Palladium Coated Copper Bonding Wires Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433294 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Palladium Coated Copper Bonding Wires Market Size

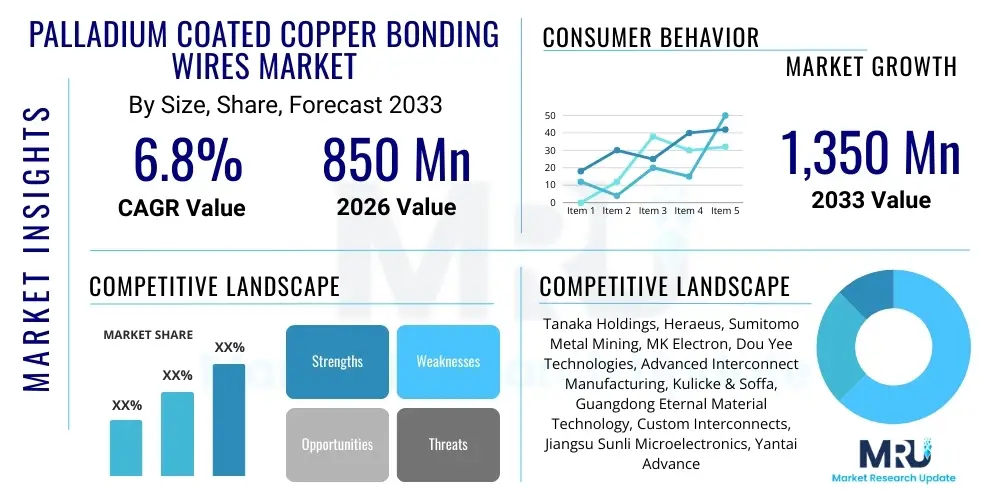

The Palladium Coated Copper Bonding Wires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $1,350 Million USD by the end of the forecast period in 2033.

Palladium Coated Copper Bonding Wires Market introduction

The Palladium Coated Copper Bonding Wires (PCCBW) market encompasses materials critical for connecting semiconductor chips (dies) to the external circuitry within integrated circuit (IC) packages. These wires serve as the electrical pathways, replacing traditional gold bonding wires in many applications due to significant cost advantages and comparable performance characteristics, particularly in terms of electrical conductivity and mechanical strength. PCCBWs are fabricated by applying an ultra-thin layer of palladium (Pd) or a Palladium-Gold alloy onto a pure copper core. This protective layer is essential as it prevents the rapid oxidation of the copper core during the wire bonding process, which utilizes high heat and ultrasonic energy.

The primary applications of these advanced bonding materials are deeply rooted in the electronics manufacturing sector, specifically in automotive electronics, consumer devices, computing, and industrial control systems. The shift towards PCCBW is driven by the volatile and high pricing of gold, coupled with the relentless demand for miniaturization and enhanced performance in semiconductor devices. The introduction of the palladium coating mitigates reliability risks associated with bare copper, such as corrosion and intermetallic compound (IMC) formation, ensuring long-term device durability and stability, which is paramount in high-reliability applications like safety-critical automotive components.

Major driving factors include the massive global expansion of IC manufacturing, particularly in Asia Pacific, the adoption of advanced packaging techniques like flip-chip and 3D stacking which still utilize periphery bonding, and the stringent cost management goals imposed by high-volume electronics producers. Furthermore, the continued technological refinement in coating deposition techniques, such as electroplating and electroless plating, has improved the uniformity and adherence of the palladium layer, making PCCBW a reliable alternative that meets rigorous industry standards, thus accelerating its market penetration across various semiconductor device types including memory chips, microcontrollers, and power management ICs.

Palladium Coated Copper Bonding Wires Market Executive Summary

The Palladium Coated Copper Bonding Wires market is undergoing substantial expansion, propelled by structural business trends focusing on cost optimization and material substitution within the semiconductor packaging industry. Key business trends indicate a strong move away from gold, positioning PCCBW as the material of choice for mainstream IC packaging, particularly in segments requiring high throughput and moderate thermal performance. Manufacturers are heavily investing in capacity expansion and process control technologies to ensure stable supply and consistent wire quality, addressing historical concerns regarding the reliability of copper-based materials. Strategic alliances between wire manufacturers and outsourced semiconductor assembly and test (OSAT) providers are defining competitive dynamics, emphasizing global supply chain resilience and technical support for advanced bonding requirements.

Regional trends highlight the dominance of the Asia Pacific (APAC) region, which serves as the global hub for semiconductor assembly and packaging operations. Countries like China, Taiwan, South Korea, and Japan are the primary consumers due to the concentration of major OSAT players and integrated device manufacturers (IDMs). While North America and Europe remain crucial for R&D and high-end automotive and defense applications, the volume consumption growth is overwhelmingly centered in APAC, driving significant regional infrastructure investments. Emerging regions, including Southeast Asia (e.g., Vietnam, Malaysia), are also seeing accelerated adoption as global supply chains diversify and manufacturing footprints expand, further cementing APAC's market leadership.

Segment trends reveal that the fine-pitch bonding segment, necessitated by the miniaturization of ICs, is experiencing the fastest growth, requiring wires with increasingly smaller diameters (below 20 µm). In terms of application, consumer electronics, particularly smartphones and IoT devices, represent the largest market segment due to sheer volume, followed closely by the automotive segment, driven by the increasing integration of advanced driver-assistance systems (ADAS) and electrification. The use of advanced coating technologies, such as double-layer palladium coating or proprietary alloy coatings, is also trending upward, addressing demands for improved wire bond loop stability and stronger resistance to hostile operating environments, thereby enhancing overall device reliability and performance lifespan.

AI Impact Analysis on Palladium Coated Copper Bonding Wires Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Palladium Coated Copper Bonding Wires market frequently center on two main themes: how AI-driven semiconductor demand affects wire consumption and how AI optimizes the manufacturing and quality control processes for these wires. Users are concerned about whether the shift to highly complex AI processors (like GPUs and specialized ASICs) demanding advanced packaging methods, such as chiplets and high-density interconnects, will accelerate the use of alternatives like copper pillars and microbumps. Conversely, users expect AI to significantly enhance operational efficiencies, specifically in predictive maintenance for wire drawing machines, optimizing plating bath chemistries for uniform palladium coating, and performing automated visual inspection (AVI) of bonded wire loops in OSAT facilities, thereby reducing defects and material waste.

The rise of generative AI and machine learning requires immense computational power, translating directly into higher demand for specialized AI chips. While many high-end AI chips utilize flip-chip or 2.5D/3D packaging that minimizes traditional wire bonding, the peripheral components, memory modules, and power management ICs associated with these systems still heavily rely on traditional wire bonding, ensuring sustained demand for PCCBWs. AI algorithms are also deployed within the wire manufacturing process itself to model the complex relationship between drawing speed, annealing temperature, and final wire characteristics, allowing for rapid adjustments to achieve tighter tolerances on parameters such as tensile strength and elongation, crucial for high-speed automatic wire bonders.

Furthermore, AI-powered defect detection is revolutionizing quality assurance in the assembly stage. Traditional wire inspection is tedious and prone to human error, but AI systems analyze thousands of images of bonded chips in real-time, identifying subtle defects like poorly formed balls, lifted bonds, or misplaced loops with superior accuracy. This improvement in quality control directly strengthens the value proposition of PCCBWs by mitigating reliability concerns, making them more competitive against gold, particularly for mission-critical applications where high yields are essential. The overall impact of AI is two-fold: slightly diversifying packaging needs at the high-end but significantly enhancing the quality, efficiency, and scalability of PCCBW production and utilization.

- AI enhances manufacturing precision through predictive modeling of wire drawing and coating processes.

- Machine Learning (ML) algorithms optimize palladium plating bath maintenance, ensuring uniform coating thickness.

- Increased demand for AI/ML chips drives peripheral demand for PCCBWs in associated power and memory ICs.

- Automated Visual Inspection (AVI) powered by AI drastically improves quality control for wire bond integrity in OSATs.

- AI aids in supply chain forecasting for key raw materials (copper and palladium), stabilizing market pricing.

DRO & Impact Forces Of Palladium Coated Copper Bonding Wires Market

The Palladium Coated Copper Bonding Wires market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its trajectory and impact forces. The primary driver remains the compelling economic advantage over gold wire, which translates into substantial cost savings for high-volume manufacturers, especially given the continuous pressure on component costs in consumer electronics. This substitution effect, coupled with the rapid growth of the overall semiconductor market driven by 5G, IoT, and cloud computing infrastructure, creates a powerful demand pull. Technological advancements in wire bonding equipment, which now handle copper-based materials more reliably, further reinforce this driving force, making the transition smoother and more cost-effective for assembly houses worldwide.

Restraints, however, pose persistent challenges to full market penetration. The inherent material stiffness of copper compared to gold can lead to reliability issues such as cratering or pad damage during the bonding process, necessitating advanced machine settings and specialized protective coatings, which adds complexity and cost. Concerns over long-term reliability, specifically the formation of brittle intermetallic compounds (IMCs) between copper and aluminum bond pads, though mitigated by the palladium layer, still require extensive qualification processes, particularly in highly sensitive fields like aerospace and medical devices. Furthermore, the reliance on palladium, a precious metal subject to supply chain volatility and geopolitical risk, introduces a variable cost structure that can occasionally hinder its attractiveness relative to other substitutes.

Opportunities for growth are concentrated in emerging applications and geographical expansion. The electrification of the automotive industry necessitates highly reliable and cost-effective power modules, where PCCBWs are increasingly being adopted due to their superior electrical performance compared to gold in high-current applications. The development of ultra-fine diameter wires (less than 18 µm) opens doors for use in high-density memory stacking (e.g., DRAM), competing directly with advanced packaging solutions. Furthermore, increasing environmental regulations push manufacturers toward more sustainable and resource-efficient materials, indirectly benefiting the copper-based solution over resource-intensive pure gold. The impact forces are generally high, showing strong elasticity with global semiconductor production volumes and medium-to-high barriers to entry due to the specialized manufacturing technology required.

Segmentation Analysis

The Palladium Coated Copper Bonding Wires market is segmented based on wire diameter, coating type, application, and end-user industry, providing a granular view of market dynamics and adoption patterns. Segmentation by wire diameter is crucial as it reflects the varying packaging density requirements across different IC types, ranging from thick wires used in power devices to ultra-fine wires required for high-pin-count microcontrollers and memory chips. The segmentation by coating type—specifically palladium layer thickness and the use of proprietary palladium alloys—distinguishes products based on reliability metrics and target applications, with thicker coatings often preferred for harsh environments or complex bonding geometries.

Segmentation based on application identifies the specific IC packages utilizing PCCBWs, such as Dual In-line Packages (DIP), Small Outline Transistors (SOT), and Ball Grid Arrays (BGA). This classification helps manufacturers align product specifications with specific packaging requirements, optimizing wire stiffness, loop profile, and bonding parameters. The end-user industry segmentation, encompassing consumer electronics, automotive, telecommunications, and industrial sectors, reveals consumption patterns linked to economic cycles and regulatory pressures, with consumer electronics historically dominating volume but the automotive segment exhibiting faster growth in value due to stringent reliability demands and long product life cycles.

Overall, the market exhibits clear differentiation between high-volume, cost-sensitive segments (primarily consumer memory and logic) driving demand for standard PCCBWs, and high-reliability segments (automotive and defense) driving demand for premium, tightly specified PCCBW products with advanced surface treatment and stringent process control. Understanding these segment behaviors is vital for stakeholders to allocate resources effectively, target strategic R&D efforts toward smaller diameters, and establish localized supply chains in major manufacturing hubs within the APAC region to capitalize on market growth effectively and efficiently.

- By Wire Diameter:

- Fine Diameter (25 µm to 50 µm)

- Ultra-Fine Diameter (15 µm to < 25 µm)

- Heavy Gauge (50 µm and above)

- By Coating Type:

- Single Layer Palladium Coating

- Multi-Layer/Alloy Coating (e.g., Pd-Au Layer)

- Proprietary Surface Treatment

- By Application:

- Logic and Microcontrollers (MCUs/MPUs)

- Memory Devices (DRAM, NAND, etc.)

- Power Management ICs (PMICs)

- Discrete Devices and LEDs

- By End-User Industry:

- Consumer Electronics (Smartphones, PCs, Wearables)

- Automotive (ADAS, Powertrain, Infotainment)

- Industrial and Healthcare

- Telecommunications and Data Center

Value Chain Analysis For Palladium Coated Copper Bonding Wires Market

The value chain for Palladium Coated Copper Bonding Wires is highly specialized, beginning with the upstream procurement of high-purity raw materials. This stage involves the sourcing of electrolytic grade copper rods and palladium metal, both of which are commodity-driven and subject to global market price fluctuations. Copper purification and rod drawing are followed by the critical wire production phase, encompassing mechanical drawing to achieve ultra-fine diameters and subsequent thermal annealing to adjust mechanical properties like elongation and tensile strength. Upstream suppliers specializing in high-quality oxygen-free copper and reliable palladium refinery services exert significant influence over material cost and purity, directly impacting the final product performance and manufacturability.

Midstream activities involve the specialized palladium coating process, typically utilizing sophisticated electroplating or electroless plating techniques to ensure a uniform and defect-free layer on the copper core. Wire manufacturers then spool the finished product, which requires meticulous handling and packaging to prevent damage before shipment to downstream users. The downstream segment is dominated by the semiconductor assembly and packaging industry, comprising large Integrated Device Manufacturers (IDMs) like Intel and Samsung, and, more prominently, Outsourced Semiconductor Assembly and Test (OSAT) companies such as ASE Group and Amkor Technology. These downstream users are the final consumers, integrating the wires into IC packages using automated high-speed wire bonders.

Distribution channels for PCCBWs are primarily direct, characterized by close technical collaboration between the wire manufacturer and the OSAT/IDM to ensure optimized performance and reliability on specific bonding equipment. Due to the technical nature and high value of the product, indirect distribution through general distributors is less common, reserved mainly for smaller-volume or specialized regional buyers. Direct sales enable efficient feedback loops regarding wire quality and performance, crucial for rapid process adjustments. The critical nature of this material in the semiconductor manufacturing process means supply chain efficiency and product qualification protocols represent significant barriers to entry for new suppliers, emphasizing established relationships and proven quality control systems throughout the entire value chain.

Palladium Coated Copper Bonding Wires Market Potential Customers

Potential customers for Palladium Coated Copper Bonding Wires are predominantly entities involved in the final stages of semiconductor manufacturing, requiring highly reliable, cost-effective interconnect solutions for mass production. The primary end-users are large Outsourced Semiconductor Assembly and Test (OSAT) providers. These companies, which handle the packaging for numerous fabless semiconductor firms, utilize vast quantities of bonding wires daily, making them the largest volume consumers. Their purchasing decisions are driven by operational efficiency, wire bonding speed compatibility, consistency, and, critically, the total cost of ownership compared to gold wire alternatives.

Another significant customer segment includes Integrated Device Manufacturers (IDMs) that maintain in-house packaging capabilities for certain products, particularly high-margin memory chips (e.g., NAND flash) or highly specialized components where process control is paramount. These IDMs value high-quality, customized bonding wire specifications that meet internal reliability standards for products sold under their own brand. Furthermore, specialized electronics manufacturers focused on high-reliability sectors such as the automotive tier-1 suppliers and aerospace/defense contractors are emerging high-value customers. While their volume is lower than general consumer electronics, they require stringent quality documentation and often mandate specific alloy compositions or coating thicknesses to guarantee long-term performance under extreme thermal and mechanical stresses.

The accelerating adoption of advanced consumer technologies, particularly in the realm of high-performance computing (HPC) and 5G infrastructure equipment, continually expands the customer base. Manufacturers of networking hardware, data center servers, and industrial control modules are increasingly qualifying PCCBWs for use in components that were previously reserved for gold. Ultimately, any entity engaged in the mass assembly of microelectronic components that utilize wire bonding technology represents a critical potential customer, driven by the universally applicable economic benefit derived from substituting gold with palladium-coated copper while maintaining stringent performance and reliability benchmarks set by the fiercely competitive electronics market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $1,350 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tanaka Holdings, Heraeus, Sumitomo Metal Mining, MK Electron, Dou Yee Technologies, Advanced Interconnect Manufacturing, Kulicke & Soffa, Guangdong Eternal Material Technology, Custom Interconnects, Jiangsu Sunli Microelectronics, Yantai Advanced Materials, Nippon Micrometal, Kangqiang Electronics, Saint-Gobain, Zhaojing Technology, Technic Inc., AMETEK, Inc., Alpha Assembly Solutions, Plating International, G.L. Electronic Materials |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Palladium Coated Copper Bonding Wires Market Key Technology Landscape

The manufacturing of Palladium Coated Copper Bonding Wires is underpinned by several sophisticated technological processes aimed at achieving superior mechanical, electrical, and thermal reliability. Core technological expertise lies in ultra-fine wire drawing, where copper rods are incrementally reduced in diameter to micro-scale dimensions (often less than 20 µm) while maintaining crystalline structure integrity. Precise control over the annealing process—the thermal treatment used to soften the wire—is crucial, as it dictates the final mechanical properties, such as elongation and tensile strength, which must be perfectly tuned for use in high-speed wire bonding machines operating at thousands of bonds per hour without breakage or loop instability. Failure in annealing control leads to wires that are either too brittle or too soft, severely impacting assembly yield.

The most distinctive technology is the palladium coating application itself, predominantly achieved through continuous electroplating or advanced electroless plating processes. Electroplating technologies must ensure exceptional uniformity and adhesion of the palladium layer, which typically ranges from 100 to 500 nanometers in thickness. The technology prevents the copper core from oxidizing at the high temperatures encountered during the thermosonic bonding process and provides a barrier against the formation of brittle copper-aluminum intermetallic compounds (IMCs) over the device's lifetime, a common failure mechanism for bare copper. Ongoing research focuses on developing proprietary palladium alloy coatings that offer even greater resistance to corrosion and improved shear strength compared to pure palladium, thereby expanding PCCBW use into higher-stress applications.

Furthermore, the technological landscape includes advancements in quality control and monitoring systems. High-resolution in-line inspection systems utilize optical and sometimes AI-enhanced imaging to continuously verify wire diameter and coating uniformity during production. At the user end, sophisticated wire bonding equipment incorporates advanced sensing and control algorithms—such as Electronic Flame Off (EFO) optimization and advanced loop control—specifically calibrated to the characteristics of PCCBWs. This integration between material science and machine technology ensures that the potential cost savings of copper are realized without compromising the critical reliability standards demanded by modern semiconductor packaging, driving the continuous co-evolution of materials and equipment technology in the sector.

Regional Highlights

- Asia Pacific (APAC): APAC is overwhelmingly the largest and fastest-growing market for Palladium Coated Copper Bonding Wires, driven by its status as the global manufacturing hub for electronics and semiconductors. Countries like China, Taiwan, South Korea, and Japan house the majority of OSAT players (e.g., ASE, Amkor) and major IDMs (e.g., Samsung, TSMC), which consume massive volumes of bonding wires. Favorable government policies supporting domestic semiconductor development, coupled with immense capacity expansions in memory and logic production, ensure that APAC maintains its dominance. The relentless focus on cost reduction in high-volume production in China and Southeast Asia makes PCCBW the default choice over gold for most mainstream commercial IC packages.

- North America: North America represents a mature but technologically demanding market, primarily focused on high-end applications, R&D, and defense/aerospace electronics. While manufacturing volume is lower compared to APAC, the region drives innovation in material science, particularly concerning advanced alloy coatings and ultra-fine pitch bonding requirements for specialized microprocessors and high-reliability devices. Demand is stable, sustained by major technology companies and defense contractors requiring stringent quality control and high-performance components, often setting the global benchmarks for PCCBW qualification.

- Europe: Europe exhibits strong demand centered on the sophisticated automotive sector and industrial automation. The rapid transition to electric vehicles (EVs) and advanced driver-assistance systems (ADAS) necessitates robust power modules and sensors, relying on highly reliable interconnects. European manufacturers prioritize consistency and adherence to strict quality standards (e.g., AEC-Q100). The market growth is closely tied to the regional automotive manufacturing output and investment in localized semiconductor fabrication facilities specializing in power electronics and specialized industrial control systems.

- Latin America, Middle East, and Africa (LAMEA): LAMEA currently accounts for the smallest share of the global PCCBW market, primarily serving as an end-market for imported finished electronics. However, incremental growth is anticipated, particularly in Mexico and Brazil, due to the gradual expansion of local electronics assembly operations and automotive manufacturing facilities serving regional markets. Market penetration is generally indirect, influenced heavily by global OSAT strategies and the region's increasing demand for affordable consumer electronics and telecommunications infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Palladium Coated Copper Bonding Wires Market.- Tanaka Holdings Co., Ltd.

- Heraeus Group

- Sumitomo Metal Mining Co., Ltd.

- MK Electron Co., Ltd.

- Dou Yee Technologies (S) Pte Ltd

- Advanced Interconnect Manufacturing (AIM)

- Kulicke & Soffa Industries, Inc. (equipment and consumables)

- Guangdong Eternal Material Technology Co., Ltd.

- Custom Interconnects Inc.

- Jiangsu Sunli Microelectronics Co., Ltd.

- Yantai Advanced Materials Co., Ltd.

- Nippon Micrometal Manufacturing Co., Ltd.

- Kangqiang Electronics Co., Ltd.

- Saint-Gobain (through specialized material divisions)

- Zhaojing Technology Co., Ltd.

- Technic Inc. (focus on plating chemistry)

- AMETEK, Inc. (specialized materials)

- Alpha Assembly Solutions (MacDermid Enthone)

- Plating International Pte Ltd

- G.L. Electronic Materials Ltd.

Frequently Asked Questions

Analyze common user questions about the Palladium Coated Copper Bonding Wires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Palladium Coated Copper Bonding Wires over traditional Gold Bonding Wires?

The primary advantage is the substantial cost reduction provided by copper compared to high-cost gold, while the thin palladium coating preserves critical reliability and manufacturability characteristics, particularly preventing rapid oxidation and inhibiting intermetallic compound formation during bonding.

How does the Palladium layer mitigate reliability issues associated with bare copper?

The palladium layer acts as a protective barrier, preventing the copper core from oxidizing at high temperatures during the thermosonic bonding process, and it significantly retards the formation of brittle copper-aluminum intermetallic compounds (IMCs) over the device's operational lifetime, enhancing long-term reliability.

Which industry segment drives the highest volume demand for Palladium Coated Copper Bonding Wires?

The Consumer Electronics segment, encompassing smartphones, PCs, and general IoT devices, drives the highest volume demand due to the massive scale of IC production for these cost-sensitive, high-throughput applications, primarily utilizing packaging services in the Asia Pacific region.

What technological challenges exist in manufacturing ultra-fine diameter Palladium Coated Copper Wires?

Key technological challenges include maintaining the mechanical integrity (tensile strength and elongation) during the ultra-fine drawing process, ensuring perfectly uniform and adherent palladium coating on extremely thin wires, and guaranteeing consistency for high-speed automated bonding without wire breakage or loop distortion.

Is the Palladium Coated Copper Bonding Wires Market impacted by the increasing adoption of flip-chip and wafer-level packaging?

While flip-chip and wafer-level packaging (WLP) are growing alternatives, PCCBW demand remains robust because peripheral components, memory chips, power management ICs, and lower-cost ICs still rely heavily on conventional wire bonding, ensuring sustained market relevance across various IC packaging levels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager