Palm Butter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440380 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Palm Butter Market Size

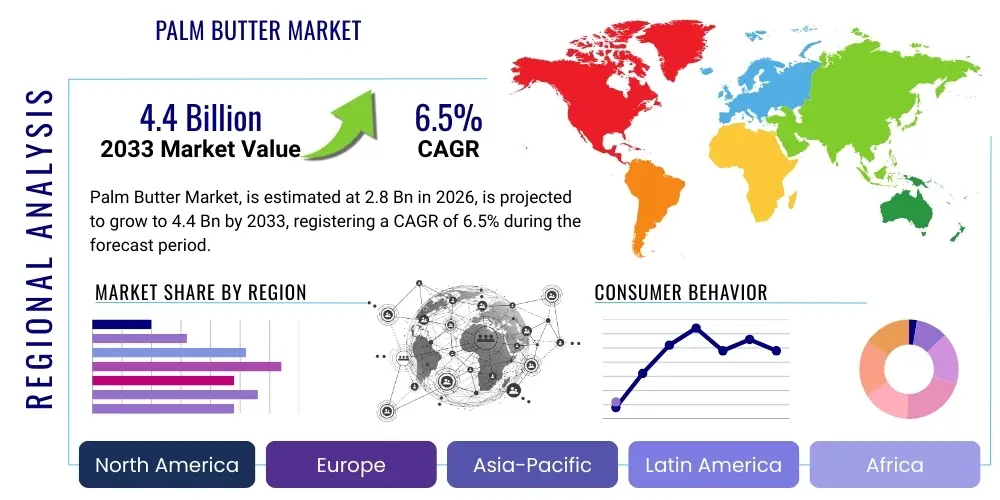

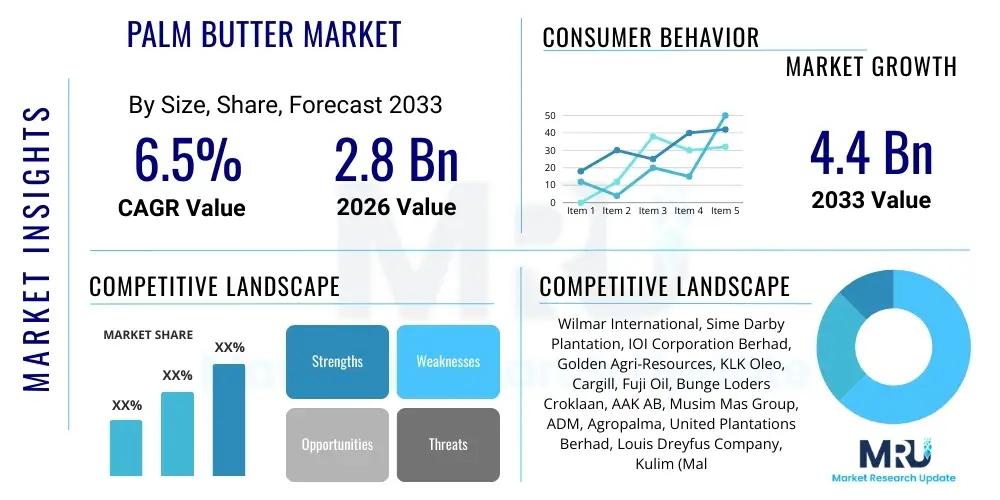

The Palm Butter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 4.4 Billion by the end of the forecast period in 2033.

Palm Butter Market introduction

The Palm Butter Market encompasses the global production, distribution, and consumption of palm butter, a semi-solid fat derived from palm oil through specialized processing techniques. This versatile ingredient is gaining significant traction across multiple industries due to its unique physical and chemical properties, making it an indispensable component in a wide array of products. Palm butter is typically characterized by its smooth texture, high oxidative stability, and a balanced profile of saturated and monounsaturated fatty acids, contributing to extended shelf life and desirable mouthfeel in various applications. Its functional attributes allow it to serve as a superior alternative to other fats in specific formulations. Major applications span the food and beverage industry, where it is extensively used in confectionery, baked goods, spreads, and ready-to-eat meals; the personal care and cosmetics sector, where it functions as an emollient, moisturizer, and thickener in lotions, creams, and soaps; and the pharmaceutical industry, often employed as an excipient or base for various formulations. The inherent benefits of palm butter include its cost-effectiveness compared to some alternative fats, its exceptional stability under various storage conditions, and its ability to impart desirable textural qualities, such as creaminess and structure, to end products. Key driving factors propelling market growth include the escalating global demand for processed foods, a burgeoning personal care industry seeking natural and effective ingredients, increasing consumer preference for plant-based fats as alternatives to animal-derived options, and the continuous innovation in product development that leverages palm butter’s functional versatility, alongside its relatively sustainable production compared to other fat sources when sourced responsibly.

Palm Butter Market Executive Summary

The Palm Butter Market is experiencing robust expansion, propelled by evolving consumer preferences and significant industrial advancements, with a global growth trajectory firmly established for the foreseeable future. Current business trends indicate a strong emphasis on sustainable sourcing practices, particularly driven by certifications from organizations such as the Roundtable on Sustainable Palm Oil (RSPO), as companies seek to mitigate environmental concerns and meet consumer demand for ethically produced ingredients. Furthermore, there is a clear trend towards product innovation, with manufacturers exploring new formulations and applications to capitalize on palm butter's functional benefits, including the development of organic and specialty palm butter variants for niche markets. Consolidation within the industry is also evident, as larger players acquire smaller producers to expand their market share and diversify their product portfolios, alongside strategic partnerships aimed at strengthening supply chains and enhancing distribution networks. Regional trends reveal a dynamic landscape, with the Asia Pacific region continuing to dominate in terms of both production and consumption, driven by its expansive food processing industry and rapidly increasing disposable incomes. Meanwhile, North America and Europe are witnessing significant growth, fueled by rising awareness regarding plant-based diets, the demand for natural ingredients in cosmetics, and stringent regulatory frameworks encouraging sustainable practices. Emerging markets in Latin America and the Middle East & Africa are also showing considerable potential, with urbanization and the expansion of modern retail channels driving increased consumption. Across market segments, the food and beverage sector remains the largest application area, consistently innovating to meet diverse culinary needs, while the personal care and cosmetics segment is demonstrating the fastest growth, attributable to palm butter’s excellent emollient and stabilizing properties. Industrial applications, encompassing pharmaceuticals and other specialty uses, are also registering steady growth, underscored by ongoing research and development into novel functionalities. These interwoven trends highlight a market characterized by innovation, sustainability efforts, and geographical expansion, collectively contributing to its optimistic outlook.

AI Impact Analysis on Palm Butter Market

Common inquiries from users regarding artificial intelligence's influence on the Palm Butter Market frequently revolve around sustainability, supply chain efficiency, quality control, and the potential for new product development. Users are particularly interested in how AI can address the long-standing environmental challenges associated with palm oil production, such as deforestation and biodiversity loss, by enabling more precise and verifiable sustainable practices. There is also significant curiosity about AI's role in optimizing the complex palm butter supply chain, from cultivation to processing and distribution, aiming for greater transparency and cost-effectiveness. Furthermore, stakeholders often question how AI technologies can ensure consistent product quality, enhance food safety, and even inspire innovative applications for palm butter in various industries. The overarching theme among these questions is a clear expectation that AI will bring about transformative improvements across the entire value chain, fostering both economic growth and environmental stewardship. Users are seeking assurances that AI integration will lead to tangible, measurable benefits, while also considering potential hurdles like data privacy, implementation costs, and the need for skilled labor to manage these advanced systems.

- Enhanced supply chain transparency and traceability through AI-powered blockchain solutions, enabling consumers and businesses to verify the origin and sustainability credentials of palm butter products, mitigating concerns about unethical sourcing.

- Optimized cultivation practices in palm oil plantations utilizing predictive analytics and machine learning to forecast yields, detect diseases, manage pests, and precisely apply fertilizers, leading to increased productivity and reduced environmental impact.

- Improved processing efficiency and quality control in palm butter manufacturing facilities through AI-driven sensors and algorithms that monitor temperature, pressure, and ingredient ratios, ensuring consistent product specifications and minimizing waste.

- Advanced deforestation monitoring and sustainable sourcing verification using satellite imagery and AI pattern recognition to track land use changes and ensure compliance with environmental standards, bolstering the industry's commitment to responsible production.

- Personalized product development and formulation optimization in cosmetics and food applications, where AI can analyze consumer preferences and ingredient interactions to create novel palm butter-based products with tailored textures, flavors, and functional benefits.

- Predictive maintenance for processing machinery, leveraging AI to anticipate equipment failures, schedule maintenance proactively, and reduce downtime, thereby improving operational efficiency and reducing costs across the production lifecycle.

- Sophisticated market trend analysis and demand forecasting, allowing manufacturers to anticipate consumer needs, optimize inventory management, and respond quickly to shifts in market dynamics, leading to more agile business strategies.

- Robotics and automation in harvesting and processing, reducing reliance on manual labor for repetitive or hazardous tasks, enhancing worker safety, and increasing the overall speed and scale of operations within the palm butter value chain.

DRO & Impact Forces Of Palm Butter Market

The Palm Butter Market is shaped by a complex interplay of drivers, restraints, and opportunities, each exerting significant influence on its trajectory, while a multitude of impact forces further modulate its growth and evolution. A primary driver is the increasing demand for versatile, plant-based fats across the global food and beverage industry, where palm butter's functional properties—such as its melting profile, oxidative stability, and ability to provide structure—make it highly desirable in applications ranging from confectionery to baked goods and spreads. The burgeoning personal care and cosmetics sector also significantly drives demand, recognizing palm butter’s excellent emollient, moisturizing, and thickening capabilities in skincare, haircare, and soap products. Furthermore, its relative cost-effectiveness compared to some other specialty fats, coupled with its consistent supply, makes it an attractive option for manufacturers seeking efficient ingredient solutions. However, the market faces considerable restraints, most notably the persistent negative perception associated with palm oil production, primarily concerning its environmental impact, including deforestation and habitat loss, which often leads to consumer backlash and scrutiny from advocacy groups. Price volatility of crude palm oil, a key raw material, also presents a challenge, affecting profit margins and supply chain stability. Intense competition from alternative vegetable oils and specialty fats, alongside evolving regulatory landscapes and trade barriers in various regions, further constrains market expansion. Amidst these challenges, significant opportunities exist, particularly in the development and promotion of sustainable palm butter variants, leveraging certifications such as RSPO to reassure consumers and industrial buyers about ethical sourcing. Expanding into niche markets, such as vegan and organic food products, specialty pharmaceuticals, and premium cosmetic formulations, offers avenues for growth. Technological advancements in processing, fractionation, and ingredient modification can unlock new functionalities for palm butter, broadening its application scope and enhancing its value proposition. Geographically, emerging economies in Asia Pacific, Latin America, and Africa present vast untapped potential, driven by urbanization, rising disposable incomes, and the expansion of local food processing industries. The overarching impact forces include stringent environmental regulations and sustainability mandates, which increasingly dictate sourcing and production practices. Shifting consumer preferences towards natural, ethically sourced, and plant-based ingredients continue to influence product development and marketing strategies. Economic stability plays a crucial role, affecting consumer purchasing power and industrial investment in new technologies. Global trade policies, tariffs, and geopolitical events can disrupt supply chains and impact raw material costs, while continuous technological innovation across the value chain remains a critical force for competitive differentiation and market evolution.

Segmentation Analysis

The Palm Butter Market is comprehensively segmented across various dimensions, reflecting the diverse applications, end-user bases, product types, and distribution channels that characterize its intricate landscape. This segmentation provides a granular view of the market's structure, allowing for a detailed understanding of consumer behavior, industrial demands, and market dynamics within specific categories. Each segment is influenced by distinct drivers and faces unique challenges, necessitating tailored strategies for market penetration and growth. The delineation into these segments enables market participants to identify lucrative opportunities, address specific consumer needs, and refine their product offerings to maximize market share, ensuring that the versatility of palm butter is effectively channeled into appropriate uses. Understanding these segmentations is paramount for strategic planning, product development, and effective resource allocation in a highly competitive global market.

- By Application:

- Food & Beverage: Encompasses a wide range of products including confectionery (chocolates, candies), baked goods (biscuits, cakes, pastries), spreads (margarines, nut butters), snack foods, and ready-to-eat meals, where palm butter provides structure, texture, and stability.

- Personal Care & Cosmetics: Utilized in lotions, creams, soaps, shampoos, conditioners, lip balms, and makeup as an emollient, moisturizer, binding agent, and thickener, valued for its skin-softening properties and stable formulation.

- Pharmaceuticals: Employed as an excipient, an ingredient that aids in the delivery or stability of active pharmaceutical ingredients, in various oral and topical medications, and as a base for ointments and suppositories.

- Industrial: Includes applications in industries such as biofuel production, lubricants, and candle making, leveraging its combustion properties and stability.

- By End-User:

- Commercial: Refers to large-scale industrial buyers such as food manufacturers, cosmetic companies, and pharmaceutical firms that purchase palm butter in bulk for inclusion in their final products.

- Retail: Covers sales through various retail channels directly to consumers for home cooking, baking, and personal use, though typically less common for pure palm butter than for products containing it.

- By Product Type:

- Organic: Palm butter produced from organically certified palm oil, adhering to strict agricultural and processing standards without synthetic pesticides, fertilizers, or GMOs, catering to the growing demand for natural and chemical-free products.

- Conventional: Standard palm butter produced without specific organic certifications, widely available and used across most industrial and commercial applications.

- By Distribution Channel:

- Supermarkets/Hypermarkets: Major retail outlets offering a wide variety of food and non-food items, serving as a primary channel for products containing palm butter and sometimes for specialized consumer-sized palm butter.

- Convenience Stores: Smaller retail shops providing quick access to everyday essentials, typically stocking finished goods that incorporate palm butter.

- Online Retail: E-commerce platforms and company websites providing direct-to-consumer sales and bulk purchasing options, growing in importance due to increasing digital penetration and convenience.

- Direct Sales: Involves direct procurement by large industrial buyers from producers or distributors, often through contractual agreements, ensuring consistent supply and quality for specific industrial applications.

Value Chain Analysis For Palm Butter Market

The value chain for the Palm Butter Market is a multi-stage process, beginning from agricultural cultivation and extending to final product consumption, involving various stakeholders and transformative activities that add value at each step. This intricate network ensures the efficient flow of raw materials, processing, and distribution, highlighting the interconnectedness of different industry players. Understanding this chain is crucial for identifying areas of efficiency improvement, cost optimization, and leveraging competitive advantages across the entire lifecycle of palm butter. The complexity of the global supply chain, particularly for palm products, necessitates robust management strategies to ensure both sustainability and quality. Optimizing each stage can lead to significant gains in market competitiveness and responsiveness to consumer demands. Furthermore, transparency across the value chain is increasingly important, driven by consumer and regulatory pressure for ethical sourcing and sustainable production practices, making traceability a critical component of modern value chain management.

Upstream analysis in the palm butter value chain primarily focuses on the cultivation of oil palm trees and the initial harvesting and milling processes. This stage begins with agricultural practices on plantations, including land preparation, planting, nurturing the palm trees, and managing pest and disease control, often employing sustainable agriculture techniques to minimize environmental impact. The fresh fruit bunches (FFBs) are then harvested and transported to nearby mills, where they undergo sterilization, stripping, pressing, and clarification to extract crude palm oil (CPO). This initial processing is critical for determining the quality of the CPO and subsequent products. Key upstream activities also involve research and development in seed genetics for improved yields and disease resistance, as well as the implementation of responsible land use policies to prevent deforestation and protect biodiversity. Sustainable sourcing initiatives, such as those promoted by RSPO, are increasingly vital at this stage, influencing market access and brand reputation. Ensuring the integrity and ethical standards of the raw material supply is paramount for the downstream processing and market acceptance of palm butter. Effective management of this upstream segment directly impacts the cost-effectiveness, quality, and sustainability profile of the final palm butter product, requiring close collaboration with growers and mill operators.

Downstream analysis encompasses the sophisticated refining and fractionation of crude palm oil to produce palm butter, followed by packaging and branding, which collectively add significant value to the raw material. Once the CPO is obtained, it undergoes a series of refining steps, including degumming, bleaching, and deodorization (RBD palm oil), to remove impurities, color, and undesirable odors, resulting in a neutral and stable fat. This refined oil is then subjected to fractionation, a physical separation process that divides palm oil into its solid (stearin) and liquid (olein) components based on their melting points. Palm butter is typically derived from specific fractions, often a blend of palm stearin and palm olein, or interesterified fractions, carefully selected to achieve the desired texture, melting profile, and functional properties suitable for various applications. Further processing may involve interesterification or hydrogenation to modify fatty acid profiles and enhance specific characteristics, although hydrogenation is less common due to health concerns about trans fats. The processed palm butter is then prepared for distribution, involving packaging into various formats—from industrial bulk containers to consumer-sized tubs—and branding to differentiate products in the market. This stage also includes quality assurance, storage, and logistics to ensure product integrity and timely delivery to customers. The choices made at this downstream stage, particularly regarding processing techniques and formulation, directly impact the final product's quality, functionality, and market positioning. Companies invest heavily in research and development to optimize these processes, introduce innovative palm butter variants, and meet specific customer demands for texture, stability, and application performance, thereby enhancing the overall value proposition.

Distribution channels for the Palm Butter Market are diverse, facilitating the movement of products from processors to end-users through both direct and indirect routes, each serving different market segments and logistical needs. Direct distribution typically involves large-volume sales from manufacturers or specialized distributors directly to industrial clients such as major food processing companies, cosmetic manufacturers, and pharmaceutical firms. These transactions are often based on long-term contracts, bulk orders, and specific quality requirements, ensuring a consistent and reliable supply for large-scale production. Direct sales allow for closer relationships between suppliers and buyers, enabling customized product specifications and direct technical support, which is particularly valuable for complex industrial applications. This channel minimizes intermediaries, potentially reducing costs and lead times, and allows for greater control over product handling and delivery. It is the preferred method for high-volume, business-to-business (B2B) transactions where product consistency and technical specifications are paramount. Effective direct distribution relies on robust logistics, efficient warehousing, and strong account management to maintain client relationships and meet specialized industrial demands, forming the backbone of supply for many large-scale manufacturers globally.

Indirect distribution, conversely, leverages a network of intermediaries to reach a broader and more fragmented customer base, including smaller businesses, retailers, and eventually individual consumers. This channel involves wholesalers, regional distributors, and various retail formats such as supermarkets, hypermarkets, convenience stores, and increasingly, online retail platforms. Wholesalers and regional distributors play a crucial role by breaking down bulk shipments from manufacturers into smaller quantities suitable for retail outlets or smaller commercial buyers, thereby extending market reach and optimizing logistics for smaller orders. Retailers then make palm butter, or products containing it, accessible to the general public. Online retail has emerged as a particularly significant indirect channel, offering convenience, wider product selection, and competitive pricing, appealing to both individual consumers and small businesses that may not have direct access to large suppliers. This channel also facilitates the marketing of specialized palm butter products, such as organic or sustainably sourced variants, to a global audience. The fragmented nature of the indirect channel requires effective marketing, brand building, and efficient supply chain management to ensure product availability and visibility across numerous points of sale. Both direct and indirect channels are critical for the overall market penetration of palm butter, with their strategic integration allowing manufacturers to cater to the diverse needs of industrial, commercial, and retail customers efficiently and comprehensively.

Palm Butter Market Potential Customers

The Palm Butter Market caters to a wide spectrum of potential customers, spanning various industries and consumer segments, driven by its versatile applications and functional benefits. End-users or buyers of palm butter include large-scale food manufacturers, who utilize it extensively in products such as confectionery, baked goods, snack foods, and dairy alternatives due to its ability to impart desired texture, stability, and mouthfeel. Bakery and confectionery producers, in particular, rely on its unique melting profile for chocolates, pastries, and spreads. The personal care and cosmetics industry represents another significant customer base, with formulators incorporating palm butter into skincare creams, lotions, soaps, haircare products, and makeup, valuing its emollient properties, thickening capabilities, and stability in formulations. Pharmaceutical companies also constitute a segment of potential customers, using palm butter as an excipient in various drug formulations, ointments, and suppositories, where its inertness and consistency are highly beneficial. Furthermore, the hospitality sector, including restaurants and catering services, often uses palm butter in cooking and food preparation. Beyond industrial and commercial buyers, a growing number of household consumers are becoming potential customers for specialty palm butter products, especially those seeking plant-based alternatives for home cooking or individuals interested in natural ingredients for DIY cosmetic formulations. The increasing demand for vegan, organic, and sustainably sourced ingredients further broadens the customer base, appealing to environmentally conscious consumers and businesses. This diverse customer landscape underscores the broad appeal and utility of palm butter, making it a critical ingredient across multiple economic sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 4.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wilmar International, Sime Darby Plantation, IOI Corporation Berhad, Golden Agri-Resources, KLK Oleo, Cargill, Fuji Oil, Bunge Loders Croklaan, AAK AB, Musim Mas Group, ADM, Agropalma, United Plantations Berhad, Louis Dreyfus Company, Kulim (Malaysia) Berhad, S.D. Foods, Intercontinental Specialty Fats, Mewah Group, TDM Berhad, Genting Plantations Berhad |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Palm Butter Market Key Technology Landscape

The Palm Butter Market's technological landscape is characterized by continuous innovation aimed at enhancing product quality, functionality, and sustainability, while also optimizing production efficiency. A core aspect of this landscape involves advanced fractionation techniques, which are physical separation processes that utilize controlled cooling to crystallize and separate palm oil into different fractions based on their melting points, allowing manufacturers to tailor palm butter with specific textural and physical properties for diverse applications. These techniques enable the production of specialized fractions like palm stearin or olein, or blends thereof, each suited for particular end-uses, from confectionery coatings to skincare bases. Interesterification is another critical technology, where the fatty acid composition of triglycerides is rearranged without altering the fatty acid types themselves, enabling the creation of palm butter with desired melting curves, plasticity, and crystallization behaviors, often used to eliminate trans fats while maintaining functionality. Enzymatic processes are gaining prominence, offering a greener alternative to chemical methods for modifying fats and oils, producing structured lipids with specific functionalities, and improving the overall quality and nutritional profile of palm butter. Supercritical fluid extraction (SFE) is an emerging technology, particularly for producing highly pure and solvent-free palm butter fractions or specialized ingredients, offering advantages in terms of product integrity and environmental friendliness compared to traditional solvent extraction methods. Beyond processing, sustainable cultivation technologies are integral, encompassing precision agriculture techniques such as remote sensing, drone monitoring, and IoT-enabled smart farming, which optimize resource utilization, monitor crop health, and enhance yield management on palm oil plantations. These technologies are crucial for improving the environmental footprint of raw material sourcing. Furthermore, advanced refining processes—including degumming, bleaching, and deodorization (RBD)—are continuously being optimized to remove impurities, enhance stability, and ensure the neutral flavor and color essential for high-quality palm butter. The integration of automation and sophisticated control systems throughout the manufacturing process ensures consistency, reduces human error, and improves overall operational efficiency. Together, these technological advancements underpin the market's ability to meet evolving consumer demands for high-quality, functional, and sustainably produced palm butter, while also addressing environmental and health considerations.

Regional Highlights

- Asia Pacific (APAC): This region dominates the global Palm Butter Market in terms of both production and consumption, primarily due to the presence of major palm oil-producing countries like Malaysia and Indonesia, which are also significant processors. Rapid industrialization, particularly in the food and beverage sector in countries like India, China, and Southeast Asian nations, fuels high demand for palm butter in various processed foods. Rising disposable incomes and an expanding urban population in APAC further contribute to the growth of confectionery, bakery, and personal care industries, all key consumers of palm butter. The region also benefits from established supply chains and a relatively lower cost of production, maintaining its stronghold in the global market.

- Europe: The European market for palm butter is characterized by a strong emphasis on sustainability and ethical sourcing, driven by stringent regulations and high consumer awareness. While not a major producer of palm oil, Europe is a significant importer and processor, with robust demand from the food, cosmetics, and pharmaceutical sectors. Countries like Germany, the UK, France, and the Netherlands show increasing preference for RSPO-certified or organic palm butter, pushing manufacturers to invest in sustainable supply chains. The growth is particularly notable in the natural and organic personal care segment, as well as in plant-based food products, where palm butter serves as a key functional ingredient.

- North America: North America presents a growing market for palm butter, propelled by increasing consumer demand for natural ingredients, plant-based diets, and functional foods. The United States and Canada are seeing greater adoption of palm butter in confectionery, baked goods, and specialty food products, as well as in the burgeoning natural cosmetics industry. Health and wellness trends are encouraging manufacturers to offer healthier alternatives, leading to increased interest in palm butter as a stable and versatile fat. There is a strong focus on transparent labeling and sustainably sourced palm products to meet evolving consumer expectations and regulatory standards.

- Latin America: This region is an emerging market with significant potential for both palm oil production and palm butter consumption. Countries like Brazil and Colombia are expanding their palm oil cultivation, driven by favorable climatic conditions and increasing domestic demand. The growth in Latin America's food processing industry, coupled with urbanization and rising disposable incomes, supports the expanding use of palm butter in local confectionery, snacks, and personal care products. Investments in infrastructure and processing technologies are contributing to the region's market development, positioning it as a future growth hub.

- Middle East and Africa (MEA): The MEA region is experiencing steady growth in the Palm Butter Market, primarily driven by increasing urbanization, population growth, and the expansion of the food and beverage sector. Countries such as UAE, Saudi Arabia, and South Africa are witnessing higher consumption of processed foods and a developing personal care industry. While the region relies heavily on imports for palm oil products, there is a growing interest in local processing capabilities and diversifying supply chains. The demand for stable, cost-effective fats like palm butter in various industrial applications continues to drive market expansion across the diverse economies of the MEA.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Palm Butter Market.- Wilmar International

- Sime Darby Plantation

- IOI Corporation Berhad

- Golden Agri-Resources

- KLK Oleo

- Cargill

- Fuji Oil

- Bunge Loders Croklaan

- AAK AB

- Musim Mas Group

- ADM

- Agropalma

- United Plantations Berhad

- Louis Dreyfus Company

- Kulim (Malaysia) Berhad

- S.D. Foods

- Intercontinental Specialty Fats

- Mewah Group

- TDM Berhad

- Genting Plantations Berhad

Frequently Asked Questions

Analyze common user questions about the Palm Butter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is palm butter and what are its primary uses?

Palm butter is a semi-solid fat derived from palm oil through specialized processing like fractionation, giving it a stable, smooth texture. It is extensively used in the food and beverage industry for confectionery, baked goods, and spreads due to its structural and textural properties. In personal care and cosmetics, it acts as an emollient and thickener in lotions and soaps. Pharmaceuticals also employ it as an excipient. Its versatility and stability make it a valuable ingredient across diverse product categories, providing functional benefits like extended shelf life and desirable mouthfeel.

Is palm butter sustainable, and how are environmental concerns being addressed?

The sustainability of palm butter is a key concern due to its association with palm oil production and historical links to deforestation. However, significant efforts are underway to promote sustainable practices. Certifications like the Roundtable on Sustainable Palm Oil (RSPO) ensure that palm butter is sourced from plantations that adhere to environmental and social criteria, minimizing negative impacts. AI and satellite monitoring are increasingly used to track deforestation and verify ethical sourcing, improving transparency and encouraging responsible production. Consumers increasingly seek certified sustainable palm butter options, driving industry-wide commitment to greener practices.

What are the main benefits of using palm butter in various products?

Palm butter offers several key benefits that make it a highly desirable ingredient. Its high oxidative stability contributes to a longer shelf life for food products by preventing rancidity. It imparts desirable textural properties, such as creaminess and structure, essential for chocolates, pastries, and spreads. In cosmetics, it functions as an excellent emollient, providing moisturizing and skin-softening effects, and as a thickener, enhancing product consistency. Furthermore, it is a cost-effective alternative to some other specialty fats, offering consistent supply and functional versatility across a wide range of applications, from food to personal care and pharmaceuticals.

How does palm butter compare to other vegetable fats or butters?

Palm butter stands out from other vegetable fats due to its unique semi-solid consistency at room temperature, high oxidative stability, and balanced fatty acid profile. Unlike liquid oils such as sunflower or soybean oil, palm butter provides structure and creaminess without hydrogenation, which can produce trans fats. While coconut oil is also solid, palm butter often has a more neutral flavor profile and different melting characteristics, making it more versatile in certain applications. Compared to dairy butter, palm butter offers a plant-based alternative with a longer shelf life and typically lower cost, making it appealing for vegan products and industrial uses where stability is paramount. Its distinct physical properties allow it to perform specific functions that other fats cannot easily replicate.

What are the key market drivers contributing to the growth of the palm butter market?

The growth of the palm butter market is propelled by several key drivers. Increasing global demand for processed foods, confectionery, and baked goods, particularly in emerging economies, significantly boosts its consumption. The burgeoning personal care and cosmetics industry, driven by a desire for natural and effective ingredients, further fuels demand for palm butter's emollient and stabilizing properties. Growing consumer preference for plant-based fats as alternatives to animal-derived options, coupled with its relatively cost-effective production, makes it an attractive choice. Furthermore, continuous innovation in product formulations that leverage palm butter's functional versatility, along with efforts to promote sustainably sourced variants, are critical factors driving market expansion and adoption across diverse sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager