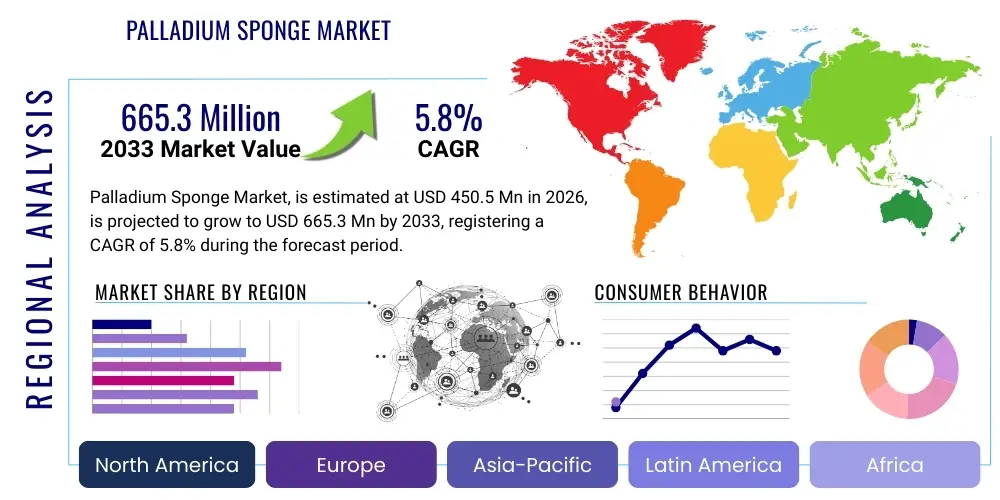

Palladium Sponge Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435947 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Palladium Sponge Market Size

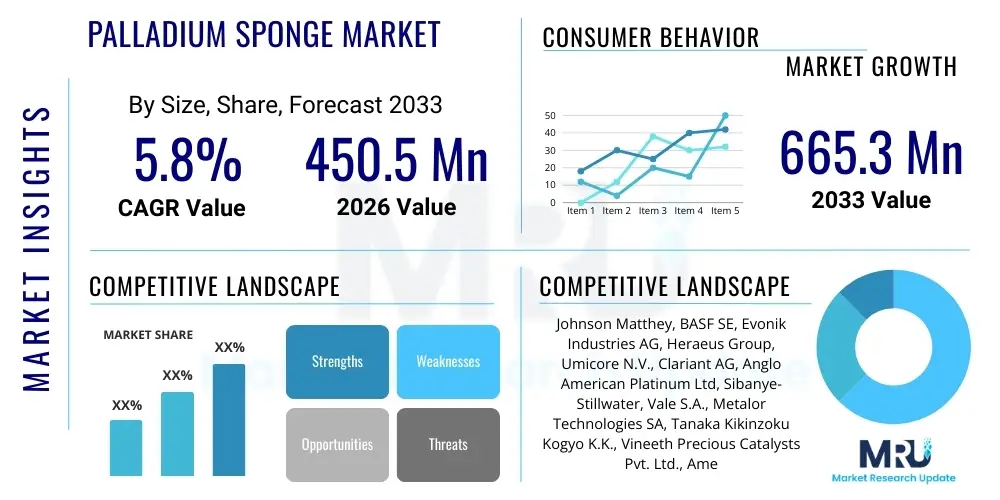

The Palladium Sponge Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 million in 2026 and is projected to reach USD 665.3 million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global demand for high-efficiency catalysts in the petrochemical and pharmaceutical industries, where palladium sponge is instrumental due to its vast surface area and superior catalytic properties. The stringent environmental regulations requiring enhanced pollution control technologies, especially in the automotive sector concerning catalytic converters, further contribute to sustained market expansion.

Palladium Sponge Market introduction

The Palladium Sponge Market encompasses the trade, manufacturing, and application of highly porous, high-purity palladium metal powder, often characterized by its high surface area-to-volume ratio, making it an exceptionally effective heterogeneous catalyst. This specific physical structure allows for maximal interaction during chemical processes, significantly improving reaction efficiency, especially in hydrogenation, dehydrogenation, and coupling reactions crucial to industrial synthesis. Palladium sponge, typically produced through chemical reduction or electrolytic processes, serves as a vital component in modern industrial chemistry, facilitating the creation of complex molecules in a clean and efficient manner, thereby minimizing waste and operational costs. The introduction of standardized high-grade sponge material has stabilized supply chains and boosted confidence among large industrial end-users globally, setting a strong foundation for future growth and application diversification.

Major applications of Palladium Sponge span across several high-value sectors, prominently including the chemical processing industry for selective catalytic conversions, the pharmaceutical sector for synthesizing active pharmaceutical ingredients (APIs), and increasingly, in hydrogen purification and storage technologies due to palladium’s unique ability to absorb hydrogen gas. Beyond traditional catalytic uses, minor but growing applications are found in electronics, where it is used in specialized sensors and conductive pastes, and in high-end jewelry and dental alloys, leveraging its corrosion resistance and biocompatibility. The primary benefit of using palladium in sponge form is the maximized surface area, which translates directly into lower catalyst loading requirements and faster reaction kinetics, offering significant economic and operational advantages over other forms of palladium catalysts.

The market is primarily driven by the escalating demand for sustainable chemical manufacturing practices and the rigorous quality standards enforced across regulated industries such as pharmaceuticals and specialty chemicals. Key driving factors include the rise in global automotive production, which, although increasingly electric, still relies heavily on catalysts in transitional phases and for certain hybrid systems, and the relentless expansion of the global petrochemical complex necessitating efficient refining and synthesis catalysts. Furthermore, ongoing research and development into novel green chemistry applications, particularly those utilizing hydrogen energy, continually open up new avenues for palladium sponge utilization, solidifying its position as an indispensable precious metal component in the modern industrial landscape.

Palladium Sponge Market Executive Summary

The Palladium Sponge Market is characterized by robust growth, driven primarily by technological advancements in catalytic efficiency and increasing regulatory pressure favoring cleaner industrial processes. Current business trends indicate a significant shift towards securing resilient supply chains, given the geopolitical risks associated with primary palladium sourcing, leading key manufacturers to invest heavily in advanced refining and recycling technologies to produce high-ppurity sponge domestically. Furthermore, major market players are focusing on developing tailored sponge morphologies optimized for specific reactions, such as low-temperature or high-pressure applications, thus expanding the product portfolio and addressing nuanced consumer needs within specialty chemicals and advanced material synthesis. Strategic collaborations between catalyst manufacturers and large-scale pharmaceutical firms are becoming common practice to co-develop customized catalytic solutions, ensuring efficient and scalable production of high-value APIs, which currently represents a critical demand segment.

Regionally, the market dynamics are polarized, with Asia Pacific exhibiting the fastest growth due to rapid industrialization, burgeoning chemical manufacturing bases in China and India, and increasing investments in refinery capacity. North America and Europe, while representing mature markets, maintain high demand due to stringent environmental regulations (especially related to vehicle emissions and industrial air quality) and significant concentration of high-tech pharmaceutical R&D facilities, driving the need for extremely high-grade palladium sponge. The Middle East and Africa (MEA) region is emerging as a critical growth area, fueled by planned expansions in petrochemical refining infrastructure, necessitating large volumes of high-performance catalysts for desulfurization and other processing tasks. This regional segmentation underscores the market's dependence on global manufacturing health and regulatory compliance standards.

Segmentation trends highlight the dominance of the high-purity (99.95% minimum) segment due to the strict quality requirements in pharmaceutical synthesis and sensitive electronic applications, where even trace impurities can compromise product integrity. By application, the chemical processing and petrochemical segments collectively hold the largest market share, though the pharmaceutical segment is projected to record the highest CAGR, reflecting the substantial capital expenditure and accelerated development cycles in the biotechnology and API manufacturing sectors. The increasing adoption of smaller particle size palladium sponge variants is also a notable trend, driven by the desire for enhanced surface area and improved kinetics in microreactor technology and continuous flow chemistry applications, facilitating process intensification across various end-user industries.

AI Impact Analysis on Palladium Sponge Market

User inquiries regarding AI's impact on the Palladium Sponge Market largely center on how artificial intelligence can optimize the discovery, synthesis, and application efficiency of palladium catalysts. Common questions revolve around AI's role in predicting catalytic performance under varied conditions, streamlining precious metal inventory management to mitigate price volatility, and automating the monitoring of complex chemical reactions utilizing palladium sponge to ensure purity and yield consistency. Users are particularly interested in machine learning (ML) applications for optimizing the recycling process of spent catalysts, a crucial component of sustainable supply chain management, and the potential for AI-driven material science to design novel palladium sponge structures with enhanced selectivity and longevity. The overarching theme is the expectation that AI will transition palladium sponge usage from empirical trial-and-error to precision engineering, thus reducing operational costs and material waste across the value chain, addressing key concerns related to raw material scarcity and environmental responsibility.

The integration of AI, particularly predictive analytics and computational chemistry, is already influencing the R&D phase of the Palladium Sponge Market. AI algorithms can rapidly screen millions of potential reaction pathways and operating parameters, drastically shortening the time required to develop new catalytic processes that utilize palladium sponge. This computational advantage allows researchers to identify the optimal sponge morphology, particle size distribution, and support material interaction necessary for highly specific industrial reactions, such as chiral synthesis in pharmaceuticals, which demand extremely high selectivity. Furthermore, AI-powered systems are deployed in large-scale chemical plants to continuously analyze real-time spectroscopic and chromatographic data, immediately flagging deviations in reaction kinetics or product purity, thereby ensuring the high performance and long operational lifespan of the installed palladium sponge catalyst bed.

For market players, AI offers strategic benefits by improving forecasting accuracy regarding demand fluctuations in key consuming sectors like automotive and specialty chemicals, enabling smarter procurement of raw palladium and reducing exposure to market price risks. In the realm of sustainability, AI-driven sorting and separation technologies are being explored to enhance the efficiency of secondary palladium recovery from spent catalysts and electronic waste, improving the circular economy model crucial for this rare material. While AI does not directly replace the physical product, its impact is transformative, shifting the market towards highly optimized, data-driven manufacturing and application, ultimately increasing the throughput and economic viability of palladium sponge usage across the global industrial complex.

- AI-driven optimization of catalyst synthesis parameters, improving surface area and pore uniformity.

- Machine learning algorithms predict optimal operating conditions for specific hydrogenation reactions using palladium sponge.

- Enhanced inventory management and demand forecasting using predictive analytics to stabilize procurement costs.

- Computational material science employed to design novel, highly selective palladium sponge morphologies for pharmaceutical APIs.

- Automated real-time monitoring of catalytic reactors ensuring maximum yield and minimizing catalyst degradation.

- Increased efficiency in precious metal recovery and recycling from spent sponge catalysts via AI-powered sorting technologies.

DRO & Impact Forces Of Palladium Sponge Market

The Palladium Sponge Market is governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its future trajectory. Primary drivers include the global push for stricter environmental regulations, particularly the requirement for high-efficiency catalysts in petrochemical desulfurization and wastewater treatment, coupled with the rapid expansion of the pharmaceutical industry’s need for selective hydrogenation catalysts. However, the market faces significant restraints, chief among them being the extreme volatility and high cost of raw palladium, compounded by geopolitical instability in major producing regions, which introduces substantial cost uncertainty for end-users. Opportunities arise mainly from technological innovation in catalyst design, focusing on creating support materials that extend the lifespan of the palladium sponge, and the burgeoning potential in hydrogen economy applications, specifically in fuel cells and high-purity hydrogen generation, offering novel long-term demand streams. These forces dictate strategic investment in recycling infrastructure and R&D focused on resource efficiency.

Drivers: A primary driver is the accelerating demand for complex Active Pharmaceutical Ingredients (APIs) where palladium sponge is irreplaceable for critical synthesis steps requiring high selectivity and mild reaction conditions. The growth in specialized chemical manufacturing, particularly fine chemicals, drives consistent high-grade demand. Furthermore, the mandatory implementation of Euro 6/7 and equivalent emission standards globally, though transitioning, continues to necessitate highly efficient catalytic solutions for internal combustion engine vehicles and industrial furnaces in the near to medium term. The efficiency gains offered by the sponge form—reducing reaction time and catalyst volume—make it economically superior for large-scale operations, reinforcing its market penetration.

Restraints: The most significant restraint is the supply chain fragility and market price manipulation characteristic of the Precious Group Metals (PGMs) sector. The high investment required for maintaining and replacing catalyst inventories poses a considerable barrier, especially for smaller market participants. Regulatory hurdles related to handling hazardous industrial catalysts and the disposal of spent materials also add to operational costs. Furthermore, the ongoing development of efficient non-PGM catalyst alternatives, while currently limited in scope, represents a potential long-term threat if breakthroughs are achieved in substituting palladium in high-volume applications.

Opportunities: Opportunities are concentrated in green chemistry and sustainable technology adoption. The emerging hydrogen economy presents substantial demand potential for palladium sponge in hydrogen purification membranes and handling systems. Investment in improved recycling technologies, leveraging advanced metallurgy and AI, offers a viable pathway to reduce reliance on primary mining, stabilizing supply, and offering a compelling value proposition to customers focused on ESG (Environmental, Social, and Governance) compliance. Developing highly dispersed palladium-nanoparticle-on-sponge systems offers avenues for enhanced performance and reduced loading requirements, improving overall resource efficiency and market competitiveness.

Segmentation Analysis

The Palladium Sponge Market is systematically segmented based on Purity Grade, Application, and End-Use Industry, providing a granular view of demand dynamics across various technological and commercial landscapes. The purity grade segmentation is crucial as it directly correlates with the sensitivity and specificity requirements of the end application; for instance, ultra-high purity grades are mandatory for critical pharmaceutical synthesis, whereas industrial-grade purity suffices for bulk chemical manufacturing. This differentiation in purity allows manufacturers to target niche markets with specialized products, optimizing production protocols and pricing strategies according to stringent regulatory standards and performance expectations.

Segmentation by application clarifies the diverse functionalities of palladium sponge, ranging from its primary role as a hydrogenation catalyst—critical in converting unsaturated organic compounds—to its use in specialized electroplating, jewelry fabrication, and sensing devices. The application matrix also includes its utility in high-temperature environments and aggressive chemical processing where resistance to corrosion and poisoning is paramount. Analyzing these segments helps in understanding which industrial processes are currently driving the bulk demand and where future growth, particularly in emerging fields like sustainable energy and advanced electronics, is anticipated to materialize, guiding strategic resource allocation for R&D and capacity expansion.

The End-Use Industry segmentation highlights the cyclical and long-term demand drivers. While the Chemical and Petrochemical sectors provide baseline, massive volume consumption, the Pharmaceutical and Electronics industries contribute to high-value, high-margin demand due to their non-negotiable requirements for exceptional purity and performance guarantees. The Automotive sector, although facing structural shifts towards electrification, still requires palladium catalysts for emission control in hybrid and large diesel applications in various global markets. Comprehensive segmentation analysis is vital for market players to diversify their product offerings and mitigate risks associated with overreliance on any single industrial segment or geographical region, ensuring a resilient operational framework.

- By Purity Grade:

- High Purity (99.95% to 99.99%)

- Ultra-High Purity (99.99% and above)

- Industrial Grade (Below 99.95%)

- By Application:

- Hydrogenation and Dehydrogenation Catalysis

- Purification and Gas Separation (Hydrogen)

- Electroplating and Coating

- Jewelry and Dentistry

- Electronics (Sensors and Components)

- By End-Use Industry:

- Chemical and Petrochemical Processing

- Pharmaceutical and Biotechnology

- Automotive (Catalytic Converters)

- Electronics and Electricals

- Refining and Metallurgy

Value Chain Analysis For Palladium Sponge Market

The Palladium Sponge value chain begins with the highly complex upstream activities encompassing raw material sourcing, primarily mining and secondary recovery (recycling) of Precious Group Metals (PGMs). The supply is heavily consolidated, predominantly originating from South Africa, Russia, and Canada, introducing inherent geopolitical and logistical risks. Refiners then take the mined ore or scrap material and engage in energy-intensive purification and separation processes to isolate high-purity palladium metal. This initial refining phase is critical, as the quality and trace element profile of the refined palladium significantly affect the subsequent production of the high-surface-area sponge form, determining its suitability for ultra-sensitive applications like chiral pharmaceutical synthesis, demanding rigorous quality control and specialized metallurgical expertise in the upstream segment.

The midstream phase focuses on the specialized manufacturing of the palladium sponge itself, typically through chemical precipitation methods, thermal decomposition, or electrochemical techniques, yielding the characteristic porous structure. This stage is dominated by specialized chemical and catalyst manufacturers who possess proprietary know-how regarding particle size control, surface modification, and stabilization techniques, optimizing the sponge for industrial catalytic performance. Distribution channels are bifurcated into direct sales and indirect networks. Direct sales are often utilized for large-volume contracts with major petrochemical firms or specialized pharmaceutical companies, facilitating technical consultation and tailored product specifications. Indirect channels involve distributors, agents, and specialized precious metals traders, who manage inventory, logistics, and smaller orders for diversified end-users globally, leveraging regional expertise and established logistics networks to ensure timely and secure delivery of this high-value material.

Downstream activities involve the incorporation of the palladium sponge into final products, primarily catalyst formulations or advanced electronic components. In the chemical industry, the sponge may be incorporated onto supports (like alumina or carbon) or used directly in reactor beds. End-users in the pharmaceutical sector require stringent certification and batch traceability for compliance. The efficiency of the recovery and recycling loop is a critical component of the downstream value chain, as the high cost of palladium necessitates recovering the metal from spent catalysts. Specialized precious metal recovery companies form the final link, extracting the palladium for re-entry into the upstream refining stage, thereby ensuring the circularity and long-term sustainability of the market supply. The integration between catalyst manufacturers and recovery specialists is vital for cost management and supply chain resilience.

Palladium Sponge Market Potential Customers

Potential customers and primary buyers of palladium sponge are predominantly large-scale industrial entities whose core operations rely on high-efficiency chemical synthesis, purification, or energy conversion. The largest cohort of end-users consists of major petrochemical and chemical companies that utilize palladium sponge as a foundational catalyst for hydrotreating processes, selective hydrogenation, and the synthesis of bulk chemicals like acetic acid derivatives and specialty polymers. These customers prioritize bulk availability, robust performance stability, and comprehensive technical support from the supplier to minimize downtime and ensure continuous, high-volume manufacturing throughput. Their procurement decisions are heavily influenced by the cost-efficiency per reaction cycle and the demonstrated longevity of the catalyst material in highly demanding operational environments.

Another high-value segment comprises global pharmaceutical and fine chemical manufacturers, including contract development and manufacturing organizations (CDMOs). These buyers require ultra-high purity palladium sponge for synthesizing complex Active Pharmaceutical Ingredients (APIs) and intermediates, where extremely low levels of contamination and high catalytic selectivity are non-negotiable to meet strict regulatory standards imposed by agencies like the FDA and EMA. For these customers, supply chain reliability, batch traceability, and compliance documentation are paramount, often outweighing minor cost considerations. The demand here is typically characterized by smaller, specialized orders but with significantly higher value concentration per unit mass, focusing heavily on tailored particle morphology for specific reaction chemistries.

Emerging potential customers include manufacturers in the burgeoning hydrogen economy, such as developers of Proton Exchange Membrane (PEM) fuel cells and hydrogen purification systems. While platinum group metals are used in this sector, palladium sponge and its derivatives are crucial for high-purity hydrogen generation and membrane technology, capitalizing on palladium's unique affinity for hydrogen. Furthermore, high-end electronics manufacturers, particularly those involved in advanced sensor technology, multilayer ceramic capacitors (MLCCs), and conductive inks, represent a growing niche, valuing the material's conductive properties and corrosion resistance. Strategic marketing efforts targeting these specialized technology firms, emphasizing technical specifications and performance guarantees, are essential for future market diversification and sustained growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 million |

| Market Forecast in 2033 | USD 665.3 million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Matthey, BASF SE, Evonik Industries AG, Heraeus Group, Umicore N.V., Clariant AG, Anglo American Platinum Ltd, Sibanye-Stillwater, Vale S.A., Metalor Technologies SA, Tanaka Kikinzoku Kogyo K.K., Vineeth Precious Catalysts Pvt. Ltd., American Elements, APMEX, Inc., Materion Corporation, Alfa Aesar (Thermo Fisher Scientific), QuantumSphere, Inc., S&P Global, SABIC, and Norilsk Nickel (Nornickel) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Palladium Sponge Market Key Technology Landscape

The technological landscape of the Palladium Sponge Market is centered on optimizing the production process to achieve precise control over the material’s microscopic structure, which is the primary determinant of its catalytic efficiency and lifespan. Traditional methods rely heavily on chemical reduction of palladium salts (like palladium chloride) using reducing agents, followed by careful washing and drying. Current technological advancements focus on refining these precipitation techniques to produce highly uniform particle sizes, typically in the nanoscale range, and controlling the porosity (or surface area) to maximize active sites while maintaining mechanical stability. Innovations in thermal treatment and sintering processes are also critical, ensuring the sponge retains its structure under harsh reaction conditions without significant agglomeration or loss of surface area, which is vital for long-term industrial application efficiency.

A significant technological focus is the development of next-generation supported palladium sponge catalysts. While the sponge itself offers high surface area, depositing it onto inert support materials—such as activated carbon, silica, or specialized ceramic monoliths—can further enhance dispersion, prevent leaching, and improve handling characteristics, especially for use in fixed-bed reactors or continuous flow chemistry systems. Advanced surface chemistry techniques, including atomic layer deposition (ALD) and surface functionalization, are being explored to modify the electronic properties of the palladium atoms on the sponge surface, thereby enhancing catalytic selectivity towards specific target molecules, which is highly desired in the complex synthesis pathways of specialty chemicals and pharmaceuticals. This tailored engineering approach represents a crucial competitive differentiator among leading catalyst manufacturers.

Furthermore, the market relies heavily on advanced analytical and characterization technologies to ensure product quality and optimize performance. Techniques like X-ray diffraction (XRD), transmission electron microscopy (TEM), and Brunauer–Emmett–Teller (BET) surface area analysis are standard tools used to meticulously analyze crystal structure, particle morphology, and pore size distribution. The deployment of these technologies ensures that the manufactured palladium sponge meets the exacting specifications required by high-stakes industries. Beyond manufacturing, the adoption of proprietary catalyst recycling and reclamation technologies, utilizing highly efficient hydrometallurgical or pyrometallurgical processes, is a cornerstone of the market's technological footprint, ensuring cost-effective and environmentally compliant management of the material throughout its lifecycle.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by massive investments in infrastructure, rapid industrialization, and expansion of the region's chemical and pharmaceutical manufacturing capabilities, particularly in China, India, and South Korea. These nations are aggressively ramping up capacity for specialty chemical production and generic API manufacturing, requiring substantial volumes of palladium catalysts. Stricter localized environmental standards, mirroring Western regulations, are also forcing refineries and industrial sites to upgrade their processes with efficient catalytic solutions. Furthermore, the region is a major hub for electronics manufacturing, utilizing high-purity palladium sponge in the production of complex electronic components and sensing technologies. Strategic emphasis on domestic supply chain independence further fuels local production and consumption.

- North America: North America represents a mature yet high-value market, primarily characterized by stringent quality control and high demand from the pharmaceutical and advanced material sectors. The presence of leading global catalyst manufacturers and high R&D spending, particularly in academic and industrial laboratories focused on green chemistry and sustainable synthesis, drives demand for ultra-high purity grades. The region is also a key player in the development of hydrogen fuel cell technologies, positioning it for long-term growth in the purification and energy segment. High operational costs necessitate a strong focus on maximizing catalyst recycling efficiency and utilizing high-performance, long-life palladium sponge variants.

- Europe: Europe holds a significant market share, fueled by strict environmental regulations (e.g., REACH compliance) that mandate efficient pollutant reduction and clean industrial processes. The automotive industry, despite its transition phase, remains a substantial consumer, alongside a robust specialty chemical sector centered in Germany and Switzerland. European demand is characterized by a strong preference for sustainably sourced and recovered palladium, aligning with the region's strong ESG mandates. Government initiatives supporting hydrogen technology development and the circular economy further solidify Europe's importance as both a consumer and innovator in palladium sponge applications.

- Latin America (LATAM): The LATAM market exhibits moderate growth, tied predominantly to the regional petrochemical and mining sectors. Brazil and Mexico are key markets, driven by refining capacity expansion and increasing domestic demand for basic chemicals. Market development is often sensitive to commodity price fluctuations and foreign investment patterns. The primary focus for palladium sponge usage here is large-scale industrial catalysis, characterized by moderate purity requirements but high volume needs.

- Middle East and Africa (MEA): MEA is an emerging, high-potential market, largely dominated by massive planned and ongoing investments in the oil and gas sector, particularly the construction of new mega-refineries and petrochemical complexes across the Gulf Cooperation Council (GCC) nations. These facilities require extensive quantities of palladium sponge catalysts for hydrotreating, desulfurization, and specialty polymer synthesis. South Africa, being a major primary source of palladium, plays a critical role in the upstream supply chain, although regional consumption is increasingly growing alongside industrial diversification efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Palladium Sponge Market.- Johnson Matthey

- BASF SE

- Evonik Industries AG

- Heraeus Group

- Umicore N.V.

- Clariant AG

- Anglo American Platinum Ltd

- Sibanye-Stillwater

- Vale S.A.

- Metalor Technologies SA

- Tanaka Kikinzoku Kogyo K.K.

- Vineeth Precious Catalysts Pvt. Ltd.

- American Elements

- APMEX, Inc.

- Materion Corporation

- Alfa Aesar (Thermo Fisher Scientific)

- QuantumSphere, Inc.

- S&P Global

- SABIC

- Norilsk Nickel (Nornickel)

Frequently Asked Questions

Analyze common user questions about the Palladium Sponge market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Palladium Sponge and how does it differ from other palladium forms?

Palladium Sponge is a high-purity, porous form of palladium metal characterized by its high surface area. Its primary difference from solid palladium or foil is the dramatically increased number of active sites, making it an exceptionally effective, high-efficiency heterogeneous catalyst essential for hydrogenation and coupling reactions in chemical and pharmaceutical manufacturing.

Which end-use industries drive the majority of demand for high-purity Palladium Sponge?

The majority of high-purity demand stems from the Pharmaceutical and Fine Chemical industries. These sectors require palladium sponge catalysts (often 99.99% purity) for synthesizing complex Active Pharmaceutical Ingredients (APIs) and chiral molecules, where purity and precise reaction selectivity are critical regulatory requirements.

How does the volatile price of raw palladium impact the Palladium Sponge market dynamics?

The high price volatility of raw palladium is the single largest restraint, introducing significant cost uncertainty for catalyst manufacturers and end-users. This volatility accelerates investments in advanced recycling and reclamation technologies to recover metal from spent sponge, thereby reducing reliance on costly primary mined sources and stabilizing long-term supply.

What role does sustainability and the circular economy play in the future of Palladium Sponge supply?

Sustainability is critical. The circular economy model, driven by enhanced recycling technologies for spent catalysts and electronic scrap, ensures a reliable, cost-effective, and ethically sourced secondary supply. Improving recycling efficiency is vital for mitigating geopolitical supply risks and adhering to global Environmental, Social, and Governance (ESG) standards.

Is the Palladium Sponge Market affected by the global shift towards electric vehicles (EVs)?

While the transition to EVs reduces long-term demand for palladium in traditional automotive catalytic converters, the market is finding new growth drivers in the hydrogen economy, where palladium sponge is necessary for hydrogen purification membranes and handling systems related to fuel cell technology, offsetting losses in the conventional automotive sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager