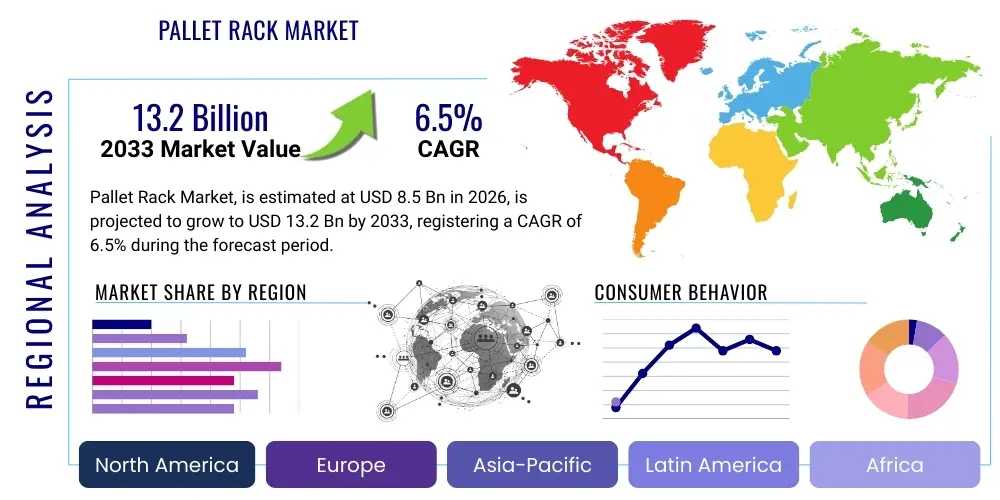

Pallet Rack Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438776 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pallet Rack Market Size

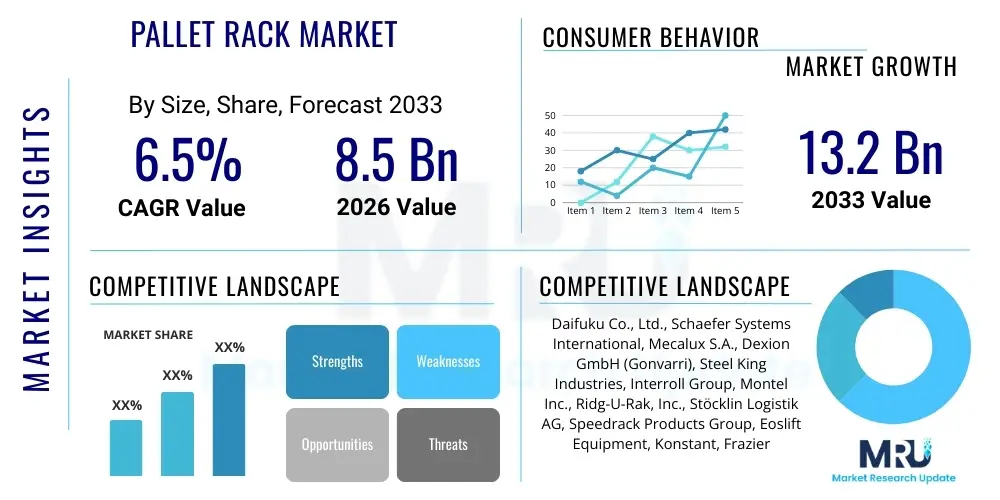

The Pallet Rack Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $13.2 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the continuous global surge in e-commerce activities, necessitating highly efficient and space-optimized warehousing solutions across logistics and retail sectors. The imperative for maximizing vertical storage capacity and improving throughput efficiency remains a central growth catalyst, pushing adoption rates of advanced racking systems like automated and high-density solutions.

Pallet Rack Market introduction

The Pallet Rack Market encompasses the manufacturing, distribution, and installation of various systems designed for the systematic storage of materials, typically unitized on pallets, within warehouses, distribution centers, and manufacturing facilities. These systems are fundamental components of modern supply chain infrastructure, crucial for optimizing floor space, improving inventory accessibility, and ensuring worker safety. Pallet racks, which range from basic selective racks to complex automated storage and retrieval systems (AS/RS) compatible structures, serve as the backbone for efficient material handling operations globally. The principal goal is to provide maximum storage density while maintaining selective access to stock keeping units (SKUs).

Product categories within this market include selective racks, drive-in/drive-thru racks, push back racks, flow racks (gravity and dynamic), and cantilever racks, each tailored to specific storage requirements, inventory turnover rates, and facility layouts. Major applications span across third-party logistics (3PL) providers, retail and wholesale distribution, food and beverage cold storage, automotive manufacturing, and general industrial warehousing. The critical benefit derived from these systems is enhanced operational efficiency, achieved through reduced labor costs, minimization of product damage, and faster inventory cycles, directly addressing the complexities introduced by modern omnichannel distribution models.

Key driving factors accelerating market expansion include rapid urbanization and globalization, which amplify the demand for timely delivery and require larger, more sophisticated storage infrastructure. The explosive growth of the e-commerce sector, characterized by high volume and diverse SKU counts, compels businesses to invest heavily in advanced, high-density racking solutions to manage fluctuating inventory levels efficiently. Furthermore, regulatory mandates concerning warehouse safety and ergonomic standards also drive the replacement or upgrading of older, less compliant racking systems, ensuring sustained market activity throughout the forecast period.

Pallet Rack Market Executive Summary

The Pallet Rack Market is experiencing transformative business trends characterized by a significant shift towards automation and high-density storage solutions, moving away from traditional selective racking in large-scale operations. Investment in systems compatible with Autonomous Mobile Robots (AMRs) and Automated Storage and Retrieval Systems (AS/RS) is increasing rapidly, driven by rising labor costs and the need for 24/7 operational capability. Manufacturers are focusing on modular and scalable designs that offer flexibility to adapt to seasonal demand fluctuations and changing product portfolios. Furthermore, sustainability considerations are prompting the use of recycled materials and optimized structural designs that reduce the overall material footprint while maximizing load-bearing capacity, influencing procurement decisions among major end-users.

Regionally, North America and Europe remain mature markets characterized by substantial replacement demand and the adoption of cutting-edge warehouse automation technologies, driven by high consumer expectations for rapid fulfillment. Conversely, the Asia Pacific region (APAC), particularly emerging economies like India and China, demonstrates the highest growth potential due to massive infrastructure development, burgeoning manufacturing sectors, and the nascent but accelerating maturity of e-commerce logistics networks. These regions are prioritizing scalable, cost-effective racking solutions for newly constructed mega-warehouses. The Middle East and Africa (MEA) are also showing promising growth, primarily supported by significant government investments in logistics hubs and free trade zones designed to enhance global trade connectivity.

Segment trends highlight the dominance of selective racking systems in terms of installed base, but dynamic systems (such as Push Back and Pallet Flow) are exhibiting faster revenue growth due to their superior density and FIFO/LIFO capabilities, essential for perishable goods and high-turnover inventory. Among end-users, the 3PL sector represents the largest consumer segment, continuously investing in flexible racking configurations to serve diverse client needs. Technology integration, specifically the pairing of racking structures with advanced Warehouse Management Systems (WMS) and Internet of Things (IoT) sensors for structural monitoring and inventory tracking, is defining the competitive edge, enabling predictive maintenance and real-time inventory visibility across all major market segments.

AI Impact Analysis on Pallet Rack Market

Common user questions regarding AI's impact on the Pallet Rack Market often revolve around optimizing layout design, predicting structural stress failures, and integrating racking systems seamlessly with AI-driven material handling equipment. Users frequently inquire: "How can AI optimize warehouse layout geometry to maximize pallet density?", "Will AI-powered structural health monitoring systems replace traditional inspection methods?", and "What data insights can AI extract from racking operations to improve throughput?" Based on these concerns, users anticipate that AI will fundamentally shift pallet rack deployment from static installation to dynamic, data-driven infrastructure. Key themes include the use of machine learning algorithms for demand forecasting, which directly dictates optimal rack type and density requirements, and the employment of computer vision systems integrated into robotic systems to ensure accurate placement and retrieval, significantly reducing rack damage and increasing safety protocols. Furthermore, predictive maintenance powered by AI is expected to minimize costly downtime associated with structural issues.

- AI algorithms analyze throughput data, inventory profiles, and order frequencies to recommend optimal rack type, depth, and layout density, maximizing storage utilization and operational flow before physical construction begins.

- Machine learning models integrate with IoT sensors embedded in rack structures to monitor stress, load distribution, and deflection in real-time, enabling predictive maintenance schedules and preventing catastrophic structural failures.

- AI-powered computer vision systems enhance safety by monitoring forklift and material handler interaction with the racks, identifying potential collision risks and ensuring adherence to operational safety zones.

- Integration with AI-driven Automated Storage and Retrieval Systems (AS/RS) allows for adaptive slotting strategies, where AI continuously reorganizes inventory placement within the racks based on real-time order velocity and access requirements.

- Optimization of energy consumption in climate-controlled warehouses (e.g., cold storage) by recommending rack configurations that minimize air circulation inefficiencies, directly impacting operational expenditure.

- AI facilitates the digital twin modeling of entire warehouse environments, allowing operators to simulate the impact of new racking installations or reconfigurations on overall system performance and throughput capacity.

DRO & Impact Forces Of Pallet Rack Market

The Pallet Rack Market is heavily influenced by a nexus of supply chain modernization drivers, significant capital investment constraints, and technological opportunities stemming from the automation wave. The primary drivers—the sustained boom in global e-commerce and the associated demand for rapid fulfillment and last-mile delivery infrastructure—compel companies to continuously upgrade warehousing capabilities, focusing on density and speed. However, substantial restraints exist, notably the high initial capital expenditure required for sophisticated automated racking systems (e.g., AS/RS compatible structures) and the challenge of finding specialized labor for installation, inspection, and maintenance of complex configurations. The primary opportunities lie in the integration of racking systems with advanced technologies like IoT sensors and robotics, transitioning racks from passive storage units into active, smart components of the automated warehouse ecosystem.

Impact forces currently reshaping the market trajectory include the shift towards omni-channel logistics, which necessitates highly flexible racking solutions capable of handling both full-pallet loads and split-case picking efficiently within the same facility. Furthermore, evolving government safety standards, particularly in high-growth industrial regions, impose stricter requirements on load testing, design, and earthquake resistance, driving demand for premium, certified racking systems. The increasing focus on labor safety and ergonomics also accelerates the adoption of semi-automated systems that reduce manual lifting and reaching, thereby enhancing overall operational resilience and minimizing liability risks for warehouse operators.

The dynamic nature of global trade and supply chain volatility, exemplified by recent geopolitical disruptions, places increased importance on inventory buffer stocks, which requires expanded, highly dense storage capabilities. This macro-economic force pushes end-users, particularly in manufacturing and food and beverage sectors, to seek maximal storage footprint solutions, such as Very Narrow Aisle (VNA) systems and double-deep racking, counterbalancing the high real estate costs associated with expansion. Successful market penetration relies increasingly on providing integrated solutions encompassing the rack structure, material handling equipment (MHE), and the associated software infrastructure, positioning solution providers as strategic partners rather than just equipment suppliers.

Segmentation Analysis

The Pallet Rack Market segmentation provides a granular view of market dynamics based on the structural type, load handling characteristics, material composition, and the diverse end-use industries served. Understanding these segments is critical for manufacturers to tailor their product offerings to specific operational needs, such as high-density requirements in cold storage or high selectivity needs in general merchandise distribution. The selective rack segment, while mature, continues to dominate the volume market due to its low cost, versatility, and 100% SKU accessibility, making it the standard choice for low-volume, high-SKU operations. However, segments focusing on density, such as push back and drive-in racks, are witnessing accelerated growth, driven by sectors requiring maximizing footprint utilization like 3PL and manufacturing. The increasing adoption of high-strength steel and hybrid structures (e.g., combining steel racking with automated systems) signifies a shift toward durability and compatibility with advanced MHE. End-user classification reveals that the 3PL sector is the most significant consumer, continuously updating its infrastructure to support diverse client requirements, followed closely by the fast-moving consumer goods (FMCG) and retail sectors.

- By Type:

- Selective Pallet Racks (Single and Double Deep)

- Drive-In and Drive-Thru Racks

- Push Back Racks

- Pallet Flow Racks (Gravity Flow)

- Cantilever Racks

- Mobile Pallet Racks (Compactors)

- Automated Storage and Retrieval System (AS/RS) Compatible Racks

- Very Narrow Aisle (VNA) Racks

- By Material:

- Steel Racks

- Aluminum Racks

- Hybrid Systems

- By Loading Capacity:

- Light Duty (Up to 500 kg/pallet)

- Medium Duty (500 kg to 1500 kg/pallet)

- Heavy Duty (Above 1500 kg/pallet)

- By End-Use Industry:

- 3PL and Logistics

- Retail and E-commerce

- Food and Beverage (Including Cold Storage)

- Manufacturing (Automotive, Heavy Machinery)

- Pharmaceutical and Healthcare

- Paper and Pulp

Value Chain Analysis For Pallet Rack Market

The value chain for the Pallet Rack Market starts with upstream suppliers providing critical raw materials, primarily high-strength steel (hot-rolled and cold-formed), often sourced from specialized mills adhering to strict structural specifications. Key upstream activities include metallurgy, material testing, and coating processes (e.g., powder coating for corrosion resistance). Manufacturers then engage in core activities such as design engineering (CAD/CAM), automated rolling, welding, and fabrication of uprights, beams, and accessories. Efficiency in this stage relies heavily on high-volume manufacturing capabilities and adherence to RMI standards. A significant value-add step involves customization and modularization to meet specific client specifications, particularly for seismic zones or unique material handling requirements.

The distribution channel is characterized by a blend of direct sales (especially for large, complex automated warehouse projects) and indirect distribution through a network of specialized material handling distributors, dealers, and system integrators. System integrators play a vital role as they often combine the racking structure with conveyor systems, automated vehicles, and WMS software, offering a holistic solution to the end-user. Direct sales are typically preferred by large 3PL companies or multinational retailers requiring standardized global installations. Indirect channels allow manufacturers to reach small and medium enterprises (SMEs) requiring standard or semi-customized solutions, relying on the distributor's regional expertise for installation and post-sales support.

Downstream activities center on installation, commissioning, inspection, and lifecycle maintenance. The installation process is highly specialized, demanding precision and adherence to strict safety protocols, often requiring certified installation teams. Post-installation, periodic safety inspections, load rating verification, and repair services constitute a stable revenue stream. The trend toward sophisticated, integrated systems has intensified the need for specialized training and maintenance contracts, further enhancing the downstream value capture for solution providers. Optimization of the value chain is increasingly focusing on reducing lead times for customized components and improving logistical efficiency in transporting bulky, fabricated steel components to the installation site.

Pallet Rack Market Potential Customers

The potential customers for the Pallet Rack Market are defined by any enterprise involved in large-scale storage, distribution, or manufacturing that requires systematic inventory management and space optimization. The dominant customer segment remains Third-Party Logistics (3PL) providers, who are constantly under pressure to enhance storage density and flexibility to meet diverse client demands, often leading them to adopt multi-functional, modular racking systems like VNA and AS/RS compatible structures. Their business model necessitates frequent updates and expansion, ensuring continuous demand for sophisticated solutions and related services.

Another rapidly expanding customer base is the E-commerce and Retail sector, encompassing both major big-box retailers establishing regional distribution centers (DCs) and pure-play online retailers building fulfillment networks. These buyers require high throughput racking systems, such as pallet flow and carton flow racks, to manage fast-moving, fragmented inventory orders efficiently. The need for rapid scalability during peak seasons makes flexible, quickly deployable solutions highly attractive to this segment, driving investment in automated racking infrastructure integrated with advanced picking technologies.

Furthermore, the Manufacturing sector, particularly automotive, electronics, and heavy machinery, constitutes a significant customer segment. These industries require heavy-duty, customized racking, often cantilever or structural steel racks, to manage large, non-standard components, raw materials, and finished goods inventories. Food and Beverage companies, especially those dealing with frozen or refrigerated products, are critical consumers of high-density, cold-storage-grade racking (often using specialized coatings and push back systems) where maximizing cube utilization and resisting corrosion are paramount purchasing criteria. The demand profile across these sectors is unified by the need for safety, durability, and integration capabilities with their existing or planned automation strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $13.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daifuku Co., Ltd., Schaefer Systems International, Mecalux S.A., Dexion GmbH (Gonvarri), Steel King Industries, Interroll Group, Montel Inc., Ridg-U-Rak, Inc., Stöcklin Logistik AG, Speedrack Products Group, Eoslift Equipment, Konstant, Frazier Industrial Company, Unarco Material Handling, ATOX Sistemas de Almacenaje |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pallet Rack Market Key Technology Landscape

The technological landscape of the Pallet Rack Market is rapidly evolving from simple structural engineering to a highly integrated component of the smart warehouse ecosystem. The foundational technology remains the utilization of high-tensile, cold-formed steel (HSS) and advanced welding techniques to ensure structural integrity and load-bearing performance compliant with stringent international codes like RMI (Rack Manufacturers Institute) and FEM (Federation Europeenne de la Manutention). However, the major technological innovation now centers on compatibility and integration with Automated Storage and Retrieval Systems (AS/RS). These dedicated AS/RS racks require exceptionally tight dimensional tolerances, high durability, and precision anchoring to support the dynamic movements and high speeds of automated cranes and shuttles, minimizing vibration and ensuring safety throughout intensive operational cycles.

A second critical technology trend is the adoption of Internet of Things (IoT) sensors and structural health monitoring (SHM). These sensors, often integrated directly into uprights and beams, continuously monitor load variations, temperature fluctuations (critical in cold storage), and impact events (collisions from forklifts). Data collected through these SHM systems are processed to provide real-time condition assessments, enabling proactive maintenance rather than reactive repairs. This technology significantly extends the operational lifespan of the racking system and ensures continuous compliance with safety regulations, making it a key differentiating factor for premium rack manufacturers.

Furthermore, technology is enhancing density through innovative mobile and dynamic systems. Mobile racking technology involves heavy-duty bases that move entire rows of racks along rails, eliminating non-productive aisles and increasing storage density by up to 90% compared to conventional selective racks. This is complemented by advanced Warehouse Management Systems (WMS) that interface directly with dynamic racks (e.g., controlling the push-back mechanisms or tracking inventory slots in flow racks), optimizing put-away and retrieval strategies. The focus on modular design using advanced laser-cutting and boltless assembly techniques facilitates faster installation and easier reconfiguration, which is essential for agile warehouse operations responding to fluctuating market demands and product cycles.

Regional Highlights

- North America: This region holds a dominant market share, primarily driven by massive investments in automation spurred by high labor costs and the established presence of global e-commerce giants. The market here is characterized by high demand for sophisticated AS/RS compatible structures, mobile racking, and rigorous structural safety standards (RMI compliance). Replacement and modernization of existing infrastructure represent significant recurring revenue opportunities.

- Europe: Europe is a mature market focusing heavily on sustainability, safety, and efficient space utilization, particularly due to high land costs. Growth is robust in specialized segments like cold chain logistics and pharmaceuticals, necessitating advanced, corrosion-resistant, high-density systems like push back and gravity flow racks. Germany, the UK, and France are key contributors, driven by stringent FEM standards and the push toward automated material handling integration.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by rapid industrialization, massive infrastructure projects in developing economies (China, India, Southeast Asia), and the exponential growth of local e-commerce platforms. While selective racks dominate the volume market due to cost efficiency, there is accelerating investment in VNA and high-density solutions to maximize footprint in mega-warehouses. This region presents the greatest potential for new installations.

- Latin America (LATAM): Growth in LATAM is steady, driven by urbanization and the expansion of retail distribution networks, particularly in Brazil and Mexico. The market is moderately fragmented, with a growing preference for resilient, medium-to-heavy-duty selective and drive-in systems that offer a balance between cost and density. Economic stability and foreign investment in logistics infrastructure are key growth determinants.

- Middle East and Africa (MEA): MEA is emerging as a significant market, bolstered by strategic government initiatives to establish regional logistics hubs (e.g., UAE, Saudi Arabia). Investment is concentrated in new, large-scale distribution centers requiring robust, high-capacity racking, often adapted for specific regional climates (e.g., intense heat resistance or protection against sand/dust erosion). The 3PL and energy sectors are primary end-users driving demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pallet Rack Market.- Daifuku Co., Ltd.

- Schaefer Systems International

- Mecalux S.A.

- Dexion GmbH (Gonvarri)

- Steel King Industries

- Interroll Group

- Montel Inc.

- Ridg-U-Rak, Inc.

- Stöcklin Logistik AG

- Speedrack Products Group

- Eoslift Equipment

- Konstant

- Frazier Industrial Company

- Unarco Material Handling

- ATOX Sistemas de Almacenaje

- Hannibal Industries

- Spanco Storage Systems

- AK Material Handling Systems

- Palanite Storage Systems

Frequently Asked Questions

Analyze common user questions about the Pallet Rack market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between selective racking and high-density racking systems?

Selective racking offers immediate, 100% accessibility to every pallet location (high selectivity, low density). High-density systems (like Drive-In or Push Back) maximize the use of floor space by reducing aisles, significantly increasing storage volume but offering lower selectivity as pallets are often stored multiple depths deep.

How does the growth of e-commerce directly influence pallet rack design and demand?

E-commerce demands high-throughput, flexible fulfillment centers that handle a high volume of small, diverse orders. This drives demand for dynamic storage solutions (Pallet Flow/Carton Flow) and AS/RS compatible racks that integrate seamlessly with robotic picking technology, maximizing both density and speed of inventory turnover.

What are the critical safety standards governing pallet rack installation?

Key standards include those set by the Rack Manufacturers Institute (RMI) in North America and the Federation Europeenne de la Manutention (FEM) in Europe. These govern design specifications, load capacity verification, seismic bracing requirements, column protection, and proper installation procedures to prevent structural failure and ensure worker safety.

What role does structural health monitoring (SHM) play in the modern pallet rack market?

SHM involves integrating IoT sensors into racking systems to measure structural variables like stress, vibration, and impact damage in real-time. This technology enables predictive maintenance, alerts operators to immediate safety risks, and provides data crucial for optimizing equipment usage, significantly reducing operational downtime and increasing asset lifespan.

Which end-user segment drives the highest demand for customized, complex racking solutions?

The Third-Party Logistics (3PL) sector drives the highest demand for customized and complex solutions. 3PLs must cater to various clients with diverse inventory requirements (e.g., cold storage, high-volume/low-SKU, low-volume/high-SKU), necessitating flexible, modular, and often multi-functional racking systems compatible with diverse material handling equipment fleets and automation levels.

The expansion of the pallet rack market is intrinsically linked to global supply chain resilience and the optimization imperatives driven by warehousing costs. As real estate prices soar and the pressure to deliver goods faster intensifies, the shift toward maximizing vertical and horizontal space utilization through advanced racking systems becomes non-negotiable. This economic reality accelerates the adoption curve for technologies such as mobile racks and Very Narrow Aisle (VNA) configurations, particularly in high-growth urban logistics centers. Investment strategies for market players must increasingly focus on robust structural engineering coupled with sophisticated software integration to offer 'smart storage' solutions, moving beyond traditional steel fabrication. The integration of sensors for real-time monitoring of inventory levels, structural integrity, and temperature variance not only enhances safety but also provides invaluable data for WMS optimization. This convergence of industrial hardware and digital intelligence defines the next phase of market evolution.

In mature markets like North America and Western Europe, the primary purchasing drivers are related to replacing aging infrastructure and upgrading existing warehouses to automation compatibility. Companies are seeking high-quality, durable materials that can withstand the demands of 24/7 automated operations and high cycling rates. This replacement cycle ensures sustained demand for premium, certified products. Conversely, in developing regions of APAC and LATAM, the focus is on large-scale greenfield projects where cost-effectiveness and rapid deployment capability are paramount. Manufacturers adapting their offerings to provide scalable, cost-optimized solutions while maintaining international safety standards are best positioned to capture market share in these emerging economic zones. The demand for specialized racking solutions is also seeing upward momentum; for example, specialized cantilever racks for lumber and piping industries, or corrosion-resistant stainless steel/galvanized racks specifically designed for harsh washdown environments in food processing facilities, reflect the increasingly niche and specialized nature of market demand within the industrial sector.

The competitive landscape remains moderately fragmented, with large international players dominating the automated and high-density segment due to the requirement for complex integration and engineering expertise, while numerous regional manufacturers specialize in standard selective racking. Vertical integration, where major players control material sourcing, fabrication, system integration, and post-sale maintenance, provides a significant competitive advantage by ensuring quality control and streamlining the supply chain, reducing lead times for large projects. Strategic partnerships between traditional rack manufacturers and technology firms specializing in robotics and AI are becoming essential for delivering the next generation of automated warehouse solutions. Furthermore, compliance with evolving environmental, social, and governance (ESG) criteria is increasingly influencing purchasing decisions, prompting manufacturers to invest in sustainable production processes and offer recyclable materials, enhancing their appeal to environmentally conscious large corporations and 3PL providers committed to reducing their carbon footprint.

Focusing deeply on the technological advancements driving market consumption, the development of modular and flexible racking systems represents a major paradigm shift. Traditional fixed racking systems often constrain a warehouse layout for decades, but modern modular designs allow for rapid dismantling and reassembly, accommodating seasonal inventory changes or shifts in product dimensions without major structural overhaul. This flexibility is highly valued by 3PLs and high-growth e-commerce companies that experience rapid shifts in their operational requirements. Furthermore, advancements in specialized coatings, particularly for cold storage environments where humidity and low temperatures accelerate metal fatigue and corrosion, are crucial. Using galvanized or specialized powder-coated materials ensures longevity and structural safety under extreme conditions, justifying the higher initial investment for end-users operating within the frozen food and pharmaceutical sectors. The integration of light-guided picking technologies directly onto the rack structure, facilitating error-reduced manual picking, bridges the gap between fully manual and fully automated systems, providing a cost-effective solution for many distribution centers.

The influence of big data and advanced analytics extends beyond merely monitoring structural health to optimizing the storage configuration itself. AI-driven simulation tools allow warehouse designers to model various rack configurations (selective, VNA, drive-in mix) against projected inventory profiles and throughput requirements to determine the optimal layout prior to construction. This pre-installation analysis minimizes costly rework and ensures the facility achieves maximum operational efficiency from day one. Additionally, the proliferation of specialized material handling equipment, such as articulated forklifts and turret trucks necessary for VNA systems, has spurred corresponding innovation in rack design, requiring exceptionally flat floors and high-precision installation tolerances. Manufacturers who can provide integrated MHE and racking bundles, guaranteeing compatibility and performance, gain a distinct competitive edge, simplifying the procurement process for end-users. Regulatory pressures concerning load capacity labeling and mandatory annual inspections are also driving the market towards products featuring integrated, verifiable load rating plaques and systems designed for easier, safer inspection access.

A detailed examination of the cold storage sub-segment illustrates a micro-market demanding specialized engineering. Cold storage racking must handle extremely heavy loads (due to frozen products) within environments where steel naturally becomes more brittle and maintenance access is challenging. This necessitates structural steel (vs. roll-formed) and complex drive-in or push-back systems combined with heated floor technology to prevent frost heave. The need to minimize the volume of refrigerated space, which is expensive to maintain, pushes demand almost exclusively toward high-density solutions, making the traditional selective rack impractical for mass frozen storage operations. Similarly, in the pharmaceutical sector, high standards for cleanliness and validation often require stainless steel components and specific coatings to prevent contamination, further segmenting the market based on material science requirements. The long-term trend strongly favors sophisticated, custom-engineered solutions over generic standardized equipment, reflecting the increasing complexity and specialization required across global logistics networks.

The market faces ongoing challenges related to sustainability and the circular economy. End-users, particularly large multinational corporations, are increasingly mandating that suppliers demonstrate clear sustainable practices, including sourcing recycled steel, minimizing waste in the manufacturing process, and offering end-of-life recycling programs for their racking components. This pressure is slowly pushing manufacturers to re-evaluate their supply chains and adopt greener production methodologies. Furthermore, global freight volatility and geopolitical trade restrictions continue to impact the pricing and availability of raw steel, creating procurement challenges and fluctuating product costs, requiring manufacturers to maintain diversified sourcing strategies and adjust pricing models dynamically. The complexity of modern warehouse operations also necessitates highly skilled personnel, both for operating sophisticated MHE in narrow aisles and for maintaining integrated automated systems, creating a significant labor shortage restraint that automation (and thus, AS/RS compatible racks) seeks to mitigate.

In terms of future opportunities, the rapid expansion of micro-fulfillment centers (MFCs), particularly in dense urban areas for local delivery, is opening a new avenue for compact, high-speed racking systems. Although MFCs primarily utilize automation, the underlying structure requires small-footprint, extremely dense vertical storage solutions compatible with high-speed shuttle systems. Manufacturers capable of developing modular, quickly deployable vertical racking for small urban spaces will tap into a high-growth niche. Another major opportunity lies in retrofitting older facilities with modern, high-density systems. As many older warehouses lack the necessary clearances or floor tolerances for cutting-edge automation, solutions like mobile selective racking offer a viable path to density improvements without requiring massive structural rebuilding. This retrofit market provides a steady stream of business distinct from large greenfield installations.

Finally, the proliferation of digital tools and services associated with racking systems is becoming a mandatory value-add. This includes offering advanced visualization tools (AR/VR) for clients to tour and validate proposed warehouse layouts before installation, detailed digital documentation of load ratings and maintenance histories accessible via mobile apps, and integration APIs allowing seamless communication between the racking infrastructure data (from IoT sensors) and enterprise Resource Planning (ERP) systems. This shift towards a service-oriented model, where the physical product is bundled with essential digital services, is crucial for long-term customer retention and establishing a reputation as a full-solution provider rather than a commodity equipment vendor. The focus is shifting from selling steel to selling optimized, verifiable storage capacity and logistical intelligence.

The analysis of the competitive framework reveals intense rivalry primarily centered on four key attributes: structural durability, pricing structure, installation lead times, and compatibility with automation technology. Companies that excel in all four areas—offering highly certified, robust products at competitive costs, delivered and installed swiftly, and ready for integration with AS/RS—are positioned as market leaders. Intellectual property related to unique connection designs (e.g., boltless systems, seismic bracing techniques) and proprietary coatings provides specific barriers to entry for new competitors. Price competition remains fierce in the standard selective rack segment, often leading to margin compression, pushing established players to focus on higher-margin, complex engineering projects such as mobile and automated solutions where specialized expertise justifies premium pricing. Furthermore, the ability to manage complex, international supply chains for steel sourcing and project execution is a critical factor for global market dominance.

The trend towards leasing or financing racking infrastructure, rather than outright purchase, particularly among 3PLs seeking operational flexibility and reduced upfront capital expenditure, is subtly altering the sales model. Manufacturers who offer flexible financing or 'Rack-as-a-Service' models can capture market share from competitors focused solely on traditional sales. This service model often includes mandatory maintenance and inspection contracts, generating predictable recurring revenue streams. From an end-user perspective, the total cost of ownership (TCO) calculation, factoring in durability, maintenance requirements, potential rack damage due to MHE interaction, and efficiency gains, is replacing initial purchase price as the most important procurement criterion. This shift favors manufacturers providing high-quality, over-engineered systems built for resilience in demanding operational environments.

Geopolitical stability continues to influence the expansion of warehousing and thus the pallet rack market. Investment in new logistics infrastructure often follows trade routes and free trade agreements, making regions with stable political and economic environments primary targets for expansion. Conversely, volatility can lead companies to concentrate inventory in strategically secure locations, temporarily boosting local demand for high-density storage to handle increased safety stock. The future success of market players will depend heavily on their agility in responding to macroeconomic shifts, their commitment to advanced manufacturing technologies (e.g., automated laser welding for precision), and their strategic alliances with technology and system integration partners to deliver turnkey, high-performance warehouse solutions globally. The market is evolving into a technology-intensive capital goods sector where engineering prowess and digital integration are paramount.

The imperative for cold chain logistics expansion, driven by pharmaceutical distribution (vaccines, biologics) and global fresh food trade, underscores a major technological demand for specialized racking. Racks in these environments must perform reliably down to -40°C, requiring materials tested for extreme cold, often involving specialized galvanized finishes that resist moisture-induced corrosion without compromising structural integrity. Push-back and mobile racking are preferred in cold storage because minimizing aisle space directly reduces the refrigerated volume, leading to massive long-term operational cost savings. Manufacturers must provide detailed thermodynamic models and engineering certifications demonstrating reliable performance in these energy-intensive environments, positioning them as essential specialists within this high-value niche segment. The complexity of these installations demands high levels of post-sale support and rigorous inspection protocols.

Digitalization of the racking lifecycle is another major competitive front. Leading manufacturers are investing heavily in providing detailed Building Information Modeling (BIM) files and digital twins of their racking systems. This allows architects, engineers, and facility managers to integrate the racking model into the overall warehouse design software, facilitating clash detection and seamless integration with other building systems (HVAC, fire suppression). The digital twin maintains a continuous record of the rack's operational history, maintenance, modifications, and structural stress data, creating a valuable asset management tool for the end-user. This move towards 'data-rich' racking systems fundamentally changes the relationship between manufacturer and customer, establishing an ongoing data partnership focused on maximizing asset utilization and safety compliance throughout the rack's service life.

Finally, the emerging market for lightweight and easily reconfigurable aluminum racking is being driven by the pharmaceutical, cosmetics, and smaller-scale e-commerce fulfillment operations where weight restrictions and quick layout changes are prioritized over extreme heavy-duty capacity. While traditional steel maintains its dominance for heavy loads, aluminum offers unique benefits in certain clean room and specialized environments where non-ferrous materials are preferred. This diversification of material offerings, combined with patented designs that ensure comparable structural strength to steel counterparts in light-to-medium duty applications, broadens the market reach of manufacturers into highly specialized industrial segments. The overall market trajectory remains decisively focused on optimizing density, enhancing automation compatibility, and guaranteeing safety through advanced monitoring and compliance technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager