Paper Cushion Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433150 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Paper Cushion Machines Market Size

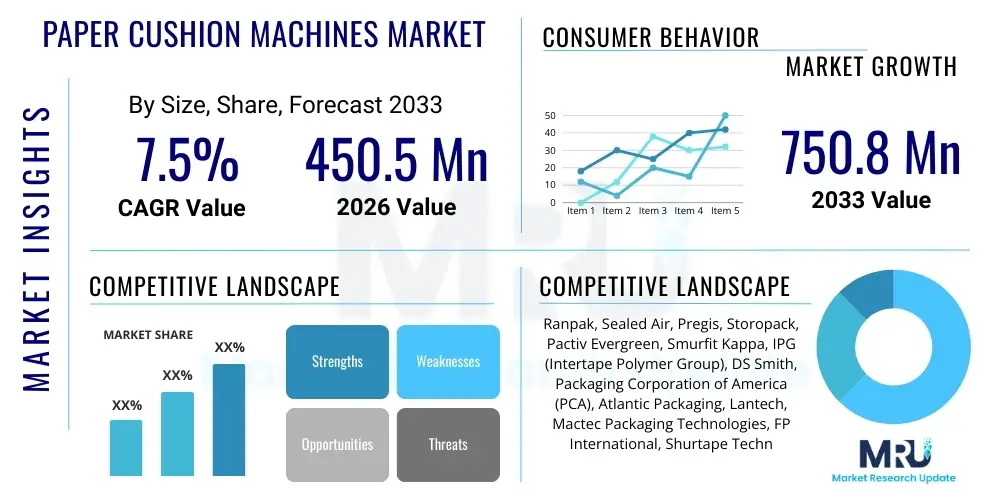

The Paper Cushion Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 750.8 Million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the increasing global emphasis on sustainable packaging solutions, driven by stringent environmental regulations and mounting consumer preference for plastic-free alternatives. The exponential expansion of the e-commerce sector, particularly in emerging economies, significantly contributes to the heightened demand for efficient, scalable, and environmentally sound protective packaging methods, making paper cushioning an indispensable component of modern logistics.

Market expansion is also characterized by technological advancements focused on machine speed, integration capabilities, and operational efficiency. Modern paper cushion machines are designed to integrate seamlessly into automated packaging lines, offering high throughput and reduced labor costs. Furthermore, the market benefits from innovation in paper materials, particularly the development of high-strength, lightweight, and 100% recycled paper stock, enhancing the protective performance while reducing material consumption. The transition from legacy void fill materials like foam peanuts and bubble wrap towards automated paper cushioning systems represents a fundamental shift in protective packaging logistics across various industries, including electronics, pharmaceuticals, and general manufacturing.

Paper Cushion Machines Market introduction

Paper Cushion Machines are sophisticated automated or semi-automated systems designed to convert rolls of specialized kraft paper into protective, shock-absorbing cushions, pads, or void fill material used primarily for packaging and protecting goods during transit. These machines are essential components in modern supply chains, ensuring product integrity while upholding corporate sustainability goals. The key applications span high-volume e-commerce fulfillment centers, industrial manufacturing lines requiring robust blocking and bracing, and third-party logistics (3PL) providers managing diverse product portfolios. The primary benefits include superior shock absorption compared to traditional materials, recyclability and biodegradability of the cushioning, on-demand material conversion which saves warehouse space, and enhanced brand image through sustainable packaging. The market is primarily driven by the escalating volume of packaged goods due to e-commerce growth, global legislative mandates restricting plastic usage, and the increasing operational need for faster, more reliable, and integrated end-of-line packaging systems.

Paper Cushion Machines Market Executive Summary

The Paper Cushion Machines Market is experiencing robust expansion, fundamentally altering protective packaging logistics worldwide. Business trends indicate a strong move toward fully automatic, high-speed machines featuring Internet of Things (IoT) capabilities for predictive maintenance and real-time operational monitoring, minimizing downtime in critical fulfillment centers. Segment trends highlight the dominance of automatic systems, particularly those catering to high-volume e-commerce applications, and a rising preference for recycled paper materials to align with circular economy initiatives. Regionally, North America and Europe remain key revenue generators, fueled by mature e-commerce infrastructures and strict environmental regulations favoring paper-based solutions. However, the Asia Pacific region is poised for the highest growth rate, propelled by rapid industrialization, burgeoning domestic e-commerce markets (especially in China and India), and significant investment in new warehousing and logistics infrastructure, necessitating scalable cushioning solutions.

AI Impact Analysis on Paper Cushion Machines Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is beginning to revolutionize the operational efficiency and strategic deployment of Paper Cushion Machines, addressing key user concerns related to material waste, packaging speed bottlenecks, and unpredictable maintenance requirements. Users frequently inquire about how AI can optimize the specific amount of cushioning needed for irregular package sizes (right-sizing), minimize human intervention in complex packaging lines, and forecast material needs accurately. The core expectation is that AI systems will transition these machines from simple conversion tools to intelligent packaging workstations. This shift is centered on using computer vision and learning algorithms to analyze product dimensions, weight distribution, and fragility, subsequently instructing the machine to dispense the precise amount of paper cushion required, drastically reducing material consumption and costs while ensuring optimal protection.

Furthermore, AI is instrumental in enhancing the predictive maintenance frameworks for these systems. Paper cushion machines, especially high-throughput models, are subject to wear and tear due to continuous operation. AI algorithms analyze vibration, temperature, throughput rates, and motor performance data collected via embedded sensors to anticipate component failure before it occurs, scheduling maintenance proactively and ensuring near-zero unplanned downtime. This capability is critical for e-commerce giants that operate 24/7 fulfillment centers where line stoppages result in substantial financial losses. By optimizing machine utilization and reducing maintenance overhead, AI extends the effective lifespan of the equipment and improves the overall return on investment for end-users.

The strategic deployment of AI also impacts inventory management and line balancing. ML models analyze incoming order patterns, product mix variability, and seasonal demand fluctuations to dynamically adjust the operational settings of multiple paper cushion machines across a fulfillment network. This allows for better synchronization with upstream picking and sorting processes, ensuring that cushioning material is always generated at the optimal speed and location, preventing bottlenecks and maintaining smooth product flow through the entire packaging process. This intelligent system integration moves the market toward fully autonomous packaging environments, highly desirable in regions facing labor shortages.

- AI-Powered Right-Sizing: Utilizing computer vision and algorithms to calculate the exact cushioning volume required for specific product dimensions and fragility levels, minimizing material waste.

- Predictive Maintenance: Analyzing sensor data (IoT) to forecast component failure in converting mechanisms, scheduling maintenance proactively to maximize machine uptime.

- Demand Forecasting Integration: Linking machine operation rates directly to warehouse management systems (WMS) and order history to ensure on-demand material readiness.

- Automated Configuration: Allowing machines to automatically adjust paper density, length, and cutting speed based on the product characteristics identified by the integrated AI vision system.

- Operational Efficiency Benchmarking: Using ML to analyze performance metrics across multiple deployed units globally to identify and apply best operating practices (GEO advantage).

DRO & Impact Forces Of Paper Cushion Machines Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The primary driver is the pervasive demand for sustainable and recyclable protective packaging, heavily influenced by global anti-plastic legislation (especially in the EU and North America) and the rapid, continuous expansion of the e-commerce sector, which necessitates high-speed void fill solutions. Opportunities lie predominantly in integrating advanced automation (robotics and AI), developing lighter yet stronger paper materials, and expanding penetration into emerging markets, particularly within the 3PL and specialized manufacturing sectors. Conversely, restraints include the initial high capital investment required for automatic machines, the competitive presence of alternative sustainable packaging solutions (e.g., molded pulp or air pillows in some low-fragility applications), and logistical challenges related to sourcing and handling large, high-quality paper rolls in geographically isolated areas. These forces exert significant impact, pushing manufacturers toward developing modular, cost-efficient, and highly automated equipment while emphasizing the long-term cost savings associated with material efficiency and reduced waste.

Segmentation Analysis

The Paper Cushion Machines Market is segmented based on several critical factors, including the degree of automation, the end-use application, the type of material utilized, and the operational volume capacity. Understanding these segments is vital for manufacturers to tailor their product offerings and for end-users to select systems that match their specific throughput and integration needs. The shift toward higher automation levels (semi-automatic and automatic) is the most defining trend, driven by rising labor costs and the need for seamless integration into high-speed fulfillment environments. Furthermore, the segmentation by application highlights the intense demand originating from the e-commerce sector, which requires rapid, reliable, and standardized protective packaging solutions for a vast array of product sizes and shapes, far exceeding the growth rates seen in traditional industrial applications.

The material type segmentation underscores the market's commitment to sustainability, with recycled paper dominating consumption. Companies are increasingly prioritizing machines compatible with 100% recycled content to fulfill their Corporate Social Responsibility (CSR) commitments, even as premium virgin kraft paper is still preferred for extremely heavy or high-fragility items requiring maximum crush strength. Capacity segmentation differentiates the market between small retail operations needing low-volume, manual solutions and large-scale 3PL providers that rely exclusively on high-volume, automated systems capable of dispensing thousands of feet of cushioning per hour, often integrated directly with conveyor systems. This structural segmentation allows market participants to accurately target specific customer needs, optimizing their supply chain and R&D strategies toward modularity and customized output formats (pads, bundles, void fill, wrapping).

- By Product Type:

- Manual Paper Cushion Machines

- Semi-Automatic Paper Cushion Machines

- Automatic Paper Cushion Machines

- By Application:

- E-commerce and Retail Packaging

- Industrial Packaging and Manufacturing

- Logistics and Third-Party Logistics (3PL)

- Food & Beverages Packaging

- Pharmaceuticals and Medical Devices

- By Material Used:

- Recycled Paper Stock

- Virgin Kraft Paper Stock

- By Cushioning Capacity:

- Low Volume (Below 50 packages/hour)

- Medium Volume (50 to 200 packages/hour)

- High Volume (Above 200 packages/hour)

Value Chain Analysis For Paper Cushion Machines Market

The value chain for the Paper Cushion Machines Market begins with the upstream suppliers responsible for providing specialized raw materials, primarily high-grade kraft paper rolls, often sourced from recycled materials or sustainably managed forests. This upstream segment is characterized by key relationships between machine manufacturers and paper producers, ensuring material compatibility (e.g., tensile strength, weight, perforation capability) is optimized for high-speed conversion. Machine manufacturing constitutes the core of the value chain, involving sophisticated R&D, component sourcing (motors, sensors, cutting mechanisms), and complex assembly, often incorporating embedded software and IoT connectivity to enhance operational data collection and machine integration. The increasing complexity of machine electronics, particularly in automatic models, necessitates strong partnerships with advanced component suppliers.

The downstream component involves distribution channels and end-user engagement. Distribution is typically handled through a mix of direct sales channels, especially for large enterprise accounts like major e-commerce platforms, and indirect channels relying on specialized industrial distributors, packaging suppliers, and 3PL consultancy firms. Direct distribution allows manufacturers greater control over installation, training, and maintenance contracts, which are crucial for ensuring machine efficiency and customer satisfaction. Indirect channels, however, provide broader geographical reach and integration with existing packaging consumable supply routes, catering effectively to small and medium-sized enterprises (SMEs).

The critical final stage is the servicing and consumables loop, which provides significant recurring revenue. Paper cushion machines require continuous replenishment of paper rolls, making the consumables market a substantial part of the overall ecosystem. Manufacturers often lock in customers through proprietary paper specifications designed to work optimally with their specific machine technology. Post-sales service, including maintenance, spare parts supply, and software updates, completes the value chain, focusing on maximizing machine uptime. This comprehensive structure emphasizes efficiency from raw material sourcing to end-of-life servicing, driving a total cost of ownership (TCO) evaluation for potential customers rather than just the initial capital expenditure.

Paper Cushion Machines Market Potential Customers

The potential customer base for Paper Cushion Machines is expansive, primarily comprising entities heavily involved in the storage, handling, and shipping of fragile or high-value goods. The dominant buyer segment is the E-commerce and Retail sector, including large online marketplaces and direct-to-consumer (D2C) brands, which require massive quantities of void fill and cushioning material daily to handle high product variance and fulfill last-mile delivery protection requirements. These customers prioritize high throughput, minimal floor space utilization, and robust system integration with existing conveyor and WMS infrastructure. The need for flexible packaging solutions that can quickly adapt to fluctuating order volumes makes automated paper cushioning systems an ideal investment for these global fulfillment centers.

Another major segment includes Third-Party Logistics (3PL) and fulfillment providers. As these companies manage packaging operations for diverse clients across multiple industries, they require highly versatile and modular cushioning machines that can handle various packaging needs—from fragile glass items to heavy industrial components—all while adhering to client-specific sustainability mandates. 3PLs often evaluate machines based on ease of integration, reliability across different shifts, and the ability to track material usage per client, which requires sophisticated data reporting capabilities often enabled by IoT connectivity embedded in the machines.

Furthermore, traditional Industrial and Manufacturing sectors represent significant long-term customers, particularly those dealing with automotive components, sensitive electronics, machinery parts, and medical devices. These industries typically require robust blocking, bracing, and heavy-duty cushioning solutions where material strength and shock absorption properties are paramount. While their packaging volumes may be lower than those of large e-commerce firms, their demand for custom, specialized paper pads (often created by the machines) for internal packaging of high-value components ensures sustained demand for heavy-duty, customized paper cushioning equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 750.8 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ranpak, Sealed Air, Pregis, Storopack, Pactiv Evergreen, Smurfit Kappa, IPG (Intertape Polymer Group), DS Smith, Packaging Corporation of America (PCA), Atlantic Packaging, Lantech, Mactec Packaging Technologies, FP International, Shurtape Technologies, Polyair, Fromm Packaging Systems, ERO-PACK GmbH, Krones AG, BÖWE SYSTEC GmbH, Neenah Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paper Cushion Machines Market Key Technology Landscape

The current technology landscape of the Paper Cushion Machines Market is characterized by a strong focus on automation, integration, and sustainable performance, driven largely by the stringent demands of high-volume e-commerce fulfillment. Key technological advancements center on developing high-speed conversion mechanisms—allowing machines to output paper cushions at rates exceeding 100 feet per minute—while maintaining excellent cushion quality and consistency. Modern systems utilize advanced servo motor technology to ensure precise paper feeding and cutting, minimizing material jams and increasing operational reliability, which is critical in automated packaging lines. Furthermore, modular design is a paramount trend, enabling end-users to deploy different machine models (tabletop, standalone, overhead) that can be easily scaled or reconfigured based on seasonal demand fluctuations or physical warehouse layouts, offering unparalleled operational flexibility.

A second major technological theme is the widespread adoption of connectivity features, largely through the deployment of IoT sensors and cloud-based monitoring systems. This technological pivot allows end-users to track crucial operational metrics such as run time, material consumption per package, error rates, and predictive maintenance diagnostics in real-time. This data integration is essential for implementing lean manufacturing principles in the packaging process, optimizing material inventories, and facilitating proactive service calls, thus maximizing the Total Equipment Effectiveness (TEE). The connectivity also supports seamless communication with Warehouse Management Systems (WMS) and Enterprise Resource Planning (ERP) systems, allowing for fully automated order fulfillment processes that dictate cushion size and quantity based on digital packing lists.

Finally, technology is heavily influencing the material handling and paper quality aspects. Innovations include the development of multi-ply paper handling capabilities within a single machine, allowing for different levels of cushioning strength depending on the product being processed, thereby offering custom protection without switching machines. Ergonomics and safety are also major considerations; newer machines feature safer loading mechanisms, reduced noise levels, and simplified Human-Machine Interfaces (HMIs) via touchscreens, making them easier and safer for warehouse staff to operate, thereby lowering training costs and minimizing the risk of operational errors.

Regional Highlights

The Paper Cushion Machines Market exhibits distinct growth patterns across key geographic regions, primarily influenced by the maturity of their e-commerce sectors, local labor costs, and prevailing environmental legislation. North America, driven by the massive logistics networks of companies like Amazon and Walmart, represents the largest revenue share. This region demands highly automated, high-speed machinery capable of continuous operation, primarily focused on labor reduction and maximum throughput. The strong push for sustainable packaging, coupled with mature recycling infrastructure, solidifies the region's position as a primary adopter of advanced paper cushioning technology, often serving as the benchmark for global performance expectations.

Europe follows closely, characterized by extremely strict sustainability mandates, such as the EU Packaging and Packaging Waste Directive revisions, which favor paper-based solutions over plastics. European demand is often centered around machines that utilize 100% recycled content and offer verifiable material certifications. The regional focus is not only on speed but also on resource efficiency and minimizing the carbon footprint of packaging operations. Germany, the UK, and France are critical markets, with strong manufacturing and logistics sectors driving substantial investment in automated packaging line retrofits. Furthermore, the European market shows a higher propensity for modular and compact machine designs suitable for smaller, urban fulfillment centers.

Asia Pacific (APAC) is projected to record the highest CAGR during the forecast period. This rapid growth is fueled by massive urbanization, the burgeoning domestic e-commerce markets in China, India, and Southeast Asia, and increasing foreign direct investment in manufacturing and logistics infrastructure. While price sensitivity remains higher in some APAC countries, the demand for scalable paper cushioning solutions is escalating rapidly as local logistics providers seek to match international quality standards and reduce reliance on cheap, often non-recyclable plastic packaging. The market here is seeing a dual trend: high-volume automatic systems for major logistical hubs and manual/semi-automatic options for the vast network of small and medium-sized local retailers and manufacturers entering the online sales arena.

- North America: Market leader defined by high automation adoption, focus on throughput maximization, and mature e-commerce infrastructure.

- Europe: Driven by strict environmental regulations, prioritizing recycled materials, modular designs, and sophisticated end-of-line integration.

- Asia Pacific (APAC): Fastest growing region due to massive e-commerce expansion, urbanization, and increasing investment in modern logistics facilities.

- Latin America (LATAM): Emerging market characterized by fragmented distribution networks and growing demand for cost-effective, semi-automatic solutions.

- Middle East and Africa (MEA): Limited adoption, primarily concentrated in regional logistics hubs (e.g., UAE, Saudi Arabia) driven by global brand presence and high-value logistics requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paper Cushion Machines Market.- Ranpak

- Sealed Air

- Pregis

- Storopack

- Pactiv Evergreen

- Smurfit Kappa

- IPG (Intertape Polymer Group)

- DS Smith

- Packaging Corporation of America (PCA)

- Atlantic Packaging

- Lantech

- Mactec Packaging Technologies

- FP International

- Shurtape Technologies

- Polyair

- Fromm Packaging Systems

- ERO-PACK GmbH

- Krones AG

- BÖWE SYSTEC GmbH

- Neenah Inc.

Frequently Asked Questions

Analyze common user questions about the Paper Cushion Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the major growth in the Paper Cushion Machines Market?

The primary driver is the exponential growth of the global e-commerce sector, which necessitates high-speed, scalable protective packaging. This demand is compounded by increasing environmental awareness, consumer pressure, and global government mandates favoring recyclable, plastic-free packaging solutions like paper cushions.

How does the total cost of ownership (TCO) compare between paper cushion systems and traditional void fill materials?

While paper cushion machines require a higher initial capital investment compared to simple dispensers for foam peanuts or air pillows, the TCO is often lower over the long term. This reduction is achieved through significant savings in material efficiency (right-sizing capabilities), reduced storage space requirements (on-demand conversion), and lower waste disposal costs, particularly in regions with high landfill taxes.

What role does automation play in the deployment of paper cushioning technology in fulfillment centers?

Automation is critical, especially for high-volume 3PLs and e-commerce companies. Automatic paper cushion machines integrate directly into conveyor lines, dispense material automatically based on package sensing, and significantly reduce reliance on manual labor, ensuring consistent, high-speed packaging throughput necessary to meet modern fulfillment demands.

Which regions demonstrate the highest potential for market expansion during the forecast period?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This expansion is driven by the rapid maturation of domestic e-commerce markets in countries like China and India, coupled with substantial investments in logistics infrastructure modernization aiming for international supply chain standards.

What are the key technological advancements influencing the performance of modern paper cushion machines?

Key technological advancements include the integration of IoT and AI for predictive maintenance and optimal material dispensing (right-sizing), the development of higher speed servo-driven conversion mechanisms, and enhanced modular machine designs that ensure seamless integration into complex, existing packaging lines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager