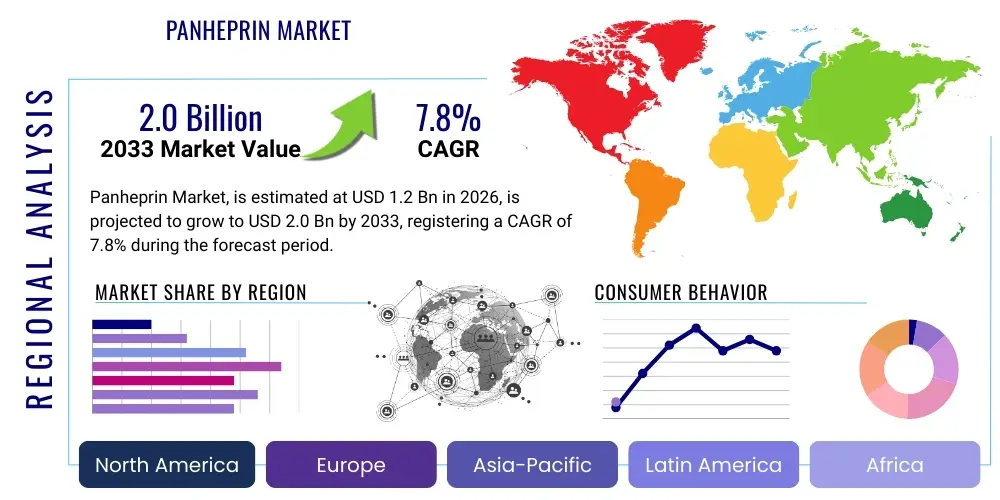

Panheprin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439090 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Panheprin Market Size

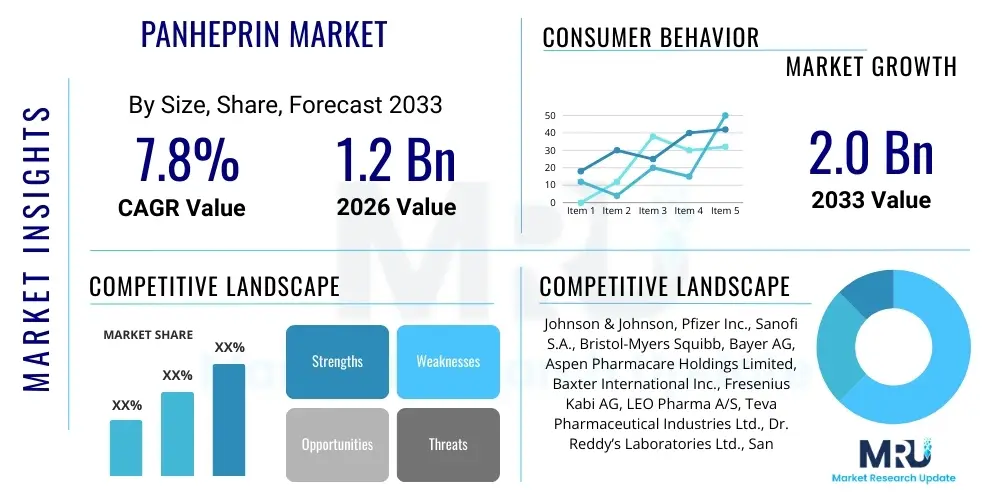

The Panheprin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.0 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally supported by the escalating prevalence of cardiovascular diseases globally, coupled with advancements in surgical procedures necessitating robust anticoagulant therapy. Furthermore, the increasing geriatric population, which inherently possesses a higher risk profile for thromboembolic events, acts as a primary demographic catalyst driving demand for effective Panheprin products across diverse healthcare settings, including acute care hospitals and specialized ambulatory surgical centers. The transition towards bioengineered and synthetic sources also enhances market stability and supply chain reliability, mitigating historical concerns related to animal-derived sourcing.

Panheprin Market introduction

The Panheprin Market encompasses the production, distribution, and utilization of Panheprin—a specialized, often highly purified or synthetic class of anticoagulant compounds designed for therapeutic interventions where blood clotting inhibition is critical. Panheprin is distinct from traditional unfractionated heparin due to its specific molecular structure or formulation enhancements, offering improved bioavailability, predictable dosing, and potentially reduced side effect profiles, particularly concerning Heparin-Induced Thrombocytopenia (HIT). The product is primarily administered via injection or continuous infusion in clinical settings, making its quality control and regulatory compliance paramount. Major applications span critical care, cardiology, vascular surgery, and renal treatment, where the prevention of clot formation is essential to patient survival and procedural success. These applications are expanding into preventative care protocols for high-risk patients, signaling a shift from reactive to proactive therapeutic use. The complex manufacturing processes involved, often requiring biological manipulation or advanced chemical synthesis, dictate a high barrier to entry and intensive capital investment, influencing competitive dynamics significantly.

Key driving factors supporting the market expansion include the global rise in lifestyle-related chronic conditions, such as diabetes and hypertension, which are potent precursors to cardiovascular complications requiring immediate or long-term anticoagulant management. Moreover, technological advancements in drug delivery systems and formulation stability have optimized the therapeutic window for Panheprin, allowing for its wider acceptance and standardization in diverse clinical protocols. The demonstrable benefits of Panheprin—including faster onset of action, highly controllable anticoagulant effect through established reversal agents, and versatility in treating complex coagulation disorders—cement its position as a cornerstone therapy in modern medicine. Global guidelines recommending aggressive anticoagulation for conditions like deep vein thrombosis (DVT), pulmonary embolism (PE), and during extracorporeal circulation procedures (e.g., dialysis, cardiac bypass) continuously fuel demand, particularly in densely populated and rapidly developing healthcare economies in Asia Pacific and Latin America.

However, the market introduction of Panheprin is continuously challenged by the proliferation of alternative anticoagulant therapies, such as novel oral anticoagulants (NOACs), which offer convenience and simplified patient management outside hospital settings. Despite this competition, Panheprin maintains a critical niche in acute, high-risk, and perioperative environments where rapid control, short half-life, and precise titration are essential, qualities often unmatched by oral alternatives. The ongoing research into standardized, non-animal-sourced Panheprin analogs seeks to address supply chain vulnerabilities and ethical concerns associated with traditional extraction methods, promising long-term sustainable growth and positioning the product favorably against future regulatory scrutiny. Successful market penetration relies heavily on robust clinical trial data demonstrating superiority or non-inferiority compared to existing standards of care, ensuring its inclusion in hospital formularies and national reimbursement schedules, thereby accelerating adoption among key clinical decision-makers.

Panheprin Market Executive Summary

The Panheprin Market is characterized by robust growth underpinned by strong clinical necessity and significant investments in biopharmaceutical innovation aimed at enhancing product safety and efficacy profiles. Current business trends indicate a definitive move toward strategic vertical integration among leading pharmaceutical manufacturers, seeking to control the entire supply chain from raw material sourcing (or synthesis) through final distribution, primarily to ensure product quality and regulatory compliance, particularly concerning purity standards mandated by major agencies like the FDA and EMA. Regional trends highlight North America and Europe as established revenue generators, driven by sophisticated healthcare infrastructure and high expenditure on specialized medications, whereas the Asia Pacific region is rapidly emerging as the fastest-growing market, propelled by increasing healthcare access, rising incidence of cardiovascular diseases, and improving diagnostic capabilities that lead to greater patient identification requiring anticoagulation therapy. This regional dynamism necessitates localized strategic adaptations concerning pricing, distribution logistics, and regulatory submissions, accounting for varied national reimbursement landscapes.

Segment trends underscore the dominance of the hospital segment, reflecting the acute nature of Panheprin administration, which typically occurs during emergency procedures, surgical interventions, and intensive care unit (ICU) stays. However, there is a discernible growth acceleration in the Ambulatory Surgical Centers (ASC) segment, driven by the increasing shift of less invasive procedures to outpatient settings, demanding portable and stable anticoagulant formulations suitable for rapid recovery protocols. Furthermore, the segmentation by application shows persistent strength in the Thrombosis and Cardiac Surgery categories, while the Dialysis segment exhibits consistent, needs-driven demand tied directly to the rising global prevalence of End-Stage Renal Disease (ESRD). The market structure remains highly competitive, with established multinational pharmaceutical companies leveraging extensive intellectual property portfolios and robust distribution networks to maintain market share against emerging specialized biotech firms focused on innovative synthetic alternatives aimed at reducing variability and immunogenicity risks associated with bio-derived products.

Overall, the market trajectory suggests sustained investment in R&D focusing on new chemical entities (NCEs) within the Panheprin class that promise enhanced therapeutic ratios, alongside substantial efforts dedicated to improving the scalability and environmental sustainability of manufacturing processes. Key competitive strategies involve securing long-term supply agreements with major hospital networks and participating aggressively in tenders organized by public health systems, especially within European markets. The successful navigation of stringent regulatory pathways, especially for biosimilar or generic versions, remains a critical factor defining market entry and subsequent success, often involving complex comparability trials. This executive analysis concludes that while external pressures from competitive drug classes exist, the irreplaceable role of Panheprin in acute critical care management ensures its sustained relevance and continuous, albeit specialized, market expansion through 2033, contingent upon effective risk management strategies related to raw material supply and adherence to evolving global pharmacopoeial standards.

AI Impact Analysis on Panheprin Market

Users frequently inquire about how Artificial Intelligence (AI) can mitigate the significant risks associated with anticoagulant therapy, specifically focusing on dose personalization, prediction of bleeding events, and optimizing manufacturing quality control for complex biologics like Panheprin. Concerns center around whether AI models can accurately predict patient response variability, given the drug's narrow therapeutic window and dependency on factors like renal function, body weight, and concurrent medication usage. Key themes emerging from these user questions revolve around leveraging AI for highly precise, real-time dosing adjustments in ICU settings using Continuous Therapeutic Monitoring (CTM) algorithms. Expectations are high regarding AI's ability to streamline the drug discovery process for safer Panheprin analogs and enhance the efficiency of large-scale bio-manufacturing by predicting process deviation, thereby ensuring batch-to-batch consistency and minimizing costly regulatory failures associated with impurity detection. The consensus is that AI will primarily serve as a critical risk mitigation and optimization tool rather than fundamentally altering the clinical application of the drug itself.

- AI enhances real-time pharmacokinetic modeling for individualized Panheprin dosing, minimizing the risk of hemorrhage or thrombosis.

- Machine learning algorithms predict patient susceptibility to adverse effects, notably Heparin-Induced Thrombocytopenia (HIT), facilitating early intervention.

- AI optimizes biomanufacturing yields and quality assurance processes, specifically detecting molecular inconsistencies in synthesized Panheprin batches.

- Generative AI accelerates the discovery of novel, structurally refined Panheprin analogs with improved safety profiles and reduced immunogenicity.

- Predictive maintenance schedules for critical manufacturing equipment are optimized using AI, ensuring uninterrupted supply chain stability for essential pharmaceuticals.

DRO & Impact Forces Of Panheprin Market

The Panheprin market dynamic is governed by a critical interplay of established clinical demand and stringent regulatory oversight. Drivers include the irreversible demographic shift towards an older population globally, dramatically increasing the prevalence of thromboembolic diseases, coupled with substantial improvements in complex surgical techniques (e.g., organ transplants, lengthy cardiac procedures) that mandate perioperative anticoagulation. These drivers are further amplified by continuous product innovation aimed at reducing the burden of monitoring, such as the development of formulations with more linear dose-response curves. Conversely, restraints predominantly stem from the inherent complexities and risks associated with traditional heparin derivatives, including the need for continuous monitoring, the risk of potentially fatal bleeding events, and the specific immunologic complication of HIT, which necessitate specialized training and institutional protocols for management. Furthermore, the emergence and aggressive marketing of competitive therapeutic classes, notably NOACs, divert market share from routine, non-acute applications, forcing Panheprin manufacturers to focus intensely on critical care niches.

Opportunities for market growth are significant and concentrated in two primary areas: geographic expansion into underserved emerging markets, particularly across Asia and Africa, where healthcare infrastructure is rapidly improving and disease burden is high, and therapeutic expansion into novel applications such as specific oncology support treatments or prophylactic use in high-risk non-surgical patient groups. Furthermore, the push towards developing fully synthetic or bioengineered Panheprin sources presents a massive opportunity to overcome the historical reliance on animal-derived materials (primarily porcine), addressing both ethical concerns and significant supply chain volatility that have plagued the industry in the past. This technological pivot promises greater standardization, enhanced purity, and improved security of supply, attracting significant venture capital and pharmaceutical R&D spending aimed at realizing these high-value, sustainable alternatives. The successful commercialization of a fully synthetic product would represent a transformative milestone, effectively neutralizing the risk of contamination crises that have previously impacted market stability.

The impact forces within this market are primarily concentrated in regulatory stringency and competitive intensity. Regulatory bodies worldwide are continuously tightening purity requirements and mandating more rigorous clinical evidence for approval, significantly increasing the cost and duration of R&D for new Panheprin products. This regulatory pressure acts as a barrier to entry, consolidating power among established players with deep financial resources and proven compliance records. Competitive forces are exerted not just by direct competitors offering alternative Panheprin formulations, but more forcefully by indirect competitors offering oral alternatives (NOACs) or other injectables (e.g., LMWH) that may be preferred in less acute settings. The pricing pressure exerted by large group purchasing organizations (GPOs) and national health services further impacts profitability, necessitating efficiency improvements in manufacturing and distribution. Overall, the market is characterized by high clinical utility but requires continuous innovation and meticulous adherence to global quality standards to sustain profitability and mitigate intrinsic therapeutic risks, making the control over intellectual property relating to synthesis and purification technologies a paramount impact force shaping future competitive advantage.

Segmentation Analysis

The Panheprin Market segmentation provides a detailed framework for understanding the diverse applications, formulations, and end-user profiles driving demand and expenditure across the global healthcare landscape. Comprehensive segmentation facilitates targeted marketing strategies and strategic resource allocation based on specific market needs, recognizing that the requirements for Panheprin utilization in a high-volume cardiac surgery environment differ markedly from those in a renal dialysis unit. Key segments are primarily defined by the source of the active pharmaceutical ingredient (API), the therapeutic application (e.g., critical care vs. chronic management), and the type of end-user facility, reflecting the varied dosage forms and quality thresholds required for specialized treatments. The complexity of the drug necessitates distinct distribution channels tailored to hospital procurement systems versus specialized clinic supply chains. This detailed analysis allows stakeholders to accurately gauge penetration rates and forecast demand fluctuations based on underlying macroeconomic and public health trends, such as shifting surgical volumes or changes in global burden of chronic kidney disease.

- By Source:

- Animal-derived (Porcine Intestinal Mucosa)

- Synthetic

- Bioengineered/Recombinant

- By Application:

- Thrombosis Prevention and Treatment (DVT/PE)

- Cardiac and Vascular Surgery

- Dialysis and Hemofiltration

- Interventional Cardiology (e.g., PCI)

- Critical Care and General Anticoagulation

- Oncology Support

- By Formulation:

- Injectable Solutions (Vials/Ampoules)

- Pre-filled Syringes

- Continuous Infusion Systems

- By End-User:

- Hospitals (Acute Care and Specialty)

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics (e.g., Dialysis Centers)

- Research and Academic Institutions

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Panheprin Market

The Panheprin market value chain begins with highly specialized upstream activities centered around raw material procurement or advanced chemical synthesis. For traditional, animal-derived Panheprin, this involves the rigorous collection and primary processing of porcine intestinal mucosa, requiring stringent animal health standards and robust tracking mechanisms to ensure traceability and minimize contamination risks, especially concerning viral or prion agents. For synthetic or bioengineered Panheprin, the upstream phase involves the production of complex intermediary molecules or the culturing and fermentation of genetically modified organisms in highly controlled bioreactors. This stage is capital-intensive and subject to intense quality control mandates, representing the primary point of vulnerability regarding supply shocks or contamination events, which have historically disrupted the global market significantly. Effective upstream management necessitates long-term contracts with certified suppliers and significant investment in proprietary purification technologies, essential for separating the active Panheprin molecule from impurities and ensuring compliance with Pharmacopoeial standards across different global markets.

The core manufacturing process, or midstream segment, involves the multi-step purification, fractionation, depolymerization, and final formulation of the Panheprin API into the finished drug product (FDP). This stage requires sophisticated analytical testing methods, including nuclear magnetic resonance (NMR) spectroscopy and high-performance liquid chromatography (HPLC), to verify molecular structure, purity, and potency. Manufacturers must adhere to Current Good Manufacturing Practices (cGMP) guidelines, often requiring parallel regulatory certifications (e.g., FDA, EMA, WHO) to serve international markets. Packaging, particularly the filling of pre-filled syringes or vials, demands aseptic conditions and specialized equipment to maintain sterility and product stability over the shelf life. Strategic success in the midstream relies on economies of scale, maximizing batch yields, and minimizing manufacturing lead times, allowing companies to respond swiftly to fluctuations in global healthcare demand, particularly during seasonal peaks or public health emergencies requiring enhanced anticoagulation capacity.

The downstream activities involve distribution through both direct and indirect channels to reach the final end-user. Direct channels are commonly utilized for large-volume sales to major hospital groups, government procurement agencies, or specialized GPOs, allowing manufacturers greater control over pricing and inventory. Indirect channels involve utilizing regional wholesalers, specialized pharmaceutical distributors, and third-party logistics (3PL) providers, particularly in geographically dispersed or emerging markets where localized expertise is necessary for navigating complex regulatory import/export procedures and cold chain requirements. Due to the critical nature of Panheprin, security of supply and robust cold chain integrity are non-negotiable aspects of the distribution strategy. Potential customers, largely comprising hospital pharmacists, procurement managers, and specialized clinic administrators, prioritize consistent supply, validated quality, and comprehensive clinical support services, making the efficiency and transparency of the downstream logistics a decisive factor in securing long-term contracts and competitive advantage. The digital integration of the supply chain, leveraging technologies like blockchain for enhanced traceability, is increasingly becoming an expected feature in the market.

Panheprin Market Potential Customers

The primary and most significant segment of potential customers for Panheprin products are acute care hospitals and large medical centers, which serve as the central hubs for intensive surgical procedures, emergency interventions, and critical care management where rapid and tightly controlled anticoagulation is mandatory. These institutional buyers, typically managed by sophisticated pharmacy and therapeutics committees (P&T) and centralized procurement departments, value clinical efficacy, established safety profiles supported by extensive real-world data, and consistency of supply above marginal cost savings. Panheprin is essential inventory for operating theaters (especially cardiac and orthopedic units), intensive care units (ICUs), and emergency departments (EDs) where patients presenting with life-threatening thromboembolic events (PE, large-vessel DVT) require immediate therapeutic loading doses or continuous infusion to stabilize their condition. Securing formulary placement within these large hospital networks, often involving competitive tendering processes and negotiation with GPOs, is the primary business development objective for market participants.

A rapidly growing segment of potential customers includes specialized ambulatory surgical centers (ASCs) and outpatient clinics, particularly those focusing on minor vascular procedures, dialysis treatment, and short-stay post-surgical recovery. As healthcare models shift toward cost-efficiency and reduced hospital stays, many procedures requiring prophylactic or brief therapeutic anticoagulation are migrated to these non-acute settings. Dialysis centers, for instance, represent a consistently high-volume purchaser of Panheprin, as the drug is integral to preventing clotting within the extracorporeal circuits during hemodialysis sessions, creating a predictable and steady demand stream tied directly to the rising prevalence of Chronic Kidney Disease (CKD). These smaller clinical entities seek user-friendly formulations, such such as pre-filled syringes, and rely heavily on simplified, stable inventory management systems provided by distributors, emphasizing product stability at ambient temperatures and reliable just-in-time delivery schedules to minimize storage overheads.

Furthermore, specialized non-clinical institutions constitute a specialized, albeit smaller, customer segment. These include academic research centers, governmental public health agencies (for stockpiling purposes), and bio-pharmaceutical companies engaged in advanced drug development. Academic medical centers often purchase specialized, highly purified Panheprin derivatives for coagulation research, clinical trials, and training purposes, prioritizing high purity and specific molecular specifications rather than bulk volume pricing. Government agencies may engage in large-scale procurement for strategic national reserves, ensuring preparedness against large-scale public health crises or potential supply chain disruptions. Engaging this customer segment requires focused scientific liaison and a clear understanding of specialized regulatory or national strategic objectives, differentiating sales efforts from the standard commercial approach targeted at routine hospital consumption. Overall, successful market penetration necessitates a differentiated strategy tailored to the distinct operational needs, risk tolerance, and purchasing power of each customer category, from high-volume hospital systems to specialized research labs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Pfizer Inc., Sanofi S.A., Bristol-Myers Squibb, Bayer AG, Aspen Pharmacare Holdings Limited, Baxter International Inc., Fresenius Kabi AG, LEO Pharma A/S, Teva Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Sandoz International GmbH, Celsus Bio-Engineered Solutions, Shanghai Green Valley Pharmaceuticals, Wockhardt Ltd., Mylan N.V., Sun Pharmaceutical Industries Ltd., Takeda Pharmaceutical Company Limited, Daiichi Sankyo Company, Limited, Aurobindo Pharma. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Panheprin Market Key Technology Landscape

The key technology landscape of the Panheprin market is defined by advanced bio-manufacturing and precision analytical chemistry, aimed at ensuring the highest level of purity and consistency for this critical therapeutic agent. Traditional Panheprin production relies on specialized extraction and purification technologies that separate the active mucopolysaccharide from complex biological matrices, requiring large-scale chemical engineering facilities and highly controlled fractionation processes. Recent technological advancements focus heavily on chromatographic techniques, ultrafiltration, and enzymatic treatments designed to enhance the purity profile, particularly eliminating contaminants such as over-sulfated chondroitin sulfate (OSCS), which led to major health crises in the past. Furthermore, the push towards developing low-molecular-weight Panheprin (LMWH) derivatives involves complex controlled depolymerization technologies that result in fragments with optimized pharmacokinetic properties, providing predictable anti-clotting activity and reducing the need for continuous monitoring, a significant technological leap that impacts clinical workflow efficiency and patient safety protocols.

The most transformative technology influencing the future landscape is the development and scaling of synthetic Panheprin analogs. This involves complex organic chemistry and polymer synthesis to create molecules that structurally and functionally mimic the biological activity of natural Panheprin but are produced entirely in a laboratory setting. This approach provides inherent advantages in quality control, eliminating the risk of animal-borne pathogens and ensuring absolute batch-to-batch consistency—a challenge inherent in biological sourcing. Technologies such as chemoenzymatic synthesis and controlled polymerization of defined saccharide subunits are leading this innovation wave. These synthetic routes, protected by robust intellectual property, offer manufacturers greater control over the molecular weight distribution and sulfation patterns, potentially leading to 'designer' Panheprins tailored for specific clinical applications (e.g., formulations with a lower tendency to induce HIT or those resistant to particular neutralizing agents).

Beyond the core drug substance production, the technology landscape includes advancements in drug delivery and monitoring systems. The incorporation of Panheprin into specialized medical devices, such as coatings for catheters, stents, and extracorporeal circuits, utilizes surface modification and molecular immobilization technologies to prevent localized thrombosis without requiring systemic anticoagulation, significantly expanding its utility. On the patient monitoring side, technological integration involves point-of-care (POC) testing devices capable of rapidly assessing coagulation status (e.g., measuring anti-Factor Xa activity) with high precision, allowing clinical staff to adjust Panheprin dosing quickly. The convergence of these analytical technologies with cloud-based AI systems facilitates the real-time, closed-loop management of Panheprin infusions in critical care, marking a crucial step towards automating and enhancing the safety of high-risk anticoagulant therapy across geographically diverse healthcare settings, thus improving patient outcomes while minimizing institutional liability risks.

Regional Highlights

- North America (NA): NA, spearheaded by the United States, represents the largest and most mature market for Panheprin, characterized by high adoption rates of advanced medical therapies, substantial healthcare expenditure, and a well-established regulatory framework (FDA). The market growth here is driven less by population expansion and more by the rising complexity of surgical procedures and aggressive management protocols for chronic cardiovascular and renal diseases. Competition is intense, focusing on product differentiation, robust supply chain resilience, and achieving favorable formulary status within major Group Purchasing Organizations (GPOs). The region is a global hub for research and development, particularly for synthetic Panheprin products and advanced drug delivery systems, attracting significant investment from both domestic and international biopharmaceutical companies seeking premium pricing opportunities for innovative formulations.

- Europe: The European Panheprin market is mature and highly consolidated, heavily influenced by national healthcare systems and centralized procurement policies, leading to significant price sensitivity and reliance on competitive tenders. Western European countries maintain high usage rates due to sophisticated geriatric care and established cardiovascular treatment centers. Growth heterogeneity exists, with established markets like Germany and the UK prioritizing biosimilar and generic Panheprin penetration to achieve cost savings, while Central and Eastern European countries show faster percentage growth driven by improving healthcare access and modernization of hospital infrastructure. The European Medicines Agency (EMA) sets stringent quality and safety standards, particularly concerning source material purity and traceability, heavily influencing manufacturing decisions across the continent.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market segment, fueled by rapid urbanization, expanding middle-class access to specialized medical services, and escalating incidence rates of lifestyle-related chronic conditions requiring anticoagulation. Countries like China and India present immense, untapped potential, investing heavily in modernizing hospital facilities and drug procurement protocols. Market expansion here is often complicated by diverse national regulatory requirements, complex logistics spanning vast geographical areas, and the necessity of tailoring pricing strategies to accommodate varying public and private reimbursement models. Local manufacturing capacity is rapidly increasing, supported by government initiatives to reduce dependence on Western imports, leading to intense competition between multinational corporations and established regional pharmaceutical producers focusing on cost-effective, locally manufactured generics.

- Latin America (LATAM): The LATAM region, including Brazil, Mexico, and Argentina, exhibits moderate growth driven by increasing public health spending and efforts to standardize clinical practice. However, market penetration is often hindered by economic instability, currency fluctuations, and reliance on fluctuating import tariffs, making supply chain resilience a critical competitive factor. Panheprin utilization is strong in tertiary care centers and large metropolitan areas where advanced cardiac and vascular surgery procedures are routinely performed. Success in LATAM requires expertise in navigating complex tender processes managed by national or provincial health ministries and establishing efficient distribution networks capable of managing temperature-sensitive products across challenging logistics environments.

- Middle East & Africa (MEA): The MEA market shows promising potential, particularly within the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) which boast high healthcare spending per capita and state-of-the-art medical tourism facilities, driving demand for premium Panheprin products. South Africa also serves as a key regional hub for advanced medical care. In the broader African continent, growth is constrained by lower penetration rates and reliance on international aid or NGO support for critical medicines, although increasing private investment in healthcare infrastructure promises gradual market maturation. The region requires products optimized for high-temperature storage conditions and packaging designed for complex transport logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Panheprin Market.- Johnson & Johnson

- Pfizer Inc.

- Sanofi S.A.

- Bristol-Myers Squibb

- Bayer AG

- Aspen Pharmacare Holdings Limited

- Baxter International Inc.

- Fresenius Kabi AG

- LEO Pharma A/S

- Teva Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Sandoz International GmbH

- Celsus Bio-Engineered Solutions

- Shanghai Green Valley Pharmaceuticals

- Wockhardt Ltd.

- Mylan N.V. (Viatris)

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Daiichi Sankyo Company, Limited

- Aurobindo Pharma

Frequently Asked Questions

Analyze common user questions about the Panheprin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Panheprin and traditional Heparin?

Panheprin is typically a classification for highly purified, specific, or synthetically modified anticoagulant compounds derived from or functionally similar to unfractionated heparin, often engineered for enhanced predictability, reduced immunogenicity risks (like HIT), and optimized dosing characteristics in acute care settings compared to standard, less fractionated heparin preparations.

How will synthetic Panheprin production impact future market supply and pricing?

Synthetic production routes are expected to significantly enhance supply chain stability by eliminating reliance on animal sourcing, mitigating risks of biological contamination crises, and improving batch-to-batch consistency. While initial synthetic products may command a premium due to high R&D costs, increased competition and scalable manufacturing could eventually exert downward pressure on overall pricing and reduce market volatility.

What are the major regulatory challenges facing manufacturers in the Panheprin market?

Manufacturers face rigorous global regulatory scrutiny, particularly concerning the purity, biological activity, and traceability of the drug substance. Key challenges include demonstrating non-inferiority for biosimilar filings, preventing contamination (especially for bio-derived products), and adhering to increasingly complex Pharmacopoeial standards across major markets like the U.S., EU, and China.

Which application segment drives the highest demand for Panheprin products?

The highest consistent demand for Panheprin is driven by critical care applications, specifically major surgical procedures (cardiac, vascular) and the treatment of acute thromboembolic events (DVT/PE). The Dialysis segment also provides substantial, non-cyclical, needs-based demand tied directly to the rising prevalence of chronic kidney failure globally.

Is the competition from Novel Oral Anticoagulants (NOACs) a significant threat to the Panheprin market?

NOACs pose a substantial threat in chronic or non-acute outpatient settings due to their convenience. However, Panheprin maintains an essential, irreplaceable role in acute critical care, surgical, and interventional cardiology environments where rapid onset, controllable half-life, and established reversibility are non-negotiable clinical requirements, thus limiting the direct impact in its core market niche.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager