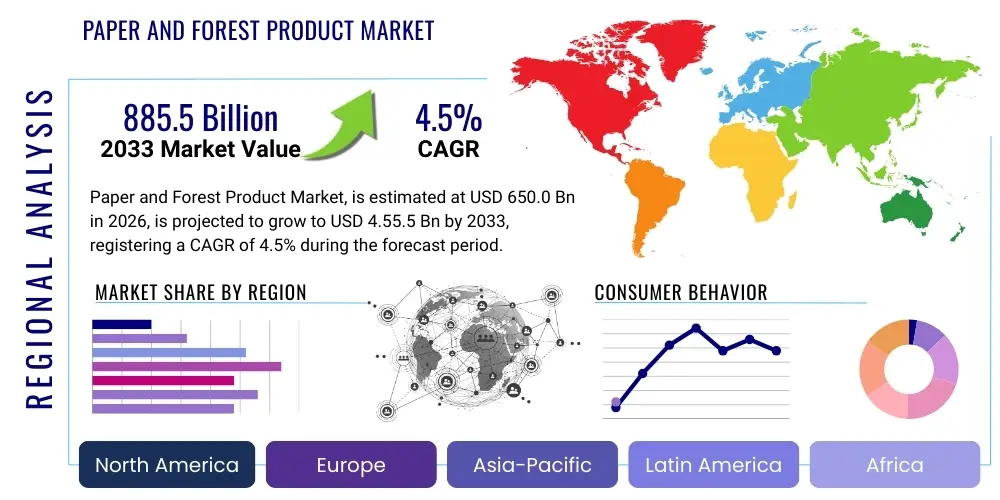

Paper and Forest Product Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436553 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Paper and Forest Product Market Size

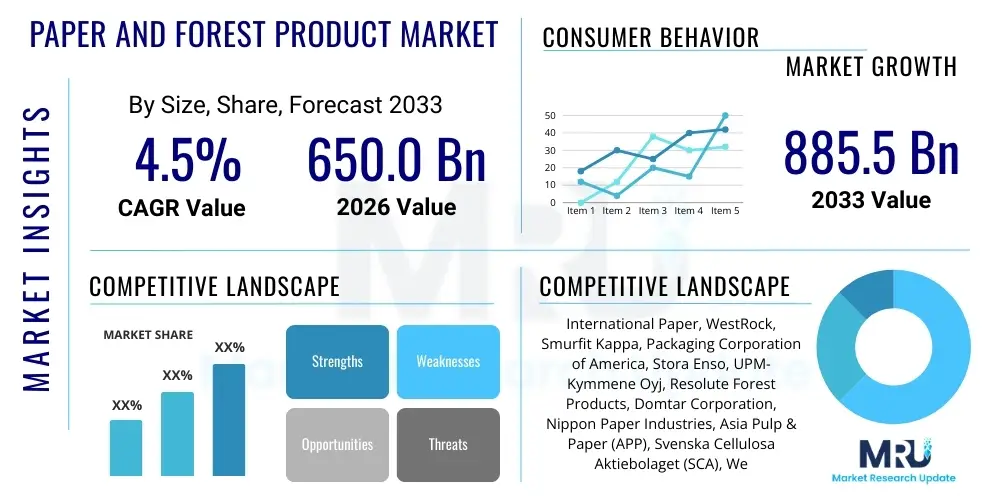

The Paper and Forest Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 650.0 Billion in 2026 and is projected to reach USD 885.5 Billion by the end of the forecast period in 2033.

Paper and Forest Product Market introduction

The global Paper and Forest Product Market encompasses the entire lifecycle of products derived from harvested wood, ranging from raw timber and pulp to finished goods like paper, packaging materials, tissue products, and engineered wood. This essential industry serves numerous sectors, including construction, printing, education, consumer goods, and logistics. Market growth is fundamentally driven by the increasing global population, which boosts demand for packaging and hygiene products, coupled with the shift towards sustainable, renewable materials as substitutes for plastics. The robust demand for e-commerce packaging, particularly corrugated boxes, is a significant tailwind supporting the market's expansion.

Products within this market are diverse, including graphic paper (newspapers, magazines), specialized paper (thermal, security), various types of dissolving pulp used in textiles, and mechanical wood products (lumber, plywood, composite panels). A key benefit of forest products is their renewability and potential for carbon sequestration, positioning them favorably in the context of global climate goals and circular economy initiatives. Furthermore, advancements in wood technology are leading to innovative materials, such as cross-laminated timber (CLT), which are transforming sustainable construction practices and opening new application avenues beyond traditional usage.

Driving factors primarily include stringent environmental regulations promoting sustainable forestry practices, heightened consumer awareness regarding biodegradable packaging alternatives, and rapid industrialization in emerging economies, which generates strong demand for construction materials and basic printing paper. However, the industry is constantly navigating challenges related to volatile raw material prices, intense competition from digital alternatives reducing graphic paper consumption, and the need for significant capital investment to modernize aging mill infrastructure to meet strict emission standards and efficiency requirements. Innovation in biomass utilization and biorefinery concepts represents a major future opportunity.

Paper and Forest Product Market Executive Summary

The Paper and Forest Product Market exhibits robust underlying growth, primarily fueled by secular trends in sustainable packaging and urbanization, despite structural declines observed in traditional printing and writing paper sectors. Business trends emphasize strategic mergers and acquisitions focused on capacity consolidation and vertical integration, aimed at optimizing global supply chains and securing long-term fiber access. Companies are heavily investing in digitalization and Industry 4.0 technologies to enhance operational efficiency, reduce waste, and improve traceability across the complex value chain, from sustainable forest management to final product delivery. Sustainability mandates are no longer optional, driving substantial shifts toward certified wood sources and the development of lightweight, high-performance packaging solutions to reduce environmental footprint.

Regional dynamics highlight the Asia Pacific (APAC) region as the dominant engine of growth, characterized by massive increases in industrial output, rapid expansion of consumer packaged goods (CPG) markets, and significant governmental investment in infrastructure and housing, translating into high demand for both lumber and containerboard. North America and Europe, while mature, are focusing on high-value segments, particularly specialty pulp, technical paper, and advanced wood construction materials, driven by stringent recycling targets and strong regulatory support for bio-based materials. The Middle East and Africa (MEA) and Latin America are poised for accelerated growth, supported by urbanization and improving living standards, although investment in local production capacity remains a critical variable.

Segmentation trends indicate a strong divergence, with the Packaging segment, including containerboard and folding carton, experiencing superior growth rates, largely due to the sustained proliferation of e-commerce. Conversely, the Printing and Writing Paper segment continues its structural contraction, necessitating significant capacity closures and diversification efforts by established players. The Pulp segment is benefiting from the strong packaging demand and the increasing use of dissolving pulp in fast-fashion textiles. Furthermore, the construction materials segment is seeing revitalization through innovations in mass timber products, which are gaining market acceptance as a green alternative to concrete and steel in large commercial and residential projects, fundamentally shifting the perception of wood as a modern building material.

AI Impact Analysis on Paper and Forest Product Market

User queries regarding AI's impact on the Paper and Forest Product Market frequently center on themes of operational efficiency, supply chain resilience, and the sustainability paradox. Users are primarily concerned with how AI can mitigate volatile input costs (fiber, energy), optimize complex logistical networks, and enhance predictive maintenance within capital-intensive paper mills. Key expectations involve leveraging machine learning for real-time quality control, minimizing raw material waste through precision forest harvesting planning, and using sophisticated analytical models to forecast market demand with greater accuracy. There is also significant interest in how AI can support compliance with increasingly complex environmental, social, and governance (ESG) reporting requirements by automating data collection and verification processes related to sustainable sourcing and carbon tracking.

The implementation of Artificial Intelligence and advanced analytics is revolutionizing core aspects of forest management and mill operations. In forestry, AI-powered satellite imagery analysis and drone mapping allow for highly optimized harvesting schedules, accurate inventory management, and early detection of diseases or forest fires, ensuring sustainable yield optimization and minimizing ecological risks. Within manufacturing, machine learning algorithms are being deployed to monitor hundreds of variables simultaneously in the pulping and papermaking processes, leading to tighter control over fiber usage, decreased energy consumption, and consistent product quality, thereby significantly reducing operational variance and downtime across critical production lines.

Beyond the factory floor, AI is transforming the commercial and supply chain functions. Predictive modeling improves raw material procurement by forecasting price fluctuations and ensuring timely fiber delivery. Furthermore, AI-driven logistics platforms optimize routes for transporting massive volumes of raw wood and finished products, leading to reduced fuel consumption and lower carbon emissions per unit shipped. As the market transitions further towards specialized and customized packaging solutions, AI tools are also essential in accelerating design cycles and matching specific performance requirements, such as moisture resistance or stacking strength, to the most efficient material composition, providing a tangible competitive advantage to early adopters.

- Enhanced predictive maintenance minimizing costly mill downtime.

- Optimization of complex forestry harvesting and logistics using machine learning.

- Real-time quality control and process parameter adjustments in paper manufacturing.

- Improved demand forecasting leading to optimized inventory levels and reduced obsolescence.

- Automation of sustainable sourcing verification and ESG reporting compliance.

- Development of smart packaging solutions enabled by data analytics.

DRO & Impact Forces Of Paper and Forest Product Market

The Paper and Forest Product Market is shaped by a confluence of powerful drivers, structural restraints, and emerging opportunities, collectively defined as the DRO framework. A primary driver is the accelerating global shift away from single-use plastics towards renewable, biodegradable paper-based alternatives, particularly in food service and e-commerce packaging, creating unprecedented demand for containerboard and specialty papers. This momentum is further amplified by increasing urbanization in developing regions, which simultaneously requires more construction timber and consumer goods packaging. Furthermore, technological improvements in pulping and recycling efficiency are making paper products more economically competitive and environmentally favorable.

However, the industry faces significant restraints. Digitalization continues to erode demand for graphic paper, necessitating difficult capacity restructuring decisions, especially in mature markets. Supply chain volatility, marked by extreme fluctuations in energy, chemical, and transportation costs, places intense pressure on operating margins, making long-term capital planning challenging. Environmental scrutiny over logging practices, despite industry efforts towards sustainable certification (like FSC and PEFC), remains a social and regulatory restraint, compelling producers to invest heavily in land management compliance and deforestation monitoring technologies.

Opportunities center on innovation in high-value segments and circular economy implementation. The development of advanced bio-materials, such as nanocellulose, lignin-based chemicals, and mass timber products (CLT, Glulam), opens up lucrative, non-traditional markets for forest resources, moving beyond commodity status. Significant opportunities also exist in developing sophisticated recycling infrastructure for complex paper products and leveraging industrial symbiosis, where pulp mills become biorefineries producing energy and high-value chemical co-products alongside traditional paper. These forces necessitate a transition toward a vertically integrated, technology-driven, and highly sustainable operational model for market resilience.

Segmentation Analysis

The Paper and Forest Product Market is comprehensively segmented based on product type, application, raw material, and geography, reflecting the highly diversified nature of the industry's outputs. The product type segmentation clearly delineates the diverging fortunes of commodity segments: packaging and tissue segments demonstrate robust growth, while printing and writing papers face secular decline. Application segmentation reveals critical end-use dependencies, with the booming E-commerce sector being the single largest driver for growth, followed closely by construction and hygiene products. Understanding these distinct segments is crucial for strategic capital allocation, allowing companies to pivot from lower-margin traditional products to higher-growth specialized materials required by modern consumer and industrial needs.

Segmentation by raw material distinguishes between virgin fiber, which is essential for high-strength packaging and food-grade papers, and recycled fiber, which is the backbone of lower-cost containerboard and newsprint production. The market dynamics in these segments are influenced by global trade policies regarding waste paper and the cyclical availability of recovered paper stock. Geographically, the segmentation underscores the market's migration toward Asia Pacific, where emerging middle classes and rapid industrial expansion fuel disproportionately high consumption rates compared to the stabilizing demand curves seen in North American and European markets. This regional heterogeneity requires tailored marketing and investment strategies focusing on localized fiber supply security and logistical efficiency.

- By Product Type:

- Printing and Writing Paper

- Packaging Paper and Board (Containerboard, Folding Boxboard)

- Tissue and Hygiene Products

- Pulp (Market Pulp, Dissolving Pulp)

- Wood Products (Lumber, Plywood, OSB, Mass Timber)

- By Application:

- Packaging (E-commerce, Food & Beverage, Industrial)

- Construction

- Consumer Goods

- Publishing and Printing

- Hygiene and Personal Care

- By Raw Material:

- Virgin Fiber

- Recycled Fiber

Value Chain Analysis For Paper and Forest Product Market

The Paper and Forest Product market value chain is extensive and highly integrated, beginning with upstream activities focused on sustainable forestry and raw material procurement. Upstream analysis involves rigorous management of timberland assets, encompassing harvesting, logistics, and primary processing (sawmills and chipping facilities). Ensuring long-term, cost-effective fiber supply requires significant capital investment in certified forest tracts and advanced harvesting technology. Direct raw material costs, primarily wood pulp and recovered paper, constitute the largest component of production expenses, making efficient fiber utilization and secure supply chain relationships paramount for profitability and operational stability throughout the downstream process.

The downstream segment involves the capital-intensive manufacturing processes, including pulping (chemical and mechanical), paper making, converting (e.g., box making, tissue converting), and finishing. The complexity here lies in optimizing chemical consumption, managing vast energy requirements, and maintaining stringent quality controls to meet highly specific end-user demands, such as moisture barriers for food packaging or precise dimensional stability for high-speed printing. Converting operations, especially for e-commerce packaging, require flexibility and localized presence to serve large, often global, fast-moving consumer goods (FMCG) clients effectively and provide just-in-time inventory solutions.

The distribution channel is critical, involving a mix of direct sales to large industrial customers (e.g., major CPG companies, large construction firms) and indirect distribution through specialized paper merchants, wholesalers, and retail channels for consumer products. The shift towards lightweight, high-volume products necessitates sophisticated logistics networks capable of handling global intermodal shipping efficiently. Direct channels offer greater control and margin capture, especially for specialty products, while indirect channels provide broader market reach and inventory buffering for standardized commodities. Effective integration and transparency across these distribution methods are essential for minimizing inventory holding costs and ensuring market responsiveness.

Paper and Forest Product Market Potential Customers

Potential customers for the Paper and Forest Product Market span almost every major industrial and consumer sector, reflecting the fundamental utility of wood-based materials. The primary end-users, or buyers, are categorized into three major groups: the Packaging and Logistics Industry, the Construction and Building Sector, and the Consumer/Retail sector. The Packaging sector, driven by global e-commerce fulfillment centers and food and beverage manufacturers, requires high volumes of corrugated board, folding cartons, and specialty food-grade papers. These buyers demand materials that offer durability, lightweight design, and increasingly, compliance with strict recyclability and compostability standards.

The Construction industry represents a significant user of lumber, plywood, engineered wood products (like OSB), and advanced materials such as Cross-Laminated Timber (CLT) and Glulam. Buyers in this segment—including residential home builders, large commercial developers, and infrastructure projects—are increasingly seeking sustainable, fast-to-install, and high-performance structural materials. The demand here is highly sensitive to interest rates, housing starts, and government infrastructure spending, making it cyclical but strategically important due to the long-term trend favoring green building certification and sustainable architecture.

The third group, the Consumer/Retail sector, includes entities that purchase large volumes of tissue products (for hygiene and personal care), printing materials (for marketing and office use), and specialized consumer packaging. Major CPG companies, retail chains, and institutional buyers (hospitals, schools) are crucial customers, prioritizing product safety, consistency, and cost efficiency. For high-growth specialty segments like dissolving pulp, the customers are primarily global textile manufacturers seeking alternatives to synthetic fibers, focusing heavily on sustainability certifications and fiber origin transparency to meet evolving consumer expectations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 Billion |

| Market Forecast in 2033 | USD 885.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | International Paper, WestRock, Smurfit Kappa, Packaging Corporation of America, Stora Enso, UPM-Kymmene Oyj, Resolute Forest Products, Domtar Corporation, Nippon Paper Industries, Asia Pulp & Paper (APP), Svenska Cellulosa Aktiebolaget (SCA), Weyerhaeuser Company, Georgia-Pacific LLC, Canfor Corporation, Mondi Group, Sappi Ltd., Kotkamills Oy, Mercer International Inc., Suzano S.A., Eldorado Brasil Celulose. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paper and Forest Product Market Key Technology Landscape

The Paper and Forest Product Market is undergoing a significant technological transformation driven by the necessity for enhanced sustainability, improved efficiency, and product diversification. Key technological advancements are focused on modernizing the pulping process, which includes the implementation of advanced chemical recovery systems and closed-loop water treatment technologies to minimize environmental discharge and improve energy self-sufficiency. Furthermore, the integration of automation and robotic systems in highly hazardous areas, such as logging and material handling, improves operational safety and precision. The adoption of sensors and IoT devices across mill operations provides granular data necessary for continuous process optimization, allowing manufacturers to maintain high product quality while reducing fiber and chemical usage.

A second crucial area of innovation lies in materials science, specifically the development and scaling of sophisticated wood-based materials. This includes the commercialization of nanocellulose and microfibrillated cellulose (MFC), which offer superior strength, barrier properties, and lightweight characteristics, making them suitable for high-performance packaging films and composite reinforcement. Simultaneously, the advancement of mass timber technologies—particularly the automated and precise manufacturing of Cross-Laminated Timber (CLT) and Glulam beams—is opening up new markets in mid-rise and high-rise construction, positioning wood as a competitive, sustainable alternative to concrete and steel. These engineered wood products require precise digital modeling and specialized manufacturing plants.

Finally, digitalization and data analytics are central to current technology investments. Implementing enterprise resource planning (ERP) systems linked with sophisticated supply chain management (SCM) platforms allows for end-to-end visibility, critical for tracking certified fiber from the forest to the final consumer. Advanced analytical tools, often powered by AI, are used for predictive maintenance, optimizing boiler and recovery operations, and improving the sorting efficiency of recovered paper stock. This technological shift is essential for increasing resource efficiency, reducing carbon intensity, and ensuring compliance with increasingly strict global traceability standards.

Regional Highlights

- Asia Pacific (APAC)

The Asia Pacific region currently dominates the global Paper and Forest Product Market and is projected to experience the highest growth rate throughout the forecast period. This robust expansion is primarily driven by massive population growth, accelerating urbanization, and the rapid expansion of the manufacturing and e-commerce sectors, particularly in China, India, and Southeast Asian countries. The shift of global manufacturing hubs to APAC has significantly increased the regional demand for industrial packaging, containerboard, and wood materials for infrastructure development. Government initiatives focused on local capacity building and infrastructure investments further bolster demand for construction timber and panel products, compensating for the decline in graphic paper consumption.

While the region is a net importer of high-quality pulp, domestic production capacity for containerboard and recycled paper is soaring. The demand for tissue and hygiene products is also rising exponentially due to improving living standards and increased consumer awareness regarding health and sanitation. Key challenges in APAC include the establishment of reliable and sustainable fiber sourcing practices, as regional forests often face pressure, and the need for significant investment in modernizing older, less efficient mills to meet international environmental standards. China remains the largest consumer and producer globally, dictating much of the regional trade flow and pricing dynamics.

Market strategies in APAC are heavily focused on localized supply chains, catering to the unique requirements of regional e-commerce giants, and prioritizing investments in advanced recycling facilities to manage the vast quantities of recovered paper generated by large urban populations. Countries like Indonesia and Vietnam are emerging as key players, benefiting from lower operating costs, although adherence to sustainable forest management certifications (like those related to peatlands) remains a high-stakes issue for international trade compliance and corporate reputation.

- North America

North America (comprising the US and Canada) is characterized by its vast, sustainably managed timber resources and technological leadership in certain high-value paper and wood products. The market here is highly mature but remains dynamic, driven by strong domestic housing markets demanding structural lumber, and significant internal e-commerce penetration fueling the containerboard sector. North American producers are leaders in manufacturing market pulp, benefiting from efficient forest operations and robust infrastructure, making them key global suppliers for markets lacking native fiber resources, particularly in Asia.

The region is actively undergoing transformation, marked by extensive capacity rationalization in printing and writing papers, with mills often converting to produce containerboard or specialty packaging grades to adapt to secular trends. Innovation in the construction segment is pivotal; the US and Canada are global leaders in the deployment of mass timber (CLT) in commercial construction, supported by changes in building codes that recognize the structural and environmental benefits of engineered wood. This transition sustains demand for high-quality, engineered wood products and presents a strong growth avenue despite general market maturity.

Sustainability and regulatory compliance are major focus areas. Producers operate under stringent environmental regulations and increasingly prioritize ESG metrics. The strong emphasis on chain-of-custody certification and biodiversity protection serves as a competitive differentiator in global trade. Furthermore, the region is highly focused on developing bio-refinery concepts, extracting high-value biochemicals from wood residuals, thereby maximizing the economic return from every harvested tree and diversifying beyond traditional commodity products.

- Europe

The European Paper and Forest Product Market is defined by its proactive focus on the circular economy, advanced recycling infrastructure, and stringent environmental policies. European countries, particularly the Nordics (Sweden, Finland), are global powerhouses in high-quality market pulp, graphic papers, and specialized packaging, supported by meticulously managed private and public forests. The regulatory environment strongly favors paper and bio-based packaging over plastics, driving robust demand for sustainable folding boxboard, liquid packaging board, and molded fiber products essential for the food service industry.

A key characteristic of the European market is its world-leading paper recycling rate, which minimizes reliance on virgin fiber for many standard packaging grades. This focus has spurred technological investment in de-inking and cleaning processes to ensure high-quality recycled input. The emphasis on high-performance materials is driving strong uptake of barrier coatings and fiber-based alternatives to plastic packaging, often co-developed through close partnerships between paper companies and major European brand owners seeking to meet ambitious corporate sustainability targets.

The European construction sector is also a significant consumer, with mass timber gaining strong traction, particularly in Germany, Austria, and the UK, supported by green public procurement mandates and a cultural preference for sustainable building methods. Challenges include high energy costs, which impact the competitiveness of energy-intensive pulp and paper operations, necessitating continuous innovation in energy efficiency and investment in renewable energy generation within mill complexes.

- Latin America (LATAM)

Latin America is strategically important due to its fast-growing, highly efficient, and globally competitive plantation forestry base, particularly in Brazil and Chile. These countries are world leaders in producing high-quality bleached eucalyptus pulp (BEP), which is prized for its strength and brightness, making them crucial swing suppliers in the global pulp trade. The region benefits from highly productive fast-growing tree species, offering a significant cost advantage in fiber production compared to boreal forests in the Northern Hemisphere. This competitive edge drives substantial capital investment into new pulp mill capacity.

Domestically, the LATAM market is spurred by expanding middle classes, leading to increasing demand for consumer tissue products and corrugated packaging driven by regional retail growth and nascent e-commerce penetration. While the construction sector is volatile, driven by macroeconomic conditions in major economies like Brazil and Mexico, the long-term outlook for wood products remains positive, linked to housing development needs.

The primary strategic focus for regional players is enhancing logistics to transport vast quantities of pulp efficiently to export markets (mainly Asia and Europe) and navigating complex political and infrastructural challenges. Sustainability in LATAM centers on combating illegal deforestation and ensuring that plantation expansion adheres to strict social and environmental governance protocols, which is vital for maintaining access to international financial markets and sophisticated customer bases.

- Middle East and Africa (MEA)

The Middle East and Africa region presents a dynamic yet fragmented market, generally characterized by high reliance on imported pulp and paper products, though local manufacturing capacity is growing. The Middle East, propelled by significant infrastructure spending, high energy availability, and rapid population expansion, has a strong demand for packaging (due to increasing food consumption and logistics needs) and specialized construction materials. Investment in local paper recycling facilities is a critical strategic imperative for energy-rich Gulf nations seeking to manage waste and diversify their industrial base.

In Africa, growth is accelerating, driven by massive urbanization, improving literacy rates (boosting demand for educational paper), and the entry of global FMCG companies, which necessitates local packaging solutions. South Africa and Egypt are key regional manufacturing hubs. However, the market faces significant operational challenges, including insufficient domestic fiber resources, high import costs for virgin pulp, and underdeveloped logistical infrastructure, which complicates distribution across the continent.

Market development hinges on establishing more efficient local recycling streams, attracting foreign direct investment for capacity expansion in containerboard and tissue production, and adapting product specifications to diverse, localized consumer needs. The region represents a long-term growth opportunity, particularly as economies mature and consumer spending power increases, transitioning from basic commodities to higher-value hygiene and sophisticated packaging grades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paper and Forest Product Market.- International Paper

- WestRock

- Smurfit Kappa

- Packaging Corporation of America

- Stora Enso

- UPM-Kymmene Oyj

- Resolute Forest Products

- Domtar Corporation

- Nippon Paper Industries

- Asia Pulp & Paper (APP)

- Svenska Cellulosa Aktiebolaget (SCA)

- Weyerhaeuser Company

- Georgia-Pacific LLC

- Canfor Corporation

- Mondi Group

- Sappi Ltd.

- Kotkamills Oy

- Mercer International Inc.

- Suzano S.A.

- Eldorado Brasil Celulose

Frequently Asked Questions

Analyze common user questions about the Paper and Forest Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Paper and Forest Product Market?

The primary driver is the accelerating global demand for sustainable and biodegradable packaging materials, especially corrugated board and specialty paper, fueled by the rapid expansion of the e-commerce sector and stringent regulations targeting single-use plastics.

How is the decline in graphic paper consumption being offset by industry players?

Industry players are offsetting the decline in graphic paper by strategically converting older mill capacity to produce high-growth segments such as containerboard, specialty packaging, and tissue products, alongside diversification into advanced wood construction materials like CLT.

Which geographical region holds the largest market share and why?

The Asia Pacific (APAC) region currently holds the largest market share due to its vast population, rapid urbanization, industrial growth, and massive domestic demand for consumer packaged goods and infrastructure-related wood products.

What role does sustainability certification play in the forest product value chain?

Sustainability certifications (FSC, PEFC) are critical as they provide verifiable assurance of responsible forestry practices, securing access to environmentally conscious markets, maintaining corporate reputation, and complying with international timber procurement policies.

What are the key technological innovations transforming the construction segment?

The key technological innovation is the industrial scaling of mass timber products, particularly Cross-Laminated Timber (CLT) and Glulam, which offer sustainable, efficient, and lightweight alternatives to traditional concrete and steel in commercial and residential construction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager