Panacis Quinquefolis Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434155 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Panacis Quinquefolis Market Size

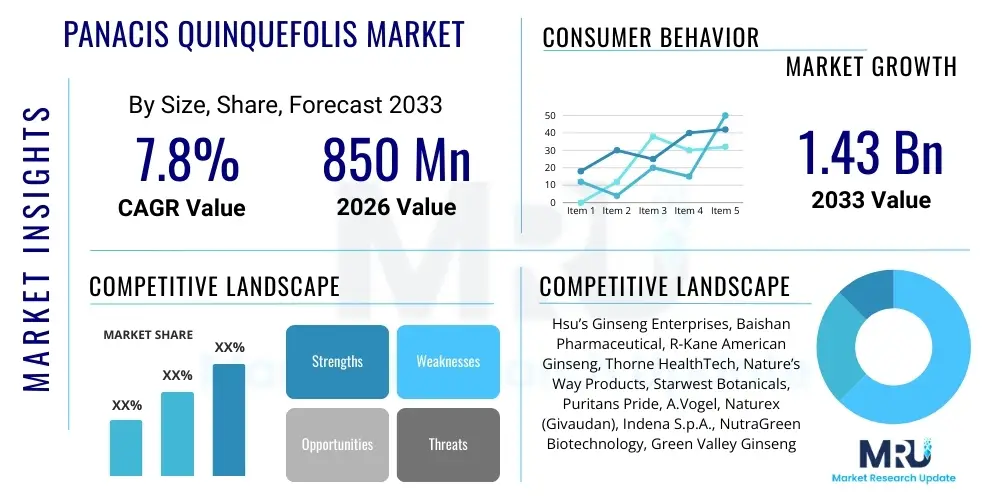

The Panacis Quinquefolis Market, primarily driven by the escalating global demand for natural health products and adaptogens, is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. This robust growth trajectory is supported by the expanding application of American Ginseng across diverse sectors, including functional foods, dietary supplements, and traditional medicine. The market is estimated at $850 Million in 2026 and is projected to reach $1.43 Billion by the end of the forecast period in 2033, reflecting increasing consumer trust in botanical ingredients proven to enhance cognitive function and boost immunity. The sustained investment in sustainable cultivation practices and advanced extraction technologies is further solidifying the market’s valuation and long-term potential.

Panacis Quinquefolis Market introduction

The Panacis Quinquefolis market, centered around American Ginseng, is characterized by its high value derived from potent ginsenosides, which are known for their anti-inflammatory, antioxidant, and adaptogenic properties. This perennial herb, native to eastern North America, is highly sought after globally, particularly in Asian markets where it is revered for promoting overall vitality and cooling yin energy. Major applications span dietary supplements, where it is often standardized for specific ginsenoside content to support cognitive health and stress reduction, and traditional Chinese medicine formulations. Its efficacy in modulating immune response and regulating blood sugar levels has positioned it as a premium ingredient in functional beverages and nutraceuticals, attracting health-conscious consumers worldwide.

The primary driving factors sustaining the market's expansion include the global shift towards preventative healthcare, the rising prevalence of chronic diseases necessitating natural complementary therapies, and the increasing disposable income in emerging economies, allowing greater access to high-value botanicals. Furthermore, extensive clinical research validating the efficacy of American Ginseng in areas like memory enhancement and fatigue management provides necessary credibility, encouraging pharmaceutical and nutraceutical manufacturers to integrate it into premium product lines. Strict quality control and the need for authenticated sourcing, primarily focusing on cultivated rather than wild-harvested roots due to conservation concerns, define the current operational landscape for market participants.

The product description highlights its slow growth cycle (typically 3–5 years for maturity), which inherently limits supply and sustains its high price point compared to other botanicals. Key benefits driving consumer adoption include improved energy levels without the stimulating effects of caffeine, enhanced mental clarity, and support for the cardiovascular system. Technological advancements in processing, such as hydro-ethanolic extraction and purification techniques, are enabling the creation of highly concentrated and bioavailable extracts, broadening the ingredient’s utility in modern product formulations and ensuring consistent quality for global distribution.

Panacis Quinquefolis Market Executive Summary

The Panacis Quinquefolis market is currently defined by significant business trends focusing on sustainability and supply chain integrity, largely in response to regulatory pressures and consumer demand for ethically sourced ingredients. Key business trends include the vertical integration of cultivation and processing operations by major market players to ensure traceability and control quality from seed to finished product, minimizing the risks associated with adulteration. The market is witnessing a strong preference shift toward certified organic and sustainably grown ginseng, driving innovation in controlled environment agriculture (CEA) techniques, which promise consistent yield and reliable supply regardless of climatic volatility. Furthermore, product innovation is accelerating, with an increasing focus on customized delivery formats such as standardized capsules, specialized tinctures, and incorporation into daily consumables like teas and energy bars, moving beyond traditional whole root consumption.

Regional trends indicate that while North America remains the primary source for high-quality American Ginseng cultivation, particularly in Wisconsin and Ontario, the Asia Pacific (APAC) region, dominated by China, Hong Kong, and Taiwan, acts as the overwhelming consumer market. This divergence necessitates complex and robust international trade logistics, highly sensitive to geopolitical factors and import/export regulations. Europe and other developed markets are demonstrating accelerating growth, primarily fueled by the neutraceutical and dietary supplement segments seeking established adaptogens. Crucially, the regulatory environment in the U.S. and Canada regarding the CITES (Convention on International Trade in Endangered Species of Wild Fauna and Flora) listing of wild American Ginseng significantly influences supply chain decisions, pushing producers towards large-scale commercial farming.

Segmentation trends highlight the growing dominance of standardized extracts and powdered forms over the whole root segment, particularly within the pharmaceutical and high-end supplement industries, due to the need for precise dosing and ease of formulation. The application segment sees Dietary Supplements maintaining the largest market share, driven by widespread health and wellness marketing. However, the Food & Beverages segment, incorporating ginseng into functional drinks and immunity boosters, is poised for the highest growth rate, reflecting consumer demand for health benefits embedded in everyday consumables. The premiumization of ginseng products, based on ginsenoside content (e.g., Rb1, Re, Rg1), dictates price dynamics and market competitiveness across all segments.

AI Impact Analysis on Panacis Quinquefolis Market

Common user questions regarding AI's influence in the Panacis Quinquefolis market frequently revolve around how technology can solve the inherent challenges of quality control, consistency, and supply chain transparency that plague high-value botanicals. Users are keenly interested in whether AI can accurately predict harvest yields based on environmental data, verify the authenticity of ginseng roots to combat counterfeiting (a major market concern), and optimize the complex extraction processes to maximize ginsenoside yield efficiently. The consensus theme is the expectation that AI should stabilize pricing, enhance product purity, and provide consumers with verifiable provenance data. Concerns often center on the initial investment costs for implementing sophisticated AI and IoT sensors in traditional agricultural settings and the potential displacement of traditional knowledge by automated systems.

AI's primary impact is revolutionizing cultivation and processing, moving the industry toward precision agriculture. Machine learning models analyze vast datasets encompassing soil composition, weather patterns, pest infestations, and plant health metrics captured via drone imagery and soil sensors. This predictive analytics capability allows cultivators to optimize irrigation, nutrient delivery, and disease management, significantly reducing crop loss and ensuring consistent maturity cycles necessary for premium quality Panacis Quinquefolis. Furthermore, in the extraction phase, AI optimizes reactor conditions (temperature, pressure, solvent ratio) in real-time, minimizing batch variability and maximizing the desired ginsenoside concentration, directly impacting the final ingredient's commercial value and therapeutic efficacy.

Beyond the field and factory, AI algorithms are being employed in sophisticated digital authentication systems. Using spectral analysis (e.g., near-infrared spectroscopy) coupled with machine learning, manufacturers can rapidly verify the species, origin, and age of the ginseng root, effectively creating a digital fingerprint for traceability. This application directly addresses consumer and regulatory demands for transparency, drastically reducing the influx of cheaper, often adulterated, or mislabeled ginseng products from different species (like Asian Ginseng or Panax notoginseng) into the high-value American Ginseng market. The integration of AI-driven supply chain platforms utilizing blockchain technology ensures that every step, from farm to consumer, is immutable and auditable, reinforcing brand trust and premium pricing.

- Supply Chain Optimization: AI-driven logistics planning reduces transit times and spoilage for highly perishable raw roots, optimizing cold chain management.

- Precision Agriculture: ML models analyze environmental data to predict ideal planting and harvesting times, maximizing ginsenoside content.

- Quality Control and Authentication: AI-enhanced spectroscopy identifies chemical markers, distinguishing authentic Panacis Quinquefolis from counterfeits or lower-grade varieties.

- Process Automation: Optimization of extraction parameters (Supercritical Fluid Extraction, SFE) using AI ensures the highest yield and purity of specific active compounds.

- Market Demand Forecasting: Predictive analytics helps processors align production volumes with forecasted global consumer demand, minimizing inventory costs and mitigating price volatility.

DRO & Impact Forces Of Panacis Quinquefolis Market

The dynamics of the Panacis Quinquefolis market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic decision-making. The primary driver is the accelerating global acceptance of herbal remedies and nutraceuticals supported by scientific validation of ginseng's adaptogenic properties, particularly among aging populations seeking natural solutions for cognitive decline and fatigue. Significant restraints include the extremely long growth cycle, which creates high entry barriers and susceptibility to weather-related crop failures, and the stringent international regulatory hurdles, especially CITES restrictions on wild harvest, which limit the expansion of traditional supply sources. Opportunities are heavily concentrated in technological innovation, specifically developing high-yielding, pest-resistant cultivars suitable for rapid, sustainable indoor farming, and expanding product applications into specialized clinical nutrition and cosmeceuticals.

Impact forces on this market are multifaceted, stemming from technological advancements, geopolitical influences, and shifts in consumer preferences. The bargaining power of buyers is moderately high due to the standardized nature of the final ingredients (ginsenoside concentration) and the availability of substitutes like Rhodiola or Ashwagandha, forcing suppliers to focus aggressively on differentiation through quality certification and origin verification. Conversely, the bargaining power of suppliers, particularly established cultivators in prime growing regions like Wisconsin, is also high because of the scarce availability of premium, cultivated root material and the extensive time commitment required for production. Regulatory changes, especially in major importing nations like China concerning tariffs and testing protocols, pose a continuous, high-intensity impact force, demanding agile supply chain management and compliance expertise.

The threat of new entrants remains relatively low due to the substantial capital requirement, specialized agricultural knowledge, and the long duration required to establish credibility in sourcing and supply. However, the threat of substitutes is significant, especially from other Panax species (like Korean Ginseng) or other powerful adaptogens, compelling manufacturers to continually emphasize the unique physiological benefits of American Ginseng (Panacis Quinquefolis) as a "cooling" or non-overstimulating tonic. Overall, the market remains highly competitive, driven by innovation in genetic research to improve yields and vertical integration strategies aimed at controlling the supply chain from the initial cultivation stage through to final product extraction, ensuring consistent material quality to justify premium pricing.

Segmentation Analysis

The Panacis Quinquefolis market is segmented based on the product form, application, and distribution channel, reflecting the varied consumer uses and industrial requirements for this high-value botanical. The analysis of these segments is crucial for identifying key growth areas and tailoring market strategies. The segmentation by form—whole root, powder, and standardized extracts—demonstrates the industry's progression towards highly processed, efficacious ingredients necessary for modern formulations, particularly within the neutraceutical sector. Standardized extracts, valued for their reliable and measured concentrations of active ginsenosides, are rapidly gaining prominence over traditional whole root sales, which primarily cater to heritage markets and traditional consumption methods.

The application segmentation reveals the broad utility of American Ginseng across diverse industries. Dietary Supplements hold the dominant share, driven by strong consumer recognition of ginseng as a cognitive and immune support agent. However, rapid expansion is expected in the Functional Foods and Beverages sector, which integrates ginseng into daily consumption items such as specialized coffees, health teas, and energy drinks, appealing to a younger, convenience-oriented demographic. Meanwhile, the incorporation of ginseng extracts into high-end cosmetics and personal care products (cosmeceuticals), capitalizing on its antioxidant and anti-aging properties, represents an important niche opportunity, although it currently accounts for a smaller market share than health-related applications.

Distribution channels are heavily influenced by the end-use segment. Business-to-Business (B2B) channels, which involve direct sales of bulk extracts and raw materials to nutraceutical manufacturers and pharmaceutical companies, remain the backbone of the industry. Conversely, Business-to-Consumer (B2C) sales, channeled through e-commerce platforms, specialized retail pharmacies, and supermarkets, are experiencing accelerated growth. The rise of sophisticated e-commerce platforms allows producers to market directly to consumers, emphasizing product transparency and storytelling related to sustainable sourcing, thereby securing higher margins and fostering brand loyalty within the fragmented consumer market.

- By Form:

- Whole Root

- Powder (Milled Root)

- Standardized Extracts (Liquid and Solid)

- Tinctures and Syrups

- By Application:

- Dietary Supplements

- Functional Foods and Beverages (Including Teas and Energy Drinks)

- Cosmetics and Personal Care (Cosmeceuticals)

- Pharmaceuticals and Traditional Medicine

- By Distribution Channel:

- B2B (Direct Supply to Manufacturers)

- B2C (Retail Sales)

- Online Retail (E-commerce)

- Pharmacy and Drug Stores

- Supermarkets and Hypermarkets

- Specialty Health Food Stores

Value Chain Analysis For Panacis Quinquefolis Market

The value chain for Panacis Quinquefolis is lengthy and complex, characterized by the high agricultural risk associated with upstream activities and the specialized processing required downstream. Upstream analysis focuses heavily on cultivation, which includes R&D into proprietary seeds, extensive land preparation, and the multi-year farming cycle requiring continuous monitoring against fungal diseases and pests. Key activities here involve authenticating seed stock, implementing sustainable farming practices (crucial for CITES compliance, even for cultivated ginseng), and executing the delicate harvest process, which requires specialized labor to minimize damage to the root structure. The costs incurred at this stage—land, labor, and time—are significant and directly determine the profitability of the entire chain.

The midstream involves initial processing, including washing, drying, and often steaming (red ginseng processing, although less common for American Ginseng than Asian), followed by the crucial stage of extraction. Advanced technologies such as Supercritical Fluid Extraction (SFE) and high-pressure liquid chromatography (HPLC) purification are employed to produce standardized extracts with guaranteed ginsenoside profiles. Contract manufacturers and specialized extract houses play a vital role in this stage, leveraging proprietary technology to achieve superior purity and yield. Quality control and laboratory testing, ensuring compliance with international pharmacopoeias and checking for contaminants like heavy metals and pesticides, are paramount before the ingredient moves downstream.

Downstream analysis covers distribution and sales, encompassing both direct and indirect channels. Direct distribution involves bulk sales of standardized ingredients (e.g., powders, liquid extracts) from the processor to large neutraceutical or pharmaceutical companies for use in their formulations (B2B). Indirect channels involve distributors, wholesalers, and retailers (physical and online) who handle the finished consumer products. The effectiveness of the indirect channel relies heavily on efficient supply chain logistics to move high-value, sometimes temperature-sensitive, products across continents to key consumer markets, primarily in East Asia. E-commerce has emerged as a particularly influential distribution channel, enabling smaller specialty brands to reach global consumers directly, often emphasizing the farm-to-bottle narrative and traceability information.

Panacis Quinquefolis Market Potential Customers

The primary buyers and end-users of Panacis Quinquefolis are concentrated in industries focused on health, wellness, and therapeutic applications, reflecting the root’s recognized medicinal and adaptogenic properties. The largest volume buyers are neutraceutical and dietary supplement manufacturers who utilize standardized extracts as core ingredients in formulations targeting immune health, stress reduction, and cognitive function enhancement. These companies demand consistency in ginsenoside concentration and meticulous documentation of purity and origin, often contracting for large, long-term supply agreements to mitigate supply volatility inherent in agricultural products. Their purchasing decisions are driven by clinical efficacy data and regulatory compliance, ensuring the final product meets consumer expectations for natural health benefits.

Another significant customer base includes specialized Traditional Chinese Medicine (TCM) practitioners and wholesale distributors who import whole, dried roots, often valuing specific attributes such as age, shape, and cultivation origin (e.g., wild vs. cultivated). This segment adheres to heritage usage patterns and traditional sourcing protocols, often involving direct relationships with established ginseng farms or certified dealers. The valuation in this segment is highly subjective, based on traditional market metrics rather than just standardized chemical composition, making it a lucrative but highly niche market requiring specific cultural and historical expertise for effective engagement.

Emerging potential customers include large-scale Food & Beverage conglomerates and premium cosmetic companies. F&B companies seek liquid extracts or powders to integrate into functional drinks, specialty teas, and fortified foods, aiming to capitalize on the wellness trend by positioning ginseng as a high-value, naturally energizing ingredient. Cosmetic firms utilize ginseng root extracts for their antioxidant and potential collagen-boosting properties in anti-aging creams, serums, and masks. These buyers prioritize water-soluble extracts, stability in formulation, and strong branding appeal, viewing Panacis Quinquefolis as a luxury botanical differentiator in highly competitive consumer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1.43 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hsu’s Ginseng Enterprises, Baishan Pharmaceutical, R-Kane American Ginseng, Thorne HealthTech, Nature’s Way Products, Starwest Botanicals, Puritans Pride, A.Vogel, Naturex (Givaudan), Indena S.p.A., NutraGreen Biotechnology, Green Valley Ginseng, Wisconsin Grown Ginseng Co., NOW Foods, Xi’an Natural Field Bio-Technique Co., Ltd., Pharmaton (Sanofi). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Panacis Quinquefolis Market Key Technology Landscape

The technological landscape in the Panacis Quinquefolis market is evolving rapidly, driven by the necessity for enhanced product quality, increased yields, and guaranteed authenticity. A primary focus is on agricultural technology, specifically the integration of Internet of Things (IoT) sensors and remote monitoring systems within ginseng farms. These tools collect real-time data on soil moisture, pH, nutrient levels, and light exposure, allowing for highly precise adjustments to the growing environment. This precision agriculture approach minimizes resource waste, such as water and fertilizer, and is crucial for mitigating common threats like root rot, thereby maximizing the harvestable yield and ensuring the ideal chemical composition (ginsenoside profile) of the root material, a key determinant of market value.

In the processing sector, advanced extraction and purification technologies are vital. Supercritical Fluid Extraction (SFE) using CO2 is gaining prominence because it allows for the precise isolation of desired ginsenosides without leaving behind harmful solvent residues, resulting in cleaner, highly concentrated, and pharmaceutical-grade extracts. This technology is critical for meeting stringent international regulatory standards, especially in Europe and North America, for dietary supplements. Furthermore, membrane filtration and chromatography techniques are used downstream to fractionate the crude extract, separating specific ginsenosides (like Rb1 and Rg1) to create proprietary, targeted ingredients for specialized health products, commanding higher premium prices in the B2B segment.

Beyond farming and extraction, authentication and traceability technologies are now standard practice. DNA barcoding and advanced spectroscopic techniques (Near-Infrared, Raman) are used to verify the genetic identity and geographic origin of the raw root, a direct response to historical issues with product adulteration and species substitution. The implementation of blockchain technology, often layered onto these authentication methods, provides an immutable record of the ginseng’s journey through the supply chain. This transparency mechanism reassures institutional buyers and consumers about the product's quality, ethical sourcing, and compliance with CITES regulations, reinforcing the high-value positioning of certified American Ginseng in the global market.

Regional Highlights

- North America (U.S. and Canada): North America is the geographical heart of Panacis Quinquefolis production, particularly Wisconsin (U.S.) and Ontario (Canada), which are renowned for cultivating the highest-quality American Ginseng. The region is characterized by advanced farming technologies, stringent agricultural standards, and a dominant position as the raw material supplier to Asian markets. While consumption is growing domestically through the dietary supplement segment, the economic engine of this region is its export prowess, supported by robust regulatory frameworks governing cultivation practices and CITES permits for trade. Innovation in cultivar development and sustainable harvesting defines this regional market.

- Asia Pacific (APAC): APAC is the largest consumer market globally, driven primarily by demand in Greater China (mainland China, Hong Kong, Taiwan) and South Korea, where Panacis Quinquefolis is deeply embedded in traditional medicine and cultural consumption. High disposable income and a strong preference for high-quality, imported American Ginseng fuel significant import volumes. Market dynamics here are highly sensitive to trade relations, tariffs, and local regulatory changes concerning imported health products. The region also acts as a hub for subsequent processing and manufacturing into final traditional medicine products before being redistributed globally.

- Europe: The European market for Panacis Quinquefolis is concentrated in the neutraceutical and functional food segments, showing consistent, albeit slower, growth. European consumers are highly focused on certified organic sourcing, rigorous quality control, and scientific validation of health claims. Market growth is constrained by high costs and regulatory hurdles (e.g., EU Novel Food Regulation) that necessitate extensive documentation for new formulations containing ginseng extracts. Germany, France, and the UK are key markets, primarily purchasing standardized extracts for use in high-end supplements and herbal medicinal products.

- Latin America and Middle East & Africa (LAMEA): These regions represent emerging opportunities. In LAMEA, consumption is currently low but is projected to grow as local distributors introduce more international health supplement brands. Growth is dependent on rising health awareness, particularly in urban centers, and increasing access to global supply chains. The market penetration is currently focused on high-net-worth consumers seeking premium imported supplements, requiring specific efforts in cold chain logistics and addressing unique regulatory approval processes across diverse national jurisdictions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Panacis Quinquefolis Market.- Hsu’s Ginseng Enterprises

- Baishan Pharmaceutical Co., Ltd.

- R-Kane American Ginseng Inc.

- Thorne HealthTech (Trained Ginseng line)

- Nature’s Way Products, LLC

- Starwest Botanicals

- Puritans Pride

- A.Vogel (Bioforce Canada Inc.)

- Naturex (Givaudan)

- Indena S.p.A.

- NutraGreen Biotechnology Co., Ltd.

- Green Valley Ginseng Farm

- Wisconsin Grown Ginseng Co-op

- NOW Foods

- Xi’an Natural Field Bio-Technique Co., Ltd.

- Pharmaton (Sanofi)

- Oregon’s Wild Harvest

- Biotics Research Corporation

- Herb Pharm

- Fytokem Products Inc.

Frequently Asked Questions

Analyze common user questions about the Panacis Quinquefolis market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Panacis Quinquefolis (American Ginseng) and Panax Ginseng (Asian Ginseng)?

The primary difference lies in their chemical profile and traditional effects. Panacis Quinquefolis, known as American Ginseng, traditionally possesses "cooling" properties, often used to reduce heat and balance stress, and is high in ginsenosides like Rb1 and Re. Panax Ginseng (Asian or Korean Ginseng) is considered "warming," used to boost vitality, and is generally higher in ginsenosides like Rg1 and Rf. This distinction dictates their specific applications in dietary supplements and traditional medicine.

What are the key drivers for the sustained growth of the Panacis Quinquefolis market?

Market growth is predominantly driven by increasing consumer awareness regarding the health benefits of adaptogens, particularly for cognitive function and stress management. Expansion into functional food and beverage formulations, coupled with the rigorous scientific validation of its therapeutic benefits, further accelerates demand. The increasing preference for natural and preventive healthcare solutions globally also acts as a significant long-term driver.

How does the regulation of CITES affect the American Ginseng supply chain?

The Convention on International Trade in Endangered Species (CITES) lists wild Panacis Quinquefolis, requiring strict permits for international trade of wild-harvested roots, restricting supply significantly. This regulation has incentivized major market players to shift almost entirely towards large-scale cultivated production, ensuring sustainable and traceable sourcing, which in turn elevates the quality and consistency of commercial extracts.

Which product form holds the largest market share and why?

Standardized extracts and powdered forms are gaining the largest market share over the whole root, especially in the neutraceutical industry. This preference is due to the need for dosage precision, ease of incorporation into capsules and beverages, and the guarantee of a specific concentration of active compounds (ginsenosides), which is essential for efficacy and regulatory compliance in modern health products.

What role does technology, specifically AI, play in improving the quality of American Ginseng?

AI plays a crucial role in enhancing quality control through precision agriculture and authentication. Machine learning algorithms analyze environmental data to optimize cultivation, maximizing ginsenoside content. Furthermore, AI-enhanced spectroscopic analysis is used in processing to authenticate the species and origin of the root material, effectively preventing fraud and ensuring high product purity throughout the supply chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager