Paper and Paperboard Trays Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432240 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Paper and Paperboard Trays Market Size

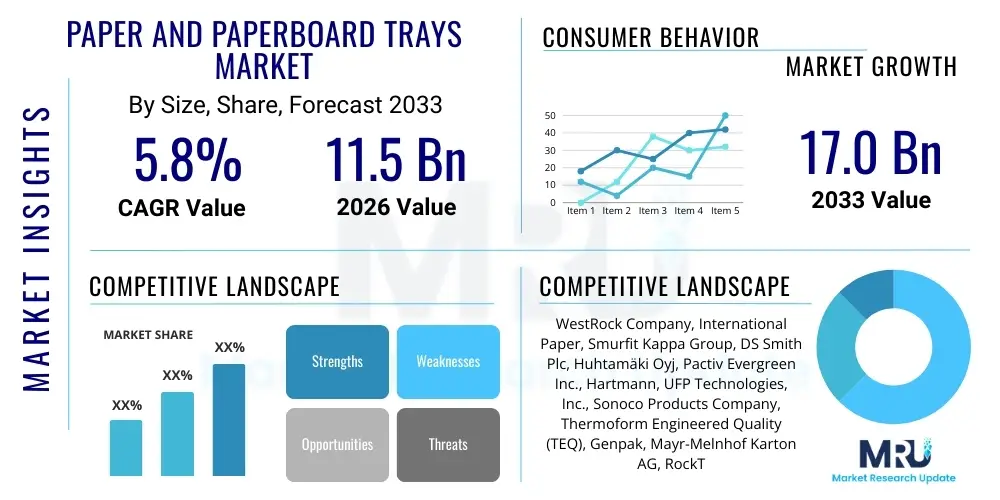

The Paper and Paperboard Trays Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 17.0 Billion by the end of the forecast period in 2033.

Paper and Paperboard Trays Market introduction

The Paper and Paperboard Trays Market encompasses the production and distribution of packaging solutions primarily manufactured from cellulosic materials, including molded pulp, corrugated fiberboard, and folding boxboard. These trays serve a crucial function in both retail and industrial logistics, providing structural integrity, protection, and enhanced presentation for diverse products. They are increasingly being utilized as a sustainable alternative to traditional plastic and styrofoam packaging across various sectors globally. The inherent renewability and recyclability of paper and paperboard position these trays favorably against a backdrop of stringent global environmental regulations and escalating consumer demand for eco-friendly packaging options. Key product variations include smooth-walled trays designed for ready-meals, rigid molded fiber trays for delicate electronics, and corrugated trays optimized for high-volume fresh produce handling and transit.

The core product, paperboard trays, is defined by its versatile design capabilities, allowing for customized shapes, dimensions, and integration with specialized barrier coatings to achieve specific performance characteristics, such as moisture resistance or grease proofing, essential for food contact applications. Major applications span the Food & Beverage industry—including fresh produce packaging, egg cartons, and meal trays—the Electronics sector for component cushioning, and industrial uses for internal transit protection. The flexibility in manufacturing processes, such as dry-process and wet-process molding, enables cost-effective production at scale while maintaining high quality standards required by modern supply chains. The global shift toward circular economy models further cements the market position of these packaging materials.

Driving factors for sustained market growth include the explosive expansion of the e-commerce sector, which necessitates lightweight yet robust primary and secondary packaging; mandatory governmental policies, particularly in Europe and parts of Asia, banning single-use plastics; and continuous technological advancements in barrier technology that expand paperboard's applicability into historically plastic-dominated areas, such as frozen foods and high-fat content items. Furthermore, the aesthetic appeal and printability of paperboard offer brands superior marketing and communication opportunities directly on the packaging surface, contributing to brand recognition and consumer engagement at the point of sale. The synergy between sustainability mandates and operational efficiency fuels continued investment in high-speed, automated production lines capable of meeting escalating demand.

Paper and Paperboard Trays Market Executive Summary

The Paper and Paperboard Trays market is exhibiting robust growth, fundamentally driven by the global imperative for sustainable packaging solutions and the rapid evolution of the retail and e-commerce landscapes. Business trends indicate significant consolidation among large packaging conglomerates aimed at achieving economies of scale and integrating advanced material science capabilities, specifically focusing on developing 100% compostable and recyclable fiber trays free from persistent chemical contaminants. Investment in sophisticated production techniques, such as precision pulp molding and the application of bio-based functional coatings, is a dominant theme among manufacturers striving to enhance product performance, particularly moisture and oxygen barrier properties necessary for extending product shelf life.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, propelled by rapid urbanization, increasing middle-class spending on packaged foods, and foundational infrastructure development supporting large-scale food processing and distribution networks. Conversely, Europe and North America maintain significant market shares, characterized by early adoption of stringent anti-plastic legislation (e.g., the EU’s Single-Use Plastics Directive) which mandates the substitution of conventional plastics with fiber-based alternatives in food service and quick-service restaurant operations. These developed markets are pioneers in closed-loop recycling programs, ensuring high post-consumer paper recovery rates, which in turn sustains the supply of recycled fiber necessary for cost-effective tray production. Latin America and MEA are emerging markets, characterized by increasing industrialization and a growing reliance on import substitution policies promoting local packaging manufacturing.

Segment trends underscore the dominance of the Food & Beverage sector, particularly the fresh produce and chilled ready-meals sub-segments, which are undergoing a swift transition to fiber-based trays to meet retailer sustainability pledges. The material segmentation reveals a steady increase in the utilization of recycled fiber (RCF) owing to cost efficiency and environmental credentials, though virgin fiber continues to be essential for applications requiring maximum purity and strength, such as medical packaging. Furthermore, molded pulp trays, valued for their excellent cushioning and stackability, are gaining traction over traditional corrugated options in intricate packaging designs. The convergence of digital printing technologies with paperboard manufacturing is enabling mass customization, allowing brands to quickly adapt tray designs and messaging in response to dynamic market demands and promotional cycles.

AI Impact Analysis on Paper and Paperboard Trays Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Paper and Paperboard Trays Market center on operational efficiency, predictive supply chain management, and sustainable design optimization. Users frequently ask how AI can enhance the precision of pulp molding machines, minimize material waste during cutting and forming, and predict fluctuations in raw material (pulp) costs and availability. Key concerns revolve around the initial investment required for AI integration, the necessity for specialized data science expertise, and how AI-driven quality control can detect subtle defects in high-speed production environments. Expectations are high concerning AI's ability to create custom, optimized tray geometries that use the minimum amount of fiber while maximizing structural resilience, directly addressing sustainability metrics and cost reduction simultaneously.

AI's primary transformative impact is observed in the optimization of complex manufacturing processes. Machine learning algorithms analyze vast datasets related to pressure, temperature, moisture content, and pulp slurry concentration in real-time to adjust machine parameters instantly. This predictive maintenance capability significantly reduces unexpected downtime, a critical factor in capital-intensive industries like packaging manufacturing. Furthermore, AI-powered computer vision systems are deployed on production lines to inspect every unit, ensuring consistency in thickness, shape, and barrier coating application far exceeding human capabilities. This enhanced quality assurance is vital for trays used in sensitive applications, such as medical devices or temperature-controlled food logistics, guaranteeing compliance with stringent industry standards and reducing batch rejection rates.

In the strategic domain, AI-driven demand forecasting leverages market signals, seasonal trends, and geopolitical factors to provide highly accurate predictions of customer needs, allowing manufacturers to optimize inventory levels of both raw materials and finished goods. This predictive capacity minimizes the risk of overstocking perishable inputs or incurring costly expedited shipping fees for shortfalls. Moreover, in product development, Generative Design AI assists engineers by exploring thousands of structural permutations to find the optimal tray design that balances material usage, stacking strength, and compatibility with automated filling systems. This accelerated design cycle shortens time-to-market for innovative packaging solutions, responding swiftly to rapidly changing retail requirements, especially within the e-commerce fulfillment segment.

- AI optimizes pulp slurry consistency and drying parameters, improving tray structural integrity and reducing cycle time.

- Machine learning algorithms predict potential equipment failures in high-speed molding machines, enabling preemptive maintenance.

- Computer vision systems utilize deep learning for real-time, high-precision quality inspection of formed trays and applied barrier coatings.

- AI-driven demand forecasting enhances supply chain resilience by accurately predicting future raw material needs and production volume requirements.

- Generative design tools accelerate the development of lightweight, optimized tray geometries, minimizing fiber consumption per unit.

- AI facilitates dynamic pricing and inventory management based on real-time market supply and competitor pricing analysis.

DRO & Impact Forces Of Paper and Paperboard Trays Market

The Paper and Paperboard Trays Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic direction of industry participants. The central driving force is the global regulatory environment, particularly mandates targeting single-use plastics, creating an immediate and substantial demand vacuum that only fiber-based alternatives can currently fill efficiently and sustainably. Coupled with this is the accelerating expansion of the food delivery and meal kit service sectors, requiring robust, biodegradable packaging solutions for chilled and fresh goods. However, the market faces significant restraints, primarily the volatile pricing and supply chain unpredictability of wood pulp, exacerbated by global logistics bottlenecks and increasing energy costs required for high-temperature drying processes. Furthermore, paperboard's intrinsic vulnerability to moisture and grease, though being addressed by advancements in barrier technology, still limits its functional applicability in certain extreme environments without the addition of coatings, which can sometimes complicate the recyclability process.

Opportunities for profound growth lie in the development and commercialization of next-generation functional coatings that are certified home-compostable and bio-renewable, eliminating reliance on conventional fossil fuel-derived barrier agents. Significant investment is being directed toward integrating smart packaging features, such as QR codes, NFC tags, and time-temperature indicators printed directly onto the trays, enhancing traceability, consumer interaction, and ensuring cold chain integrity. The strategic development of paperboard trays suitable for ovenable and microwavable applications represents a critical opportunity, allowing manufacturers to penetrate the premium prepared meals segment currently dominated by aluminum and plastic trays. Impact forces, therefore, center on sustainability pressure from large corporate buyers (CPGs and retailers) who are mandating aggressive targets for packaging circularity, forcing the entire value chain to innovate quickly. Geopolitical shifts impacting trade routes and raw material sourcing also act as powerful, external impact forces dictating regional production strategies and competitive pricing dynamics.

The impact forces operate on multiple levels: the environmental impact force demands immediate reduction in carbon footprint and maximization of recycled content, compelling manufacturers to certify their materials and processes. The technological impact force spurs innovation in molding precision and automation, lowering unit manufacturing costs and improving barrier performance. The regulatory impact force creates market certainty for sustainable products while penalizing non-compliant plastic use, establishing a clear path for fiber replacement. Ultimately, the successful navigation of these forces hinges upon a manufacturer’s ability to secure long-term, stable access to sustainable virgin or recycled fiber sources and maintain a competitive edge through continuous investment in processing technologies that enhance product resilience and maintain cost parity with conventional packaging formats.

Segmentation Analysis

The Paper and Paperboard Trays Market is comprehensively segmented based on material, tray type, and end-use application, providing a granular view of market dynamics and targeted growth areas. This segmentation helps stakeholders understand which fiber sources are preferred for specific performance requirements and how different manufacturing methods (e.g., molding vs. folding) cater to distinct customer needs, ranging from structural support in transit to aesthetic presentation on shelves. The interplay between material type, which defines sustainability metrics and cost structures, and end-use application, which dictates required functionality (e.g., stackability, temperature resistance), is crucial for strategic market positioning. The increasing demand for customization means that manufacturers must offer a diversified portfolio that addresses specialized constraints, such as compatibility with automated high-speed filling lines used by large food producers.

Segmentation by material—Virgin Fiber versus Recycled Fiber—is significant because it directly impacts both the product's environmental narrative and its suitability for direct food contact. Virgin fiber is often specified for primary food packaging or high-end electronics where purity and maximum strength are non-negotiable, offering superior consistency. Conversely, recycled fiber offers a lower cost base and improved circularity scores, making it highly preferred for secondary packaging, industrial protection, and certain non-direct food contact applications. The trajectory of this segmentation is heavily influenced by regulatory incentives promoting the use of recycled content and advancements in fiber cleaning and de-inking technologies that enhance the quality of Recycled Content Fiber (RCF).

End-Use segmentation clearly illustrates the market's primary revenue drivers. The Food & Beverage sector remains paramount, driven by demand for fresh produce trays, meat/poultry packaging, and frozen food containers. However, the Industrial and Electronics segments are growing rapidly, utilizing molded pulp trays for shock absorption and component organization during shipping, capitalizing on their superior protective properties and eco-friendly attributes compared to foam inserts. Understanding the nuanced needs within each end-use segment, such as the specific thermal requirements for airline catering trays versus the delicate surface protection needed for smartphone packaging, is essential for targeted product development and market penetration strategies across different geographic territories.

- By Material:

- Virgin Fiber

- Recycled Fiber (RCF)

- By Tray Type:

- Molded Pulp Trays (Dry Process, Wet Process, Thermoformed)

- Corrugated Trays

- Folding Carton Trays (Boxboard)

- Formed Fibre Trays

- By End-Use Application:

- Food & Beverage (Fresh Produce, Dairy/Eggs, Ready Meals, Meat & Poultry, Bakery)

- Electronics & Consumer Goods (Component Packaging, Inserts, Protective Shells)

- Healthcare & Pharmaceutical (Medical Device Trays, Sterile Packaging Inserts)

- Industrial & Logistics (Parts Protection, Transit Trays, Automotive Components)

Value Chain Analysis For Paper and Paperboard Trays Market

The value chain of the Paper and Paperboard Trays Market begins with upstream activities involving the sourcing and processing of raw cellulosic materials, primarily wood pulp (virgin or recycled fiber) and wastepaper collection. Upstream analysis focuses on sustainable forestry management practices (e.g., FSC certification) for virgin fiber and efficient municipal recycling infrastructure for secondary fiber sources. The volatile costs associated with chemical pulping, bleaching agents, and essential utilities like water and energy exert substantial pressure on upstream profitability. Key strategic actions here involve vertical integration by large players to secure consistent, high-quality fiber supply and mitigate price volatility. The conversion stage, where fiber is transformed into usable pulp boards and then molded or formed into trays, is the most capital-intensive phase, involving specialized machinery for wet-forming, drying, pressing, and subsequent barrier coating application.

The downstream analysis focuses on the distribution channels and the ultimate consumption of the trays by end-user industries. Distribution channels are bifurcated into direct sales to large Fast-Moving Consumer Goods (FMCG) corporations, major retailers, and e-commerce fulfillment centers, and indirect sales conducted through packaging distributors and wholesalers who service small-to-medium enterprises (SMEs). Direct channels often involve complex, long-term contracts demanding customized, just-in-time delivery schedules, requiring significant logistical sophistication from the manufacturer. The end-users, such as fresh produce packagers or electronics assemblers, exert powerful influence over product specifications, demanding certifications for food safety, structural performance (compression strength), and environmental claims, often pushing manufacturers to invest in specific testing and verification processes.

The role of distribution channels is critical for market reach. Direct sales are prevalent for high-volume, standardized trays and specialized items where technical consultancy is required. Conversely, indirect channels (distributors) offer inventory management and localized logistics support, which is essential for penetrating fragmented markets and catering to smaller customers that lack the scale for direct manufacturer relationships. The final stage in the value chain involves end-of-life management, which is a differentiating factor for paperboard trays. Efficient recycling infrastructure and consumer participation in sorting programs complete the circularity loop, ensuring the long-term viability and sustainability narrative of paper-based packaging, reinforcing its competitive advantage over non-recyclable plastic alternatives.

Paper and Paperboard Trays Market Potential Customers

Potential customers for Paper and Paperboard Trays span a wide array of industries seeking cost-effective, sustainable, and protective packaging solutions. The largest segment of buyers comprises major Food & Beverage manufacturers and processors, including multinational corporations specializing in ready-meals, chilled desserts, fresh cut fruits, and raw protein (meat, poultry, and fish). These customers prioritize trays that offer exceptional temperature resilience, are compatible with modified atmosphere packaging (MAP) systems, and possess reliable grease and moisture barriers to maintain product integrity throughout the supply chain and consumer use. Their purchasing decisions are heavily influenced by regulatory compliance standards (FDA, EFSA) and corporate mandates to eliminate non-recyclable plastic packaging entirely by targeted deadlines, typically set between 2025 and 2030.

A rapidly expanding customer base is found within the e-commerce and retail logistics sectors, specifically companies specializing in meal kit delivery services and online grocery fulfillment. These businesses require trays that are robust enough to withstand complex multi-modal transit systems (trucking, sorting, last-mile delivery) while minimizing dimensional weight, thereby reducing shipping costs. For these customers, molded fiber trays are highly attractive due to their lightweight structure and excellent shock absorption properties, which protect delicate contents like glassware, electronics components, and fresh, bruised-sensitive produce during handling. The ability of manufacturers to supply trays that integrate seamlessly with automated robotic pick-and-place systems is a key differentiator in securing long-term contracts with these technologically advanced logistics providers.

Furthermore, major players in the Electronics and Automotive parts manufacturing sectors represent significant potential buyers for industrial protective trays. These customers utilize precision molded pulp as a sustainable alternative to polystyrene and PVC foam for housing expensive or fragile components (e.g., semiconductors, circuit boards, camera modules). The primary buying criteria here include customized fit, anti-static properties (for electronics), and resistance to thermal shock. The healthcare industry is also emerging as a niche but high-value customer, requiring sterilized or sterilization-compatible paperboard trays for single-use medical device kits and pharmaceutical transit packaging, where material purity and low particulate emission are critical technical specifications driving purchasing decisions and supplier qualification processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 17.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WestRock Company, International Paper, Smurfit Kappa Group, DS Smith Plc, Huhtamäki Oyj, Pactiv Evergreen Inc., Hartmann, UFP Technologies, Inc., Sonoco Products Company, Thermoform Engineered Quality (TEQ), Genpak, Mayr-Melnhof Karton AG, RockTenn (now WestRock), FiberCel Packaging LLC, Henry Molded Products, Inc., CDL-Cellulosa S.p.A., Brodrene Hartmann A/S, Fabri-Kal, Tekni-Plex, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paper and Paperboard Trays Market Key Technology Landscape

The technological landscape for Paper and Paperboard Trays is rapidly evolving, driven primarily by the need to enhance product functionality (especially barrier properties) while simultaneously reducing manufacturing costs and improving circularity. A critical area of development is in the precision molding of pulp, moving beyond traditional coarse methods to fine-finish thermoformed fiber processes. These advanced techniques utilize complex, heated tooling and high pressure to create exceptionally smooth, dense, and dimensionally accurate trays, often referred to as "smooth-walled fiber," which can directly substitute plastic trays in high-barrier food packaging applications like oven-ready meals. This requires significant investment in automated pressing and drying lines, enabling higher output rates and superior surface finish suitable for high-quality printing and labeling.

Another pivotal technological advancement involves sustainable barrier coatings. Historically, paperboard barrier requirements were met using petroleum-derived polyethylene (PE) coatings, which complicated recycling. Current R&D focuses intensely on developing bio-based polymers (such as PLA, PHA, or advanced cellulose derivatives) and mineral-based coatings that provide effective resistance to oxygen, water vapor, and grease, yet fully dissolve or break down during standard industrial or home composting processes, or are easily separated during standard paper recycling pulping. The ability to apply these coatings uniformly and effectively at industrial speeds is facilitated by technologies like curtain coating and specialized spray application systems, which minimize material usage and ensure coverage consistency across complex tray geometries.

Furthermore, operational technology, particularly in production automation and digital integration, is reshaping the market. Manufacturers are adopting advanced robotic systems for stacking, packaging, and palletizing the finished trays, minimizing manual handling and reducing the risk of contamination or damage. Digital printing technologies are increasingly integrated into the converting process, allowing for variable data printing (VDP) and short-run customized graphics directly onto the tray surface, offering significant marketing advantages and shortening lead times compared to conventional offset printing methods. The focus on lightweighting—reducing the material (grammage) required per tray without compromising structural integrity—is also a continuous technological challenge addressed through advanced fiber engineering and structural simulation software.

Regional Highlights

- Asia Pacific (APAC): The APAC region is projected to register the highest growth rate, fueled by robust economic development, massive population bases transitioning to packaged food consumption, and increasing awareness of plastic waste issues in countries like India and China. The expansion of modern retail chains and sophisticated cold chain infrastructure supports the uptake of high-quality paperboard trays. Manufacturing hubs are expanding rapidly, benefiting from lower operating costs and governmental support for domestic packaging industries, positioning APAC as both a major producer and a rapidly growing consumer.

- Europe: Europe holds a substantial market share, driven primarily by stringent regulatory frameworks such as the EU Packaging and Packaging Waste Regulation (PPWR) and national legislation targeting plastic reduction. High consumer environmental consciousness dictates strong demand for certified sustainable products, favoring manufacturers capable of supplying trays made from high recycled content and certified compostable barriers. Innovation here focuses heavily on closed-loop systems, ensuring high recycling rates for paper fiber packaging used in food service and retail.

- North America: North America represents a mature yet dynamic market, characterized by large-scale consumption in the quick-service restaurant (QSR) sector and robust demand from the e-commerce giants for protective shipping inserts. The region is seeing rapid adoption of molded pulp trays as replacements for polystyrene foam, particularly in electronics and industrial packaging. Growth is heavily influenced by voluntary corporate sustainability pledges from major retailers and food service operators, accelerating the switch to fiber-based alternatives.

- Latin America (LATAM): The LATAM market is in an emerging growth phase, characterized by increasing industrialization and foreign investment in food processing. Key growth opportunities lie in Brazil and Mexico, where expanding urban populations are driving demand for convenience foods packaged in sustainable materials. Challenges include developing reliable local supplies of high-quality recycled fiber and modernizing packaging conversion technologies to meet international standards.

- Middle East and Africa (MEA): Growth in MEA is sector-specific, with significant demand from rapidly modernizing retail and hospitality sectors in the GCC countries. Investment in new manufacturing capacities, often driven by government diversification strategies, aims to reduce reliance on imported packaging. The adoption rate is slower than in Europe but is accelerating due to rising tourism and stringent food safety requirements demanding reliable, single-use packaging solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paper and Paperboard Trays Market.- WestRock Company

- International Paper

- Smurfit Kappa Group

- DS Smith Plc

- Huhtamäki Oyj

- Pactiv Evergreen Inc.

- Hartmann

- UFP Technologies, Inc.

- Sonoco Products Company

- Thermoform Engineered Quality (TEQ)

- Genpak

- Mayr-Melnhof Karton AG

- RockTenn (now WestRock)

- FiberCel Packaging LLC

- Henry Molded Products, Inc.

- CDL-Cellulosa S.p.A.

- Brodrene Hartmann A/S

- Fabri-Kal

- Tekni-Plex, Inc.

- Mondi Group

Frequently Asked Questions

Analyze common user questions about the Paper and Paperboard Trays market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the accelerated demand for paper and paperboard trays?

The primary driver is global regulatory pressure, particularly bans on single-use plastics (e.g., EU SUPD), coupled with overwhelming consumer preference and major corporate mandates for sustainable, biodegradable, and highly recyclable packaging alternatives across the food service and retail sectors.

How do manufacturers address the moisture and grease resistance limitations of paperboard trays?

Manufacturers utilize advanced barrier technologies, increasingly focusing on fully compostable, bio-based coatings (such as PLA derivatives or mineral-based slurries) that provide necessary functional protection without compromising the fiber tray's end-of-life recyclability or compostability credentials, expanding applicability to wet and fatty foods.

Which end-use segment is the largest consumer of paper and paperboard trays?

The Food and Beverage segment, specifically sub-segments like fresh produce packaging, egg cartons, and chilled/frozen ready-meals, represents the largest revenue share due to the high volume of consumables requiring protective and regulatory-compliant packaging solutions.

What technological advancements are key to future market growth in molded pulp trays?

Key advancements include precision thermoforming processes to create smooth, high-density trays that compete directly with plastic; integration of AI for quality control and process optimization; and the development of lightweighting techniques to reduce material consumption per unit while maintaining structural integrity required for shipping.

What are the main risks associated with the raw material supply chain for paperboard tray manufacturers?

The main risks involve significant volatility in the cost and availability of virgin and recycled wood pulp due to global logistics bottlenecks, increasing energy costs associated with pulping and drying processes, and geopolitical factors impacting sustainable timber harvesting and wastepaper recovery rates internationally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager