Paper Dry Strength Agent Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436598 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Paper Dry Strength Agent Sales Market Size

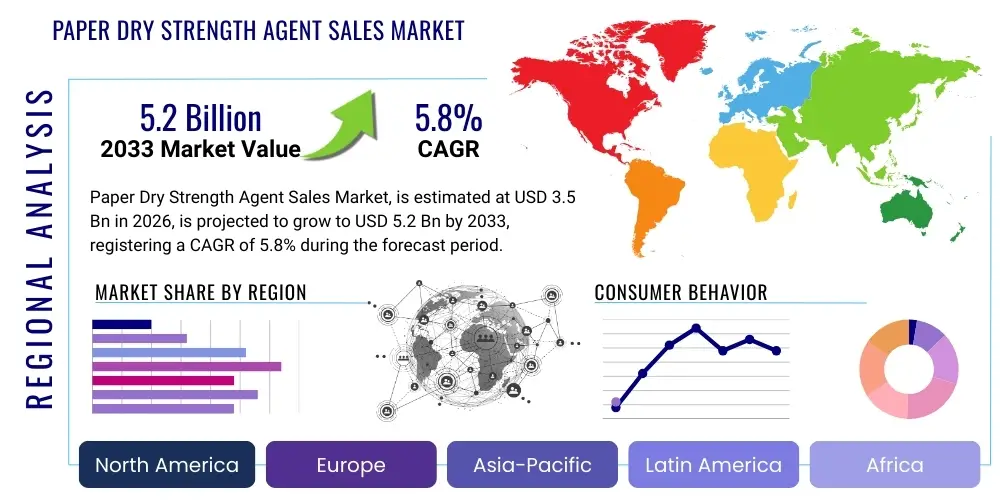

The Paper Dry Strength Agent Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Paper Dry Strength Agent Sales Market introduction

The Paper Dry Strength Agent Sales Market encompasses the global trade of specialty chemical additives designed to significantly improve the mechanical properties of paper and paperboard products, specifically focusing on tensile strength, burst strength, and internal bond strength under dry conditions. These agents are crucial for enhancing the performance and durability of fiber-based materials, which is particularly vital in packaging, tissue, and printing paper sectors. Key products include various forms of polyacrylamide (PAM), modified starches, and other synthetic polymers like glyoxalated polyacrylamide (GPAM), all tailored to maximize fiber-to-fiber bonding efficiency.

The primary application areas for dry strength agents are broad, covering almost every facet of the pulp and paper industry. They are indispensably used in the production of corrugated board, containerboard, and carton board where high strength-to-weight ratios are essential for structural integrity and safe transportation of goods. Furthermore, these additives facilitate the use of recycled fiber, allowing manufacturers to maintain high paper quality standards even when utilizing less optimal raw materials, aligning with global sustainability objectives and reducing reliance on virgin pulp. The ability of these agents to enhance retention and drainage during the papermaking process also leads to improved machine efficiency and reduced energy consumption.

Driving factors for this market include the sustained global demand for high-performance packaging materials, especially driven by the e-commerce boom and the subsequent need for stronger and lighter shipping boxes. Regulatory pressures favoring sustainable packaging alternatives over plastics further accelerate the adoption of high-quality paperboard, necessitating increased usage of effective dry strength agents. Continuous technological advancements focused on developing bio-based or highly efficient synthetic strength resins that offer superior performance at lower dosage rates also contribute significantly to market expansion and competitiveness.

Paper Dry Strength Agent Sales Market Executive Summary

The global Paper Dry Strength Agent Sales Market is characterized by robust growth, primarily driven by the expansion of the packaging industry and the increasing focus on fiber recycling efficiency worldwide. Business trends indicate a shift towards specialized, high-performance chemistries, such as cationic starch and amphoteric polyacrylamides, which offer dual benefits of strength enhancement and improved retention. Major players are heavily investing in research and development to formulate agents effective in neutral and alkaline papermaking environments, catering to the prevalent production conditions globally. Strategic mergers and acquisitions are common as companies seek to expand their geographic footprint, integrate specialized technologies, and secure raw material supply chains, maintaining competitive pricing and product differentiation in a highly application-specific market.

Regionally, the Asia Pacific (APAC) dominates the market, largely due to the massive scale of paper and paperboard production in countries like China and India, fueled by rapid industrialization and urbanization. North America and Europe show mature but stable growth, highly concentrated on high-end specialty papers and sustainability-driven recycled content optimization. These regions are prioritizing agents that minimize environmental impact and comply with stringent food contact regulations, pushing demand for renewable and low-toxicity strength chemicals. Latin America and the Middle East and Africa (MEA) represent emerging growth hubs, driven by nascent local paper manufacturing capacities and increasing consumer packaged goods consumption.

Segment trends highlight the dominance of Polyacrylamide (PAM) derivatives due to their versatility and superior performance across various fiber types. However, natural polymer-based agents, particularly chemically modified starches, are seeing accelerated demand as manufacturers seek cost-effective and bio-degradable alternatives, especially in bulk production applications like linerboard and fluting medium. The packaging paper segment remains the largest end-use application, consistently requiring high dry strength for structural integrity, while the tissue and towel segment shows promising growth for agents that improve absorbency while maintaining wet and dry tensile strength integrity during usage.

AI Impact Analysis on Paper Dry Strength Agent Sales Market

Common user questions regarding AI's influence in the Paper Dry Strength Agent Market often revolve around predictive modeling for chemical dosage optimization, quality control automation, and the discovery of novel chemical structures. Users are keen to understand if AI can significantly reduce chemical consumption while maintaining or improving paper quality, addressing concerns about raw material costs and production variability. The key themes summarized from user inquiries indicate a strong expectation that AI and Machine Learning (ML) will revolutionize process control by analyzing real-time machine data, pulp characteristics, and additive performance kinetics, leading to highly optimized chemical recipes and minimized operational downtime. Furthermore, there is considerable interest in AI's role in accelerating material science R&D, specifically in simulating polymer-fiber interactions to rapidly identify more effective and sustainable dry strength agents.

- AI-driven optimization of chemical dosing in wet-end chemistry, reducing material waste by up to 15%.

- Predictive maintenance analytics for paper machine systems, minimizing production interruptions related to chemical consistency.

- Machine learning algorithms analyzing fiber morphology to customize dry strength agent formulations for specific pulp blends (virgin vs. recycled).

- Accelerated discovery of novel bio-based polymer structures using generative AI for sustainable strength agent development.

- Automated quality control systems integrating computer vision and ML to monitor paper tensile strength in real-time.

- Supply chain risk prediction for key raw materials (e.g., acrylamide, starch) utilizing AI-driven market intelligence platforms.

DRO & Impact Forces Of Paper Dry Strength Agent Sales Market

The market for Paper Dry Strength Agents is propelled by the continuous expansion of the global packaging industry, particularly the e-commerce sector, which necessitates stronger, lighter, and more durable corrugated materials. This driver is powerfully reinforced by environmental regulations demanding higher usage of recycled fibers, making dry strength agents essential to compensate for the quality degradation inherent in secondary fiber utilization. Conversely, the market faces significant restraints, primarily high and volatile raw material costs (such as acrylamide monomer and starch), which directly impact profitability. Additionally, the technical complexity of integrating these agents into the wet-end process, requiring precise pH and temperature control, poses a hurdle for smaller or less technologically advanced mills. The primary opportunity lies in the development and commercialization of bio-based and green chemistries that satisfy sustainability goals while delivering high performance, opening new lucrative avenues, especially in environmentally conscious regions.

The impact forces influencing this market are diverse, encompassing technological push, economic shifts, and regulatory pull. Technological advancements, particularly in polymer synthesis, consistently introduce more efficient products, creating market disruption by rendering older chemistries obsolete. Economic forces, such as fluctuations in global pulp prices and the overall health of industrial manufacturing, directly correlate with the demand for paper products and, subsequently, the demand for strength agents. Furthermore, the rising consumer demand for plastic reduction in packaging exerts a significant pull force, increasing the performance requirements for fiber-based substitutes. These forces combine to create a dynamic environment where innovation in product formulation is crucial for sustained market leadership.

The development of customized dry strength programs tailored to specific paper grades and mill operational parameters acts as a persistent impact force, driving specialization and value-added services among chemical suppliers. Suppliers are increasingly partnering with mills to implement total wet-end management solutions rather than just selling commodities. The persistent need for water and energy conservation in the papermaking process also compels mills to adopt high-efficiency agents that improve drainage and retention, indirectly boosting demand for advanced polymer chemistries. Overall market trajectory is defined by a delicate balance between cost optimization pressures and the unwavering need for enhanced paper quality in critical applications.

Segmentation Analysis

The Paper Dry Strength Agent Sales Market is comprehensively segmented based on the type of chemical composition, the specific application or paper grade, and the geographical region. This segmentation provides a granular view of market dynamics, highlighting areas of high growth and technological focus. The primary classification by product type distinguishes between synthetic polymers (like Polyacrylamides and their derivatives) and natural polymers (primarily modified starches). Segmentation by application is critical, as the required strength profile varies significantly between packaging paper (demanding high internal bond strength) and writing/printing paper (focused on surface strength and lower basis weight requirements). Understanding these segments is crucial for strategic market positioning, enabling suppliers to tailor products and services to meet distinct industry needs, from heavy-duty containerboard production to high-speed tissue manufacturing.

- By Product Type:

- Synthetic Agents (e.g., Polyacrylamide (PAM), Glyoxalated Polyacrylamide (GPAM), Polyethyleneimine (PEI), Polyamidoamine-epichlorohydrin (PAE))

- Natural Agents (e.g., Modified Starches (Cationic, Amphoteric), Guar Gum, Cellulose Derivatives)

- By Application:

- Packaging Paper and Board (Linerboard, Fluting, Carton Board, Corrugated Board)

- Printing and Writing Paper

- Tissue and Towel Paper

- Specialty Paper (e.g., Filter Paper, Industrial Sacks)

- By Form:

- Powder

- Liquid (Emulsion, Solution)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Paper Dry Strength Agent Sales Market

The value chain for the Paper Dry Strength Agent Market begins with the upstream suppliers providing fundamental chemical monomers, primarily acrylamide, starch, and various synthetic intermediates required for polymerization. The stability and pricing of these raw materials, which are often petrochemical-derived, heavily influence the final cost structure of the dry strength agents. Key players in this stage are large chemical producers and agricultural commodity providers. The manufacturing stage involves complex polymerization, blending, and modification processes, where suppliers like Kemira, Solenis, and BASF transform monomers into specialized, high-performance strength resins, demanding significant R&D investment and strict quality control to ensure product efficacy and consistency.

The distribution channel is crucial, typically involving a blend of direct sales models for large, globally integrated paper companies and indirect distribution through specialized regional chemical distributors and agents for smaller, local mills. Direct sales allow for customized technical service and close partnership, which is vital given the highly technical nature of wet-end chemistry optimization. Indirect channels provide local stocking, quicker turnaround, and localized technical support in diverse regional markets. Effective logistics, especially concerning the transportation of liquid and emulsion forms, is paramount to maintaining product stability and ensuring timely delivery to continuously operating paper mills worldwide, demanding specialized handling of potentially sensitive chemical formulations.

Downstream analysis focuses on the paper manufacturers, the direct consumers of these agents, who integrate them into their pulp slurry during the wet-end phase. The success of the dry strength agent is measured by its impact on the finished product's physical properties, machine runnability, and overall cost-efficiency. End-users benefit through higher paper quality, reduced fiber usage (via better retention), and the capability to use higher ratios of cheaper, recycled fiber without sacrificing performance. The ultimate consumer, ranging from e-commerce retailers utilizing strong packaging to households using durable tissue products, dictates the necessary performance characteristics, thereby driving demand back up the value chain toward formulation optimization.

Paper Dry Strength Agent Sales Market Potential Customers

The primary customers in the Paper Dry Strength Agent Sales Market are integrated pulp and paper manufacturing companies across the globe, ranging from multinational corporations operating dozens of mills to independent regional producers. These entities represent the immediate buyers and incorporate the additives directly into their production processes. The demand profile of these buyers is highly fragmented based on the specific type of paper produced; for instance, mills producing packaging board prioritize maximum tensile and burst strength, while tissue manufacturers seek a balance between softness, bulk, and strength to prevent tearing.

Secondary but equally important buyers include specialized converting companies that occasionally require pre-treated or chemically enhanced paperboard for niche applications, although bulk purchasing remains centered at the manufacturing mill level. The growth of the potential customer base is intrinsically linked to global industrial output, e-commerce proliferation, and public policy favoring fiber-based packaging. Purchasing decisions are driven not only by price but, critically, by the total cost of ownership, encompassing machine runnability improvements, chemical efficacy per ton of paper, and compliance with environmental and food safety standards relevant to the end product's application.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kemira Oyj, Solenis LLC, BASF SE, Ashland Global Holdings Inc., Harima Chemicals Group, Seiko PMC Corporation, CP Kelco, Buckman Laboratories International Inc., Fuzhou Z&Y Polymer Co. Ltd., SNF Group, Imerys S.A., Dow Inc., Arakawa Chemical Industries Ltd., Kuraray Co. Ltd., Thermax Limited, Shandong Crownchem Industries Co., Ltd., China National Paper Dry Strength Agent Sales, Weifang Greatland Chemicals Co., Ltd., Ercros S.A., Kolb Distribution AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paper Dry Strength Agent Sales Market Key Technology Landscape

The technological landscape of the Paper Dry Strength Agent Market is dominated by advancements in polymer chemistry, focusing on creating high-efficiency additives that perform optimally under varying mill conditions, such as high conductivity and neutral pH. The most pervasive technologies center around the synthesis of functionalized polymers, including Glyoxalated Polyacrylamide (GPAM), which offers superior retention and drainage properties alongside enhanced dry strength. A key trend involves tailoring the charge density and molecular weight of these synthetic polymers (e.g., highly cationic PAM) to maximize absorption onto cellulosic fibers, even in the presence of competing ions or contaminants found in recycled fiber systems. This technical evolution ensures that mills can maintain consistent paper quality while aggressively increasing their use of secondary fibers.

A significant technological shift is the rise of sustainable and bio-based dry strength agents, driven by regulatory pressures and corporate sustainability mandates. This involves innovative chemical modification of natural starches and other polysaccharides (like cellulose derivatives or chitin). Techniques such as enzymatic or chemical cationization are used to enhance the natural polymers’ binding capacity and make them compatible with modern papermaking processes. These bio-based solutions often integrate dual functionality, providing both dry strength and improved retention, challenging the traditional dominance of petrochemical-derived agents. Furthermore, emulsion polymerization techniques are continually being refined to produce highly stable, ready-to-use liquid agents, simplifying handling and dosing at the mill level.

Integration technology, which involves the sophisticated blending of multiple chemistries, represents another critical area of innovation. Many modern papermaking processes utilize complex systems where dry strength agents are synergistically combined with wet strength resins, sizing agents, and retention aids. Suppliers are developing "smart packages" or formulated systems that optimize the total wet-end chemistry through advanced monitoring and control systems (often leveraging sensor technology and data analytics). The focus is moving beyond single-product performance to delivering holistic process improvement, enabling paper mills to achieve higher machine speeds and superior product homogeneity with minimum chemical complexity and operational variance.

Regional Highlights

The geographical analysis reveals distinct market maturity and growth dynamics across key regions. The Asia Pacific (APAC) region stands out as the largest and fastest-growing market, primarily fueled by the massive paper production capacities in China, which accounts for a substantial portion of global paper and paperboard output. Economic growth, expanding urbanization, and the resulting surge in packaging demand across emerging economies like India and Southeast Asia drive high volume consumption of dry strength agents, particularly cationic starches and basic PAM formulations aimed at cost-efficiency and high throughput in linerboard and duplex board production.

North America and Europe represent mature markets characterized by stringent quality standards and a profound focus on sustainability and recycling mandates. Demand here is geared toward high-performance, specialized synthetic agents (like GPAM) that enable higher recycled content usage while meeting demanding specifications for food-contact packaging and specialty papers. European regulations, such as those related to REACH and bio-based content, are accelerating the adoption of premium, low-toxicity, and naturally derived strength additives, driving innovation toward green chemistry solutions.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets showing accelerated growth. LATAM's market expansion is linked to growing domestic consumption and increasing exports of agricultural products, boosting the need for strong corrugated packaging. In MEA, particularly the GCC countries, investments in localized paper manufacturing facilities, catering to growing regional consumer demand, are generating new opportunities for suppliers. However, these regions often face challenges related to logistics infrastructure and reliance on imported chemical inputs, making cost-effectiveness a crucial competitive factor.

- Asia Pacific (APAC): Dominates the market share due to unparalleled manufacturing scale; significant demand from China and India for packaging and printing paper; high adoption of cost-effective modified starches and large-volume synthetic polymers.

- North America: Focuses on premium, high-efficiency agents for optimizing recycled fiber utilization; strong market for food-grade and specialized packaging applications; driven by strict quality specifications and sustainability goals.

- Europe: Driven by environmental policies and the circular economy mandate; strong shift towards bio-based and renewable dry strength chemistries; high growth in the high-end tissue and sophisticated carton board segments.

- Latin America (LATAM): Growing manufacturing base, especially in Brazil and Mexico; increasing demand for corrugated board for domestic use and export packaging; market sensitive to economic stability and currency fluctuations.

- Middle East and Africa (MEA): Nascent growth driven by localized paper capacity expansion; high potential for infrastructure-related paper demand; competitive landscape focused on basic, reliable dry strength solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paper Dry Strength Agent Sales Market.- Kemira Oyj

- Solenis LLC

- BASF SE

- Ashland Global Holdings Inc.

- Harima Chemicals Group

- Seiko PMC Corporation

- CP Kelco

- Buckman Laboratories International Inc.

- Fuzhou Z&Y Polymer Co. Ltd.

- SNF Group

- Imerys S.A.

- Dow Inc.

- Arakawa Chemical Industries Ltd.

- Kuraray Co. Ltd.

- Thermax Limited

- Shandong Crownchem Industries Co., Ltd.

- China National Paper Dry Strength Agent Sales

- Weifang Greatland Chemicals Co., Ltd.

- Ercros S.A.

- Kolb Distribution AG

Frequently Asked Questions

Analyze common user questions about the Paper Dry Strength Agent Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary chemical types used as dry strength agents in papermaking?

The primary chemical categories include Synthetic Agents, mainly Polyacrylamide (PAM) and its derivatives like Glyoxalated Polyacrylamide (GPAM), and Natural Agents, predominantly chemically Modified Starches (such as Cationic Starches), which are preferred for their cost-effectiveness and biodegradability.

How does the increasing use of recycled fiber impact the demand for dry strength agents?

Recycled fiber usage increases the demand for high-performance dry strength agents because recycled pulp often has weaker and shorter fibers. Advanced agents are necessary to compensate for this fiber degradation, ensuring the finished paper product meets required strength specifications, particularly in packaging applications.

Which application segment drives the highest volume sales in the Paper Dry Strength Agent Market?

The Packaging Paper and Board segment, including linerboard, fluting medium, and carton board, accounts for the highest volume sales. This is driven by the global need for durable, strong, and lightweight shipping materials necessitated by the continuous expansion of the e-commerce sector.

What is the current growth trend regarding bio-based dry strength agents?

Bio-based dry strength agents, such as modified starches and cellulose derivatives, are experiencing rapid growth. This trend is driven by stringent environmental regulations, corporate sustainability goals, and consumer preference for products derived from renewable resources, positioning them as a critical area for R&D investment.

What role does the cationic charge of the agent play in dry strength performance?

The cationic charge is crucial as it facilitates electrostatic attraction between the polymer molecules and the negatively charged cellulosic fibers and fines in the pulp slurry. This optimized adsorption enhances retention and maximizes the efficacy of the agent in forming strong hydrogen and covalent bonds between fibers during the drying process, thereby boosting overall dry strength.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager