps and separate, robust facilities focusing on the heavy-duty pump assembly and mechanical complexity of high-ratio hydraulic airless systems. Significant capital investment in automation within the manufacturing process is essential here, guaranteeing stringent quality control standards, ensuring product reliability under extended commercial usage, and efficiently scaling production volumes to meet growing global demand.

Downstream activities concentrate intensely on comprehensive distribution, targeted sales, and critical aftermarket support services. The distribution infrastructure is typically bifurcated: direct sales forces and highly specialized technical dealers serve large industrial clients and professional contractor firms, offering detailed application training, complex system integration expertise, and immediate access to specialized maintenance parts. Conversely, high-volume indirect channels, comprising massive home improvement retailers (physical stores and online presences) and dedicated global e-commerce platforms, efficiently handle the high turnover rate of the DIY and smaller professional segments. The aftermarket value stream—including the sale of high-margin consumables (spray tips, filters, hoses), pump repair kits, and certified maintenance and rental services—forms a substantial and increasingly important component of the overall market. Maintaining expansive, technically competent service networks and efficient spare parts logistics is indispensable for ensuring maximum equipment uptime, which is a key determinant of brand loyalty among professional users.

Paint Sprayer Market Potential Customers

The market for paint sprayers addresses a vastly diverse clientele, ranging from highly specialized industrial operators to mass-market individual consumers, all united by the common goal of achieving highly efficient, high-quality surface coating application. The largest and most value-intensive segment of buyers consists of professional painting contractors who specialize in large-scale residential development, high-end commercial finishing, and large civil infrastructure projects. These professional buyers prioritize ruggedness, high pressure capability, superior flow rates necessary for high-viscosity architectural coatings, and robust reliability under continuous, demanding usage conditions. Their procurement strategy involves purchasing heavy-duty airless sprayers and advanced accessories, typically sourced through authorized dealers or specialized industrial suppliers who can provide expert technical consultation, specialized training, and readily accessible, certified service and maintenance plans to minimize costly operational downtime.

Industrial end-users constitute the second crucial customer base, characterized by highly specific and non-negotiable coating requirements. This group includes global automotive assembly plants (OEMs), large furniture manufacturers, aerospace maintenance facilities, and heavy machinery fabricators involved in the energy and mining sectors. These customers require highly specialized, capital-intensive equipment, such as automated robotic painting cells integrated with precision electrostatic spray guns or sophisticated plural-component systems designed for two-part coatings. Their focus is almost exclusively on achieving perfect film build consistency, maximizing material transfer efficiency (to conserve expensive materials), and ensuring the system can handle complex, durable coatings like fluoropolymers and specialized ceramics. Purchasing decisions in this segment are centralized, driven by detailed total cost of ownership (TCO) analysis, adherence to rigorous quality standards, and the vendor's proven ability to provide continuous, high-level engineering and integration support.

The third major and fastest-growing customer demographic consists of DIY enthusiasts, ambitious homeowners, and smaller property maintenance professionals engaging in renovation and home improvement projects. These buyers are inherently price-sensitive, demand ease of initial setup, prioritize portability, and require equipment versatility for application across common interior and exterior paints. They typically procure entry-level electric airless or consumer-focused HVLP units, which are primarily purchased through accessible mass retail channels, specialized online marketplaces, and burgeoning e-commerce platforms. Marketing strategies targeting this demographic emphasize intuitive, simplified operating instructions, rapid cleaning features, and lightweight, compact designs. The explosive growth of this segment, supported by easily digestible online instructional content, represents a key high-volume opportunity for manufacturers focused on designing user-friendly, accessible spray technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | CAGR 6.9% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Graco Inc., Wagner SprayTech Corp., Nordson Corporation, Carlisle Companies Incorporated (through its divisions like Binks and DeVilbiss), Anest Iwata Corporation, Sata GmbH & Co. KG, 3M Company (Abrasives and Finishing Materials), Fuji Spray Ltd., Titan Tool Inc., Campbell Hausfeld (A division of The Marmon Group), Kremlin Rexson (Sames Kremlin), Walther Pilot (Division of J. Wagner GmbH), C.A. Technologies, Lemmer Spray Equipment Inc., Tritech Industries, Apollo Sprayers International Inc., Rigo Srl, Ingersoll Rand Inc., ITW Finishing (Division of Illinois Tool Works), TPC (Total Power Coating). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paint Sprayer Market Key Technology Landscape

The technological landscape of the Paint Sprayer Market is undergoing a rapid and profound transformation, primarily motivated by the uncompromising pursuit of superior transfer efficiency (HTE), unprecedented application precision, and significantly enhanced user mobility across all application environments. A pivotal and continually improving technology is the advancement in High Volume Low Pressure (HVLP) systems. These systems efficiently utilize a large volume of air at very low pressure to delicately atomize the coating material, which fundamentally reduces overspray by up to 30% compared to older conventional technologies. Modern HVLP turbines are significantly quieter, more energy-efficient, and dramatically more portable, making them the industry standard for achieving impeccable fine finishing quality in intricate woodworking, detailed furniture manufacturing, and high-end automotive refinishing where both material savings and a flawless, mirror-like finish are non-negotiable requirements. Manufacturers are continuously refining the internal geometries of air cap and fluid nozzle assemblies using advanced computational fluid dynamics (CFD) simulations to optimize the spray fan pattern specifically for varying coating viscosities, including the complex fluid dynamics of high-solids and waterborne formulations.

Another dominant technological trend profoundly impacting the high-performance professional segment involves the integration of highly sophisticated electronic control systems into modern airless sprayers. High-end professional and industrial airless units now routinely feature advanced electronic pressure control (EPC) systems. These systems utilize highly accurate pressure transducers to continuously monitor and instantaneously regulate pump pressure thousands of times per second, effectively eliminating the pressure fluctuations (pumps) that traditionally caused undesirable variations in film thickness and inconsistent finish quality. This precise level of electronic control is absolutely vital when applying highly specialized, expensive, or critically measured coatings, such as protective epoxies and fireproofing materials. Furthermore, the explosive demand for cordless mobility has propelled intense, multi-million dollar research and development efforts in battery technology, leading to the market introduction of extremely powerful 60V and 80V lithium-ion platforms that deliver sustained pressure and flow rates fully comparable to, or exceeding, professional corded electric models. This innovation grants unprecedented operational freedom and significantly boosts productivity on large job sites by eliminating the dependence on cumbersome power cords and fixed power infrastructure.

The strategic incorporation of electrostatic technology represents the highest-end industrial segment's key technological focus, particularly in applications involving metal components. Electrostatic sprayers utilize a powerful electric field to impart an electrical charge onto the finely atomized paint particles, causing them to be strongly attracted to the grounded metallic workpiece (e.g., automotive bodies, metal cabinets). This phenomenon, known as the "wrap-around effect," achieves market-leading transfer efficiencies often exceeding 90%, leading to unprecedented material savings, minimal VOC emissions, and superior coating coverage on complex, three-dimensional shapes. While inherently specialized, capital-intensive, and primarily used in high-throughput industrial settings, the long-term efficiency gains and substantial material conservation profoundly justify the initial investment. Moving forward, the focus is strategically shifting toward complete smart integration, including IoT-enabled systems that meticulously track detailed material usage statistics, monitor pump and motor health in real-time, and provide complex diagnostic data accessible remotely via dedicated mobile applications, transforming the highly advanced sprayer from a standalone mechanical tool into a digitally integrated, critical asset management solution for the modern factory floor.

Regional Highlights

North America represents a critically mature yet dynamically innovating market for paint sprayers, predominantly driven by high labor costs, which incentivize investment in speed-enhancing technology, and exceptionally stringent occupational safety and environmental standards, particularly concerning volatile organic compounds (VOCs). This challenging regulatory environment mandates the rapid adoption of highly advanced, high-efficiency coating equipment, including sophisticated airless systems utilizing proportional pressure control and state-of-the-art precision HVLP technology. The region maintains exceptionally strong demand from the large professional construction segment, which requires highly durable, high-capacity equipment suitable for rapid application on large-scale commercial, institutional, and high-end residential developments. Furthermore, the robust automotive repair, refinishing, and customization sector ensures continuous, high-value demand for specialized, high-fidelity fine finishing sprayers. The most significant regional growth is concentrated within the cordless segment, where manufacturers are relentlessly focused on maximizing battery runtime and elevating power output to definitively enhance professional contractor mobility and overall productivity across diverse project locations.

Europe is uniquely characterized by a profound and deep-rooted institutional emphasis on sustainability, exceptional finish quality, and highly specialized industrial finishing applications across sectors like aerospace and high-end furniture. The European Union’s extensive regulatory framework, particularly the aggressive implementation of VOC emissions directives, has served as a powerful principal driver for the mandated adoption of High-Transfer Efficiency (HTE) technology, compelling the use of highly sophisticated HVLP, robotic, and precision electrostatic systems across virtually all professional finishing sectors. The market demand structure is significantly diversified, ranging from the complex, high-speed robotic painting installations common in major German automotive manufacturing facilities and French aerospace plants, to the meticulous, high-quality finishing standards required in the renowned Italian furniture and design industries. Western European countries consistently show a strong preference for premium, extremely durable, and technologically advanced equipment, while the Eastern European markets present a relatively faster growth trajectory, fueled by accelerated modernization of construction practices and increasing foreign investment in infrastructure repair, favoring durable, high-throughput airless systems for architectural coatings.

The Asia Pacific (APAC) region remains the undisputed epicenter of future market growth, underpinned by the unparalleled rates of rapid urbanization, explosive industrialization, and massive, sustained infrastructure development occurring across China, India, and the dynamic nations of Southeast Asia. The sheer scale and speed of new construction, factory expansion, and mass production necessitate high-speed coating application methods across architectural and industrial spheres, making powerful professional airless sprayers the unequivocally dominant technology category in terms of volume. While significant price sensitivity remains a defining factor, driving intense demand for locally manufactured, high-volume, cost-effective units, the rapid influx and expansion of multinational corporations is concurrently boosting the adoption of higher-quality, specialized imported systems, particularly within high-tech manufacturing, complex automotive supply chains, and large industrial painting projects. The quickly expanding middle class across APAC is simultaneously transforming the DIY segment, creating immense and sustained opportunities for global manufacturers to penetrate new consumer segments with highly accessible, reliable, and exceptionally easy-to-use electric sprayers. Strategic investment in deeply localized distribution channels, comprehensive service networks, and tailored product offerings is absolutely paramount for successfully capitalizing on the region's diverse, fast-moving, and massive market landscape.

Latin America (LATAM) and the Middle East & Africa (MEA) collectively represent important emerging markets with substantial long-term potential, though their growth is characterized by greater economic volatility and regional infrastructural variances. In LATAM, market expansion is closely tied to recovering and expanding construction sectors and the growth of domestic manufacturing industries, with standard airless technology being the dominant and preferred choice for residential and commercial architectural coatings. Market maturity is highly variable across the continent, with countries like Brazil and Mexico exhibiting significantly higher professional equipment adoption rates and established distribution networks. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, sees market demand largely driven by massive, ongoing mega infrastructure projects, high-rise commercial real estate development, and the critical oil and gas sector. The energy industry demands heavy-duty, protective coating application systems, often requiring powerful hydraulic or high-pressure pneumatic units specifically engineered for applying high-solids, extremely durable coatings necessary to protect assets in highly corrosive, arid environments. Successful market penetration in these regions fundamentally relies on developing robust localized service centers, providing certified technical training, and securing partnerships with regional contractors capable of handling specialized, complex coating applications.

- North America: Focus on HTE, high-performance cordless systems, and demanding automotive finishing; market driven by high labor costs and environmental compliance.

- Europe: Driven by stringent VOC regulations and high demand for precision in industrial finishing (automotive, machinery, furniture); strong preference for sophisticated electrostatic and HVLP technologies.

- Asia Pacific (APAC): Highest growth rate globally, fueled by massive construction and infrastructure projects; primary technology demand is for high-volume airless sprayers and a rapidly expanding, price-sensitive DIY segment.

- Latin America & MEA: Emerging markets driven by recovering infrastructure investment and critical need for protective coatings in the energy and mining sectors; high potential for robust professional airless systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paint Sprayer Market.- Graco Inc.

- Wagner SprayTech Corp.

- Nordson Corporation

- Carlisle Companies Incorporated (including Binks and DeVilbiss brands)

- Anest Iwata Corporation

- Sata GmbH & Co. KG

- 3M Company (Industrial Coating Solutions)

- Fuji Spray Ltd.

- Titan Tool Inc.

- Campbell Hausfeld (The Marmon Group)

- Kremlin Rexson (Sames Kremlin)

- Walther Pilot (J. Wagner GmbH subsidiary)

- C.A. Technologies

- Lemmer Spray Equipment Inc.

- Tritech Industries

- Apollo Sprayers International Inc.

- Rigo Srl

- Ingersoll Rand Inc. (Pneumatic Systems)

- ITW Finishing (Divisions like Gema, Ransburg, and Devilbiss)

- TPC (Total Power Coating)

- Euromair

- Larius S.p.A.

- Amsler Equipment Inc.

Frequently Asked Questions

Analyze common user questions about the Paint Sprayer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Airless and HVLP paint sprayers?

Airless sprayers atomize paint solely by forcing it through a small, specialized tip at extremely high pressure (2,000–3,000 psi), making them uniquely suitable for high-speed application of thick materials (latex, heavy primers) over very large architectural surfaces like walls and industrial decking. HVLP (High Volume Low Pressure) sprayers, conversely, utilize a large volume of air at very low pressure (1–10 psi) to gently atomize the paint, resulting in superior control, exceptionally minimal overspray, and a flawless, fine finish. Consequently, HVLP is the preferred system for detailed woodworking, furniture, and precision automotive detailing where finish quality and material conservation are paramount.

How are environmental regulations impacting the adoption of new paint sprayer technologies?

Strict global environmental regulations, particularly those heavily focused on limiting Volatile Organic Compound (VOC) emissions from coatings, are acting as a strong catalyst, directly accelerating the mandated adoption of High-Transfer Efficiency (HTE) technologies. HTE systems, which critically include advanced HVLP and cutting-edge electrostatic sprayers, ensure that a greater proportion (often 65% to 90%) of the expensive coating material adheres to the target surface. This regulatory pressure makes the investment in highly efficient, precision-focused equipment an operational necessity for industrial and professional users seeking to reduce waste, lower material costs, and ensure full compliance with regional air quality standards.

Which end-user segment is projected to show the fastest growth rate?

The DIY (Do-It-Yourself) and Consumer end-user segment is currently projected to exhibit the fastest Compound Annual Growth Rate (CAGR) globally. This growth is predominantly driven by the increasing commercial availability of highly affordable, portable, and user-friendly electric and powerful cordless sprayers. The widespread, sustained trend in home renovation projects, coupled with the mass accessibility of high-quality instructional content online, empowers consumers to confidently achieve near-professional-looking finishes, driving consistently high-volume sales through optimized mass retail channels and rapidly expanding global e-commerce platforms.

What are the key advantages of using battery-powered (cordless) paint sprayers for professionals?

Cordless paint sprayers, powered by robust, high-voltage lithium-ion technology, offer professional contractors significant, measurable advantages in mobility and operational efficiency. They entirely eliminate the time-consuming need for extension cords, fixed air lines, and large power generators on diverse job sites. The primary benefits include a dramatic reduction in project setup time, substantial improvement in job site safety by removing trip hazards, and the essential ability to work seamlessly and powerfully in remote or outdoor locations. Recent technological advancements ensure these professional cordless units now deliver operational pressure and flow rates fully comparable to traditional corded electric models.

How is digital technology influencing the functionality of modern industrial spray systems?

Modern high-end industrial spray systems are undergoing profound integration with advanced digital and IoT technology, fundamentally transforming them into highly intelligent, networked assets. This pervasive digitalization includes sophisticated electronic proportional pressure monitoring for absolute consistency, integrated fluid sensors for real-time tracking of material consumption rates, and comprehensive diagnostic systems accessible remotely via dedicated cloud platforms and mobile applications. This level of smart integration enables precise predictive maintenance scheduling, sophisticated optimization of fluid delivery based on ambient conditions, and provides essential data analytics crucial for maintaining Six Sigma quality control and continuous process improvement in high-volume, automated production lines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager