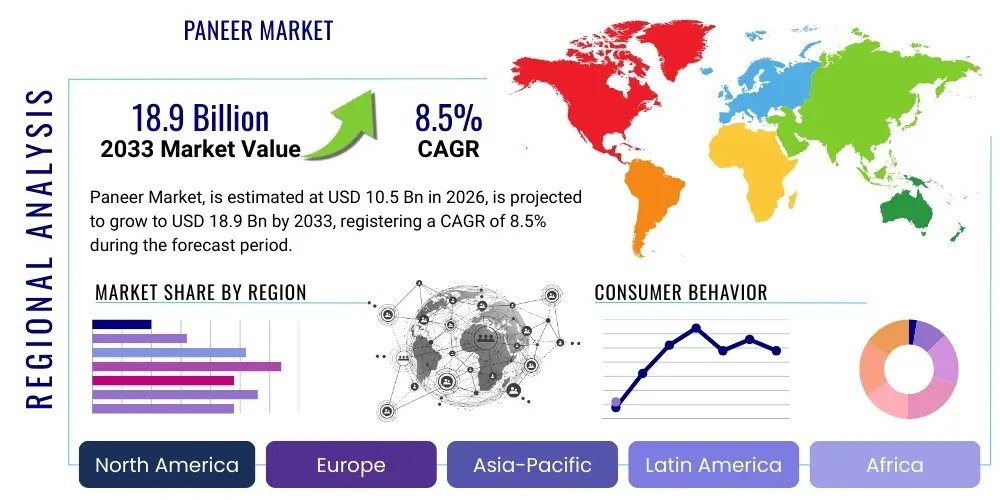

Paneer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438279 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Paneer Market Size

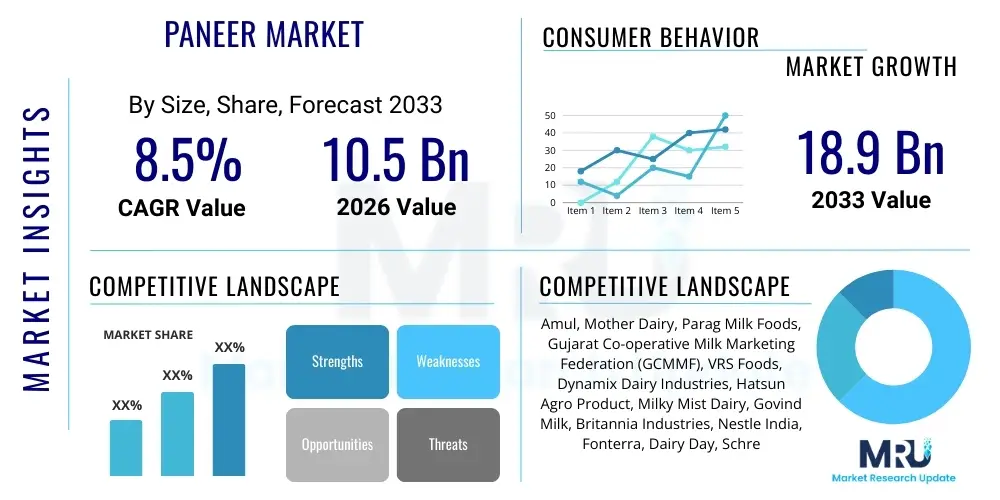

The Paneer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 18.9 Billion by the end of the forecast period in 2033.

Paneer Market introduction

The Paneer Market encompasses the production, distribution, and consumption of fresh, non-melting, acid-set cheese widely consumed across South Asia, particularly India. Paneer, traditionally made by curdling heated milk with lemon juice or vinegar, is a fundamental source of protein in vegetarian diets, driving its sustained demand. The modern market is characterized by a shift from loose, local dairy sales to packaged, branded, and hygienically processed paneer, offering extended shelf life and standardized quality. This transformation is heavily influenced by urbanization, rising disposable incomes, and the growing preference for convenience foods, propelling its integration into modern retail channels and food service industries globally. Major applications span from traditional Indian cuisine to fusion dishes, snacks, and ready-to-eat meals, cementing its position as a versatile dairy product.

Product characteristics vary based on moisture content and texture, catering to diverse culinary needs, such as firm blocks for grilling (Tikka) or softer varieties for curries (Matar Paneer). The primary benefits of paneer include its high protein content, rich calcium profile, and versatility in preparation, making it highly attractive to health-conscious consumers. Furthermore, the product is increasingly being utilized in processed forms, such as frozen paneer cubes, paneer butter masala mixes, and paneer-based snacks, facilitating easier meal preparation for time-constrained urban populations. The market scope now extends beyond traditional geographies, driven by the expanding South Asian diaspora and the increasing global interest in ethnic foods, promoting exports and establishing manufacturing hubs outside the core region.

Key driving factors accelerating market growth involve technological advancements in milk processing and packaging, which enhance food safety and reduce spoilage rates. Government initiatives promoting dairy farming and organized dairy sectors, particularly in India, provide a robust supply chain foundation. Additionally, effective marketing strategies focusing on the nutritional benefits and the convenience of packaged paneer are critical for boosting consumer adoption in competitive retail environments. The continued shift toward plant-based alternatives also subtly influences the market, necessitating product diversification, such as fortified or lower-fat paneer varieties, to maintain market share among diverse consumer segments seeking healthier options.

Paneer Market Executive Summary

The Paneer Market is experiencing robust expansion, fundamentally driven by significant business trends related to organized dairy processing and the rapid adoption of cold chain logistics. Modernization in processing facilities, utilizing Ultra-High Temperature (UHT) technology and advanced vacuum packaging, is extending the product's shelf stability, allowing major dairy cooperatives and private entities to capture wider geographic markets. Business strategies are increasingly centered on vertical integration, ensuring control over milk sourcing and quality, alongside aggressive brand positioning and product innovation, especially in fortified, flavored, and low-fat paneer variants to cater to contemporary health trends. The shift towards large-scale production facilities enables economies of scale, making branded paneer more accessible and competitive against traditional, unorganized sector offerings.

Regionally, the market exhibits a clear concentration in Asia Pacific, with India dominating both production and consumption due to its intrinsic cultural and culinary reliance on dairy products. However, significant growth momentum is observed in regions with substantial South Asian diaspora, such as North America, Europe, and the Middle East, where packaged paneer imports and localized manufacturing facilities are expanding rapidly to meet ethnic demand. Emerging markets in Southeast Asia also show potential, driven by rising protein consumption and urbanization. Regional trends highlight divergent packaging preferences, with vacuum-sealed blocks preferred in export markets for durability, while flexible pouch packaging remains popular for domestic fresh consumption in high-volume Asian markets, optimizing cost and logistics efficiency.

Segment trends are predominantly shaped by application and distribution channels. The retail segment, encompassing supermarkets, hypermarkets, and online grocery platforms, is the fastest-growing distribution channel, capitalizing on consumer demand for convenience and diverse product choices. In terms of application, the household segment remains the largest consumer, but the Food Service Industry (FSI), including restaurants, hotels, and catering services, is exhibiting accelerating growth due to the increasing professionalization of food preparation and the expansion of quick-service restaurant (QSR) chains featuring paneer-based items. Product type segmentation favors the plain/unflavored paneer category, though the flavored and marinated segment is gaining traction, representing a key area for future product diversification and premiumization efforts targeting younger demographics seeking ready-to-cook solutions.

AI Impact Analysis on Paneer Market

User queries regarding the impact of Artificial Intelligence (AI) on the Paneer Market primarily revolve around optimizing dairy farm efficiency, enhancing quality control and safety standards, and streamlining supply chain operations. Common concerns include how AI can address milk quality variability, predict demand fluctuations in high-volume retail sectors, and automate complex dairy processing steps like coagulation and pressing to ensure consistent texture and moisture content. Users seek clarity on AI's role in predictive maintenance for large dairy processing equipment and its capability to analyze consumer feedback data to rapidly inform product development, especially concerning flavor profiles and nutritional attributes. The analysis confirms a strong expectation that AI will move the market toward hyper-efficiency, guaranteeing higher throughput, minimizing waste, and significantly elevating the benchmark for hygiene and product consistency, critical factors for export readiness and consumer trust in packaged paneer.

- AI-driven predictive analytics optimize raw milk procurement by forecasting supply and quality based on farm data, weather patterns, and cow health metrics.

- Machine Vision systems utilizing AI monitor paneer texture, color, and size during the processing line, ensuring uniformity and adherence to quality specifications in real-time.

- Automated quality testing, leveraging spectral analysis and AI algorithms, detects contaminants or deviations in protein and fat composition faster and more accurately than traditional lab methods.

- AI optimizes cold chain logistics by dynamically adjusting refrigeration parameters and predicting potential equipment failures during transportation, thereby minimizing spoilage and extending shelf life.

- Generative AI tools assist in analyzing vast amounts of consumer data, social media trends, and regional dietary preferences to accelerate the development of innovative paneer products, such as fortified or ethnic-flavored variants.

- Smart factory implementations use AI for predictive maintenance of pasteurizers, homogenizers, and packaging machinery, reducing unplanned downtime and enhancing operational efficiency across paneer manufacturing units.

DRO & Impact Forces Of Paneer Market

The Paneer Market growth is primarily driven by the expanding vegetarian population globally, particularly in Asia, coupled with the increasing consumer awareness regarding the nutritional benefits of high-protein, calcium-rich dairy products. The rapid growth of organized retail and e-commerce platforms facilitates the wider accessibility of branded, hygienic, and long-shelf-life paneer variants, overcoming traditional distribution limitations inherent in the unorganized dairy sector. Opportunities are generated through product diversification into fortified, flavored, and low-fat paneer, addressing evolving health consciousness and catering to modern consumer demands for convenient, ready-to-use ingredients. Furthermore, increasing investment in advanced packaging technologies, such as modified atmosphere and vacuum sealing, significantly reduces product wastage, directly contributing to profitability and market expansion, while robust marketing strategies highlight the cultural relevance and culinary versatility of paneer.

Restraints primarily involve the highly perishable nature of fresh paneer, necessitating expensive and complex cold chain infrastructure throughout the supply chain, which poses a significant challenge in developing regions with inconsistent power supply. The market also faces substantial competition from unbranded, locally produced paneer, which often undercuts the price of packaged products, particularly in rural and semi-urban areas. Additionally, fluctuations in raw milk prices, influenced by seasonal variations and cattle feed costs, impact the profit margins of paneer manufacturers. The increasing trend toward plant-based alternatives, such as tofu and other vegan protein sources, presents a long-term threat, requiring the dairy industry to invest continuously in product differentiation and promoting the inherent nutritional superiority of dairy protein.

Impact Forces are multifaceted, with governmental regulations on food safety and dairy standards acting as a major external force, compelling the unorganized sector to transition toward hygienic practices or risk obsolescence, favoring large, compliant players. Technological advancements in continuous paneer manufacturing processes increase efficiency and consistency, impacting competitiveness across the value chain. Economic factors, such as rising disposable income, significantly amplify consumer purchasing power, driving the transition from unbranded to branded products. Demographic shifts, including urbanization and the rise of nuclear families, amplify the demand for convenient, ready-to-cook paneer products, ensuring sustained market impetus and driving innovation in smaller pack sizes suitable for modern retail environments.

Segmentation Analysis

The Paneer Market is comprehensively segmented based on product type, application, and distribution channel, providing a granular view of consumer preferences and operational dynamics across the industry. Product type segmentation distinguishes between the traditional, high-volume plain/unflavored paneer and the emerging segment of flavored/marinated paneer, which caters to the demand for quick meal preparation and culinary experimentation. Application analysis categorizes consumption into Household usage and the Food Service Industry (FSI), reflecting the contrasting bulk and quality requirements of professional kitchens versus individual consumers. The distribution channel breakdown highlights the pivotal shift from traditional, unorganized retail formats (local dairy shops) toward modern trade outlets, underscoring the importance of cold chain logistics and brand visibility in capturing contemporary market share.

- By Product Type:

- Plain Paneer (Unflavored)

- Flavored/Marinated Paneer (e.g., Tikka, Mint, Chili)

- Low-Fat Paneer

- Frozen Paneer

- By Application:

- Household/Retail Consumption

- Food Service Industry (HORECA, Institutional)

- Industrial Processing (Snack Manufacturing, Ready-to-Eat Meals)

- By Distribution Channel:

- Supermarkets/Hypermarkets (Modern Trade)

- Convenience Stores (General Trade)

- Online Retail (E-commerce)

- Direct Sales (Dairy Outlets, Institutional Supply)

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Paneer Market

The Paneer market value chain begins with intensive upstream activities focused on raw milk procurement. This stage involves complex dynamics, including sourcing from organized dairy cooperatives, contract farming, or small individual farmers. Ensuring high-quality raw milk supply is paramount, necessitating stringent quality checks, testing for adulteration, and maintaining rapid chilling infrastructure at collection centers. Investment in cattle breeding programs, efficient feeding mechanisms, and veterinarian services further optimize the upstream segment, directly influencing the final product yield and protein content. The transition from traditional sourcing to technology-enabled smart farms, using IoT for monitoring animal health and milk output, represents a crucial modernization trend in this initial phase, reducing variability and improving traceability, which are vital for branded paneer manufacturers.

The midstream phase focuses on processing, encompassing pasteurization, coagulation, pressing, cutting, and packaging. Modern processing plants utilize automated Continuous Paneer Making (CPM) lines to ensure uniformity, hygiene, and high capacity throughput. This stage involves substantial capital expenditure on sophisticated machinery, cold storage facilities, and adherence to international food safety certifications (such as HACCP and ISO standards). Packaging technology is critical here, with innovations like Modified Atmosphere Packaging (MAP) and vacuum sealing significantly extending the short shelf life of paneer, thereby enabling wider distribution and mitigating inventory loss. Operational efficiency and energy management in the processing phase directly impact the overall cost structure and competitive positioning of the final product in the retail environment.

Downstream activities include distribution and sales, covering both direct and indirect channels. Direct channels involve dedicated dairy outlets or institutional supply contracts (HORECA), offering manufacturers greater control over pricing and delivery scheduling. Indirect channels, which dominate urban markets, rely heavily on modern trade (supermarkets, hypermarkets) and the rapidly expanding e-commerce sector. Effective cold chain logistics management is indispensable in the downstream segment, requiring refrigerated trucks and cold storage facilities at retail points. Marketing, branding, and promotional activities also form a crucial part of the downstream value, establishing brand recognition and driving consumer pull. The optimization of this final stage ensures product freshness and maximizes accessibility, crucial determinants of success in the competitive packaged paneer segment.

Paneer Market Potential Customers

The primary segment of potential customers for the Paneer Market consists of vegetarian households, particularly those across South Asia (India, Pakistan, Bangladesh, Nepal) where paneer is a dietary staple and a primary source of high-quality animal protein. This demographic values paneer for its cultural relevance, versatility in traditional cuisine, and its high nutritional profile, especially for growing children and lactating mothers. Urbanization and the rise of double-income nuclear families within this demographic amplify the demand for convenient, pre-cut, and pre-marinated paneer products that reduce preparation time while maintaining nutritional integrity. Manufacturers target this group through large-format packaging and value-for-money propositions offered via modern retail channels.

Another rapidly expanding customer base is the Food Service Industry (FSI), including restaurants, hotels, catering companies, and specialized sweet shops (mithaiwalas). These professional buyers prioritize consistent quality, bulk availability, and specific textural properties suitable for high-heat cooking and preparation like tikkas or deep-fried snacks. This segment requires business-to-business supply chains characterized by stringent contracts, just-in-time delivery capabilities, and high standards of hygiene documentation. The expansion of ethnic restaurant chains globally further enhances the international demand from the FSI segment, requiring reliable suppliers capable of meeting large-volume export orders with extended shelf life.

Additionally, health-conscious consumers and fitness enthusiasts across developed markets (North America, Europe) represent significant potential, often driven by the search for vegetarian protein alternatives to meat or soy. This group is interested in specialized paneer products, such as low-fat, high-protein, or organically produced variants. The increasing popularity of globally conscious eating, coupled with the growth of the South Asian diaspora, means that international consumers are becoming increasingly familiar with paneer, positioning it as a premium, versatile ingredient for fusion cooking. Marketing efforts aimed at this segment emphasize clean labeling, high protein-to-fat ratios, and the natural, non-processed nature of the cheese.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 18.9 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amul, Mother Dairy, Parag Milk Foods, Gujarat Co-operative Milk Marketing Federation (GCMMF), VRS Foods, Dynamix Dairy Industries, Hatsun Agro Product, Milky Mist Dairy, Govind Milk, Britannia Industries, Nestle India, Fonterra, Dairy Day, Schreiber Foods, Kwality Dairy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paneer Market Key Technology Landscape

The manufacturing process of paneer, while fundamentally traditional, is being rapidly revolutionized by advanced processing and packaging technologies aimed at improving hygiene, consistency, and shelf life. Continuous Paneer Making (CPM) systems are pivotal, automating the sequential steps of milk standardization, heating, coagulation using approved acids, whey drainage, pressing, and chilling. These mechanized systems replace laborious batch processes, significantly reducing human contact, thereby minimizing the risk of microbial contamination and ensuring consistent density and moisture content, crucial for meeting packaged product specifications. Furthermore, advancements in homogenization and ultra-filtration technologies are being utilized upstream to standardize milk composition, allowing manufacturers to produce low-fat paneer variants without compromising textural integrity or yield, directly catering to health-conscious consumers.

In the post-production phase, packaging technology represents the single most important innovation driver for market expansion. Modified Atmosphere Packaging (MAP) involves replacing the air inside the packet with a specific mixture of gases (typically nitrogen and carbon dioxide) to slow down spoilage and inhibit microbial growth, effectively doubling or tripling the traditional shelf life of fresh paneer. Vacuum packaging is also widely employed, especially for export and long-distance distribution, maintaining the product’s freshness and preventing moisture loss. The incorporation of smart packaging solutions, such as temperature sensors and time-temperature indicators (TTIs), is an emerging trend that provides real-time visibility into cold chain compliance, enhancing consumer confidence and reducing returns due to spoilage, particularly in sensitive global supply routes.

Digital technologies, specifically IoT and automation, are transforming plant operations. IoT sensors are deployed across the processing line to monitor parameters like pH, temperature, and pressure, feeding data into centralized Manufacturing Execution Systems (MES) for real-time process control and quality assurance. This data-driven approach allows for rapid identification and correction of deviations, minimizing batch variations. Moreover, sophisticated cleaning-in-place (CIP) and sterilization-in-place (SIP) systems, guided by automated controls, ensure that the high hygienic standards required for dairy processing are consistently met, reinforcing the brand promise of purity and safety, which is essential for penetrating premium retail segments and international markets.

Regional Highlights

The Paneer market demonstrates highly asymmetrical regional dynamics, heavily concentrated in Asia Pacific, but with expanding influence across global diaspora hubs, necessitating tailored production and distribution strategies to maximize market penetration and efficiency across varied geographic landscapes. Asia Pacific, specifically India, remains the undisputed epicenter of both consumption and production, driven by deep cultural integration of paneer into daily diets and the existence of vast, although increasingly organized, raw milk supply chains. The market here is characterized by fierce competition between traditional cooperatives (like Amul and Mother Dairy) and large private players, with growth being fueled by the rapid expansion of modern retail outlets into tier 2 and tier 3 cities, alongside significant governmental investment in dairy infrastructure, including chilling centers and processing capacity upgrades. Demand is consistently high for both fresh and frozen variants, catering to a burgeoning middle class seeking convenient, high-protein vegetarian options. The technological modernization in packaging, particularly shelf-life extension techniques, is the primary factor enabling large brands to supersede local unorganized sellers, driving regional formalization.

North America and Europe represent critical growth regions, primarily propelled by the large and affluent South Asian diaspora that maintains strong dietary preferences for authentic cuisine ingredients. In these regions, the market is characterized by a strong dependence on reliable cold chain imports, though localized production is gaining momentum, particularly in countries like the United States, Canada, and the United Kingdom, where manufacturers can source local high-quality milk and adhere to stringent Western food safety standards. The packaged paneer in these regions is often positioned as a premium specialty cheese, targeted not only at ethnic communities but also increasingly at mainstream consumers interested in global cuisines and vegetarian protein alternatives. Distribution largely occurs through specialized ethnic grocery stores and major supermarket chains, where shelf presence and premium branding are crucial for success, demanding robust supply chain integration and high-quality vacuum packaging to guarantee freshness upon arrival.

The Middle East and Africa (MEA), particularly the GCC countries, exhibit significant potential due to a large expatriate population from India, Pakistan, and Bangladesh, combined with high per capita expenditure capabilities. Countries like the UAE and Saudi Arabia are major importers, requiring specialized logistical operations to handle perishable products in hot climates, making advanced refrigeration and rapid transit essential components of the supply chain strategy. Furthermore, emerging African economies are showing preliminary adoption trends driven by urbanization and changing dietary patterns, though market penetration remains challenging due to fragmented distribution networks and lower cold chain reliability. Latin America currently holds a niche market presence, primarily catering to small ethnic pockets and high-end culinary sectors exploring global ingredients, representing a long-term opportunity area contingent on increased global food fusion trends and improved trade logistics. Manufacturers targeting MEA and Latin America must strategically focus on durable, extended-shelf-life products and robust distribution partnerships to mitigate high regional distribution risks.

The competitive landscape across all regions is heavily influenced by quality certifications and adherence to local food regulatory bodies. In APAC, the focus is on scaling operations and achieving cost efficiency, while in North America and Europe, the emphasis shifts to premium positioning, organic sourcing claims, and strict hygiene compliance. The market is subtly segmented geographically by product moisture content—drier, firmer paneer is often preferred in areas where it is used primarily for grilling (tikka), while softer varieties are preferred in areas specializing in curries and sweets. Understanding these nuanced regional culinary preferences is paramount for manufacturers to successfully tailor their product offerings and packaging formats, ensuring optimal sensory acceptance and maximizing localized market capture. This strategic regional specialization, leveraging both localized production and efficient global exports, defines the successful trajectory of the Paneer Market over the forecast period.

- Asia Pacific (APAC): Dominates the market; characterized by high domestic consumption (India), rapid shift from unorganized to organized retail, and heavy investment in dairy processing infrastructure.

- North America: Significant growth driven by the South Asian diaspora; premium positioning of paneer as a specialty cheese; focus on import reliability and stringent food safety compliance.

- Europe: Steady growth fueled by ethnic communities and increasing mainstream interest in vegetarian protein; reliance on advanced packaging technologies (MAP) for extended shelf life.

- Middle East & Africa (MEA): High import market (GCC countries); logistical challenges due to climate requiring robust cold chain infrastructure; growing demand from expatriate populations.

- Latin America: Emerging niche market; potential driven by global food trends; current consumption is low but offers long-term diversification opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paneer Market.- Amul (Gujarat Co-operative Milk Marketing Federation - GCMMF)

- Mother Dairy Fruit & Vegetable Pvt. Ltd.

- Parag Milk Foods Ltd.

- VRS Foods Private Limited

- Dynamix Dairy Industries Ltd.

- Hatsun Agro Product Ltd.

- Milky Mist Dairy Food Private Limited

- Govind Milk & Milk Products Pvt. Ltd.

- Britannia Industries Limited

- Nestle India Limited

- Fonterra Co-operative Group

- Dairy Day

- Schreiber Foods, Inc.

- Kwality Dairy (India) Ltd.

- Aakash Namkeen Pvt. Ltd.

- Prabhat Dairy Ltd.

- Gokul Dairy

- IDMC Limited (Dairy Equipment Supplier Influence)

Frequently Asked Questions

Analyze common user questions about the Paneer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the shift from loose to packaged paneer in the market?

The primary drivers include rising urbanization and disposable incomes, increased consumer awareness regarding hygiene and food safety, and the growth of organized retail chains that offer standardized, branded products with certified quality and extended shelf life, facilitated by advanced packaging technologies.

How does the volatile price of raw milk affect the profitability of paneer manufacturers?

Raw milk price volatility, often influenced by seasonal supply and fodder costs, directly compresses profit margins, especially for small and mid-sized manufacturers. Larger players mitigate this risk through integrated supply chains and long-term contracts with dairy farmers.

Which geographical region exhibits the fastest growth potential for paneer consumption outside of Asia?

North America and Europe display the highest potential outside of Asia, driven by the expanding South Asian diaspora and the growing acceptance of paneer in mainstream food service and retail segments as a versatile, high-protein vegetarian cheese alternative.

What key technological innovations are enhancing the shelf life and safety of paneer?

Key innovations include Continuous Paneer Making (CPM) systems for hygienic production, Modified Atmosphere Packaging (MAP) and vacuum sealing for shelf-life extension, and the use of IoT sensors for real-time temperature monitoring within the cold chain logistics network.

What is the market outlook for flavored and marinated paneer products?

The outlook is positive, driven by consumer demand for convenience, ready-to-cook meal solutions, and product differentiation. Flavored and marinated segments cater to younger demographics and are crucial for the premiumization strategy adopted by major dairy companies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager