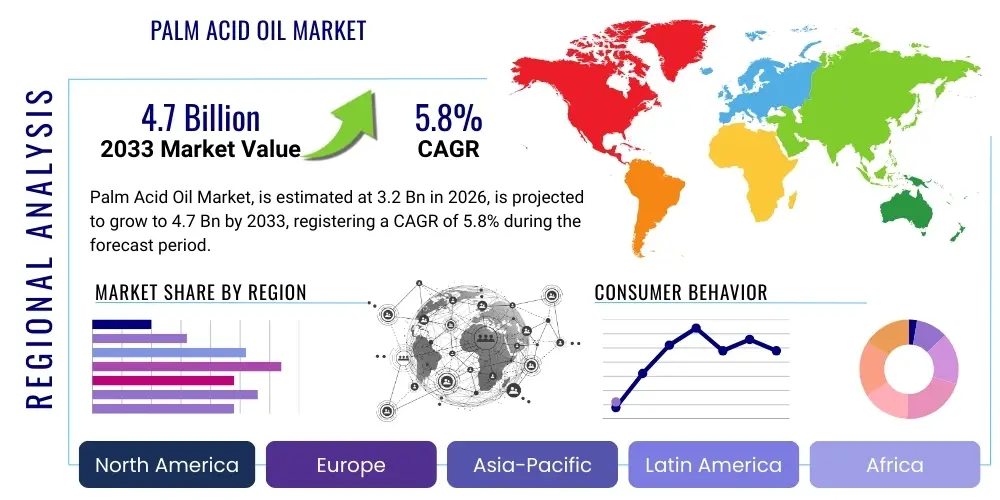

Palm Acid Oil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439249 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Palm Acid Oil Market Size

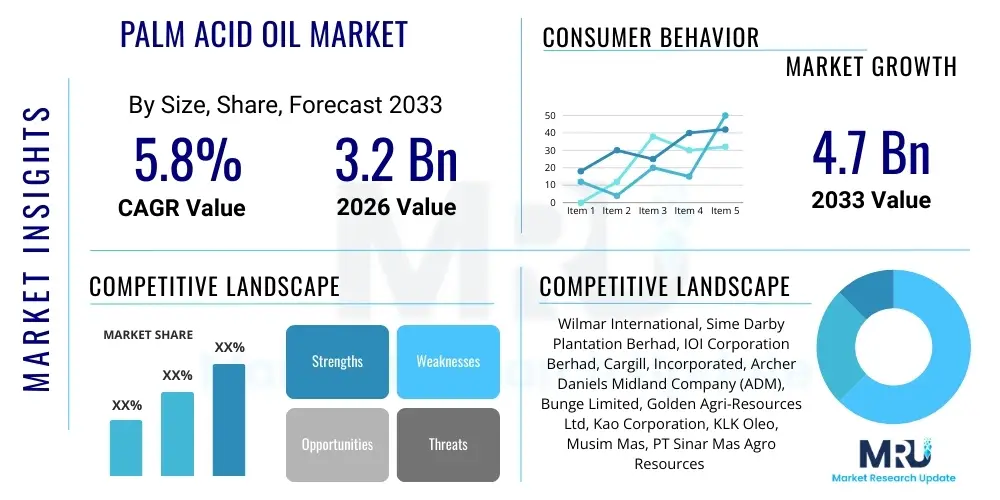

The Palm Acid Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.2 billion in 2026 and is projected to reach USD 4.7 billion by the end of the forecast period in 2033.

Palm Acid Oil Market introduction

The Palm Acid Oil (PAO) market encompasses the global trade and utilization of a reddish-brown, semi-solid by-product derived from the chemical refining of crude palm oil. PAO is predominantly composed of free fatty acids (FFAs), neutral oil, and other impurities, making it a valuable, cost-effective raw material across various industrial sectors. Its inherent composition, characterized by high FFA content, positions it as a sought-after alternative to more expensive virgin oils and fats, thereby driving its integration into sustainable manufacturing practices.

Key applications of PAO include its extensive use in the production of biodiesel, where it serves as a crucial feedstock due to its high energy content and favorable fatty acid profile. Furthermore, the oleochemical industry widely employs PAO for manufacturing fatty acids, soaps, and detergents, capitalizing on its emulsifying and cleansing properties. In the agricultural sector, PAO is incorporated into animal feed formulations to enhance energy content and promote livestock health, reflecting its versatility. The primary benefits of PAO lie in its economic viability as a recycled by-product, contributing to waste reduction and circular economy principles within the palm oil value chain.

The market’s expansion is significantly propelled by several driving factors, including the escalating global demand for sustainable and cost-effective raw materials in response to increasing environmental consciousness and regulatory pressures. The robust growth of the biodiesel industry, particularly in regions promoting renewable energy sources, is a major consumption driver. Additionally, the continuous expansion of the oleochemical sector, fueled by diverse applications in personal care, industrial cleaners, and lubricants, further stimulates PAO demand. The rising utilization of PAO in animal feed due to its nutritional benefits also contributes to its market growth, underscoring its broad industrial appeal and economic advantages.

Palm Acid Oil Market Executive Summary

The Palm Acid Oil (PAO) market is characterized by dynamic business trends reflecting global sustainability imperatives and economic pressures. There is a growing emphasis on optimizing PAO extraction and purification processes to enhance quality and expand application potential, alongside strategic efforts by major players to secure stable supply chains and manage price volatility inherent in agricultural commodities. Collaborative ventures between palm oil refiners and end-use industries are becoming more prevalent, aiming to develop specialized PAO grades for niche markets and ensure efficient by-product utilization. Furthermore, the market is witnessing increased investment in research and development to explore new applications and improve the environmental footprint of PAO production and usage, aligning with broader corporate sustainability goals.

Regionally, the market exhibits a clear concentration of production and consumption. Asia Pacific, particularly countries like Indonesia and Malaysia which are dominant palm oil producers, continues to be the largest market for PAO, driven by high domestic supply and robust demand from regional biodiesel and oleochemical industries. Europe represents a significant consumption hub, largely influenced by stringent renewable energy directives and a mature oleochemical sector, often importing PAO as a cost-effective feedstock. North America is experiencing steady growth, propelled by demand from the animal feed and oleochemical sectors, while Latin America and the Middle East & Africa show emerging potential, driven by expanding agricultural and industrial bases, albeit at a slower pace compared to established markets.

Segment-wise, the biodiesel application remains the most significant consumer of PAO, owing to the global push for cleaner fuels and the economic attractiveness of PAO as a biodiesel feedstock. The soaps and detergents segment also holds a substantial share, benefiting from PAO's cost-effectiveness as a source of fatty acids for saponification. The animal feed segment is experiencing notable growth, with PAO recognized for its energy-boosting properties in livestock nutrition. Emerging trends include the development of higher-grade PAO suitable for specialized fatty acid derivatives and other oleochemical products, indicating a gradual shift towards higher-value applications as refining technologies advance. This segmentation highlights the diverse utility and expanding industrial integration of PAO across various sectors.

AI Impact Analysis on Palm Acid Oil Market

User questions related to AI's impact on the Palm Acid Oil market frequently revolve around how artificial intelligence can optimize production efficiency, enhance product quality, and improve supply chain resilience. Common concerns include the potential for AI to predict raw material price fluctuations, streamline inventory management, and even identify new, sustainable applications for PAO. Users are keen to understand if AI can contribute to more precise blending ratios for various PAO grades, leading to better yield and reduced waste, and how it might help in navigating the complex regulatory landscape surrounding palm oil by-products. The overarching theme is an expectation that AI will bring about a new era of predictive analytics and operational excellence, addressing existing challenges in cost-efficiency, quality control, and environmental compliance within the PAO value chain.

- Optimized resource allocation and process control in palm oil refining, leading to improved PAO yield and quality consistency.

- Predictive maintenance for machinery in refineries, reducing downtime and operational costs associated with PAO production.

- Enhanced supply chain forecasting and logistics, minimizing transportation costs and ensuring timely delivery of PAO to end-users.

- Data-driven quality control and blending optimization, ensuring PAO meets specific application requirements (e.g., biodiesel, animal feed).

- Market demand prediction and price forecasting, enabling better purchasing and sales strategies for PAO traders and consumers.

- Identification of new, higher-value applications for PAO through advanced material science and compositional analysis.

- Improved sustainability monitoring and reporting, tracking environmental metrics across the PAO value chain.

DRO & Impact Forces Of Palm Acid Oil Market

The Palm Acid Oil (PAO) market is shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the escalating global demand for biodiesel, fueled by renewable energy mandates and a push towards reducing reliance on fossil fuels; PAO serves as a cost-effective and readily available feedstock for this industry. Additionally, the continuous expansion of the oleochemical sector, encompassing products like fatty acids, soaps, and detergents, significantly boosts PAO consumption due to its versatile chemical properties. The growing awareness and adoption of PAO in the animal feed industry, valued for its high energy content and nutritional benefits for livestock, further contribute to market growth, highlighting its multi-sectoral utility and economic advantages as a by-product.

Conversely, several restraints impede the market's full potential. The inherent price volatility of crude palm oil, the primary raw material for PAO, directly impacts PAO production costs and market pricing, introducing uncertainty for buyers and sellers. Stringent environmental regulations and sustainability concerns surrounding palm oil cultivation, including deforestation and land use change, can affect the social license to operate for producers and influence consumer perception of palm-derived products, including PAO. Competition from alternative feedstocks, such as used cooking oil, soybean oil, or tallow, in applications like biodiesel and oleochemicals, also poses a challenge, particularly when their prices or regulatory frameworks become more favorable. Moreover, the variable quality of PAO, depending on the refining process and source, can be a hurdle for consistent industrial application.

Despite these restraints, the PAO market presents substantial opportunities. The burgeoning demand from emerging economies, particularly in Asia Pacific, Latin America, and Africa, driven by industrialization and population growth, offers new avenues for market penetration. The increasing trend towards green chemistry and the circular economy further positions PAO as a sustainable raw material, encouraging its adoption in eco-friendly product formulations. Technological advancements in refining and processing techniques are enabling the production of higher-grade PAO with reduced impurities, opening doors for its use in more specialized and higher-value applications. Diversification into niche applications, such as lubricants, bioplastics, or specialized surfactants, also represents a growth opportunity, moving beyond traditional uses. These factors collectively illustrate a market poised for growth despite its challenges.

Segmentation Analysis

The Palm Acid Oil (PAO) market is comprehensively segmented to provide a detailed understanding of its diverse applications, grades, and geographical distribution. This segmentation allows for precise market analysis, identifying key growth areas and trends across different end-use industries and consumer preferences. The primary segmentation categories include application, where PAO's various industrial uses are delineated, and grade, which differentiates the quality and purity levels suitable for specific purposes. Regional segmentation further highlights the varying dynamics of supply, demand, and regulatory landscapes across major global markets, offering a holistic view of the market's structure and operational intricacies.

- By Application

- Biodiesel

- Soaps & Detergents

- Animal Feed

- Fatty Acids

- Others (e.g., industrial cleaners, lubricants)

- By Grade

- Industrial Grade

- Feed Grade

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Palm Acid Oil Market

The value chain for the Palm Acid Oil (PAO) market begins with the upstream activities of crude palm oil (CPO) production, which involves oil palm cultivation, harvesting, and milling in plantations. Following this, CPO undergoes refining processes to remove impurities, a step during which PAO is generated as a by-product. The quality and volume of PAO are directly influenced by the efficiency and technology employed in these upstream refining operations. Key players in this stage are large palm oil conglomerates that control vast plantations and integrated refining facilities, ensuring a consistent supply of both CPO and its derivatives, including PAO, to the market. Efficient logistics and storage are crucial here to maintain the quality of the CPO before refining and the PAO itself once produced.

Moving downstream, the PAO is then distributed to a diverse array of end-user industries for further processing and incorporation into their final products. This includes biodiesel manufacturers who convert PAO into renewable fuels, oleochemical companies that fractionate PAO into various fatty acids for use in personal care and industrial applications, and animal feed producers who incorporate it as an energy supplement. Soap and detergent manufacturers also represent a significant downstream segment, utilizing PAO for its saponification properties. The effectiveness of the downstream segment relies heavily on the technical capabilities of these industries to process and integrate PAO into their production lines, often requiring specialized equipment and expertise to handle its specific characteristics.

Distribution channels for PAO are varied, involving both direct and indirect sales mechanisms. Large-scale producers often engage in direct sales to major industrial consumers through long-term contracts, ensuring stable supply and pricing. Indirect channels involve a network of traders, distributors, and brokers who play a crucial role in aggregating PAO from smaller refiners and distributing it to a wider range of medium and small-sized end-users across different geographies. These intermediaries provide vital logistical support, market access, and sometimes, technical assistance to both producers and consumers. The efficiency of these distribution networks is critical for maintaining market liquidity and responding to fluctuating regional demands, ultimately connecting PAO supply with its diverse industrial applications.

Palm Acid Oil Market Potential Customers

The Palm Acid Oil (PAO) market caters to a broad spectrum of industrial buyers who leverage its cost-effectiveness and versatile chemical profile. Prominent among these are biodiesel manufacturers, who represent a significant end-user segment due to PAO's suitability as a fatty acid feedstock for transesterification, contributing to renewable fuel production. The growing global emphasis on cleaner energy solutions positions these manufacturers as key drivers of PAO demand. Similarly, the oleochemical industry is a crucial customer base, utilizing PAO as a raw material for producing a wide range of fatty acids, fatty alcohols, and glycerine, which are then integrated into products like lubricants, surfactants, and cosmetics. Their continuous innovation and expansion directly influence PAO consumption patterns.

Another substantial customer segment comprises the soap and detergent industries, where PAO is valued for its fatty acid content, which is essential for saponification processes. Its ability to provide bulk and cleansing properties at a competitive price makes it an attractive alternative to other fats and oils in various cleaning formulations. Additionally, the animal feed industry forms a rapidly expanding customer base, with PAO being incorporated into livestock and poultry feed formulations as a concentrated energy source. Farmers and feed compounders seek PAO to enhance the nutritional value of feed, thereby supporting animal growth and productivity, particularly in regions with intensive livestock farming practices. This segment benefits from PAO's economic viability and its role in sustainable animal nutrition programs.

Beyond these major sectors, PAO also finds potential in niche applications, expanding its customer reach. This includes industries involved in industrial cleaners, specialized lubricants, and even certain pharmaceutical or personal care applications where specific fatty acid profiles are beneficial. Companies focused on green chemistry initiatives or seeking to utilize sustainable by-products are increasingly exploring PAO for new product development. The diversity of these potential customers underscores PAO's foundational role in numerous industrial processes, demonstrating its adaptability and value as a versatile raw material across various manufacturing sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 billion |

| Market Forecast in 2033 | USD 4.7 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wilmar International, Sime Darby Plantation Berhad, IOI Corporation Berhad, Cargill, Incorporated, Archer Daniels Midland Company (ADM), Bunge Limited, Golden Agri-Resources Ltd, Kao Corporation, KLK Oleo, Musim Mas, PT Sinar Mas Agro Resources and Technology Tbk (SMART), FGV Holdings Berhad, United Plantations Berhad, Louis Dreyfus Company, Apical Group, PT Astra Agro Lestari Tbk, AAK AB, Oleon N.V., P.T. Dharma Satya Nusantara Tbk, IOI Loders Croklaan |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Palm Acid Oil Market Key Technology Landscape

The Palm Acid Oil (PAO) market benefits from a continually evolving technological landscape aimed at optimizing its production, enhancing its quality, and diversifying its applications. Traditional refining processes for crude palm oil, which generate PAO as a by-product, heavily rely on degumming, bleaching, and deodorization. However, advancements in these areas now focus on improving efficiency and reducing waste. For instance, enhanced physical refining techniques minimize chemical usage, leading to a cleaner PAO output with fewer impurities. Modern solvent extraction methods and membrane filtration technologies are also being explored to separate fatty acids more precisely, allowing for the creation of higher-grade PAO suitable for specific industrial requirements, thereby expanding its market utility and value proposition.

Beyond extraction and purification, significant technological progress is observed in the downstream processing of PAO. Enzymatic hydrolysis, for example, offers a greener and more efficient alternative to conventional methods for producing free fatty acids from PAO, which are then used in oleochemicals. Esterification technologies are crucial for converting PAO into various esters, including fatty acid methyl esters (FAME) for biodiesel production, with catalyst innovations leading to higher yields and reduced processing times. Furthermore, advanced analytical techniques such as Gas Chromatography-Mass Spectrometry (GC-MS) and Near-Infrared (NIR) spectroscopy are vital for comprehensive quality control, ensuring that PAO batches meet stringent specifications for different end-use applications, thereby building trust and consistency in the supply chain.

The integration of digital technologies, particularly in areas like process automation and data analytics, is also transforming the PAO market. Automated control systems in refineries help maintain optimal operating conditions, leading to consistent PAO quality and reduced energy consumption. Predictive maintenance using IoT sensors and AI algorithms minimizes equipment breakdowns, ensuring uninterrupted production flows. Furthermore, blockchain technology is being explored to enhance traceability and transparency throughout the palm oil supply chain, addressing sustainability concerns and verifying the ethical sourcing of PAO. These technological advancements collectively contribute to a more efficient, sustainable, and versatile PAO market, enabling producers to meet diverse industrial demands while adhering to environmental and quality standards.

Regional Highlights

- Asia Pacific: This region dominates the Palm Acid Oil market, primarily due to Indonesia and Malaysia being the world's largest palm oil producers. High domestic refining capacities ensure abundant PAO supply, while robust demand from biodiesel, oleochemical, and animal feed industries in China, India, and Southeast Asia drives significant consumption. Rapid industrialization and a growing focus on cost-effective raw materials further cement APAC's leading position.

- Europe: A key import market for Palm Acid Oil, Europe exhibits strong demand driven by its advanced biodiesel industry and well-established oleochemical sector. Stringent renewable energy mandates and a preference for sustainable feedstocks boost PAO utilization. However, strict environmental regulations and sustainability concerns surrounding palm oil present both challenges and opportunities for certified, traceable PAO.

- North America: The market in North America is growing steadily, propelled by the expanding animal feed industry and a mature oleochemical sector. While not a major palm oil producer, the region imports PAO to meet industrial demands for fatty acids and energy supplements. Increasing awareness of by-product utilization and circular economy principles also contributes to its market development.

- Latin America: This region is an emerging market for Palm Acid Oil, with countries like Brazil and Colombia showing potential in palm oil production and associated industries. Growth is driven by expanding biodiesel production capacity and a developing animal feed sector. Local production helps reduce reliance on imports, fostering regional market dynamics.

- Middle East & Africa (MEA): The MEA region presents nascent but growing opportunities for Palm Acid Oil. Expanding industrial bases, particularly in the production of soaps, detergents, and animal feed, are increasing demand. Investment in local manufacturing and the search for cost-effective raw materials are key drivers for market development in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Palm Acid Oil Market.- Wilmar International

- Sime Darby Plantation Berhad

- IOI Corporation Berhad

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Bunge Limited

- Golden Agri-Resources Ltd

- Kao Corporation

- KLK Oleo

- Musim Mas

- PT Sinar Mas Agro Resources and Technology Tbk (SMART)

- FGV Holdings Berhad

- United Plantations Berhad

- Louis Dreyfus Company

- Apical Group

- PT Astra Agro Lestari Tbk

- AAK AB

- Oleon N.V.

- P.T. Dharma Satya Nusantara Tbk

- IOI Loders Croklaan

Frequently Asked Questions

What is Palm Acid Oil (PAO) and how is it produced?

Palm Acid Oil (PAO) is a reddish-brown, semi-solid by-product derived from the chemical refining process of crude palm oil. It consists primarily of free fatty acids (FFAs), neutral oil, and moisture, generated during the neutralization stage where FFAs are removed from crude palm oil to produce refined palm oil.

What are the primary applications of Palm Acid Oil?

PAO's primary applications include its extensive use as a cost-effective feedstock for biodiesel production, a raw material in the manufacturing of soaps and detergents, an energy supplement in animal feed formulations, and a source of fatty acids for the oleochemical industry.

Is Palm Acid Oil a sustainable product?

As a by-product of palm oil refining, PAO contributes to sustainability by utilizing waste from a primary agricultural process, thereby promoting a circular economy. Its sustainability profile often depends on the ethical sourcing and sustainable cultivation practices of the crude palm oil from which it is derived.

What factors influence the price of Palm Acid Oil?

The price of Palm Acid Oil is significantly influenced by several factors, including the global price of crude palm oil, supply and demand dynamics from major consuming sectors like biodiesel and oleochemicals, prevailing crude oil prices, and overall economic conditions affecting industrial production and commodity markets.

How does the quality of Palm Acid Oil vary?

PAO quality varies based on the refining process of the crude palm oil, the quality of the crude oil itself, and storage conditions. Key parameters defining quality include the percentage of free fatty acids (FFA content), moisture, impurities, and unsaponifiable matter (MIU), which dictate its suitability for specific industrial applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Palm Acid Oil Market Size Report By Type (PAO Yellowish, PAO Brownish), By Application (Soap, Animal Feeds, Biodiesel, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Palm Acid Oil Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (PAO Yellowish, PAO Brownish), By Application (Soap, Animal Feeds, Biodiesel, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager