Pallet Conveyor Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433319 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Pallet Conveyor Systems Market Size

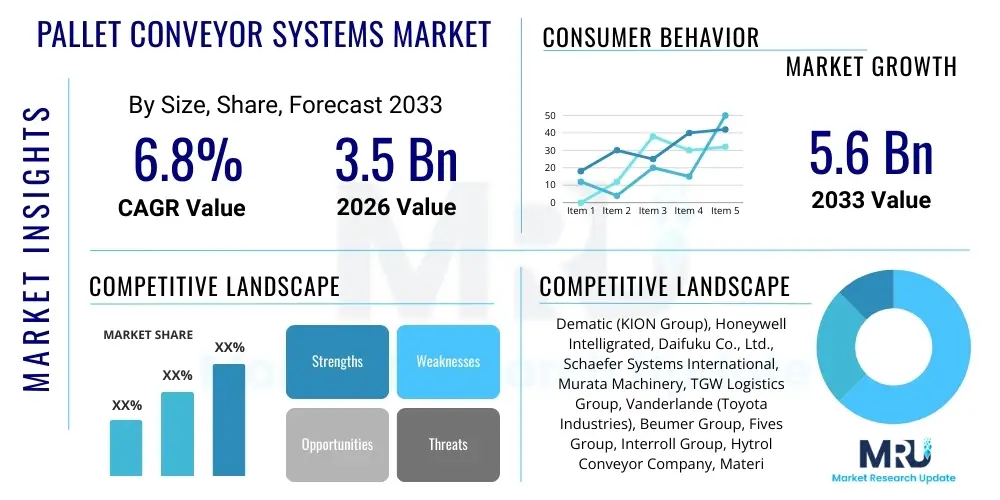

The Pallet Conveyor Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Pallet Conveyor Systems Market introduction

Pallet conveyor systems represent the backbone of automated material handling within manufacturing, distribution centers, and warehousing environments globally. These systems are specifically designed to transport large, heavy unit loads, typically standardized pallets (such as EURO pallets, standard 48x40 inch GMA pallets, or custom industrial sizes), efficiently across various stages of production or storage. The core function is to facilitate streamlined flow, minimizing manual intervention and maximizing throughput speed, which is critical for modern supply chain logistics that demand rapid, precise, and continuous movement of goods. These robust mechanical solutions are engineered for longevity and high load capacity, often forming kilometers-long networks within massive logistical complexes, acting as the critical link between various processing stations and high-bay storage solutions. The implementation of these systems is a direct response to the global pressure to reduce operational expenditure while simultaneously increasing output velocity and accuracy, making them indispensable components of any industrialized supply chain infrastructure.

The product description spans robust mechanical structures capable of handling extreme weight capacities, frequently exceeding 2,000 kilograms per pallet position, depending on the system type—roller or chain. Key physical components include heavy-duty steel or aluminum frames, precision-engineered motors (often utilizing highly efficient servomotors or geared drives), complex drive systems (shaft-mounted or decentralized), optical and proximity sensors, and sophisticated control units (PLCs). The conveying surface itself varies: powered roller conveyors use motor-driven friction elements, while chain conveyors utilize heavy-gauge continuous chains running in tracks. Major applications are concentrated in the most capital-intensive sectors: fast-moving consumer goods (FMCG) where mass production requires constant flow; automotive manufacturing for precise sequenced parts delivery; specialized high-volume electronics assembly; food and beverage processing which demands hygienic and often stainless steel construction; and large-scale e-commerce fulfillment centers where rapid sorting and dispatch of millions of items are paramount. The reliability and interoperability of these systems with other automated equipment, such as robotic arms, Automatic Guided Vehicles (AGVs), and Automated Storage and Retrieval Systems (AS/RS), defines their value proposition.

The primary benefits derived from adopting pallet conveyor systems include significant reductions in reliance on human labor for physically demanding tasks, leading to decreased operational expenditure and minimized risk of human error in sequencing and routing. Furthermore, they enhance workplace safety by minimizing manual lifting and transport of heavy, potentially unstable loads. The systems deliver remarkable improvements in overall system accuracy, traceability, and speed, crucial for meeting just-in-time (JIT) manufacturing deadlines. Driving factors fueling sustained market growth include the escalating global demand for e-commerce, which necessitates extensive investment in scalable, automated warehouses; the accelerated modernization of global logistics infrastructure; and the pervasive industrial trend towards Industry 4.0 integration. This trend demands fully interconnected and autonomous material flow solutions capable of data exchange, predictive maintenance, and autonomous decision-making across varied industrial sectors, ensuring that pallet conveyors remain a pivotal technology for achieving scalable and reliable logistical efficiency worldwide.

Pallet Conveyor Systems Market Executive Summary

The global Pallet Conveyor Systems Market is experiencing a paradigm shift, transitioning from simple transport mechanism suppliers to providers of integrated, intelligent material flow solutions. Current business trends heavily favor advanced modularity and standardization, enabling faster deployment and greater adaptability to fluctuating production requirements and seasonal demand peaks, particularly within the 3PL and e-commerce spaces. Manufacturers are increasingly focusing on developing systems with embedded diagnostics and energy management capabilities, leveraging VFDs and specialized lightweight materials to enhance performance while decreasing environmental impact and operational costs. A notable competitive strategy involves expanding service offerings, including comprehensive lifetime maintenance contracts and software updates, transforming equipment sales into long-term technology partnerships. Strategic mergers and acquisitions, where automation hardware providers acquire specialized software or robotics companies, define the current landscape, ensuring end-to-end integrated solutions are available to large enterprise clients seeking turnkey automation.

Geographically, market expansion is heavily skewed toward the Asia Pacific (APAC) region, which commands the highest growth trajectory due to aggressive infrastructure development and the rapid expansion of regional industrial giants and e-tailers. Countries such as China, Vietnam, and India are rapidly automating their vast manufacturing facilities to improve global competitiveness and meet domestic consumption spikes. While North America and Europe demonstrate slower overall growth rates due to market saturation, the demand within these regions is focused on replacement cycles, system retrofits, and high-specification advanced systems that integrate seamlessly with cutting-edge technologies like vision systems and sophisticated AS/RS towers. Investment in mature markets emphasizes enhancing existing capacity rather than building entirely new infrastructure, focusing intensely on software optimization and predictive analytics to squeeze maximum efficiency from established assets.

Segmentation analysis confirms the prominence of the powered roller conveyor segment, favored for its flexibility in handling diverse pallet weights and its compatibility with accumulation technology, crucial for buffer zones. However, the chain conveyor segment demonstrates robust resilience, particularly in niche, heavy-duty applications like raw material handling in lumber or metal processing plants. Technology-wise, the fastest growth is seen in control systems and software components. Buyers are prioritizing systems capable of bidirectional communication with enterprise software, allowing for dynamic re-routing and load balancing based on immediate operational conditions. This demand for intelligent control affirms that the value creation is migrating from mechanical robustness alone toward systemic intelligence and digital integration, transforming the conveyor system into a smart, critical node within the digital supply chain ecosystem. Custom-engineered solutions for highly complex assembly sequences, such as those found in aerospace, continue to command premium pricing and specialized market attention.

AI Impact Analysis on Pallet Conveyor Systems Market

Common user questions regarding AI’s impact on Pallet Conveyor Systems primarily revolve around improved system efficiency, predictive maintenance capabilities, and the integration of autonomous decision-making in material flow management. Users are particularly keen on understanding how AI algorithms can optimize pallet routing in real-time within complex networks, minimize bottlenecks, and dynamically adjust conveyor speeds based on anticipated load variations or upstream production schedules. Concerns often center on the complexity and cost of retrofitting existing conventional systems with advanced AI controllers and the cybersecurity risks associated with network-connected autonomous systems. Expectations are high for AI to deliver near-zero downtime through sophisticated failure prediction and condition monitoring, transforming reactive maintenance into a proactive, intelligent process within large logistical facilities.

- AI enhances predictive maintenance by analyzing sensor data (vibration, temperature, current draw) to forecast component failure, drastically reducing unscheduled downtime.

- Real-time dynamic routing optimization minimizes transit times and energy consumption by adjusting flow paths based on current congestion and priority levels.

- Machine learning algorithms improve inventory accuracy and tracking by correlating visual inspection data with RFID and sensor inputs.

- Automated fault detection and diagnosis via computer vision and acoustic analysis reduce manual inspection labor.

- AI-driven energy management optimizes motor speeds and operational cycles based on throughput demand, yielding substantial power savings.

- Integration with warehouse management systems (WMS) allows for intelligent buffering and sequencing, crucial for just-in-time (JIT) manufacturing environments.

- Enables collaborative robotics (cobots) to interface smoothly with conveyor systems for seamless pick-and-place or pallet wrapping tasks.

- Facilitates anomaly detection in pallet loading and integrity, ensuring compliance with shipping standards before transport.

DRO & Impact Forces Of Pallet Conveyor Systems Market

The market dynamics are defined by a strong set of drivers centered on the imperative for operational efficiency and labor reduction across industrialized economies. The rapid proliferation of e-commerce platforms mandates robust, high-speed internal logistics capable of 24/7 operation, making automated pallet conveyors essential infrastructure. Simultaneously, the global shortage of skilled warehouse labor and the rising cost of manual operations provide a compelling economic justification for capital investment in automated material handling solutions. These drivers are further amplified by governmental pushes for safer workplaces, reducing liability and increasing the attractiveness of automated systems that minimize human interaction with heavy machinery, thereby promoting continuous system upgrades and modernization across sectors.

Restraints, however, temper this growth trajectory. The initial capital outlay required for implementing comprehensive, large-scale pallet conveyor systems remains prohibitively high for small and medium-sized enterprises (SMEs), often necessitating extended payback periods and complex financing structures. Furthermore, the complexity inherent in integrating new automated systems with legacy infrastructure presents significant technical and operational challenges, requiring highly specialized engineering expertise and substantial downtime during the transition phase. The lack of standardization in pallet dimensions across some emerging markets, coupled with the need for specialized environmental controls in industries like cold chain or hazardous chemicals, also complicates the design and deployment process, demanding customized and costly solutions rather than off-the-shelf standardized equipment, thus limiting immediate scale adoption.

Opportunities for expansion lie predominantly in modularity, technological convergence, and service-based models. The development of flexible, scalable conveyor sections allows companies, particularly SMEs, to start small and expand their automation footprint incrementally, democratizing access to these advanced technologies. Moreover, the integration of IoT sensors, machine vision systems, and sophisticated control software (Industry 4.0 integration) creates new value propositions, moving the market beyond simple transport solutions toward intelligent, fully traceable logistics platforms. The increasing adoption of rental or Robotics-as-a-Service (RaaS) models for material handling equipment also lowers the barrier to entry, particularly in developing regions, serving as a critical market opportunity for vendors capable of offering subscription-based utilization rather than outright purchase.

- Drivers:

- Surging growth in e-commerce and logistics sector volumes demanding high throughput.

- Increasing labor costs and persistent shortage of skilled manual labor globally.

- Strong industry focus on improving operational throughput and efficiency (OEE).

- Regulatory pressure emphasizing workplace safety and ergonomic improvements, favoring automation.

- Restraints:

- High initial capital investment and complex installation processes requiring long payback periods.

- Challenges associated with integrating new systems with existing legacy infrastructure and potential downtime.

- Vulnerability to global supply chain disruptions affecting specialized electronic component availability.

- Opportunities:

- Development of flexible, modular, and energy-efficient conveyor systems.

- Rising adoption of IoT and AI for predictive maintenance, remote diagnostics, and smart routing.

- Expansion into emerging economies investing heavily in modern warehousing infrastructure.

- Growing interest in rental and leasing models (RaaS) for automation equipment to lower entry barriers.

Segmentation Analysis

The Pallet Conveyor Systems Market is extensively segmented based on the type of conveyor, the function it performs, the end-use industry utilizing the system, and the physical location of deployment. This multi-dimensional segmentation is crucial for understanding specific market niches and technological preferences. The mechanical design, whether based on chains, gravity rollers, powered rollers, or specialized belts, dictates the system's capacity, achievable speed, and suitability for different environmental conditions (e.g., high humidity, corrosive agents, or temperature extremes). Functional segmentation highlights specialized applications such as accumulation, which manages inventory flow buffers for upstream processing, versus basic conveyance, which provides long-distance movement between fixed points. These differentiations are paramount for vendors designing tailored material handling solutions optimized for specific client logistical bottlenecks.

From an industrial perspective, the end-use segmentation is dominated by highly automated sectors, particularly food and beverage, which requires stringent hygienic design, rapid throughput, and often continuous operation in temperature-controlled zones, and the automotive industry, which depends absolutely on precise sequencing and robust equipment for heavy component delivery to assembly lines. The pharmaceuticals sector is also a significant consumer, driven by stringent traceability requirements (regulatory compliance) and the need for controlled environments to protect sensitive products. The choice of conveyor type is often dictated by the characteristics of the load, such as stability, footprint variability, and weight distribution. For example, heavy-duty applications in primary manufacturing generally favor robust chain conveyors due to their torque capacity, while diverse, high-mix distribution centers typically rely on versatile powered roller systems for greater flexibility and speed.

The increasing complexity of modern logistics necessitates systems that can interface seamlessly with sophisticated control infrastructure. Therefore, segmentation by component and technology reveals a strong and growing demand for sophisticated sensors, high-speed programmable logic controllers (PLCs), advanced motor controls (VFDs), and supervisory control and data acquisition (SCADA) systems. The market for controls and software is growing significantly faster than the traditional mechanical hardware segment, indicating that intelligence, connectivity, and data processing capabilities are now the key decision factors for large buyers focused on operational visibility and predictive performance. Furthermore, highly customized engineered systems, designed specifically for unique facility constraints, challenging gradients, or specialized transfer requirements, command significantly higher price points and represent a substantial and technically demanding portion of the total market value compared to standardized modular offerings.

- By Conveyor Type:

- Roller Conveyors (Powered Roller Conveyors, Zero Pressure Accumulation (ZPA) Conveyors, Gravity Roller Conveyors)

- Chain Conveyors (Double Chain Conveyors, Triple Chain Conveyors, Multi-Strand Systems)

- Slat/Belt Conveyors (Heavy Duty Belt Conveyors, Inclined/Declined Systems)

- Modular Plastic Belt Conveyors (For specific hygiene/washdown environments)

- Specialty Conveyors (Overhead Pallet Systems, Vertical Reciprocating Conveyors (VRCs), Turntables)

- By Function:

- Transportation (Basic point-to-point movement, Long-haul transport)

- Accumulation (Buffering, sequencing, and metering of flow)

- Sorting and Diverting (Utilizing pop-up transfers or side-pushes)

- Transfer and Lifting (Shuttle carts, Vertical transfers, and right-angle transfers)

- By End-Use Industry:

- Food and Beverage (Including Cold Chain Logistics and Brewing)

- Automotive and Aerospace (Component sequencing and assembly lines)

- E-commerce and Retail Distribution Centers (High-throughput fulfillment)

- Pharmaceuticals and Healthcare (Controlled environments and traceability)

- Chemicals and Petrochemicals (Hazardous and heavy bulk handling)

- Manufacturing and Heavy Industry (Metalworking, Paper and Pulp)

- By Component:

- Mechanical Components (Frames, Rollers, Chains, Bearings, Drives)

- Electrical and Control Systems (PLCs, Sensors, HMI, Variable Frequency Drives (VFDs))

Value Chain Analysis For Pallet Conveyor Systems Market

The value chain for pallet conveyor systems commences with upstream activities focusing intensely on the sourcing and precision manufacturing of raw materials and specialized components. This involves the procurement of high-grade, often corrosion-resistant steel and structural aluminum for frames and supports, specific engineered plastics for modular belts, and sophisticated electrical components such as high-efficiency motors, robust industrial bearings, and complex sensor arrays compliant with industrial safety standards. Key upstream challenges involve ensuring the consistent quality and dimensional accuracy of custom fabricated metal parts and managing the increasingly volatile supply stability of electronic components essential for modern automation features like IoT connectivity. Optimization at this initial stage is mission-critical, as superior material quality dictates system longevity and reliability, while efficient material sourcing minimizes costs which often represent a significant portion of the final system price, driving fierce competition among specialized component suppliers.

Midstream activities encompass the core manufacturing, bespoke system design, and complex integration assembly processes. This stage requires significant specialized engineering expertise to design systems tailored not only to specific client floor plans and capacity requirements but also to integrate with existing legacy operational infrastructure. Leading manufacturers leverage advanced digital tools, including Computer-Aided Design (CAD), sophisticated finite element analysis (FEA), and emulation software to accurately model dynamic performance, detect potential mechanical stress points, and identify logistical bottlenecks before physical construction commences. The physical assembly involves the precise integration of heavy mechanical structures, motorization elements, safety interlocking systems, and the intricate wiring of centralized and decentralized control panels. Value addition here is highly concentrated in modularity, allowing for pre-testing of sub-assemblies and quicker, less disruptive installation time at the customer site, a key metric for minimizing client operational downtime.

Downstream analysis highlights the critical functions of distribution, highly specialized installation, rigorous integration with client software, and comprehensive post-sales maintenance and support. Distribution often utilizes a hybrid model: direct sales teams are engaged for negotiating large, complex, fully customized projects, while a network of authorized system integrators or distributors handles standardized modular solutions and local installations. System integration is arguably the most critical value-add service in the downstream chain, ensuring the new conveyor infrastructure interfaces flawlessly and exchanges data reliably with existing Warehouse Management Systems (WMS), Enterprise Resource Planning (ERP) platforms, and other third-party automation equipment such as sorting machines or AS/RS. Direct channels maximize control over intellectual property and the high-margin revenue derived from long-term service contracts and software updates, whereas indirect channels provide essential local market knowledge, specialized installation teams, and rapid-response maintenance capabilities across wide geographical areas.

Pallet Conveyor Systems Market Potential Customers

The core customer base for pallet conveyor systems spans a highly diverse range of industries that share a critical reliance on moving substantial quantities of standardized, heavy unit loads efficiently, rapidly, and repetitively. These end-users are typically large-scale operations focused intensely on optimizing high-volume production or throughput metrics. Primary potential customers are the major players in the logistics and distribution sector, notably sophisticated third-party logistics (3PL) providers managing complex client supply chains, and large domestic and international retail chains (including grocery and big-box stores) that operate expansive fulfillment, regional distribution, and cross-docking centers. For these clients, the foundational requirement is the ability to rapidly and reliably process thousands of pallets per shift without human intervention or error, making modern automated conveyors an indispensable, strategic capital investment essential for maintaining competitive delivery timelines.

Beyond the core logistics sector, the manufacturing industry represents an equally crucial and technically demanding customer segment. The automotive industry is a prime example, requiring ultra-precise, synchronous delivery of heavy powertrain components and large assemblies on pallets directly to tightly scheduled assembly line stations (often termed Just-In-Sequence or JIT/JIS delivery). Similarly, the food and beverage sector, including large commercial bakeries, breweries, dairies, and soft drink bottlers, constitutes massive buyers, driven by the dual needs of high-speed case and pallet handling and compliance with strict hygiene regulations. These buyers specifically prioritize robust systems offering high sanitation capabilities, exceptional uptime, and often seek corrosion-resistant stainless steel or specialized polymeric solutions suitable for frequent high-pressure wash-down environments, ensuring continuous production flow under challenging conditions.

Emerging high-growth buyer segments include highly regulated industries such as pharmaceutical manufacturers and the chemicals industry. Pharmaceutical companies require controlled, validated internal transport for sensitive, high-value products, necessitating systems with advanced tracking and tamper-evident capabilities to meet regulatory validation requirements. The chemical industry, conversely, often deals with extremely heavy or potentially hazardous chemical loads, requiring specialized, heavy-duty chain conveyors and advanced safety interlocks. Furthermore, any new facility or significant expansion project undertaken to accommodate growth in automation, regardless of the industry—be it a new regional distribution center, a modernization project in an older factory, or the establishment of a greenfield facility—is automatically a high-potential customer, seeking comprehensive, future-proof, turnkey material handling packages that utilize robust pallet conveyors as the non-negotiable foundational transport layer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dematic (KION Group), Honeywell Intelligrated, Daifuku Co., Ltd., Schaefer Systems International, Murata Machinery, TGW Logistics Group, Vanderlande (Toyota Industries), Beumer Group, Fives Group, Interroll Group, Hytrol Conveyor Company, Material Handling Systems (MHS), Bastian Solutions (Toyota Advanced Logistics), Kardex Group, Conveyor Systems Ltd (CSL), DMW&H, Siemens Logistics, Continental Conveyor & Equipment, System Logistics, Shuttleworth LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pallet Conveyor Systems Market Key Technology Landscape

The technological evolution of pallet conveyor systems is intricately linked to the broader principles of Industry 4.0, emphasizing connectivity, intelligence, and adaptability. Central to this transformation is the adoption of highly advanced decentralized control systems, often utilizing modern fieldbus protocols like Profinet, EtherNet/IP, or Power and Free systems, replacing older, complex point-to-point wiring architectures. This fundamental shift allows for significantly faster system commissioning, highly accurate real-time diagnostics, and greater flexibility in modifying system layouts or operational parameters without extensive physical rewiring or control panel adjustments. Furthermore, the integration of advanced sensors—including high-resolution laser profilers for automatic pallet dimensioning, sophisticated vision systems for load integrity checks, and high-precision encoders—provides unparalleled real-time data feedback on material flow, which is crucial for operational visibility and optimization.

A major and continuous focus for research and development remains on enhancing energy efficiency, driven by both the need to drastically reduce operating expenses (a key component of Total Cost of Ownership) and to comply with increasingly strict global environmental sustainability mandates. This is realized through the widespread deployment of the highest efficiency class motors, particularly IE4 and IE5 rated permanent magnet synchronous motors, combined with sophisticated intelligent Variable Frequency Drives (VFDs) that allow motor torque and speed to be adjusted precisely and dynamically according to the actual load weight and immediate flow requirement, completely avoiding unnecessary full-speed or fixed-rate operation. The continuous refinement of Zero Pressure Accumulation (ZPA) technology further conserves energy by effectively powering down specific conveyor zones when no load is present or when a buffer is full, a critical optimization feature in long, complex conveyor lines with highly variable queuing requirements.

The contemporary pallet conveyor system is fundamentally conceived not as an isolated mechanical asset but as a critical, interconnected component of a hybrid automation ecosystem. Technological advancements focus heavily on making these systems natively compatible with other automated material handling equipment, often referred to as system interoperability. This includes the development of standardized, automated transfer interfaces that allow pallets to be seamlessly loaded onto or received from Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), high-bay Automated Storage and Retrieval Systems (AS/RS), or highly automated stretch wrapping machinery with high-degree precision. Communication protocols are standardized across the facility to facilitate reliable, high-speed data exchange regarding load identification (using RFID or QR codes), destination coordinates, and sequencing status, usually orchestrated by a centralized Warehouse Control System (WCS) or a Manufacturing Execution System (MES). This integration capability ensures that new installations are robustly future-proofed, ready to adapt efficiently to emerging robotic technologies and the most demanding logistical scenarios, such such as dynamic sequencing for hyper-personalized e-commerce orders or highly flexible batch-of-one manufacturing processes.

Regional Highlights

Regional dynamics play a crucial role in shaping the Pallet Conveyor Systems market, largely influenced by varying levels of industrial maturity, local labor costs, technological adoption rates, and governmental investment in infrastructure and automation initiatives. The demand profile and preferred technology often differ significantly between mature Western markets and rapidly industrializing regions.

- Asia Pacific (APAC): This region is universally identified as the fastest-growing market globally, underpinned by massive industrialization efforts, rapidly expanding manufacturing bases (particularly in consumer electronics, automotive parts, and apparel), and the explosive growth of the domestic e-commerce sector across nations like China, India, Japan, and South Korea. High population density coupled with rising middle-class consumerism necessitates the immediate establishment of larger, highly automated distribution and fulfillment centers. Government initiatives promoting smart manufacturing (e.g., Made in China 2025) and logistical efficiency further accelerate the wholesale adoption of new, high-throughput conveyor systems, often prioritizing speed and capacity over initial complexity.

- North America: Representing a highly mature and technologically advanced market, North America maintains strong and consistent demand driven primarily by continuous modernization, high labor costs, and ongoing optimization efforts within massive retail, pharmaceutical, and 3PL warehousing operations. The critical economic pressure from high wages provides an extremely strong financial incentive for large-scale automation investments and rapid ROI. Investment is heavily focused on implementing advanced software integration (WMS/WES systems), complex sortation solutions, and the implementation of AI-driven predictive maintenance protocols to maximize the operational lifespan and reliability of existing infrastructure.

- Europe: The European market is characterized by stringent regulatory standards concerning workplace safety, environmental impact, and energy efficiency, compelling the adoption of high-quality, sustainable conveyor solutions. Demand is particularly robust across Central and Western Europe (Germany, France, Benelux, UK), especially in automotive production, complex food and beverage processing, and general manufacturing sectors. European companies frequently invest in highly customized and modular systems capable of precise integration into older, established factory buildings, focusing intensely on balancing high efficiency output with the physical limitations posed by existing limited floor space and infrastructure constraints.

- Latin America (LATAM): Growth in LATAM is deemed promising but generally proceeds at a moderate pace, primarily concentrated in industrialized economic centers like Brazil, Mexico, and Chile, directly linked to foreign investment, industrial expansion, and burgeoning domestic e-commerce activities. The market often exhibits a tendency to favor less complex, more cost-effective systems initially. However, increasing regional competition and the entry of global 3PL players are rapidly driving the need for higher levels of automation in strategic logistical hubs near major population centers. Investment in this region remains sensitive to economic stability and currency fluctuations, often leading to phased, incremental automation projects.

- Middle East and Africa (MEA): The MEA market is undergoing foundational growth, particularly in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) due to ambitious economic diversification plans and major infrastructure mega-projects focused on developing world-class logistics and transit hubs. Investment is concentrated in sectors like oil and gas downstream operations (requiring explosion-proof/heavy-duty conveyors), large-scale food supply chain modernization, and the establishment of new retail fulfillment operations, requiring robust, heavy-duty conveyor solutions capable of operating reliably and effectively in the region's characteristically harsh and extreme environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pallet Conveyor Systems Market.- Dematic (KION Group)

- Honeywell Intelligrated

- Daifuku Co., Ltd.

- Schaefer Systems International

- Murata Machinery

- TGW Logistics Group

- Vanderlande (Toyota Industries)

- Beumer Group

- Fives Group

- Interroll Group

- Hytrol Conveyor Company

- Material Handling Systems (MHS)

- Bastian Solutions (Toyota Advanced Logistics)

- Kardex Group

- Conveyor Systems Ltd (CSL)

- DMW&H

- Siemens Logistics

- Continental Conveyor & Equipment

- System Logistics

- Shuttleworth LLC

- Alvey Group

- Lauyans & Company

Frequently Asked Questions

Analyze common user questions about the Pallet Conveyor Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Pallet Conveyor Systems Market?

The primary drivers include the exponential growth in global e-commerce necessitating highly automated fulfillment centers, the pressing need to offset rising operational costs stemming from chronic labor shortages, and widespread industrial adoption of Industry 4.0 standards requiring fully integrated, high-throughput material handling solutions in advanced manufacturing and logistics.

How does Zero Pressure Accumulation (ZPA) technology improve pallet handling efficiency?

ZPA technology utilizes sophisticated sensors and decentralized electronic controls to ensure conveyed pallets never physically touch during accumulation or queuing. This process prevents product damage, minimizes conveyor wear and noise, and significantly reduces energy consumption by allowing conveyor motor sections to operate only when actively needed for transport, thereby optimizing overall flow management.

Which industry segment is the largest end-user of pallet conveyor systems and why?

The E-commerce and Retail Distribution Centers segment, often integrated with Third-Party Logistics (3PL) providers, typically constitutes the largest end-user base globally. These sectors require rapid, continuous processing and exceptionally high-volume movement of standardized palletized goods to meet strict customer delivery deadlines, driving persistent, substantial investments in automation infrastructure.

What are the main operational differences and optimal use cases between Roller and Chain pallet conveyor systems?

Powered Roller conveyors offer superior flexibility, quiet operation, and are ideal for accumulation (ZPA) and general medium-to-heavy-duty handling in distribution environments. Chain conveyors, conversely, are extremely robust, offer high torque, and are preferred for moving very heavy, unstable, or non-standard pallets in harsh environments like automotive assembly, beverage bottling, or primary metal processing plants where durability is paramount.

What role does AI and IoT integration play in modern pallet conveyor operations and maintenance?

AI integrates into modern systems by enabling predictive maintenance through the analysis of IoT sensor data (vibration, current draw) to forecast component failure, drastically minimizing unscheduled downtime. Furthermore, AI optimizes real-time routing and sequencing, adjusting flow rates dynamically to eliminate bottlenecks and ensure the highest possible efficiency and throughput.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager